Features to look for in business expense tracker

The outflow of cash for any company will have constant increments as it grows. With this comes the need to track and monitor expenses. Be it for maintaining financial records or for audit purposes, knowing where, why, and how much of your money is being spent on what is important to growth. This is where a business expense tracker comes into play.

What is business expense tracker?

Traditionally, your accountant or finance team would tally all expense reports and receipts manually in a book or on an Excel sheet. This process is time-consuming and prone to human error.

A business expense tracker, however, automatically records expenses in real-time, providing a more accurate and efficient method of tracking. These trackers are often part of a larger expense management system, linked to business expense cards. Financial controllers gain full visibility into employee spending by connecting the tracker to these cards.

Every time an employee makes a purchase, the transaction is automatically recorded in the expense management software, ensuring that all expenses are accurately tracked and easily accessible.

Types of business expense trackers

Managing business expenses efficiently is crucial for maintaining financial health and ensuring smooth operations. Whether you are a small business owner or manage finances for a large enterprise, choosing the right expense tracker can streamline your processes and reduce headaches.

Below are a few of the different types of business expense trackers and their key features.

Manual expense tracker

Definition

A manual expense tracker involves recording business expenses by hand, usually on spreadsheets or in physical ledgers. This method requires entering each transaction individually, ensuring that all financial data is logged accurately. Despite being labor-intensive, it allows for a high level of control and customization, making it ideal for those who prefer hands-on financial management.

Pros

● Customizable

You can tailor your tracking system to fit specific business needs without being constrained by software limitations.

● Cost-effective

There is little to no cost involved, aside from materials or software like Excel.

● Data control

Full control over your financial data, with no dependency on third-party software.

Cons

● Time-consuming

Manually entering and organizing expenses can be tedious and prone to errors, especially as the volume of transactions grows.

● Limited analysis

It’s challenging to generate comprehensive reports or insights without extensive manual effort.

● Lack of automation

No features like automatic data entry, receipt scanning, or integration with bank accounts, making it less efficient for larger businesses.

Automated expense tracker

Definition

An automated expense tracker utilizes software to record, categorize, and analyze business expenses with minimal manual intervention. These tools often integrate with bank accounts, credit cards, and other financial systems to automatically capture and categorize expenses, providing real-time financial insights. Automated trackers are designed to streamline the expense management process, offering features like receipt scanning, reporting, and integration with other financial tools.

Pros

● Efficiency

Automates data entry and categorization, saving time and reducing human error.

● Real-time insights

Provides up-to-date financial data, helping with quick decision-making and better cash flow management.

● Scalability

Suitable for businesses of all sizes, with features that grow with your business needs.

Cons

● Cost

Subscription fees for premium software can be expensive, especially for small businesses with limited budgets.

● Learning curve

It may require time to learn and adapt to the software, especially for those unfamiliar with digital tools.

● Data security

Storing sensitive financial information in the cloud or on third-party servers raises potential security concerns.

Benefits of business expense tracker

A business expense tracker is more than just a tool for recording transactions; it's a powerful resource that can streamline financial management and enhance overall business efficiency.

By leveraging the right features, businesses can gain deeper insights, improve cash flow, and simplify complex processes.

1. Real-time data monitoring

Real-time data monitoring allows businesses to keep track of their financial status as transactions occur. This feature provides instant visibility into spending patterns, helping business owners make informed decisions quickly.

It eliminates the lag between expense occurrence and recording, enabling proactive management of finances and preventing budget overruns before they become significant issues.

2. Automated data entry

Automated data entry reduces the manual workload by capturing and inputting transaction details directly from bank accounts, credit cards, or receipts.

This feature minimizes the risk of human error, ensuring accuracy in financial records. It also frees up time for employees to focus on higher-value tasks, boosting productivity and efficiency across the organization.

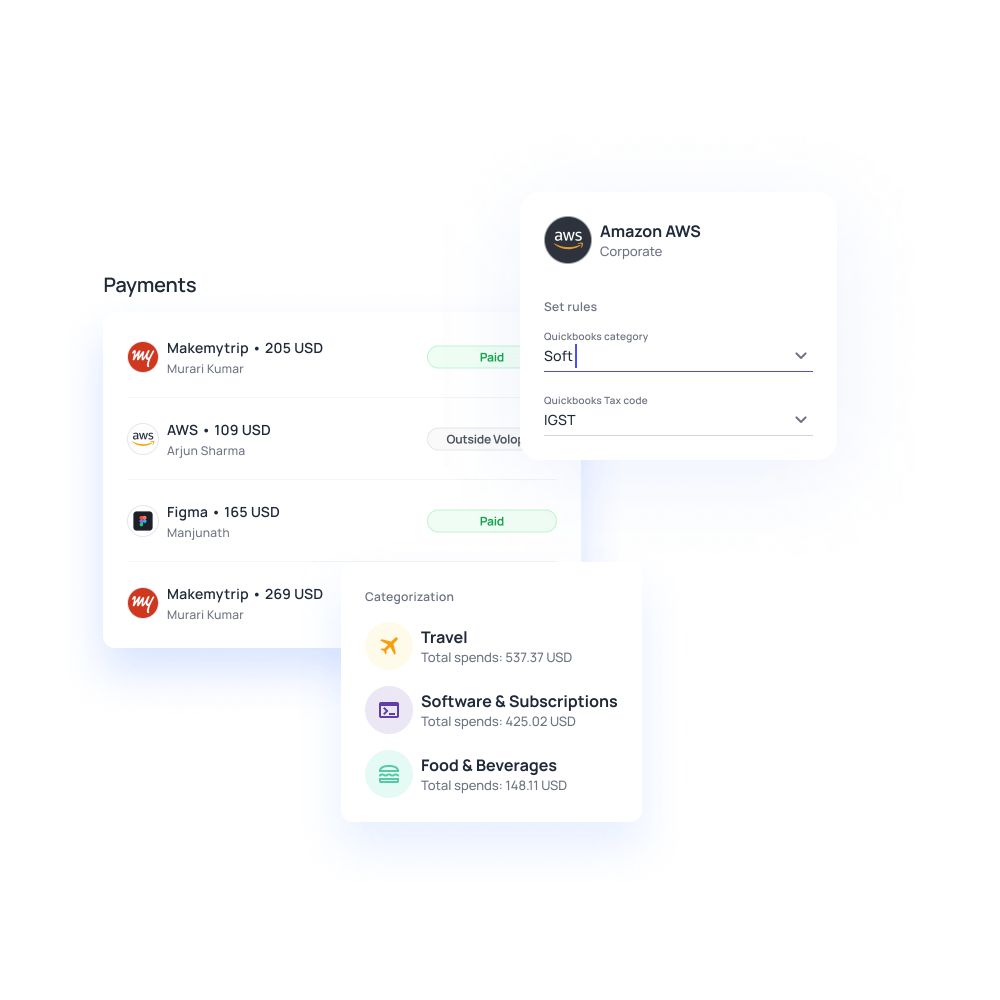

3. Detailed expense categorization

Expense categorization is crucial for understanding where your money is going. A good expense tracker automatically categorizes expenses based on predefined criteria, making it easier to identify trends and areas of overspending. This level of detail helps businesses allocate resources more effectively and adjust spending strategies as needed.

4. Simplified expense reporting

Expense reporting becomes a breeze with a robust expense tracker. These tools can generate detailed reports with just a few clicks, providing insights into spending habits, budget adherence, and financial health.

Simplified reporting not only saves time but also enhances transparency, making it easier to share financial data with stakeholders or auditors.

Related page: How to create an expense report for your business easily?

5. Faster reimbursements

An efficient expense tracker can expedite the reimbursement process by streamlining the submission and approval of expense claims. Employees can submit their expenses digitally, and managers can quickly review and approve them, leading to faster payouts. This improves employee satisfaction and reduces the administrative burden of handling paper-based claims.

6. Smarter budgeting and financial planning

By providing a clear view of expenses and trends, an expense tracker aids in smarter budgeting and financial planning. Businesses can set more accurate budgets based on real-time data and past spending patterns, allowing for better resource allocation and financial forecasting. This proactive approach helps in avoiding cash shortfalls and ensuring financial stability.

7. Improved cash flow management

Effective cash flow management is essential for any business, and an expense tracker plays a key role in this. By monitoring expenses closely, businesses can better manage their cash outflows, ensuring that they have enough liquidity to meet their obligations. This leads to more stable cash flow and reduces the risk of financial strain.

8. Simplified tax compliance

A business expense tracker simplifies tax compliance by organizing and categorizing expenses in a way that aligns with tax regulations.

This feature makes it easier to identify deductible expenses and generate accurate tax reports, reducing the risk of errors or audits. Simplified tax compliance also saves time during tax season, allowing businesses to focus on growth.

9. Integration with accounting systems

Integration with accounting systems is a valuable feature that ensures seamless data flow between your expense tracker and your broader financial management tools.

This integration eliminates the need for manual data transfers, reducing the risk of errors and ensuring that your financial data is always up-to-date and accurate. It also streamlines processes like reconciliation and financial reporting.

Key features to look for in a business expense tracker

Choosing the right business expense tracker is essential for maintaining financial efficiency and control. The right tool can simplify complex processes, enhance security, and ensure smooth financial operations. Here are the key features to consider when selecting an expense tracker for your business.

Receipt scanning app

A receipt tracker or being able to attach a receipt with every expense that is made using the corporate credit cards is a feature that you should make sure is part of the business expense tracker.

Having the ability to do so will save your finance team a lot of time which is spent in collecting, sorting, and matching receipts with expense reports. Giving your employee the ability to directly attach a receipt within an expense claim makes it super simple for financial controllers to carry out the reconciliation process.

Related read: Benefits of receipt scanning app for your business

Mobile app

Every employee in your company will have a different smartphone. The two major platforms being Android and iOS, you’d want to make sure that the expense tracker you’re using has an app available for both these operating systems.

If not, it could cause problems and incur extra costs for your business to get an employee a phone that supports the expense tracker app.

Integrating with accounting software

This is a crucial feature to have for a business expense tracking app. A major reason why expenses need to be tracked is so that they can be entered into the company ledgers. And this can only be done once all expenses are matched and reconciled to be genuine and authentic.

If the expense tracker can integrate directly with the accounting software you use, it helps the finance department match and reconcile all expenses faster and sync directly with your company books for accounting purposes.

Sync with credit cards

As mentioned earlier, a business expense tracking app is usually a part of a bigger expense management tool. Part of this ecosystem is corporate credit cards that are provided to every employee to carry out their daily expenses.

So a sync with these cards means that each transaction conducted through them is automatically recorded in real-time on the expense management platform as an expense record. This is visible to the employee who made the purchase as well as all the admins of the platform.

Mileage tracking

A mileage expense tracker feature allows employees to claim reimbursements for travel expenses. When an employee has to travel to a place for business purposes using their private vehicle or personal funds, they can claim reimbursements based on the distance traveled.

The company can preset an amount per mile. The employee, later on, must submit their receipt and add the miles traveled to claim their reimbursement.

Ease of use

While not a feature, how easy an expense tracker app is to use will surely decide whether your company adopts it or not.

Ease of use has many factors such as the learning curve required for employees to use it, how beneficial it is to your finance team, does it actually make the expense management faster, and so on. Depending on your organization’s needs and requirements, choose an expense tracker that will give you the most flexibility and value.

Simplified reimbursement

A good expense tracker should offer a streamlined reimbursement process, allowing employees to submit expenses quickly and easily. Features like mobile receipt capture, automated policy checks, and direct integration with payroll systems can speed up approvals and payments.

Simplified reimbursement not only saves time but also improves employee satisfaction by reducing the hassle and wait time associated with expense claims.

Set up multi-level approvals

For larger organizations or those with complex structures, the ability to set up multi-level approvals is crucial. This feature enables you to create a hierarchy for expense approvals, ensuring that spending is reviewed and authorized by the appropriate personnel before it is finalized.

Multi-level approvals add an extra layer of oversight, helping to prevent unauthorized or excessive spending.

Sync with business accounts

Synchronization with business accounts is a vital feature that allows for real-time tracking of expenses. By linking your expense tracker with company bank accounts, credit cards, and other financial platforms, you ensure that all transactions are automatically recorded and categorized.

This reduces manual entry, minimizes errors, and provides an up-to-date view of your financial status at all times.

Security and data protection

Given the sensitive nature of financial data, security, and data protection should be top priorities when selecting an expense tracker. Look for features like data encryption, secure cloud storage, and multi-factor authentication to safeguard your information.

Compliance with data protection regulations, such as GDPR or SOC 2, is also important to ensure that your business and customer data are secure.

Cost-effectiveness

While advanced features are important, the cost-effectiveness of an expense tracker is a key consideration for any business. Evaluate the pricing structure whether it’s subscription-based, one-time payment, or usage-based to ensure it fits within your budget.

Consider the long-term benefits and potential savings the tracker offers by reducing administrative costs and improving financial accuracy.

Customer support and updates

Reliable customer support and regular updates are essential features that ensure your expense tracker remains functional and up-to-date. Look for providers that offer responsive support channels, such as live chat, email, or phone assistance.

Regular software updates are also crucial, as they introduce new features, improve functionality, and address security vulnerabilities, keeping your system running smoothly over time.

Expense insights

Tracking your company expenses within one platform should give you the ability to monitor and control them. Since your financial controller is the one who will be allotted funds to every department, as an admin you’ll be able to see which team is utilizing their budget and to what degree.

You get even deeper expense insights when you’re able to see exactly how much and on what each employee is spending.

Related page: Advantages of using expense management analytics

Challenges of implementing business expense tracker

While a business expense tracker can greatly enhance financial management, implementing one is not without its challenges. Understanding these potential obstacles can help you plan more effectively and ensure a smoother transition.

Here are some common challenges businesses face when adopting an expense tracker.

Integration challenges

Integrating a new expense tracker with existing systems can be complex, especially if your business relies on multiple platforms for financial management.

Compatibility issues may arise, requiring custom solutions or additional software to bridge gaps. These integration challenges can lead to delays, increased costs, and potential disruptions in your financial processes, making it crucial to choose a tracker with robust integration capabilities.

Data entry errors or missing data

Despite automation, data entry errors or missing data can still occur, particularly during the initial setup or when transitioning from manual processes.

Inaccuracies in categorizing or recording expenses can lead to financial discrepancies and misinformed decision-making. Ensuring data accuracy requires diligent setup, regular audits, and employee training to minimize these errors and maintain reliable financial records.

Cost of implementation

The cost of implementing a business expense tracker can be a significant barrier, especially for small businesses or startups. Beyond the software purchase or subscription fees, there may be additional expenses for setup, customization, and ongoing maintenance.

Weighing these costs against the expected benefits is crucial to determine if the investment will deliver a positive return for your business.

Providing training for employees

Introducing a new expense tracker often requires providing training for employees, which can be time-consuming and disruptive.

Ensuring that all users are comfortable with the new system and understand how to use it effectively is vital for successful implementation. This training process may involve additional costs and temporarily reduce productivity as employees learn the new system, but it is essential for long-term success.

How to select the ideal business expense tracker for your business?

Selecting the right business expense tracker is crucial for effective financial management and operational efficiency. With many options available, it’s important to choose a tool that aligns with your specific needs and business goals.

Here’s a guide to help you make the right decision.

1. Assess your business requirements

Start by assessing your business’s unique needs and challenges. Consider factors such as the size of your company, the volume of transactions, and your current expense management processes.

Understanding these requirements will help you narrow down options and focus on trackers that are tailored to your business's specific circumstances.

2. Identify must-have features and functionality

Once you understand your needs, identify the key features and functionality that are essential for your business. This might include automated data entry, integration with accounting software, multi-level approvals, or robust reporting capabilities.

Prioritize these must-have features to ensure the expense tracker you choose will effectively support your financial management processes.

3. Evaluate integration capabilities

Ensure that the expense tracker can seamlessly integrate with your existing systems, such as accounting software, payroll platforms, and bank accounts.

Strong integration capabilities are essential for minimizing manual data entry and ensuring that your financial data is consistent across all platforms. This will also make it easier to implement and manage the tracker over time.

4. Consider scalability and flexibility

As your business grows, your expense management needs will likely evolve. Choose a tracker that is scalable and flexible, allowing you to add more users, features, or functionality as needed.

This ensures that the tool will continue to meet your needs as your business expands, avoiding the need for costly replacements or upgrades later on.

5. Focus on user experience

An intuitive and user-friendly interface is critical for ensuring that employees can easily adopt and use the tracker.

Consider the user experience for both the administrators and the end-users who will be submitting expenses. A well-designed tool will reduce training time, increase user satisfaction, and minimize errors.

6. Factor in cost considerations

Evaluate the cost of the expense tracker in relation to your budget and expected return on investment. Consider both the upfront costs and any ongoing expenses, such as subscription fees or maintenance charges.

Balance these costs against the features and benefits offered to ensure you’re getting the best value for your money.

7. Read reviews and seek recommendations

Gather insights from other businesses or industry peers who have used the expense trackers you’re considering.

Reading reviews and seeking recommendations can provide valuable information on the tool’s performance, reliability, and customer support. This real-world feedback can help you make a more informed decision.

8. Check provider credibility and support

Investigate the credibility and track record of the expense tracker provider. Look for companies with a strong reputation for reliability, security, and customer support.

Ensure that they offer adequate support channels, such as live chat, phone support, or dedicated account managers, to assist you in case of issues or questions.

9. Request a trial or demo

Before making a final decision, request a trial or demo of the expense tracker. This allows you to test the tool in a real-world setting, evaluate its ease of use, and see how well it meets your business needs.

A trial period also gives you the chance to involve key stakeholders and gather their feedback before committing to a purchase.

Automate your expense tacking with Volopay

Track business expenses easily with Volopay

When you choose to onboard with Volopay, you’re not just opting for a business expense tracker, but an entire expense management system. As an admin, you’ll get the ability to assign every team with a certain budget each month and also control how much every employee can spend using their corporate expense management card. All the transactions that take place using the physical or virtual Volopay cards get recorded on the platform in real-time giving you complete real-time visibility and keeping things transparent.

Using the expense tracker app, your employees will also get the option to attach their expense receipts directly to these recorded statements using the Volopay app. This way, they won’t have to create expense reports at the end of each month and your finance team will not have to sit and sort through all this data to match and reconcile expenses.

1. Streamlined expense reporting

Volopay simplifies the expense reporting process, allowing businesses to generate detailed reports with just a few clicks.

This streamlined approach saves time and reduces the administrative burden on your finance team, ensuring that all expenses are accurately tracked and categorized. With Volopay, you can quickly access insights into spending patterns, making it easier to manage budgets and financial planning.

2. Real-time transaction recording

With Volopay, all transactions are recorded in real-time, providing you with up-to-date financial data whenever you need it.

This feature allows for immediate tracking of expenses, giving you a clear view of your cash flow and enabling quick decision-making. Real-time transaction recording helps prevent discrepancies and ensures that your financial data is always current.

3. User-friendly experience

Volopay offers a user-friendly interface that makes it easy for employees and finance teams alike to navigate the platform. The intuitive design minimizes the learning curve, allowing users to quickly adapt and start managing expenses efficiently.

Whether you’re submitting expenses, approving transactions, or generating reports, Volopay’s interface is designed to make the process as smooth and straightforward as possible.

4. Integration with accounting systems

Volopay seamlessly integrates with popular accounting systems, ensuring that your financial data flows effortlessly between platforms.

This integration reduces manual data entry, minimizing the risk of errors and ensuring consistency across your financial records. By connecting with your accounting software, Volopay helps streamline reconciliation and financial reporting, saving you time and effort.

5. Employee reimbursement

Volopay simplifies employee reimbursement by allowing expenses to be submitted and approved digitally.

This efficient process speeds up the reimbursement timeline, ensuring that employees are promptly compensated for their out-of-pocket expenses. The platform’s automated workflow reduces the administrative burden and ensures that reimbursements are processed accurately and quickly.

6. Multi-level approvals

Volopay’s multi-level approval feature allows you to set up a hierarchical approval process for expenses, ensuring that all transactions are reviewed and authorized by the appropriate personnel.

This added layer of control helps prevent unauthorized spending and ensures that expenses align with company policies. Multi-level approvals are customizable, allowing you to tailor the workflow to fit your organization’s needs.

7. Employee spending control

With Volopay, businesses can easily implement employee spending controls to manage and monitor expenses effectively. You can set spending limits, restrict certain types of expenses, and receive alerts for transactions that exceed predefined thresholds.

These controls help ensure that spending remains within budget and in compliance with company policies, reducing the risk of financial mismanagement.

FAQs

Tracking business expenses is essential for accurate financial management, ensuring that spending stays within budget, and providing insights that inform better business decisions.

Business expense trackers typically offer strong security measures, including data encryption, secure cloud storage, and multi-factor authentication, to protect sensitive financial information.

Yes, many business expense trackers integrate seamlessly with popular accounting software, ensuring that your financial data is consistent and easily accessible across platforms.

Yes, many business expense trackers offer mobile apps, allowing users to manage expenses, submit receipts, and monitor spending on the go.

A business expense tracker helps with budgeting by providing real-time insights into spending patterns, allowing for more accurate budget planning and better financial control.

Yes, many business expense trackers are equipped to handle international transactions, support multiple currencies, and provide tools for managing global expenses.

Business expense trackers are typically scalable, offering features that can expand as your business grows, such as adding users, increasing transaction volumes, and integrating new systems.

Yes, expense trackers help with compliance and auditing by organizing and categorizing expenses, generating detailed reports, and ensuring adherence to financial regulations.

Yes, Volopay offers comprehensive expense tracking features, including real-time transaction recording, automated reporting, and integration with accounting systems, tailored for efficient business financial management.

Yes, Volopay supports businesses with international operations by offering multi-currency support, international transaction capabilities, and tools to manage global expenses seamlessly.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free