What is corporate credit card reconciliation and how to do it?

Credit card reconciliation is a crucial financial process for businesses, ensuring accurate tracking of transactions as part of effective corporate credit card management.

This involves comparing credit card statements with internal records to ensure consistency. To understand it better, explore the types of credit card reconciliation and its importance.

What is corporate card reconciliation?

Corporate credit card reconciliation is the process by which finance and accounting teams confirm that the transactions that are showing in a business's credit card statement are accurate and matching with entries made in the company’s general ledger.

For efficient and accurate financial reporting, you must confirm that these transactions did actually take place. You must also ensure that the expenses that have been entered on both credit card statement as well as general ledger are correct and valid.

The process of reconciliation usually takes place at the end of every month, while towards the end of each quarter or financial year a more significant financial closing happens.

How do you reconcile a company credit card?

Company credit card reconciliation can either be done manually or with the help of automation. When it is done manually, the finance team or the accountants physically verify each and every transaction showing in the card statement.

They do this by matching the transaction made against the entries made in the general ledger books of the company. On the other hand, if you choose to do it with an automated expense management system this entire process happens automatically where the software synchronizes itself with the accounting systems to reconcile the accounts.

Types of credit card reconciliation

Credit card statements

Credit card statement reconciliation involves comparing the transactions listed on the credit card statement with the company's internal records.

This type of reconciliation helps ensure that all recorded transactions match the actual charges made and helps identify any discrepancies.

Credit card merchant services

Credit card merchant services reconciliation entails verifying the transactions processed through a merchant account.

This involves comparing sales records with deposits received from the credit card processor, ensuring all transactions are accounted for and correctly processed.

How does credit card transaction work?

When you use a credit card for business expenses, the payment might happen instantaneously, but there is a lot that goes on in the backend. The credit card transaction process for a company expense looks something like this

1. A cardholder (In this case an employee) uses a corporate card to complete a purchase.

2. The merchant creates a purchase request using the card, which is then processed by standard networks like VISA, MasterCard, Maestro, etc., and forwarded to your credit partner.

3. Based on the credit limit of the business expense card used, the transaction is either approved or declined. The merchant receives an approved transaction status if the transaction is approved. At this point, the authorization of the purchase is successful.

4. At the end of each day, the merchant’s bank sends across batches of approved transactions to the payment processors.

5. The payment networks then pass on these details to the card associations, in this case, your credit provider.

6. The issuing bank within your credit partner’s network charges your account and transfers the necessary amount to the merchant’s bank.

7. Now, the transaction is complete.

8. At the end of each month or the agreed-upon interval, your credit provider will send you a credit card transaction statement to be paid.

Corporate credit card reconciliation process

1. Collecting and sorting receipts

The process starts with collecting and sorting proof of expenses, i.e. receipts or invoices. Receipts come in various forms and are essential for ensuring accountability for money spent. Collect and store purchase receipts and invoices for future reference.

2. Matching expenses to transactions

Once you have collected and sorted all the receipts and invoices the next step is to use them to match expenses made against transactions recorded. This is done by matching credit card statements to business expenses reported with the receipts.

3. Notifying your bank in case of errors

Either with or without intention, there is always a probability of errors being made. Your finance teams must be alert to detecting these errors and mistakes. When errors are identified your teams must not waste time and notify the banks immediately.

Close your accounting books faster with Volopay

Why is credit card reconciliation important?

Financial transparency

Credit card reconciliation enhances financial transparency by providing a clear and accurate view of a company's financial activities. This transparency is crucial for stakeholders, including investors and auditors, who rely on accurate financial information to make informed decisions.

Budgeting and forecasting

Accurate financial records resulting from regular reconciliation play a vital role in effective budgeting and forecasting. Businesses can use this reliable data to plan future expenditures, allocate resources efficiently, and make informed strategic financial decisions.

Compliance

Maintaining accurate and reconciled financial records is essential for compliance with regulatory requirements. Regular reconciliation ensures that businesses adhere to financial reporting standards and are thoroughly prepared for audits, reducing the risk of non-compliance penalties.

Fraud prevention

Regular reconciliation is a powerful tool for detecting and preventing fraud. By closely monitoring transactions, businesses can quickly identify unauthorized or suspicious activities and take corrective actions to mitigate potential financial losses.

Error identification

Reconciliation helps identify errors in the transaction records. By comparing statements with internal records, businesses can spot and correct mistakes, such as duplicate charges or incorrect amounts, ensuring the accuracy of financial records.

How to do credit card reconciliation?

1. Preparation for the process

● Gather all necessary documents

Before starting the reconciliation process, collect all relevant documents, including monthly credit card statements, receipts, invoices, and records of transactions. Having all necessary paperwork at hand will streamline the process and help ensure accuracy.

● Access to the right software

Utilize reliable accounting software to facilitate the reconciliation process. The right software can automate many aspects of reconciliation, reducing manual effort and the potential for errors.

2. Review the statements

● Examine monthly statements

Carefully review the monthly credit card statements. Check each transaction listed to ensure that it corresponds with your internal records and documentation.

3. Match transactions on the credit card statement with receipts, invoices, and internal records

Compare each transaction on the credit card statement with the corresponding receipts, invoices, and internal transaction records.

Ensure that the amounts, dates, and descriptions match. This might take time to do manually, hence it is best to use the help of an expense management software that can match data automatically.

4. Investigate discrepancies if any

If you find any discrepancies between the credit card statement and your records, investigate the cause. Common discrepancies might include duplicate charges, unauthorized transactions, or incorrect amounts.

5. Adjusting records

Make necessary adjustments to your internal records to correct any discrepancies. Ensure that all adjustments are accurately documented and reflected in your financial statements.

6. Prepare a summary of the reconciliation process

Summarize the reconciliation process, detailing the steps taken, discrepancies found, and adjustments made. This summary provides a clear overview of the reconciliation process and helps maintain transparency.

7. Generate reconciliation reports

Use your accounting software to generate detailed reconciliation reports. These reports should outline all transactions, discrepancies, and adjustments, providing a comprehensive view of the reconciliation process.

8. Documentation and record-keeping

Maintain thorough documentation of the reconciliation process, including statements, receipts, invoices, and reports. Proper record-keeping is essential for future reference and compliance purposes.

9. Automation and software solutions

Consider implementing reconciliation software to streamline the process. Automated solutions can significantly reduce manual effort, improve accuracy, and expedite the reconciliation process. Many software options offer features such as automatic transaction matching, discrepancy alerts, and comprehensive reporting tools.

Making corporate credit card reconciliation easier

The traditional method of reconciliation involves your finance team carrying out a manual check of all credit card expenses on the card statement and making sure that they match with the company expenses in your ledger. This is done to ensure the legitimacy of all transactions, check whether each transaction did occur, and can be traced back to expenses made by your employees.

If all the payments in your business ledger match with the expenses on the credit card statement, then your account books for the month can be closed. In a situation where there is a discrepancy between the statement and the expenses in the company ledger, then your finance team must find out the source of the payment and which employee carried out the transaction to clarify and solve the issue.

This entire process of matching business expenses with credit card transactions is a tedious and time-consuming activity for your finance team, even if there are no discrepancies. But thanks to the introduction of advanced fintech solutions, the accounting process is becoming more simplified each day.

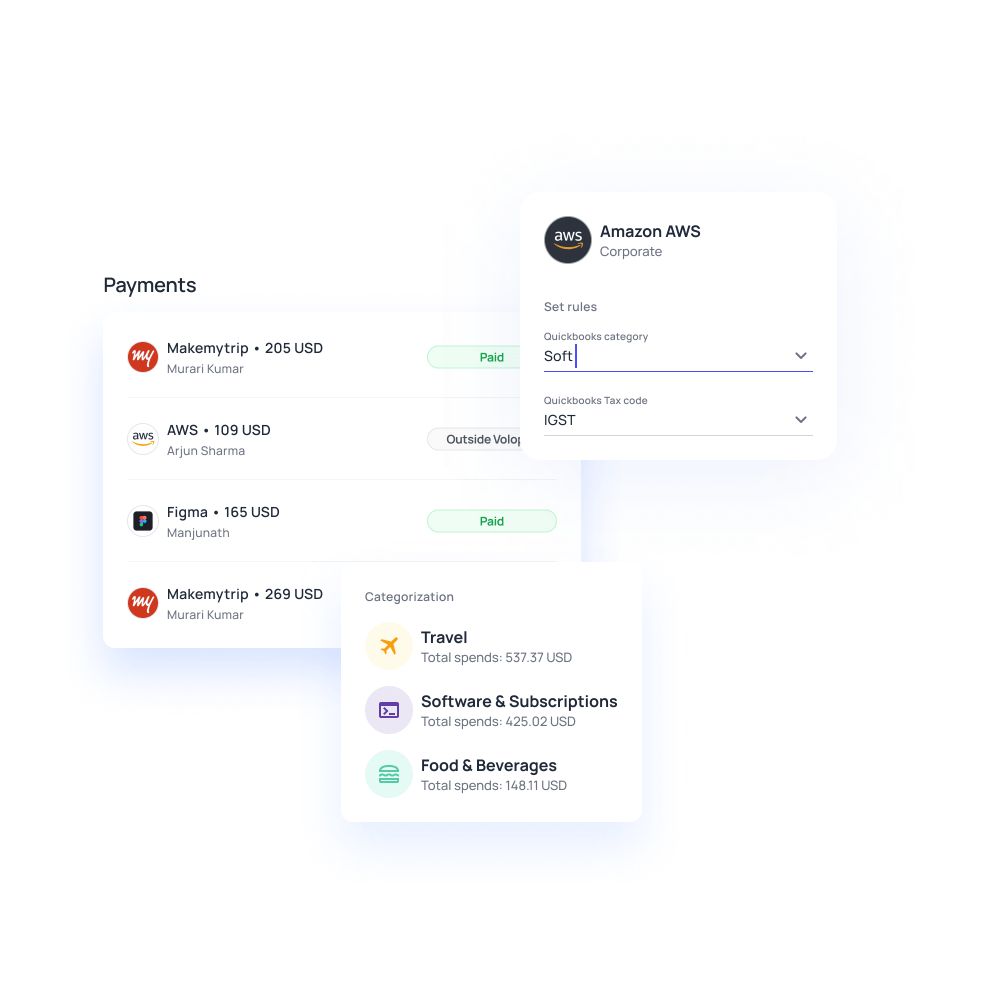

For this particular case of reconciliation, businesses now have access to receipt scanner apps as part of an expense management software in the market. This allows the employees to directly scan and upload receipts of the credit card expenses they’ve made which can later be matched to card statements.

This is possible thanks to a technology known as OCR(optical character recognition). Using your credit provider’s app the OCR tech automatically reads important data from the picture of the receipt that you’ve uploaded and the credit card statement from the respective integrated accounting software.

The software then matches the values from the uploaded expense receipts and the statements from your accounting software to verify whether the expenses match the transactions on the statement.

The fact that all of this matching, reconciliation, and credit card processing for small businesses took hours and days to complete, now gets done automatically within a few seconds is a big deal for finance teams. Being able to close the books in such an efficient manner also helps prove your business's financial health.

Automate your reconciliation process with Volopay

Benefits of automating credit card reconciliation

1. Streamlined expense management

Automation simplifies and streamlines the management of expenses by automatically capturing and categorizing transactions. This leads to more accurate and timely expense reporting, reducing the likelihood of errors and discrepancies.

Suggested read: Corporate credit cards for expense management

2. Reduced burden for the finance team

Automated reconciliation reduces the manual workload for finance teams, allowing them to focus on more strategic tasks. This alleviates the repetitive and time-consuming nature of manual reconciliation processes.

3. Cashback, rewards, and other perks

Automation ensures that all eligible transactions are accurately captured and processed, maximizing the benefits from credit card rewards, cash back, and other perks. This can lead to significant savings and added value for the business.

4. Increased efficiency and time savings

Automation speeds up the reconciliation process, drastically reducing the time required to match transactions and investigate discrepancies. This increased efficiency allows for quicker financial close cycles and timely financial reporting.

5. Control on spending

Automated systems provide real-time visibility into corporate spending, enabling better control and monitoring of expenses. Businesses can set spending limits, monitor compliance with corporate policies, and identify unauthorized transactions swiftly.

6. Enhanced fraud detection

Automation enhances fraud detection capabilities by continuously monitoring transactions for unusual patterns or anomalies. This proactive approach helps in the early detection and prevention of fraudulent activities, protecting the business from potential financial losses.

7. Simplified exception handling

Automated reconciliation tools can flag exceptions and discrepancies automatically, making it easier to investigate and resolve issues. This simplification of exception-handling processes reduces the time and effort required to address discrepancies.

8. Better cash flow management

With accurate and timely reconciliation, businesses can maintain a clear and up-to-date view of their cash flow, which helps improve cash flow overall. This improved visibility aids in better cash flow management, ensuring that the business has the liquidity needed to meet its obligations and invest in growth opportunities.

Challenges in corporate credit card reconciliations

While credit card reconciliation is essential for maintaining accurate financial records, businesses often face several challenges during the process.

Here’s a look at some of the key challenges in corporate credit card reconciliations

Manual process

Manual reconciliation involves a significant amount of data entry, transaction matching, and error checking, which is both time-consuming and labor-intensive.

Finance teams must spend countless hours sifting through transaction records, receipts, and statements to ensure everything matches. This manual effort increases the potential for human error and delays, ultimately making the reconciliation process inefficient and less reliable.

Increased volume of transactions

As businesses grow, the volume of credit card transactions can increase exponentially. This surge in transaction volume can overwhelm finance teams, making it increasingly difficult to keep up with the reconciliation process.

High transaction volumes can lead to missed transactions, delayed reconciliations, and an increased risk of errors, which can compromise the accuracy and timeliness of financial reporting.

Reduced accuracy of reconciliations

Manual reconciliation processes are prone to errors due to the repetitive nature of data entry and matching. Mistakes such as data entry errors, incorrect transaction amounts, and overlooked discrepancies are common in manual processes.

These errors can significantly reduce the accuracy of reconciliations, leading to inaccurate financial records and potential financial misstatements.

Recognizing and rectifying policy violations

Ensuring compliance with corporate spending policies is a critical aspect of credit card reconciliation. However, identifying and rectifying policy violations, such as unauthorized or excessive spending, can be challenging without automated tools.

Manual processes often fail to catch these violations in a timely manner, increasing the risk of non-compliance and financial loss.

Diverse data sources

Businesses often deal with transactions from multiple credit card providers, bank statements, and internal financial systems, each with its own data format.

Reconciling transactions from these diverse data sources can be complex and time-consuming. The lack of standardized data formats complicates the reconciliation process, increasing the risk of discrepancies and errors.

Difficulty in expense categorization

Accurate expense categorization is crucial for financial reporting and analysis. However, manually categorizing expenses can be challenging, especially when transaction descriptions are ambiguous or unclear.

This difficulty can lead to inconsistent and inaccurate expense categorization, complicating financial analysis and decision-making.

Lack of visibility into employee spending

Without proper tools and processes, gaining real-time visibility into employee spending is difficult. This lack of visibility can hinder effective monitoring and control of expenses, increasing the risk of unauthorized or inappropriate spending.

Businesses need real-time insights to manage and control employee spending effectively, ensuring compliance with corporate policies and budgets.

Reconcile expenses in real-time with one click of a button

Best practices for corporate credit card reconciliation

Effective corporate credit card reconciliation is crucial for maintaining accurate financial records and ensuring financial integrity. Implementing best practices can significantly enhance the reconciliation process, reducing errors and improving efficiency.

Here are some best practices for corporate credit card reconciliation:

Practice regular reconciliation

Regular reconciliation is essential for timely identification and resolution of discrepancies. Conducting reconciliation frequently, such as monthly or even weekly, ensures that any issues are promptly addressed. This practice helps maintain accurate financial records and provides a clear, up-to-date view of the company’s financial status.

Use reconciliation software

Leverage reconciliation software to automate and streamline the reconciliation process. These tools can match transactions, flag discrepancies, and generate reports automatically. Using reconciliation software reduces manual effort, enhances accuracy, and allows the finance team to focus on more strategic tasks.

Set clear expense policies

Establish and communicate clear expense policies to all employees. These policies should outline permissible expenses, spending limits, and the documentation required for each transaction. Clear guidelines help prevent unauthorized spending and ensure compliance with corporate policies.

Employee training

Provide training for employees on the importance of credit card reconciliation and adherence to expense policies. Educate them on how to accurately record and submit expenses, the significance of timely submissions, and how to recognize potential fraud. Well-informed employees contribute to a smoother and more compliant reconciliation process.

Implement audit trails

Maintain comprehensive audit trails for all credit card transactions. Audit trails provide a detailed record of each transaction, including who authorized and processed it. This transparency is crucial for accountability, helps in investigating discrepancies, and ensures compliance with regulatory requirements.

Implement a reconciliation checklist

Develop and use a reconciliation checklist to ensure a systematic and thorough approach to the reconciliation process. A checklist can include steps such as gathering documents, reviewing statements, matching transactions, investigating discrepancies, and generating reports. Using a checklist helps ensure that no critical steps are overlooked.

Regularly review credit access and limits

Periodically review and adjust credit card access and spending limits for employees based on their roles and responsibilities. Regular reviews help ensure that credit limits align with current needs and reduce the risk of unauthorized or excessive spending.

Secure storage of confidential information

Ensure that all confidential information related to credit card transactions is stored securely. Implement robust security measures, such as encryption and access controls, to protect sensitive data from unauthorized access and potential breaches. Secure storage of confidential information helps maintain data integrity and protects against fraud.

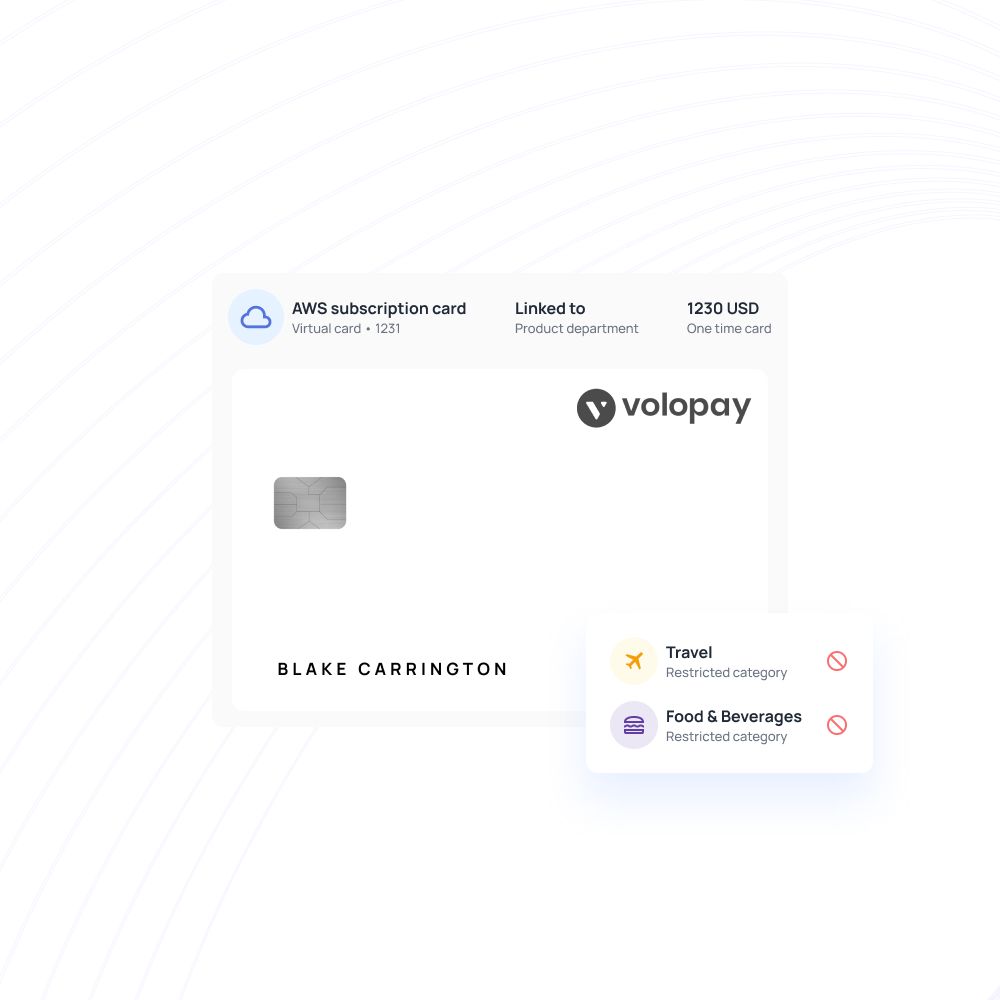

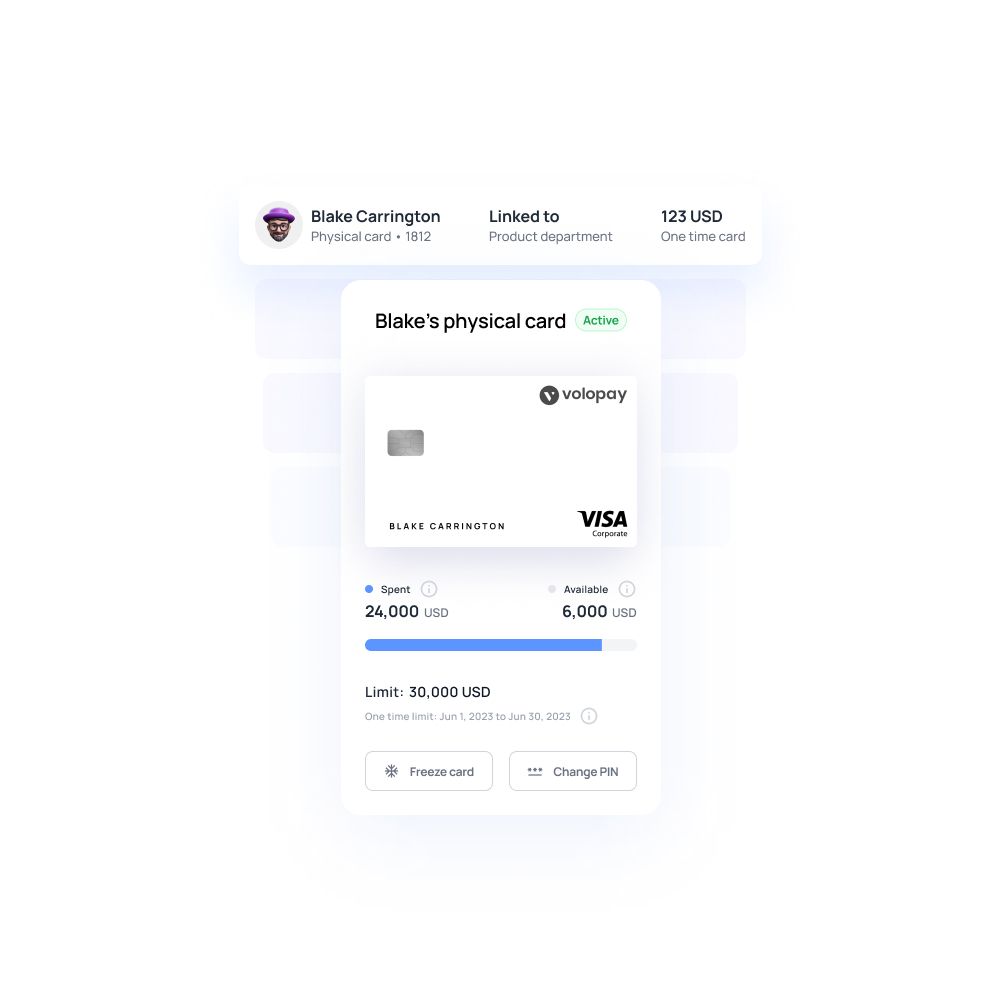

Expense management with Volopay

Automating your expense management with Volopay becomes extremely easy once you integrate your accounting software with our platform. Each card transaction that your employees conduct using Volopay corporate cards is recorded in real-time on the Volopay dashboard with the ability to instantly add the necessary details and attach the relevant expense receipt.

This makes it super simple for your finance team to match company expenses with your card statements and sync directly to your accounting software. What might have taken days at the end of each month, quarter, and financial year will now take only hours to complete.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free

FAQs

Yes, with the help of expense reconciliation software you can automate the credit card reconciliation process.

Credit card statement reconciliation means the process by which card statements are matched against receipts and invoices.

When businesses reconcile credit card statements they basically match the statement against receipts and invoices.

Yes, you can easily download all card transactions in the form of a PDF from the ‘Expenses’ tab under ‘Cards’ on our dashboard.

Corporate credit card reconciliation helps prevent fraud by regularly reviewing and verifying each transaction against internal records, receipts, and statements. This process allows businesses to quickly identify unauthorized transactions, suspicious activities, or discrepancies.

By promptly detecting these issues, companies can take immediate action to investigate and mitigate potential fraud, thereby safeguarding their financial assets.

The frequency of corporate credit card reconciliation depends on the volume of transactions and the company's financial policies. However, it is generally recommended to conduct reconciliation at least monthly.

For businesses with high transaction volumes, weekly or even daily reconciliations may be more appropriate. Regular reconciliation ensures timely identification and resolution of discrepancies, maintaining accurate financial records.

Investigate discrepancies thoroughly, contact card issuers or merchants if necessary, adjust internal records to reflect accurate details, document the resolution process, and review policies to prevent future issues

Reconciliation software integrates via data imports, APIs, and synchronization. It automates transaction matching, flags discrepancies, and updates the accounting system, reducing manual effort and errors while enhancing accuracy.

Yes, reconciliation software scales to fit businesses of all sizes. It automates processes for small businesses and efficiently handles high transaction volumes for large enterprises, providing tailored solutions to meet specific needs.