Virtual debit cards: Safe and secure spending for businesses

The original debit card was already a hit when it first came out. Since their initial appearance, debit cards have been used to conduct countless transactions across the globe. Now, however, the debit card, like the world around us, has evolved. The digital revolution has given us its superior successor, the virtual prepaid debit card.

What are virtual debit cards?

A virtual prepaid debit card is essentially the same as your typical debit card, just in a digital or virtual form. It is capable of storing the same data and funds that a physical debit card can. These cards can be issued by a bank or an authorized SaaS provider and can be accessed from your provider’s mobile or web-based application.

They can be used to make all the purchases that a typical debit card is capable of. While virtual debit cards can be used in any store that accepts the usual chip-enabled cards they cannot, however, be used to make in-store purchases or ATM withdrawals.

Virtual cards for business: Pay securely online

Virtual prepaid debit cards are gaining popularity especially because of the added layers of security they come with. These cards have emerged as a much safer mode of managing payments. Let’s take a look at why this is so and what exactly makes the virtual corporate cards such a safe and efficient choice:

Block and deactivate virtual card

Virtual debit cards can be easily blocked, frozen, or deactivated with just the click of a few buttons. To do this with a physical debit card you would have to connect with your bank and follow protocols before blocking or deactivating the card. If, however, fraudulent activity is done using a virtual card online, you get immediate visibility and can instantly block the card directly from your provider’s card management platform.

Access transactions in real-time

Virtual prepaid debit cards are linked with spend management software that records and reconciles transactions in real-time. This means that your purchases get recorded and displayed on the platform as soon as they are made. Real-time visibility enables you to catch fraudulent activity at its source and stop it from hampering your books before it gets too late.

Reduce internal and external fraud

Features such as the one-time debit card and two-factor authentication add an extra layer of security to your virtual payment cards. When working together they serve as excellent protection against both internal as well as external fraud. Besides this, virtual debit card softwares typically come with bank-grade security that is hard to bypass.

Quick and easy online payments

A virtual prepaid debit card can be used as soon as it is created, which is also instantaneous. They’re especially suited to making online payments because the card itself is virtual. It is stored on your phone from where you can make the purchase directly. Virtual prepaid debit cards can be used to make online payments from your phone with a click or two processed in seconds.

Personalized expense management

You can further protect your virtual spending by utilizing the customizability of virtual cards. All your virtual payment cards can be controlled from one unified control center. Through this control center, you can access and set specific parameters that will then trigger or cancel payments as per your instructions.

Cloud data backup and storage

The data you gather from your virtual spending using these cards is stored safely in a cloud-based storage system. All transactions, supporting documentation, and data are protected against loss and damage by online security. Moreover, cloud storage can be accessed from anywhere and by anyone as long as they have login credentials, a working device, and the internet.

Added security measures

Virtual card providers, like Volopay, never store any personal information that you input into their platforms. Additionally, every transaction is protected by the 3DS protocol. These payments applications also undergo regular and rigorous Vulnerability Assessment and Penetrations Testing (VAPT) testing to ensure absolute security.

Want to streamline your business spending with virtual debit cards?

Ideal features to look for in business virtual debit cards

Customizable spend control options

Being able to control and customize the way your cards are being used is integral to why virtual cards are such a great payment method. Without features like single-use or one-time debit cards, spend parameter control, auto-approvals, etc. the ease-of-use and security factors become much less powerful.

Integration with your existing accounting system

Transitioning to a new system should not have to include the tedious process of transferring data. It can not only be difficult but also inefficient and error-prone. Look for a virtual card provider that is API enabled and can easily sync with your existing accounting system. This will save you a lot of time, money, and effort.

Manages all recurring saas subscriptions

Virtual debit cards are especially useful in managing subscriptions. When choosing a provider always enquire whether they are equipped to handle recurring payments. Capable platforms should allow you to leverage automation and preset parameters that can trigger or cancel a payment automatically.

Integrates with digital wallets

If your virtual cards cannot integrate with your digital wallets then the process of adding and managing funds becomes cumbersome. Volopay equipped with systems that can seamlessly integrate with your digital wallets.

Automatic spend tracking

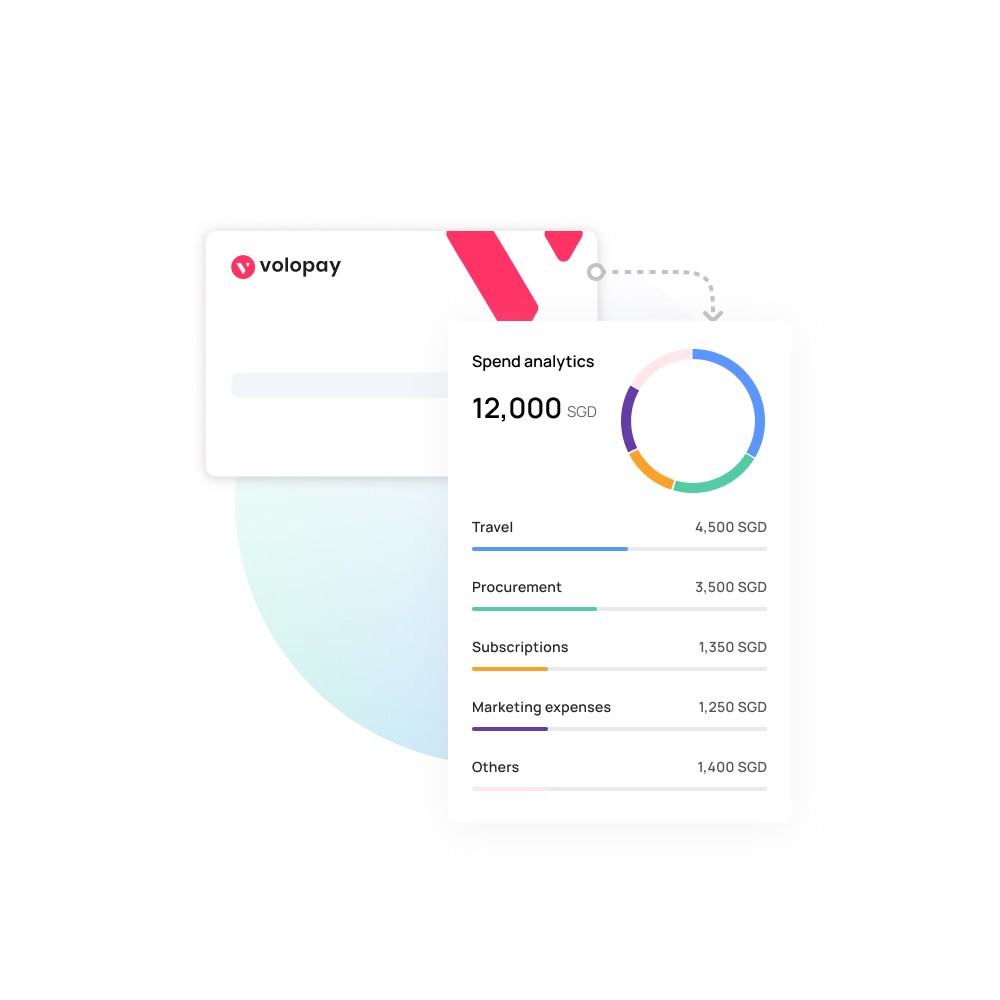

Virtual visa debit card should be able to track spending in real-time. This allows you to gain constant visibility transactions the card is being used for. Automatic spend tracking is a key feature that helps make virtual spending secure by making sure all purchases are kept under a lens.

How to create virtual debit card?

Instant card creation

Volopay cards can be created in an instant. All it takes is 4 easy-to-follow steps and a few seconds of your time.

Create a virtual debit card in 4 simple steps

1. Go to the "Cards" tab on your Volopay Dashboard;

2. Navigate to virtual cards and click on the add icon on the top right corner

3. Fill out details (e.g. Card name, amount, budget, owner, expiration date, etc.), verify them and click continue

4. Receive your virtual prepaid debit card in an instant!

How to customize virtual debit card for employee?

Manage your cards online

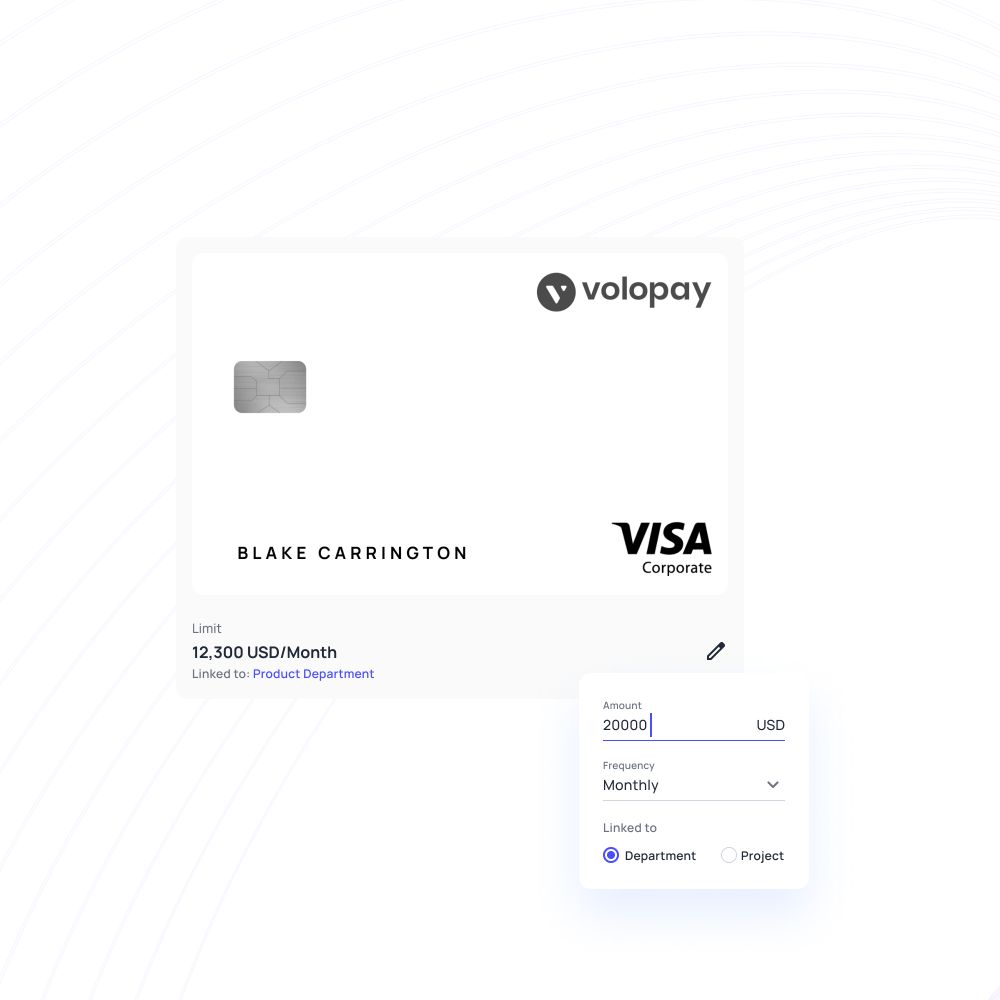

You can manage your virtual cards online very easily from the cards’ dedicated dashboard. From the dashboard you can create dedicated cards for each of your vendors, set up recurring payments and customize how your card is going to be used and for what purpose.

Require transaction authorization:

The manner of authorization that is required to make transactions via virtual cards can also be customized. You can set up different levels of approvers for different spend levels. This way you can ensure your approval workflow is always working as per your organizational requirements.

Setting up spend limits

You can even customize the limits for usage of your virtual cards. For instance, you can set a particular limit on how much can be held or spent from the card, you can set limits on the dates of payment and even on which vendors the card can be used for.

Enable transaction notification

Lastly, you can customize your virtual cards to send notifications to required stakeholders whenever a transaction is made, thus ensuring constant visibility and transparency over spending behaviour of your employees.

How does Volopay virtual debit card work?

Easy fund transfers

Transfer funds, top up your cards anytime, anywhere, with only a few clicks. Just add money to your BillPay balance and allocate funds to individual virtual debit cards as you require. With Volopay instant virtual debit card instant payments are a breeze.

Maintain constant visibility

Track your spending in real-time and ensure nothing fraudulent ever goes unnoticed again. With Volopay, spending is easy, reconciliation is instantaneous and the analytics are as detailed as they come.

Manage subscriptions

Never again have to worry about missing a monthly payment ever again. Set up recurring payments with customizable parameters that you can tailor as per your needs.

Go virtual, stay secured

Cloud-protected data, layers of bank-level security, and regular, rigorous, testing are just a few examples of the steps we take and the lengths we go to to ensure your data is safe, secure, and air-tight.

FAQs on virtual cards

You can use a virtual debit card just like a physical bank card would be used. Alongside online purchases, you can use a virtual card for contactless payments in stores by adding it to Apple Pay or Google Pay. You can even withdraw money from ATMs with some virtual debit cards.

Virtual debit cards can be used anywhere required, just like a physical card provided by a bank.

You can use a virtual debit card at the POS or Point of Sale machine at stores just like you would with a physical debit card.

No, the CVV does not change every time it is used for an online transaction.

Similar to physical debit cards, you can use virtual debit cards to pay directly at a point of sale machine or online.

Getting an instant virtual debit card online with Volopay is as easy as it gets. All you need to do is go on the Volopay software and follow a couple of super easy to follow steps and you can create your virtual card almost instantly.

Trusted by finance teams at startups to enterprises.