How to improve your business budget efficiently?

No matter the size, industry, and location of your business, budgets, and forecasts are key drivers to forging business success. Creating a sound business budget plan can make the difference between raking in revenue and paying from your own pockets for overpriced expenses. By improving your budgeting skills, you can create an efficient and effective budget optimized for the upcoming fiscal year.

Improve your business budget in 10 simple ways

Real-time data

Preparing for the future while looking at the past? The number one mistake that companies make while preparing a business budget plan is looking at old data from six months to a year ago!

In a dynamic corporate environment, you need real-time, live data to create accurate budgets and forecasts for company resources. By seeing what expenses your company is processing now, real-time data can help us see the blind spots in our budgeting plan for what’s coming.

Clearly define your goals

Every aspect of your business runs on an OKR (Objectives and Key Results) goal system. From the Sales team’s sole objective to bring in more revenue, to the accounting team’s mission to accurately file financial information of the company, everything runs on goals, and the same applies to budgets.

Without a predefined budget goal, it becomes almost impossible to keep track of what the company is budgeting for. Is it optimizing costs? Or find financial blind spots? Without a clear goal with a set timeline, it is difficult to reach your target and use this budget for future references.

Set realistic budget

Oftentimes, in a quest for perfection, companies set out unrealistic budget goals, with unwarranted budget cuts. This is a surefire way to contaminate any real findings that could’ve emerged from reviewing this budget in the future. Therefore, while creating a business budget, it’s best to be cautiously idealistic and create forecasts and budgets based on solid, real-time revenue numbers so that the budget can measure corporate spend performance accurately.

Eliminate spreadsheets

Back when digital spreadsheets were all the rage, the corporate world was still limited to crunching budget projections on calculators. However, in this hyper-digital age, spreadsheets have become obsolete due to their limited functionality. Using the right budgeting software can revolutionize the way businesses create budgets and forecasts for the fiscal year.

Fill the communication gap

To make all departments work harmoniously and have a coherent understanding of the budgets, there needs to be an open line of communication around budgets and resource allocation. Ensure that the budget is shared with every employee since they are the ones who would have to adhere to and maintain it in the first place. Be open and welcome to suggestions and feedback. Listen to the in-house experts and let them assist you in creating a judicious budget for the upcoming project/month/quarter/year.

Make use of rolling budgets & forecasting

Instead of utilizing year-old data that isn’t up-to-date with the dynamics of your business, use rolling budgets and forecasting. Create budgets based on the previous quarter, instead of at the beginning of the year. Rolling budgets and forecasts are broader and continually evolving, meaning that your budget strategies will improve based on real-time data from previous quarters, constantly realigning themselves with the pace of your company’s growth.

Keep an eye on cash flow and profit

Cash flow and profit tracking are two different metrics, however together they offer an unparalleled insight into your company’s financial wellbeing. We highly recommend that you include realistic cashflow and profit targets into your budgeting plans, as without them you might not have an accurate reflection of your business's fiscal performance.

Related read: Advantages and disadvantages of retained profit for businesses

Pick budgeting methods which suits you best

There are 5 different budgeting methods that dominate corporate budgeting strategies. Companies usually end up using one form of budgeting since it’s familiar and comfortable to use. However, using a different budgeting method can act as a fresh set of eyes to assess your budgeting plans.

1. Incremental budgeting: By adjusting the previous or existing fiscal budget with a fixed or steady increment or a percentage to achieve new budget values is referred to as incremental budgeting. In this budgeting format, any previous financial period becomes the starting point for the new one.

2. Activity-based budgeting (ABB): This type of corporate budgeting primarily focuses on activities to forecast operational budgets for the new or current budget. ABB dons on a top-down approach and uses the “IDENTIFY (cost drivers), DETERMINE (total units) and ESTIMATE (cost per activity)” model to calculate the estimated overhead for a certain fiscal period.

3. Zero-based budgeting: This type of business budget is exactly how it sounds: All budgets for a new or current fiscal period are assumed to be zero and created from scratch.

4. Value proposition budgeting: This type of budgeting is a mix of incremental and zero-based budgeting, by identifying unnecessary costs and performing a cost-benefit analysis to justify their continuation in the new budget.

5. Flexible budgeting: Adopting a “roll with the punches” attitude, flexible budgeting follows no strict pattern and allows business owners to adapt their budgets as per the ups and downs of the company’s revenue levels.

Track and manage

Budgets are meant to be followed, therefore every little delineation must be reported promptly. Whether it’s something as small as an increase in office supplies, or a competitive rate put out by your competitors, keeping a vigilant eye on the factors that could impact your budget will help you forecast changes proactively.

Have contingency business budget plan in place

When it comes to corporate budgeting, staying cautiously optimistic and abundantly realistic is the only way to ensure that your business is prepared for the unexpected. Having a ‘Plan B’ or even a ‘Plan C’ in case of worst-case scenarios will keep you ahead of the curve than your competitors. Keep an eye out for any abnormality in market conditions and economic trends that can potentially jeopardize your business.

Related read: 7 effective budgeting tips for small businesses

How can Volopay help you in budgeting?

The main purpose of budgeting is to identify cost-saving avenues and optimize our expenses. For that, you need a spend management platform that understands your need for customizable budgeting tools that foster a cost-effective ecosystem within the business.

You can do that and then some more with Volopay real-time expense management software that automates workflows and integrates multiple budgeting tools and resources onto one universal platform.

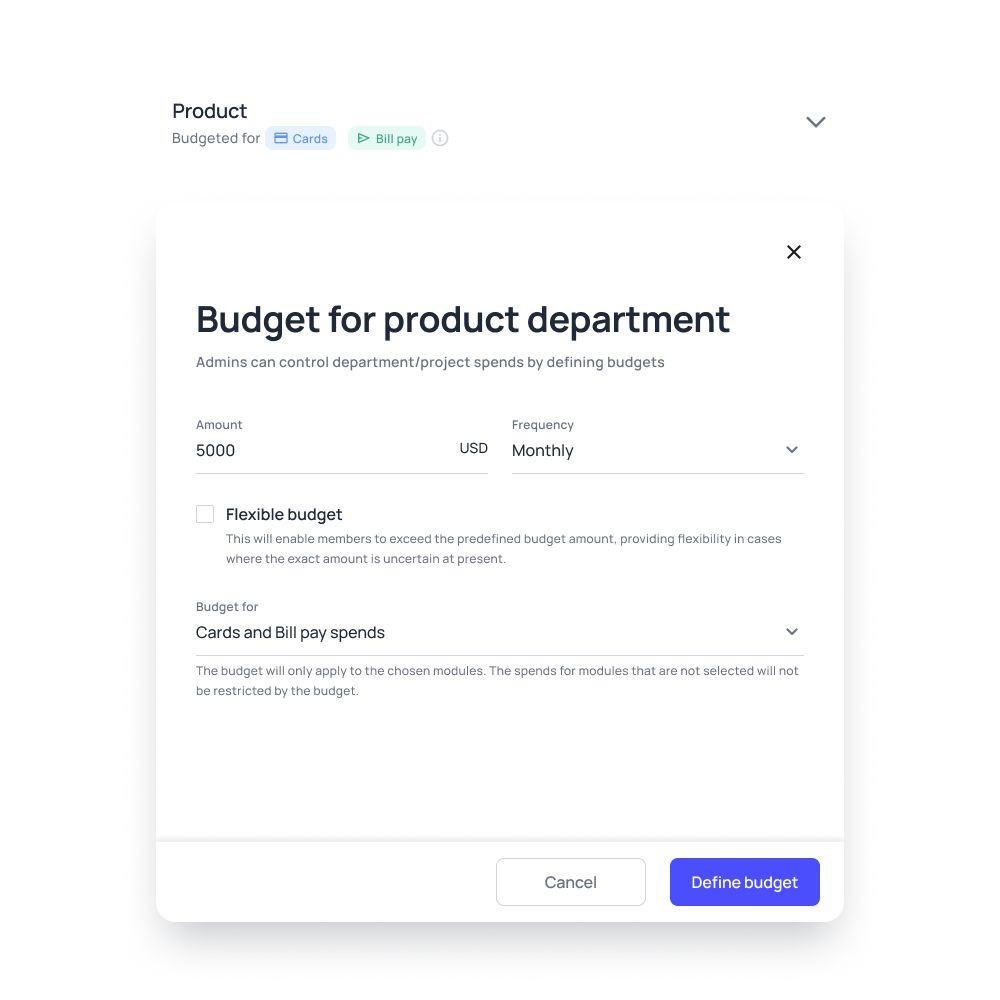

Set budget limit

Volopay comes with an innovative and customized in-built department feature that allows admins to manage spending in a more granular fashion on a departmental level or based on different events or projects. One department’s format does not fit every expense category.

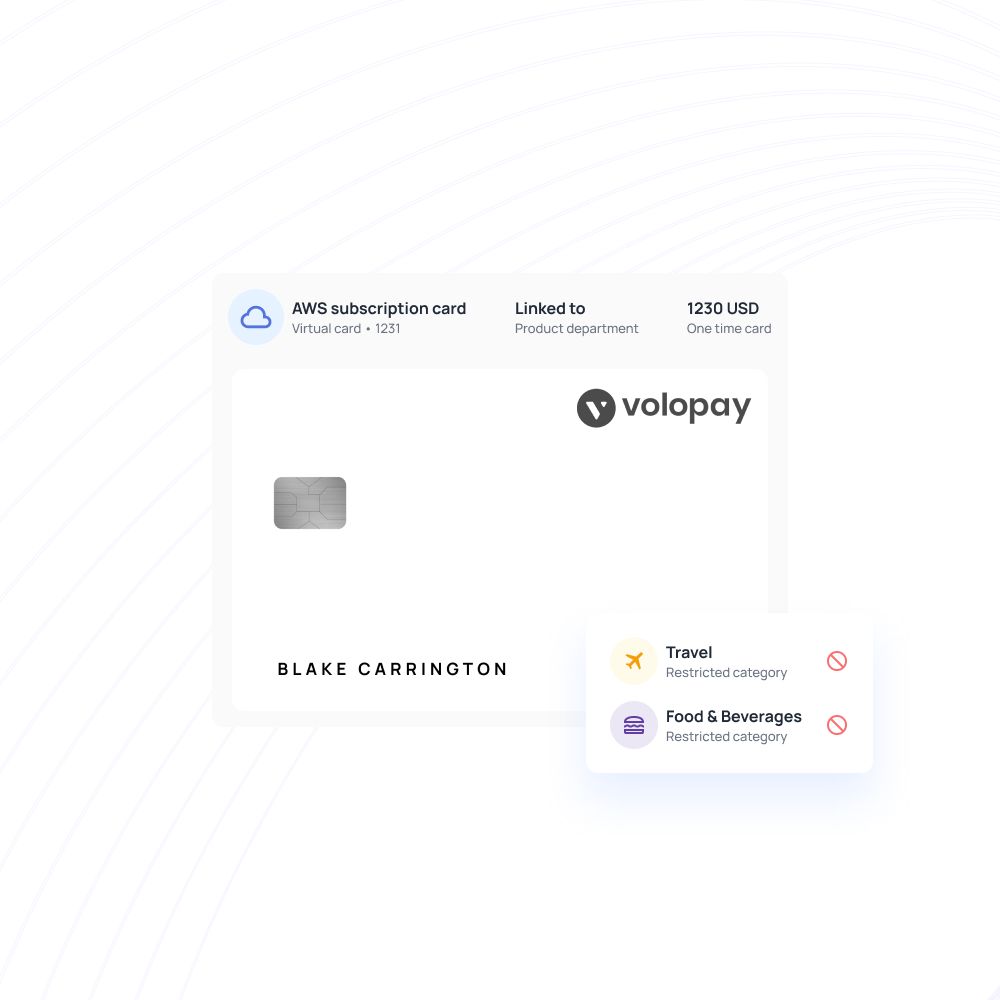

Volopay offers dual card modes: ad-hoc for those one-off types of payments or a recurring mode that needs to get replenished after every specific cycle. Simply create a physical or virtual card for an employee in the department they belong to, set the mode and the spending limit.

Eliminate frauds

If an employee goes over the spending limit, our software notifies you in real-time, giving the rein of budgetary control back into your hands. Volopay also arms you with the tools to safeguard your company’s finances.

In case of fraudulent activity, instantly block or freeze a specific card, until you get the all-clear. And when the time to create your departmental budget report comes along, all the necessary information is available in a centralized database, accessible from anywhere and seamlessly integrated with your pre-existing accounting software.

Trusted by finance teams at startups to enterprises.