Manage employee expenses with corporate cards

When you slowly transition from a small business to a medium or slightly large company, it’s quite common to struggle with employee expense management. You might have had different strategies to manage employee expenses and keep that under control, but it will take time to fall in place.

Small companies are generally under the impression that they will have perfect screening methods for employee reimbursements. But CFOs don’t have the time to validate requests one at a time. Before you can breathe and stop this turmoil, your corporate expense management gets messed up, consuming a prominent part of your budget.

Can you solve this problem by distributing corporate cards for employees? We will show you how this can be a valued addition to your accounting process.

How corporate cards function

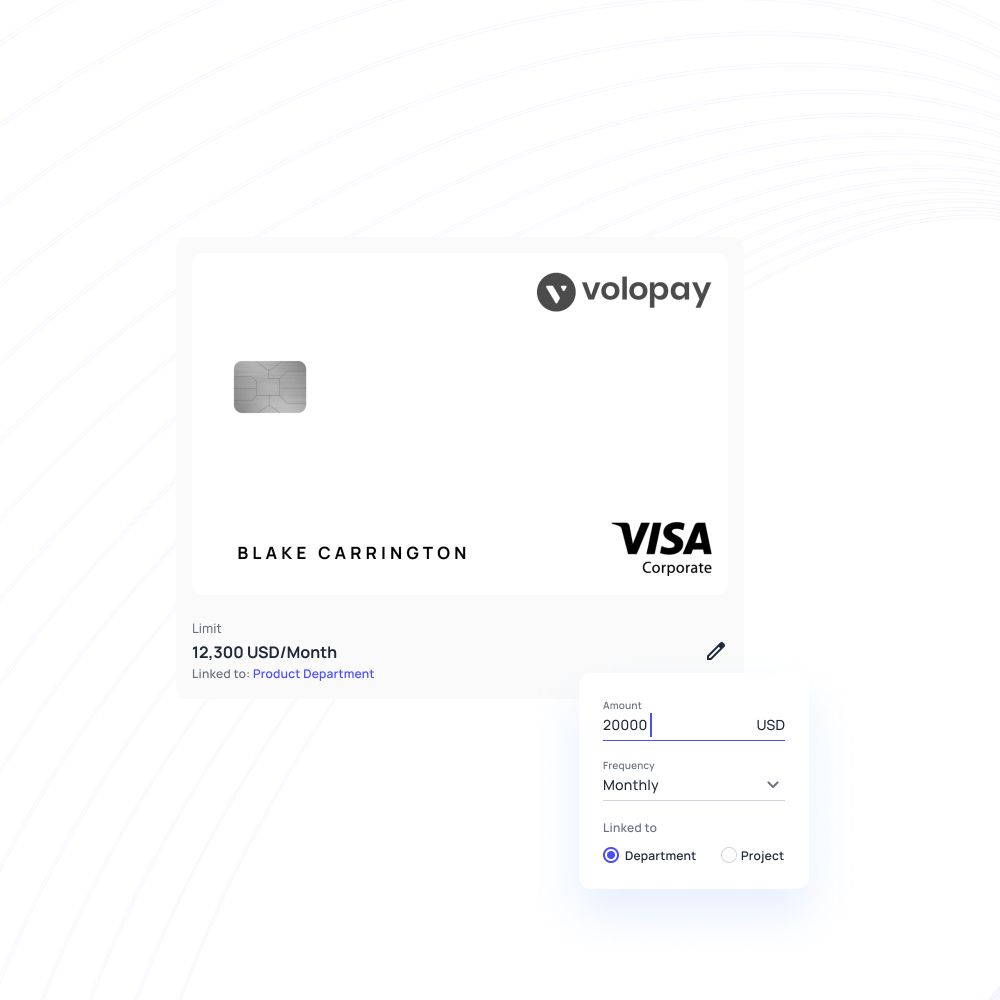

Corporate cards have a centralized management system where an admin can manage the functionalities and track the expenses of physical and virtual cards present.

Virtual cards can potentially change your corporate expense management altogether due to their versatility. The admin can create a virtual card, assign a budget category to draw funds from, share with a user and delete after usage.

Corporate expense management cards tick two boxes at the same time. One, you get to manage employee expenses just by distributing a card. Two, employees feel at liberty to spend on their own will for making authorized expenses, but the overall control is still with the finance team.

How do I choose which employee gets corporate card?

Top executives and people from departments who travel monthly are in dire need of a regulated corporate expense management solution.

They are tired of the cumbersome reimbursement procedures. Any time-saving alternative like this can benefit them.

They don’t have to make out-of-pocket expenses anymore and collect bills to prove that. Manage employee expenses and track them in real-time with corporate cards.

With corporate cards, employees can make bookings online with the funds assigned to them and request more, if required.

Paying extra attention to vendor invoices due to frequent upswing in their pricing? Wasting human resources and money to cap the vendor payouts within limits? Use corporate cards instead.

If the payment exceeds the approved limit, you can load corporate cards with the required money and design an approval workflow.

By setting limits on corporate cards, you get notified when vendors try to charge more than usual, helping sort pricing discrepancies beforehand. This can save your business a lot of time and money.

If you use SaaS tools and applications with monthly subscription fees, corporate cards are the right choice to pay them at the end of the cycle.

As you can create corporate cards in unlimited numbers, you can have one card for each tool. This way, you can definitely avoid mixing up one with another and bring organization in the corporate expense management.

Corporate cards can put your monthly recurring payments on a autopilot mode and reduce human labor and a lot of time for a business it also helps you in managing employee expenses.

It's time to manage employee expenses more efficiently than ever

Managing employee expenses with corporate cards

Employee expense reimbursement and daily allowances exhausting your budget constantly? Here is how Volopay can help you watch your expenses and replace any employee expense management software you already have been using.

Archive or block corporate cards

Corporate cards can be disabled or blocked if they are not in use. When you set automated payments through cards, you will never notice when you get charged automatically. But if you decide to do away with monthly billing, simply block the card to avoid processing payment from that card anymore.

Sync with accounting software

Spend no time on manual work as Volopay syncs with your other accounting software automatically and manually. Businesses use other accounting applications than employee expense management software. If they work together, it spares manual work, and your reports and statements will be accurate.

Create recurring payment

Some business payments can occur monthly or can be one time. In both cases, your accounts team can put corporate cards to use. Set the payment frequency based on your needs and discard the card after use. Set expiry dates on cards used for one-time purposes so that they will automatically stop working.

Set limitations on spending

Every company has its T&E policies that state the permissible limits in spending for each category. However, they are hard to insist on and follow over time without any means to manage employee expenses in real-time. Volopay brings you a nicer alternative for this, which is setting limits. They can only be eligible for employee reimbursement or card usage if the payment is within limits.

Separate cards for every user

One simple trick to effectively managing employee expenses is to separate the expenses of each employee for better tracking and visibility. Distribute one card for each employee as each has a different spending pattern. Providing corporate cards for employees can reduce the need for employee reimbursements and keeping one card for each employee makes it easier to set budgets.

Benefits of expense management software

Going through the list of expenses at the end of the month can be baffling and leave you with questions regarding each payment. Track payments in real-time and view what’s happening in your accounts receivables. The corporate card management platform in Volopay is designed to facilitate easy tracking without looking much into each card.

Accounting integration

Going through the list of expenses at the end of the month can be baffling and leave you with any questions regarding each payment. Track payments in real-time and view what’s happening in your accounts receivables at any time. The expense management platform in Volopay is designed to facilitate easy tracking without looking much into each card.

Manage payments

Manage employee expenses and other payments in a hassle-free fashion. Schedule payments, make one-time and recurring payments, employee reimbursements, and subscriptions in one place with Volopay. With this, you will never have to worry about late or missed payments, overcharging, exhausting budgets, or other payment concerns.

Real-time visibility

Going through the list of expenses at the end of the month can be baffling and leave you with questions regarding each payment. Track payments in real-time and view what’s happening in your accounts receivables. Expense management platform in Volopay is designed to facilitate easy tracking without looking much into each card.

Security

Protect your account by using cards that are not directly linked to the main account. Due to this, you can cut off any card from the network if you sense a security breach. This violation cannot affect your main account where your money is held. Volopay’s corporate cards are safe to use in other aspects.

Set custom controls

Provide corporate cards for independent employees and each with its set of controls and budgets. Custom controls and workflows enable a customized way to manage employee expenses. Volopay lets you create cards, each with a different approval workflow, budget, frequency levels, and expiration dates.

Managing employee expenses with Volopay

Issue corporate cards for employees

By distributing corporate cards for employees, you can view the whole set of expenses made by each employee for each card. Identify the needs of each employee, create a budget accordingly and set spending limits that you cannot achieve with traditional employee expense reimbursement methods.

Create an individual budget for the employees

If it’s hard to manage the overall budget allocated for employees, set individual budgets for each employee. Volopay makes it possible to create different budget categories and tag them with every card you create. This way, you can track the expense of each employee or a team, for that matter.

Set multi-level approvals

Approvals are required to spend more than what has been allocated for a card. In such cases, you can set multi-level permissions to analyze the reason for additional funds. Multi-level approvals can put a cap on unnecessary spending and let the approvers frequently track if they are on a budget or exceeding it.

Extracting the data from the Invoice & receipt

Collect bills, receipts, and bank statements related to each employee's expense to extract data for tracking purposes. Receipts can be handy to verify if a payment entry is a valid employee expense or not. Receipts and payment confirmation documents are another way to track and categorize employee expenses.

Track and monitor the expense - Identify fraudulent activity

We have to consider the fact that employee frauds are still prevalent. Providing corporate cards for employees can also lead them to utilize that for their expenses. That’s why keeping track of where the card details have been used is mandatory. After all, cards have been designed to reduce employee workload and make business expenses effortless; employees must realize that and use it sensibly.

Related pages to corporate cards

Explore the differences between corporate cards and employee reimbursements to discover which method offers more efficiency and cost-effectiveness.

Choosing the right corporate card provider is crucial. Learn what features, controls, and support your business should prioritize before making a decision.

Understand the risks of employee corporate card misuse and learn how to prevent it with smart controls, clear policies, and real-time tracking.

Get Volopay for your business

Get started free