Factors to consider when choosing a corporate card program in the US

Managing business expenses at scale requires more than just handing out cards to employees. A well-chosen corporate card program gives you control, visibility, and flexibility, all essential for growing companies in the US. But with each provider offering different tools, fees, and policies, it’s easy to end up with a solution that doesn’t fit.

Choosing the right corporate card for your business expenses isn’t just about convenience; it’s about building a financial system that supports smarter spending, better compliance, and streamlined operations. This guide is designed to help you cut through the noise and focus on what really matters when selecting a corporate card program for your business.

What is a corporate card program?

A corporate card program gives your business a structured way to manage employee spending. It’s a smarter, more secure way to handle business payments.

Instead of relying on personal cards or manual reimbursements, you can issue business cards that are tied directly to your company’s financial system. These cards are meant for official expenses, such as travel, software, or supplies, and let you track where and how money is being spent.

Most programs include tools that let you set individual limits, monitor usage in real time, and manage approvals. This setup helps improve accountability, speeds up reporting, and reduces the risk of errors.

Corporate card types available in the US

When selecting a corporate card program, it is essential to familiarize yourself with the various card types available in the United States. Each card type provides distinct features tailored to meet specific business requirements.

Credit cards

Corporate credit cards allow businesses to borrow funds up to a set limit and pay them back later. They help build business credit and often offer rewards or cashback, but require timely repayments to avoid interest charges.

Prepaid cards

Prepaid corporate cards are loaded with a fixed amount of funds in advance. They don’t involve credit or debt, making them ideal for companies that want tighter control over employee spending without the risk of overspending.

Debit cards

Corporate debit cards pull funds directly from your business bank account. They offer real-time spending without the need for credit approval and are best for companies that want to avoid borrowing.

Virtual cards

Virtual cards are digital-only tools and perfect for secure online payments. They add an extra layer of security and are quite easy to issue and manage efficiently at scale.

Key benefits of corporate card programs for businesses

A well-designed corporate card program not only facilitates expense coverage but also enhances the overall efficiency of business operations. If you’re wondering how do corporate cards help your business, below are some of the significant advantages they offer.

Track business expenses in real-time

Corporate cards give you instant visibility into how money is being spent.

You can monitor transactions as they happen, helping you spot unusual activity early and keep budgets in check without waiting for end-of-month reports.

Optimize cash flow management

With the ability to set credit limits and manage payment cycles, corporate credit card programs help you maintain better control over your company’s cash flow.

You can time payments to match your revenue patterns and avoid sudden liquidity gaps.

Streamline employee expense reporting

Manual expense reports are usually quite time-consuming and prone to errors.

A good corporate card program helps manage employee expenses efficiently by linking transactions to the right employee and department.

Earn valuable reward points

Corporate credit card programs often provide rewards such as cashback, travel miles, or redeemable points for business purchases.

These benefits can help reduce your business expenses and enhance value, particularly for companies with high travel frequency or significant spending levels.

Boost operational expense efficiency

By centralizing expenses through a single system, you reduce the complexity of managing multiple payment methods.

This improves tracking, and reduces the chances of duplicate or unauthorized payments, while increasing overall efficiency in how you handle business spending.

Looking for the best corporate cards for your business?

Why corporate cards matter for small businesses

Managing team expenses manually can slow down operations. With corporate cards for small business operations, you can simplify payments and reimbursements by eliminating cash handling and lengthy claim processes.

Every transaction is tracked instantly, giving you complete visibility. This automation not only improves accuracy but also saves time, letting you focus on running and growing your business.

Corporate cards help you establish a solid financial footprint for your company.

Consistent and responsible card usage builds your business credit history, opening doors to better loan options and vendor relationships.

By leveraging this credibility, you enhance the reputation of your business in the marketplace, making it easier to negotiate favorable payment terms and access future growth opportunities.

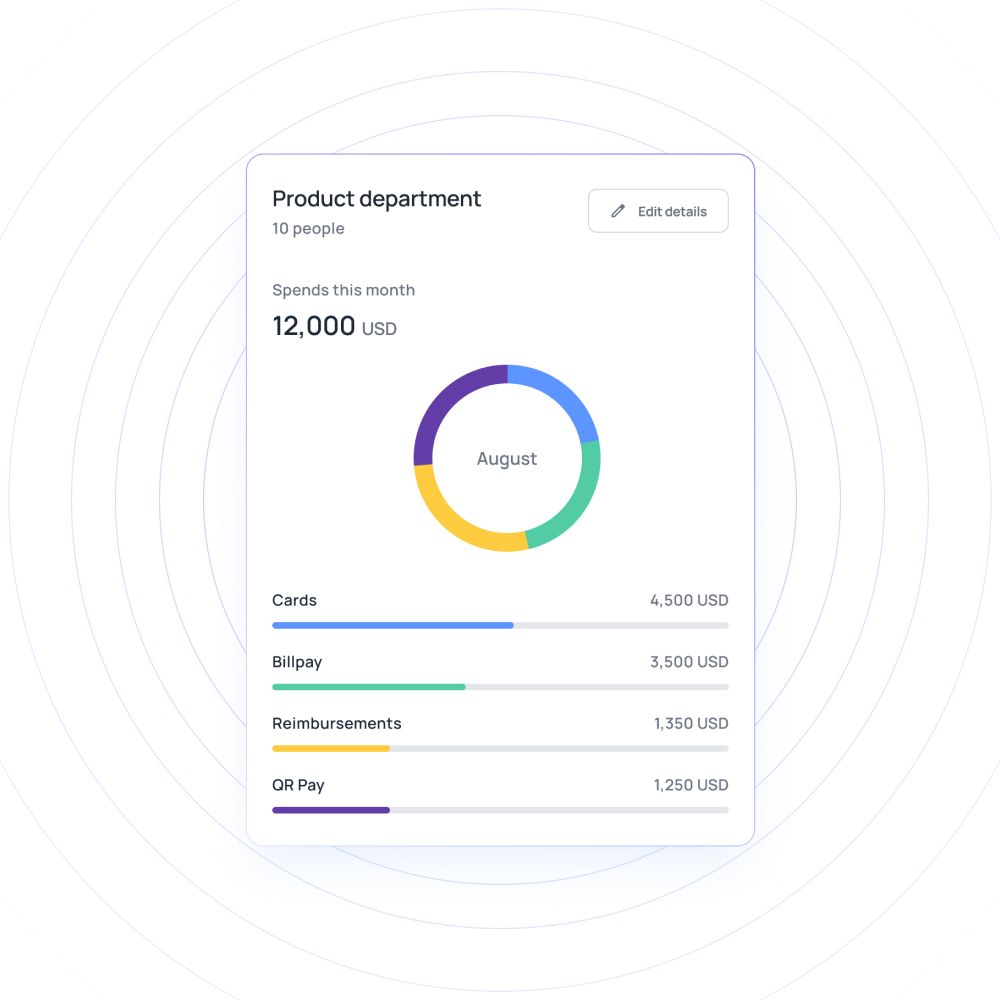

Corporate cards allow you to monitor spending patterns, analyze trends, and forecast more accurately. You can allocate specific budgets per team or project, ensuring no overspending occurs.

This visibility enables better financial planning, empowering you to make proactive decisions that align with your goals while maintaining control over operational costs and overall business performance.

Corporate cards eliminate the tedious paperwork associated with reimbursements and expense reports. Automated expense tracking and digital records reduce the administrative burden on finance teams.

Instead of chasing receipts or verifying claims, your employees can focus on more valuable tasks. This efficiency helps streamline workflows and improve overall productivity within your small business.

Giving teams access to corporate cards with predefined limits enables faster decision-making. Employees can make necessary purchases without waiting for approvals or reimbursements.

You maintain full visibility and control through real-time tracking. This empowerment builds accountability, enhances operational flexibility, and supports day-to-day business operations while maintaining strong financial governance.

Features to look for in a corporate card for small businesses

When choosing a corporate card for small business needs, focus on features that simplify expense management and enhance visibility. The right card should offer flexibility, automation, and control, helping you scale efficiently. Look for tools that reduce manual work, ensure compliance, and support smart, data-driven financial decisions that boost growth.

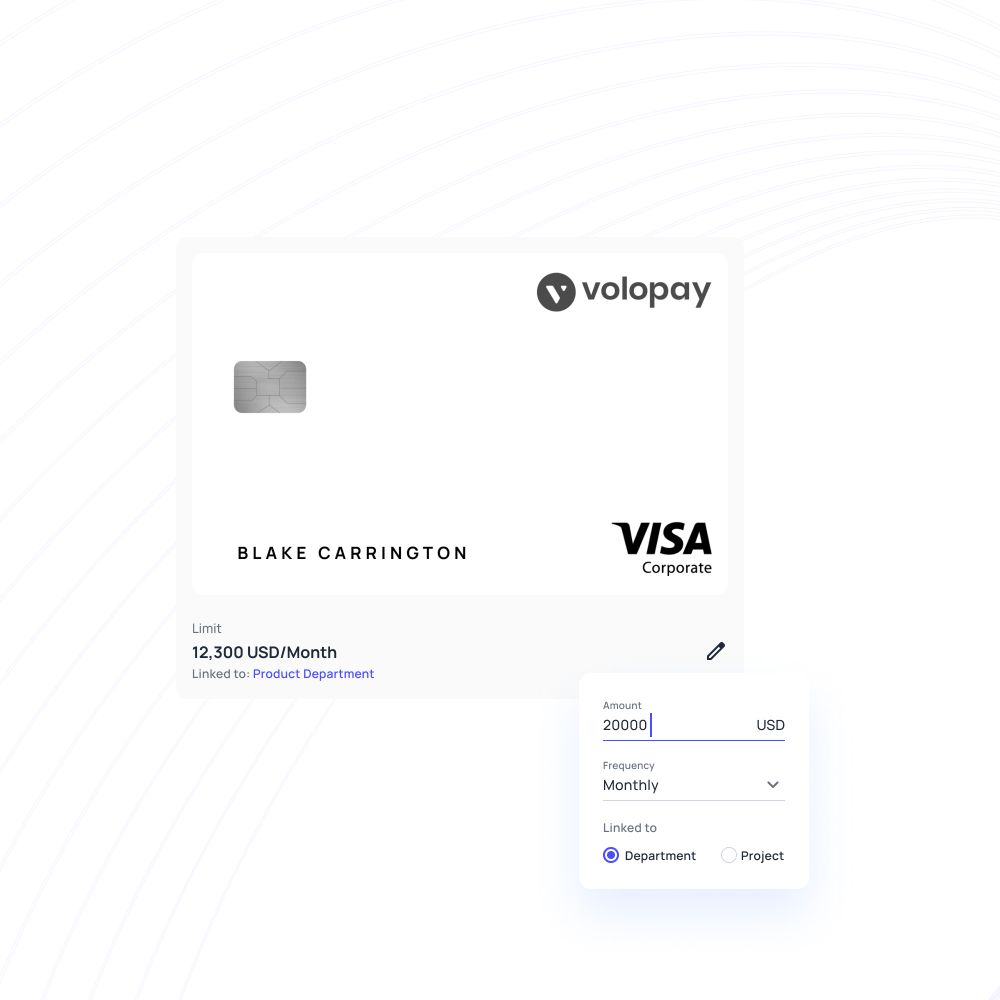

Customizable spend limits

Set personalized spending limits for departments or employees to prevent overspending and misuse. Custom limits let you stay within budget while maintaining operational freedom.

By tailoring limits based on roles and projects, you ensure responsible spending across teams, strengthen financial discipline, and promote greater transparency within your business operations.

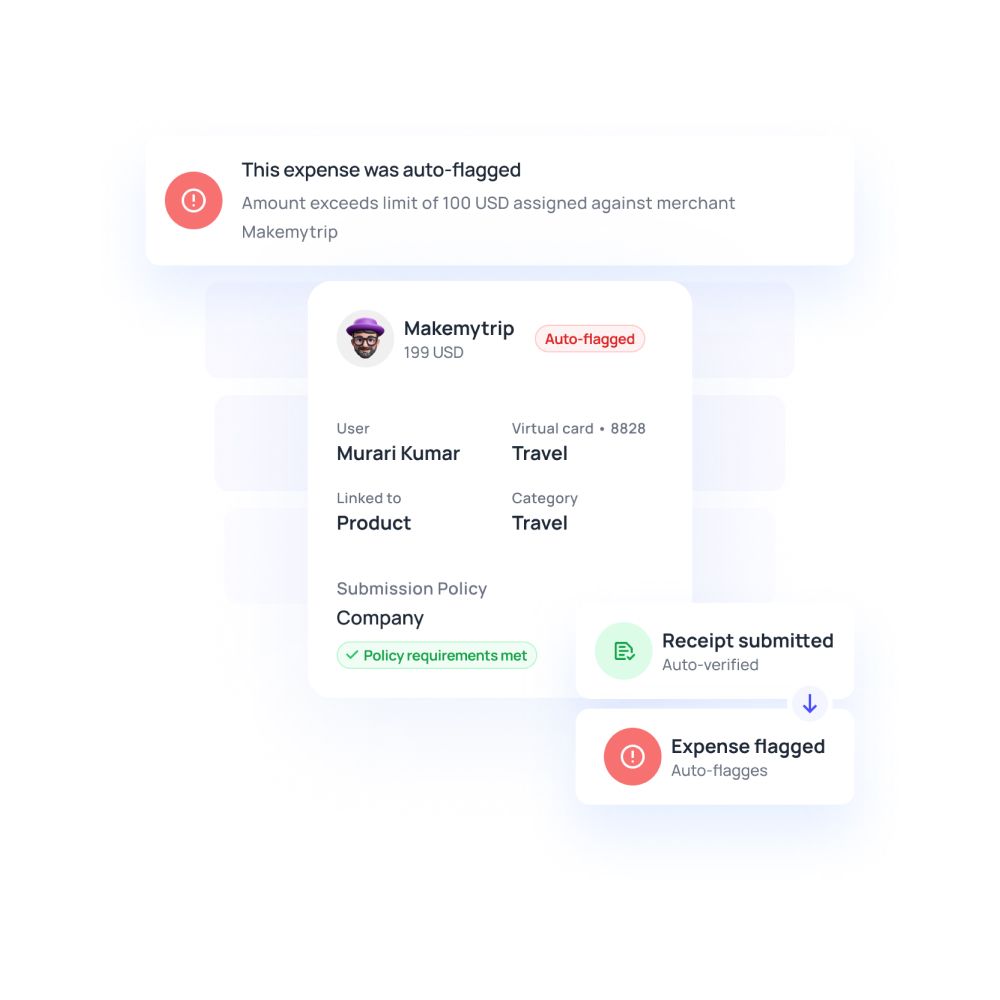

Real-time spend tracking

Gain instant visibility into every expense with real-time spend tracking. This feature allows you to monitor transactions as they happen, ensuring quick detection of irregularities.

By keeping your finger on the pulse of daily spending, you maintain tighter control over cash flow and enhance your ability to make timely financial decisions.

Detailed spend analytics

Access detailed analytics to understand where your money goes. Categorized insights help you identify trends, control unnecessary costs, and optimize spending strategies.

With these data-driven reports, you can make informed decisions that improve financial health and profitability while maintaining transparency across all levels of your organization.

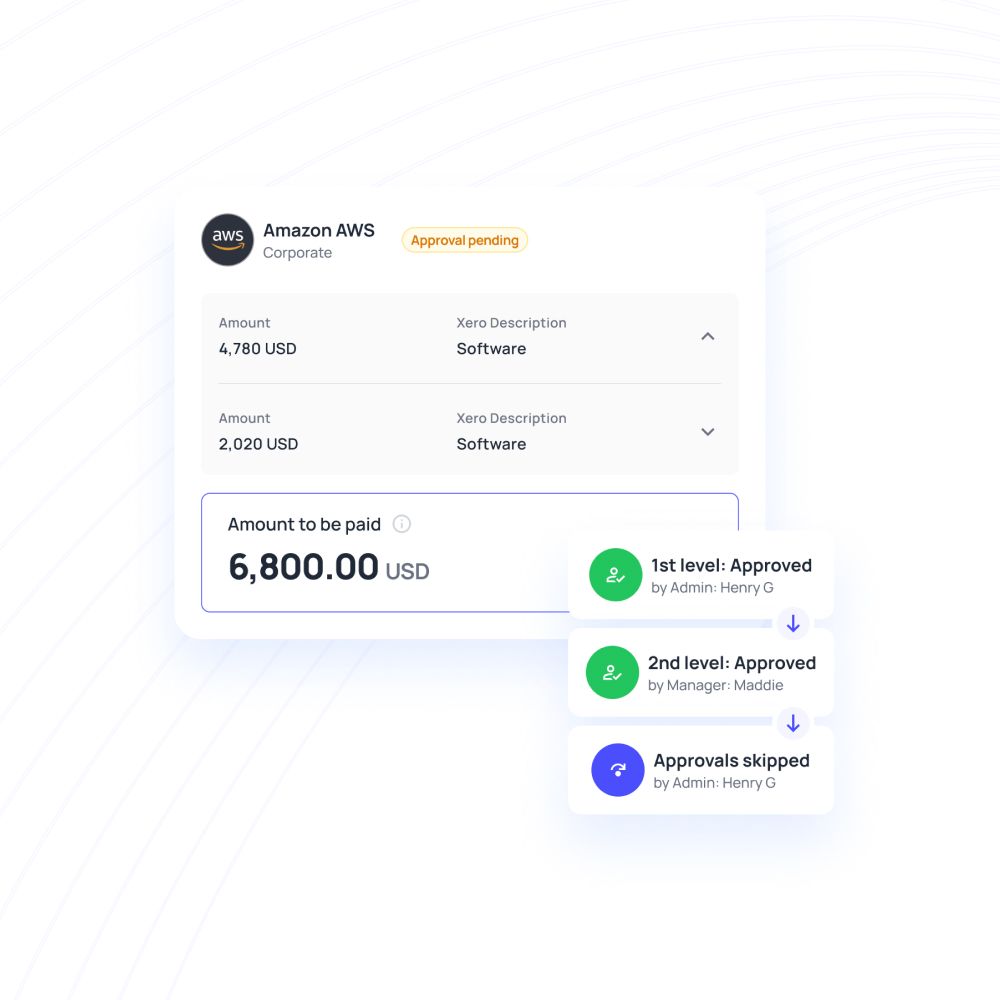

Custom approval workflows

Set up custom approval workflows that align with your internal policies. Define who authorizes specific expenses, creating a clear chain of accountability.

This system prevents unauthorized purchases, streamlines approvals, and ensures every transaction complies with your company’s financial protocols while promoting efficiency and control in expense management.

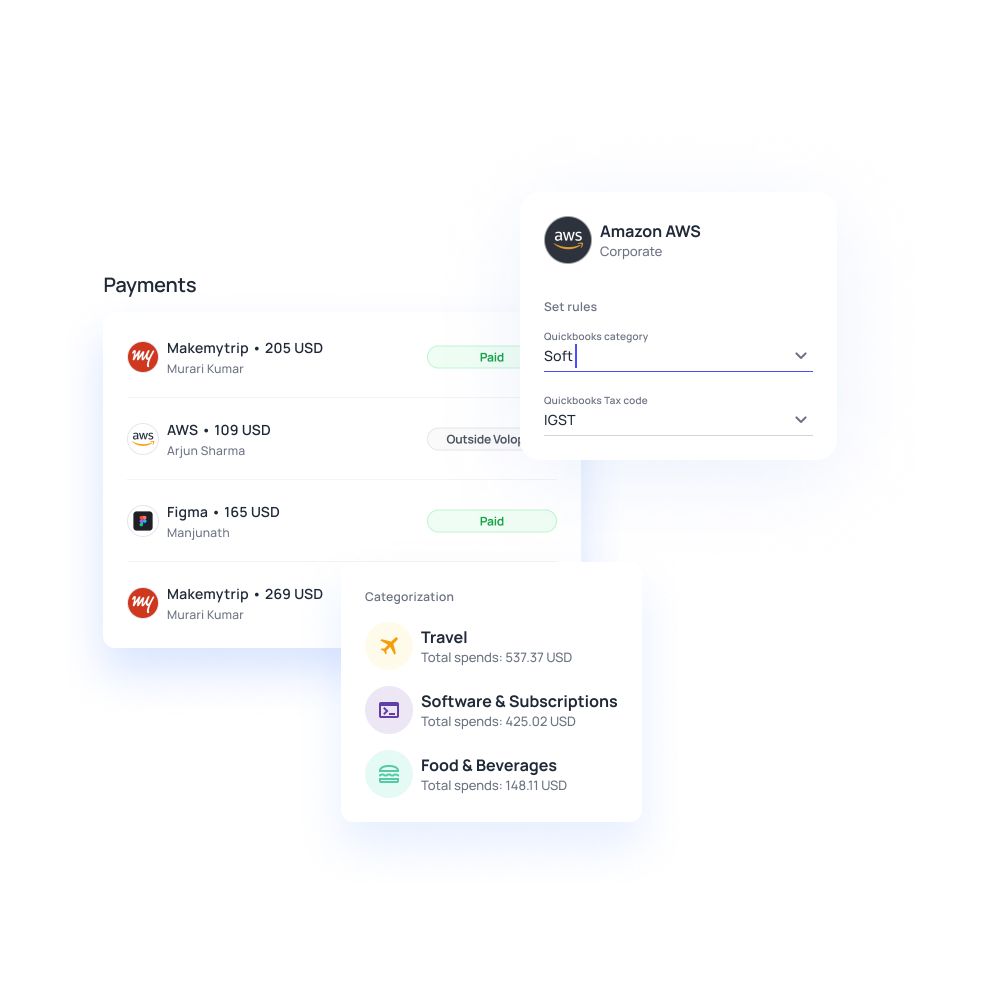

Automated expense categorization

Automated expense categorization eliminates manual data entry and errors. Each transaction is automatically sorted into relevant categories for easier reporting and analysis.

This feature simplifies expense tracking, saves time for finance teams, and ensures accurate records, allowing you to close books faster and maintain consistent financial clarity throughout operations.

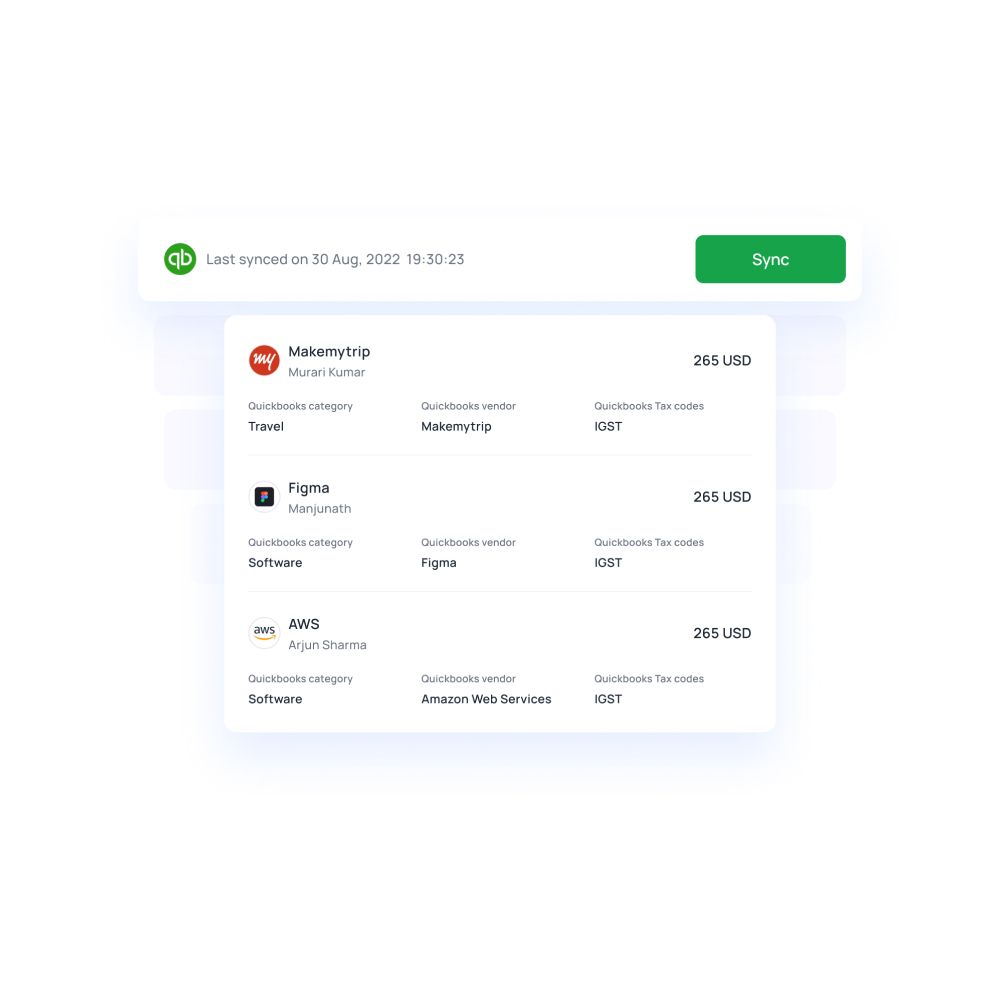

Accounting software integrations

Integrations with accounting software streamline financial management by syncing transactions automatically. This eliminates double data entry, reduces human error, and simplifies reconciliation.

By connecting your corporate cards directly to platforms like QuickBooks or Xero, you ensure seamless bookkeeping and up-to-date financial insights across your business systems.

Scalable employee management

As your business expands, scalable employee management becomes crucial. Corporate cards that allow easy addition or removal of users provide flexibility and control.

You can instantly assign cards, set limits, and monitor expenses for new hires. This adaptability ensures your financial systems grow smoothly alongside your evolving business structure.

Manage business costs smarter with corporate cards

Essential factors for choosing a corporate card program

Not all corporate card programs are built the same. When selecting one for your business, it's important to look beyond the surface. The features, fees, and security policies offered can make a big difference. Below are the key factors every US-based company should evaluate before committing to a provider.

Consider low annual card fees

Certain providers impose an annual fee for each card or account issued. While these fees may initially appear minimal, they can accumulate significantly when scaling or issuing cards across teams.

It is essential to evaluate these costs in relation to the program’s benefits. Seek providers that offer competitive pricing or waive fees based on usage or transaction volume.

Evaluate transaction processing fee structures

Many corporate card programs include transaction fees, especially for cross-border or currency-specific purchases. These fees can quietly eat into your budget if left unchecked.

Before choosing a provider, review the cost breakdown for both domestic and international transactions. Look for transparent pricing and consider how these fees might affect your most frequent types of purchases.

Compare competitive foreign exchange rates

If your business involves international travel or vendors, foreign exchange (FX) rates matter. Some providers apply high FX markups on top of market rates.

This can make even small purchases costlier than expected. Look for corporate credit card programs that offer low or mid-market FX markups, especially if overseas transactions are common in your operations.

Avoid hidden service charges, penalties

Not all fees are immediately apparent. Certain programs conceal costs within the fine print, such as late payment fees, card replacement charges, inactivity penalties, or limit breach penalties, which can accumulate quickly.

It is essential to request a comprehensive fee disclosure before committing to a program. Opting for a provider with transparent pricing and minimal hidden charges can help avoid unforeseen expenses in the future.

Ensure provider offers data encryption

Security should be a top priority when selecting a corporate card provider. Make sure the platform uses strong encryption protocols to protect sensitive information like transaction records and cardholder data.

Compliance with standards such as PCI DSS is a good sign that your provider takes data protection seriously. With increasing cyber threats, choosing a provider that prioritizes security helps safeguard both company funds and employee privacy.

Verify real-time fraud monitoring tools

Fraud can happen quickly, and delayed responses cost money. A good corporate card program should include automated fraud detection powered by AI or machine learning.

These systems can flag unusual behavior instantly and alert you or block suspicious transactions. The faster you’re alerted, the faster you can act to prevent loss.

Set customizable individual card budgets

Employees have varying spending requirements. An effective corporate card program should enable the establishment of individual limits on a daily, weekly, or monthly basis.

Whether an employee frequently travels or incurs expenses occasionally, this flexibility ensures control is maintained while equipping employees with the necessary tools to work efficiently.

Instant employee cards issuance

Waiting days to issue new cards can slow down operations. A strong corporate card program should let you generate physical or virtual cards for employees instantly.

This is especially helpful for new hires, emergency purchases, or project-based needs. Fast issuance keeps your teams moving without delays or bottlenecks.

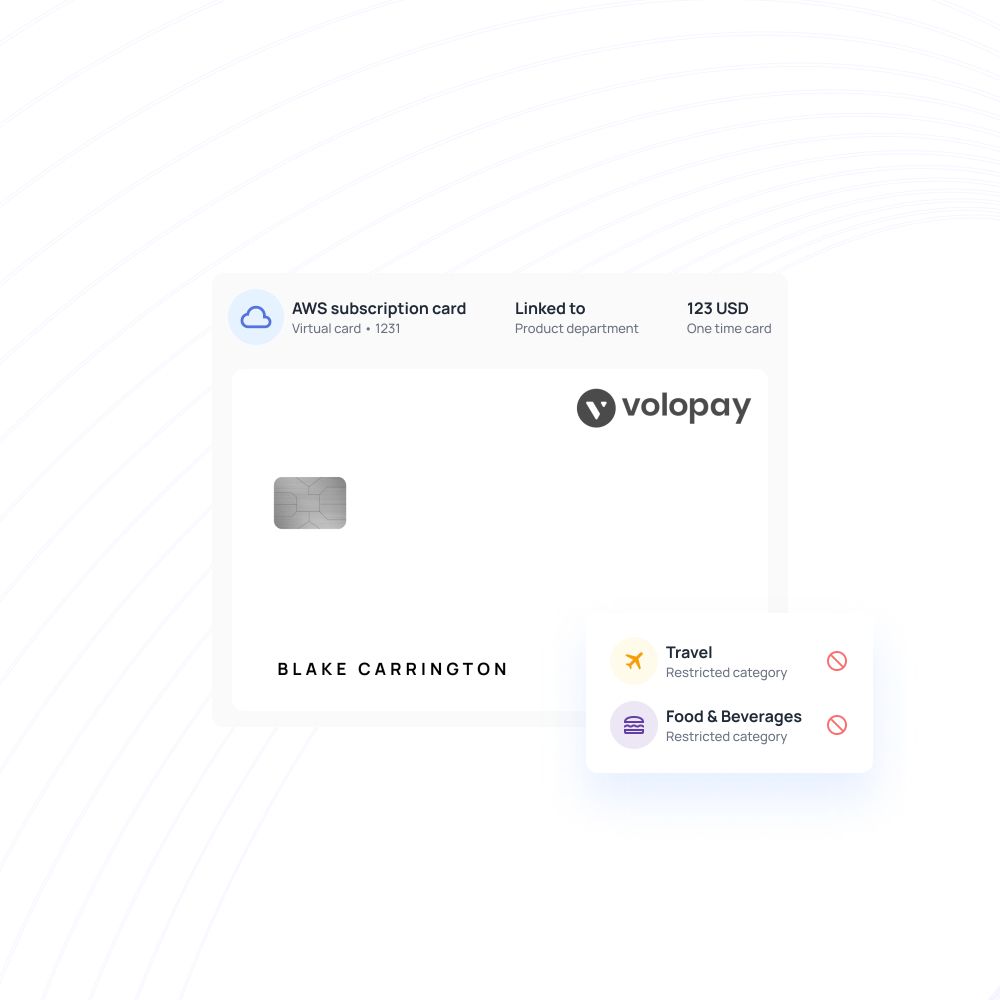

Availability of both physical and virtual corporate cards

Different situations call for different formats. Virtual cards work best for online purchases and subscriptions, while physical cards are more practical for travel and in-person spending.

The ideal program offers both and allows you to issue either based on the situation. This flexibility adds convenience without compromising control.

Centralize account management via dashboard

Managing multiple cards without a unified system creates chaos. Corporate card management becomes efficient with a good corporate card platform that provides a central dashboard to oversee all card activity—spending, approvals, limits, and policy compliance. Centralized control saves time and gives finance teams a complete picture of company-wide expenses in one place.

Why choosing Volopay’s corporate card program is a smart choice for US businesses

Volopay’s corporate card program offers a unified platform built to give your business full control over spending without the typical complexity of legacy systems. Whether you're a small team or a large enterprise, the tools are designed to scale with your needs.

Selecting an appropriate corporate card program is crucial for enhancing control, efficiency, and transparency in managing your business finances. By prioritizing features that meet your specific requirements, you can minimize hidden expenses and discover more effective ways to handle spending. Volopay provides the tools necessary to achieve this.

Unified platform

Manage cards, approvals, reimbursements, and budgets from one intuitive dashboard.

Issue and track physical cards with ease, while virtual cards offer flexible online spending—all within Volopay’s unified platform.

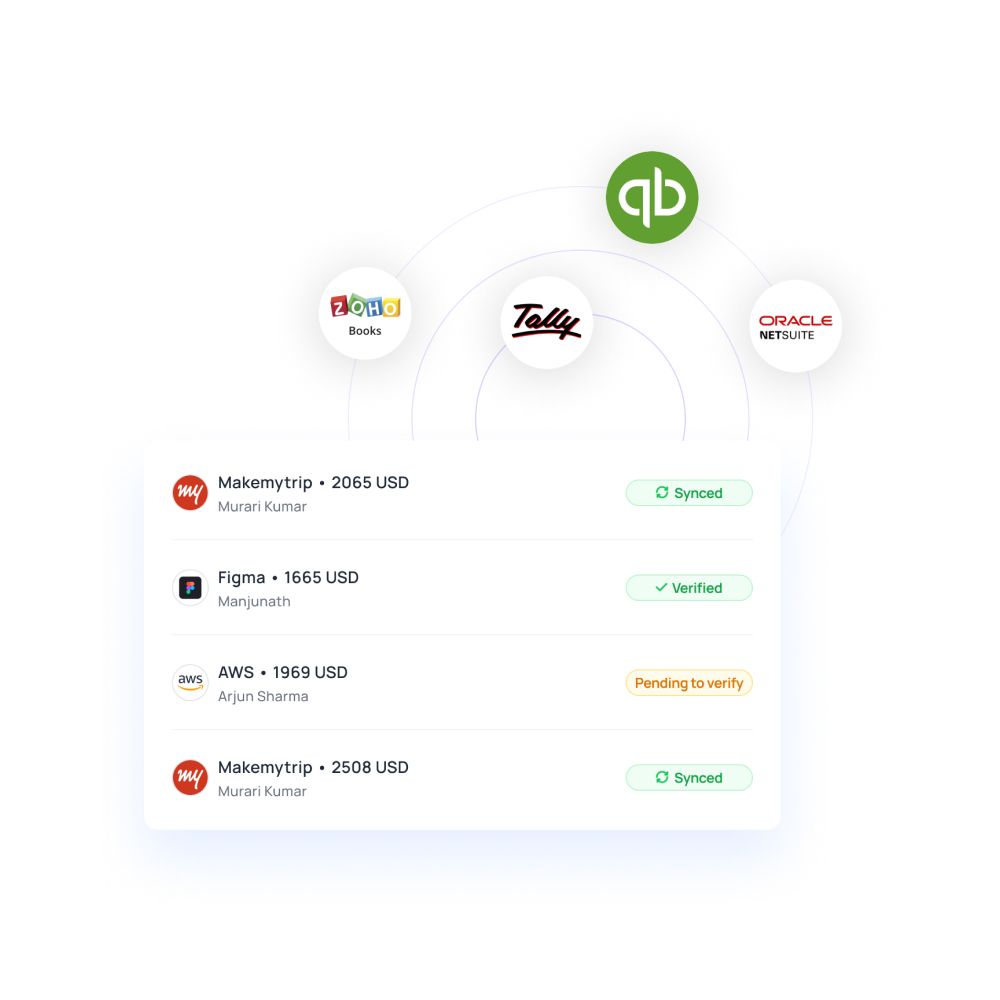

Seamless sync

Volopay connects directly with popular accounting software like QuickBooks, Zoho Books, and Tally.

This automatic integration reduces manual data entry and makes reconciliation easier and faster, no more uploading spreadsheets or chasing receipts.

Robust security

Every transaction is protected with enterprise-grade security, including PCI DSS-compliant encryption and advanced fraud detection tools. Real-time alerts and controls let you act quickly in case of suspicious activity.

Scalable features

Volopay is built to grow with your business. Whether you're managing a few employees or multiple departments across regions, the platform offers flexible controls, custom roles, and card issuance tools that adapt to your structure.

FAQs

Yes. Volopay’s virtual corporate credit cards can be linked to your company policies and specific department budgets. Any request for payment that goes against these will be automatically declined.

Yes, we do! You can create unlimited corporate virtual cards with the click of a button, and they will be available for immediate use. These virtual credit cards can be customized depending on their use.

With Volopay, you can create single-use corporate cards and burner cards. When creating a card, you can choose the amount to be loaded and the preferred expiry date. Cards can also be frozen or blocked by administrators.

We have a dedicated customer success team that is available to help you. We schedule demos to help you set up and integrate accounts, and live support is available to all clients.

Corporate cards automate payments, track expenses in real time, and reduce manual errors. They eliminate reimbursement delays, lower processing costs, and improve cash flow visibility, helping small businesses streamline operations and allocate resources more efficiently toward growth and profitability.

Yes, corporate cards are ideal for small businesses and startups. They provide better expense control, instant visibility, and flexibility to manage limited budgets effectively while building financial discipline and preparing for scalable future growth.

Corporate cards simplify tax preparation by automatically recording and categorizing every transaction. This reduces manual data entry, minimizes errors, and ensures accurate, organized financial documentation, making it easier to reconcile books and file taxes confidently.

Corporate cards eliminate paper receipts, manual reimbursement forms, and redundant approvals. With automated expense tracking and integrated reporting, finance teams spend less time on data entry and audits, allowing greater focus on strategic tasks.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now