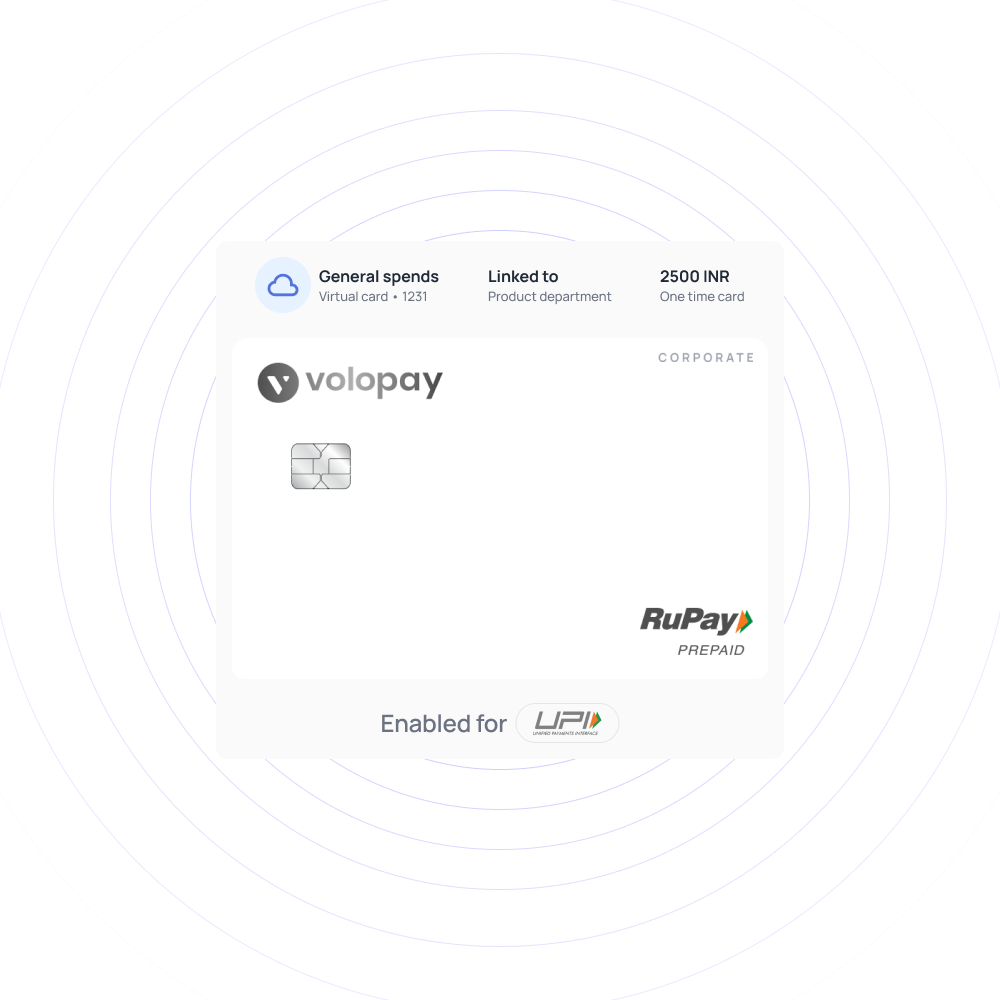

👋 Exciting news! UPI payments are now available in India! Sign up now →

Volopay - The best virtual prepaid and credit card in India

Use the Volopay virtual prepaid card to manage your company's payments efficiently. Similar to a virtual credit card, get a faster and more secure payment experience by making contactless payments at merchant checkouts using our smart virtual prepaid cards.

Empower your employees by allowing them to make company purchases without having to pay using their personal funds.

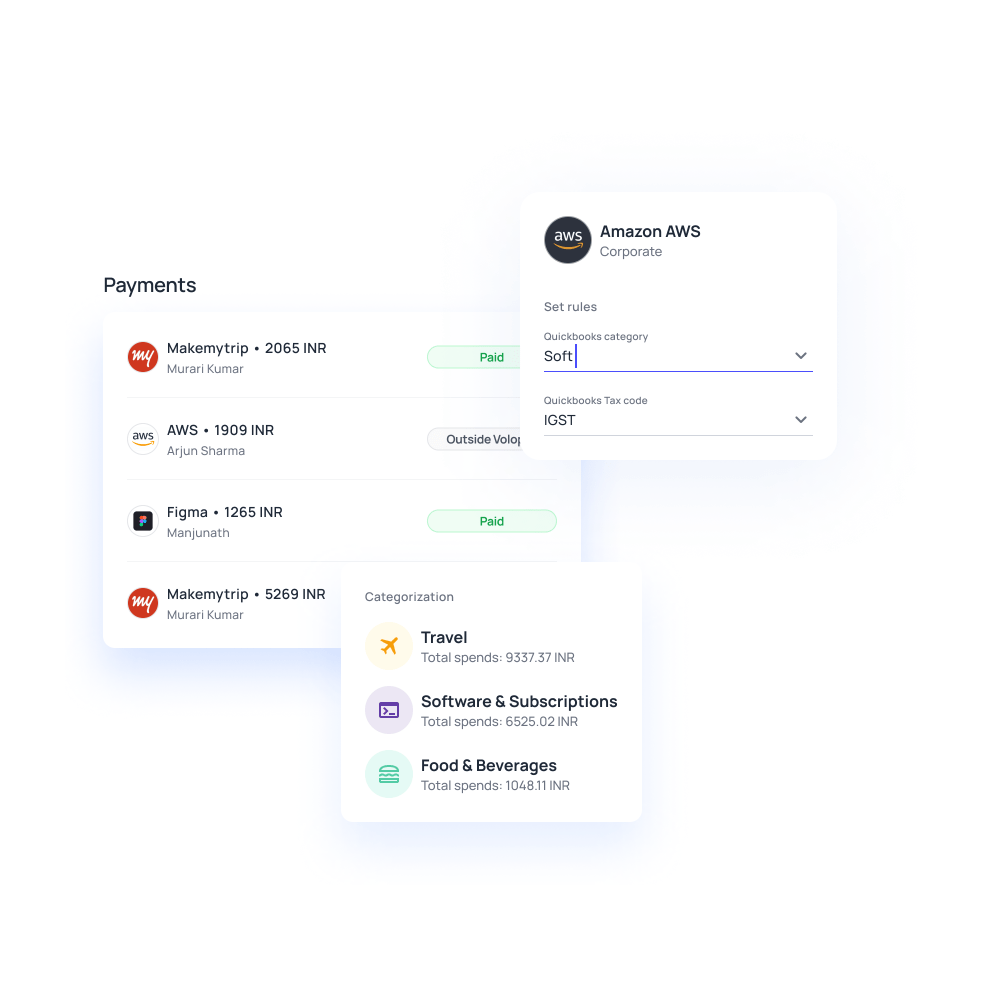

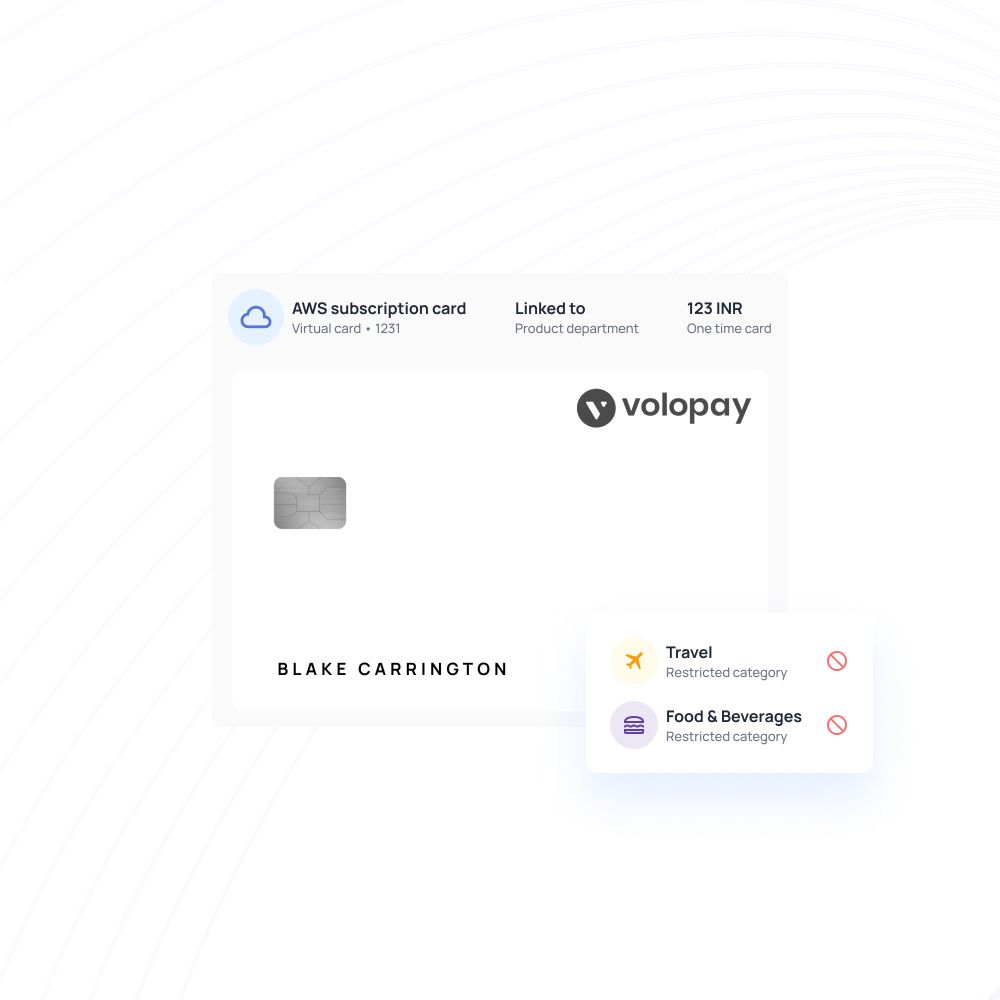

SaaS subscription management

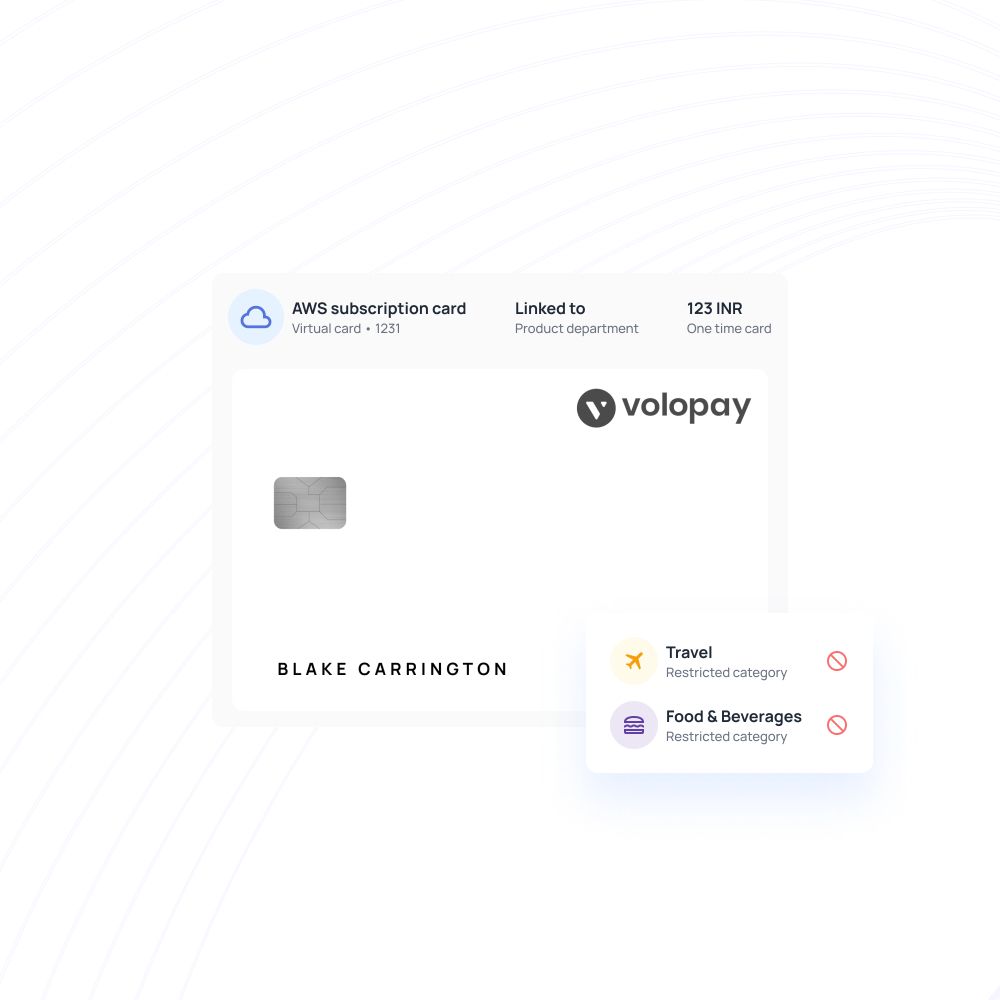

By creating multiple business virtual cards, keep your SaaS payments under control and ensure that no unnecessary or outdated subscriptions get in the way of money management.

Keep track of budgets and payouts for each SaaS billing by creating a one-time or recurring payment card, or simply allocate a virtual prepaid card particular to a vendor.

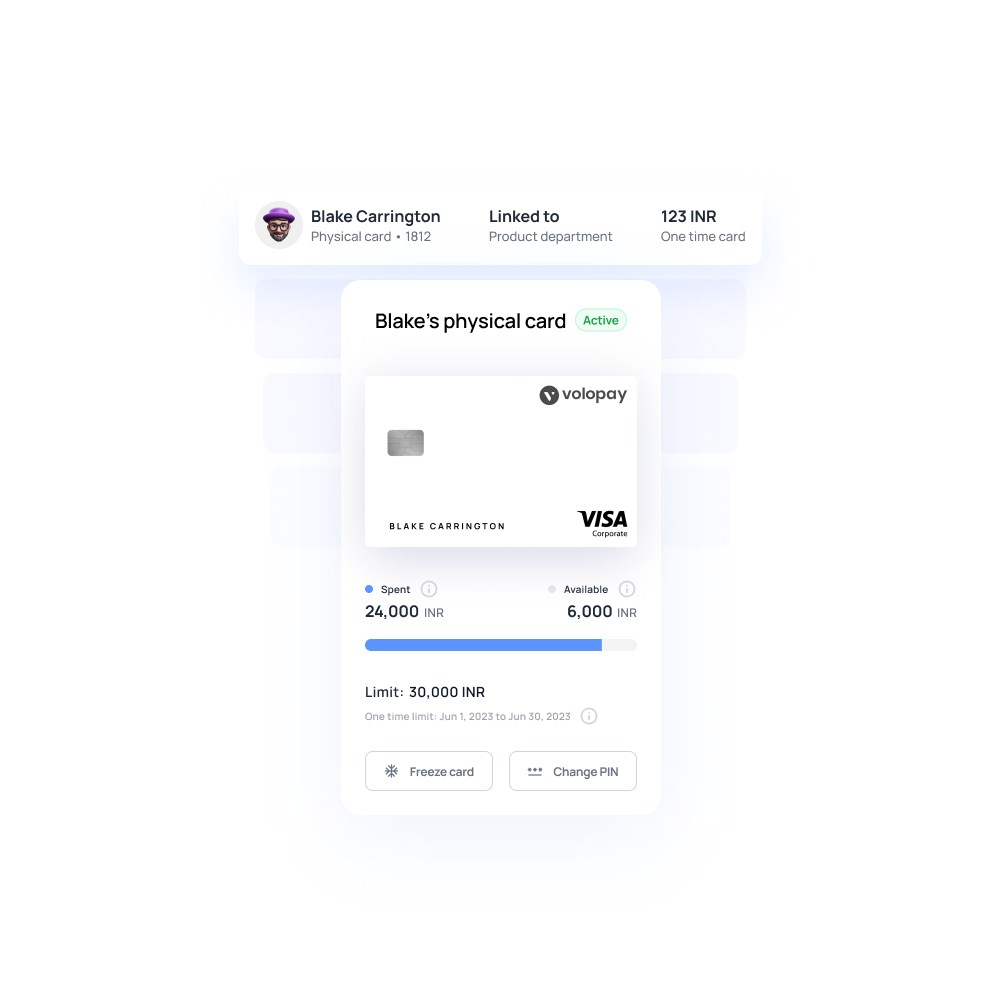

Safe and secure online payments

The Volopay corporate card, like a virtual credit card in India, is compliant with all the regulatory guidelines in the country. Issued by VISA, Volopay virtual business cards have the same encryption and security as any other bank-grade credit card. You won't have to limit yourself to an exhaustible and shared list of virtual credit cards. Instead of worrying about data leaks or misplaced cards, you can generate an infinite number of virtual cards.

There is no risk of fraud because this virtual card is not linked to your company's bank account. For peace of mind, you can keep your cards organized and separated, loaded or frozen, as needed.

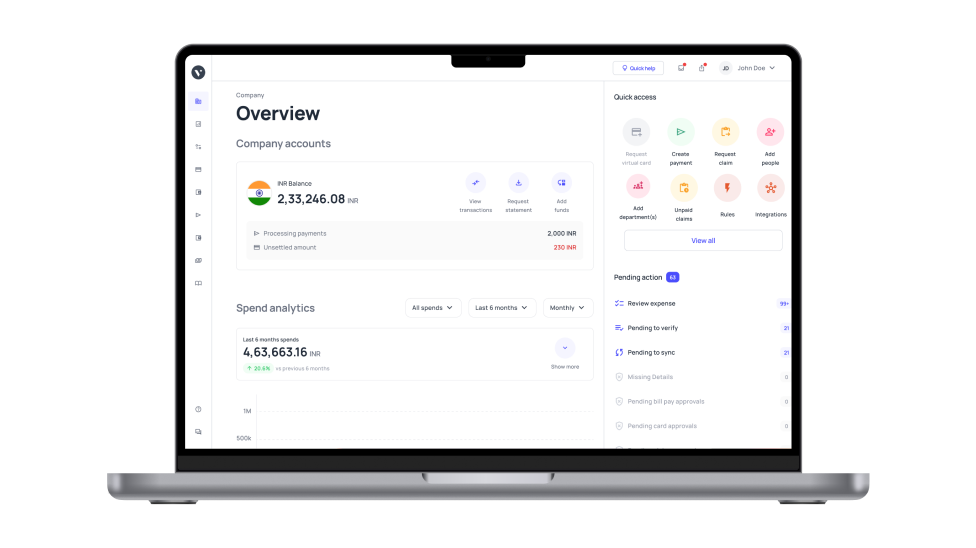

Real-time spend visibility

The biggest demand for a business virtual credit card comes from wanting visibility. Since your business virtual card is linked to your Volopay account, any transactions or expenses are updated immediately in your Volopay account — no different from a business virtual credit card.

Every swipe and transaction made is recorded in real time. You can track your spending data at any time and from any location. There's no chance of data loss, as you'll always know how much money is leaving the organization.

Faster and simpler payments with UPI

Volopay’s UPI-enabled virtual cards make business payments seamless, secure, and instantly accessible. Activate UPI in seconds and make hassle-free transactions from your mobile while tracking every expense in real-time on a centralized dashboard.

Set spending limits and gain full control over company finances. With advanced security and universal merchant compatibility, your business payments are always safe and hassle-free. Every transaction is logged instantly, ensuring complete transparency and better financial management.

Perfect virtual card solution for your business!

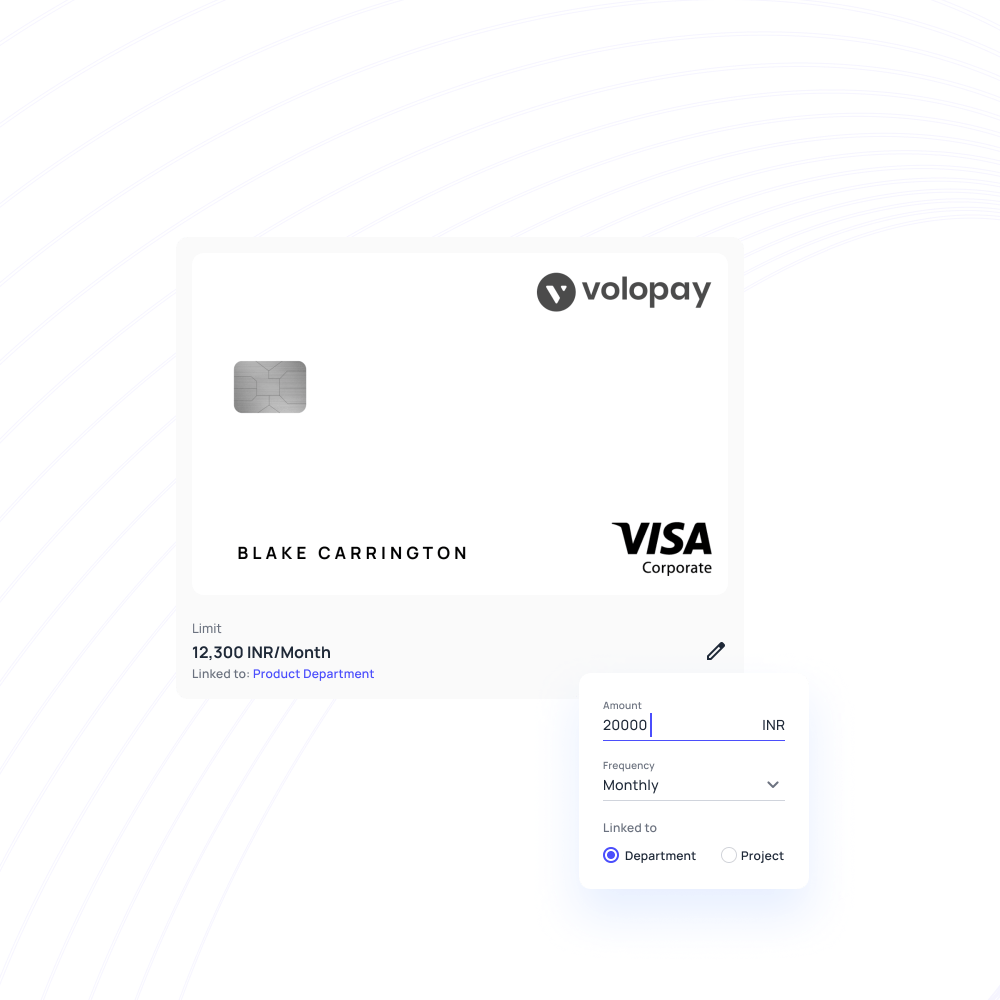

Set precise spending limits

Set spending limits for each virtual card so you can keep track of how it's being used. Company spending policies are enforced by default, and any transactions that exceed a specific limit set by you will be declined automatically. You can also set policies for cards linked to specific departments or projects, for versatile usage.

Admins can also control the refill amount for cards with refreshing limits, including how often the budget of the card is reset.

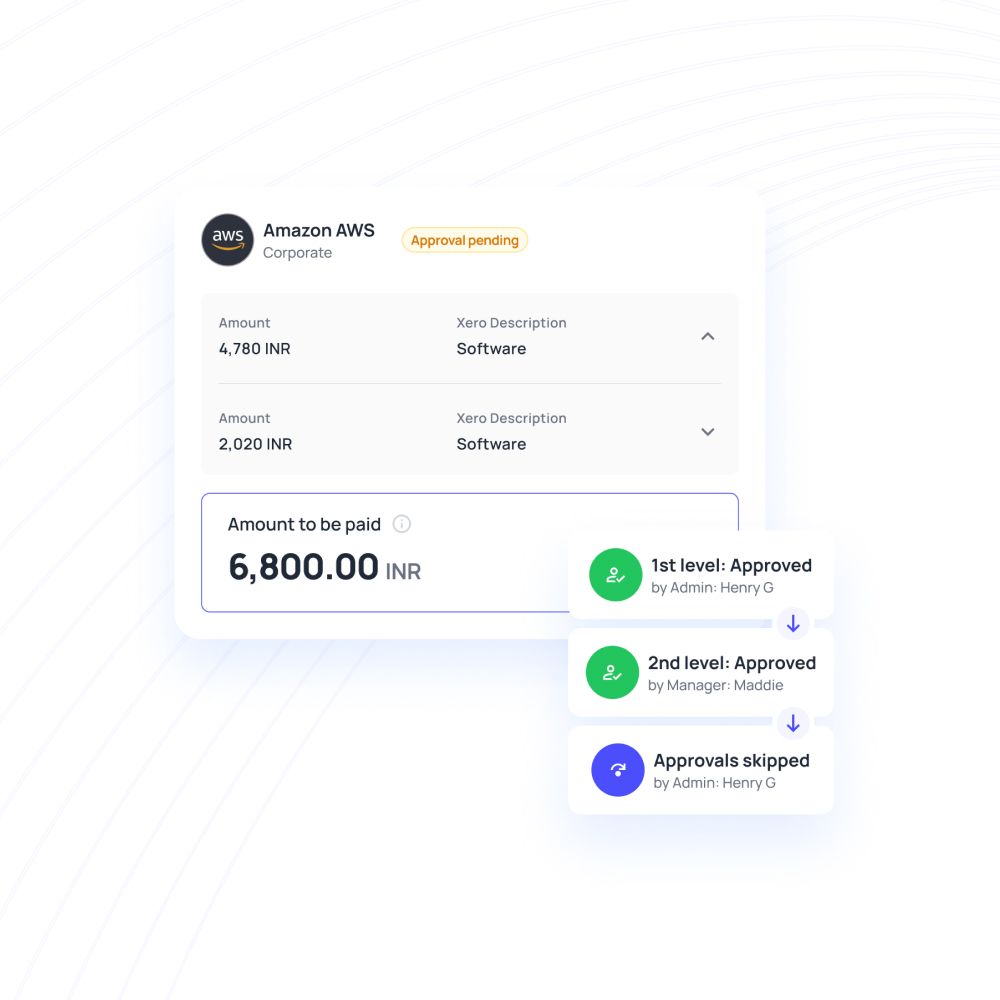

Multi-level approval workflows

Create five levels of approvers, each of whom is responsible for reviewing spending and funding requests. This is a one-time setup, following which push alerts and fast payouts ensure that everything works smoothly.

Non-compliant virtual prepaid card transactions are automatically rejected, saving approvers time and effort.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Benefits of issuing virtual card to employees

Reduces reconciliation burden

Virtual prepaid card payments are easy to track and comprehend since these payments come with labels and codes. The finance team doesn't have to chase for receipts and explanations from the accounting team.

Also, these payments get synced with the main ledger automatically, thereby eliminating the need for human labor to reconcile card payments.

Easier vendor management

Depending on the number of vendors, create as many virtual cards as you want and assign them to individual vendors. You can easily monitor each card payment, like a virtual credit card.

Make online payments quickly, and track separate department and vendor expenses hassle-free. As you start working with more vendors, create more virtual prepaid cards and make on-time payments.

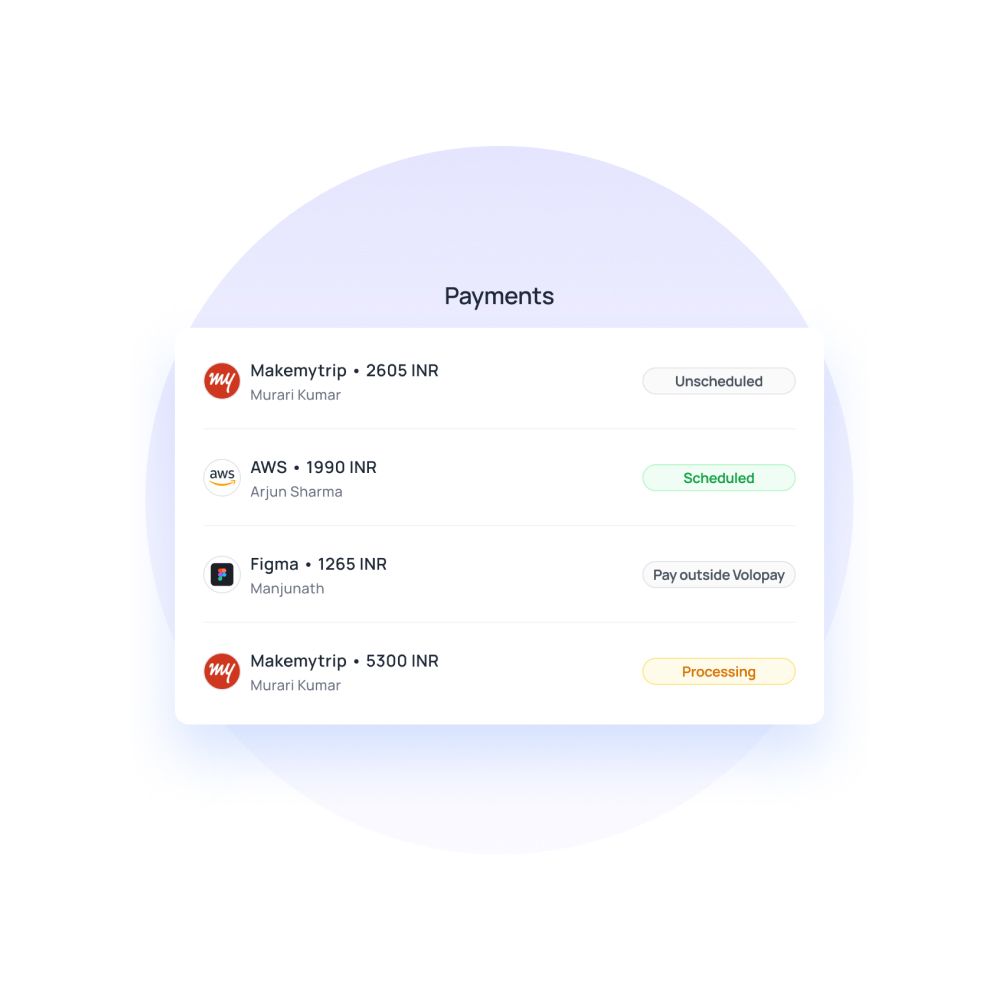

Faster business payments

Making business payments like ticket bookings, reservations, and fuel card recharges is quickest with a virtual card. Like with a virtual credit card, you just need to enter virtual prepaid card details and complete the payment online.

Since virtual prepaid card payments are different from wire transfers, online transactions can be completed quickly.

Experience seamless transactions with business virtual cards

Why choose Volopay virtual card?

1. Compliance & security

With bank-level security and double encryption, Volopay is committed to protecting your data.

2. Easy to create

Create your virtual prepaid card and get them assigned to a spending category or employee with just a few clicks.

3. No hidden fees

With no hidden fees charged during local payments, Volopay offers the best competitive rates in the market.

4. Unlimited virtual cards

A time-consuming expense reporting process can become tiresome for employees. Issue a virtual prepaid card to any employee to help them manage business spending by themselves.

You can create unlimited virtual cards and assign them to each of your authorized employees. The virtual card can better manage and control employee-related and departmental expenses.

5. Assign and manage budget

Assign and manage the budget allocated to each department or project by internally linking your virtual card.

Additionally, you can keep track of expenses related to a particular department or project, and spot overspending. By directing departmental funds to virtual card payments, you will get greater control over how the company's money is used.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay is a centralized business financial control center that combines innovative solutions such as smart corporate cards, AP automation, efficient automated accounting, approvals, and employee reimbursements.

Global corporate card

Make use of Volopay global corporate cards to manage international transactions with ease, offering features like worldwide acceptance, seamless expense tracking, and effortless subscription management, all with no top-up limits.

Subscription management

Create payments and schedule them using our virtual cards for subscriptions to avoid late payments and service interruptions. Real-time tracking can help you avoid making numerous payments.

Block and freeze options also protect you from spending for SaaS models that you no longer use.

Real-time visibility

Our business virtual cards allow tracking payments. Our expense-reporting system is entirely open and transparent.

All of your transactions are updated as soon as they happen, providing you a complete picture of your cash flow. Everything is precisely documented immediately away, whether it's accounts payable or a simple swipe of a card.

Business prepaid card

We offer business prepaid cards with built-in spending limit controls that you can assign to employees. With these prepaid cards, you can easily track all expenses in real-time and reconcile your account in a matter of seconds.

Multi level approvals

Instill a sense of accountability by using maker-checker processes and approval levels. On the platform, you can set up up to five tiers of approvers, each of whom verifies and confirms that payments are right and nothing is done arbitrarily. Due to pre-set constraints, non-compliant transactions are immediately rejected.

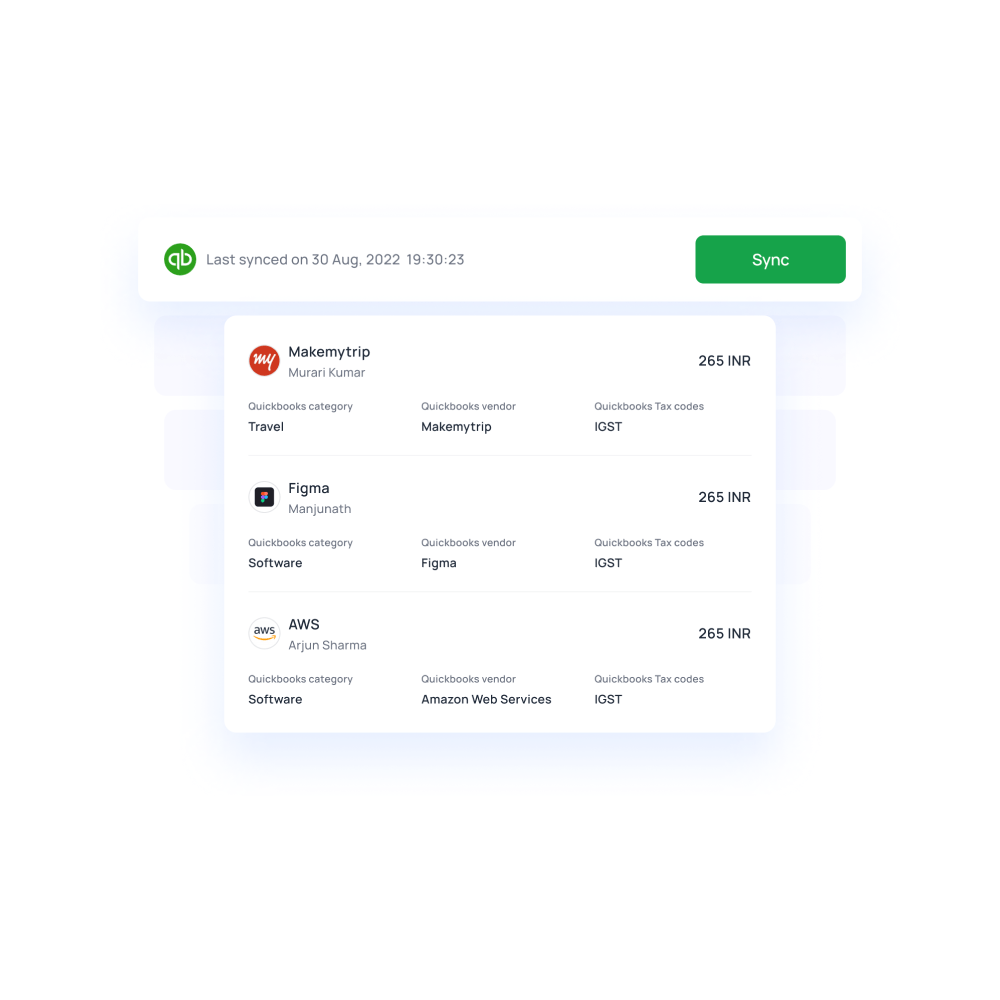

Accounting automation

From the first card swipe until the closure of the books, accounting automation can greatly benefit your account structure. The world's most popular accounting software list seamlessly integrates with our platform for smooth reconciliation and data analysis.

There's no need to sync manually. Simply connect the two systems and observe how they interact to keep your data up to date.

Explore more about virtual cards

Get to know the step by step guide on how to apply for a virtual credit card for your business in India.

Read our article to know what a virtual debit card is, its benefits and how to get one for your business.

Get to know in detail what a prepaid card is and how to apply one for your business.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on virtual card

From your India account dashboard, you may request a virtual Volopay card. Simply go to the card section and click on Create Virtual Card. You'll need to enter certain information, such as the employee's name, card expiry date, department to which the card belongs, approval line, recurring vs one-time use, and so on. It's ready to use after you hit the generate button.

You can acquire your virtual card right away. The card is ready to use as soon as you generate it. It will remain valid until you set an expiration date for it, or unless an administrator blocks or freezes the card.

When it comes to spending, your virtual card is fully under your control. Administrators can assign up to five levels of approvers for expense verification and card loading requests. It works in a hierarchical manner, with first-level approval being followed by second-level approval, and so on, with approval only being granted once the highest level of permission has been cleared. You may also freeze and block cards, as well as set expiration dates for them, to keep track of your spending.

A virtual credit card can be used for almost any online business expense. Similar to a physical card, it has a unique 16 digit number, CVV, and expiry date that need to be input when making an online payment.

Our physical cards support ATM withdrawal on the prefunded model.

Your company account approval's initial evaluation is within 2 business days. We will advise you if any additional documents are required. Once the company account is approved, you will need to complete each user's KYC, which happens within 24 hours.

As per RBI regulations, all financial and non-financial institutions need to undertake KYC for their customers for the issuance of PPI instruments.