The role of effective corporate credit card management

When your company relies on multiple cards for daily spending, effective corporate credit card management is essential to keep finances clear and under control. Without proper oversight, hidden costs, misuse, and compliance issues can quickly erode profits.

For growing companies, especially those using a corporate credit card for startups, smart management ensures spending visibility, budget protection, and responsible team empowerment. Discover how strategic card oversight can drive business success and financial clarity.

What is corporate credit card management?

Managing corporate credit cards involves more than simply handing them out to employees. It means implementing clear spending policies, assigning budgets, tracking every transaction in real time, and reconciling statements without delays.

When using a corporate credit card for employees, a structured approach helps prevent misuse, minimize fraud, and maintain budget control. With defined processes in place, your company can stay compliant, gain full visibility into expenses, and empower teams to spend responsibly within approved limits.

Who needs corporate credit card oversight?

Finance teams depend on strong oversight to monitor spending and keep it aligned with company budgets. Operations managers need it to manage daily expenses efficiently without surprise costs. Department heads rely on oversight tools to approve or reject purchases quickly, ensuring teams follow spending policies.

Using a corporate credit card for expense management helps streamline these processes by centralizing control and visibility. Together, clear oversight keeps transactions transparent, prevents misuse, and strengthens accountability. Good oversight supports smarter spending decisions and protects the company’s financial health overall.

Volopay’s role in streamlining corporate card management

Volopay makes it easy to handle every aspect of corporate card management. It provides smart corporate cards connected to customizable spending limits and real-time tracking. Automated approvals and seamless expense reporting help reduce paperwork and errors.

With integration into your accounting system, reconciliations become faster and more accurate. Volopay gives finance teams and managers full visibility and control, so your business stays compliant, organized, and ready to scale spending confidently.

Challenges businesses face in managing corporate credit cards

Shared cards, manual reporting, and delays

Many companies still rely on shared corporate credit cards, leading to confusion over who made specific purchases. Manual expense reporting adds extra work for employees and creates delays in approvals.

This outdated process results in slow reimbursements, limited transparency, and constant follow-ups. Without proper tools, businesses waste time fixing errors instead of focusing on strategic spending and growth opportunities.

Reconciliation chaos and missing receipts

Tracking down receipts and matching them to statements can become a nightmare for finance teams. Missing receipts create incomplete records and inaccurate books. Manual reconciliation takes hours and raises the risk of human error.

When spending data is scattered, financial reports are delayed and unreliable. Businesses struggle to close books promptly, which impacts planning, budgeting, and overall decision-making accuracy.

Inflexible controls from traditional banks

Traditional banks often provide rigid corporate credit card programs with limited spending controls. Changing limits or issuing cards can take days, slowing operations and causing bottlenecks. Employees lack the flexibility to handle urgent purchases while staying within policy.

Weak controls expose companies to fraud and overspending risks. Without modern solutions, finance teams juggle employee needs with strict budget oversight and policy enforcement.

Why scalable corporate credit card management is essential for growing businesses

Spend visibility across teams and functions

Centralized tracking gives you a clear view of every dollar spent across different teams, projects, and departments.

With one system in place, finance teams can monitor spending in real time and catch inconsistencies before they become problems.

This visibility removes guesswork, prevents duplicate payments, and improves budget accuracy.

Managing expenses transparently helps everyone stay aligned with financial goals, making your growing business more agile and accountable at every level.

Avoiding overspending and fraud

Scalable oversight stops overspending and fraud from draining company resources. Policy-backed cards come with built-in limits and approval rules, ensuring every transaction follows clear guidelines.

Real-time alerts flag suspicious activity immediately, protecting funds from misuse or error. Automated expense tracking reduces human mistakes and duplicate charges.

This proactive control helps growing companies stay within budget, meet compliance requirements, and build trust with stakeholders by minimizing wasteful or unauthorized spending.

Enabling empowered employees

Empowering employees with spending freedom doesn’t mean losing control. With smart systems for managing corporate credit cards, you can assign budgets, track spending, and automate approvals.

Employees feel trusted to make quick purchases for work needs while knowing clear spend limits and policies guide them. This balance encourages accountability and reduces bottlenecks in day-to-day business operations.

As your company grows, employees work faster, and finance teams stay confident knowing spending stays within set boundaries.

Real-world use cases for corporate credit card management for businesses

Departmental budgets and marketing campaigns

Marketing and departmental spending can spiral quickly without clear limits. Assigned cards with preset budgets keep costs controlled for each project or campaign.

Finance teams monitor spending in real time and adjust limits if needed. This avoids overruns and ensures spending aligns with company goals, helping departments deliver results without unexpected costs.

Travel and client entertainment spends

Business travel and client entertainment often lead to unpredictable expenses. Issuing individual or team cards with usage caps keeps spending in check.

Managers can approve or reject expenses instantly, reducing misuse and delays. Automated receipt tracking eliminates paperwork and speeds up reporting, keeping travel spending compliant and easy to audit.

Vendor and SaaS subscriptions

Corporate credit card management simplifies how businesses pay vendors and manage SaaS subscriptions. Virtual cards dedicated to each subscription prevent duplicate charges and make canceling services easy.

Finance teams can pause or adjust limits instantly if needed. Tracking all vendor costs in one place avoids surprise renewals and hidden leaks.

Petty cash and remote teams

Petty cash boxes and manual reimbursements slow down teams and invite errors. Reloadable cards give remote employees instant access to approved funds.

Finance controls how much can be spent and tops up balances as needed. Every purchase is tracked automatically, making small expenses efficient and fraud-resistant for distributed teams.

Features to look for in a modern corporate credit card platform

Your corporate credit card platform should let you issue virtual cards instantly and get physical cards delivered quickly.

This way, your team can make purchases or book travel without unnecessary delays.

Fast card issuance keeps spending smooth and secure, whether you’re supporting remote staff or handling urgent business expenses.

If your business operates globally, you need a card platform that supports multiple currencies and hassle-free international payments.

This saves you foreign transaction fees and makes cross-border spending simple.

Your traveling employees can pay overseas without issues, and your finance team can handle international vendors smoothly.

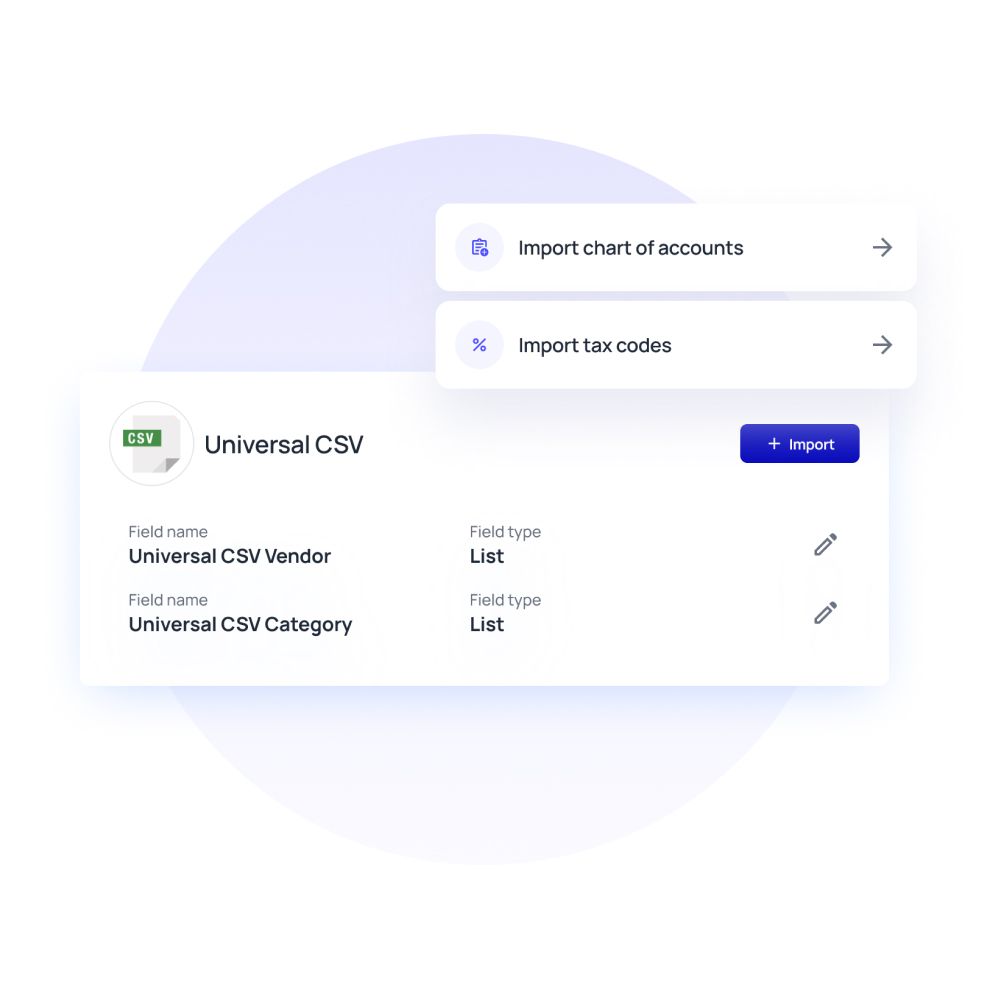

Make sure your card platform integrates easily with your ERP and accounting tools. Automated syncing saves you from manual data entry, prevents mistakes, and speeds up reconciliation.

With everything connected, you always have accurate, up-to-date books and clear visibility into spending, helping you close accounts faster and stay compliant.

Get instant visibility into every transaction your team makes. A good platform sends real-time alerts for unusual activity and helps you catch errors or fraud quickly.

With live monitoring, you stay compliant, react fast to policy breaches, and keep your company’s funds protected without waiting for month-end reports.

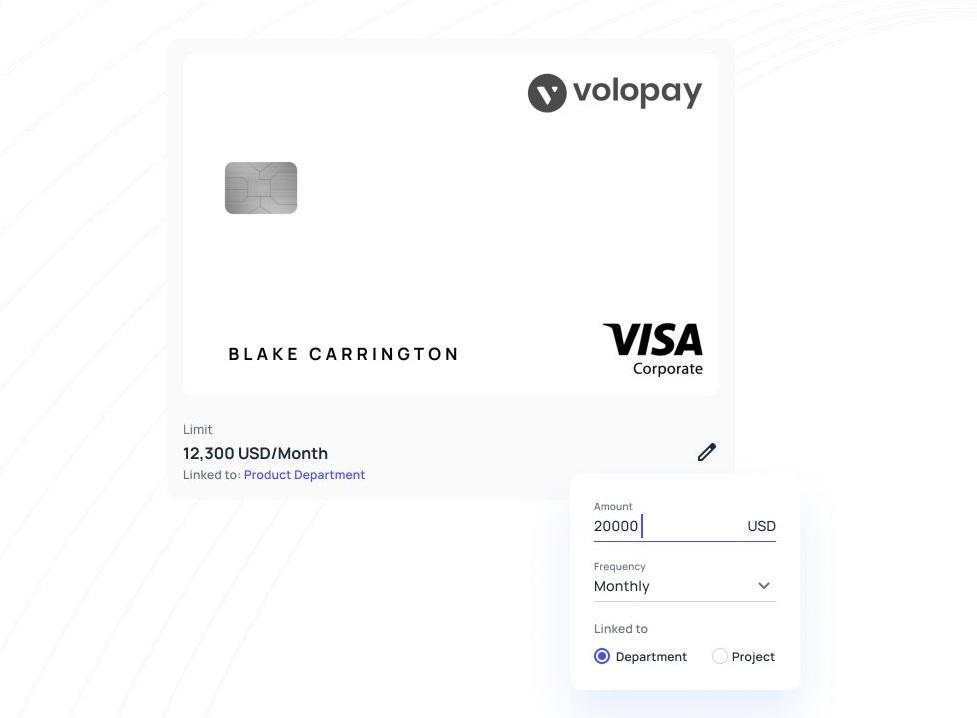

Choose a card platform that lets you set custom spending limits by role, department, or project. This helps you control business budgets and avoid overspending.

Adjust limits anytime to match project needs or policy changes. With clear controls in place, you maintain financial discipline while giving teams the flexibility to spend responsibly.

How Volopay simplifies corporate card management

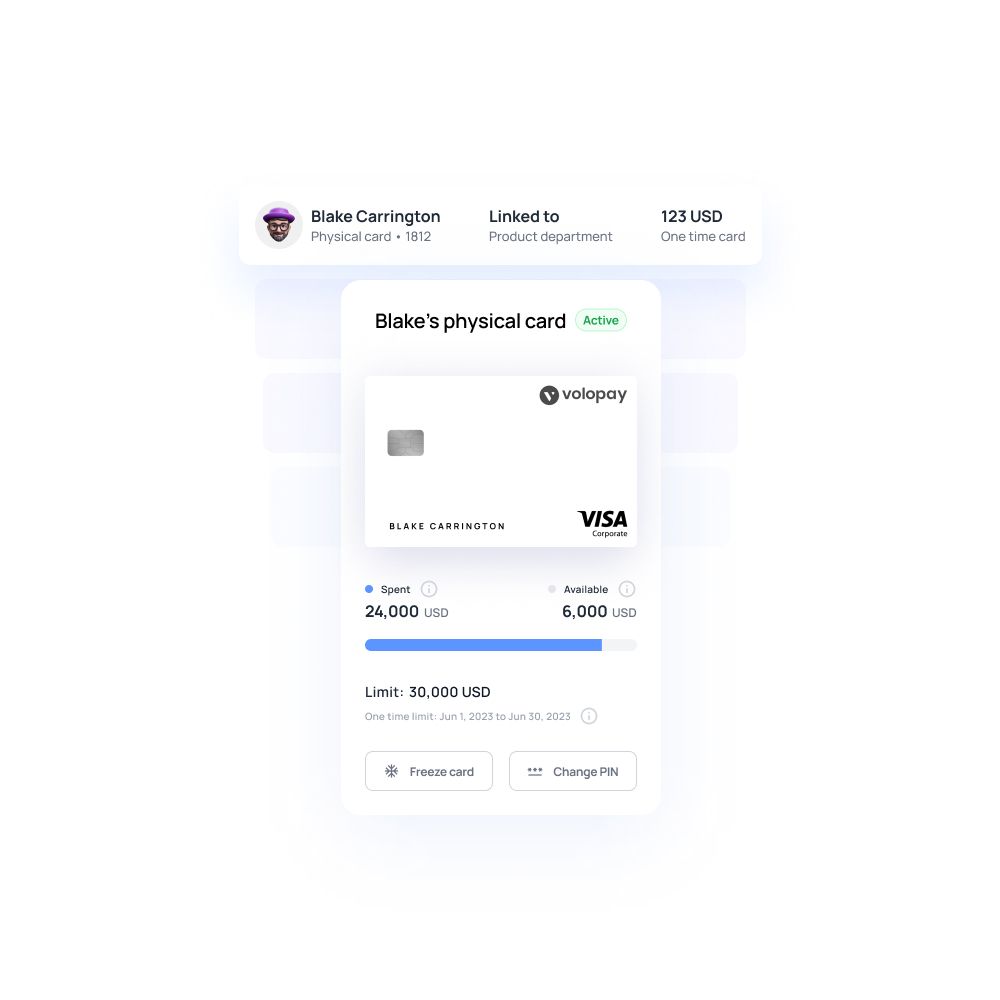

Granular controls for each employee or team

Volopay gives you total control over how every employee or team uses their corporate card.

Easily assign cards to staff, set individual or project-specific spending limits, and freeze or pause cards instantly if needed. This level of customization keeps spending in check and aligns usage with your company’s budget policies.

You gain peace of mind knowing each cardholder spends only within approved boundaries.

Automated business expense categorization

Save countless hours and reduce manual accounting errors with Volopay’s smart automation. Transactions are automatically categorized and mapped to the correct general ledger codes.

This means your finance team spends less time sorting receipts and more time focusing on strategic financial decisions. Accurate books lead to faster closing cycles and smoother audits every month.

Real-time dashboard and budget oversight

Stay on top of company spending with Volopay’s real-time dashboards and budget tracking tools. CFOs and admins get real-time visibility into every card transaction as it happens.

This live insight helps you identify unusual spending, track budget utilization, and make quick adjustments to keep finances on target at all times. Greater transparency helps you build trust with stakeholders and maintain financial discipline.

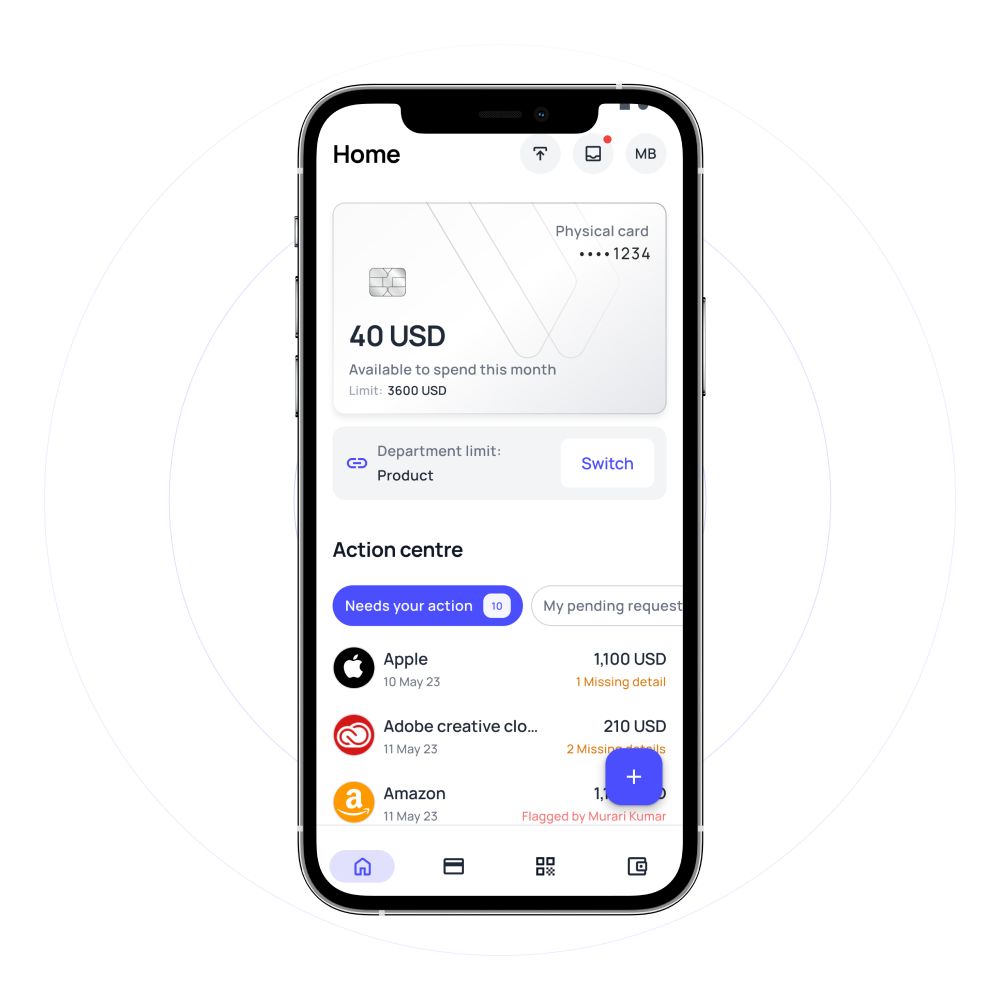

Mobile and web accessibility

Manage your corporate cards and approve or submit expenses anytime, anywhere with Volopay’s user-friendly mobile app and web platform. Employees can capture receipts on the go, while managers can review and control spending remotely.

This level of access keeps operations smooth and ensures financial oversight even when you’re away from the office. Flexibility like this boosts productivity and speeds up expense reporting cycles.

Corporate cards that scale with you

Volopay’s corporate cards grow alongside your business. Whether you have a team of ten or a thousand, you can issue unlimited cards, customize controls, and manage spending with ease.

As your company expands, Volopay’s flexible platform adapts to new teams, budgets, and spending needs without added complexity. You won’t outgrow your card system, no matter how big your business gets.

Best practices for businesses to manage corporate credit cards efficiently

Define card policies and ownership clearly

Establish clear policies outlining who gets a corporate card, spending limits, and approved expense categories. Assign card ownership to specific employees or teams to ensure accountability for every transaction.

With Volopay, you can easily enforce these rules and monitor usage, reducing misuse and aligning spending habits with company financial guidelines.

Use pre-approvals and multi-layer workflows

Incorporate pre-approvals and layered approval workflows to ensure every expense is justified before payment. Volopay lets you build custom workflows with multiple approvers, adding an extra layer of security and compliance.

This proactive approach prevents unauthorized spending, improves transparency, and keeps your company aligned with regulatory and budget requirements.

Centralize reporting and use spend analytics

Consolidate all card transactions into one dashboard and analyze spending patterns regularly. Volopay’s robust reporting tools and real-time spend analytics help you spot trends, control budgets, and find cost-saving opportunities.

Monthly reviews allow you to adjust policies and allocations, ensuring your corporate card program stays efficient and cost-effective year-round.

How Volopay compares to traditional card issuers

Traditional banks often take days or weeks to issue corporate cards, creating frustrating bottlenecks for growing teams that need to spend immediately.

Volopay eliminates this waiting period by allowing you to generate virtual cards instantly and request physical cards quickly.

Fast issuance helps you empower new hires, cover urgent expenses, and keep projects moving without the usual banking red tape slowing you down.

Unlike traditional corporate cards that require extra software or manual tracking to manage spending, Volopay has advanced controls built directly into the platform.

You can set spending limits, approve transactions, freeze cards, and monitor usage all in one place.

This removes the hassle of juggling multiple different tools and ensures your team stays compliant without relying on third-party integrations or spreadsheets.

Most traditional cards aren’t designed to handle multiple currencies and international entities smoothly, leading to extra fees and confusion.

Volopay simplifies global operations by supporting multi-currency transactions and different legal entities from a single dashboard.

Whether you’re paying overseas vendors or funding international teams, you get consistent oversight and cost control, helping your business grow across borders effortlessly.

How to set up a corporate card management system

1. Select a platform based on your needs

Don’t settle for just any corporate card—choose a platform that matches how your company operates and grows. Look for flexible controls, multi-currency support, real-time tracking, and easy integrations with your accounting tools. Volopay gives you all of this in one place, letting you scale your card program as your team and spending needs expand.

2. Onboard employees and set card rules

Once you have your platform, roll it out to your team with clear guidelines. Assign cards to employees, set spending limits by role or project, and establish approval workflows to standardize spending.

With Volopay, it’s easy to configure permissions and usage policies for every cardholder. This consistency keeps expenses predictable and minimizes misuse across departments.

3. Integrate with your expense tools and ERP

A robust card management system should connect seamlessly with your existing expense software and ERP to save time and prevent errors. Volopay’s plug-and-play integrations sync transaction data instantly with your accounting tools.

This automation reduces manual entry, ensures up-to-date ledgers, and simplifies audits. Smooth connections between systems mean your finance team works more efficiently every month.

4. Monitor usage and optimize over time

Setting up your corporate card program is just the start—continuous improvement is key. Use Volopay’s detailed analytics and reporting tools to monitor card usage, spot trends, and adjust budgets or spending limits as needed.

Build feedback loops by reviewing reports regularly and refining policies. This proactive approach helps you maintain control and maximize efficiency as your company evolves.

FAQs on corporate credit card management

Corporate credit card management data provides insights into spending patterns, cost centers, and budget utilization. This data can be analyzed to identify cost-saving opportunities, optimize budget allocations, and make informed strategic decisions that align with business goals and financial health.

Yes, you can instantly create virtual corporate cards dedicated to a vendor, subscription, or project. This lets you set custom limits and monitor usage securely. It’s an easy way to control recurring payments and reduce fraud risks, with Volopay making management simple and flexible.

Corporate credit card management focuses on issuing cards, setting limits, and controlling usage. Expense management is broader; it tracks, approves, and records all company expenses, including reimbursements and invoices. Together, they streamline spending, enforce policies, and reduce fraud, making reporting more efficient for finance teams.

Corporate credit cards cover business expenses like travel bookings, office supplies, vendor payments, subscriptions, and team events. They help separate personal and business spending clearly. With spending controls in place, your company sets rules for what’s allowed, ensuring purchases follow policy guidelines and are easy to track.

Use a smart platform like Volopay to assign cards, set spending rules for each team, and monitor transactions in real time. This keeps spending organized and ensures every team stays within budget. Centralized controls make managing multiple cards simple and stress-free for finance teams and administrators.

Volopay automates reconciliation by syncing card transactions with your accounting software. Receipts and categories match in real time, reducing manual work and errors. Finance teams spend less time verifying charges and more time on strategic tasks, ensuring financial records stay clean, compliant, and audit-ready.

Volopay helps companies establish effective spending controls by allowing customizable spending limits, implementing approval workflows, and providing real-time transaction monitoring. These features ensure that all expenses are within budget and compliant with company policies, reducing the risk of overspending and misuse.