A complete guide to corporate virtual cards for business

In a fast-paced business environment, managing expenses efficiently is essential. Corporate virtual cards offer a seamless, secure, and flexible solution for handling your business transactions.

Virtual corporate cards provide you with a unique way to control spending, streamline payments, and enhance overall security, making them an invaluable tool for modern businesses.

By integrating a corporate virtual credit card into your financial strategy, you can significantly reduce the risks associated with traditional payment methods. Corporate virtual cards transform your business operations, providing you with the financial agility needed to stay and thrive in the competitive market.

What are corporate cards?

Corporate cards are linked to the company’s budget. In this way, employees can pay for business-related expenses without having to use cash or their personal cards.

Virtual cards for business are a company liability, and they don’t affect employees’ personal credit scores or loans. Rather, the company pays back all credit loans and designs policies on how the card needs to be used.

What are corporate physical and virtual cards?

Corporate virtual cards go one step further and digitize the process for safety, health, and ease of record transcription. They are also easier to issue and freeze, removing the hassle of transferring physical cards from employee to employee. This highlights how virtual cards are more secure than physical cards, as they minimize risks associated with theft or loss while providing better control over transactions.

Physical cards are best for employees that are not shifting departments or moving in the near future (for instance, upper-level management or C-suite executives). On the other hand, virtual cards are beneficial for rotating employees and one-time expenses. They are linked to a digitally generated card number, and the administrator can decide who the card should belong to, what the limit will be, and when it will expire.

They are as easy to use as any other payment gateway or money transfer app and come without the risk of theft or loss. Instant virtual cards are also unlimited in their generation capacity, unlike physical cards.

For a more detailed comparison, refer our article on key difference between physical cards vs virtual cards

What are virtual credit cards?

A virtual credit card is a digital version of a credit card. It functions in the same way as a physical card without there being an actual physical equivalent. With a unique 16-digit number, virtual credit cards are a quicker way of accessing a credit line and handling expenses.

A corporate virtual card can be issued by a fintech company, financial institution, or online banking service. They also have better data protection since they can’t be stolen or lost like a physical credit card. They are as credible as physical cards and do make a difference to your credit score.

What are virtual debit cards?

Virtual debit cards are an online version of physical debit cards. They are linked to a bank account and can be utilized for transactions where the option to swipe or tap a chip is absent. Commonly linked to apps like Apple Pay or Google Pay, they make online purchases easier.

They are accessed through your bank’s mobile application and have the same features as a physical card - a unique number, the ability to set a unique passcode, unique CVV. The only drawback is that they cannot be used with a card machine or to withdraw funds from an ATM.

How do corporate virtual cards work?

Corporate virtual cards are digital payment solutions designed to optimize how you manage business expenses. When you issue a corporate virtual credit card, you generate a unique card number linked directly to your company’s bank account.

This corporate virtual card can be used for online purchases, subscription management, and vendor payments, providing your business with enhanced security and control. You can set precise spending limits, monitor transactions in real time, and restrict usage to specific vendors or categories, helping you prevent unauthorized spending and reduce fraud risk.

Virtual corporate cards eliminate the need for physical cards, reducing the risk of loss or theft. By using corporate cards, you simplify expense management and improve financial oversight, allowing your business to operate more efficiently and securely. Implementing corporate virtual cards in your financial strategy provides you with a flexible and secure payment solution that adapts to the dynamic needs of your business.

Different types of virtual cards for business

Single payment

Single payment cards originated from gift cards. Designed for one-time use, they have not become helpful for companies that need to provide employees with cards for a single event or transaction.

They’re quite easy to create. You simply need to specify the expiration date for each card, as well as the amount of credit you wish to load. With companies like Volopay, you can also link these cards to your policies to ensure they follow the correct protocol for use. Additionally, they can be linked to budgets for improved bookkeeping.

Recurring payments

Recurring payments make up a large portion of spends in any department or company. Usually SaaS, but also for fixed contract vendors, these invoices have a tendency to get lost. There is even a risk of making payments twice.

Having a dedicated corporate card for vendors and recurring payments significantly smooths the management process. Corporate virtual prepaid cards can be created specifically for individual vendors, and all invoices and receipts can be conveniently attached to that card. This greatly enhances spending analysis and accounting efficiency, reducing errors considerably.

Get corporate virtual cards with enhanced security features

Benefits of virtual cards for business

Corporate virtual cards offer instant issuance, allowing you to generate a card number immediately. This feature is especially beneficial for onboarding new employees or handling urgent business expenses without waiting for physical cards to arrive.

Virtual cards offer unparalleled flexibility for your business. You can issue and manage cards remotely, making them ideal for remote teams and international operations. This flexibility ensures that your business remains agile and responsive to changing needs.

A corporate virtual credit card significantly reduces fraud risk by eliminating the need for physical cards. You can deactivate a card instantly if suspicious activity is detected, protecting your business from unauthorized transactions and financial loss.

Corporate virtual cards simplify the reconciliation process by recording transactions in real time. This feature allows you to effortlessly match expenses with invoices, reducing the time spent on manual checks. The efficiency of this process minimizes errors and ensures your financial records are accurate and up to date.

Using virtual corporate cards enhances your budgeting capabilities by allowing you to assign specific budgets to different departments or projects. You can monitor spending in real-time, ensuring that you stay within budget. This approach helps you maintain financial discipline and make informed financial decisions.

You can fully customize virtual corporate cards to fit your business's specific needs. You can set spending limits, restrict card usage to particular vendors, and even define expiration dates. This high level of customization ensures that your business maintains strict control over expenses while effectively meeting unique operational and financial requirements.

Corporate virtual cards provide enhanced visibility and control over your business expenses. You can track every transaction, identify spending patterns, and gain insights into your financial operations. This transparency supports better decision-making and financial planning.

Corporate virtual cards streamline your AP process by automating vendor payments, minimizing manual errors, and improving payment accuracy. This efficiency saves time and resources, allowing your AP team to focus on strategic activities and boosting overall productivity in your operations.

Simplify expense reporting with virtual cards by enabling employees to submit expenses electronically. This reduces paperwork, speeds up reimbursement, and boosts productivity. The system ensures timely, accurate expense management, benefiting both employees and your financial management.

Drawbacks of virtual cards for business

1. Limited acceptance

Corporate virtual cards may face limited acceptance with some vendors, especially those who prefer traditional payment methods. This limitation can restrict your business’s ability to use corporate virtual credit card universally, necessitating alternative payment solutions in certain situations.

2. Challenges with integration

Integrating virtual corporate cards with existing financial systems and software can present challenges. Your business may need to invest time and resources in ensuring that corporate virtual cards work seamlessly with accounting, payroll, and expense management systems.

3. Limited to online payments

Corporate virtual credit card are primarily designed for online transactions. If your business frequently requires in-person payments, the absence of a physical card can be a drawback, requiring you to rely on other payment methods for such situations.

4. Lack of physical card presence

The lack of a physical card can be a disadvantage for businesses that need to make payments in physical stores or during travel. While virtual corporate cards offer convenience for online subscription management, and are ideal for online transactions, they may not be suitable for all business scenarios.

5. Reliance on technology

Using corporate virtual cards means relying heavily on technology. Any technical issues, such as system outages or connectivity problems, can disrupt your ability to make payments. This reliance requires robust IT support to ensure continuous and reliable access to virtual corporate cards.

Best practices to manage virtual business credit cards

1. Establish a clear policy

Create a comprehensive corporate card policy outlining the use of corporate virtual cards. Define acceptable expenses, reporting procedures, and compliance requirements. By establishing these guidelines, you ensure consistent use and prevent misuse across your business, helping maintain financial discipline and clear communication of expectations.

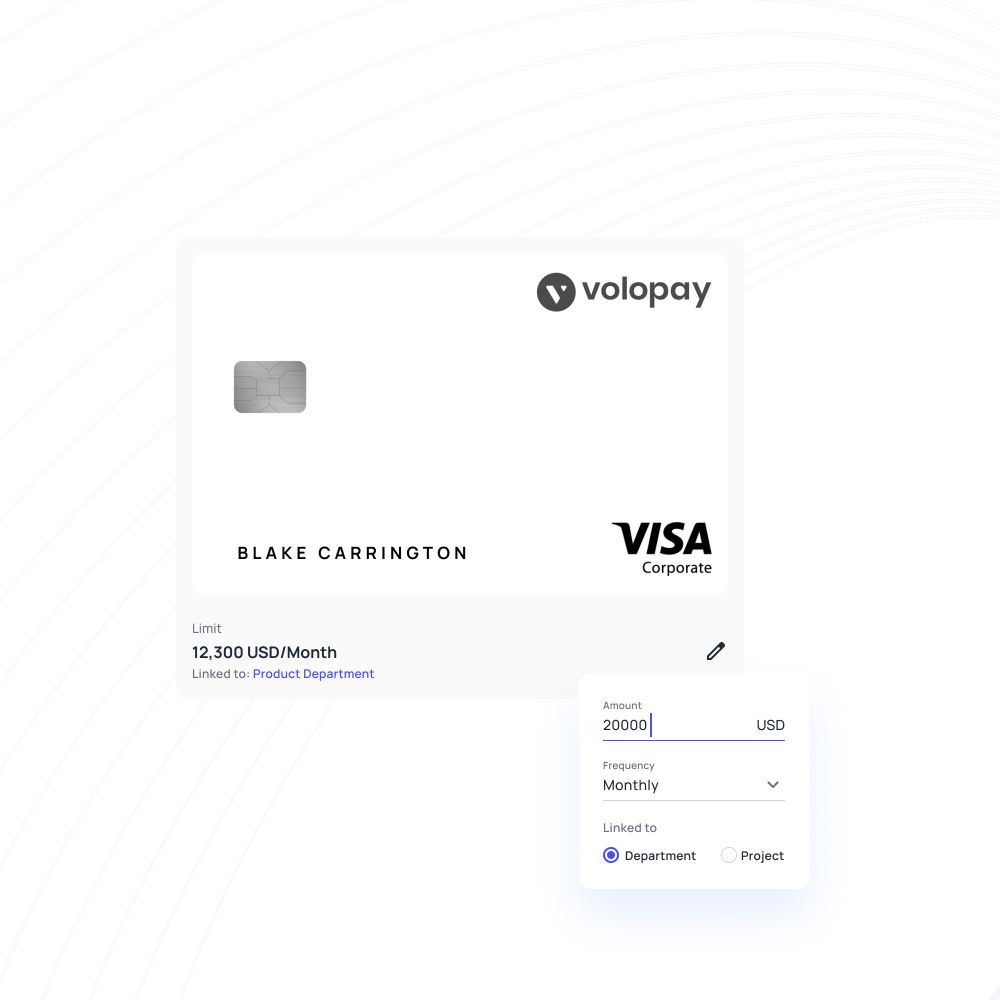

2. Set spending limits on each card

Implement spending limits on each corporate virtual credit card to control expenses effectively, including marketing expense management. Customize these limits according to roles and responsibilities within your business. This practice ensures you control spending and align financial management with operational needs, maintaining discipline and avoiding overspending.

3. Manage employee authorization

Carefully manage who is authorized to use corporate virtual cards. Assign cards only to trusted employees, and regularly review and update authorization lists. This process helps you maintain control, prevent unauthorized use, and ensure that only appropriate personnel have access to the cards.

4. Utilize a centralized platform

Use a centralized platform to manage all your virtual corporate cards. Ensure the platform offers real-time transaction visibility, easy card issuance and deactivation, and streamlined expense tracking. Centralizing management simplifies oversight and helps you maintain control over your business’s financial transactions.

For expert recommendations on the best business virtual credit card platforms, read our blog on best virtual credit card providers in the US to optimize your card management.

5. Monitor expenses regularly

Regularly monitor expenses made with corporate virtual cards. Review transactions frequently to identify any discrepancies or unusual activity. Staying vigilant ensures you are aware of your financial status and can address issues quickly, maintaining accurate records and preventing potential problems.

6. Provide employee training

Train your employees on the proper use of virtual corporate cards. Educate them about your policies, spending limits, and the importance of accurate expense reporting to promote responsible card usage, ensure compliance with your business standards, and minimise the risk of errors or misuse.

7. Enforce spending controls

Enforce spending controls by setting up automated alerts and notifications for transactions exceeding limits or falling outside approved categories. These controls help you maintain oversight, prevent overspending, and detect potential fraud, ensuring that your business remains within budget and secure.

Get better control and visibility over your business spends

Advantages of virtual credit cards over business cards

1. Reduced incidents of fraud

Virtual cards do not propose the same kind of data loss risk that physical cards do. Since they cannot be swiped at a vendor or ATM machine, there is a highly reduced risk of hacked software getting the card information.

Additionally, since these cards can be linked to specific vendors without being attached to your company’s bank account, your banking information stays safe. Having a different virtual card for different vendors also lets you identify which payment gateway is posing a risk. Compliance teams can, then, track any issues without having to sort through a web of information.

2. Allows easy integration into expense management software

While spending out-of-pocket can definitely be tracked, it is a very arduous process. There is always a risk of human error, misreporting, and paperwork getting lost. Spend management platforms allow for integrations with accounting software.

Your virtual card provider can let you link your transaction history with your software of choice. After that, it is simply a matter of integrating it with your card, and all your transactions are synced with the accounting system for the finance and compliance teams to go over.

3. Real-time spend visibility

Virtual card transactions get immediately recorded, with a real-time spend report being generated. Spend management systems like Volopay have web, email, and mobile applications for you to get notified every time a card is swiped and what the transaction information is. These spends can also be analyzed and synced with your accounting software in real-time.

This kind of transparency in spending patterns helps create a more accountable and healthier spending culture within your organization. Using virtual cards for B2B payments makes it easier to stay on top of recurring costs and prevent any unnecessary overspending.

4. Easy and fast payment option for employees

All employees that spend company money can be issued a corporate credit card in their own name, which not only streamlines transactions but also enhances employee satisfaction by providing them with immediate access to funds. Since cards are linked to budgets, departments can also better track how and when their money is being spent, and how they can optimize their financial plans. Virtual credit cards don’t just make accounting faster - the actual transaction is quicker, too.

Since credit cards don’t require the same kind of sanctions as debit cards or wire transfers, cross-border and domestic payments are a lot smoother. There is also lesser risk and liability since the payment works on a credit basis instead of a money transfer.

5. Increased control on expenses

It might feel scary to just hand over virtual credit cards to your employees, but rest assured this process is fully under the control of the company’s administrators. Virtual cards for business have the option to be customized in its usage rules.

You can choose which card can be used by which people, who approves any changes in the limit, and what the maximum allowed limit can be. All delegated approvers have the authority to decline expenses if the details provided are not sufficient. There are also auto-decline settings that help enforce financial policies.

6. Improved expense management

The entire goal of expense management software is to streamline the process. Whether you rely on manual paperwork or data entry, it is still a lot of time and money wasted in managing your expense records.

This only gets further complicated when you need to create analysis reports. Digitized expense management and virtual credit cards can automate a large chunk of this process. Not only is the data less likely to become redundant, but it is also easier to perform any analytical functions on it.

7. Prevents shadow spend

Shadow spending or shadow spend is a phenomenon where procurement policies are bypassed by employees to enable purchases on corporate credit cards that have not been authorized prior to the purchase being made.

The best tool that can help prevent shadow spend is the virtual card. You can simply load the card with only the amount that has been authorized to be spent, so the question of overspending or unauthorized spending does not even arise because there will be no excess funds available.

Related read: 7 benefits of virtual cards for businesses

Who is eligible to apply for virtual cards?

Eligibility for virtual cards varies from country to country, as well as card provider to provider.

For instance, in Singapore, UOB and American Express only issue cards to companies that have a minimum of 15 authorized employees. Although the limitation is not set on travelers anymore, it can become tricky to pinpoint which 15 employees (to begin with) will be issued a card. Before applying for a corporate card program in Singapore, ensure that you have a minimum of 15 employees assigned as authorized cardholders.

Companies also need to have an annual revenue greeted than $4 million, and annual expenses of at least $250,000. These numbers should be verifiable and pinpoint to a structured organization with tangible financial plans.

Although corporate cards do not require you to attach your personal credit score to the application, the company’s taxation history, spend history, and credit score are an important part of determining if they will get approved for a corporate card program.

How to get a virtual credit card?

You can apply for a virtual card program with either a banking establishment or a spend management platform such as Volopay. Keep in mind that your personal credit score does not determine your eligibility for a corporate card program.

All your documentation that is requested will be company-related and will need you to fulfill the terms and conditions for virtual card eligibility of that country. Your card provider might also have certain requirements for issuing virtual cards. This process might seem daunting but it is much smoother than it looks.

Or simply, get corporate credit cards with Volopay. We will assist you in the process and help you understand what to expect throughout the application process. Once approved, your account will be onboarded and your finance team orientation will begin. After that, your virtual cards are just one button click away.

Issue unlimited virtual cards for your employees instantly with Volopay

Why choose Volopay as your virtual card provider?

Volopay’s corporate card program is ideal for businesses scaling up, or already booming and looking for expense management solutions. In fact, Volopay is one of the best prepaid business card provider available in the US, offering features designed to streamline spending and improve financial control.

We offer a variety of services, and your team can take a walk through them!

Low exchange rate

Volopay has some of the lowest exchange rates in the market! Cross-border payments are supported with swift and non-swift payments, and over 130 currencies are present for you to choose from.

Your Volopay virtual cards make the headache of international transactions nonexistent!

Instant virtual cards issuing

Virtual cards can be issued with a click of a button on the Volopay administrator panel. Simply choose which budget the card will be linked to, whose name goes on the card, and what your expiry date of choice is.

Define the spending limit, and your instant virtual card is ready for immediate use. Opting for a Volopay corporate prepaid card or virtual card lets you add money directly from your bank account, with the funds instantly available for use.

Built-in spend limits

Monitoring a high volume of virtual corporate cards can be tricky. Volopay aims to make your work less tedious, especially when it comes to approvals.

You can set spending limits on all cards, as well as spend controls. These allow transactions over certain amounts to require specific approval and auto-decline any transactions that go against your company policies.

Get vendor-specific cards

If you have a specific vendor you make frequent payments to, recurring or otherwise, you can create an instant virtual card just for that vendor. Assign a budget to the card, and load the amount you wish to.

This lets you track all transactions for a vendor in one place, all of which are synced to your accounting software. Having vendor-specific cards also protects you from data theft, since the same card is not being used for all vendors - so, any possible leak is easier to catch and resolve.

Set custom controls

As a Volopay client, you will have full control over how your company’s transactions take place. You can set up custom controls on cards, deciding which ones are renewable, which ones are one-time use.

Company policies can be modified to suit your needs, and department-specific policies can be assigned to budgets (all of which get automatically linked to cards under them). You can also delegate multi-level approvers for specific cards and budgets to control whose authorization is needed for a transaction or reimbursement verification.

Easily map every receipt to the payment made

Volopay’s software matches receipts to invoices, all of which can be traced on the same interface. Pending invoices can be highlighted, and paid invoices can be automatically linked to receipts and the virtual corporate card used to pay them.

All of this data can also be synced to your accounting software of choice. Volopay allows integrations with bookkeeping software like Xero, Quickbooks, and Netsuite, none of which requires any manual transliteration or editing. Simply plug and play to access your paper trails and spend analytics.

Related pages

Discover how virtual cards can enhance security, streamline transactions, and simplify expense management for your eCommerce business.

Explore the key differences between virtual cards and company cards to determine the best payment solution for your business needs.

Discover how virtual card payments streamline and secure your accounts payable process, improving efficiency while reducing manual work and errors.

FAQ's

Right now, Volopay virtual cards are available in Singapore, Australia, India, Singapore, Indonesia, and the Philippines.

Virtual cards are legal to use for both customers and business users. They are accepted everywhere for online transactions. As long as you get your virtual cards from a valid provider, you won’t land in trouble. As they exist online, it’s impossible for others to steal your card information. So, they are safe to use too.

Volopay virtual cards are multi-purposeful. They can be used in eCommerce platforms and online payment gateways of vendors. Your employees can use virtual cards to book flight tickets, make hotel reservations, and buy equipment online. You can automate your monthly SaaS payments using virtual cards.

In-store payments are possible with virtual cards if you connect them to mobile wallet applications. But this is available in certain locations only. You can connect your virtual card with Google Pay (Singapore users) or Apple Pay (Australian users) and use them to scan and pay.

Yes, corporate virtual cards can be used for travel and entertainment expenses, provided the vendor accepts virtual payments. You can issue virtual corporate cards for specific trips or events, set spending limits, and monitor transactions in real-time, ensuring that your business travel expenses remain controlled and within budget.

To know more, read - Virtual card payment for business travel expenses

Corporate virtual cards can seamlessly integrate with various expense management systems. This integration allows you to automate expense tracking, streamline reporting, and maintain accurate financial records. Using a centralized platform, your business can enhance efficiency and reduce manual entry errors.

If a corporate virtual credit card is lost or compromised, you can instantly deactivate it through your management platform. This immediate action minimizes the risk of unauthorized transactions and financial loss. You can then issue a new corporate virtual credit card without any delay, ensuring continuity in your business operations.

Virtual credit cards for business differ from traditional corporate credit cards in several ways. They are digital and lack a physical form, offering enhanced security and flexibility. Virtual corporate cards can be issued instantly, customized for specific uses, and easily managed through a centralized platform, providing your business with greater control over expenses.

Corporate virtual cards are managed with robust compliance and audit trails. Every transaction is recorded in real time, providing detailed reports and visibility into spending patterns. This transparency helps your business maintain compliance with financial regulations and simplifies the auditing process, ensuring accountability and accurate financial management.