How maker checker brings better control over expense approvals?

The maker checker, maker, and checker, two-man rule, or 4 eye principle are one of the most influential authorization principles that the information systems of financial organizations work with. A business’s maker checker workflow is a two-pronged tool using which a transaction is approved or rejected in that company. It is also known as the 4-eyes principle because of the use of a dual approval system.

The maker checker process was introduced as a means of boosting visibility and control over finances and increasing transparency. Since its introduction, it has served to facilitate authority delegation, operational efficiency, and decision-making in a company.

What does dual approval mean?

As we’ve already mentioned, the maker checker process is also called the 4-eyes principle because of the use of a dual approval system. Dual approval or dual authorization works on one simple premise - that there must be two entities or individuals that must be involved in the approval, rejection process.

These two entities involved are known as the maker and the checker, respectively. The first individual, the maker, is the one who is responsible for generating or creating the request for approval. The other individual, the checker, is the one who is responsible for checking, verifying, and approving (or denying) the request.

How does the maker checker feature help businesses?

The use of maker checker features has been touted to be an industry-wide best practice. Its use has vastly improved the pace at which approvals flow, among a host of other benefits. Given below are some examples of how advantageous using a maker checker can be for your business.

Data loss or hacks

Sensitive company data is always at the risk of phishers and hackers. In the presence of dual approval, maker checker systems can catch and block the activity of this kind. For instance, this system can identify phishing activity by checking the location of transactions and verifying it against existing customer data.

Internal fraud

Cases of fraudulent activity within a company’s workforce, however unfortunate, is also common. Maker checkers dissuade this kind of behavior, it deters white-collar crime and establishes a level of transparency that lets you identify and curb fraudulent activity before it can harm your finances.

Manual error

Double-checking crucial pieces of information is never a bad idea. An extra set of eyes checking and verifying sensitive information can help you curb errors that arise out of manual processes. Any errors that might have been missed by the ‘maker’ can be corrected by the ‘checker’.

Payment frauds

Cases of digital checks and transactional protocols being bypassed by fraudsters are becoming increasingly common. A dual approval system assures such activity does not go unchecked.

Steps to create maker checker workflow for expense approvals

Start by enabling the maker checker feature on your expense management system. If you don’t have expense management software it would be wise to onboard one that has maker checker facilities, e.g. Volopay. Once you’ve enabled this feature you can then proceed to configure it as per your requirements. For instance, you can select which transactions to run the maker checker on.

Next, you can add the ‘enterers’ or ‘makers’ to your system. As and when these individuals submit or ‘make’ an approval request it will appear on your dashboard from where you can then proceed to approve or deny the requests. If you have set auto-approval parameters then there will be no need for manual approvals, the system will take care of it.

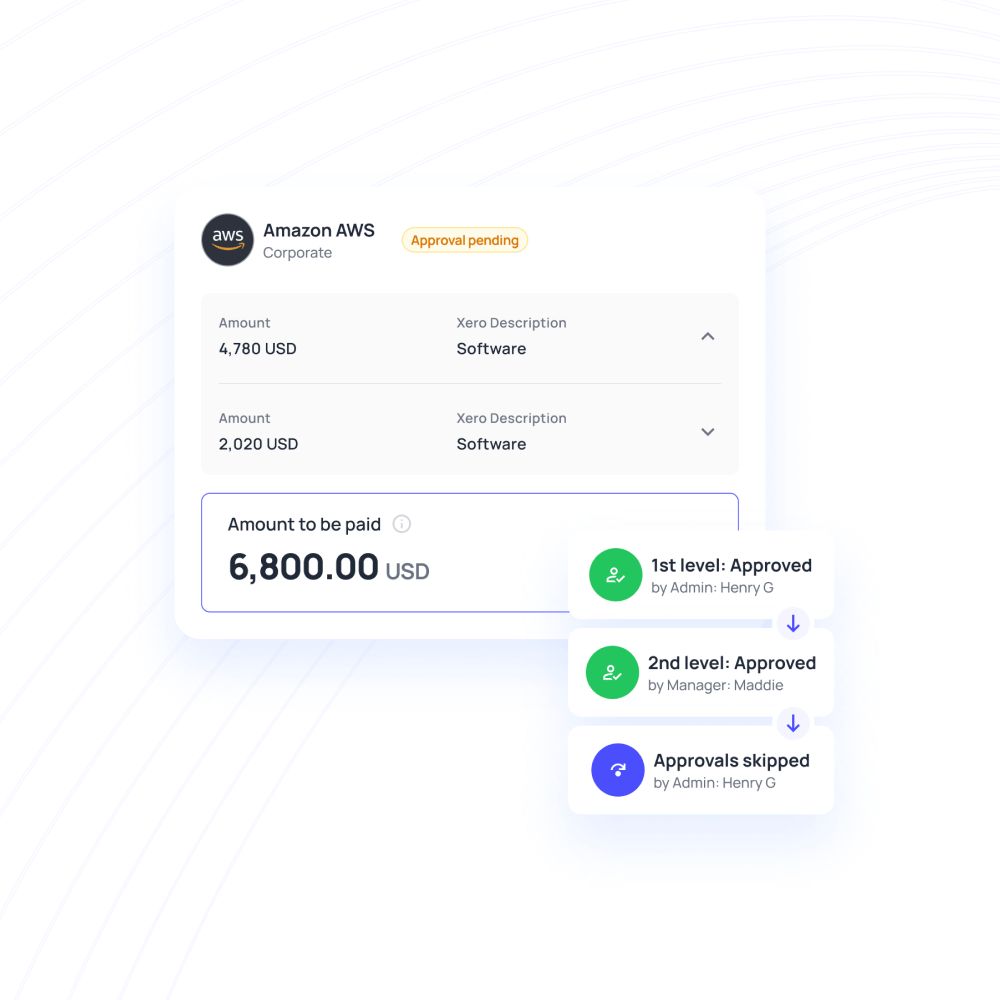

At this point, you’ll have to add the approvers and assign approval roles to them. You can also set multi level approvals for different expense ranges. If the approver is submitting an expense themself or you have auto expense approval parameters set then the approval will be automated by the system.

Lastly, locate ‘payments pending for approval’ on your dashboard. Here you’ll get a comprehensive overview of each transaction. You’ll find the status of approval (e.g. processing, paid, or pending approval), amount, budget, and vendor details as well, you can click on individual expenses to get further details such as date, owner, and so on. Once you’ve verified these details you can then proceed to change the status of approval to approved or rejected, as required.

Benefits of maker checker workflow for expense approvals

A major pain point of older approval workflows had was getting claims and requests approved manually. Finance teams would often have to run around, emails would lie in spam folders unanswered, and so on. With a maker checker in place, the need for manual collaboration is minimized. Whatever collaboration is required can be completely automated by the system itself, i.e. it can send out approval requests, notify individuals and inform ‘makers’ of the outcome of their request, and so on.

Maker checker workflows come hand-in-hand with the perks of the software that provide them. With Volopay, for instance, not only do you get a state-of-the-art maker checker, but a system that can make expense management feel like a breeze. With these platforms, you can set up highly customized maker checker processes, automate payments and approvals, and even set recurring payments. To sum it up, alongside maker checker workflows you get a complete package of the perks of automation.

Maker checker workflows have made business approval systems much more efficient than they used to be. This feature not only works as a barrier against errors and fraud but also significantly speeds up the process. In fact, with software that comes equipped with maker checkers, you can check and approve transactions on the go, in real-time.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free