Beginner's guide to strategic financial management

Finance management is not just about making budgets, setting spending goals, and managing the assets and liabilities of the company.

The goal of a finance team is to utilize financial resources to the most to conduce profitable outcomes. They need a roadmap to accomplish this efficiently. That’s where financial management strategies help.

Without this, a business will run out of funds to meet its long-term objectives. Strategic financial management is about increasing the ROI on each investment of the company to higher extents.

This guide is a must-read for financial managers and CFOs to understand what is strategic financial management and why they need it.

What is strategic financial management?

Strategic financial management is a guideline for financial managers to increase the market value of their organizations with available resources.

It guides us on how to align financial strategies with business goals and make decisions about asset usage.

Features of financial management strategies

Financial management strategies can be

• Well-structured principles that are also adjustable

• It varies and evolves over time, aimed at improving organizational performance

• Focuses majorly on the growth and profitability of the business

• Not based on fictitious but actual data where past data is analyzed using quantitative and qualitative financial practices

Goal setting process

There are two different approaches followed to set strategic goals for teams to strive for. Either a fast or smart goal-setting process is used.

Goal setting process promotes conversations, find workable strategies, and encourages stakeholder participation.

Smart goal-setting process — This traditional approach to goal-setting aids in creating goals that are time-bound, measurable, and fixed.

Fast goal-setting process — Opposite to the former, this involves creating goals that are dynamic, ambitious, by time.

Strategic vs. tactical financial management

Strategic financial management concentrates on long-term success, whereas the tactical approach has its eyes on short-term wins.

If a business follows strategic financial management, it creates goals based on what it wants to achieve in the ultimate future. That means it is even okay to lose some in the present.

Since the strategic type only deals with long-term plans, it doesn’t mind making modifications or compromises in short-term objectives.

With tactical planning, the team lays significant plans first and ideates short-term goals for frequent intervals. These short goals are the primary focus that is conducive to attaining what’s reserved as the big picture.

Companies choose either one of these, keeping the stakeholders in mind. Making rapid decisions with only long-term goals in mind can affect stock prices or the overall reputation of the company.

Though it only leads to a positive fruition, not all stakeholders will be okay with it.

The importance of strategic financial management

To stay on top of the competition and make progress toward achieving its long-term vision, a company should use its capital wisely.

Strategic financial management lays the foundation and teaches management how to steer teams toward that. It’s not only about resource management.

Other than setting targets to achieve, strategic management also aims to tackle challenges that may come the way. Instead of facing risks head-on, you will have risk mitigation strategies that catch them before it spreads.

There are other guaranteed benefits too.

1. Understanding your available capital

Capital is not just the monetary value of funds available. It also includes assets or any value-adding component your business owns. That includes your savings, machinery, properties, and funds from investment sources.

This available capital fuels day-to-day operations smoothly. Hence, it’s important for any business to know the value of capital they have in reserves.

Available capital also serves its purpose at any point in time when a business operates. This cumulative value of capital can help while measuring the growth of your business and its assets.

Strategic financial management is very much needed for evaluating capital as it reveals where a business stands right then.

2. Recognizing your credit and loan needs

As you know the available funds, it’s easier to compare your business goals and see what’s needed more.

To start your production and buy the materials needed, you need funds. Understanding your available resources help you how far you can fuel your operations.

The rest of the funding requirements can be matched with obtaining a business loan or credit. Now you can easily measure how much money will be needed to accomplish your goals in the near future.

Depending on your business structure and funding needs, you can choose the financing type. The obtained funding can be strategized and spent effectively on business operations in an effort to yield maximum outcomes.

3. Strategic vs. tactical financial management

Strategic financial management concentrates on long-term success, whereas the tactical approach has its eyes on short-term wins.

If a business follows strategic financial management, it creates goals based on what it wants to achieve in the ultimate future. That means it is even okay to lose some in the present.

Since the strategic type only deals with long-term plans, it doesn’t mind making modifications or compromises in short-term objectives.

With tactical planning, the team lays significant plans first and ideates short-term goals for frequent intervals. These short goals are the primary focus that is conducive to attaining what’s reserved as the big picture.

Companies choose either one of these, keeping the stakeholders in mind. Making rapid decisions with only long-term goals in mind can affect stock prices or the overall reputation of the company.

Though it only leads to a positive fruition, not all stakeholders will be okay with it.

4. Expense control

No matter how planned you are and how accurate your budgets are, unpredictable expenses can easily creep their way up. To employ cost control and improve profitability, strategic financial management strategies are required.

Sharing a detailed budgeting plan for each team and enforcing strong controls can reduce overhead expenses. It gives finance managers a chance to revise their expense policies to suit the present needs.

Employee travel expenses are often uncontrollable in smaller organizations with weak reporting options. That can be overcome by setting strong and explicit policies along with automated expense reporting software.

5. Maximizing your ROI

Knowing what goes in and comes out makes you aware of your current financial state of affairs. Every investment your business makes will be financially quantifiable.

Also, you can choose the best among the available options when you know how you can invest. With cost control strategies, your expenses can be reduced.

This way, you can maximize the return on your investment and grow your business. When finances and business goals are aligned together, you can create high-yielding outcomes (higher sales and revenue generation).

Based on this ROI, you can set a benchmark for your teams and keep striving for more.

6. Making beneficial financial decisions

Financial decisions cannot be taken out on a whim. A CFO needs to perform data analysis, go through previous expense reports, and use advanced analytics tools.

When empowered with all of this, they can come up with solid financial decisions that benefit the company. These are decisions that bring great results and generate higher revenues.

As CFOs receive 360-degree visibility into their accounting, they can find out poorly-performing sectors and do the necessary.

No weak sections are hidden from their attention or need someone to point out. Thorough expense analysis leads to strategic decision making contributing data-backed, powerful decisions.

7. Recognizing financial challenges

Small businesses face tons of financial challenges throughout their way. From lack of funds to neck-deep debt repayments, the financial challenges they encounter are countless.

Identifying the problems ahead will give you more time to work on a fix. Unless there is strategic financial management, there is no final fix for this.

You will face both internal and external financial challenges. Internal challenges can be about the new pricing plan you plan to introduce or cash flow limitations.

External challenges include an increase in raw material costs or having to alter marketing strategies due to beat a new competitor.

8. Resilience and a stronger work culture

A well-planned financial strategy will equip you with tools and techniques with which you can combat these internal and external financial challenges. Otherwise, you get caught up in the mess where it’s too late to respond to a challenge.

That postpones other growth plans you had for the moment. Your employees can work in a relaxed environment where there are contingency plans and strong risk management practices in existence.

With strategic financial management, you foster a culture that’s well-resilient and flexible to environmental, legal, and market-level shifts.

The elements of strategic financial management

Financial management denotes the management of financial resources a business owns. In other words, it’s about how a business invests its wealth and manages the income that comes out of it.

The head person who oversees the activities related to this is the financial manager. Their job is to make budgets, analyze spending, invest the company’s assets and resources, identify cost-saving opportunities, and carry out negotiations with suppliers.

They also collaborate with the company’s top management to make major decisions and work with the accounting head to supervise payables and receivables.

Financial management strategy means the maximum utilization of resources to get maximum benefits to improve profit ranges.

Financial planning and goal setting

Strategic financial planning involve understanding what your company stands for, what its values are, and what it strives to achieve in the future.

Only when you truly comprehend this, can you create tangible and transparent financial goals.

Such goals minimize tension and controversies at all levels of the organization and unite everyone together (stakeholders, employees, and leadership) to achieve them.

Every year there must be annual financial planning where strategic goals are set or renewed from the last few years.

Without goals to chase, it’s a hazy path to follow forward. And what if there is instability? No one would know what to prioritize and how to clear the mess.

To progress the company in any intended direction, strategic goal-setting must be done by observing past years’ data. These goals also must align with organizational goals and objectives and deal with the effective allocation of resources.

The financial goals that you set will be about managing cash flows, increasing margins, increasing or stabilizing revenue, setting budgets, and more.

• A good strategic goal will help you

• Actively map the available resources to the running and future projects

• Avert risks and be actively ready with mitigation strategies

• Make strong short-term and long-term budgeting decisions

• Devise metrics to measure the success of these goals for every department

• Bring IT, marketing, operations, and sales in one line and enable coordinated working.

How your strategic goal should look like?

• Measurable - a goal cannot be vague and exist only in papers. There must be parameters to measure its success. Only when you can put a number around it can you measure where you are now in achieving them. Example of a strategic financial goal - Increase investing back into the business by 10%.

• Purpose-driven - A goal must be able to push the team’s effort in one direction. You must ensure that these goals are in line with achieving the ultimate vision of your company. Every business has its purpose for existence. Only when they design goals around it, they can outperform their plans.

• Specific - You can even set goals like increasing revenue or reducing costs. But they are not specific. It passes no clear information. That means no single team can take accountability for accomplishing that. One example of a specific goal can be - Reducing air travel costs by 50% or tripling sales in the next quarter.

Building a P&L statement

Making a profit and loss statement also falls under strategic financial management. By gathering your financial records together, you make the P&L statement. This is to understand how much profit you are making and what losses are incurred.

What is a P&L statement?

A profit and loss statement is a document that showcases the income and expenses of a definite period. It has to be made frequently to understand how close your business is to the target revenue.

Usually, it’s made annually or quarterly. Also, this document is very different from a balance sheet that records all expenses, equity, assets, and liabilities.

Why does a business need a P&L document?

A P&L statement is required to

1. Track profit and losses from time to time and, notice improvements.

2. show the income and expenses together. Hence cash flow at a certain point can be predicted. Thus future expenses can be planned when the cash flow is high.

3. Demonstrate how and when to make maximized profit.

4. Draw an indicator of the company’s financial health and performance.

5. Show banks, investors, and financial institutions as proof of your financial stability and obtain financial assistance.

6. To forecast revenue of the upcoming year and set financial goals and targets.

7. Identify tax obligations.

8. Find and curb unnecessary expenses and thereby boost profit margins.

What parameters does a P&L statement help to find?

• Direct expenses of a business that’s needed to manufacture the product (material cost, wages, utility costs)

• Indirect expenses (marketing and advertising costs, taxes, and administration costs)

• Gross profit obtained directly from selling goods

• Net profit or loss (The difference between total income and expenses)

Strategic expense planning can be done only when you make profit and loss statements frequently.

Proactive and sustainable budgeting

Businesses make budgets are made to control overhead expenses. This has the roadmap for all departments on how to spend and what to spend on. If there is one element that connects to the core of all departments, then that is budgeting.

Proactive budgets are more efficient and prepared to sail through any calamities or turbulences and still keep the business on track.

Such budgets lessen the burden on finance teams as it has been made taking into consideration every strategic plan made in the above steps.

Proactive and strategic budgets sustain it till the end, helping you complete commitments successfully.

Why proactive budgeting is needed?

More often, budgeting sets off well but becomes reactive as the company starts implementing its strategic plans one after another. Before you can stabilize, you will be on the verge of overspending. Strategic budget planning can help you.

1. Achieve better results and help with sticking to budgets till the end of the fiscal year

2. Make perfect financial decisions and gives the finance team peace of mind

3. Think and plan every expense of the financial year according to the organized goals.

4. Tweak spending based on your budgets and goals

5. Compare the spending with the budget at the end of every spending period to see if you have stuck through

6. To smartly allocate whole available funds for operational costs, debt repayments, and emergency savings.

Taxes and compliance

Strategic financial planning also include tax management. This doesn’t mean planning or paying taxes. Rather it’s about having a holistic approach to save money spent on tax by efficient expense planning.

Traditional tax planning is all about reviewing tax exemptions and deductions available and utilizing them. By doing so, they just reduce the tax payments.

For example, if there is an exemption available for certain industrial activity, the business can find its scope and avail that.

But strategic tax planning will not just consider tax deductions available, but all facets of an organization like

• Business structure

• Employee benefits

• Protection of assets

• Estate planning, and succession planning of owners

Reviewing all the above aspects is necessary because if any of them gets affected by a tax change, others get affected too.

Why strategic tax planning is required?

1. To reduce tax liabilities and stay unstressed during the taxation period.

2. Save time during tax seasons and stay more efficient with maintaining records.

3. To stay compliant with changing local body tax regulations.

4. Planning major purchasing decisions according to the tax benefits (either before or after taxation) and not getting into purchasing during the wrong period,

5. To plan your business’s long-term wealth and growth.

6. To save more money that’s wasted on taxes and increase the capital that can be utilized for other activities.

Building your financial management strategy

We know the importance of strategic financial management now. How do you use your resources and accelerate your business growth efficiently?

To support your business activities, come up with foolproof growth strategies, and smoothen your entry into new markets, you need a flexible financial strategy.

Also, if you want to secure funding, you should provide a clear picture of your financial requirements and future plans to your investors.

Here is how you can create foolproof financial management strategies.

Analysis of historical financial records

In order to derive data-backed financial decisions, finance teams analyze historical data and old financial statements. Internal teams do this to monitor the health of the organization and see how it is financially performing.

Why is historical records analysis important?

Historical financial records act like a blueprint and guide them in making the right decisions in the future.

It teaches them to learn from patterns and how not to repeat the same mistakes. Also, there is a lot to understand about how those problems are fixed.

By adjusting the values slightly, the finance team can successfully project future budgeting plans. The old data can act like a benchmark, upon which you can compare the current goals and draw new metrics to follow.

What are the financial data from the past that are put to analysis?

• Balance sheets of the past two-three years

• Cash flow statements

• Profit and loss statement

• Income statements

• Other valuation statements'

All the above documents are mostly interconnected and talk about similar happenings.

How to analyze historical financial data to derive useful findings?

Most companies follow or have their own standards for recording the financial activities of the company. Hence, it’s easy for the analyst to compare and cross-verify documents.

There are three techniques that are commonly used to analyze financial data from the past.

• Horizontal analysis

• Vertical analysis

• Ratio analysis

Building a business budget

At this stage, you will have enough data findings that can help with making sharp business budgets. Budgets are usually designed for longer time periods, like a year, or half-yearly. But you can also have monthly and quarterly budgets to boost the efficiency of resource usage.

Why should you build a budget?

A strategic business budget is needed for the following reasons.

1. To support the operational expenses without exhausting your working capital.

2. To maintain cash flow in a positive way and plan timely payments.

3. To face unexpected challenges and manage to get out of it.

4. To not get into debt or clear the existing debts quicker and thereby have a good credit rating.

5. To fund your growth activities that can help in scaling up your business.

How to build a business budget?

Strategic budgeting involves preparing budgets that align with the long-term objectives of the company. Your long-term goals usually take more than two or three years to pan out.

But a budget serves a lesser period of time. Hence, it’s important to create budgets keeping in mind the long-term goals of your business.

Deriving budgets from the goals set is not an easy process. We do that with a step-by-step approach.

• Objectives - These are the long-term strategic goals that you have developed for your business.

• Strategy - These are the guidelines for your company on how to achieve them.

• Measurement - To evaluate how close are we to achieving the goals.

• Target - The last stage when we get closer to the end which marks the last stage of goal accomplishment.

Now, every team will have its own objectives and strategies and need budgets to catalyze that. To design a budget for them for a short period of time, you must,

1. Predict the cost required for the short duration based on analyzing expenses data from the past.

2. Find out the activities they are required to perform in the short period and allocate funds one after the other.

3. Repeat the same step for the next quarter or budgeting period and create multiple budgets that can lead them to achieve the ultimate goal.

Track your spending and expenses

There is no way you can find out if your budget works or not unless you measure and track the expenses. Now to do this on a mass scale, you will need a lot of help.

Imagine a company with 10+ departments, each having 10 different categories of spending. That takes a lot of pen and paper and math for one measuring attempt.

How to measure the expenses of a company?

There are many ways to do it.

1. Old school methods that involve pen and paper. Let’s not use this as it involves plenty of numbers and can take forever to finish.

2. Spreadsheets - You will import your accounts payable data from statements and other payment systems and fill them in a sheet. Even if this is a copy-paste task, you must be careful while pasting and calculating.

3. Lastly, payment applications. If your business has an integrated payment system, you can track your expenses right there by going into the history. Modern accounting applications like Volopay allow real-time payment tracking, which you can do anytime, anywhere.

4. These applications automatically group and categorize expenses, so you can easily download reports for better understanding. This up-to-date information can be shared with anyone in charge of finance within an organization.

5. There are stand-alone budgeting applications too. They will get access to your payment history and plot curves to show if your spending harmonizes with the budget.

Automate your financial processes

For the finance team, there are so many core tasks to do. And if they keep performing repetitive and time-taking administrative activities, it’s going to shift their attention from the above strategic planning works.

That’s why it’s important to automate the financial processes to increase business finance and accounting efficiency and leave the hard jobs with technology.

Why automation is required in accounting and finance?

1. To prepare financial management strategies, you require up-to-date and accurate data, which automation can help with.

2. To make tracking and monitoring easy.

3. To streamline the toughest accounting tasks and not waste much around them.

4. To make data-driven financial decisions with reliable and anytime access to financial data.

5. To stay compliant with the regulatory requirements on how to record and store accounting data.

6. To reduce fraud and keep your sensitive information away from predators’ eyes.

What financial tasks can be automated?

1. Invoicing and expense management - This includes the end-to-end cycle of invoicing from receiving it to making the payment to syncing it with GL.

2. Payroll and expense reporting - Timely payouts can be made possible with payroll applications and corporate credit cards for employees.

3. Core bookkeeping tasks - Sadly, still many small businesses rely on inadequate practices and have very little data in hand to make decisions. With advanced bookkeeping and integration techniques, this gap can be matched.

4. Accounts receivable - Payments received from different methods and modes can be integrated and coordinated through one platform. This will also have invoicing software that generates invoices and payment reminders.

While automation is necessary to minimize manual work, integration is what is needed to connect all applications that perform different tasks together and work as a team.

There are all-in-one suites available for accounting and finance tasks. But there are chances of losing out or more core features that you will badly need.

Also, for every additional module you want to use, it will require an upgrade, which means additional expenses. So, you need fully functional applications that are affordable and also should offer everything they can.

This is possible only when you select modern cloud-based applications with open APIs that allow connection with other applications.

Use Volopay for your strategic financial management

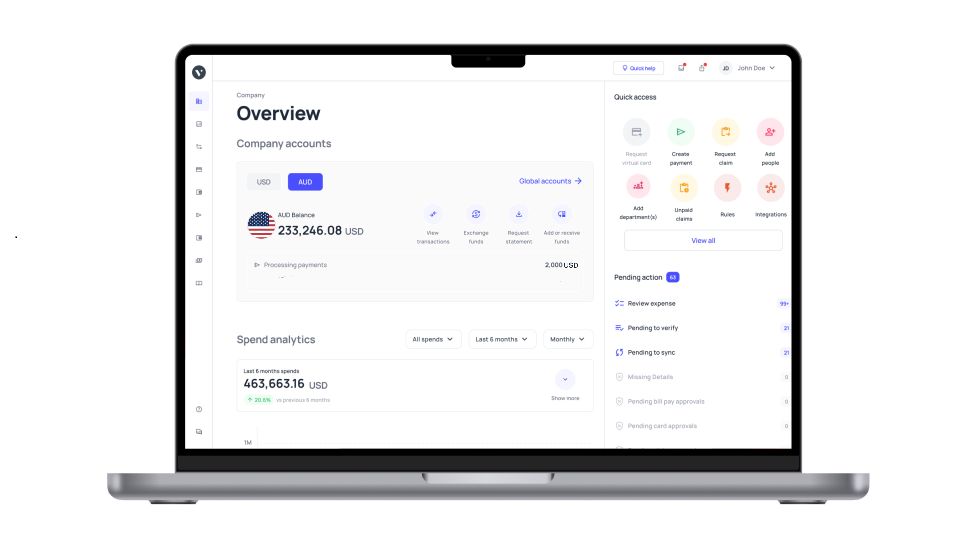

We have seen how the integration of applications is essential for collaborative financial management. With that, let’s discuss how Volopay can be a tool to strengthen your strategic financial management.

To begin with, Volopay is an expense management system that can automate your entire accounts payable process. Here is what it can do for your business.

Timely payments

Volopay has safe and fast payment windows through which you can make vendor payments on time. You can make both local and international payments and schedule them ahead too.

Centralized payment management

You must be able to see every payment that you make in the same place for stress-free tracking. That is possible with Volopay.

You make all business payments in one place and also have a real-time view of where your money goes every single instant. Periodical tracking is very important to have an idea if your budget works or not.

Budgets and departments

To use your allocated funds effectively, you need a budget, which you might have already made. With Volopay's business budgeting software, you can easily upload your budgets within the app for each spending category.

Every expense that you make will be internally tagged to a departmental budget. That’s how you can measure and analyze how your budget works and also have an idea if an exhaust happens.

Corporate cards

Volopay's corporate cards are what your employees need for a relaxed business trip experience. You can create unlimited virtual cards with Volopay and manage them from a single location.

These cards also work great for strategizing and making SaaS subscription payments. There are recurring cards that can be set in a way to dispense payments at the same time every month.

Financial insights

Other than the accurate, timely expense data it presents, you can also receive insights into your spending habits. You are able to choose a spending category or a time period or even a vendor and see every payment made.

This is shown visually for better understanding. No graphs or complicated spreadsheet formulas are needed.

Finally, Integration

Volopay comes with integration abilities using which you can connect to your bookkeeping applications like Xero or Quickbooks.

It doesn’t require any programming skills. Once you connect, you can sync and feed your payment data instantly to your GL with a click.

And that’s how Volopay offers you a comprehensive set of tools needed to automate accounting management.

When you are equipped with the right technology, your progress toward achieving your strategic goals will be faster and more impactful.