Virtual cards vs company credit cards: Which one to choose?

Technology improvements are skyrocketing, but everything comes with some positives and some difficult challenges. Today you have the facility of buying anything anywhere just by swiping your credit or debit card. But the risk of making payments on deceitful websites or fraud companies still keeps hanging up on you.

Taking into consideration all the drawbacks tailed to the use of company credit cards, a unique solution in the form of virtual cards has been introduced. A virtual credit card is a smart step for any growing company. These cards facilitate businesses with a more secure, customizable, and trackable way for online payment.

Along with this, virtual cards for businesses give the employees of your company the equipment to pay directly from their desktops. This is a faster, safer, and easier way to make payments and manage finances. When considering the difference between virtual cards and company cards, virtual cards offer more flexibility, enhanced security, and detailed control over company spending, making them an ideal choice for modern businesses.

What are virtual cards?

A virtual card is an electronic form of a physical card. These exist only online but contain all the information that a normal physical card has: a card number, a security CVV code, and an expiration date.

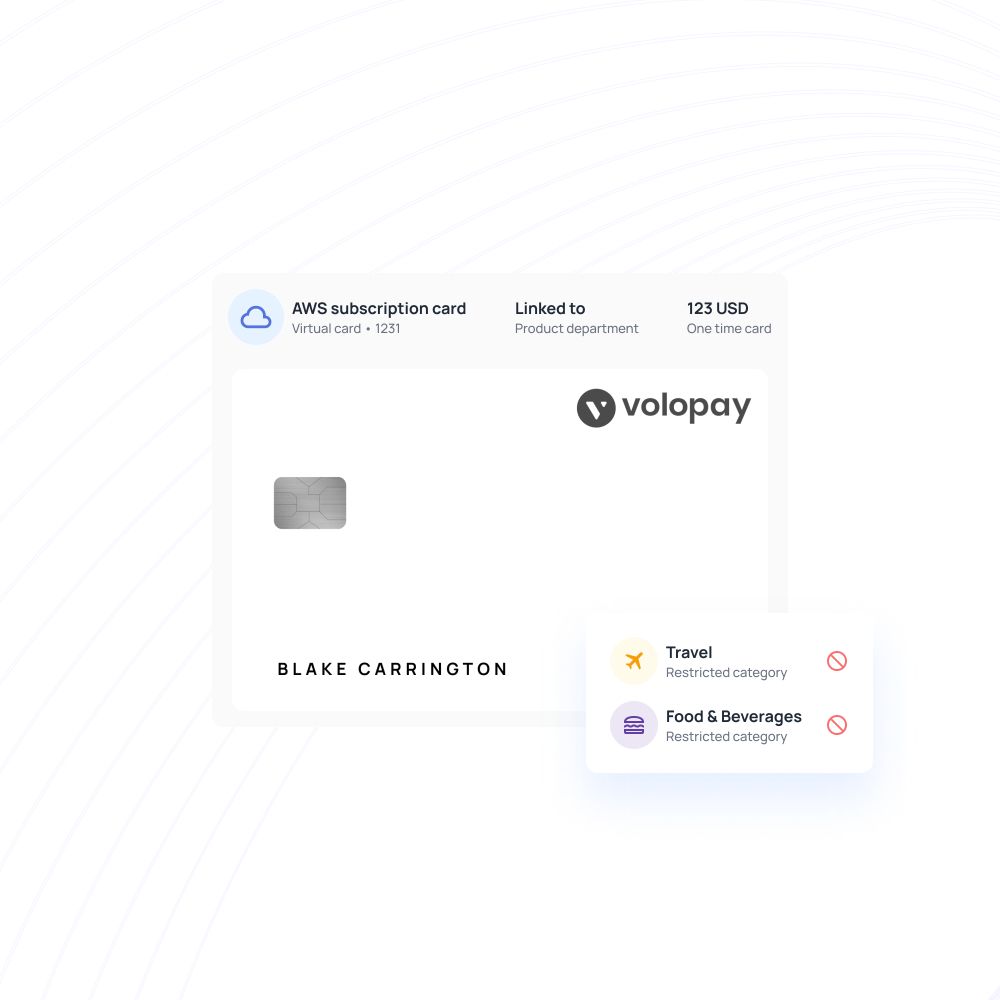

A specific amount of money is loaded into these cards to make all kinds of business payments. Each card can be made for one-time use, which provides a great level of security or recurring payments like monthly subscriptions.

How does a virtual card work?

The working of a virtual card is pretty simple. While making any online payment, when you reach the checkout point where you have to enter your card details, instead of pulling out a physical card, you have to copy-paste the information from a virtual card.

Virtual cards provide smooth payments for:

- Subscriptions and all types of Saas software monthly payments.

- All expenses in regards to business trips, hotel residence, travel tickets.

- Miscellaneous expenses or random expenses like office supplies, event fees, etc.

Benefits of using virtual cards for B2B payments

More financial control

By using virtual cards, your whole payment and expense system gets organized because of which you never miss a deadline or due payment date.

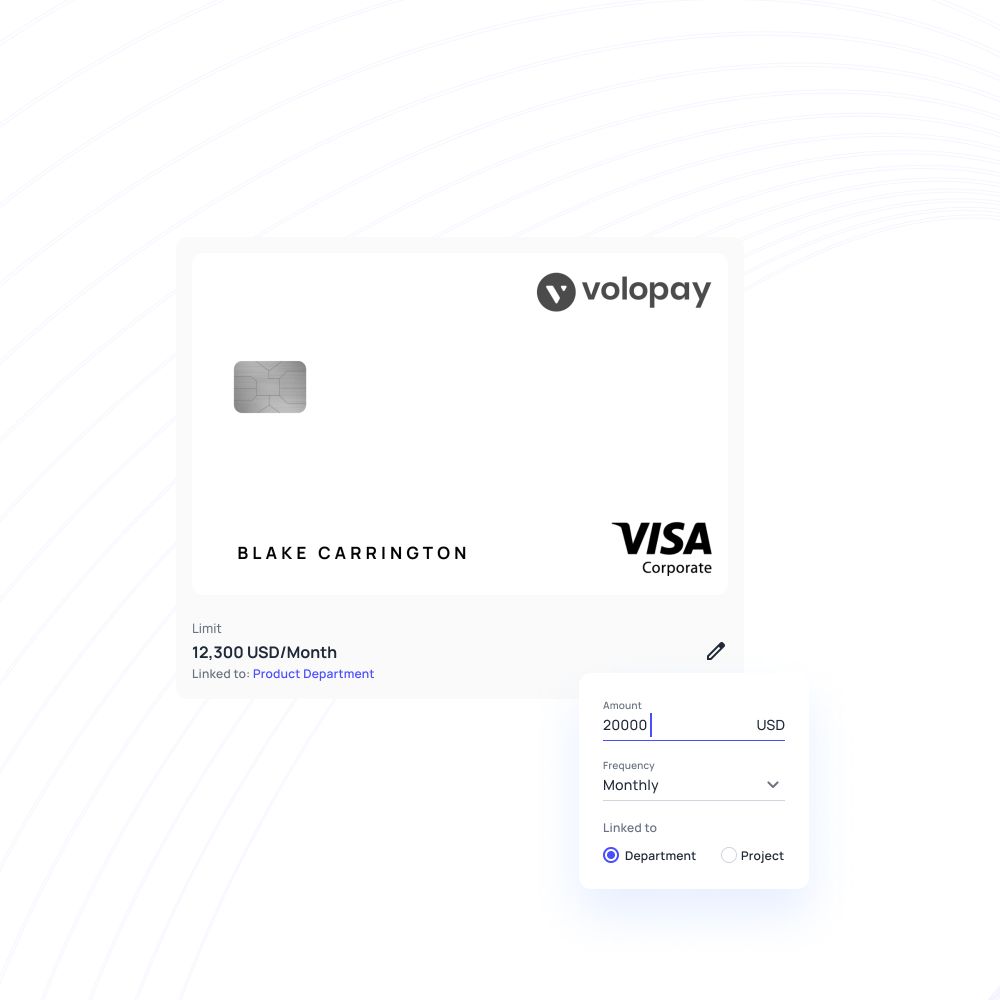

Additionally, the spend limit control gives you better financial control, helping you stay within budget and prevent unexpected spending.

Automates spend policies

For every virtual card, you have the option of specifying an amount & transactions made from that card cannot exceed the limit.

Once you have set that limit, software automatically enforces company spending policies without the need for manual verification.

Security

Virtual cards give you the feature of setting a card limit, time of expiration, unique card information, and no link with the bank your bank account.

Another effective security measure entailing virtual cards is that you can freeze or block cards in case of any problem. This helps eliminate the possibility of any card frauds.

Improved transaction details

Alternatives of virtual cards are ACH and wire transfers. These electronic method users face one major problem, which is the limited space available for remittance details.

In comparison to these, virtual cards offer much more characters for filling in transaction details and other important information.

Set specific employee or department cards

Virtual cards are immensely helpful in terms of day-to-day business spending, offering businesses a streamlined way to manage finances efficiently.

You can assign specific virtual cards to each employee or to a particular department, ensuring that each area of your business has its own dedicated spending account.

Automates labor and time-intensive tasks

Virtual cards are effective alternatives to conventional labor and time-intensive tasks like analyzing payments, keeping track of payment deadlines, etc.

With virtual cards in place, the AP team members won’t have to worry about cumbersome tasks and can focus on work that requires more attention.

Streamline your business payments with virtual cards

Company credit cards vs virtual cards - Why virtual cards are better?

Single use or recurring payments

Single-use virtual credit cards or virtual debit cards are extremely secure because they expire immediately after the payment is made.

Recurring-use virtual cards give you the advantage of tracking all the payments in real-time and also looking over the weekly, monthly, and annual spending of your company.

A company credit card would offer none of these advantages.

Digital real time tracking

While making payments from a company credit card, you will have to wait to hear from the vendor or supplier if they received the money, and if they did not, you would have to make several phone calls to banks, to other team members to resolve the problem.

Whereas with virtual cards, you get the benefit of tracking all the transactions undertaken in real-time. You will have instant information about each step of the payment.

Create unlimited virtual cards

For getting a company credit card, you have to follow various steps before acquiring it.

But this is not the case with instant virtual credit cards. You can create as many virtual cards as you want online for free.

Every card has its own unique number and CVV code, which help in protection against fraud as they expire after one-time use or have a set validity time limit.

Sync with expense management software

A proper financial team of experts has to be created in a company using a company credit card to track all the transactions, analyze every payment, make spending reports, and reconcile expenses.

With virtual cards, a load of these cumbersome tasks gets eliminated. Either your virtual card provider would offer an integrated financial expense management tool facility, or you can sync your expense management tool with your virtual credit or debit card platform.

This gives the financial team the opportunity to invest time in other important work like expense planning and policymaking. Also, you don’t have to wait for your staff to get you the expense report.

Set approvals/limits for certain payments

The greatest advantage that comes with virtual cards is the system of approvals and authorizations.

Your finance team can track all transactions and see who made it when and for what purpose. By using platforms like Volopay, you won’t have to give your employees high-limit cards and deal with responsibility problems.

You can just assign every employee a separate virtual card or create vendor-specific cards. A spend request would be created, and once the request is approved, the payment is made.

Approval systems facilitate the financial teams to react to transactions while it is being made instead of looking at it at the end of the year.

Sync with your accounting software

Virtual cards for businesses automate the major laborious tasks of the finance team, which are reconciliation and reporting work.

With an integrated accounting system, you wouldn’t have to worry about any potential entry mistakes or the possibility of someone forgetting to add an appropriate tag to a transaction.

The automated system records all transactions and enters them into the correct expense account, as it runs on recurring codes and instructions.

Using a company credit card would make it mandatory for you to have a special accounting team working on the ledgers.

Why choose Volopay's virtual cards?

Volopay’s virtual cards are unique, allocated fund cards that offer extra protection and security for all your online transactions.

Instant virtual cards

We offer the service to create unlimited virtual cards for business payments. Create as many virtual cards as you want for each employee, online vendor, or supplier.

Categorize virtual cards

Every virtual card can be categorized into different departments and teams according to convenience. This gives your company the benefit of organizing your finances properly.

A unique card to every spender - no card sharing

Now that you get the option to create a separate virtual card for every spender, the inconvenience of sharing one card all over the company gets settled. Along with this, you get the added feature of tracking down each payment or expense to the person responsible in case of any problem.

Set multi level approvals

Whenever any of your employees have to make a payment, a request is launched for payment approval. Each expense request goes through two levels of approval, a primary and a secondary one. Once the payment is approved by both levels, the payment is immediately made. All this process takes place in real-time, so this does not take hours; it is just a matter of minutes.

Now you make ask, launching a request every time even if the approval takes just a few minutes is not a convenient option. For this, we provide the feature of specific authorization and automatic approvals for certain types of payment which, according to your company, are important.

Freeze, block, unblock cards with greater flexibility

In situations where some suspected fraudulent activities are shown on your virtual card, you can immediately block or deactivate the card with just one click either from the web platform or through the Volopay mobile app. The facility to use any of the ways to block your card helps you take immediate action and secure yourself from any loss.

One time use or recurring payments - subscription management

Volopay provides both one-time use virtual cards and recurring payments virtual cards. A one-time use card is created to make payment one time to one vendor or supplier, and after the payment, that particular virtual card expires.

Recurring payment virtual credit cards for subscriptions can help you effectively manage all your SaaS and other subscriptions. For example, SaaS tool payments are expensive and have to pass through approval.

Volopay makes your work easy here, and it tracks all the approvals, notes all the payments made to different tools, and also gives information about who made the payment and when. Using one corporate credit card for all tool payments and not having all the automated facilities which Volopay offers is a tedious and expensive risk.

Sync with your accounting software and automate reconciliation

Once you connect your Volopay account with one of the accounting software offered, the reconciliation task for bookkeepers becomes easy. The software automatically syncs the expense with the accounting system, so you don’t have to worry about matching each invoice to expenses and then entering it in the right entry field.

Eliminate employee reimbursements

Employee reimbursement means that the company would pay its employees for any out-of-pocket expenses incurred by them on any of the business-related things. For example, any extra expense your employee makes on a business trip, you can easily reimburse the employee on his/her Volopay virtual card.

Trusted by finance teams at startups to enterprises.

FAQs on virtual cards

You can get instant virtual cards from a spend management platform like Volopay. On your Volopay dashboard, you have to click on “Cards” > “Virtual Cards”> on the top right corner, you see an option “+Virtual Card.”

Logically, you don’t have to carry this card around in your pocket, nor do you have to swipe it at different places, so to an extent, the vulnerability to fraud gets diminished here. Furthermore, none of your bank account details are connected to the virtual card, and the unique card number and one-time expiry make virtual cards an extremely safe option for your business.

To add money to your virtual card in Volopay, follow the given steps:

- On your Volopay dashboard, click on “Overview.”

- Check your balance in Bill Pay because you can only transfer money from your Bill Pay balance to your Card balance.

- Under Bill pay, you can have the Cards and the balance your cards have.

- Click on the “Allocate funds” option, fill in the required details, and select the card you want to add money to.

Bring Volopay to your business

Get started free