How do corporate cards help your businesses to spend less & save more?

Corporate cards were created as a way to avoid those painful expense reports and give a seamless spending process. They provide a new level of spending, which means as the card is pre-loaded with a certain amount, you are not permitted to spend more than that amount.

And if you want more funds in your cards you always have the option to request more funds. Corporate cards eliminate the need for everything that the traditional process created from manual data entry, filing expense reports to reconciliation. Hence, they are the most powerful single business spend management tool.

Features of Volopay’s corporate cards

Volopay’s corporate cards are just like your personal debit or credit card. The cards are VISA authorized and are embossed with a 16-digit card no, an expiry date, and a CVV.

Multi level approval policy

Set approvers to approve funds requested when an employee exceeds a set spending limit. A fund request can go up to a 3-level approval process set within the approval policy. This gives you a clear record of who approved the request and for what purchase the funds are requested.

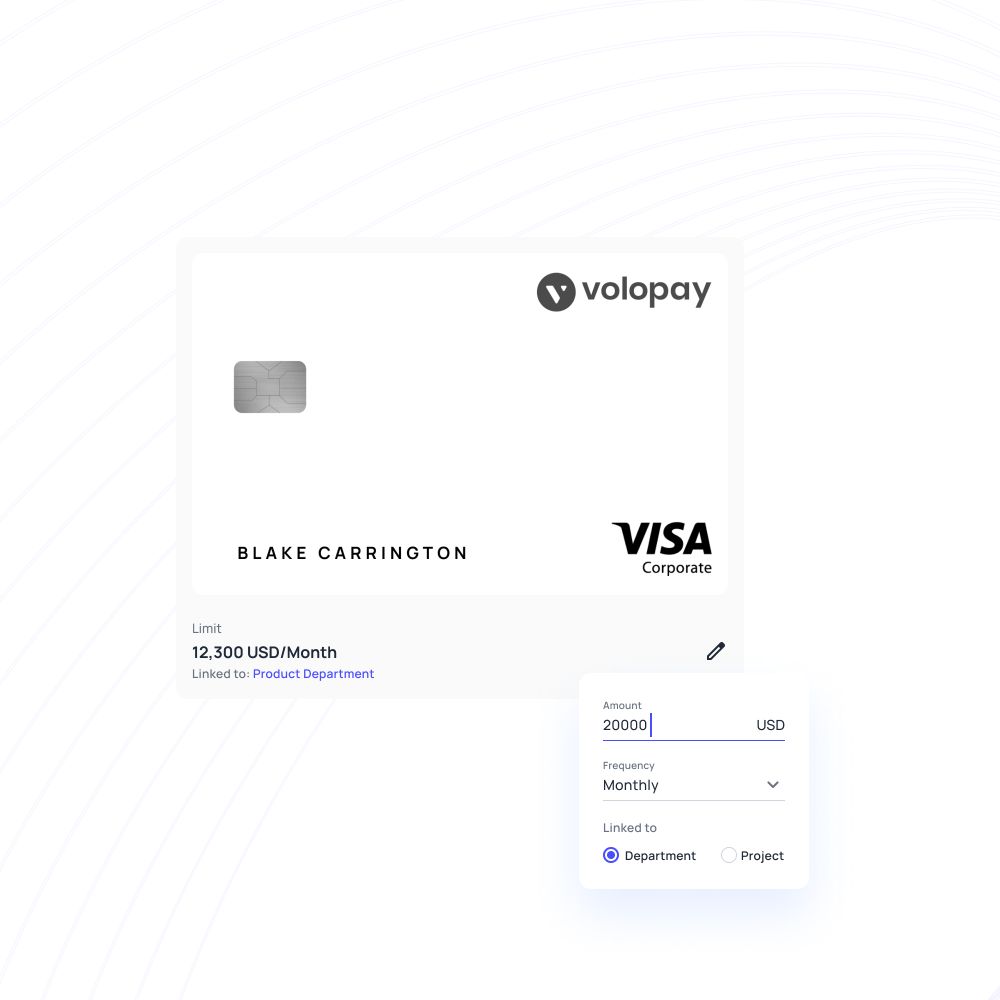

Built in spending limit

Take control of your company’s spending by setting unique spending limits on cards, according to expense categories or types to help you stay within budget. With this, you can make purchases up to a certain amount per month without obtaining approval. This avoids the tedious admin of approving every little expense.

Automated accounting

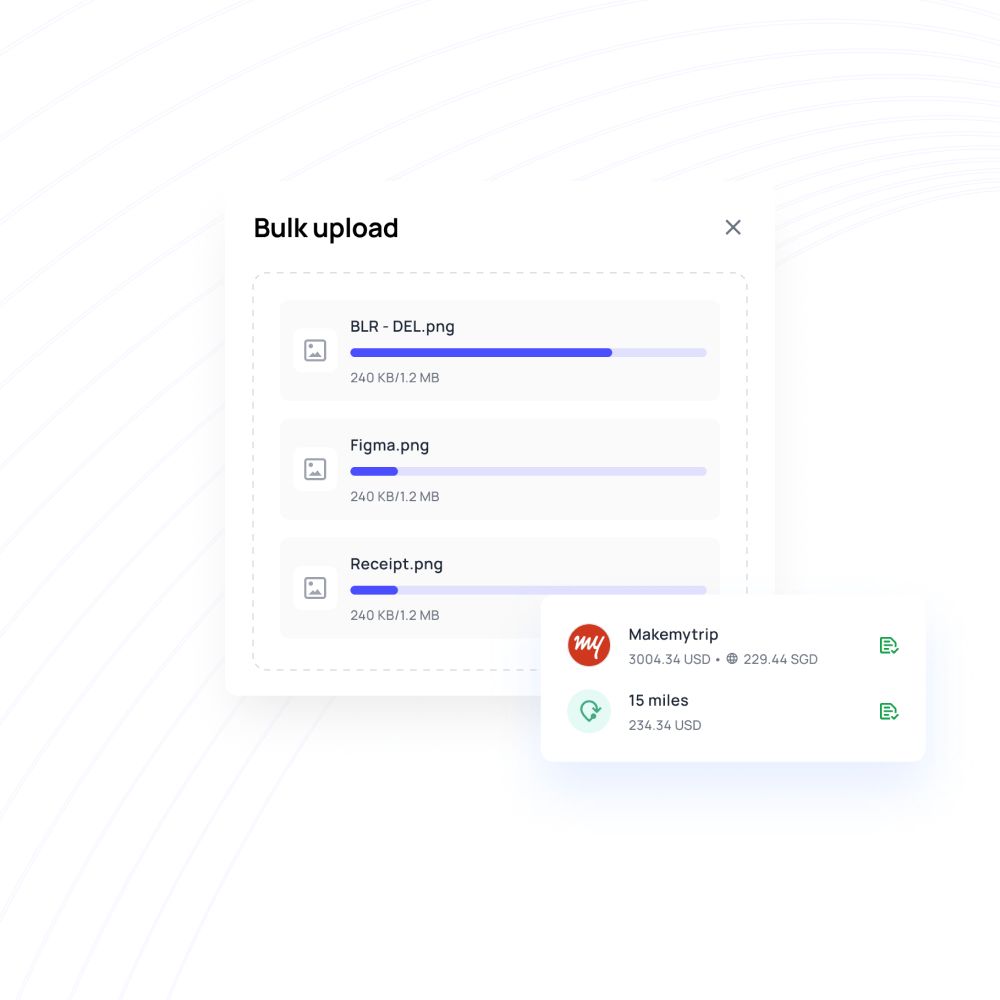

Automate your accounting process by effortlessly integrating Volopay transactions & receipts into your existing system along with all the automated encoding. Volopay integrates with Xero, Quickbooks, and Netsuite. So, choose your preferred accounting tool and export your transactions with just a click.

Maker checker

With maker checker being enabled, all the requests need the approval of at least 2 distinct approvers in the approval flow.

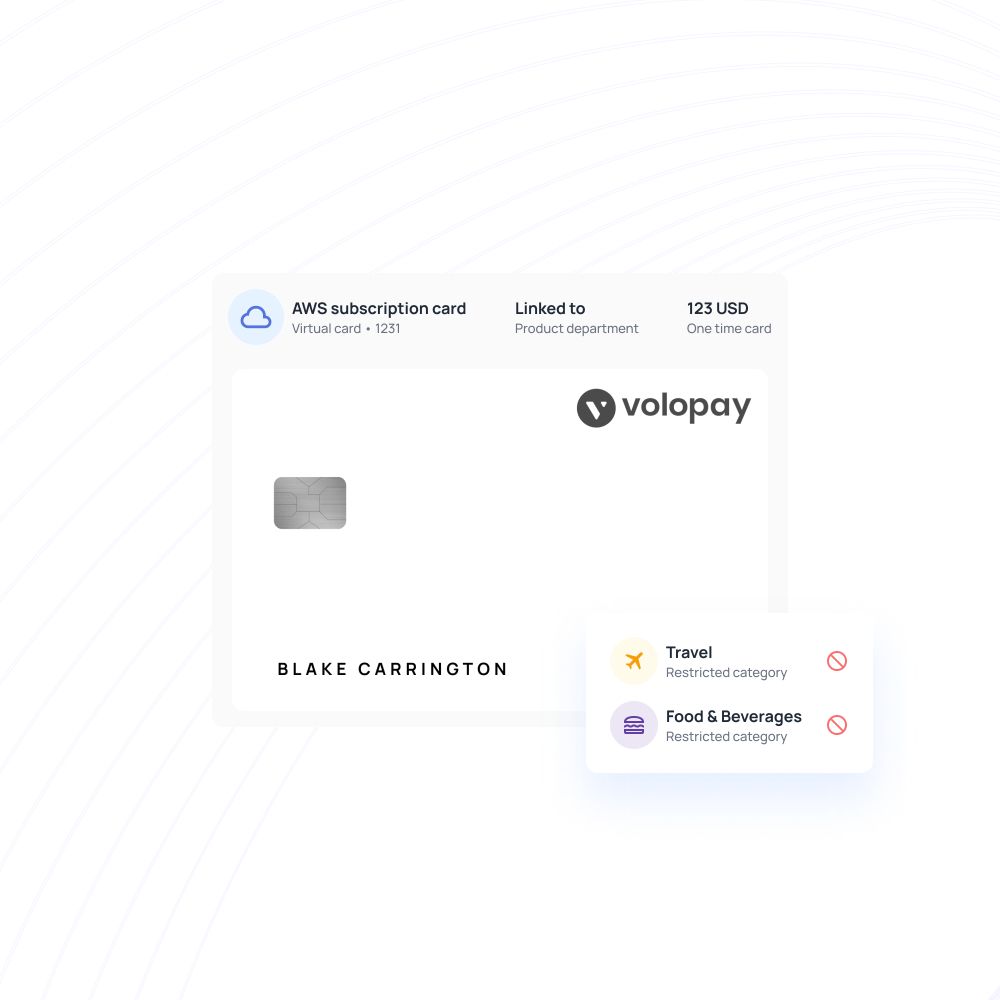

Eliminate out-of-policy expenses

Set spending rules and limits and your cards which will automatically decline any transactions that don't follow them.

Budgets

Set monthly or quarterly budgets to control the expenses. You can create budgets according to expense categories or expense types. From a simple overview, you may track budget progress in real-time.

Accounting reconciliation

No more spending hours in matching receipts with details of transactions. The moment you upload a receipt it just automatically gets matched to the expense. And you can access transactions and receipts from one single platform.

Card reports

Through the corporate cards dashboard get detailed reports regarding the overall number of active, inactive, and unassigned cards, cards that haven't been configured, total transaction amounts, and transactions that haven't been submitted.

Custom controls

Block or approve online transactions, ATM withdrawals, merchants and have complete control over how employees use their corporate cards.

Access to company’s funds

As every employee has their card, it removes the burden of borrowing or hunting down the card whenever they need to make a payment. Hence enables them to be their most productive selves.

Real time visibility overspends

Get real-time spend visibility as every payment made with a corporate expense card is recorded at the time it is made. This lets finance teams track, control, and check-in at any time and examines all of the company's spending, broken down by team, expense category, and other factors.

Company credit cards vs corporate expense cards

Company credit cards vs corporate expense cards

Volopay’s physical card

Physical cards basically are employee cards. These cards are issued to the employees and funds are loaded according to their requirements.

- Linked to multiple budgets

- Can be used internationally

- Can set spend limits for each card

- Pay on-line or in-store

Volopay's virtual cards

Volopay’s virtual cards are unique, budget-specific cards that provide extra security for all online transactions. Examples include virtual cards for LinkedIn budget, Facebook advertising, or Google Ads.

- Budget specific cards

- Card spend analytics

- Multiple user access

- No paperwork

- Protect misuse of funds

Streamline your business expenses with corporate cards

Benefits of using corporate cards for your business

Travel expenses

Employees can use corporate cards while undertaking a business trip too. Payments for hotels, flights, taxis, and others can be swiftly managed through a single card.

Payments

The cards can be used to make in-store as well as online payments. Here’s the big catch!! You can even withdraw money at an ATM through these cards.

Subscription management

Easy management of your subscriptions like LinkedIn, Netflix, etc can be done through corporate cards. Also, they notify you about your upcoming payments in advance, to remind you to load funds in the specific card.

Employee expenses

Every employee is issued a physical card that can be used to make payments for office supplies, legal fees, or other petty expenses. Employees don't have to submit receipts for every expenses. Instead, they can use their card to make the payment & the transaction details will be recorded simultaneously.

Corporate card policy

Having a well-defined corporate credit card policy is a terrific approach to lay out the groundwork for how your employees will utilize their corporate cards. The idea is to make your company's corporate card policy as comprehensive and transparent as possible.

Effective corporate card management plays a key role in enforcing this policy, ensuring a positive spending culture while protecting your company and your employees from poor spending practices.

Choose when spending limits should be applied

While incorporating your corporate card's policy make sure to choose how you want your expense limits to be. Volopay allows you to set daily, monthly, and yearly expense limits. When a cost limit is reached, you have the option of warning the employee or prohibiting them from filing any additional claims.

Choose allowable purchases

Consider what type of purchases and from which vendor/ merchant can be made through cards. List down even the minor expenses that don't fall into any spending category because these are the ones that take a huge toll on your budget.

- Some permissible expenses are:

- Office supplies

- Subscriptions

- Client meetings

- Meals and entertainment

- Software

Define approval process

Choose how you want to set your approval process for the purchases. Having approvers deny or accept the fund's request is one approach to ensure you have visibility into their spending and regulate the amount of money they spend.

Volopay provides you the option to either set an approval process every time an employee needs to make purchases or only when an employee requests more funds into the card.

Keys to choosing right corporate card for your business

The functioning of any business payment card should align with the needs of the organization. The card should be adaptive enough to work in accordance with the company's processes. Also, it should be flexible enough to adapt to new variations.

The acquiring cost is not the only cost that should be considered while choosing a corporate card. Apart from it, indirect costs like issuing and distributing costs should be also taken into consideration. Annual maintenance charges, transaction fees, and other petty costs should also contribute towards the final decision.

Having multiple methods of payment is what makes a corporate card fully efficient. The card should support all forms of payments, domestic as well as international. Nowadays, UPI is the emerging form of payment. Cards that are enabled with UPI payments have an edge over other alternatives.

Protecting accounting data stands indispensable. The corporate cards store crucial data like beneficiary name, account no., and transaction details. Volopay’s entire stack of physical cards is VISA authorized. Thus, users need not worry about data piracy. All the transfers through the software are validated and safely transacted to the beneficiary.

The corporate card selected for your organization should be adaptable for the employees. Cards with complex structures or rules can be difficult for employees to deploy in their work processes. There shouldn't be any discrepancy between card services & employees' expectations. Proper guidance is imparted regarding the card functionality.

Corporate cards vs employee reimbursements

Corporate cards and employee reimbursements are the most common methods to settle employee expenses. Companies adopt either of the two based on criteria like company size, annual turnover, employee workforce, credit management, and risk assessment. On the other hand, some companies use a hybrid approach, where the higher-level employees are issued a corporate credit card and the lower-level employees are granted time-to-time reimbursements.

Reimbursement programs

Reimbursement programs are a highly acclaimed yet age-old method used by small enterprises to manage their tiny workforce. Employees make use of their personal money to pay for company-related expenses and the company reimburses the total amount against the bill of purchase.

Adopting reimbursement reduces the possibility of overspending. Generating expense reports gives granular details for each expense incurred by every employee. While on a business trip, employees will carefully manage their expenses as first they have to make the payment. Moreover, the risk of cards being stolen/misused is also negligible.

Get the best corporate cards for your business

Corporate cards are an easy way to finance employees. Employees use cards to make business purchases and other payments. The corporate card network is centrally linked to an expense management system that has built-in controls, real-time visibility, and other functionality for streamlining the entire process. Additionally, employees earn perks like cashback, air miles, and shopping vouchers for certain payments.

But, companies are quite skeptical about issuing an individual card to every employee. Allocating cards to every employee increases the chances of personal expenses by them. Therefore, selecting the right approach is absolutely essential to manage employee costs effectively.

Volopay vs Competitors

- Transaction limits

- Pre approval

- Link to multiple budgets

- Card wise spend breakup

- Data security

- Cashbacks

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free

Related pages to corporate credit cards

With the help of corporate credit card expense management, you can streamline your expenses, and simplify the reconciliation process.

It's common for businesses to struggle with employee expense management. Know how Volopay can help.

With corporate credit cards, businesses can manage their accounts and track expenses more efficiently.