Virtual cards vs company cards: Which is best for your business?

Company credit cards have so many features we all love. One of the most obvious ones is that company cards provide ease of payment literally anywhere in the world. Along with this, non of your employees or you have to carry around big bags of cash for payments or travel, such a relief. Plus online payments for subscriptions or vendors have become so much more convenient with company credit cards.

The astounding fact is that the whole concept of e-commerce would have been a failure without these plastic cards. Agreed that company cards have numerous advantages, however, their drawbacks aren’t less. There are many problems that a business cannot afford to keep suffering just because they issue corporate credit cards for employees.

These disadvantages are difficult tracking, annoying to share cards, no solid accountability system. You must be thinking these are all offline or in-store payment problems, what about credit card online payments? Think about the number of times you share your card details online for management tool subscriptions, how risky is that?

Cons of using company cards for online payment

No real-time tracking of the payments

This is a major issue that is most of the time overlooked by many company managers. There is some amount of control you can exercise on the spending limits of a company credit card however, it is still difficult to see that the purchases made from the cards are genuine and from trusted suppliers or merchants.

To avoid this problem without changing the card form the best you can do is, clearly instruct your employees to purchase only from a particular vendor or they can spend only a specific amount of money. Even after this, there are chances that some of the company employees may purchase unauthorized items and it will only be at the end of the year that you’ll get any information related to that purchase.

Not keeping business and personal expenses separately

This is another major issue that occurs every now and then. Many companies do not identify the blurring boundaries between business and personal expenses. There is a great possibility that your team members or employees write off personal expenses as business ones on the company card very easily because there isn’t any strong method of detecting these kinds of expenditures if your business uses company credit cards.

Missing a payments

Missing payments or paying business due late is not an appreciated practice, in fact, this can cause serious damage to your company profile by decreasing the business credit score. If the payments are delayed more than 30 days, there is the possibility of losing up to 83 credit points, and if the delay is more than 90 days the credit score can drop from 27 to 133 points. Although if the payments are made in less than 30 days your company doesn’t lose any points or won’t see any drop in the credit score.

Payments made within 30 days or before the due date displays your company as an authentic business. With company cards, the task of keeping up with payment deadlines becomes immensely difficult because there is no automatic reminder or notification feature entailing it. To get reminders you will have to set calendar popups or email reminders.

No data on who is in charge of every payment occurring on the card

It is comparatively very simple to keep a track of all your subscriptions and personal payments in your head because you as an individual person would have a small number of obligated payments to take care of in contrast to a business. So maybe you have Netflix, Gym, Spotify, and insurance subscriptions which can easily be kept in mind.

However, when it comes to a business it's a whole different arena. Your business uses numerous subscriptions for various tasks. For a quick progressing startup or small business, these numbers may be in the hundreds. To get an idea of the amount of money being spent by each team, ask the members of the head to give you a number. Most probably you won’t get this answer in 10 minutes.

Now, this more than 10 minutes should not be taken because subscription payments or vendor payments are recurring and can be easily tracked through a company card by your bank. However, it takes more time because the whole process is designed in such a way that it becomes very difficult to access data.

You'll be in trouble if you reach your spending limit

It is commonly known that credit cards are issued with a certain spending limit. While using a personal credit card this limit isn’t a big deal because how can you spend from your monthly salary or what is your individual monthly budget. But when it comes to businesses, the case becomes complicated. Different departments have distinct requirements, the tech team may buy some equipment.

However, they may not realize that there is another big payment coming from the hiring department. The company credit card will max out and one of the two will have to wait for the next month. There are so many major and large expenses made in a business simultaneously that your company card is bound to max out and this creates roadblocks for departments that weren’t able to get the resources.

Taking cash in advance

Taking a cash advance is one of the most precarious things to do with a company card. From the very time to withdraw cash, interest starts accumulating on that cash amount and remember there is no grace period. Along with this, you may have to pay a cash advance fee which can be up to 5% of the withdrawn amount.

Difficulty to find fraudulent activity

What if there is some unofficial or unauthorized purchase made on the company card. How quickly do you think you’ll be able to detect it? These company card breaches are not only hacks but also include employees buying non-business-related items and sanctioning them as business expenses. Due to the lack of any strong real-time tracking system or any feature that would ensure transparency, it becomes extremely challenging to spot any fraudulent payments.

These forbidden expenses only come to notice until the end of every month. Still, you are able to track down who made the fraud payment. Everyone would already have access to the card and a strict regulatory measure may work to some extent but won’t eradicate the problem from its roots.

Need to get the new credit card if there is a fraudulent activity

After the detection of some fraudulent activity on the company credit card, the best solution you can adopt is to cancel that card. But canceling the card would mean that all your recurring subscription payments will be declined. Someone from the team will have to login into all your business accounts like HubSpot, LinkedIn, GoogleAdWords, and a hundred others again to add the new company credit card credentials.

The whole system will have to be reset to get everything back to normal, which would involve buying a new company credit card and putting people to do the reset. This also means that you will discover some tools you didn’t even realize you had subscriptions for until the payment fails. Plus there will be many emails asking for the new subscription credentials. A clear chaotic situation. As an easy solution for all these problems virtual cards were invented.

Virtual cards from the best virtual credit card providers in the US eliminate this headache. You can instantly deactivate and replace virtual cards without interrupting ongoing transactions, streamlining the process and ensuring minimal disruption to your business.

Empower your employees with smart virtual cards from Volopay

Virtual cards have advantage over physical company cards

Small businesses usually use one corporate card which is shared with the employees. This makes the business vulnerable to problems related to reconciliations.

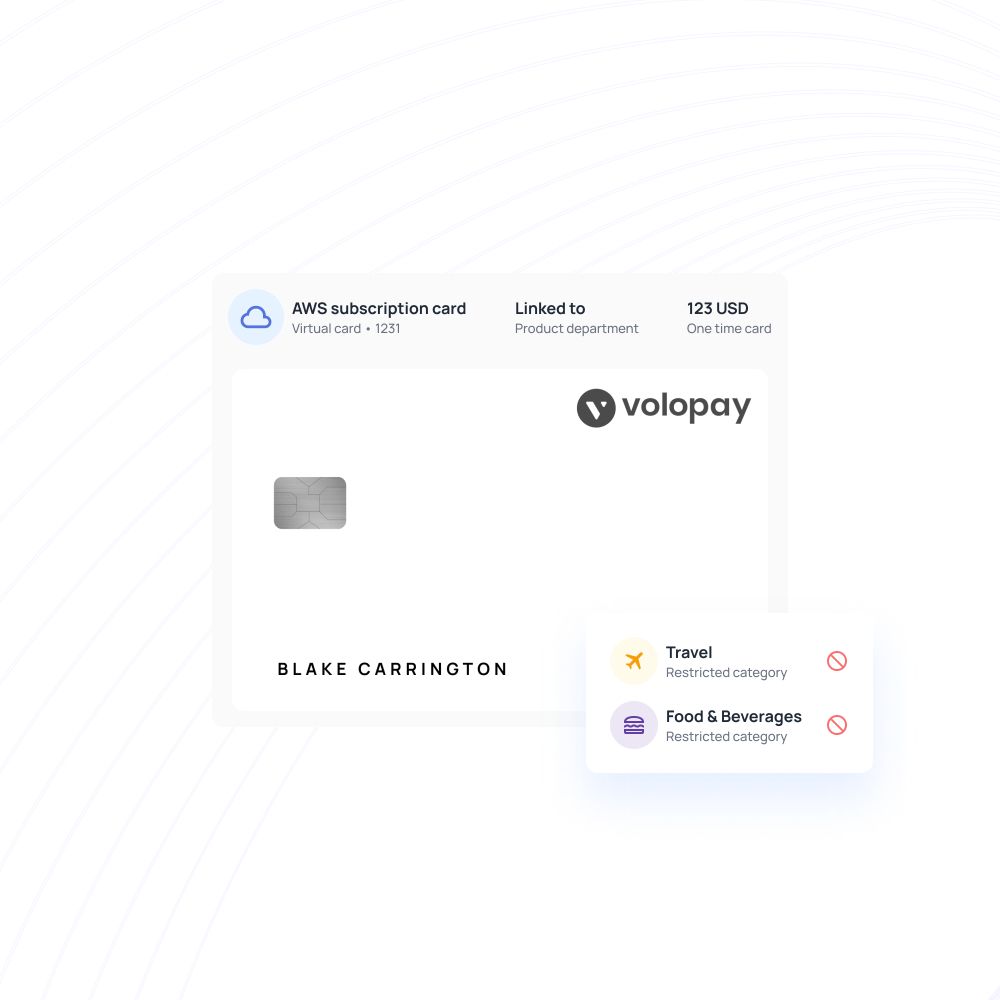

To avoid problems like this, rather than using one company credit card, your business can generate unlimited virtual cards to serve the different needs of your business.

You can assign one virtual card for one purpose or set a time period for the validity of the virtual cards and also set specific monetary limits.

Along with this, using virtual cards comes with the benefits of real-time accounting by this you will always have information on the expenses and transactions made.

In today’s modern times, Using virtual cards for online payments is the best option for everyone to save themselves from fraudulent activities. This is because even if your virtual card number is leaked or compromised in any other way, you can instantly deactivate freeze, or block your card with just a few clicks on your mobile. Virtual credit cards, especially single-use number cards give you immense security against fraud. This feature not only secures your actual accounts number but it also becomes invalid after one transaction, meaning it becomes useless. Virtual cards also provide you the feature to set a spending limit and expiration date.

In comparison to company credit cards, virtual credit cards provide a much higher degree of security, by allowing you to set transaction limits and accurately track expenses against their invoices.

Each single-use virtual card has a unique 16-digit number, making it impossible to steal or reuse. If the spending limit is exceeded, the card is blocked, preventing any further transactions.

There will be no need to give the vendors an open line of credit and this innovative payment feature significantly reduces the possibility of fraud.

Overall, the difference between virtual and physical cards becomes evident in their enhanced security features and greater control over spending.

More and more companies each day are moving towards the option of using virtual credit for online virtual payments because of one simple reason: it saves them a lot of time and money. The features it offers are unique 16-digit card numbers, single-use only option, innovative security system and so many more. You won’t have to spend time and money making spreadsheets, tracking paper trails, reconciling each payment, Virtual cards can do everything for your business in a way you would have never imagined before.

Payment administration and spending controls can have a dynamic effect on your business expenses. By specifying limits on transactions, validity periods, merchant categories, and employee access, your company expenses will be much better organized, allowing you to enjoy the benefits of virtual cards. These controls not only help streamline your spending but also prevent unauthorized payments, keeping your employees accountable. Virtual cards for business can be a literal game-changer in enhancing financial management and security.

To make a smart business, it is important to have an effective and technologically advanced approval process to safeguard all spending.

Any corporate virtual card provider gives you the facility to set up multi-level approval processes to manage the business card funds and reimbursements.

These multi-level approval workflows let you. Direct the spend requests to the right people given the spend amount. Quickly approve any requests or unblock your team. Get all the notifications regarding spend, instantly.

Volopay virtual card for payment automation

Hopefully, by now you must have decided to replace your company credit card with virtual cards. How about we give you the best option, choose a virtual card vendor which is also an all-in-one spend management solution as well.

Choose Volopay to take your business to the next level. Our state of art virtual cards can be requested as needed. They come with a multitude of controls such as setting the card expiry, spend limits and freeze/unfreeze and block.

Our web and mobile apps are equipped with the features to display card numbers, CVV and expiry. These cards also have a spending limit that is refreshed every month. This means you can easily manage all your subscriptions and also allot one virtual card to each department or payment category of your business, to help things run smoothly.

FAQs

Your organization can earn cashback by paying for business expenses. They can avail this opportunity by paying with virtual credit cards. You can earn cash rebates as and when you use a virtual credit card while paying for business expenses. The more you do transactions with a virtual credit card, the more you earn back.

Virtual card owners can analyze their spending by setting up monthly budgets in their virtual cards. This function allows them to spend securely and at the same, it avoids overspending. It becomes convenient for the owners to locate the areas of overspending and where they can cut down expenses.

Any user can file a request for a virtual card on Volopay. Now, your virtual credit cards are just a few clicks away. You can save your wealth and time by managing all your subscriptions on a single platform.

Virtual cards work similarly like your physical bank card. It's just that your physical cards are now replaced with digital/virtual cards offered by Volopay. These are encrypted virtual cards that provide a convenient way to make payments.

With the help of virtual cards, users can make payments securely and conveniently. Virtual debit cards for business reduce the risk of exposing personal debit or credit card details to strangers, making them an ideal solution for managing expenses. The chances of fraud or misuse of information are negligible, allowing users to utilize virtual cards for online payments with confidence.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free