Guide to simplifying your sales expense reporting

Sales teams are at the front of an organization’s growth efforts. Sales bring revenue and revenue brings growth. However, while sales contribute to organizational development it too must be kept in check. Sales expenses are only a part of the process and they are bound to become a problem later if not taken care of with haste.

As your business continues to grow so will the number of clients your sales teams will be meeting every day. As you grow so will your sales expenses. To ensure these expenses don’t get out of hand you need a system in place. This system needs to be adept at tracking sales expense reports, verifying them, and reimbursing the same effectively.

Common sales expenses that you should know

Sales expenses are the costs incurred by your sales department throughout the process of selling your product. These expenses can cover a range of different transactions. Before you start working on streamlining your sales expenses you need to first get acquainted with what they are. While the nuances of sales expense will differ from company to company there are general categories that most companies work with.

General sales expenses

- Sales team management costs

- Travel expenses

- Client entertainment expenses

- Trade show costs

- Sponsorship deals

- Sales administrative staff salaries, benefits, and bonuses

- Training and development costs

- Recruitment expenses

- Commissions owed to sales executives

Subscription based sales expenses

- Sales software subscriptions

- Customer Relationship Management (CRM) software subscriptions

- Email Marketing software subscriptions

- Cold calling software subscriptions

- Expenses incurred for sales campaigns

- Telephone and internet charges

Manage your sales spending with advanced expense reporting

Challenges of manual expense reporting

The manual expense reporting process is infamous for the number of obstacles that come with it. Tracking, reconciling, and reimbursing sales expense reports manually means hours of labor and a huge scope of mismanagement. Here’s what makes manual expense reporting so challenging:

Delay in reimbursement

Manual reimbursements can take anywhere around a month, sometimes even longer to be processed. Starting from the point where employees have to submit physical receipts along with their expense claims to the point of actual reimbursement is a very time-consuming process.

Finance personnel needs to waste a lot of time running around employees, gatekeepers, and other individuals just to get an expense verified. Moreover, delayed reimbursements also do not do any good for your overall employee morale.

Data inaccuracy

Inaccurate data can derail an entire expense reporting process. Business expenses need to be recorded without any errors or mistakes. However, manually recording data also brings with it the guaranteed presence of human errors. It is only natural for people to make mistakes and the same goes for your finance personnel.

Verifying and recording data stored on physical receipts, expense claim forms, and general ledger is a mammoth task. Manually managing it can spell disaster for your expense data.

Complicated expense policies

While expense reporting policies are important they are not, however, very useful when they are complicated, especially if your system is manual. Policies that employees do not understand or do not have access to are never going to be able to serve their purpose. Complicated expense reporting policies are even harder to implement when your system is manual, employees are bound to violate guidelines or overspend without even realizing it.

Duplicate details

The problem of duplicate invoices being issued, double or duplicate payment of previously paid invoices, and such other instances of duplication is common in manual expense reporting systems. Employees are bound to make errors, record information incorrectly, or just forget they’ve already processed an invoice - these are scenarios that are common with manual expense reporting.

Time consuming

Given the fact that in a manual expense reporting system expense claims have to go through multiple layers of checks and approvals, it’s obvious that the process is going to be time-consuming.

Finance personnel has to manually read each expense claim form, match it with receipts and other proof of purchase, confirm approval and follow several other steps before they can finally reimburse an expense. This is still given that the system moves uninterruptedly. If, however, you hit a snag in the middle consider that another few hours added on.

Related page: How to create an expense report for your business easily?

4 ways to simplify your sales expense reporting

Have clear expense policy

Sales executives often fail to abide by company t&e expense reporting policies because they find the policy documents hard to understand, or simply because they couldn’t find them. While policymakers themselves might not find the policies to be complicated, it’s not always the same for your employees.

Setting clear-cut, easy-to-understand policy guidelines can go a long way in helping you simplify sales expense reporting. Accessible policies are much more likely to be followed by those who will be using them in the first place - your sales executives.

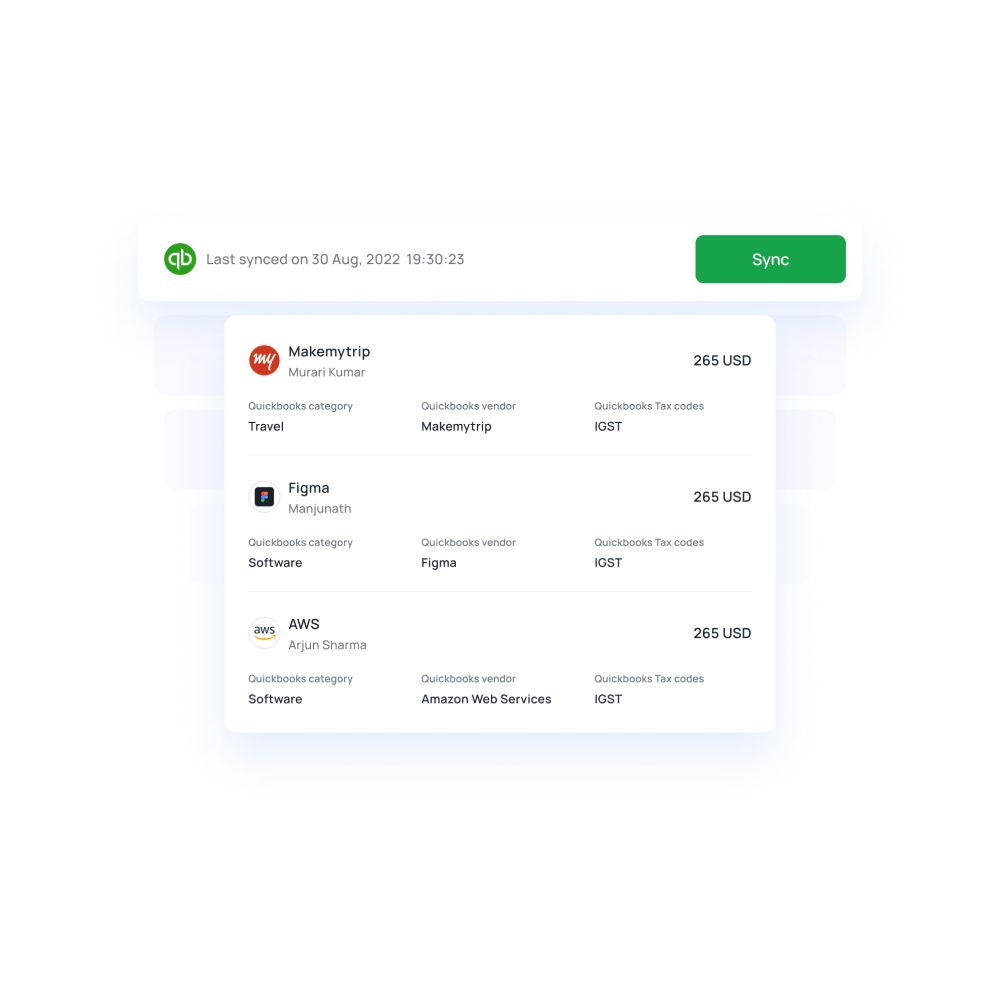

Digitize receipts and invoices

You can eradicate all expense reporting obstacles that arise out of receipts and invoices by digitizing your invoicing system. Issues such as duplicate invoices, double or missed payments, and erroneous recording of invoice data are all the outcomes of manually managing invoices.

Now, with the help of Optical Character Recognition (OCR), the software can read and store all the data on your receipts and invoices without making any mistakes or errors. Besides, all receipts and invoices uploaded to this software are stored safely so that you never have to worry about missing documents again.

Allocate the budget

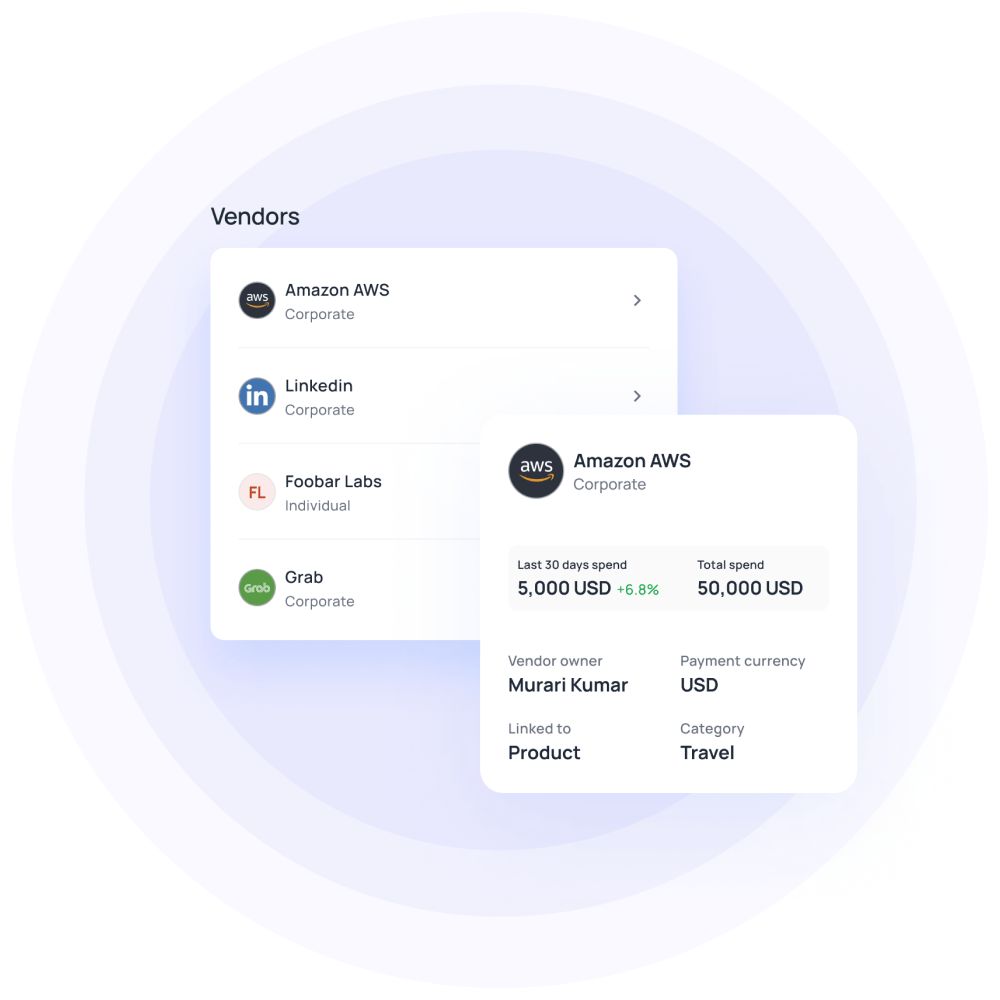

Sales expenses can come from a wide range of channels. Sales personnel often need to meet clients, travel to places, go out on dinners and incur many such out-of-pocket expenses in the course of their work. Tracking and managing all these expenses can become a burden on your finance teams.

Solve this problem by using a system wherein you can allocate budgets to individual expense categories. The budgeting feature of expense management platforms can work as a huge boost to expense reporting for small businesses. With these platforms, you can allocate customized budgets, request and receive funds instantaneously, and set parameters for their use.

Better visibility

A significant chunk of obstacles that accountants face with sales expense reporting comes from a general lack of visibility over operations. Manual expense reporting offers little to no visibility over business expenses. Switching to an automated reporting platform is your best bet in fixing this issue.

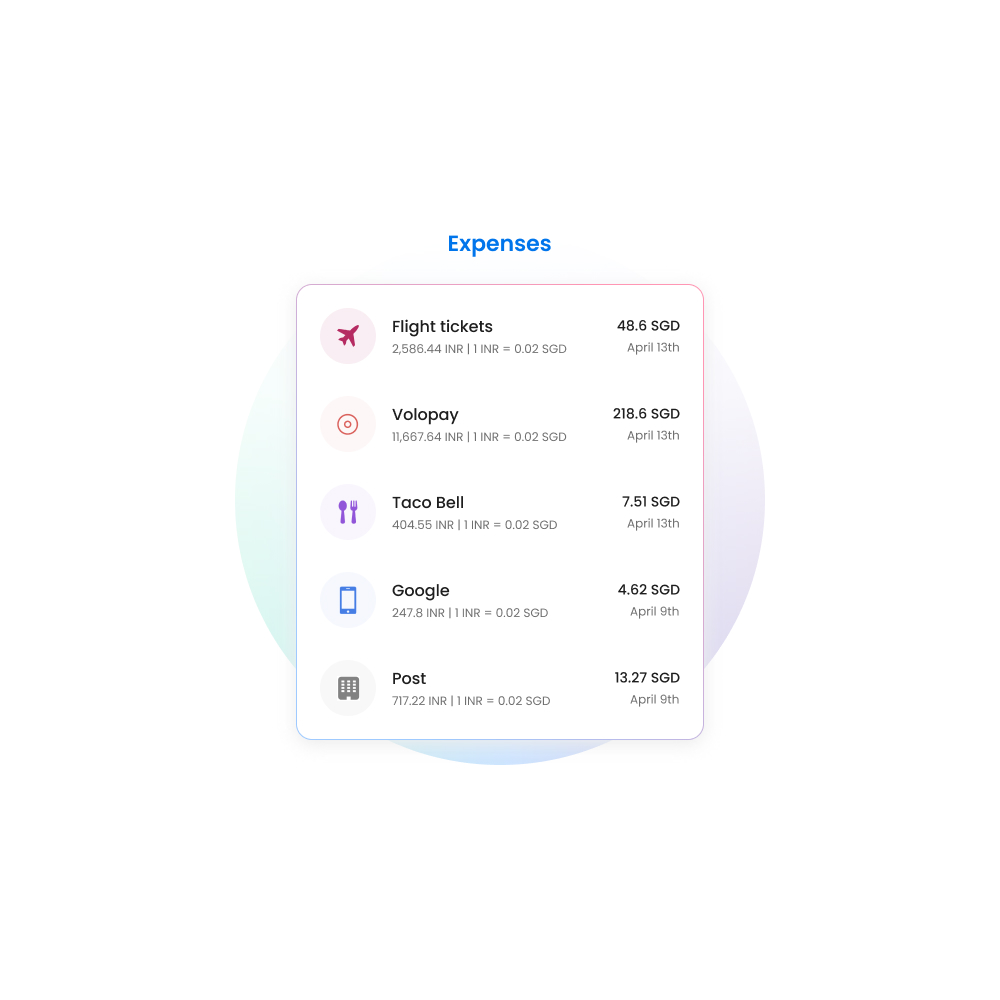

These platforms come fitted with dashboards that consolidate all expense tracking and reporting processes in one place. With these dashboards, you get an all-in-one control center from where you can see how and where your money is being spent. To be specific, these dashboards give you an overview of the status of your funds, the particulars of the expenses that have been incurred using these funds, and a lot more.

Automate sales expense reporting with Volopay

To get the best out of your sales expense reporting system all you need to do is automate it. There’s no doubting the fact that automation is the future of finance. This holds particularly for sales expenses, simply because sales teams are the ones that incur the most out-of-pocket expenses.

No longer do your employees have to wait for approvals on their expense claims. With Volopay's online expense reporting you can set up automatic approvals, custom approval workflows, and auto-flagging parameters for dubious activities.

In case you do suspect the possibility of fraudulent use you can instantaneously block or freeze the card from the Volopay platform. If your organization has multiple departments you can also set up custom approval policies for each of these departments or just have a default company-wide approval policy.

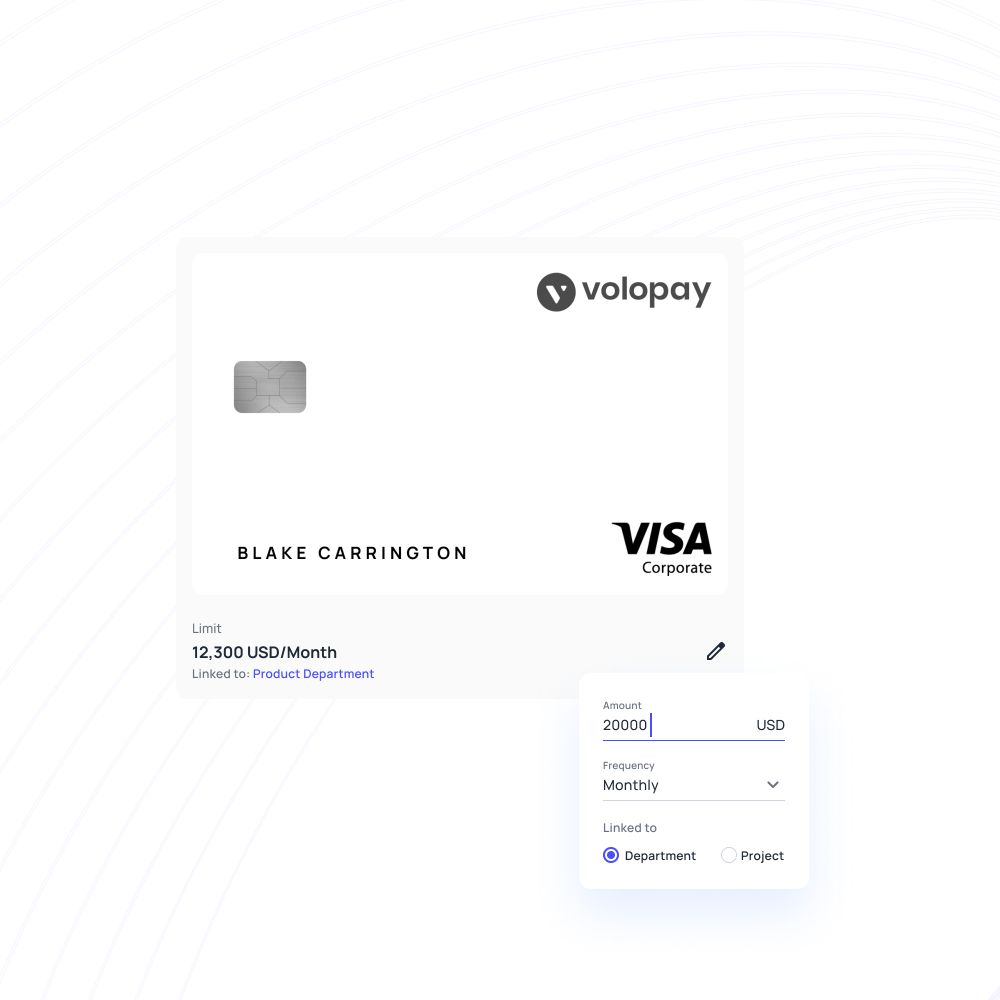

Corporate cards for sales expenses

Volopay offers cards that can be issued in both physical and virtual forms. In fact, you can issue unlimited virtual cards for as many different expenses as your salesperson might have to incur. What’s more, is that you can easily allocate the funds your employees need on these cards.

They can instantaneously request increases as well. You can also use dedicated cards with customized parameters for all your software subscriptions to set up recurring payments for them.

Real time expense reporting

Expenses made via these cards are reported and reconciled by the software in real-time. With real-time expense reporting, you can maintain complete visibility over all your sales expense activities and cater to special cases as soon as required. With Volopay ensure all your sales expenses are always managed efficiently. You can also automate your approvals.

Trusted by finance teams at startups to enterprises.