Effective financial management strategies for your business in 2025

A successful business plan always comes with comprehensive, yet ever-evolving, financial management strategies. How you manage procurement, allocation and the subsequent utilization of funds and finances will determine how smooth your cash flow, as well as workflow, is.

The purpose behind having a finance strategy is to ensure the presence of an adequate and regular supply of funds towards fulfilling the present and future requirements of an organization. The more effective financial management is in your company the more you will be able to maximize your revenue generation and utilization.

Like any other system, in order for your financial management machine to work at its fullest potential, it needs to be at its well-oiled best. There are a number of steps you can take to ensure that your financial strategy is as effective as it can be; but, before we get into that let’s first understand what exactly financial management is.

What is financial management?

Financial management, or planning, represents that part of your business plan which is focused on using financial data and projections to put the rest of your plan into context.

Financial management strategies focus on elements such as financial resources, cost structure analysis, profit potential estimation, accounting functions, and so on. Basically, a finance strategy concerns itself with the identification of sources, usages, and management of funds. It deals with the alignment of strategic financial decisions with the corporate and business objectives of an organization to gain a market advantage.

Therefore, the reasoning behind financial management is to predict your company's financial performance in the future. This function is hinged on three fundamental practices:

● Forecasting financials

● Stress testing key inputs required to drive your growth

● Preparing for the capital requirements your business needs

Moreover, financial management must not focus on the short-term; instead, it is a forward-thinking approach wherein long-term growth is prioritized to secure a sustainable financial future.

What are financial management strategies?

Financial management strategies are essentially general principles that your company can implement to reap maximum benefits out of financial systems and processes. These strategies can be customized to suit your company’s specific goals, needs, and means in procuring and utilizing funds.

The main goal driving financial management strategies is the maximization of the financial value of an organization. These strategies evaluate financial performance, forecast future financial performance, plan capital structure and manage any other financial activities and decisions that could impact strategic financial decisions.

So, essentially, finance strategy helps set up a roadmap that companies can follow to manage the usages, availability of sources, and allocation of funds. It works to align financial management with the corporate and business objectives of an organization to ensure holistic progress.

Why financial strategies are important?

The importance of financial management strategies lies in it helping you develop a vision for your company’s success. It helps you establish a set of controlling principles under which your company can enjoy optimal operations.

At a fundamental level, a business strategy is pretty much based on financial strategy. In almost all business decisions an organization’s assets, cash flow, and liabilities are bound to be involved. All business strategies have to manage current business income, external financing requirements, fund procurement schedules, current cash flow position, and annual tax payments. What objectives you set for funding and how these tie into your vision is integral to developing a business strategy. Basically, creating a business strategy can be hard without a financial strategy.

Financial strategies help you check whether your goals are realistic, tackle unexpected challenges and it also helps you understand where your money is going. Besides these, other aspects of business strategies that financial strategies help include:

● Current financial position.

● Identifying any risks to your company’s current financial situation.

● Identifying the need for financing to fund expansions or operations.

● Identifying and setting income goals for the foreseeable future.

● Identifying sources to look into in order to increase income.

● Highlighting the need for new relationships or partnerships needed to achieve financial objectives.

● Establishing need to hire particular skills needed to attain the financial objectives set.

● Find the best balance between spending versus saving.

Types of financial strategies

1. Dividend strategy

A financial strategy used to determine the percentage of profits that is to be distributed amongst shareholders after retaining a portion of profits as a surplus for the future investment is called the Dividend strategy. It is employed to maximize shareholders’ return while at the same time generating capital necessary for future investment purposes. They aim to do this while ensuring the least cost of capital as well as risk. Dividend strategies are basically used to balance current returns and capital gains.

2. Capital structure planning

Equity capital, retained earnings, preference capital, and debt capital combined are called the capital structure of a company. Capital structure strategies are formulated for a company to balance the advantages and disadvantages or risks associated with equity, preference, and debt capital.

3. Investment planning

Investment planning or capital budgeting is the process of strategizing how to invest capital. After a company acquires capital one of the steps that come after is investing that capital. Capital investment strategies are concerned with this step and the investments they usually deal with are in the context of long-term assets.

Investment planning is the type of strategic financial management that works to establish, expand, diversify and modernize your company. It also includes disinvestment practices like selling or replacing old or outdated long-term assets.

4. Working capital planning

Last, but not least, we have capital planning strategies. Financial management strategies that help manage the need, procurement, allocation, and future of cash in your company are your working capital planning strategies. These strategies are responsible for the management of your working capital. They also help maintain the availability of adequate working capital that is needed to operate the daily and routine activities of the business.

Strategies of financial management

For your company’s financial management strategies to work at their best, you need to ensure that your approach when formulating them is as effective as it can be. To do this you need to keep a few fundamental elements in mind. While these elements can be tailored to suit your organization, some of the overarching strategies that you can tailor are:

Analyze financial statements

Regular evaluation of financial statements is an important step to take when determining financial strategies. Being able to read, analyze and act on the numbers and data that your balance sheet represents can go a long way in streamlining your strategies.

Strategic financial decisions can be greatly improved if you are able to effectively utilize your financial statements. These statements help you see your company’s current financial position and at the same time outline its trajectory for success or failure.

By reviewing cash flow and income statements you can analyze the generation or use of cash as well as the company’s performance. This is especially useful when studied according to periodic or annual performance.

Equipped with this information you can ensure that any strategic financial planning you do is thorough and based on evidence.

Evaluate profits and losses

Closely connected to financial statements, evaluating your income statements, i.e. profits and losses, is another important step you can take in perfecting financial management strategies.

By building your profits and losses you can review the costs and benefits of your current business strategies. They help you see what’s working, what’s not, and what can be tweaked to see changes in these as well. They represent a historical summary of your business’s performance and thus act as a barometer, a testing tool for the same.

You should ideally use your profit and loss, or income, statements to analyze revenue, cost of goods sold, gross profit, expenses, and net profit.

Create and monitor budgets

Budgeting is a skill that all managers and decision-makers in your company should be adept at. How well you create and manage your budgets will determine how well you are able to stick to plans of action that lead to your business objectives.

By isolating different elements of your teams’ work you can break it down into a comprehensive deliverables list. You can then use these lists to allocate budgets, monitor them, and relocate funds when necessary.

Having a clearly outlined budget and sticking to it also means you can better track your business’s performance and subsequently communicate the same to necessary stakeholders. This can then be used to inform company-wide initiatives.

Monitor debtors

Once a company has been in business for a few years it is bound to have a set of customers who become returning customers. With these individuals or entities, a certain level of trust is developed courtesy of which you provide them with credit purchase facilities.

How much money you allocate to credit lines, what is the cap you sent on credit purchases, and what strategies you adopt in recovering these debts will all impact strategic financial planning. The better your strategies are at accommodating these factors the more effective financial management will be in your company.

Update and safeguard records

Protecting finance data and ensuring privacy in business activities is key to effective financial management. By protecting data you ensure that your financial management strategies are free from external influences. If your records are not protected they are open to manipulation and also fraud.

The best option you can choose to guarantee the complete security of your financial information is to adopt software that specializes in this task. You can set passwords, parameters, and checks to determine who gets access to and how much information is made available to who.

Track your expenses in real-time

Proactive tracking of expenses ensures that you have complete visibility over all financial activities in your company. In modern business settings, you need to be able to view, manage and correct your books as fast as possible.

Using corporate cards and, or, employing an automated system to manage your expenses means that you can make strategic financial decisions in less than half the time it would previously take.

Get started with Volopay

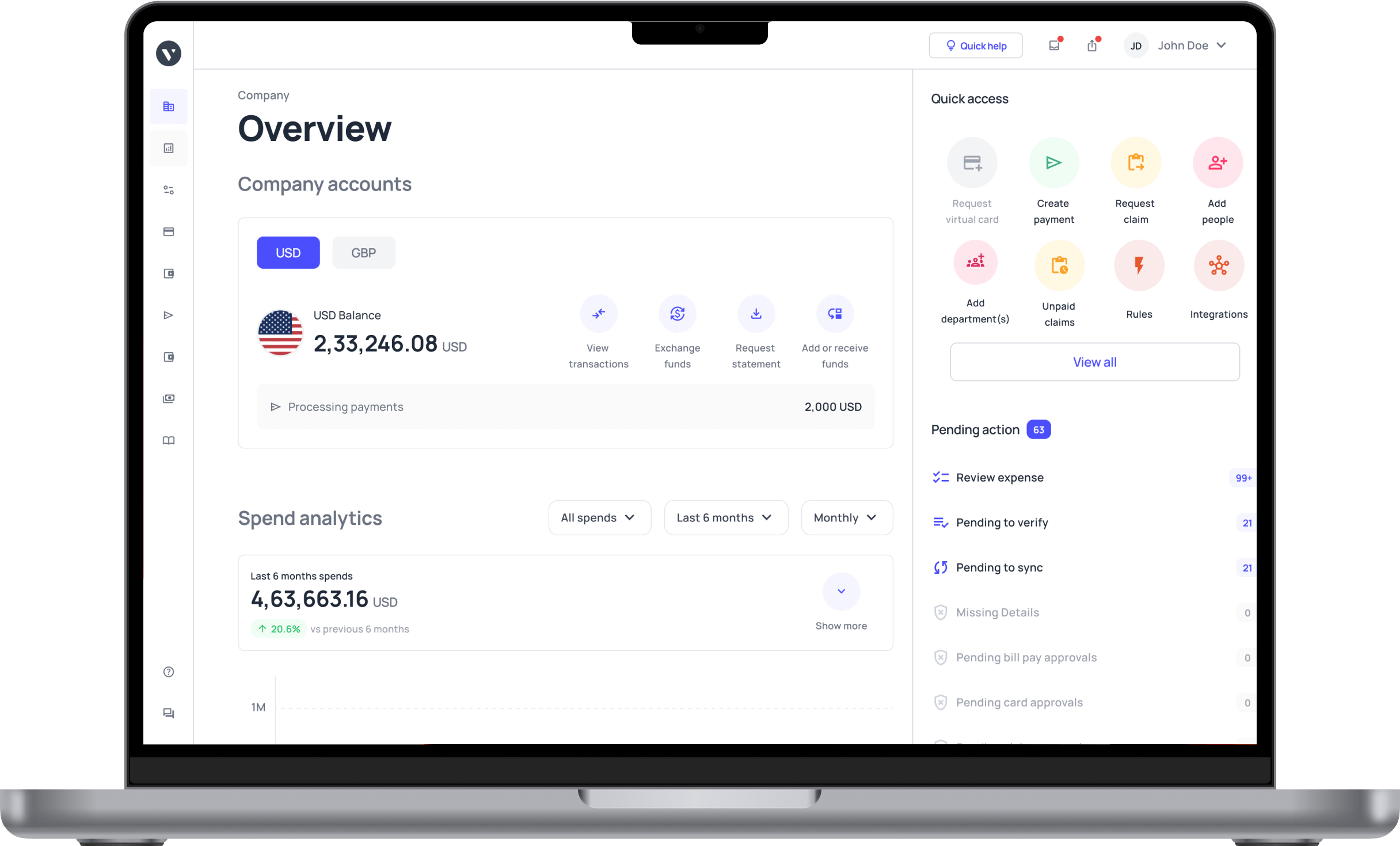

When it comes to execution, choosing the right tool can go a long way in determining how well-equipped your finance teams are at designing and managing your financial strategies.

Once you’ve determined your business’s core principles - goals, needs, and means - the next step is to find the right platform to execute it with.

With Volopay, you get exactly this and more. Features like real-time expense tracking and corporate cards give you the ability to maintain constant visibility and a high degree of control over your expenses.

Volopay also helps you consolidate out-of-pocket expenses and reimburse them with a few clicks, this means that your finance teams have to spend less time with mundane tasks and focus more on implementing and streamlining your financial strategies.

You can also use Volopay to automatically enforce policy checks, set advanced expense approval workflows, and spend smarter with proactive control over business expenses.