Corporate credit cards for startups and small businesses

Starting and growing a business involves juggling numerous responsibilities. Among these, managing finances is critical. One powerful tool that startups and small businesses can leverage is the corporate credit card.

Business credit cards for startups can benefit your company and streamline your financial operations. Listed below are reasons why they benefit both the company as well as the employees using them.

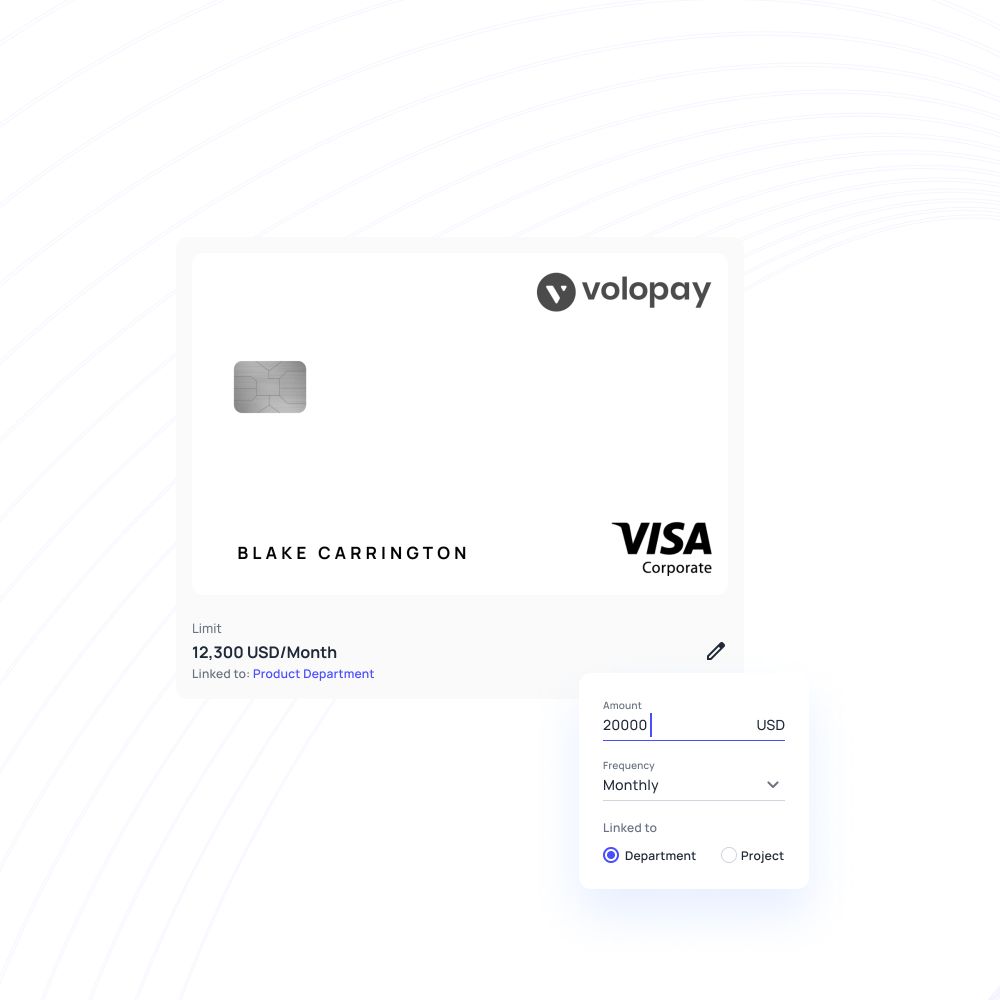

Why does your company need corporate cards?

Usage of corporate cards in managing employee expenses is increasingly gaining popularity.

Corporate cards or business payment cards are yet another expense management tool wherein funds are loaded by the admin for employees to make business payments or expenses. This allows real-time tracking of all transcations.

Employees use these corporate cards for business expenses, avoiding out-of-pocket costs or using the company credit cards.

How can corporate cards benefit your company?

Streamlined expense management

One of the primary advantages of corporate credit cards is the ability to streamline expense management.

Instead of dealing with multiple receipts, reimbursement requests, and petty cash transactions, all business-related expenses can be consolidated into one or several corporate cards.

This centralization simplifies tracking, auditing, and reporting expenses, saving time and reducing administrative burden.

To learn more about how corporate credit cards can manage expenses more efficiently, streamline reporting, and cut down on manual processes, explore our blog on Corporate credit cards for easy expense management.

Enhanced visibility and control

Corporate credit cards provide enhanced visibility and control over company spending.

Business owners and financial managers can monitor transactions in real time, set spending limits for individual employees, and receive detailed reports on expenditures.

This level of oversight helps in identifying spending patterns, detecting unauthorized purchases, and ensuring that budget constraints are adhered to.

Improved cash flow

Cash flow is a crucial aspect of any business, especially for startups and small businesses that may face irregular income streams.

Corporate credit cards can improve cash flow management by offering grace periods between the purchase date and the payment due date.

This extended period allows businesses to use their cash reserves for other operational needs while deferring payment until the end of the billing cycle.

Related read- Ways to improve cash flow in a business

Employee convenience

Issuing corporate credit cards to employees can enhance their convenience and efficiency.

Employees no longer need to use personal funds for business expenses and wait for reimbursement, which can be both time-consuming and financially straining.

With corporate cards, employees can directly charge travel, meals, and other business-related expenses, making it easier for them to focus on their work without financial distractions.

Rewards and perks

Many corporate credit cards come with attractive rewards and perks, such as cashback, travel points, and discounts on business services. These rewards can add up quickly, providing additional value to the company.

For businesses that frequently travel or make large purchases, these rewards can lead to significant cost savings and added benefits, such as travel insurance or access to airport lounges.

Improved integration capabilities

Modern corporate credit cards often integrate seamlessly with accounting software and expense management tools.

This integration can automate the process of recording transactions, categorizing expenses, and generating reports.

By reducing manual data entry and minimizing errors, businesses can ensure more accurate financial records and improve overall efficiency.

Enhanced security

Security is a major concern for businesses of all sizes.

Corporate credit cards offer enhanced security features, such as fraud protection, real-time transaction alerts, and the ability to easily lock or cancel cards if they are lost or stolen.

These features help protect the company from fraudulent activities and unauthorized expenses, providing peace of mind to business owners.

Improved vendor relationships

Having a corporate credit card can also help improve relationships with vendors and suppliers.

Businesses can use the cards to make timely payments, ensuring that suppliers are paid on time and maintaining a positive relationship.

Some vendors may even offer discounts or incentives for payments made via corporate credit cards, further benefiting the business.

Easier expense reporting

Expense reporting can be a tedious and time-consuming process. Corporate credit cards simplify this task by providing detailed statements and transaction histories.

These records can be easily imported into expense reporting systems, reducing the time and effort required to compile and verify expense reports. This efficiency can lead to faster reimbursements and more accurate financial reporting.

Reduced paperwork

Corporate credit cards significantly reduce the amount of paperwork associated with managing business expenses.

Instead of dealing with piles of receipts and manual reimbursement forms, businesses can rely on digital records and automated processes.

This paperwork reduction not only saves time but also supports environmental sustainability by minimizing paper usage.

How do corporate credit cards benefit employees?

No paperwork required

Corporate credit cards for startups eliminate the need for employees to manage and submit paper receipts and reimbursement forms.

Instead, transactions are recorded electronically, simplifying the process of tracking and reporting expenses.

Reducing paperwork not only helps saves time but also significantly lowers the risk of errors and prevents the loss of important receipts.

No out-of-pocket expenses

With corporate credit cards, employees no longer need to use their funds for business-related expenses.

This means they don’t have to wait for reimbursements, which can sometimes take weeks to process.

By charging expenses to the company card, employees avoid using their own money and the associated strain.

Quick additional fund requests

Corporate credit cards often come with the flexibility to quickly adjust spending limits.

If an employee needs additional funds for a specific project or unexpected expense, they can request an increase in their card limit, which can be approved swiftly.

This agility ensures that employees can handle business needs promptly without financial delays.

Faster reimbursements

In cases where reimbursements are still necessary, the use of corporate credit cards streamlines the process.

Expense reporting and approval can be handled more efficiently, leading to faster reimbursements.

This ensures that employees are compensated quickly, which helps in maintaining their financial well-being and morale.

Manage all your business expenses in real time

How corporate credit cards benefit finance team

Improved visibility and control

Corporate credit cards provide real-time visibility into company spending, enabling the finance team to monitor transactions as they occur.

This transparency allows for better oversight of expenditures, helping to identify and address any irregularities or unauthorized spending promptly.

Finance managers can also set spending limits and restrictions, ensuring that expenses align with the company's budget and policies.

Streamlined expense management

Managing expenses becomes much simpler with corporate credit cards.

Instead of handling numerous individual reimbursement requests, the finance team can consolidate expenses into a single system.

This centralization reduces administrative workload and minimizes the risk of errors. The ease of tracking and managing expenses also improves overall efficiency and accuracy.

Enhanced financial reporting

Corporate credit cards for startups facilitate more accurate and timely financial reporting.

Detailed statements and transaction histories provided by the card issuer can be easily integrated into the company’s financial reporting systems.

This ensures that the finance team has up-to-date information on expenses, aiding in the preparation of accurate financial statements and reports.

Compliance and audit support

Maintaining compliance with financial regulations and preparing for audits is made easier with corporate credit cards.

Detailed transaction records and reports support adherence to internal policies and external regulatory requirements.

During audits, the finance team can quickly provide comprehensive documentation, reducing the time and effort required for audit preparation.

Automated accounting

Many corporate credit cards offer integration with accounting software, automating the process of recording and categorizing expenses.

Automation reduces manual data entry, minimizing errors, and saving time.

The finance team can focus on more strategic tasks, such as financial analysis and planning, rather than routine bookkeeping.

Fraud prevention

Corporate credit cards come with robust fraud prevention features.

These include real-time transaction alerts, spending controls, and the ability to quickly freeze or cancel cards if suspicious activity is detected.

These measures help in mitigating potential financial losses and ensuring the overall security of company funds.

Why choose corporate cards over company credit cards?

Choosing the right type of credit card for your business can significantly impact financial management and operational efficiency. Here’s a comparison of corporate cards versus company credit cards across key aspects to help you make an informed decision.

1. Liability

● Corporate cards

Liability for corporate cards often lies with the company, which means the business is responsible for the charges incurred. This setup can protect employees from personal liability, making it easier to manage company expenses without impacting individual credit scores.

● Company credit cards

Company credit cards may require individual employees to assume liability for the expenses they incur. This can affect employees' credit scores and place financial responsibility on them, which might deter some employees from using these cards.

2. Spend controls

● Corporate cards

Corporate cards typically offer advanced spending controls, allowing businesses to set specific limits for each cardholder, restrict types of purchases, and monitor transactions in real time. This level of control helps in enforcing company policies and budgets.

● Company credit cards

Spend controls on company credit cards may be less robust. While some controls are available, they might not offer the same level of customization and real-time oversight as corporate cards, potentially leading to less efficient expense management.

3. Spend limits and requirements

● Corporate cards

Corporate cards generally come with higher spending limits tailored to business needs. They may also offer more flexible requirements, accommodating the varying spending patterns of different departments or projects within the company.

● Company credit cards

Company credit cards often have lower spending limits, which might not be sufficient for larger purchases or high-volume transactions. This can restrict the card’s usability for businesses with substantial or fluctuating expenses.

4. Payment terms

● Corporate cards

Corporate credit cards for startups often provide more favorable payment terms, such as extended billing cycles or grace periods, which can help businesses manage cash flow more effectively. These terms can be crucial for startups and small businesses with tight cash reserves.

● Company credit cards

Payment terms for company credit cards may not be as flexible, potentially leading to tighter cash flow constraints. Businesses might need to pay off balances more quickly, which can be challenging during periods of high expenditure.

5. Misuse of cards

● Corporate cards

With corporate cards, misuse can be more easily controlled and detected due to the enhanced monitoring and spending controls. Businesses can quickly identify and address unauthorized transactions, reducing the risk of misuse.

● Company credit cards

Misuse of company credit cards can be harder to detect if spending controls and monitoring capabilities are limited. This can lead to higher risks of unauthorized or inappropriate spending, affecting the company’s finances.

6. Visibiltiy and control

● Corporate cards

Corporate cards offer superior visibility and control over expenditures. Detailed reporting, real-time transaction tracking, and integration with financial software provide a comprehensive view of spending, aiding in better financial management.

● Company credit cards

While company credit cards do provide some level of visibility, it is often not as detailed or integrated. This can make it more challenging to track and manage expenses efficiently, potentially leading to gaps in financial oversight.

7. Out-of-pocket expenses

● Corporate cards

Employees using corporate cards typically do not have to cover business expenses out of their own pockets. This arrangement eliminates the need for reimbursement processes, enhancing convenience and financial comfort for employees.

● Company credit cards

With company credit cards, employees might still need to cover some expenses personally and seek reimbursement later. This can create a financial burden and inconvenience, particularly if reimbursement processes are slow or cumbersome.

How do corporate cards work?

Corporate cards are linked to your expense management system and generally involve a 7 step process:

● Get corporate cards for employees and distribute them to every employee.

● Set card settings like spending limits, approval workflows.

● Approve or deny funds requests.

● Attach paper receipts of corporate card purchases.

● Prepare and label transactions, verify information, and sync to your accounting software.

● Reconcile payments easily by accessing transactions and receipts from one single platform.

● Reimburse employees in a click.

● Corporate cards work in 2 different scenarios:

Virtual cards: Virtual credit cards employ randomly generated numbers. Your card gets an expiration date and a security code, so you may use the virtual card number to make purchases online or through an app without ever taking your card out of your wallet or revealing your accurate account information.

Physical cards: Physical cards can be used to make purchases online, in-store, and in-app, and you can add them to mobile wallets.

Get better control and visibility over your business spends

How to choose the best corporate credit card for startups?

Selecting the right corporate credit card is crucial for managing your startup’s finances efficiently. With numerous options available, it’s important to consider various factors to ensure you choose the best card that meets your business needs. Here’s a guide to help you make an informed decision.

Evaluate your startup’s needs

Start by assessing the specific financial needs of your startup. Consider the types of expenses you incur most frequently, such as travel, office supplies, or software subscriptions.

Determine whether you need a card with a high credit limit to accommodate large purchases or one that offers rewards on everyday expenses. Understanding your spending patterns will help you narrow down your options.

Check eligibility requirements

Different corporate credit cards have varying eligibility criteria. Some may require a certain business revenue level or a minimum number of years in operation.

Ensure that your startup meets the eligibility requirements before applying. Additionally, consider whether the card issuer performs a personal credit check on the business owner, as this could impact your credit score.

Compare potential fees and interest rates

Examine the fees associated with each corporate credit card. Look for annual fees, late payment fees, foreign transaction fees, and balance transfer fees. Compare these fees across different cards to find the most cost-effective option.

Additionally, consider the interest rates charged on outstanding balances. Lower interest rates can save your startup money if you need to carry a balance from month to month.

Compare terms and conditions of different providers

Carefully review the terms and conditions of various corporate credit cards.

Pay attention to details such as the billing cycle, grace period for payments, and penalties for late payments.

Understanding these terms will help you manage your cash flow effectively and avoid unnecessary charges.

Look at the expense management features offered

Expense management features can significantly streamline your financial operations.

Look for cards that offer detailed spending reports, real-time transaction tracking, and the ability to categorize expenses.

These features can help you monitor spending, enforce budget controls, and simplify the process of expense reporting.

Check integration capabilities

Integration with your existing accounting and expense management software is essential for efficient financial management.

Ensure that the corporate credit card you choose can seamlessly integrate with your software, automating data entry and reducing the risk of errors.

This integration can save time and enhance the accuracy of your financial records.

Leverage reporting and analytical insights

Corporate credit cards for startups that offer robust reporting and analytical tools can provide valuable insights into your spending patterns.

Look for cards that generate detailed reports on expenses, categorize transactions, and offer analytics to help you identify trends and optimize your spending.

These insights can inform your budgeting and financial planning processes.

Ensure customer support

Reliable customer support is crucial when issues or questions arise. Choose a card issuer that offers responsive and accessible customer service.

Check for availability of support channels such as phone, email, and live chat. Good customer support can help resolve issues quickly and minimize disruptions to your business operations.

Prioritize security and fraud protection

Security should be a top priority when selecting a corporate credit card.

Look for cards that offer robust fraud protection features, such as real-time transaction alerts, the ability to freeze or cancel cards instantly, and liability protection against unauthorized charges.

Ensuring strong security measures can protect your startup from financial losses and potential fraud.

How to get a corporate credit card for startups?

Securing a corporate credit card for your startup can enhance financial management and support business growth. Here's a step-by-step guide to help you navigate the process.

1. Build your business credit history

Before applying for a corporate credit card, it’s essential to establish a solid business credit history.

Start by registering your business with credit reporting agencies and ensuring that any existing business credit accounts are in good standing. Pay bills on time, manage debt effectively, and keep your credit utilization low.

A strong business credit profile increases your chances of approval and may result in better credit terms. If your business has never used any other form of credit, then make sure that you have a positive cash flow and have good financial stability.

2. Gather required documentation

To apply for a corporate credit card, you’ll need to provide specific documentation. Typically, this includes:

● Business registration documents: Proof of your business’s legal status.

● Financial statements: Recent profit and loss statements, balance sheets, and cash flow statements.

● Tax returns: Business tax returns for the past few years.

● Employer Identification Number (EIN): Issued by the IRS for tax purposes.

● Personal information of the business owner: Including a Social Security Number (SSN) and personal credit history.

3. Apply for the card

Research various corporate credit cards for startups to find one that suits your startup’s needs. Consider factors such as rewards programs, interest rates, fees, and expense management features.

Once you’ve selected a card, complete the application process. Many issuers allow you to apply online, while others may require a visit to a local branch or a consultation with a business banker.

4. Wait for approval

After submitting your application, the card issuer will review your business and personal credit history, financial statements, and other relevant information. This process can take anywhere from a few days to a few weeks.

Be prepared for potential follow-up questions or requests for additional documentation. Once approved, you’ll receive your corporate credit cards and instructions on how to activate them.

5. Implement card management policies

Once you have your corporate credit card, it’s crucial to establish and implement card management policies. These policies should include:

● Spending limits: Set limits for each cardholder based on their role and spending needs.

● Authorized usage: Clearly define what types of expenses are allowed.

● Expense reporting: Establish procedures for documenting and reporting expenses.

● Monitoring and oversight: Implement regular reviews of card transactions to ensure compliance with company policies.

Implementing card management policies is crucial for maintaining financial control and efficiency. For a detailed approach to managing corporate credit cards, refer to our Guide to corporate credit card management.

6. Review policies regularly

Regularly review and update your card management policies to reflect changes in your business operations or financial goals.

This includes adjusting spending limits, revising authorized usage guidelines, and incorporating feedback from employees.

Staying proactive with policy reviews helps maintain control over expenses and adapts to your startup’s evolving needs.

Get started with Volopay: Take control of your startup's finances

Volopay offers a comprehensive corporate card solution tailored to the unique needs of startups and small businesses. By leveraging Volopay’s corporate card benefits, you can streamline financial operations, enhance control over expenses, and support your company’s growth. Here’s an overview of the key features and benefits Volopay provides.

1. Physical and virtual cards

Volopay offers both physical and virtual cards to meet diverse business needs.

Physical cards are ideal for in-person transactions, while virtual cards can be used for online purchases and subscriptions.

Having both options ensures flexibility and security in managing your company’s expenditures.

2. Multi-level approvals

Implementing multi-level approval workflows is crucial for maintaining control over company spending. Volopay allows you to set up custom approval hierarchies with up to 5 levels of approvers.

This ensures that expenses are reviewed and approved by the appropriate personnel before they are incurred. This feature helps prevent unauthorized spending and promotes accountability.

3. Spend limits and controls

With Volopay, you can set spending limits and controls for each cardholder, aligning expenditures with your budget and financial policies.

These controls can be tailored to individual roles and departments, providing a granular level of oversight and reducing the risk of overspending.

4. Quick and easy payments

Volopay simplifies the payment process, allowing for quick and easy transactions.

Whether it’s paying for office supplies, travel expenses, or software subscriptions, the seamless payment process saves time and reduces administrative hassle. This efficiency is particularly valuable for startups with limited resources.

5. Vendor payouts

Managing vendor payments can be a complex and time-consuming task.

Volopay streamlines this process by allowing you to schedule and automate vendor payouts.

This feature ensures timely payments, strengthens vendor relationships, and frees up your team to focus on more strategic activities.

6. Streamlined reconciliation

Reconciliation of expenses is often a tedious and error-prone process.

Volopay’s platform simplifies reconciliation by automatically matching transactions with receipts and invoices.

This automation reduces the time spent on manual reconciliation, minimizes errors, and ensures accurate financial records.

7. Automated expense categorization

Volopay’s automated expense categorization feature helps in organizing and managing expenses efficiently.

The platform automatically categorizes transactions based on predefined criteria, making it easier to track spending and generate financial reports. This feature supports better budgeting and financial planning.

8. Unlimited cards

Depending on the market you are operating in, Volopay offers the flexibility to issue unlimited cards to your team, ensuring that each employee has the necessary tools to manage their expenses.

This capability supports scalability, allowing your financial infrastructure to grow alongside your business.

9. Accounting integration

Seamless integration with accounting software is essential for efficient financial management.

Volopay integrates with popular accounting platforms like QuickBooks, Xero, and NetSuite.

This integration automates data entry, reduces errors, and ensures that your financial records are always up-to-date.

10. Real-time expense tracking

Real-time expense tracking provides immediate visibility into company spending.

Volopay’s platform allows you to monitor transactions as they occur, providing insights into spending patterns and helping to identify potential issues early.

This real-time visibility supports proactive financial management and informed decision-making.

Trusted by finance teams at startups to enterprises.

Get started with Volopay's corporate cards

Related pages to corporate credit cards

Explore the key differences between corporate credit cards and business credit cards to choose the right option for your company's financial needs.

Expense reporting tools, credit limits, and spend control, are some of the features you should look for while choosing the corporate cards. Discover more.

Learn what corporate credit card reconciliation is and how to match your credit card statements with your records to ensure accuracy and detect discrepancies.