7 benefits of virtual cards for businesses

Virtual cards for businesses are one of the most credible digital payment solutions companies can use to clear accounts payable. Recently, they have become the sensation of the B2B payments world due to their versatility and secure nature. A company can create as many cards as possible and assign them to their respective vendor or any payment motive they have.

With virtual cards, you have your card details protected, unlike a physical card openly exposed to anyone. They are so convenient to create and maintain budgets to insist on spending control. These corporate cards for business expenses offer an additional layer of security and flexibility, making them an ideal choice for managing company finances.

What is a virtual debit card?

Virtual debit cards are similar to the ATM cards we have for our bank accounts, except that these are for business usage. With virtual debit cards, companies load a certain amount to their business bank account balance, which is reflected in their overall card balance. So, while making transactions using virtual debit cards, you pay from your own company money.

What is a virtual credit card?

A corporate virtual credit card is like a typical credit card where your card management platform will add a credit amount to your card. Let’s say there is $50k added to your balance. You create a virtual credit card, assign budgets, make payments and pay the amount spent at the end of the payment period.

What are the benefits of virtual cards over physical cards?

Streamline accounts payable process

Virtual payment cards are an effective replacement for orthodox and inconvenient paper-based, labor-intensive tasks. With virtual cards, members of the accounts payable team can focus their energies on financial planning and other responsibilities.

This approach saves time, decreases vulnerability to human error, and streamlines the entire accounts payable process. The benefits of virtual card payments to the accounts payable team include enhanced efficiency and accuracy, enabling the AP department to overcome the challenges of the payment process more effectively.

Improved accountability

You no longer need to worry about mystery payments or chase down the accounts department to get receipts of the payments processed. Because every expense to be made and made is categorized, labeled, and neatly organized. With the clear visibility that virtual cards for businesses offer, there is increased transparency and accountability.

As there are several virtual cards for each payment category, you have visual data of how your money is spent. This feature becomes particularly advantageous when managing specific costs, such as marketing expense management using virtual cards, which ensures streamlined oversight of campaign spending. Since everything is neatly recorded, your accounting will have no trouble tallying and reconciling this to the overall financial statement.

Improved security

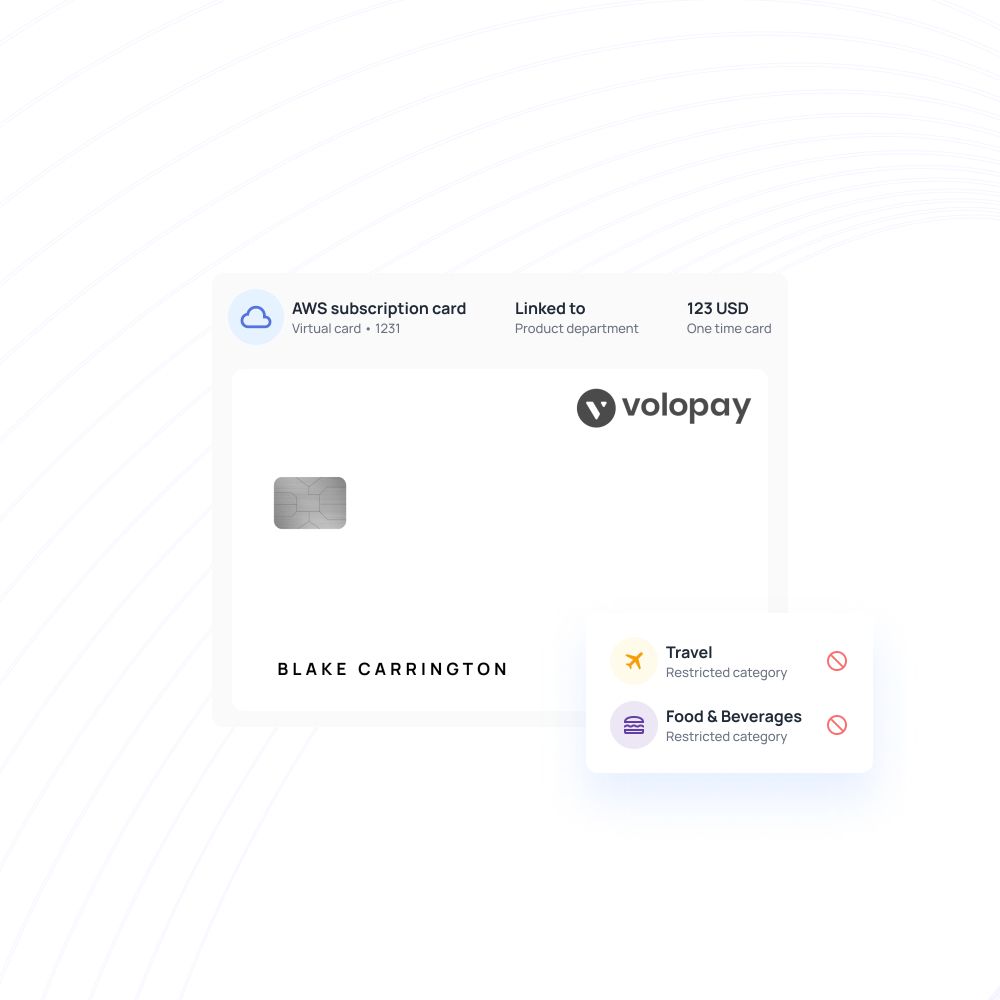

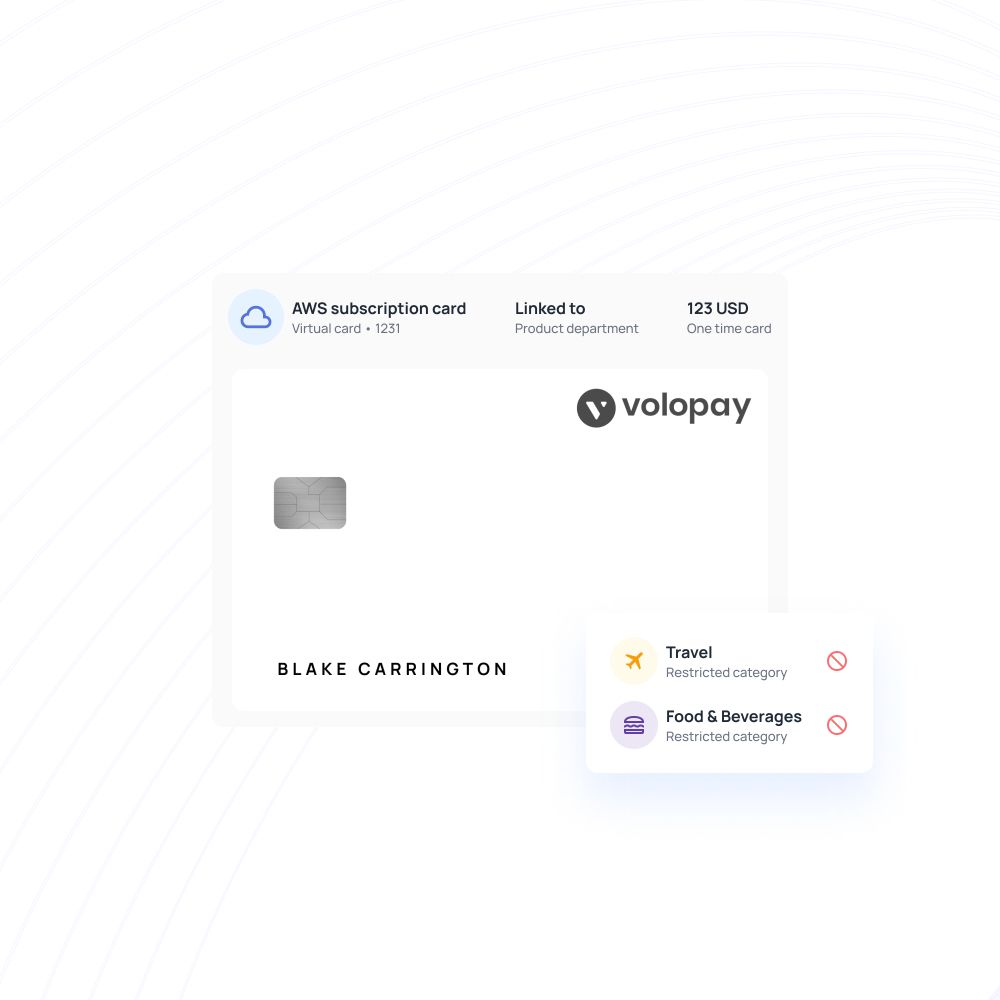

Perhaps this is the feature that shows how virtual payment cards are better than physical cards. Since they don’t exist like physical cards, it’s nearly impossible to steal them or use their information without consent and you can issue one-time cards too. So, there is no way they can use the same card in the future for any fraudulent activities.

Additionally, you can freeze, cancel, or delete a card instantly if you suspect a security breach or compromise. While virtual cards, like any digital payment solution, can be subject to illicit actions, they are generally safer than other payment methods. Each created card functions independently, and businesses can easily issue corporate credit cards for employees, further enhancing security and control over spending.

Eases the tracking and reconciliation burden

Only the finance team knows the pain associated with running behind teams in an attempt to find receipts and payment intentions. It can be challenging for them to find and track why the accounting team has made a specific payment and where the receipt or invoice is. The good news for them is that virtual cards come with clear labels. And there is also an expense code for them to track.

With labels and codes, It’s easier to see who the payment is made for and who initiated it. You can also submit receipts while paying a bill through a virtual corporate card. These benefits of virtual cards improve employee satisfaction, as it streamlines the entire reconciliation process for both ends, the finance team and the employees doing the spending.

Through software integrations, every payment made using virtual corporate cards can be synced with the general ledger. Both automated and manual syncing are available for the admin to choose and enable. Virtual cards indeed make their lives easier.

Better spend control

Over the years, one thing that every organization has strived to follow is cost-cutting and expense management. They know that making budget charts or cutting down subscriptions will never work in the long run. With a bank-issued physical card, you will never know how much is spent or how often it has been swiped. And the same goes with any other traditional mode of payment.

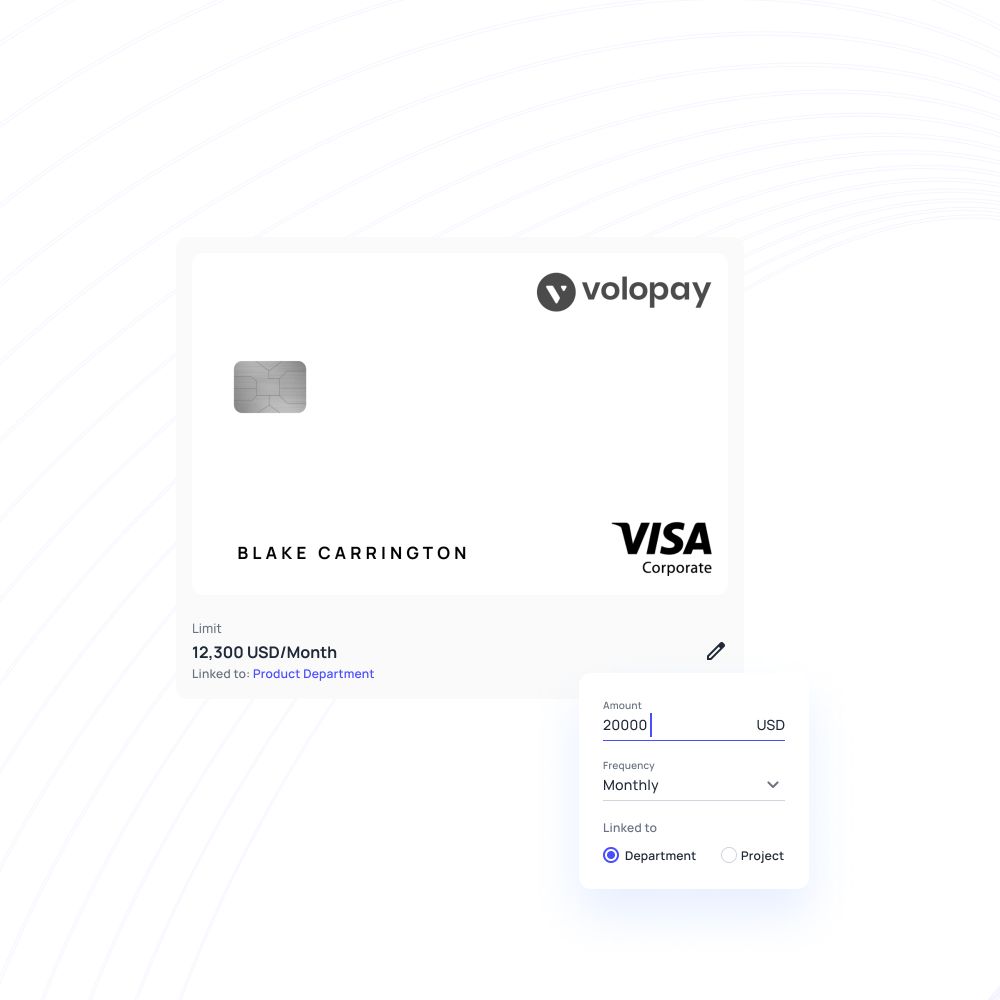

However, with virtual corporate cards, you can set up cards for each expense and designate budgets. This system prevents overspending by notifying you about how much is remaining. If additional funds are needed, requests go through primary and secondary levels of approval. This level of control allows you to monitor spending and swiftly prevent unnecessary expenses.

Can generate single or multi-use cards

A business handles a variety of accounts payable. Some payments, where they just have to pay once, and others have to be frequent. In the case of physical cards, issuing a single usage is not possible. And blocking a card after use can take weeks after raising a request.

But virtual cards for business give you the privilege of marking a card for single use or multiple uses. This feature of virtual cards empower HR teams in fostering employee benefits to your employees. Make the virtual credit card or debit card work for you the way you want to clear off your transactions.

Simplifies vendor management

You can create virtual payment cards in your card management platform from the best virtual credit card providers in the US, based on the number of vendors you have. This way, you can track the total number of vendors your company has across all departments and see how much money is spent on them. This visibility over accounts payable is also advantageous when working on expense analytics and insights.

Virtual cards for business are more favorable than physical cards, weighing all the above factors. Timely payments are another guaranteed feature, and your vendors will love you for this. In short, virtual cards are cut out for vendor payments, notwithstanding the number of vendors your company has.

Will virtual cards replace physical cards?

We cannot say that physical cards are not utilitarian; they have their advantages. They are efficient for personal spending and in-store purchases, while virtual cards excel in online purchases, e-subscriptions, and electronic money transfers.

The benefits of virtual cards include protecting original account information from online theft, while physical cards symbolize brand value.

The difference lies in usability; issuing multiple virtual cards is straightforward, whereas obtaining numerous physical cards can be time-consuming. Together, a successful financial structure requires both physical and virtual cards.

Try out Volopay's corporate cards for your business

Volopay corporate cards for business offer you the best of both worlds as you can have physical and virtual cards. Our virtual corporate cards are best for your business because you can make either single payment, recurring subscription payment, and even vendor payments with them.

The card management platform is neat and visualizing where you can see the virtual and physical prepaid cards distributed, their balances, budgets, name, and so on. If a card is no longer in use, you can delete that or freeze the user.

With a single click, you can create a new virtual card and set up budgets, make it ready for transactions, and enjoy the benefits of virtual cards. The admin receives notifications for every transaction that occurs through the cards. So, there is the right level of control flowing around.

Volopay virtual corporate cards are incredibly safe. Here is how! Each virtual card has a unique number, and if any fraudulent activities occur, other cards are safe and untouchable.

\The user can request funds if they need and it goes through a level of approvals. And in no time, they have the money they need in their account. Volopay virtual corporate cards are changing how companies make their online transactions while acknowledging the pain points finance teams and employees go through.

Related pages

Discover the advantages of using virtual cards for eCommerce businesses, including enhanced security, improved budgeting, and streamlined transactions.

Learn how virtual card payments enhance business travel spending with better expense tracking, and simplified transaction management.

Discover how virtual cards streamline B2B payments, offering enhanced security, precise control, and simplified reconciliation for your business transactions.

FAQ's

The only difference between a physical and a virtual card is that the formal one has a physical appearance, but the latter doesn’t. You can create virtual cards online from your card provider’s platform. It looks exactly like a physical card with a card number, name, and other details. They can be used while making online purchases and payments.

A virtual credit card work very similar to regular credit cards. The only difference is that the former exists in electronic forms. It can be created online through your card provider platform. Each card will have its own card number and CVV. Using that, you can schedule or make online payments.

Virtual cards can be created for each expense category. Expense management can’t get easier than this for businesses with numerous ranges of expenses. All the expenses can be tracked within the same platform. As cards are linked with departmental budgets, monitoring departmental spending is feasible. Without importing expenses to a sheet or making graphs, you can see how much each department is spending.

Virtual cards are extremely safe to use for business purposes. Each virtual card acts independently and is not related to other cards created together. If a card's details are exposed, it can be safely expelled from the system without affecting other cards. As it’s possible to track centrally, no employee can use them for unauthorized purposes.

Volopay offers unlimited virtual cards that you can create, use, and distribute. No matter how many cards you have, you can manage them from the same dashboard. You can tag each card to a budget and department for clear tracking purposes.