How to protect your business from credit card frauds

Protecting sensitive information has been an ever-challenging task. Many businesses have implemented solutions for fraud protection. However, there still exist various instances of inevitable fraud. According to a survey, in 2019 almost 81% of companies were defrauded. Whether or not you were amongst these organizations, you should now start looking for ways for the online security of your business.

This is where virtual credit cards come into the picture. Imposters have discovered and created many unimaginable ways to create panic into the finances of businesses but most of these unethical practices are categorized under credit card frauds and can be smoothly mitigated with a virtual credit card. This new technology is transforming the way businesses think and deal with credit card payments.

Volopay provides businesses with the facility to procure as many virtual cards as they require and helps in keeping the information safe by shielding sensitive account details and other data from anyone online. Volopay virtual credit cards create a barrier between your credit card information and cyber identity thieves.

What is credit card fraud?

Credit card fraud is described as a type of identity theft in which unauthorized access is forced by taking one’s credit card information and further charging purchases or removing funds from it. These frauds are categorized under two groups.

Application fraud

Application fraud is defined as the uncertified opening of credit card accounts in someone else’s name. This happens when a fraudster somehow obtains enough personal information about a person to completely fulfill all formalities on the credit card application or at least enough to present believable counterfeit documents. This fraud is serious because the victim may get the information very late.

Account takeovers

Account takeovers are basically criminal confiscation of a person’s existing credit card account. In this type of credit card fraud, the imposter manages to gather enough personal information about the cardholder to modify the account details like billing address, amount limit etc. The hijacker then reports the card lost or stolen in order to get a new one and further make unauthorized purchases with it.

Common types of credit card frauds

After the two main categories, credit card fraud can further be divided into four other types:

1. Lost or Stolen credit cards used without the permission of the owner.

2. Skimmed credit card where the card is copied or duplicated with a special machine.

3. Leaked card details like card number, date of birth or the owner, name of the cardholder, address. This information is stolen from the online database or through email scans, then sold over the internet or through the phone. This is also known as ‘card-not-present’ fraud.

How virtual cards are better at protecting you from fraud?

Top executives and people from departments who travel monthly are in dire need of a regulated corporate expense management solution. They are tired of the cumbersome employee reimbursement procedures. Any time-saving alternative like this can benefit them. They don’t have to make out-of-pocket expenses anymore and collect bills to prove that. Manage employee expenses and track them in real-time with corporate credit card also they can make seamless travel bookings.

However, there is a very slim chance that the imposters might make some unauthorized purchases, but still all the chaos of closing bank accounts, replacing cards, or changing payment methods. You can easily just report the unauthorized transaction and your work will be done. And with the Fair Credit Billing Act in place, your company will never have to be responsible for charges more than $50, although there are many corporate credit card issuers that take down the liability amount to zero.

Virtual cards are your way to stay ahead of criminals, especially if you use a single-use card number. Along with protecting your actual accounts number, the virtual credit card number becomes invalid after one transaction, which means that the number will become purposeless for the hackers. While using virtual corporate cards you also get the option to establish a virtual credit card with a predefined spending limit and a specific expiration date.

Virtual cards: the solution to fraud protection

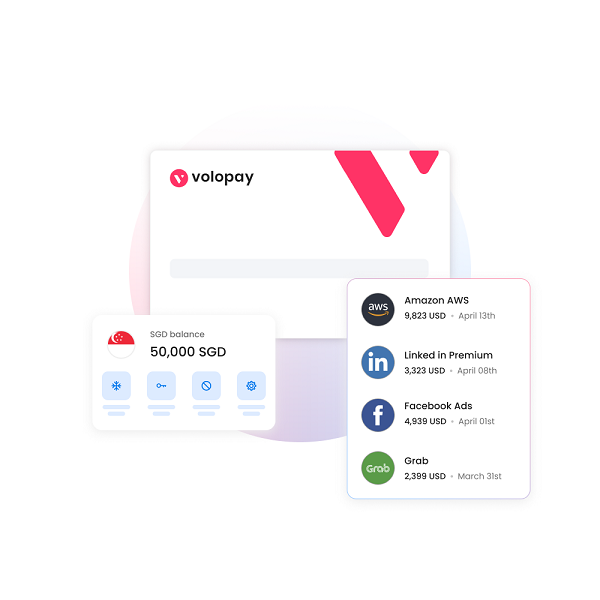

Volopay’s virtual cards are unique, allocated fund cards that offer extra protection and security for all your online transactions. We offer the service to create infinite virtual cards for business payments. You can create a virtual card for each online vendor (AWS, Google, LinkedIn, etc.) and never face the problem of Short Payments and Overpayment.

To ensure maximum security of your money and sensitive financial information on the card, we have incorporated different tools and methods that help in virtual credit card protection and credit card fraud detection. For starters, we are a legally licensed virtual card provider and spend management platform in Singapore and all the money you have in your Volopay account is held in escrow. Second, each and every transaction you make from your virtual corporate cards are tracked in real-time. This means that whenever any of your employees make any transaction you will be immediately notified and all the information like the amount of expense, owner, time, date, and purpose is all updated in real-time.

Along with this, you get an extremely well-designed approval workflow system in which whenever anyone from the company will use the corporate credit card for making any expense, that expense will have to be first verified by you and other responsible members of the financial team like managers. It is only after the approval that the expense is actually made. Furthermore, with the facility to create as many corporate cards as you want according to your requirements, in Volopay you can easily divide your budget and Saas fees over multiple cards so that the same card isn’t used at too many places and all the data is properly categorized and effortless to report. This feature also helps you to manage all your payments and detect if ever a vendor is charging you more than needed or even when a subscription isn’t required your company is still paying for it.

Moving forwards, Volopay’s virtual credit cards are non-transferable and everything is transparent. Virtual cards can be only linked to one budget, meaning you can set card limits under individual budgets and can change the active card limit accordingly to different budgets. For example, the employee can use the physical card for a marketing-related payment using the marketing budget which will have a specific fund limit. He can also use the card for tech-related spending by switching to a different budget called tech for which there is another fund limit. However, you can also set recurring funds so that on a monthly basis the physical cards will have funds topped up under each budget. Moreover, at any point in time, you can change the status of your card if you detect any suspicious activity.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free