7 effective budgeting tips for small businesses

What are the budgeting tips for small businesses?

The biggest takeaway from managing a small business is learning business budget planning and handling monthly business expenses. Budgeting is creating a plan to spend the business money for a certain period. Business budget planning will help you estimate what expenses you can carry out with your money.

The goal of making a business budget is to make better financial decisions and focus on the most essential expenses for the growth of your business. This way, you avoid unnecessary expenses and thereby save money.

Budgeting for business owners can sound like a complex and intimidating task. But with a clever business budget, you can tackle even any uncertain situation that may come your way. Budgeting becomes indispensable for small businesses because they can quickly get into debt without taking the proper steps. If the company’s hunger to grow is rightly handled with a sharp budget, you can save yourself from cash flow difficulties and meet your goals.

What is business budget plan?

A business budget is the overall ensemble of financial plans to follow not to exceed the spending limit. A business budget plan is an action where a group of people (finance team) figure out the company’s budget based on their financial outcomes and future goals for monthly business expenses. A small business budget is even simpler than this but holds more importance. The result of this process throws light on expenses and revenue prediction of a specific time in the future.

It is the CFO, or any executive who is equivalent to that oversees the process and approves the budgets. As small businesses are limited in staffing and might not have a CFO, it falls under the business owner’s control or anyone with finance and budgeting knowledge. Lack of proper monitoring is why small business budgets are in need of accuracy and reliability.

The contribution of the accounting department is also noteworthy as they provide insights from monthly business expenses and the previous quarter’s spending. Through this strategic financial management and budget planning, a company can solve many financial bottlenecks.

Tips for creating better budget for your business

Make sure all expenses are included

If you look at your monthly business expenses, you can distinctively categorize them into three categories.

● Fixed costs

● Variable expenses

● One time expenses

Fixed costs are recurring expenses that you pay every month after month - employee salary, office rent, electricity and internet bills, software subscription fees, office maintenance, and insurance.

Variable expenses are those that occur repetitively, yet you wouldn’t be able to predict them due to their dynamic nature. Examples are transportation, marketing, and advertising costs, tax, and office supplies.

One-time expense is an investment that you make concerning your business. It can be an equipment purchase or refurbishment costs. While creating budgets, you cannot avoid any of this, and your accounting team should make sure that every type of expense is captured.

Overestimate expenses

Keeping a flexible and overestimated budget can help small businesses big time while running a business. As a small business, you might not have the safety net that big companies have to protect themselves from unanticipated expenses.

Owing to the lower capital amount small firms have, underestimations in the small business budget can hit hard. On the other hand, you can save money and enhance cash flow when the actual expense is lower than expected.

Determine and understand your risks

Let’s not forget that the whole budgeting process is an estimation based on assumptions. We cannot deny that every line of the budget is associated with an equal amount of risk. It can surpass or shortfall the estimated line.

Do a risk assessment and ask questions on each line to understand what made the personnel quote the amount. Prioritize based on the impact that budget is going to bring about. Get more insights on each critical line to make your forecast more accurate. Perform detailed risk management on your budgeting to identify and mitigate risks.

Understand your industry

Prices and expenses vary from one industry to another. Sound knowledge about industry and cost standards is mandatory to become a contributing member of the budgeting team. Otherwise, there are chances of false or low estimation, which can break your capital.

Take the advice of an accountant

Accountants are well-enlightened about budgeting and expenses. They understand expenses deeply as they process credits and debits of the company and possess adequate knowledge about taxes. They can contribute even better to creating small business budgets.

Create a budgeting team

Creating a budgeting team can make way for a more accurate estimation of expenses. This team can solely analyze accounts payable and receivables to conclude how much budget is to be allocated.

Constantly revive your budget

Your first worksheet cannot be your final budget plan. Be ready to make necessary tweaks here and there based on its performance and your accounting team’s inputs.

How does budgeting software help create better business budget?

1. Generate financial reports and analysis

Financial reports are data sheets that carry the overall financial performance of a company, including its expenses, income, profit, taxes, etc. Conventionally, accountants use spreadsheets and computing software to create budgeting strategies. This method is both time-consuming and complex to work on.

With budgeting software, you don’t have to work on anything as it automatically generates financial reports, pulling them out of your accounting software. You can do it within a snap of a finger, and the data will be 100 percent accurate.

2. Cash flow planning

Cash flow planning is vital to find out if they have enough cash flowing in and out in the future to make sure they can still handle business expenses. Through cash flow projections, you can determine the running cash your business will have in different periods in the future. Cash flow planning is an integral part of budgeting, and the business budget app can do that simultaneously for you.

3. Revenue forecasting and analysis

Revenue forecasting is an estimation of how much revenue your business will make, either monthly or quarterly. Prediction of sales and revenue for the coming years can help you make the budgeting plan and make informed decisions in your small business budget.

For a small business, knowing the forecasted revenue is crucial to plan the allocation of resources and identify which area to invest in. With some historical data, your small business budget app can generate revenue forecasting reports in no time.

4. Real time budget tracking

Budgeting doesn’t end after making your business budget. You have to constantly go over it to identify if you are sticking to the budget and if there are any overruns. If done manually, there is a lot that you can miss. But budgeting software gives you the liberty of real-time budget analysis. It can let you know before there is a mishap or deviation. A business budget app can provide these insights by being in constant sync with your accounting and payment applications.

5. Reporting and analytics

A budget analysis report is an overview of every budgeting decision made and the actual expenses spent for that item. The accounting team usually causes this after the end of the budgeting quarter. You can also create this out of the business budget app as well. It will make clear if you were able to follow the budget or overspent the money.

How can Volopay help businesses in budgeting?

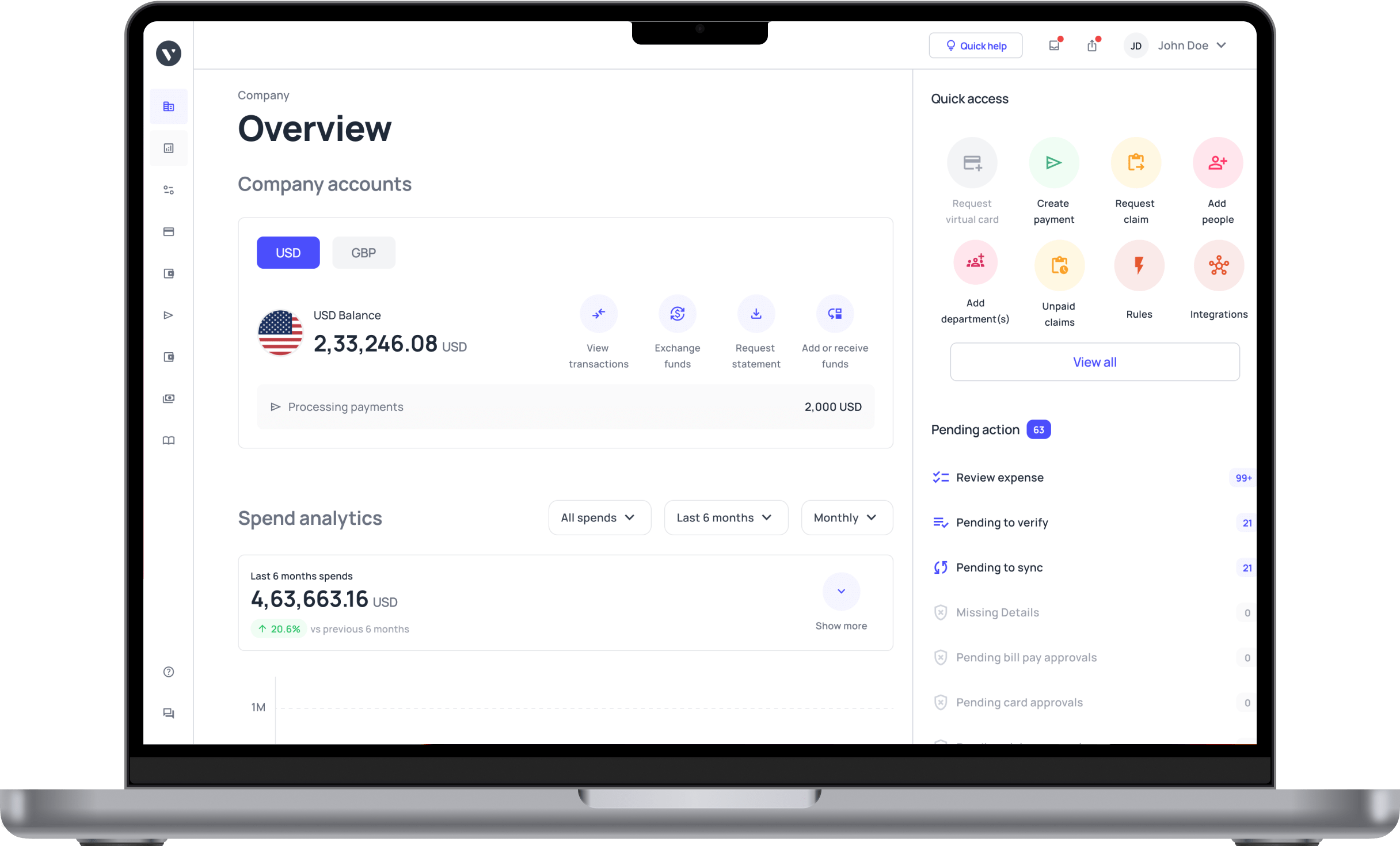

Volopay budgeting software is a sophisticated platform that can help you plan and track the budgets of every department. The interface is visually aiding by showing if the budgets have exceeded or not through color-coding. You can create budgets for each department or sector and assign the amount based on its payment cycle, whether a one-time or recurring expense. You can add owners and members who will monitor the budget for not crossing the limit.

Post creation, you can associate these budgets with corporate cards (both physical and virtual), which you can later use for spending. Following is a scenario explaining how this works. You create a budget for employee travel allowance setting $500 as the budget amount, and you add accountants as budget owners here. Later while creating virtual cards for your employees to utilize this money, you can map this travel allowance budget. This way, you can track if the budget has been rightly spent or overspent in real-time.

Budgets also work while making a vendor payment through your business account. Once the budget has been set, both employees and accountants can only use up to the preset budget for a specific spending element. If they have to exceed, the budget owner should approve. So, every expense you do through Volopay’s spend management system is directly recorded into the budgeting app giving the budget owner complete control over costs.