8 expenses you should never put on business credit card

Company credit cards help organizations mitigate a number of payment-related issues. These cards are issued to employees to help cut down out-of-pocket expenses, consolidate expenses and make reimbursement easier.

These cards are used to manage all kinds of expenses that a company might face. However, just because it is possible to put any expense required on these cards, it is safe not to do so. Business credit cards for small business must be used strategically for your organization to get the best out of them.

Benefits of using business credit cards for small business

Business credit cards for small businesses can be used to purchase almost anything and everything you might require for running your business efficiently.

These cards give employees a line of credit using which they can procure anything, from equipment to travel.

This line of credit helps your employees mitigate situations where there is a lack of funds or where they have to incur out-of-pocket expenses.

Business credit cards for small businesses also offer a wide range of benefits, attractive rewards, and valuable cashbacks on usage.

This can include comprehensive rewards programs, exclusive perks in flyer miles, and generous cashbacks on various eligible purchases.

Card providers often have tie-ups with partner organizations. Any purchases made or services availed from these partners may also come at discounted rates.

Reimbursing employees using manual process is an extremely time-consuming and costly venture.

With company credit cards at hand, this issue has become a thing of the past.

Now, managing employee expenses and reimbursements has become prompt action where most of the heavy lifting is done by these cards and the software they are powered by; all you need to do is make the expense using your corporate credit card.

Corporate credit card providers like Volopay work very similar to how banks do, just with easier access and better features.

Similarly, the protection these cards come with is at par with banking institutions, if not better, providing security and peace of mind.

They offer significant protection on travel and purchases. For example, protection can come in the form of zero forex fees, purchase extended warranty protection on cellphones, auto rental damage collision waivers, and trip cancellation or interruption insurance.

One of the best features that business credit cards come with is accounting integration.

Card management software can seamlessly sync and integrate itself with your pre-existing accounting software, like Xero or Quickbooks.

Once integrated, you can use your card management dashboard to get a comprehensive overview of all your accounts payables, receivables, and any other transactions. With these tools, you can easily track spending and maintain complete control over your finances.

Manage your business spending wisely with Volopay

Expenses you should never charge on business credit card

Personal expenditures

Using a credit card for business expenses as well as personal expenses can be highly detrimental.

It can negatively impact your business credit score, violate card issuer agreements, and even your own company spending policies.

Entertaining clients

Entertainment costs can hugely vary from client to client.

While your company spending policy can account for this and set limits it is not wise to overspend on client entertainment, especially with a business credit card.

Personal travel costs

Often on a business trip employees might feel the urge to spend on personal whims (e.g. fancy hotels, overstays, etc.).

All such expenses will appear in spend histories and the employee’s goodwill is bound to get negatively impacted.

Cash advances

Charging cash advances on your business credit card is also strongly not recommended due to the high costs involved.

This is because APR on cash advances is almost always higher than the APR you get on your purchase. Cash advances also provide no grace period and come with a hefty fee.

Expensive purchases

Business credit card limits are set at a particularly high rate especially to lure companies into making expensive purchases.

However, if you are a small business, using up your credit score too quickly on unnecessary, expensive purchases can negatively impact your credit score.

Risky investments

Cryptocurrency, gambling, and other high-risk expenses are not advisable to charge to your business credit card.

The liabilities that come with risky investments are just not worth it. The negative outcomes of such investments greatly outweigh the positive ones.

Legal disputes

A company that uses its corporate credit card to pay for its legal expenses is a clear red flag for investors.

It sends a concerning message to potential investors that the organization could be in a spot of financial distress.

Payroll

Payroll also falls under the category of expensive purchases. It is a high-volume expense that is also recurring.

Putting payroll under your business credit card expenses can bring interest rate risk and generate debt.

Effects of putting all your spending on business credit card

Using a business credit card to manage all your spending might seem lucrative. In fact, people often put personal expenses on business cards in order to boost their personal credit scores. However, this is not usually how credit scores work. You could, however, benefit from putting expenses on business cards instead of personal - it could keep your utilization ratio low.

The flip side of this is that company credit cards come with much higher interest rates. They also offer much less in terms of consumer protection. While some issuers have voluntarily introduced some protective measures, it is still not universal.

Another point to keep in mind is that most of these cards offer services that change when the card is used for purposes not related to business. An example of this is the Chase card that offers primary auto insurance coverage when a vehicle is rented for business purposes but downgrades the same package if the vehicle is rented for personal use.

Understanding the differences between business credit and debit cards is important, as different types of cards may offer varied benefits and risks depending on how they are used.

What is a corporate credit card policy?

A corporate credit card policy is a document that an employer issues along with the credit card to their employees. This document serves purposes like outlining guidelines for card usage as well as preventing possible misuse.

Having a concrete corporate card policy in place is important because it outlines what counts as misuse and can thus help prevent fraudulent credit card usages.

Quick steps for creating an effective corporate credit card policy

Card responsibilities

You must outline what the responsibilities of the cardholder are. This must include vital statements like cards cannot be used for personal expenses, only authorized person with name on the credit card for business expenses can use it and PIN and card must be stored safely.

Spending & budget limits

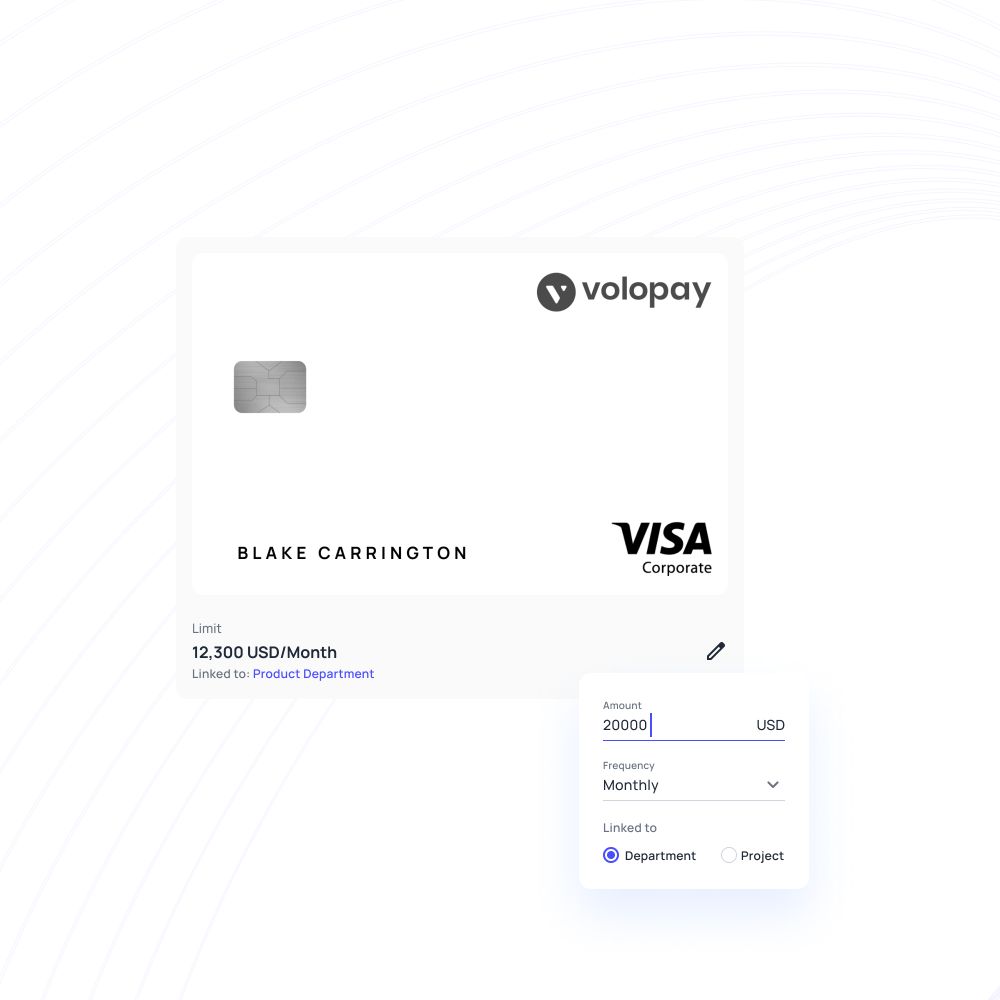

Employee spending and budget limits must also be clearly mentioned in the corporate credit card policy document. This limit can be set according to the level of authorization the card user has.

Approval requests

It is also necessary to mention in your corporate credit card policy document which are the levels of employees that must request approval or authorization before making certain purchases.

Make secure and convenient business payments with corporate cards

Business credit card rules every business owner should follow

While there are no hard and fast company credit card rules that are legally mandatory for business owners to follow, there are some principles that are useful when followed. These rules or principles are meant to help you get the best out of your business credit card:

1. Never use your business credit cards to cover personal expenses. Using company cards for personal expenses spells a recipe for disaster. Use your business credit cards only to serve the purpose they were made for - to cover business expenses

2. Use the tools that company credit cards come with to monitor and track how your employees are using these cards. Keeping a check on employee expenses will help you highlight dubious activity before it gets too late. Establish proper controls for these cards and ensure all spending activity is always kept under a microscope.

3. While traditional business credit cards often come with spending limits, certain options, such as a business charge card, may provide more flexibility for businesses requiring higher purchasing power. A capless spend limit ensures access to necessary funds, especially during emergencies.

4. Check the rewards, benefits, and perks before onboarding a card provider. Choose the provider whose offers suit your organization best.

5. Avoid cancelling a company credit card if you think there’s something wrong with it. You can always just freeze or block it, this way you can recover any important data that might have been on that card. Closing a card abruptly can have a negative impact on your company's credit score.

6. If your card provider comes with welcome offers make sure to avail of them. While other offers usually come with some criterion attached, welcome offers usually don’t.

7. Utilize spending bonuses offered by your card provider. Aim to onboard a card provider that offers threshold-based spending bonuses that are ideal for your business spending pattern.

Strategies to ensure good credit card practices

● Ensure your employees are accountable for the expenses they make, establish an accountability system before you get your cards.

● Do not hand out cards to all employees. Conduct a thorough check of which employees really require a company credit card before handing them out.

● Ensure that you have set limits on how much can be spent using your company cards, who can use them, and where they can be used.

● Use card management dashboards to keep track of all transactions. Keep a check and watch out for fraudulent activity.

● Lastly, make sure you are wise about how you use your cards. A Business credit card for small business comes with high spending limits and a number of features that can make it tempting to whip out the card everywhere. Use these cards only when you truly need credit.

Choose Volopay for your business payments

In light of our observations, it is clear that business credit cards can be quite useful, but they must also be used wisely. To make the use of such cards easier opt for a card provider that is flexible and easy to work with.

Volopay is the perfect option as a card provider that is not only flexible but also tailored to your needs. Volopay corporate cards can be issued in both physical and virtual versions.

In fact, you can issue unlimited virtual cards to your employees completely free of charge; you can use this feature to give out on-time or burner cards to employees for them to use or just as gift cards or bonuses. You can also use such cards to set up recurring payments.

With these cards, you can maintain wallets with multiple currencies (e.g. USD, GBP, EUR, AUD, etc.), pay international vendors, and make forex conversions without the fear of wallet-burning forex rates. What’s more is that all expenses made via these cards are tracked, recorded, and reconciled all in real-time. You can also set customized spend parameters to ensure these cards are not misused.

Simplify your business spending with Volopay's corporate cards

FAQs

Business credit cards are designed to be used for all business-related expenses. You can charge pretty much anything on them.

You should not put any personal expenses on a business credit card.

You should put all expenses related to business purposes on a small business card.

The purpose of a business credit card is to help manage the business expenses of a company.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free