How to easily automate your expense approval process?

Managing business expenses manually is often slow, error-prone, and highly inefficient. Each reimbursement or payment request requires several manual checks, leading to delays and unnecessary administrative workload.

By choosing to automate expense approval process, you streamline every stage, from submission to final approval. Automation eliminates repetitive tasks, ensures faster approvals, minimizes human errors, and provides real-time visibility.

It helps businesses maintain control while saving significant time and resources. As a result, your finance team can focus on higher-value work like budgeting, forecasting, and strategic decision-making rather than wasting hours chasing receipts and approvals.

The challenges businesses face with manual expense approval workflows

1. Slow approvals cause operational delays

Manual expense approvals involve multiple handoffs and dependencies, which often slow down workflows. Approvers may overlook or delay requests due to email clutter or absence, causing bottlenecks in reimbursement cycles.

These approval lags directly impact cash flow and employee satisfaction. Automating this process ensures timely actions, seamless tracking, and faster processing across teams.

2. Manual errors increase risk

When relying on manual data entry and verification, human mistakes are inevitable. Misplaced receipts, duplicate claims, or incorrect expense codes can easily slip through the cracks.

These inaccuracies not only affect reporting accuracy but also lead to compliance risks. By choosing to automate expense approvals, you significantly reduce these costly manual errors.

3. Difficulty scaling approval processes

As your business grows, managing increasing expense requests manually becomes unmanageable. Spreadsheets and emails are not designed to handle large volumes efficiently.

The more employees and departments you add, the more time and coordination the process demands. Automated systems adapt to scaling needs, maintaining consistency and speed without extra administrative burden.

4. Gaps in compliance and audit readiness

Manual workflows often lack proper documentation and traceability, creating compliance challenges during audits. Missing receipts or untracked approval trails can lead to financial discrepancies.

Automation ensures that every transaction is logged, easily retrievable, and audit-ready. You gain transparency and accountability, reducing the risk of non-compliance or policy violations.

What is expense approval automation?

Expense approval automation is the use of digital tools to simplify and speed up how businesses review, validate, and approve expense requests.

Instead of handling receipts and spreadsheets manually, automation software centralizes submissions, routes them to approvers based on predefined rules, and tracks every step in real time. This system minimizes manual intervention, ensures policy compliance, and eliminates approval delays.

By understanding how to automate expense approval process, you can create a seamless workflow that enhances accuracy, transparency, and financial control, allowing your team to focus more on strategic growth and less on tedious administrative tasks.

How automation solves manual expense approval challenges

Speed up approvals and shorten reimbursement cycles

Automation accelerates approval workflows by instantly routing expense claims to the right approvers. Notifications and reminders reduce waiting time, ensuring faster reviews and approvals.

Employees get reimbursed quickly, enhancing satisfaction and trust in the process. This efficiency improves cash flow management and keeps financial operations running smoothly without unnecessary hold-ups.

Reduce errors and ensure policy compliance

Automated systems validate expense submissions against company policies and pre-set rules, reducing human error. They automatically flag duplicate or non-compliant claims before processing.

This eliminates inaccuracies common in manual workflows and ensures all expenses follow internal guidelines. As a result, you maintain accuracy, compliance, and complete control over financial integrity.

Gain real-time visibility and complete transparency

Automation platforms provide live dashboards that show every stage of expense approval and spending patterns. This real-time visibility helps you monitor budgets, detect anomalies, and make informed financial decisions.

Transparency across departments fosters accountability, ensuring all transactions are tracked and easily auditable. It creates an open and efficient expense management environment.

Streamline multi-level approval workflows

With automation, complex multi-level approvals become effortless. The system automatically routes each expense to the right approver hierarchy, ensuring no steps are missed.

Approvers can review and act from any device, improving turnaround time. This eliminates bottlenecks, simplifies coordination, and standardizes processes across departments for faster, more efficient expense management.

Strengthen control and prevent fraud

Automated approval systems enforce spending limits, track audit trails, and restrict unauthorized access, ensuring secure company financial data. Every transaction is verified, documented, and monitored, reducing the chance of fraud or misuse.

Instant alerts flag suspicious activity, allowing you to take prompt action. This control ensures financial security while maintaining accountability at every stage of expense management.

How to automate your expense approval process for every business expense

When you automate expense approval process, you simplify how every business expense—whether corporate card charges, reimbursements, or vendor payments—is handled. Automation eliminates manual tasks, enforces policy rules, and ensures accuracy at every stage.

It standardizes expense tracking and shortens approval cycles, giving you real-time insights. This streamlined system improves efficiency, saves time, and enhances overall financial transparency for your entire organization.

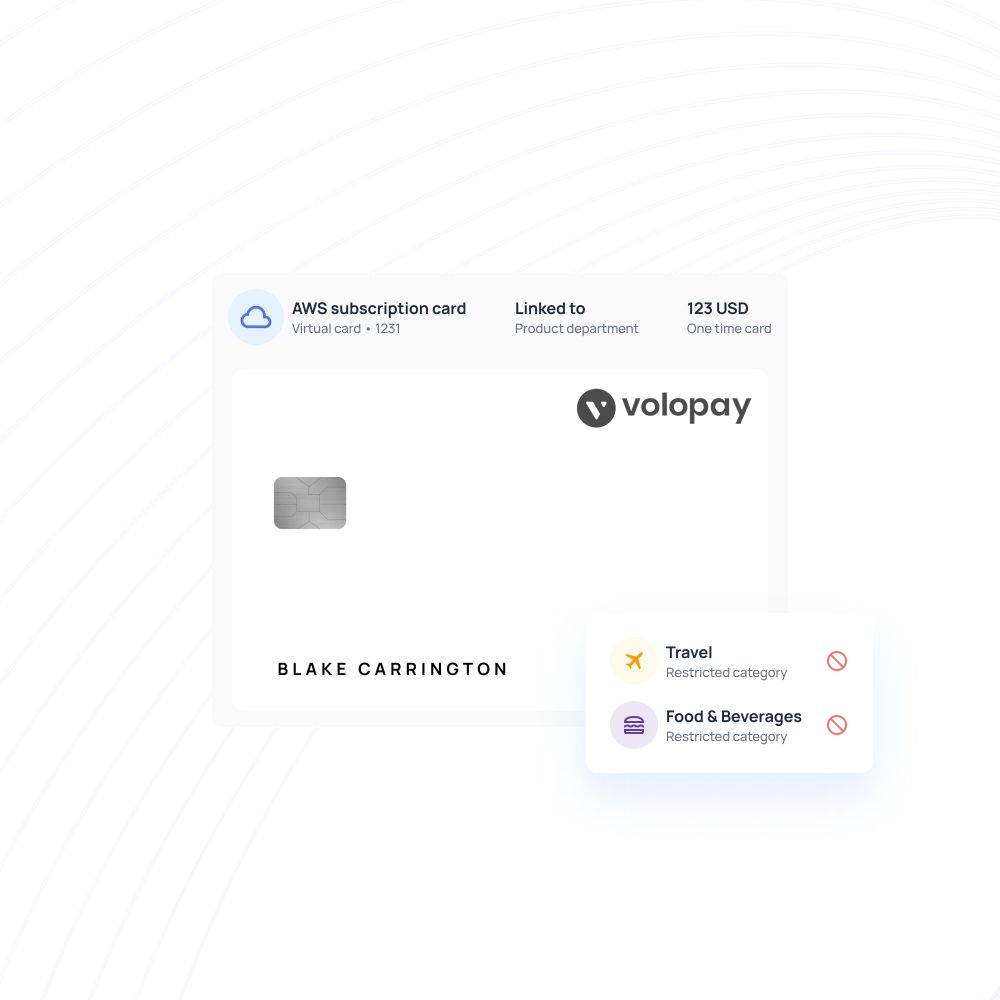

Automate corporate card expense approvals for faster transaction processing

Set spending limits for each cardholder

Automation allows you to assign spending limits to each corporate card based on role, department, or project. These controls prevent overspending and unauthorized purchases.

With limits configured in advance, approvals happen instantly within defined thresholds. This proactive approach strengthens budget management while reducing the need for constant manual monitoring or intervention.

Automate approval rules by category or amount

You can automate expense approvals by configuring system rules that route expenses automatically based on amount or category. For instance, smaller expenses might auto-approve, while larger ones require managerial review.

This logic-driven process ensures speed, accuracy, and compliance without unnecessary delays, helping your finance team manage high volumes effortlessly and efficiently.

Track corporate card transactions in real time

Automation provides live tracking of all corporate card transactions, giving you full visibility into spending behavior. You can instantly see where funds are going and identify any irregularities.

Real-time data improves decision-making, simplifies reporting, and enables timely corrective actions to maintain budgetary discipline across your organization’s financial operations.

Receive instant alerts for unusual spending

Automated systems send real-time alerts whenever unusual or unauthorized transactions occur. These instant notifications help you detect potential fraud early and respond before it escalates.

With continuous monitoring and transparency, your finance team stays informed, ensuring every transaction aligns with your company’s spending policies and financial objectives.

Enforce company policies automatically

Automation ensures that every transaction complies with pre-set company policies. It flags out-of-policy expenses and prevents approvals until corrected.

This built-in enforcement keeps spending within approved limits and maintains compliance. The system eliminates subjective decisions, ensuring consistent adherence to financial policies across all departments and employees.

Streamline employee reimbursement approvals for quicker payouts

Employees can easily upload receipts and submit reimbursement claims through digital platforms. Automation eliminates paper-based submissions and manual reviews.

All data is captured instantly, making it easier for managers to verify details and approve requests promptly. This simplifies the process while ensuring every claim is properly documented and traceable.

Automation tools classify each employee expense under the correct category, such as travel, meals, or office supplies. This automatic sorting saves time, improves accuracy, and streamlines accounting.

Categorization also ensures expense data aligns with financial reports, giving your finance team better visibility into company-wide spending patterns and budget utilization.

With automation, employee reimbursements are processed much faster. Once approved, payments can be automatically initiated, minimizing waiting periods. Real-time tracking ensures complete transparency, and employees receive funds promptly.

This efficiency enhances satisfaction and also reduces workload for finance teams managing multiple claims simultaneously.

Automation removes repetitive manual verification tasks by validating data automatically. It cross-checks receipts, expense amounts, and policy compliance in seconds.

This drastically reduces the risk of human error, ensuring accurate payouts and preventing duplicate or fraudulent submissions. Your finance process becomes smoother, faster, and far more reliable.

Automated reimbursement systems are configured with predefined company policies. They automatically flag non-compliant claims, ensuring only valid expenses are approved. This safeguards financial integrity, reduces compliance risks, and creates a consistent approval framework.

Every reimbursement follows clear rules, maintaining transparency and accountability across your organization’s financial operations.

Simplify procure-to-pay (P2P) workflows for better efficiency

1. Automate vendor and purchase request approvals

By integrating expense approval automation within your P2P system, vendor and purchase requests move faster through digital workflows. Each request is automatically routed to the right approver based on rules and policies.

This eliminates delays, reduces paperwork, and ensures consistency, helping your procurement and finance teams operate with improved speed and efficiency.

2. Route requests to the correct approver instantly

Automation ensures purchase and vendor requests reach the right decision-maker without manual intervention. Intelligent routing rules determine the correct approver based on department, project, or spending threshold.

This eliminates confusion and delays, streamlining the entire P2P approval journey. Instant routing improves coordination and shortens processing times across multiple business functions.

3. Ensure accurate accounting and coding

Automated systems assign the correct accounting codes to every purchase or vendor expense automatically. This eliminates manual entry mistakes and ensures data accuracy across ledgers.

It also streamlines reconciliation and reporting for your finance team, creating a consistent and reliable audit trail that strengthens financial transparency and compliance.

4. Track every step of P2P in real time

Automation allows you to track purchase requests, approvals, and payments in real time. This end-to-end visibility ensures accountability and prevents bottlenecks in procurement workflows.

You can instantly identify pending actions, monitor vendor performance, and ensure smoother cash flow management, all within a centralized and transparent digital ecosystem.

5. Generate reports for audits and budgeting

With automated tracking, you can easily generate detailed P2P reports that support audit readiness and financial planning. Every transaction is logged and categorized, creating a complete data trail.

These insights help you optimize spending, forecast budgets more accurately, and maintain compliance with internal and external financial regulations.

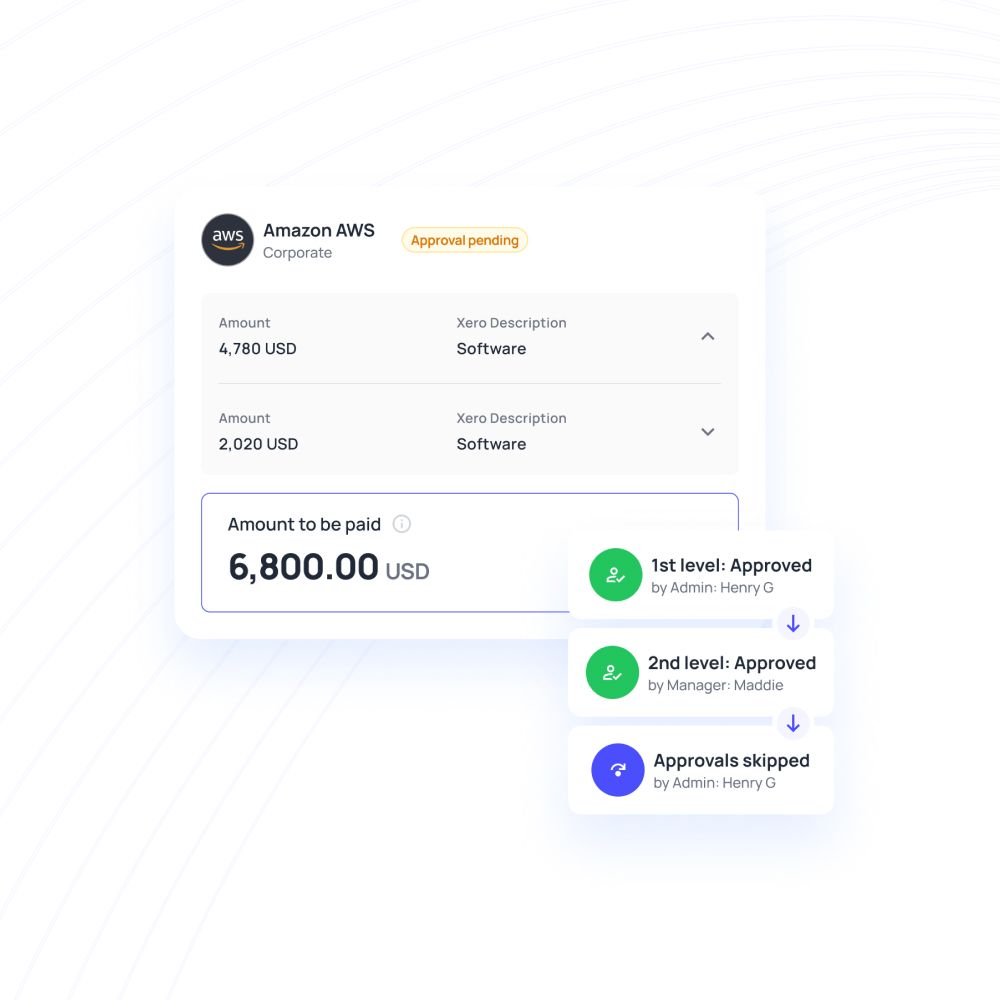

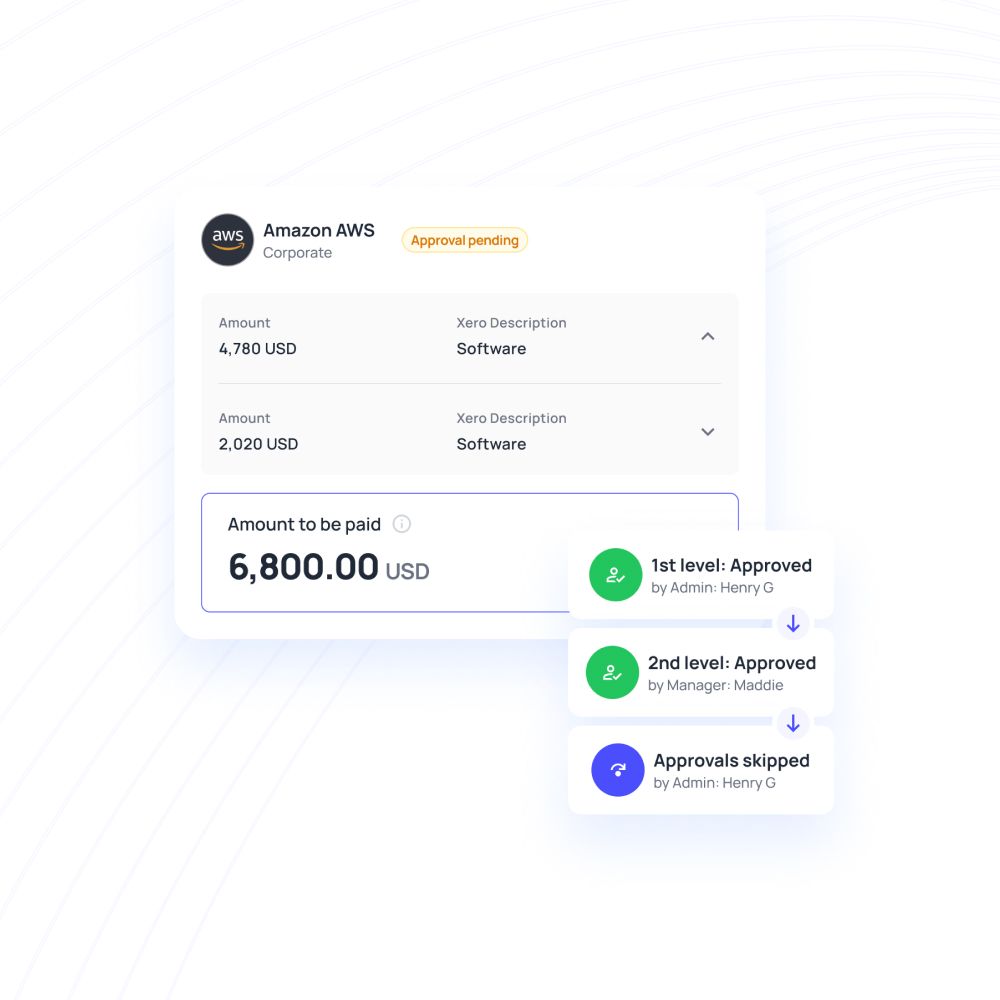

Understanding multi-level approval workflows

What are multi-level approvals?

Multi-level approvals involve a structured process where expense or purchase requests pass through multiple authorization levels before final approval. Each level validates the request based on responsibility and threshold limits.

A key component of this structure is the maker-checker approval workflow, where one person initiates (the “maker”) and another verifies or approves (the “checker”) each transaction. This segregation of duties ensures accuracy, reduces fraud risk, and reinforces accountability across departments.

This layered structure ensures oversight, accountability, and compliance, making it ideal for businesses that handle large volumes of expenses and complex spending hierarchies. Multi-level approvals also help prevent errors and unauthorized spending. By involving multiple approvers, you strengthen checks and balances across departments.

How does multi-level approval work?

In a multi-level workflow, each expense request moves through predefined approval stages based on amount, department, or purpose. For example, low-value expenses may require a single approval, while higher-value ones move through managers, department heads, and finance teams.

When you learn how to automate expense approval process, these steps happen automatically. Rules and routing ensure accuracy, transparency, and faster processing across departments. Automated notifications remind approvers of pending tasks, preventing delays.

The system also logs each approval for audit purposes. This eliminates manual follow-ups, improving overall workflow efficiency. Additionally, multi-level workflows allow for flexible customization, letting organizations set unique approval chains for different expense types or projects.

How multi-level approvals improve workflow efficiency

Multi-level approvals enhance efficiency by distributing decision-making across appropriate authority levels. This structure prevents bottlenecks, minimizes approval conflicts, and ensures accountability throughout the process.

Automation further refines this system by instantly routing tasks, sending reminders, and logging actions in real time. It also provides managers with detailed insights into approval times and bottlenecks, allowing for continuous process optimization.

Employees experience fewer delays and have clearer expectations of the approval path. Overall, this method balances control with speed, helping your organization scale approval processes without sacrificing accuracy or compliance. Moreover, it strengthens financial governance by ensuring that every high-value or sensitive expense receives the necessary scrutiny before approval.

Advantages of multi-level approvals

Custom workflows

Multi-level approvals come with the perk of customization.

You can design custom approval workflow systems, assign gatekeepers at required levels, and set custom parameters for approval as per your spend policy.

You can also automate these expense approvals if they meet your custom parameters, this is especially quite advantageous for subscriptions and periodic payments.

Prevent bottlenecks

Multi-level approval workflows ensures that tasks are less likely to get jammed up and bottlenecked because of a lack of attention.

Through push notifications and reminders, this system helps your finance team keep approval tasks in their direct line of sight.

This means that they can approve or request requisitions as & when they are made rather than having them pile up till the end of the month & create bottlenecks.

Decentralize

Decentralizing your approval workflow is particularly important for larger organizations. Not every expense needs to be approved by all levels of approvers. With a clearly defined team structure, you can easily delegate responsibility and create custom spend policies for different teams.

Each member’s request will go to their manager first. This ensures that a request will reach someone only if it’s relevant for their role, therefore cutting down on unnecessary steps that might have otherwise taken time and effort if followed.

Improved efficiency

Traditionally, expense approval could take days, even months to complete. The advantage of having automated multi-level expense approval in place has cut this time down to a few seconds, maybe an hour or two at most.

Once an employee submits a request the approver gets notified immediately and can take the required steps. If, instead, you have automatic approvals for particular spend limits and the requested amount is below this the approval and subsequent money transfer process are almost instantaneous.

Flag unauthorized transactions

If an employee submits a request for an expense that does not stick to approval policy guidelines you can flag them in real-time on the spend management software’s dashboard itself.

The need to wait until the month’s end to highlight and investigate such transactions is eradicated by multi-level approvals.

The approval parameters you set will vet and prevent unauthorized transactions from being completed before any manual interaction is needed or keep it halted until human interaction becomes necessary.

Significantly strengthened accountability

Let’s say you have set an individual as an approver at a particular expense level. There might be a case where, due to some reason, the individual does authorize a spend that should not have been.

Because automated approval software keeps a record of all transactions, who requested them, how much, who approved them when etc. you can easily identify the responsible individuals and clarify the reasoning behind the approval.

This feature ensures that accountability is maintained and at the same time it is also easy for your finance teams to identify who is accountable for what.

Better spend control

By using automated pre-set parameters, you can create a culture of accountability and get nuanced control over how you approve expenses. Because spend controls are applied before spending happens, you can flag unauthorized spending in real-time.

This is much better than having to demand explanations after finding out at the end of the month that expenses have gone over budget or are not related to the business.

What’s more, is that this control extends to the customization perk as well. This means that you can, in real-time, set custom parameters that prevent budgetary violations or policy deviations before they even happen.

Increased transparency

The traditional business approval process used paper trails as the means of establishing transparency and visibility over the expense approval process. While this might have been useful it is far from easy, error-free, or seamless.

Automated approval workflow systems are equipped with analytical tools and data storage features. Every transaction is automatically recorded and stored in a database that can be accessed anytime in the future.

Moreover, these records are detailed and much less likely to have errors because errors are flagged at the time of the transaction itself. This allows you to have a level of transparency that is far-reaching as well as easier to control.

How to create efficient multi level pre-approval workflow process?

Keep the route simple and clear

The more complicated your process is, the harder it will be to complete. Keep it simple, design the request form such that it only requires the information that you need, e.g. the cost; the name of supplier; expense account (if known); purchase frequency (recurring or one-time); and any supporting documentation, like invoices.

Next, once the information has been acquired, the purchase request should reach the concerned approvers automatically. At this point, your employees should also be able to know who the request needs to be approved by, even if there are multiple approvals required. To make this process even easier you can adopt the use of virtual cards. These make the system almost entirely automated and provide an extra layer of visibility and security.

Clearly define stages and approvers

For your approval workflow process to flow seamlessly it’s obvious that you need to ensure the stages of approval and their particular approvers must be clearly defined. Without this clarity, it will become difficult for you and your employees to determine who is responsible for what and at which stage. You might then have to manually vet every expense request and process individual requisitions without the help of a blueprint to help direct this process.

Clear directions are especially important in cases where there are multiple approvals required. These approval workflows can easily hit roadblocks if even one of the approvers is unavailable, uninformed, or takes time to process the request. Ensure the stages and approvers are all clearly defined and informed at all times.

Improve real-time expense visibility

You can adopt an automated approval system that has in-built tools and features to help you keep track of all expense requests and approvals in real-time. These systems come pre-equipped with facilities that notify you or the required personnel when a request is submitted in real-time via a push notification.

It also helps you maintain constant visibility over who owns which transaction, what it’s for, who approved it and what the supporting documents are, without having to verify the same through the end of the month reports.

Design approval matrix

To ensure that expense requests always reach the correct approver, you can design an expense approval workflow using an approval matrix. This involves establishing an automated framework that directs spend requests to the responsible approvers based on the employee making the purchase, spend limits, designations, and reporting flow.

To make it even more flexible, you can design specific approval policies for every department. For instance, you could program a parameter that requires any marketing expense to go through both the marketing head and the CEO, while ancillary expenses can only require approval from the general manager.

As your business grows, you could also introduce finance personnel into your approval workflow. In case you want your CFO or controller to approve any particular expense requests you can program it into your approval matrix as well.

Create inter-departmental, spend-type, and-category flows

The level of customization that modern approval workflow systems provide can do wonders for you if you’re trying to make your system more efficient. The organizational structure of companies is not universal and therefore neither is the flow of expense requisitions and approvals. Different companies structure their teams and departments differently.

With the help of customization, you can program particular approval workflows depending on exactly how you want the process to play out within your company’s system. You can set inter-departmental approvers for particular spend types and workflows that fall into particular categories. For example, you could include a finance person as an approver for your marketing department’s ad expenditure when it is to be made in the domain of Google or social media ads.

Make it easy to approve or deny requests

This is arguably the most obvious box you’ll need to tick if you’re trying to make your multi-level pre-approval process more efficient. You must ensure that spend requests are as easy to approve or deny as they are to make. The more you complicate the process the harder it will be for your employees to complete it with speed and perfection.

It becomes especially easy if you’re using a spend management system that automates this process. These platforms send notifications or emails in real-time and only require a few clicks to approve, deny or forward the approval as required.

Include spend request process for recurring payments

You can preset certain approvals for subscriptions or recurring payments. For example, if you have a subscription payment owed monthly to a vendor who supplies raw materials regularly. You can specify the amount, renewal frequency, payee, and payment time from before and set it as a recurring payment. The expense approval system will automatically make the payments as per your specified parameters.

This not only saves time and effort that you would have otherwise had to give on a monthly basis, but it also ensures the workflow is uninterrupted. You can also use virtual cards to be blocked before a particular date to prevent auto-renewal of said subscriptions.

Ensure audit trail

Establishing audit trails with paper-based, traditional approval workflows was labor-intensive given the amount of digging that could have been required. Instead, you can boost efficiency with multi-level approvals with spend management tools that make document collection and storage easy.

These systems make it easy to access information needed to conduct internal and external reviews. They keep your company prepared and equipped in the face of reviews by establishing clear and solid audit trails.

Clearly define types of workflow

How well you define your workflow will determine how easy it is to navigate. Your expense approval process should have clearly defined categories for workflow types. You can customize your workflow as much as you want but keep in mind that you should have clearly stated policies and guidelines that help your employees navigate the system. These policies should include definitive guidelines in cases of:

- Multiple stages: You should have definitive stages that explain what needs to be done at which point in the approval cycle, who to approach when etc. It’s important to have clearly defined stages to avoid confusion regarding the direction of the approval workflow.

- Multiple approvers: Employees submitting a requisition, as well as the approval gatekeepers, need to be aware of who needs to approve what. Expenses that require multiple approvals can be easily delayed. To prevent this, clearly define who the approver at each stage is.

- Hierarchy in case of multiple approvers: Again, the need for multiple approvers can also be marred by confusion regarding approver hierarchy. You must designate approvers at each level of expense, determine whose sanction is needed to approve which kinds of expense and who holds veto powers.

- Process types; linear and nonlinear: Not all approval workflows work the same way. Some processes, for example, budget approvals, require a nonlinear process wherein multiple steps or tasks have to be completed before a budget can be approved. Linear workflows, for example, expense reimbursements, are much more straightforward, a reimbursement request is submitted which is then either approved or not, depending on company policy. If you approve workflows, clearly define which processes are linear and which aren’t.

- Submission and approvals: Lastly, clearly outline which processes in the company need approvals in the first place. Once you’ve determined which processes need to be approved also define what supporting documents, e.g. forms, invoices, receipts, etc., need to be submitted for that approval workflow to initiate.

Extending multi-level approvals across your communication platforms

Implement multi-level approval rules across platforms

You can set multi-level approval rules to operate seamlessly across all communication platforms your team uses. This ensures every expense or purchase request follows the same workflow, whether submitted via email, chat apps, or internal portals. Consistent rules eliminate confusion and prevent delays, keeping approvals standardized and efficient.

Enable remote approvals for managers

Automation allows managers to review and approve requests from anywhere, using mobile devices or web platforms. Remote approval capability ensures workflow continuity even when key approvers are off-site. This flexibility reduces delays, maintains accountability, and allows faster decision-making without relying on in-office presence.

Maintain policy consistency across channels

With multi-platform approval automation, company policies are applied uniformly across all communication channels. Each request is checked against the same compliance rules, spending limits, and approval hierarchies. This prevents discrepancies, ensures fairness, and safeguards your organization against policy violations or financial errors.

Automate notifications and escalations

Automated notifications alert approvers when tasks are pending, while escalations route delayed requests to higher authorities. This proactive system ensures approvals stay on track, prevents bottlenecks, and maintains workflow efficiency. Employees and managers remain informed, reducing follow-ups and improving accountability across departments.

Track approval progress and metrics

Automation provides detailed tracking of every approval request and stage across all platforms. You can monitor progress, identify bottlenecks, and analyze key performance metrics. This visibility enables continuous optimization of approval workflows, ensuring faster processing, better compliance, and measurable improvements in operational efficiency.

How to automate expense approvals across Slack and Teams

You can streamline approvals directly within collaboration tools by implementing Slack approval automation and Teams approval automation. Expense requests submitted via these platforms are routed automatically to the right approvers.

This reduces delays, eliminates manual tracking, and provides instant visibility, making expense management faster, more transparent, and fully integrated into your daily communication channels.

1. Choose the right expense management tool

Select an expense management platform that supports both Slack approval workflows and Teams approval workflows. Look for features like multi-level approvals, real-time notifications, and integration capabilities.

The right tool ensures seamless communication, accurate tracking, and automated routing, allowing your team to manage approvals without switching between multiple systems.

2. Set up integration

Integrate your chosen expense tool with Slack and Teams so requests flow directly into the channels your team uses daily. Automated connections ensure every submission appears instantly for review.

This setup eliminates manual entry, reduces errors, and ensures approvers see requests in the platforms where they already collaborate, saving time and effort.

3. Configure approval rules

Define approval rules based on amount, department, or expense type within the integrated system. Multi-level routing ensures high-value requests reach the necessary approvers automatically.

These rules enforce company policies consistently while maintaining speed and accountability across Slack approval workflows and Teams approval workflows.

4. Enable real-time notifications

Activate real-time alerts so approvers receive instant notifications for pending requests. Automated reminders prevent delays and ensure no submission is overlooked.

Notifications also keep employees informed about approval status, enhancing transparency and reducing follow-ups across communication platforms. Additionally, these alerts can be customized by priority or department, ensuring critical requests receive immediate attention.

5. Monitor and optimize the workflow

Regularly review approval metrics and workflow performance to identify bottlenecks or inefficiencies. Continuous monitoring allows you to adjust rules, optimize routing, and improve processing speed.

Optimizing Slack approval automation and Teams approval automation ensures faster approvals, stronger compliance, and a more efficient expense management system over time.

Ensuring compliance and control with automation

With expense approval automation, you can automatically enforce company policies for every expense. Rules for spending limits, allowed categories, and approval hierarchies are applied consistently.

This reduces manual oversight, ensures guideline adherence, and prevents non-compliant or unauthorized transactions from being approved, strengthening financial control.

Automation provides live visibility into all business expenses as they occur. You can track spending patterns, detect anomalies, and monitor budget adherence immediately.

Real-time monitoring ensures you make informed decisions, prevent overspending, and maintain financial discipline across departments without relying on delayed manual reports.

Every expense transaction and approval is logged automatically, creating a complete digital audit trail. This ensures accountability and transparency for managers and finance teams.

During audits, you can quickly retrieve records and demonstrate compliance, making financial reporting simpler, more accurate, and fully traceable across your organization.

Automated systems flag suspicious activity and non-compliant expenses in real time. By enforcing rules and cross-checking submissions, the system reduces the risk of fraud, duplicate claims, or policy violations.

This proactive approach safeguards company funds and ensures consistent adherence to internal financial controls.

Automation ensures all expense data is stored securely and in compliance with regulatory standards. Digital records support audits, tax filings, and legal requirements while protecting sensitive information.

You maintain both operational efficiency and regulatory compliance, reducing risk and enhancing trust in your financial processes.

Key outcomes of expense approval automation

Faster approval turnaround and reduced processing time

Automated workflows accelerate expense approvals by routing requests instantly and minimizing manual intervention. Approvers receive notifications in real time, and tasks are completed faster.

This reduces processing time, shortens reimbursement cycles, and ensures your team can focus on strategic activities rather than repetitive administrative work.

Stronger policy compliance and audit readiness

Automation enforces consistent policy adherence across all expense types. Each transaction is validated and logged, making audit preparation seamless.

You reduce the risk of errors or non-compliance while ensuring transparency, accountability, and readiness for internal or external audits without extra administrative effort.

Improved employee experience and productivity

Employees benefit from quicker approvals, instant notifications, and simplified submission processes. Less manual paperwork and faster reimbursements improve satisfaction and morale.

By streamlining the workflow, your team can focus on core responsibilities, enhancing productivity and fostering a more efficient and engaged workforce.

Enhanced financial visibility and control

Automation provides a centralized view of all expenses, allowing you to monitor budgets, track spending patterns, and detect anomalies. Real-time insights improve decision-making and strengthen financial control.

You gain both operational efficiency and strategic visibility, ensuring your organization manages expenses proactively and effectively.

Choosing the right platform to automate expense approvals

1. Identify key features needed for your business

Start by listing the features your organization requires, such as multi-level approvals, real-time tracking, policy enforcement, and integration with accounting software.

Understanding these needs ensures you select a platform that addresses your specific expense workflows. Proper feature alignment simplifies implementation and maximizes the value of automation.

2. Compare automation tools and platforms

Evaluate multiple expense automation solutions based on usability, scalability, cost, and support. Compare how each platform handles approvals, reporting, and compliance.

Side-by-side comparison helps you identify the solution that fits your business size and operational requirements while providing long-term efficiency and ROI.

3. Assess multi-level approval capabilities

Ensure the platform supports complex multi-level approval workflows for different departments, roles, and expense types. The system should allow custom routing rules based on amount, category, or hierarchy. Robust multi-level functionality improves control, reduces bottlenecks, and streamlines approvals across your organization.

4. Ensure compliance and audit support

Select a platform that automatically enforces company policies and maintains comprehensive audit trails. It should generate reports for internal reviews and external audits.

Compliance-ready solutions reduce regulatory risk and ensure that your financial processes remain transparent and verifiable. Additionally, these platforms make it easier to identify and address discrepancies before they escalate.

5. Evaluate integration with existing accounting systems

Check if the platform seamlessly integrates with your accounting software, ERP, or payroll systems. Smooth integration avoids duplicate data entry, ensures accuracy, and improves reporting efficiency. Compatible systems streamline reconciliations and provide a unified view of all financial transactions across your organization.

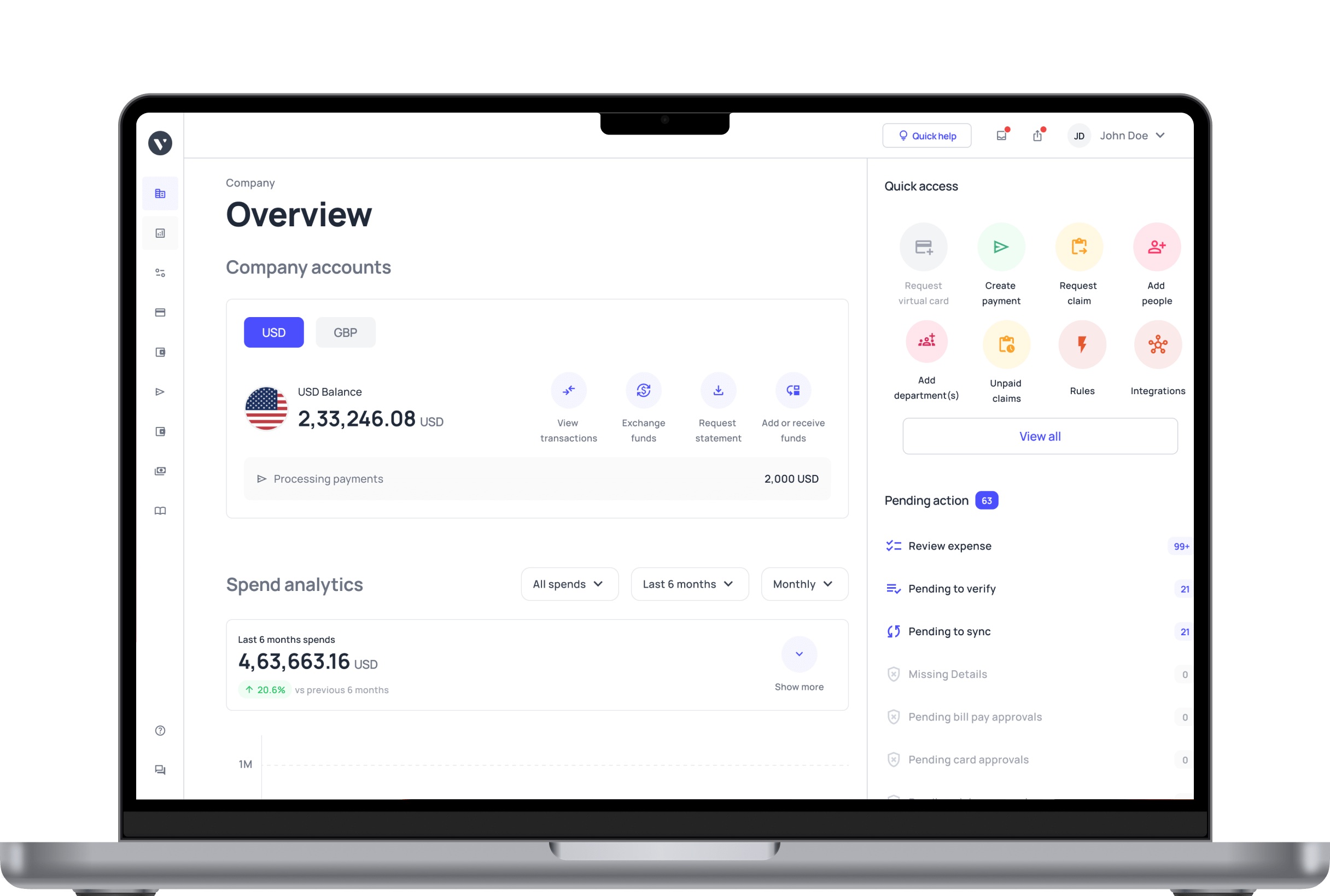

How Volopay simplifies and automates expense approvals

Volopay's expense management software centralizes and automates all business expense approvals, reducing manual tasks and approval delays. Our platform offers real-time visibility, policy-driven workflows, and audit-ready records.

By streamlining processes, Volopay helps you maintain financial control, improve efficiency, and enhance compliance across all teams and expense types. It also adapts to growing business needs, ensuring scalability without added complexity.

Centralize management of all business spend

Volopay consolidates all employees, corporate cards, and vendor expenses in a single platform. Centralized management simplifies tracking, reporting, and approvals.

With a unified system, you gain a clear overview of spending, enabling better budgeting, cost control, and strategic financial decision-making across your organization. This centralization also reduces errors caused by fragmented expense data across multiple tools.

Implement policy-driven automation

You can configure automated multi-level workflows based on spending limits, departments, and expense types. Volopay ensures every expense complies with company policies before approval.

This reduces manual errors, enforces accountability, and guarantees consistent adherence to financial rules across all teams. It also speeds up approvals by automatically routing requests according to the predefined policies.

Gain real-time spend controls

Volopay provides instant visibility into all transactions, allowing you to monitor budgets and detect anomalies in real time. You can set alerts, track approvals, and respond quickly to unexpected expenses.

This proactive approach enhances control, minimizes overspending, and keeps your finances on track. Real-time monitoring also enables managers to make informed decisions immediately without waiting for periodic reports.

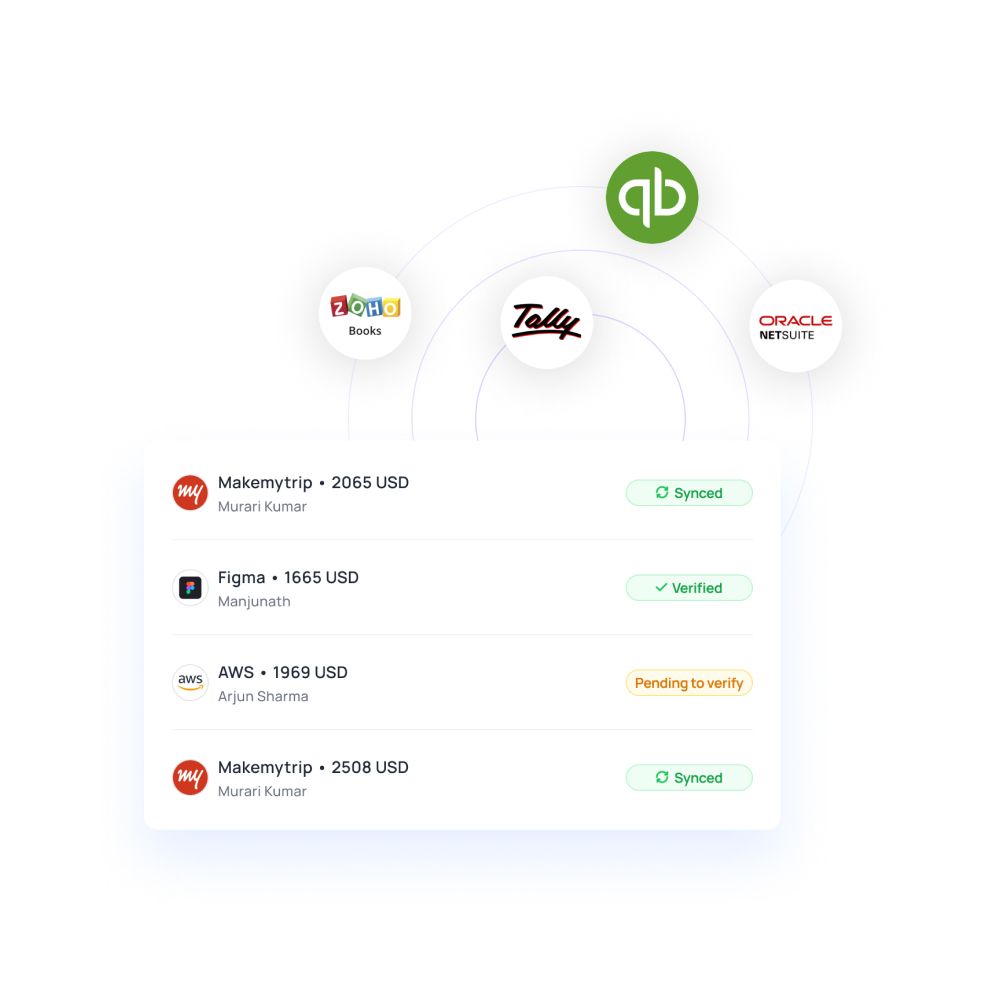

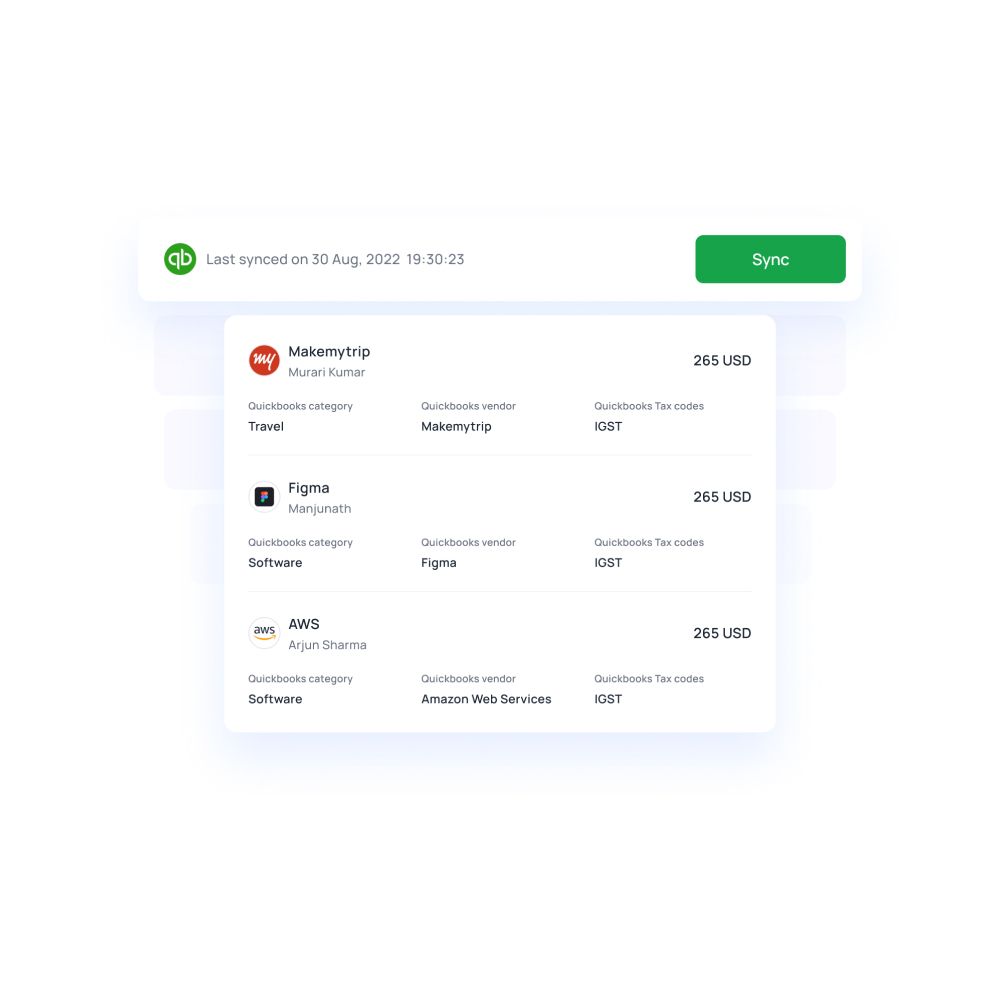

Leverage deep integrations

Volopay seamlessly connects with popular accounting, ERP, and payroll systems. Integration ensures data flows automatically, reducing manual entry and reconciliation errors.

This connectivity streamlines reporting, improves accuracy, and provides a comprehensive view of your organization’s financial ecosystem. It also ensures consistency across financial platforms, reducing the risk of mismatched or duplicated data.

Maintain transparent audit trails

Every expense and approval is recorded automatically, creating a detailed digital audit trail. Volopay ensures transparency, simplifies internal reviews, and supports external audits effortlessly.

Complete traceability enhances compliance, accountability, and financial governance across all expense types and business units. This comprehensive trail also helps identify process improvements and reinforces organizational trust in financial management.

Bring Volopay to your business

Get started now

FAQs

Yes, automation platforms like Volopay allow you to manage approvals for corporate card expenses, employee reimbursements, vendor payments, and recurring purchases. All expense types can follow pre-configured rules to ensure efficiency and compliance across your organization.

Approval automation enforces predefined company policies, spending limits, and category rules for every expense. Requests that violate policies are automatically flagged or blocked, ensuring all approvals adhere to internal guidelines without requiring manual intervention.

Yes, you can configure automation to instantly approve low-value or recurring expenses. This speeds up processing, reduces manual workload, and ensures routine expenses are handled consistently without unnecessary delays.

Volopay automates approvals by routing expense requests through predefined workflows, applying company policies, and notifying approvers in real time. Multi-level approvals and audit trails ensure accuracy, compliance, and faster reimbursement cycles for businesses.

Yes, Volopay provides instant notifications to approvers for pending requests and alerts for exceptions or policy violations. These notifications improve response time, transparency, and accountability across all expense workflows.

Trusted by finance teams at startups to enterprises.