7 easy steps to create a startup budget

Preparing a budget for a business is a complex process. It becomes more complicated if you’re planning for a startup. Several factors should be considered while preparing a small business budget.

Even a rupee plays a significant role in the process of making a budget for new business. To make a more complex situation, you may also try to gain maximum growth with meagre cash flow. This leads to limited scope for financial planning. While gathering the steps for preparing a startup budget, I contemplated that budget-making is a crucial part of every business process.

According to a survey, 60% of small businesses are operating without a budget. Well, I have mentioned the steps of how you can design an efficient budget for your startup despite the fact that you are using paper, spreadsheets, or software.

Why is budgeting significant for startup success?

You might know that planning a budget for your new business does more than just prevent financial troubles. It assists in preparing well-designed and analyzed financial decisions.

Budgeting is often referred to as the most crucial step in operating a business. There are several available reasons for a startup owner to think about budgeting:

● Offers insight on when to recruit employees

● A regular budget can help you in avoiding over-borrowing and fundraising.

● It offers a proper estimation of your break-even point. It helps you in knowing exactly when to amend important variables.

● It predicts the cash shortfalls precisely hence enabling you to manage your funds accordingly.

● Generate accurate financial statements to share with lenders or invest.

What are the types of startup budgets?

You have already learned the importance of budgeting for startups success. Let’s see what alternatives you can select from. There are two main kinds of startup budgets. However, there are numerous alternatives to the types of startup business budgets you can select from.

1. One-year budget

The one-year budget is known to predict daily, weekly, or monthly startup expenses. Preparing a P&L and a rolling budget is a suitable way of doing this. For your highly dynamic business, management of risks & start-up costs has to be done consistently.

You are advised to rely on a short-interval rolling startup budget in case you’re planning for a new business. These short-interval rolling budgets are updated consistently every year. It is rightly stated that focus on preparing a monthly or quarterly startup budget to do future planning.

2. Long-duration budget

A budget that lasts over 2 or 4 years allows you to think about your long-run financial goals. You might be wondering how you can set particular goals when your business is in the early stages.

A long-term budget does not demand specific assumptions for objectives. Let us understand it in an easier manner. To predict a 4-year revenue model, you can specify it against assumptions of the 4-year industrial growth trends. You just need to keep updates of calculated percentage rises, inflations, etc.

7 easy steps on how to create a startup budget

Presently, you have the essential information on how budget-making can be demonstrated critical for your business procedures. You really want not need to approximate your costs directly down forthright or anticipate the future impeccably to set up an advantageous spending plan.

What counts is that you foresee numbers in view of seller quotes, contender examination, or statistical surveying. Remember to be cautious when projections are your subject. I would prefer to recommend you misjudge spending plan costs and underrate financial plan income.

Likewise, switching the standard might prompt undesirable results. We should go through 7 simple tasks to set up a startup financial plan for carrying accomplishment to your business.

1. Set a target

The first step in how to create a startup budget involves setting goals. An enormous number of individuals misjudge the meaning of get-together information and investigate results with regard to budget-making.

For cutting-edge monetary preparation, apparatuses like bookkeeping programming, MS Excel, and Google Sheets are very advantageous.

Without a rush, search for a timetable and format that best suits your business. Take on a propensity for testing mechanized equations by entering any worth according to your craving. This helps with keeping away from long periods of information passage just to figure out the estimations are mistaken.

Further, attempt to set a forthright goal. It helps you in drawing a contrast between the 'would-be-smarter to-have' and the 'absolute necessities. While setting up your startup financial plan, make sure to store a few assets for crisis purposes. At any rate, a secret stash for the impending 3 months' should be held by your firm. Along these lines, setting up an objective is the essential prerequisite.

2. List income sources

While setting up a budget plan for your startup, find out about the wellsprings of your raising money. As a startup proprietor, you should know where your income is. You might even utilize client personas to work out your income really. It additionally predicts their buying recurrence.

You can likewise draw a contrast between assessed transformations, possibilities by area, and so on. CRM programming with better innovation helps you in doing this. Indeed, you may likewise surmise your make back the initial investment results. Attempt to think of various approaches to being practical while assessing likely pay or subsidizing sources like speculation pay, investment funds, or advances.

Talk about habitually with your creation, deals, and showcasing groups to conclude ventures to take up. Make sure to add an addition to this assessed sum to adapt to unexpected open doors. Guarantee that all that you consider is reasonable and legitimate.

3. Categorize costs into revenue buckets

Assembling expenses often seem complicated, but we have made it a simple process for your business. The method is to differentiate your expenses into Operational and Capital expenditure.

The Capital expenditure consists of any huge investments like equipment, land areas, etc. Investments done on capital are subject to a return in interest. Well, you may require performing a deep study of present versus upcoming investments.

Remember to list down all information on finance-related to each project phase. Regularly, you might need to do a knee-profound investigation of current versus future speculations. At the same time, guarantee that you notice all monetary data related to each undertaking stage. This leads to the alignment of your capital expenditure with long-lasting financial objectives.

The allocation of percentages for your gross income doesn’t remain consistent. It varies from business to business.

4. Determine variable costs

The term itself suggests that these expenditures changes with your production and sales. The most basic illustrations of variable costs consist of Raw Materials, Utilities, Advertising expenditure, etc.

You can file a request for quotes from manufacturers and contractors for several of these expenses. Well, you must keep in mind to determine how season and time may have an effect on these, too.

Travel, administrative, and general expense fall under this list. Businesses can approximate these on previous data. Remember to prepare quantifiable predictions for everything. While the businesses have decided upon their fixed and variable expenses, attempt an accelerated round-up to convert your budgeting into a realistic one.

5. Accommodate interest and taxes

Well, I wish this situation never really arises for your business, but if you hold debt, you are required to cover up interest. With a huge cash balance, you can receive interest income. The payment of annual taxes also requires a budget. The rate of annual tax may vary from state to state.

The troubles of net operating downfalls may be a result of your firm’s previous losses.

6. Create estimates for financial statements

The formation of appraisals for fiscal summaries is perplexing for a startup during your financial plan-making process. You might want to project just for capital uses alongside your P&L account.

All things considered, you are encouraged to make a stride further. You ought to plan gauges for your monetary record. Alongside it, surmised your P&L for broad income assessment.

Thus, you can have a thought of how much financing you really require. Enroll your resources/liabilities to ensure that your business is liberated from the postponement or nonattendance of subsidizing.

7. Integrate with all departments

By mentioning integration, all that I mean is: Plan your complete budget by involving everyone in the platoon. Everyone consists of R&D, Sales, department heads, HR, and top-level management.

While planning for a startup, individuals are supposed to confirm that your budget-making strategy is recognized in the outside world. To grow your business conveniently, offer budgeting the significance it requires through intra-departmental meetings.

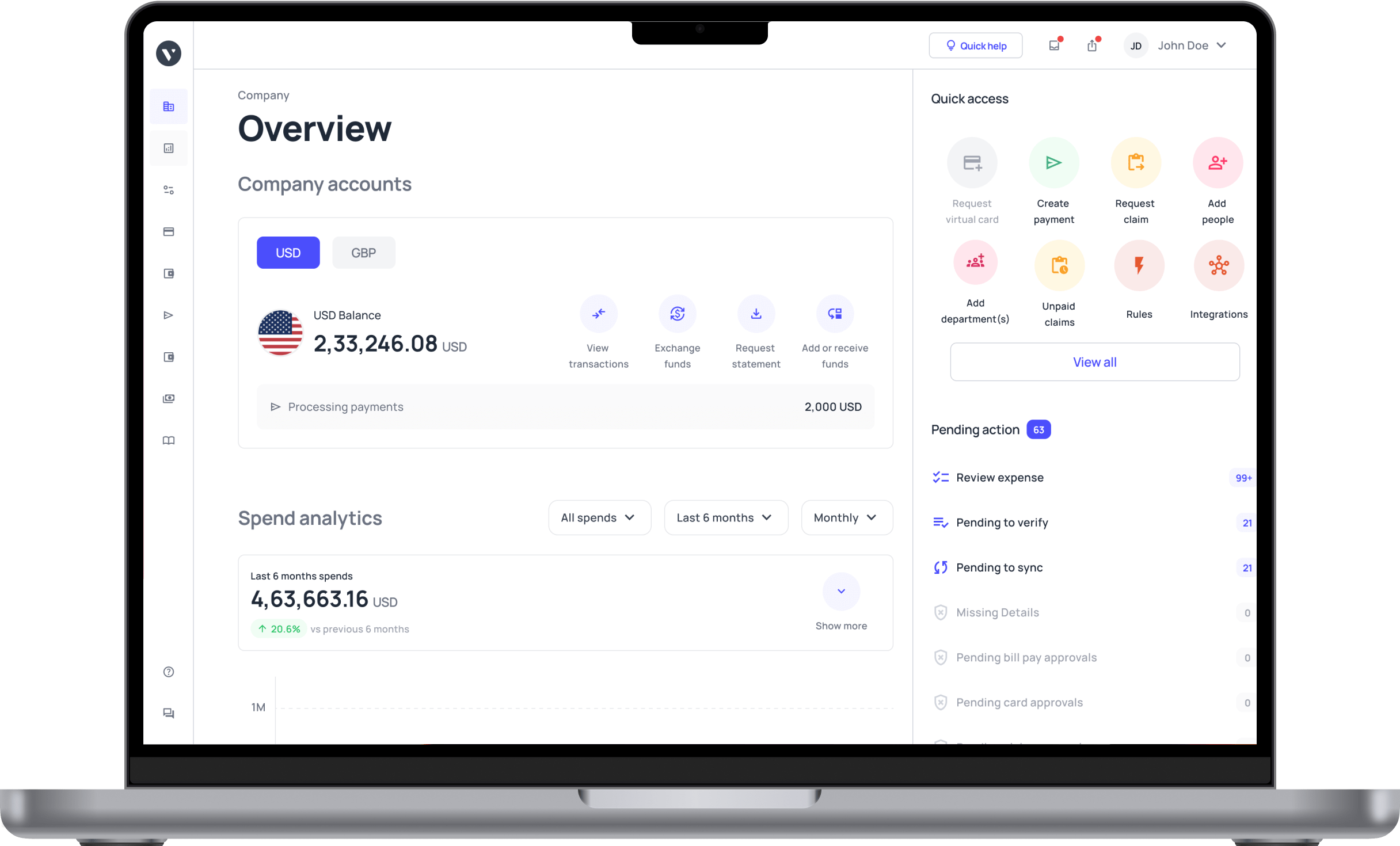

Make budgeting smooth & easy, with Volopay

Adopting the right accounting software and budgeting tool can make a huge difference in the way your business functions and all the tasks are planned.

Volopay is an all-in-one spend management platform that has been designed and optimized to provide you with the best features for handling all your problems. We are equipped with the most advanced accounting system available in the market. Our software can store, process, and manage huge quantities of financial data with extreme ease.

Other smart features we provide are OCR, index and search, and analytical tools to assist you in sorting your business data and abstract meaning insights from it. With Volopay, your data is secured and protected with multiple security tools.