What is a corporate card and how does it work?

When it comes to managing company expenses, corporate cards linked with tracking and controlling features have become the go-to choice for most organizations. Corporate credit cards for startups are particularly beneficial, offering flexibility and control. Corporate card programs are emerging as one of the best options for businesses to give their employees the liberty to spend while proactively managing and controlling their budgets.

What are corporate cards?

A corporate card is a credit card issued by a company and provided to its employees. When you issue a company credit card for employees, they can use it to carry out business expenses such as corporate travel, hotel and lodging, subscription payments, and more. Corporate cards come in various forms, including physical corporate cards, virtual credit cards, and virtual debit cards.

The major benefit of using these cards is that they allow employees to make relevant and necessary expenses without having to spend directly from their accounts. Unlike business credit cards, corporate cards simplify expense management by eliminating the need for reimbursements, so employees no longer have to worry about waiting weeks or months for claims.

What are the different types of corporate cards?

1. Corporate credit cards

Corporate credit cards are the most common type of corporate card. They are issued to employees and are linked to the company's credit account. These cards enable employees to make purchases on credit, and the company is responsible for paying the credit card bill at the end of the billing cycle.

2. Corporate travel cards

Corporate travel cards are designed specifically for business-related travel expenses. They come with travel-related rewards and incentives. This makes them an excellent choice for frequent business travelers who can accumulate points, miles, or cashback on their trips.

3. Corporate expense management cards

These cards are integrated with expense management systems, providing businesses with real-time transaction tracking and categorization. They simplify expense reporting and help enforce company spending policies.

4. Corporate prepaid cards

Business prepaid cards are funded by the company with a predetermined amount. Employees can use these cards up to the available balance. Once the funds are exhausted, the card needs to be reloaded to continue using it.

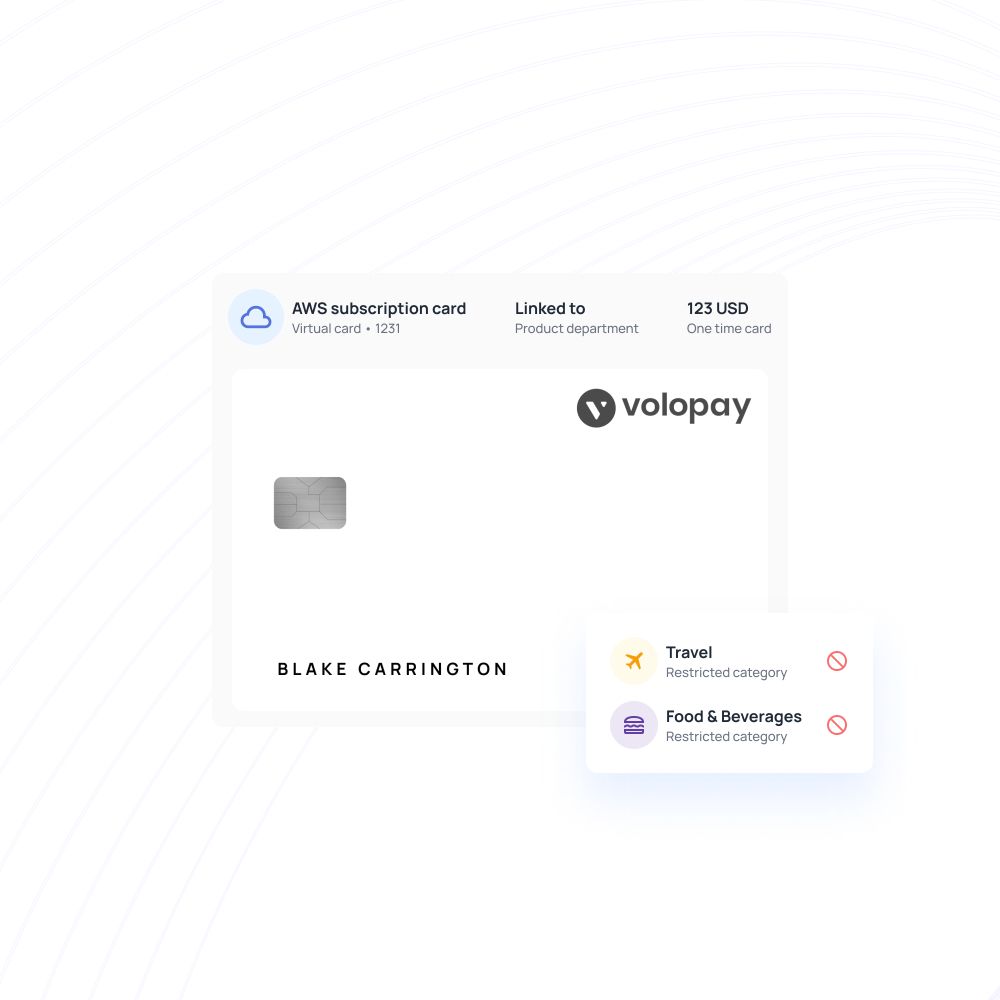

5. Corporate virtual cards

Virtual cards put simply are corporate cards that don’t have a tangible/physical form. Business virtual cards are used for online purchases. They function in the same way any other credit card would work, except that they are not usable for physical in-person purchases.

What is a corporate credit card?

A corporate credit card is a payment card issued by a company to its employees, allowing them to make business-related purchases on credit.

The primary purpose of these cards is to provide a convenient payment method for employees while enabling the company to monitor and control spending effectively through corporate credit card management.

Features and benefits of corporate credit card

● Individual and centralized card issuance

Corporate credit cards can be issued to individual employees, allowing the company to track individual expenses, or they can be issued centrally to a department for specific projects.

● Expense categorization

The best corporate credit cards often come with expense categorization features, automatically tagging transactions with relevant expense categories, making reporting more streamlined.

● Real-time spend tracking

With real-time transaction tracking, companies can monitor spending as it happens, gaining better visibility into their financials.

● Expense management system integration

Corporate credit card transactions can be seamlessly integrated into expense management systems, streamlining the entire expense management process.

● Detailed reporting and analytics

Companies receive detailed reports and analytics on employee spending, helping them identify trends and areas where cost-saving measures can be implemented.

● Centralized expense data

The use of corporate credit cards centralizes expense data, simplifying financial reconciliation and audits.

Looking for corporate cards to manage your business expenses?

What is a corporate travel card?

Corporate travel cards are made to cater to the needs of business travelers. They allow employees to charge travel-related expenses like flights, accommodations, and meals directly to the company.

Features and benefits of corporate travel cards

● Streamlined travel expense management

Corporate travel cards simplify the process of managing travel expenses, reducing the administrative burden for both employees and finance teams.

● Travel-related rewards and incentives

These cards often come with travel rewards, such as frequent flyer miles or hotel loyalty points, providing incentives for employees to use them for business travel.

● Global acceptance and currency conversion

Corporate travel cards are widely accepted around the world, and many cards offer currency conversion features, eliminating the need for employees to carry multiple currencies.

● Enhanced security and fraud protection

Travel cards come with robust security measures, protecting both the company and employees from potential fraud during their travels.

What is a corporate expense management card?

Corporate expense management cards are designed to simplify and control employee spending on business-related expenses.

Other types of corporate cards such as corporate credit cards, corporate prepaid cards, and corporate travel cards may also fall under this category.

Features and benefits of corporate expense management card

● Simplified expense reporting and reimbursements

These cards streamline the expense reporting process, reducing paperwork and administrative efforts for both employees and finance teams.

● Spend limit and category restrictions

Companies can set spending limits and category restrictions on these cards, ensuring compliance with spending policies.

● Real-time transaction tracking and reporting

Expense management cards offer real-time transaction tracking, enabling businesses to monitor expenses as they occur.

● Compliance with expense policies

By enforcing spending limits and policies through corporate cards for expense management, companies can maintain better control over their finances and ensure compliance with regulatory requirements.

● Enhanced employee control

Employees have the flexibility to make business purchases without the need for upfront reimbursements, enhancing their spending control.

What is a corporate prepaid card?

Corporate prepaid cards are funded by the company with a predetermined amount. These cards are very similar to normal debit cards.

Employees can use these cards until the available balance is depleted or till they hit the spending limit mark that has been set on their card.

Features and benefits of corporate prepaid card

Ideal for employee per diem and allowances

Prepaid cards are commonly used to provide employees with per diem or allowance funds, ensuring they have the necessary funds for business expenses.

Reduced risk of overspending

Since prepaid cards have a fixed amount in the form of a card balance, there is no risk of overspending beyond the allocated budget.

Cost control and budgeting

Corporate prepaid cards help businesses control costs effectively by allocating specific budgets to employees.

Get corporate cards equipped with a complete financial stack

How do corporate cards work?

Corporate credit cards are generally a part of a corporate card program that offers companies the ability to issue individual cards for all their employees. These cards are connected to a credit line from the provider. The credit limit that each company gets for their cards is decided based on their financial eligibility and as per the card program that they choose.

Once the company cards are issued and delivered for each employee that the organization requested, they must be activated as per the provider’s system requirements. For Volopay cards, the activation process is as simple as logging in to the mobile app and entering the activation code that you received along with your card.

Factors to consider when opting for corporate cards

1. Does it have virtual & physical cards?

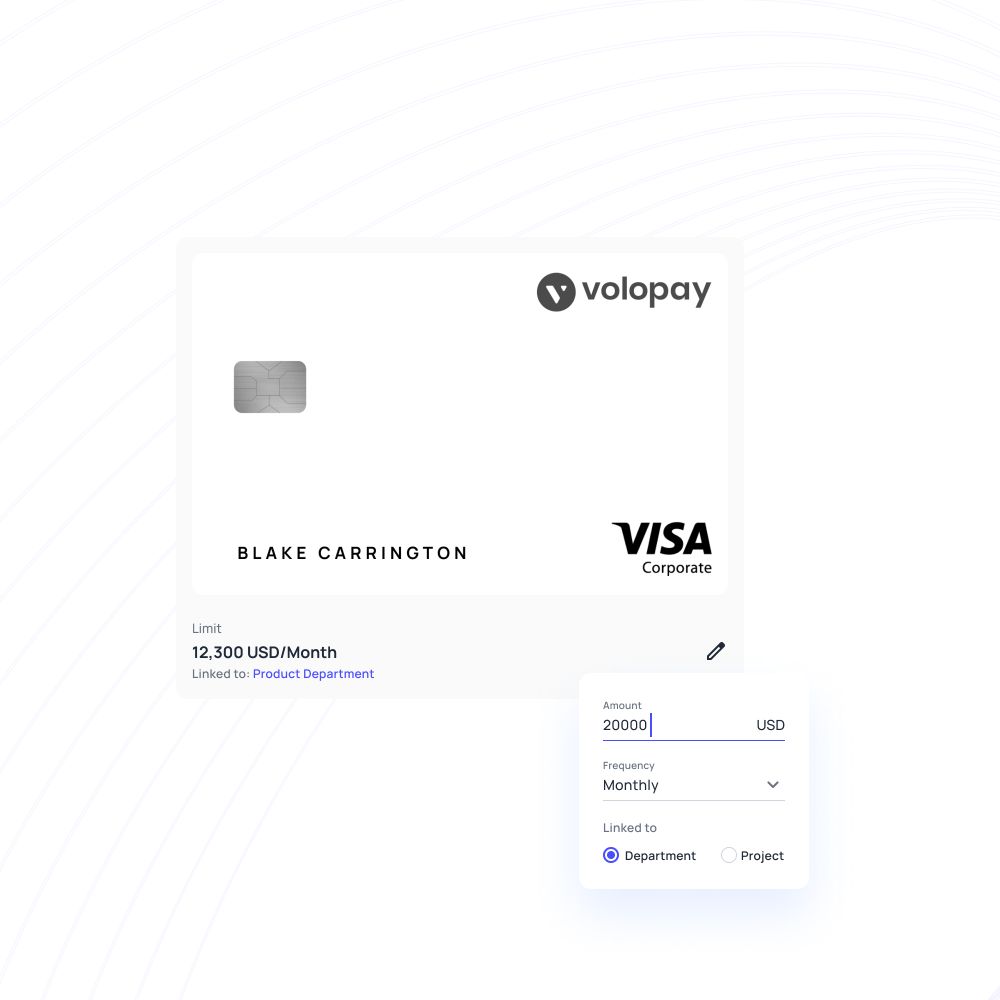

When choosing a corporate card provider, it’s important to not only check if they offer both virtual and physical cards but also understand the types of cards available—credit, debit, or prepaid cards. Each type has unique benefits that cater to different business needs. Having access to both virtual and physical cards ensure flexibility for employees while managing business expenses efficiently.

You can also explore our page on the best corporate card in the US to understand why Volopay is the smartest choice for corporate cards.

2. Can I set payment limits?

The last thing you want is employees having complete access to your entire budget and spending it rashly on expenses. This is what often happens with traditional corporate cards.

You should choose a corporate card program that allows you to set limits on how much can be spent through each credit card as is the case with business debit cards.

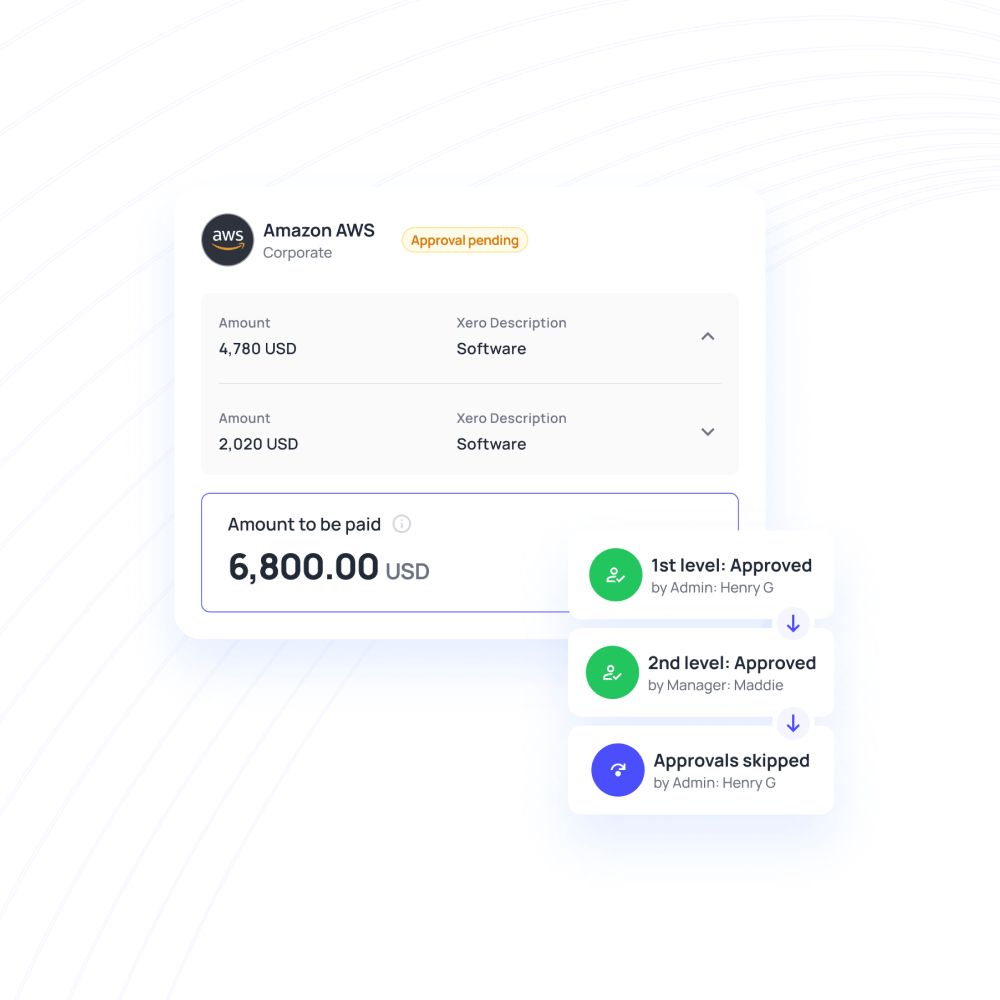

3. Can I set approval workflows?

Setting payment limits is one form of control. But traditional employee debit cards are also prone to spending on unnecessary expenses without prior approval or confirmation from major stakeholders. Select corporate cards that give you the ability to create and set up custom approval workflows.

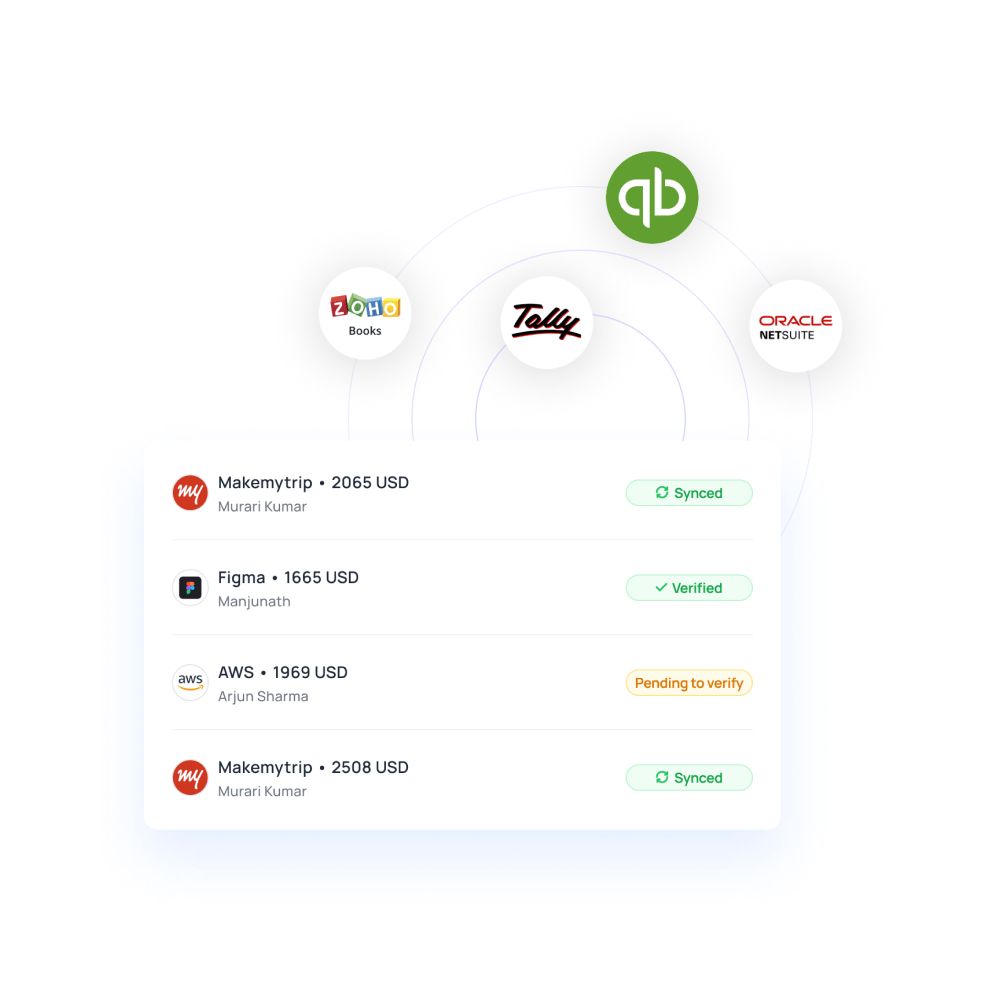

4. Is it possible to sync with accounting software?

If corporate cards are meant to make managing expenses easier, the accounting of all these transactions should also be simple.

All the tracking and reporting of expenses made through cards must happen in such a way that can easily and automatically sync with your accounting software.

5. Is it possible to manage expense reports?

Do not choose a corporate card program that does not give you the functionality to track and control how your money is being spent by employees.

Real-time visibility over each transaction from every card allows the finance department to monitor and keep track of all expenses so that there is complete transparency.

6. Can I set restrictions for vendors?

While you want your employees to have the freedom to make spending decisions, there will be certain expenses that are not allowed as per most company expense policies.

To enforce these rules, your corporate card system should have the option to block specific merchant category codes and stop transactions from such vendors from being executed.

For a deeper dive into what makes a corporate card program truly effective for your business, explore our guide on Factors to consider when choosing a corporate card program in the US.

How corporate cards help in smarter spending?

Issue individual virtual cards

A major benefit of Volopay’s corporate credit card program is the ability to create unlimited virtual cards for each employee on the platform.

One of the key benefits of virtual cards is enhanced security, as each card can be linked to specific budgets or vendors, reducing fraud risk and improving financial control.

Manage your subscription easily

Since you can make unlimited virtual cards, you can create a card for every subscription that your company uses and assign it to the employees who deal with the particular subscription.

This way, the virtual card dashboard on Volopay pretty much becomes a way to manage payments for all your subscription services.

Request for funds

Using the Volopay mobile app or the dashboard on your computer system, employees can easily request additional funds whenever required.

All of this happens in real-time making the process of getting funds smoother than the traditional approach where it took weeks for an employee to receive the requested amount.

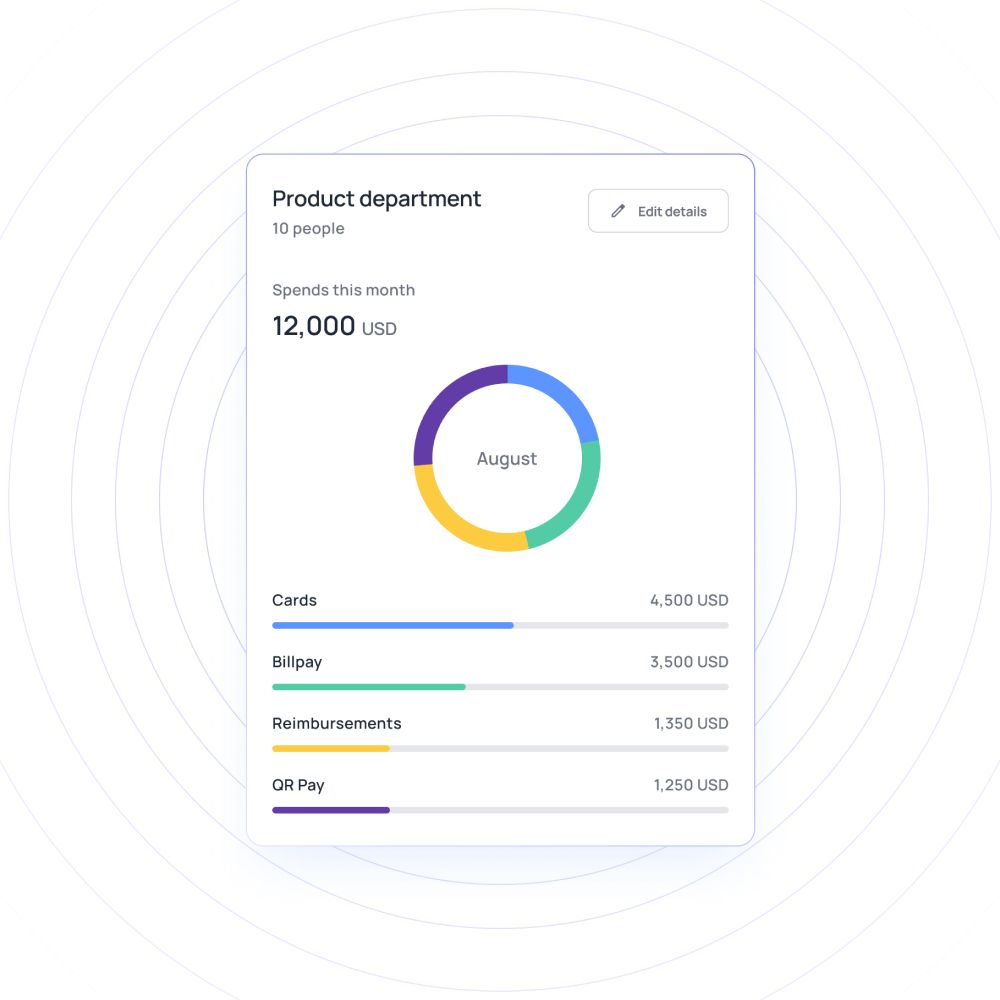

Allocate budgets as per departments

Virtual cards that your employees use won’t directly utilize the credit from your Volopay balance. You will get the option to create separate budgets for each department in your company.

The cards will then be assigned to a particular budget for spending purposes. This way you get deeper control of your company funds.

Set multi level approvals

To ensure that employees are complying with the company’s expense policy, you can set up multi-level approval workflows.

You can set custom ranges of the amount being spent through a card that will trigger the need for approvers to approve a transaction before it is executed.

Freeze and block corporate cards

If you feel like your card data has been compromised due to entering it on a site, then you can temporarily freeze or permanently block the card through the Volopay dashboard.

This way, no money from your budget will be at risk of further fraud.

Get full control of your business expenses with corporate cards

What are some of the fraud prevention options for corporate cards?

1. EMV chip technology

EMV chip technology adds an extra layer of security to corporate cards, making them more secure against counterfeiting and card skimming that can happen frequently at ATMs.

2. Two-factor authentication

Many corporate cards implement two-factor authentication, requiring additional verification steps for online transactions.

The extra code for payments, also known as an OTP is often sent to the registered mobile number and email ID for verification.

3. Transaction alerts

Cardholders can receive real-time transaction alerts via SMS or email, notifying them of any suspicious activity.

So if an employee sees that an expense was made using their card, but they did not make it, they can immediately temporarily freeze the card so that it cannot be used anymore.

4. Data encryption

Corporate card issuers often use data encryption to protect sensitive cardholder information. You should make sure that the card provider you choose has the necessary certification in order to issue and manage the cards.

5. Fraud protection services

Financial institutions offering corporate cards typically provide fraud protection services, reducing the liability of the company and its employees in case of fraudulent transactions.

6. Easy to activate and deactivate the card

Corporate cards can be easily activated and deactivated, allowing companies to control card usage when needed.

What are the use cases of corporate cards?

The benefit of these physical corporate cards over virtual cards is that they can be used for both in-person as well as online transactions.

These company cards are essential for traveling sales members who need constant access to funds for client visits, business dinners, commute, and so on.

You might come across many merchants, stores, restaurants, etc. that accept common wallets and payment methods like Google Pay and Apple Pay.

To make contactless payments through these apps, you can simply add your Volopay corporate card to both these apps easily.

Employees can use the Volopay corporate card as a travel and expense card for business trips.

Depending on the company expense policy that you have set up, employees can use their cards to make purchases for entertainment and dining purposes. You can also use it for foreign transactions wherever VISA is accepted.

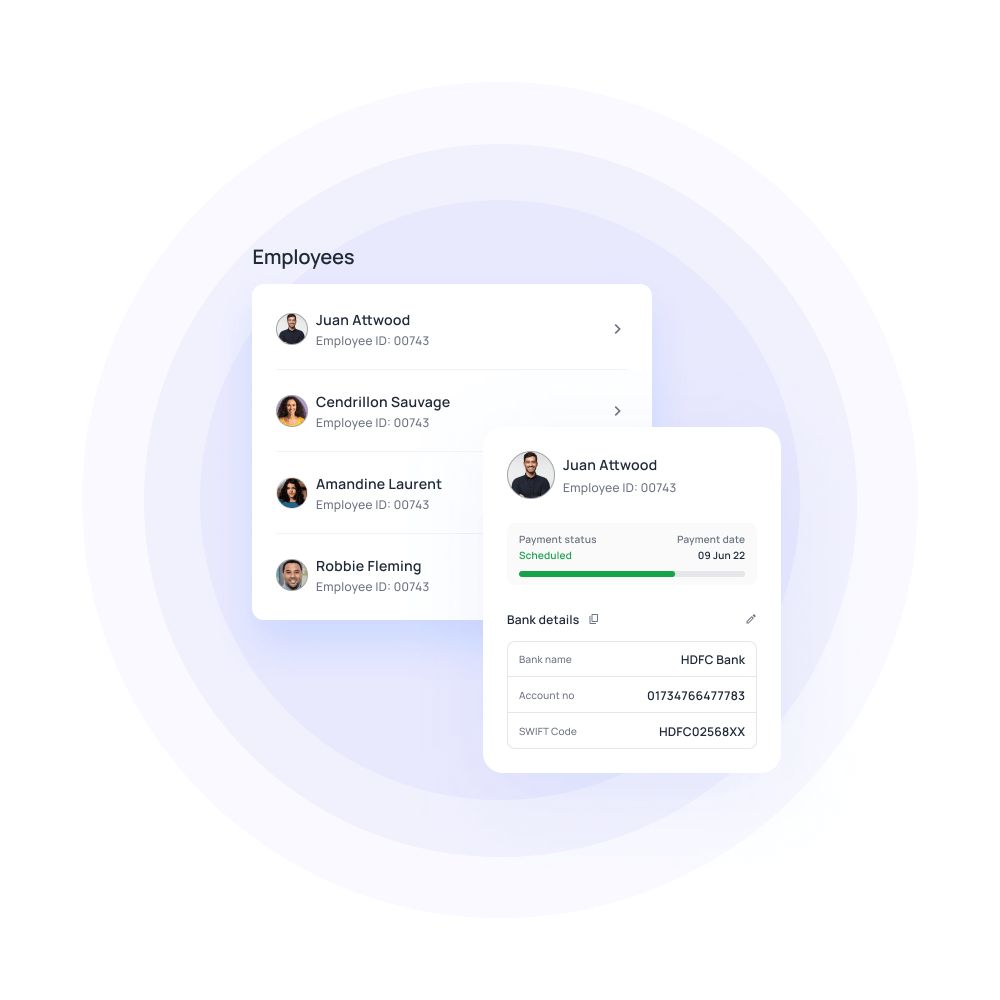

As your company scales up and expands its operations, new employees will be continuously joining your organization to support its growth and development.

To issue corporate credit cards for them, all you have to do is head to your admin dashboard, fill in the necessary details and submit the request for new cards.

Providing your employees with a premium company payroll card not only helps them feel more trusted and valued but also encourages them to become a deeper part of the organization.

This initiative is also a fantastic way to promote and reinforce your company culture, showcasing your commitment to employee empowerment and engagement.

When an employee is traveling to another country and has to make a card payment or needs to withdraw cash from an ATM, they can do this using their physical Volopay cards.

The admin from your company on the Volopay platform must simply enable this specific setting through the dashboard to facilitate the transaction process.

How do corporate cards help in expense reporting?

Since every expense is tracked and recorded, you can constantly check the difference between planned budget utilization and the actual amount that is being used.

This gives a good insight into whether the budget forecasting was accurate or tweaks need to be made in the future.

Every transaction made through a Volopay corporate card will be recorded in real-time on your dashboard for easy tracking and review.

This gives finance teams visibility to quickly address any issues and track daily expenses, allowing for budget adjustments as needed.

Your company’s financial controller or admin on the Volopay platform can easily access and update card settings and approve requests from both desktop and mobile apps.

If the admin cannot access a laptop or desktop, they can still manage corporate cards using their smartphones.

How to manage corporate card expenses?

Understanding how corporate cards help your business is the first step toward using them effectively. These cards streamline payments, reduce the need for reimbursements, and offer real-time visibility into company spending. More importantly, they provide a powerful way to manage employee expenses with greater accuracy and control.

But to truly unlock their potential, businesses must implement strong corporate card expense management practices. With proper controls, approval workflows, and clearly defined policies, companies can minimize misuse, ensure compliance, and maintain full oversight of their financial operations.

Set limits on spending

Another way to manage employee spending through corporate cards is by setting custom limits for each card. You can easily do this for each physical and virtual card that you have issued through our platform.

Corporate card issuance

The great part about our corporate card program is that you get to choose how many employees get a company card. There are no minimum amount of employees required for you to get Volopay corporate credit cards.

Expense policy awareness

While making sure that all your employees are aware of the guidelines in your company expense policy, you don’t get real control unless you can enforce these rules.

But with Volopay, you can make sure that no expenses outside the ones that the company policy allows are made thanks to approval systems.

You can also directly block certain merchant category codes to avoid any transactions being processed with them.

Monitor employee spending

Employees should submit expense reports for purchases made using their corporate credit card for employees, with assigned approvers to approve or reject them.

This way, you can monitor your employee spending, identify any potential employee corporate card misuse, and take corrective action when necessary.

Monitoring your employee spending not only helps pinpoint misuse but also acts as a deterrent, discouraging employees from misusing their corporate cards in the first place.

Get the best corporate credit card program for your business

What are the benefits of using corporate cards?

1. Set custom controls

Spending limits on each card that can be modified at any time and custom approval workflows ensure that the business is always in control of how the budget is being utilized throughout all the departments.

2. Enhanced security

The ability to instantly freeze or block a card from your mobile app makes using Volopay corporate cards a more secure option than traditional business credit cards.

Virtual cards are also more secure than physical cards as they are not directly linked to any bank account.

3. Simple and easy to use

Your Volopay corporate cards can be used to make business expenses as soon as you receive them.

Like any other cards, all you have to do to use them is swipe your card in-store or enter your card details for online payments.

Expense reporting is equally easy and can be done on the go using Volopay’s mobile app, which is tied to your corporate cards.

4. Maker checker

Volopay corporate cards use the maker checker approach. This ensures that there are no chances of expenses that are not allowed.

One person might make a mistake, but when there is an expense maker and an expense checker, or in this case multiple checkers, then you can be sure that all transactions follow the company policy.

5. Sync all transactions with accounting software

Once the expenses are recorded on our platform, you can easily sync them to your accounting software.

Our integrations support some of the most widely used accounting tools including Xero, Quickbooks, Deskera, Netsuite, and MYOB. This ensures that you have no problems seamlessly moving data from your Volopay ledger to your entire company ledger and closing the books of accounts faster.

6. Easy expense tracking and reporting

Corporate cards provide detailed transaction data, simplifying expense tracking and reporting. This makes it easier for both the employee making the expenses and the finance team of the company who need to track and control budgets.

7. Improved cash flow management

Corporate credit cards offer businesses better cash flow management by delaying payments to credit card issuers.

8. Reduced burden of reimbursement

Corporate cards minimize the need for employee reimbursements, saving time and effort for both employees and finance teams.

9. Better financial control

Companies can enforce spending limits and track expenses in real-time, ensuring better financial control.

10. Reduced paperwork

Corporate cards significantly reduce the paperwork associated with expense management and reimbursements. Employees don’t have to create lengthy expense reports anymore.

11. Streamlined accounting process

By integrating corporate card transactions with expense management systems, the accounting process becomes more efficient as most of these systems can easily sync and export data across platforms.

12. Enhanced vendor relationships

Corporate cards can lead to improved vendor relationships through faster payments and negotiated benefits like early payment discounts.

13. Employee convenience

Employees benefit from the convenience of using a corporate card for business expenses rather than having to use their personal funds and then file for reimbursements later.

14. Time-saving

The automation of expense management processes linked with corporate cards saves valuable time for employees and finance teams.

15. Global acceptance

Most corporate cards are accepted worldwide, providing a reliable payment method for a business to make any type of payment.

Get your Volopay corporate card today!

Trusted by finance teams at startups to enterprises.

FAQs

Using corporate credit cards to make your business expenses means that your employees don't have to make out-of-pocket expenses and wait around for reimbursement. Issuing cards to your employees will empower them. With designated cards for business expenses, you can also set spending limits, have multi-level approval policies, and earn rewards to cut back on your spending.

You can manage and control your business spending better with corporate cards. They also often offer other perks such as easy accounting integration and no personal guarantees when it comes to business expenses. Some corporate card issuers will also have rewards and a cashback system that could benefit your company and its spending.

Businesses should opt for corporate cards when many employees need access to funds on a day-to-day basis for their tasks. Common examples include marketing teams who need budgets for advertising, software subscriptions, etc., and sales teams for client visits, stay at hotels, and travel expenses.

A physical card can be used for both physical in-store and online transactions, whereas a virtual card can only be used for online purchases. When it comes to safety and security, a virtual card is a better option as there is no chance of losing it. It is also more secure as it is not directly connected to a bank account; so even if the card details are compromised, the hacker won’t be able to withdraw any money.

If you’re going to pay back employees in the form of reimbursements, you might as well give them smart corporate cards. Most organizations are worried about employees making expenses that are not allowed.

When you choose to issue Volopay cards, you don’t need to worry about these issues. We call them smart corporate cards for a reason. You get to choose the spending limit of each card and also set custom approval workflows.

By doing this, you not only maintain control over your budgets but also avoid the lengthy and cumbersome process of reimbursements.

An AMEX card will have a higher credit limit but it is also tougher for most businesses to acquire. While AMEX also offers employee cards, you probably won’t find the same level of tracking and real-time control that you get with smart corporate cards with Volopay.

If you aim to optimize the utilization of your budget to the highest efficiency, then you should choose a corporate card program such as the one offered by Volopay.

A traditional business credit card does not offer the same level of control and tracking that is offered by a smart corporate card provider like Volopay. Plus, you only get to issue one business credit card for your business entity rather than having multiple cards for your employees.