8 Step business budgeting process and best practices

Creating a business budget, implementing it, and abiding by it is a long and difficult process. Every new day brings new problems, new expenses, and new setbacks. As a result, you keep delaying the process of budget creation or don’t create it at all.

On the other hand, there is a whole complicated budget prepared in spreadsheets, where every tiny expense is accounted for.

Whatever be the case, it is vital for you to understand and grasp the concepts and techniques of the business budgeting process.

Even if your company has a budget, its effectiveness depends on your implementation and policies, which come under good budgeting strategies.

What is strategic budgeting process in business?

Strategic budgeting plays a key role in strategic financial management, helping businesses forecast complex spending patterns and revenue targets.

Business budgeting tools allow focusing attention on detailed data for easier allocation of funds, generation of greater revenue, and achievement of long-term targets.

A company’s budget goals mainly include:

• Growth and escalation

• Research and development

• Risk management

• Productivity and competence

According to your company, there may be other goals as well. Although, once your targets are set, the next step is to give attention to specific areas of the company budget and formulate a comprehensive spending plan.

All decisions related to corporate budgeting depend on the amount and quality of data available.

Usually, every company has its own ways of budgeting and achieving its targets.

However, there are some basic approaches to business budget planning - Top-down budgeting and Bottom-up budgeting.

What is bottom-up budgeting?

The basic definition of the Bottom-Up Budgeting Approach is when the budget is initially prepared by each department and then passed forward to the senior management.

The name itself suggests the point of origination of the budget and where the budget is eventually passed on, inside the company.

The process starts when each department clearly lays down and identifies the goals and objectives of the projects a particular department is planning to work on in the coming year and the associated costs for running the department.

After the department prepares its list of upcoming projects and the costs connected with it, everything should be combined into one single budget.

All the department budgets are then given to the finance department by each department’s head or project leads, for the creation of one whole budget for the entire organization.

Ultimately, the budget is then submitted to the company’s senior management for evaluation and approval.

It is advised that the management should discreetly check whether the budget is aligned with the values and goals of the company for the commencing year.

After the complete approval of the budget, the estimations are then sent back to the finance department which then further distributes the resources among various departments.

What is top-down budgeting?

This process is initiated by the company’s senior manager, who drafts a budget and passes it down to be followed by other employees.

So, the senior managers conduct a meeting, in which the intent or agenda is to outline the goals and objectives of the coming fiscal year. In doing so, they take into consideration and majorly utilize all the data available from the previous fiscal year’s budgets and financial statements.

Along with this, they also analyze that information parallel to the dynamically changing business models and market scenarios.

The steps of budgeting involve developing objectives for the business, the members of the senior management reviewing feedback from the different department heads, and the contributions made by each department in the previous financial year.

After the objectives are set and clearly recognized, the finance department steps in and works on integrating those objectives into a budget.

The work of the finance department is to create a budget by allocating or distributing funds among different departments in the company based on the previous financial year’s data and adjustments for the current year's target achievement.

Post the allocation process, the specific budget is then passed to specific departments and the responsibility to create a budget specific to their department is given in the hands of the department heads.

Every department-level budget must specify its aim and show how the allocated funds will be utilized to meet the revenue and profit goals. It should be very specific and precise in outlining each expense.

The last step involved in this budgeting process is the finance department combining all the department-level budgets and reviewing them to ensure that everything properly complies with the goals and objectives given by the management at the initial stage of this process.

However, some adjustments can be made according to the valid needs of some departments.

Once this whole procedure is successfully completed, the finance department must look over the performance of each department and make sure that everything is aligned to the budget constraints and the budget should be a guiding book for the management to make any amendments and allocate resources accordingly.

Different types of budgets in growing businesses

1. Master budget

Majority of the businesses begin with preparing a Master budget, which is the one where the entire coming fiscal year projections are predicted.

This budget includes forecasting for all the items which are accounted for in the balance sheet, income statement, and cash flow statement.

These predictions consist of operating costs, revenue, expenditure, expenses, and capital.

2. Static budget

A static budget is created by using numbers that are obtained from the planned output and input decided by the various departments of the company.

This is the first step of the budgeting method for businesses - identifying the funds and resources available with the company and how much will be spent in the upcoming financial year.

The major aspect that a static budget looks at is fixed expenses. These expenses are not dependent on production quantities or sales.

For example, the machinery cost would be a fixed cost and will have no variations because of changes in the sales quantity of the company.

There are industries and companies which use static budgets as the foundation or baseline or initial beginning point, and further, along the process, they make adjustments at the end of the fiscal year, if there is anything more or less required in the budget.

On the other hand, there are some industries such as non-profit organizations which acquire donations or grants, which in turn is their static budget and from that, they keep exceeding.

Economic forecasting techniques are used to establish realistic numbers while creating a static budget.

3. Operating budget

The expense and revenue generated from the daily business activities of the company are categorized under an operating budget.

This budget specifically focuses on the operating expenses of the company from the cost of the goods sold to the income generated from that.

Along with this all the overhead and administrative costs connected with the production of the goods and services sold daily are also considered under an operating budget.

However, the operating budget doesn't include items such as capital expenditures and long-term debt.

4. Cash-flow budget

The amount of cash that a company earns during a specific period of time is categorized under a cash flow budget.

The cash generated by the company is utilized to pay expenses and re-invest in the business hence a regular cash inflow and outflow is important.

For example, examining the account payable of the company, that is the money that needs to be paid to your vendors or suppliers, can be useful in the allocation of funds and forecasting what remaining money is there with the company.

A cash flow budget can help you in analyzing the past actions and make further decisions on the required changes and adjustments.

There may be times when a business is stuck with zero cash inflow and obliged to make payments, this is when that company can borrow a short-term working capital line of credit from the bank.

Along with this, businesses can also negotiate terms for flexible payment with their vendors, which can be a huge benefit during a negative cash flow period.

Why is budgeting important in business?

While running a business, it is common to get overwhelmed by the daily operations and problems, which may lead to a lack of attention towards the overall future picture of the company.

Between all this, you must be wondering how can budgeting help a business?

A smart business invests time in creating and managing a budget, allocating resources for optimum benefit, reviewing business plans, and observing financial scenarios to assess how the business is performing.

Company budgeting tools give you a clear picture of the capital available with the company, helps in estimating the expenditure, and forecasts revenue earnings for the future.

Through a company budget, you can estimate your business’s performance in coordination with the expenditure.

Additionally, you can also make sure that there are enough resources available to support the company’s growth and development through various initiatives.

Benefits of business budgeting also include reduced costs, increased cash flow, boosted profits, and better returns on investments.

The success of a business majorly depends on its budget because if you have no command over your spending or expenditure, any business plan would be a simple waste of time.

Also without a strategic budget, you won’t be able to identify your business objectives and the achievement duration.

Basically, a budget is a calculated plan which is formulated to:

• Make sure that the company is in a condition where the present business commitments can be funded

• Govern the finances of the business

• Facilitate the business to achieve its targets and make strong financial settlements or decisions

• Ensure that the company has enough funds for future endeavors

Small business budgeting tools present you with the opportunity to look at and control the financial situation of the company.

This, in turn, helps you to plan the business’s short-term and long-term expenses which may include the costs of increasing production levels, hiring new employees, etc.

A budget also brings together all the company members from the board of directors to the employees, so that everyone has adequate information on all the status updates and other important information regarding the business development.

There is no way you can ignore or underestimate the importance of budget.

Here are some points which clearly state the importance of strategic budgeting and business budgeting tools.

Be prepared for emergencies

Running a business is a risky and dynamic game, anything can change or take a turn at any time.

Hence it is essential to have a plan or a strategy to deal with unexpected business situations.

By creating a budget and implementing it, you can keep aside some money for urgent or emergency matters. This way you won’t have to cut down funds from other areas of the business operations.

Be a magnet for investors

A business with an organized and planned budget shows its commitment which a business without a budget may not necessarily be displaying.

Investors will only make a move for your company if all your funds are properly accounted for and distributed effectively between various departments.

Hence, when an investor would get a look at your business’s budget sheets and understand how much money is being spent and at what place, he/she will be more willing and confident in making an investment.

Set and achieve financial goals

To measure the growth of a company, there have to be some indicators of factors through which we can reach a calculated conclusion. One of these indicators is financial goals.

Every company must have financial goals, which when achieved can show how well a company did in that year and will the operations expand or be at a normal stage.

So, without a budget, the business owner may be completely oblivious of the company performance status, and only at the end of the year will he/she get information regarding the same.

A budget helps the business owner and all the shareholders to be aware of the business’s position, track the growth and development of the company and also analyze how the company funds being spent.

Set sales goals

Every business had some sales processes and strategies with a sales team looking over them.

A company budget includes all the sales expenses and also helps in forecasting how much sales you can expect in the coming years, what would be the profit earned from it, and in what timeframe.

Once you have all these statistics together and have some clearly established sales goals that are aligned with the budget, your business is a good fly.

Make bold financial decisions

Every business owner is responsible for making some big business decisions that have an impact on all the operations of the company.

To ensure that these decisions are beneficial and for the good of the company, a budget can be very handy. You will see that making important decisions with a budget makes the whole process easier.

From deciding to raise salaries to give bonuses to expanding the business, you can make an informed decision with a proper budget in place.

Pay off debt

One of the major benefits entailing a budget is to have enough funds to pay off debts.

A budget consists of the whole list of all the products and services being sold and each of their expenses and a line of other items for each expenditure, one of them is debt.

Till the time your business clearly follows the budget and everything is accounted for properly, paying debts monthly or quarterly won’t seem like a big task.

Easily prepare taxes

Having a budget can make the whole tax filing process much easier, no matter you do it on your own or hire a professional to do it.

As the budget has every tiny detail of the expense and income of the business, while tax filing you can save a significant amount of time and money.

Master budgeting with Volopay’s smart software

What are the steps involved in budgeting process?

A business budgeting process allows a company to strategize and prepare its budget for a given period of time, mostly one financial year.

Business budgeting process steps involve, analyzing the previous year's budgets, evaluating and forecasting the company’s revenue for the coming year, and managing team budgets by allotting funds to different departments through departmental budgeting.

After all, this is done, the senior management members of the company step in and give their input on the budget.

The budget managers and finance team combine everything together and create a final budget.

A company’s budget can be taken as a plan of action.

Steps of a strategic budgeting process help you set your priorities and targets for the coming financial year and divide the company’s financial resources in a manner that all the goals are successfully achieved.

1. Cost analysis

Before you begin the budgeting creation process, you need to have enough information and research related to the operational costs of your business.

A thorough knowledge about your costs gives you the baseline to create an effective budget.

If you create a temporary rough budget and later go on to realize that you need more money to run your business operations, this will completely destroy your business targets and growth.

Your budget should help you increase the business revenue and profit enough to support the business in expansion and growth.

Your budget should be divided into fixed, variable, one-time, and unexpected costs.

Fixed expenses could be machinery, rent, or insurance. Variable costs consist of things like commission and the cost of goods and services sold.

Even if you overestimate your costs, it is fine because you still need money to organize your future expenses.

If your business is fresh in the market, you must consider the start-up costs as well.

2. Cost negotiation with vendors

For this step to be useful, your company should be in business for more than a year and working in an industry that depends on its supplier to sell products and services.

Before creating your budget, it will be insightful to have a talk with your suppliers regarding their pricing and if there are chances of getting some discounts on materials, products, or services important for your business.

Negotiations give you the opportunity to build trustworthy vendor relationships which ultimately benefit in the form of positive cash flow.

For example, your business might be seasonal.

So when you have enough funds saved up you can pay your vendors in advance and this can be used as compensation for times when your business isn’t doing so well and you are unable to make payments.

The final goal is to create an efficient payment system that reduces your business cost.

3. Revenue estimation

A lot of businesses have struggled in the past by overestimating the company revenue and as a result, they end up borrowing more cash to keep the operations running.

Overestimation defeated the whole meaning behind creating a budget.

To have a realistic idea of the business revenue, it is advised to evaluate the past revenue data.

Tracking your business revenue should be a periodical process, like monthly, quarterly, or annually.

The previous year’s revenue data will be your reference point to set realistic revenue goals for the coming year.

The crucial step is to base your assumptions on prudential data to set practical goals for your company and eventually lead to a drastic improvement in the business’s development.

4. Gross profit margin determination

After the business has handled all its expenses at the end of the year, the remaining money you are left with is known as Gross Profit Margins.

It provides useful insights into the financial conditions and future change requirements for your business.

Consider the below example to comprehend the significance of Gross Profit Margin as a company budgeting tool:

Just assume that your business earned a revenue of $10,000,000 this year however, you still have to pay your debts.

At the end of the year, when you sit down to calculate your business profits, it turns out that your expenses were more than the revenue earned.

This means that the business did not do well and it is not a good sign for the growth of the business.

Now, your task would be to identify areas where non-benefiting expenses are being made and also find a way to eliminate those. O

ne of the best ways to do the same is by listing out the cost of all the goods or services sold and reducing that amount from the overall sales revenue. This information gives you the real picture of your business’s performance.

5. Cash flow projection

A company’s cash flow comprises two elements- vendor payments and customer payments.

It is important to strike a balance between these two in order to draw a cash flow projection for your company. Cash flow projection is an effective small business budgeting tool.

A great way to ensure that you get all your customer payments in time, you must have flexible payment terms and compatibility with all common payment channels.

Unfortunately, you will still have to deal with a small percentage of customers who might not abide by the terms and conditions, in which case your cash flow may be pulled back a little because of the missing payments.

To encourage your customers to pay on time, you can offer rewards on early payments or a grace period and also strict business policies on any late payments.

Along with this, it is absolutely important to keep some money allocated in the budget for ‘bad debt’, just in case a customer doesn’t pay at all.

Once you have an idea of the incoming cash flow, it will be easy to designate funds to employee salaries and travel expenses.

To make payments even easier, you can put aside some money to pay off your fixed supplier expenses.

After this, if you still have money left, you can put it into spending on business initiatives like new machinery or structural development.

6. Consideration of seasonal and industry trends

Achieving all your business goals and reaching a good estimate every month is a hypothetical or unrealistic situation.

Throughout the year, there are some months where your business is at the highest peak and then there are some months where sales are a little lagged behind.

This happens due to the seasonal nature of business. Inconsistency in the industry trends can have a bad impact on the business and may result in negative cash flow.

During these times, all the company funds need to be spent effectively so that the business doesn’t reach the verge of a break-even or shutting down completely.

To be prepared for such situations, while curating a budget assemble all the data to see in which months the business is performing its best.

Once you know the peak months, your aim should be to generate enough revenue during those times that it becomes easier for the business to stay afloat during the slower sales period or off-seasons.

For example, assume yourself to be the business owner of an air-conditioner company. Your products will be in high demand during the summer season, i.e, you will generate most of your revenue during this period.

However, for the rest of the winter season months, you can keep the business standing with the revenue earned from the summertime and also target to export your products to hotter countries.

This will help you assess how useful your products can be during the off-season and what should be the revenue expectations during the peak periods of the business.

7. Spending goals determination

Creating a budget doesn’t only mean that you have to add your costs and subtract them from your revenue. It is vital to know how well is the company fund being spent and how is the company doing with it.

Setting spending goals will help you maintain a system to check if the company funds are being spent at the right places and unwanted expenses are being avoided.

For example, if there is money being spent on unused office supplies for the marketing or operational division of the business, it is time to cut them off.

The saved money can then be put to better use like marketing campaigns, lead generation, revenue increment, etc.

Carefully calculate and invest in those areas or expenses from which your company can make more money in the long run.

8. Combining everything

Once you have completed all the previous steps and collected all the information, the last step is to put everything together and create your company budget.

Subtract your fixed and variable costs from the company’s income to get an idea of the funds available for carrying on business operations. Make sure that the budget also has some emergency funds kept aside for any unexpected expenses.

Now you are all prepared to use your money efficiently to achieve the company’s short-term and long-term goals.

4 business budgeting best practices

Here are some practices you can implement during the ongoing budgeting process.

Assumptions first, then numbers and figures

When you or anyone, in general, think about budgets, the first thing that comes into our minds is a whole lot of numbers, figures, and spreadsheets.

However, it is a suggested practice to first definitively lay down the base of budget, its purpose, and a reading guide manual for it.

This is because these assumptions help you reach calculations, which is somewhere more important than the numbers and figures, as these come secondary to the intent of the budget.

On that account, the first thing your budget file should show is the assumption of what product or services are going to be sold in the coming year, at what prices and volumes.

Along with these, the assumptions should also include driving factors of the company expenses, like marketing campaigns or the number of employees, etc.

The idea is to have both an operations and finance budget in hand, as both these are closely interwoven and ultimately boost the growth of your company.

Clear and measurable KPIs

A business budget for a small business must include variable costs sections. This section includes the overall goals and objectives of your company.

Keeping this in mind, you should execute methods to control your company’s expenditure and focus the funds towards top priority things. This will help you track your progress as the budget gets implemented throughout the year.

KPIs aka Key Performance Indicators can be vital in setting the direction of your company’s budget.

You can plan every small step, every tiny detail related to your business, along with focusing on the overall growth with the help of KPIs.

The only challenging part here is to determine what KPIs should be considered. The only precaution you must take while planning your company’s KPIs is that those should be easily measurable.

Some of the common KPIs included in the budgeting methods for business are:

• Sales and Marketing ventures

• Return on investment

• Operating cash flow

• Accounts Payable and Account Receivable

• Turnover Rate

The 3 classic don’ts

While following the steps involved in the budgeting process, there are some areas you should always be careful within any decision.

Here are some things you must avoid:

• Don't amplify the estimated revenue and profit

• Don’t forget taxes like state taxes, federal taxes

• Don’t forget the periodical nature of business– it may be going great one month and not so good in the other month

Timely review budgets

It is vital to understand the importance of a budget and review it. You cannot just make a budget and sit on it. It is crucial to check, analyze and make amends according to the changes that turn up as the year progresses.

This can help you notice flaws or errors in your plan and also understand the stability of your business.

So you can start by scheduling budget reviews periodically and as time goes along, you can consider the frequency of the reviewing because you see there aren’t many amends required, you don’t have to do it every month.

Through this, you may also discover that there are some hidden funds available you can allocate.

Business budgeting software for accounting and finance teams

A business budgeting software aims to automate and optimize your budgeting process so that the whole procedure takes less time and all the errors arriving from the manual labor of the finance team can be eliminated.

The processes need to be automated depending on your business type and how the employees and especially the finance team members function or operate.

Furthermore, whatever be the size of your company, a substantial small business budgeting software should have the following elements:

Spontaneous interface

One of the most crucial and elementary processes is that of analyzing and evaluating the budget statements.

However, it is not only the finance team that needs the budget for functioning, other departments and the management also require the budget for making further decisions.

This is why a budget has to be comprehensive and easy to comprehend at the same time.

A budgeting software creates the perfect budget interface which can instill efficient amalgamation of the different departments of the company.

Live expense tracking

If you have the facility of real-time budget monitoring, it gives you the assurance that you will always possess a clear understanding of how much is being spent where, and how is left.

This will not only protect you from going into losses but will also help you comprehend how your employees spend and what measures can be taken to optimize the company's spending.

Related read - Features to look for in business expense tracker

Cloud-based data

Your business growth can be seriously hampered if you are dependent on paperwork and separate spreadsheets for everything.

An online business budgeting software provides you with the feature to access your company budget anytime and from anywhere.

Cloud-based software also ensures that you never lose or misplace any documents or data.

Check this out - 7 benefits of cloud based expense management system

Process automation

Business finance budgeting can be easily streamlined. All the manual, slow and redundant tasks can be automated, which saves you a lot of time and money and also upgrades your company’s overall productivity.

The spared hours or days of the finance team means that the members can now focus their energies on other important tasks.

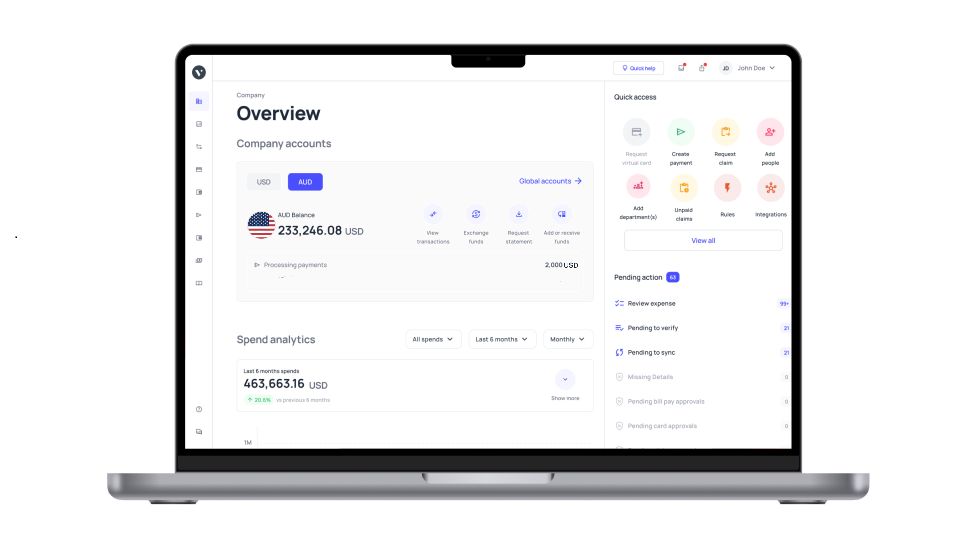

Volopay - Introducing modern business budgeting tool for your company

A smart business has a smart budget which helps in the profitable growth and development of the company.

An automated and strategically planned budget is the key to achieve all the business goals and induce prudential spending habits throughout the company.

Choose a budgeting solution that helps to improve your game with hassle-free and efficient budgeting tools.

Volopay is a simple, reputable, and chaos-free, business budgeting software through which you can:

1. Organize all the team budgets in one place

Forget depending on different spreadsheets to look over the budget of different teams.

With Volopay you can organize and consolidate all the budgets on one platform, so you can easily manage the spend amount and policies and also track every expense made by various departments.

2. Set up an approval workflow

While your teams are spending money on business operations, it is essential for the managers to have control and clear visibility over all the expenses.

Volopay’s budgeting tools consist of multi-level approval workflow management so that the heads can make a quick decision on every expense request.

The employees simply have to create a purchase or expense request which can be approved or denied based on its vitality immediately by the managers or financial heads.

3. Track everything with real-time visibility

Once a budget is formulated, it is important to track the company's spending.

Volopay gives you the facility to look over and control every expense with real-time visibility which shows when was the payment made, to whom and how much was it.

4. Automate the whole budgeting process

Updating every spreadsheet manually can be a nightmare. With Volopay you can integrate all your credit cards, budget policies, and expense terms in real-time, through which you have immediate access to up-to-date financial reports, all expenses and get are served with automated data entry.

5. Integrate with your accounting software

The sole aim of business budgeting is to save your time and labor. Keeping this in mind, Volopay offers accounting software integration, with software like Quickbooks, Xero, Netsuite, and many more.

6. Get instant financial reports

With Volopay you have the facility to see in real-time how much budget was assigned to every team and how it is dealing with it. This means you don’t have to wait till the end of the year to see some results and give you insights.