👋 Exciting news! UPI payments are now available in India! Sign up now →

Manage invoices with the best accounts payable software in India

Don’t waste your time with manual accounts payable processes – use accounts payable software instead. Save time and money by streamlining all your invoices, vendor payments, and expense reports with the best accounts payable software in India.

Volopay's Bill pay feature with accounts payable automation efficiently manages all vendor payments and expense reports. Our comprehensive accounts payable management solution helps automate your AP process, saving both time and money.

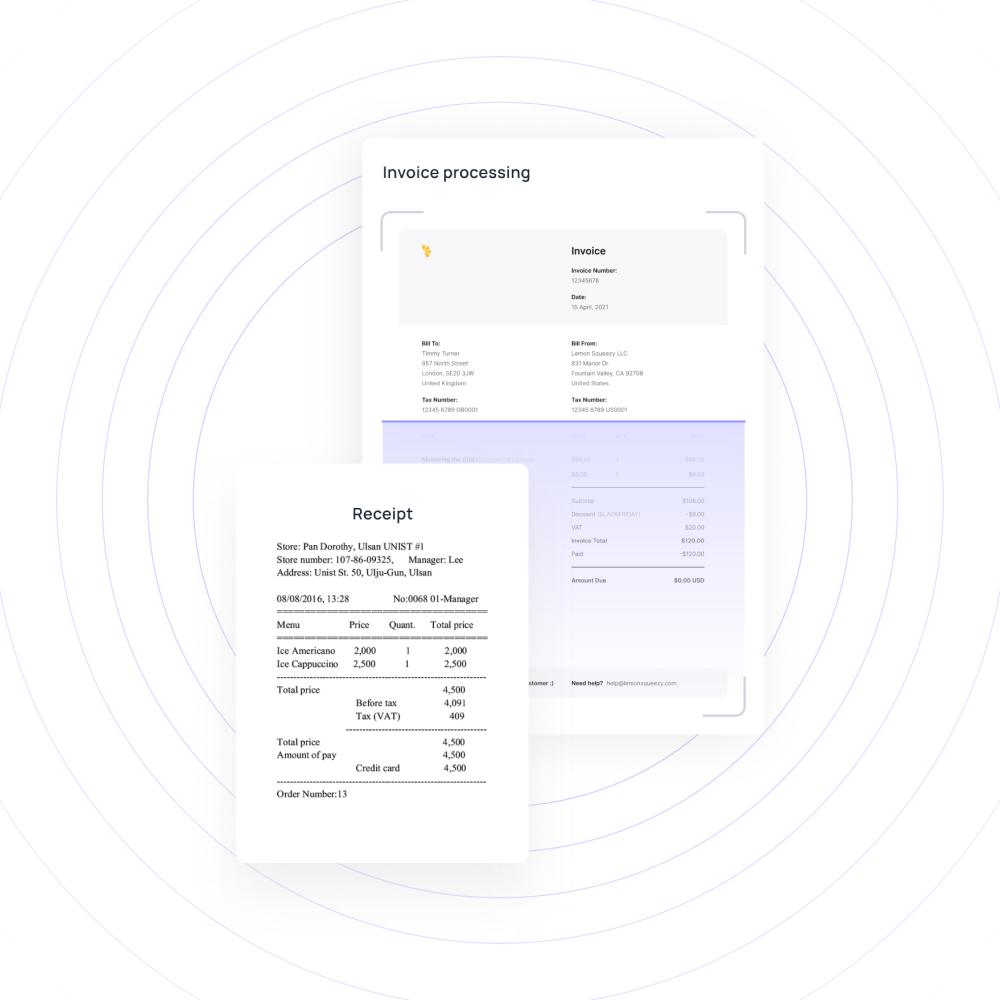

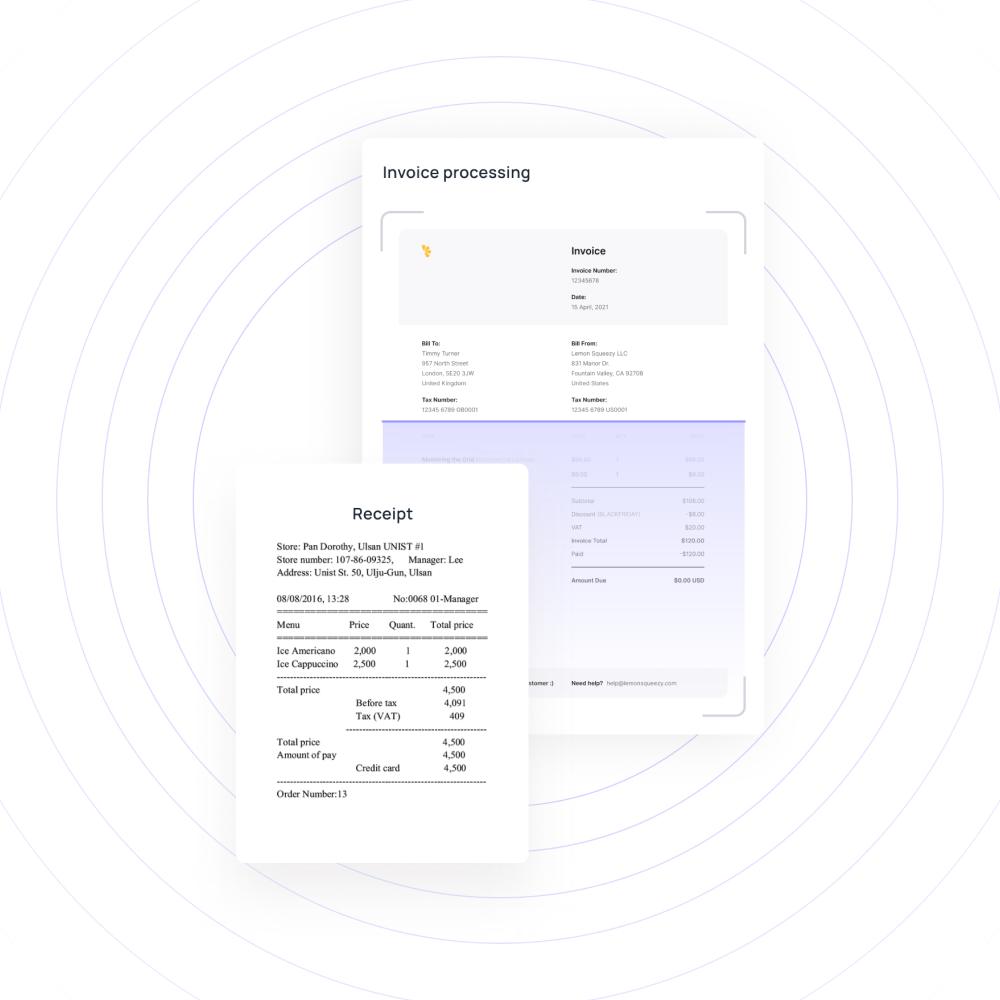

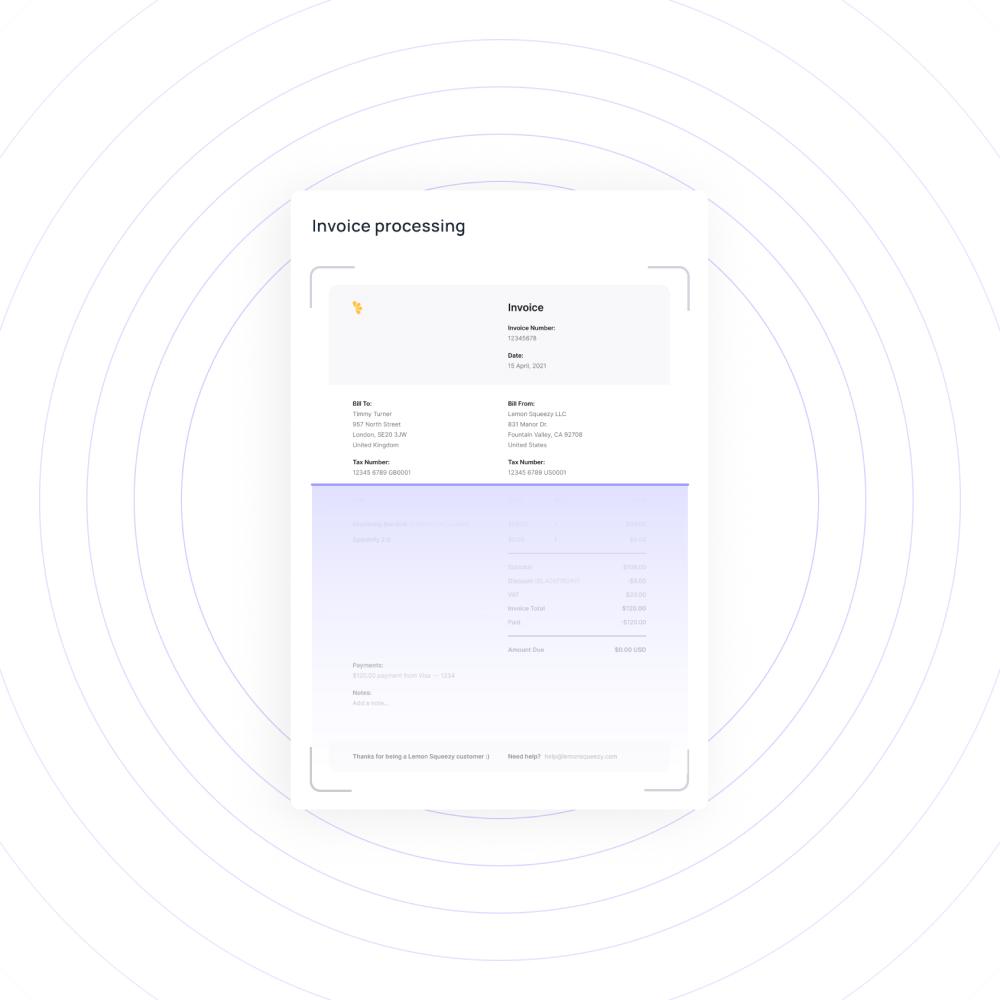

Process invoices in no time

Submit an invoice on the platform and automatically generate a bill. Easily scan your invoices by using Volopay’s optical character recognition (OCR) capabilities to make quick work of your AP processes.

Access to features like bulk invoice upload and split invoice line items on your dashboard. Simplify your invoice processing with the best accounts payable software in India.

Expense reporting system integration

As an all-in-one solution for your financial management, Volopay offers robust expense reporting and accounts payable automation tools for your accounts payable management. Get real-time invoices and updates along with bill payment records, automatically logged and stored directly on your system.

You won’t need several separate clunky processes. Process your invoices, make your payments, and directly create expense reports through Volopay accounts payable software.

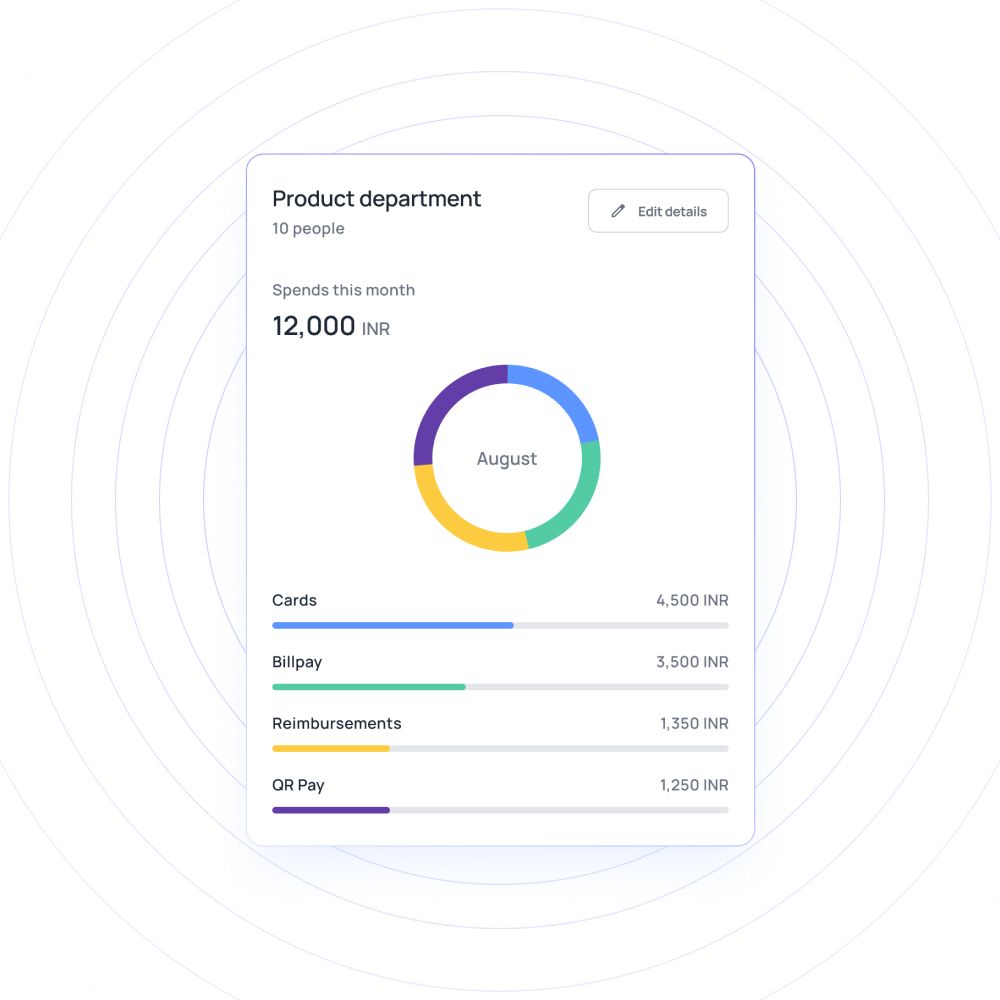

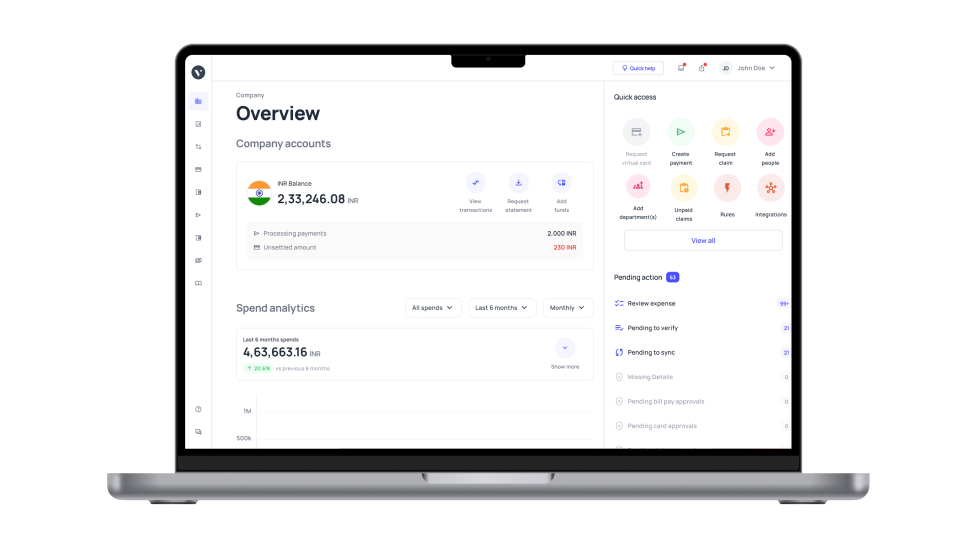

Gain insights into spending patterns

Take advantage of the real-time log updates of your bill payments. There’s no need to wait until the end of the month to collect all your payment receipts. Get rid of time-wasting and confusing processes with Volopay's accounts payable software.

With Volopay, you’ll be able to view all your transactions in just a few clicks at any time. Use the tools available on your dashboard to gain insights into your spending patterns.

Stay ahead with real-time invoice tracking

You can accurately track your invoices from anywhere, at any time. Centralizing your processes with the help of accounts payable automation software allows you to easily view your invoice status. Get notified of when an invoice has been approved. When you make a payment to suppliers, it is logged on to the platform in real time.

Each payment record is synced directly with your general ledger and filtered accordingly. Duplicate payments can be automatically flagged, helping you avoid overspending with our accounts payable software.

Setting up prepaid cards for travel expense management

Streamline your AP process for enhanced efficiency

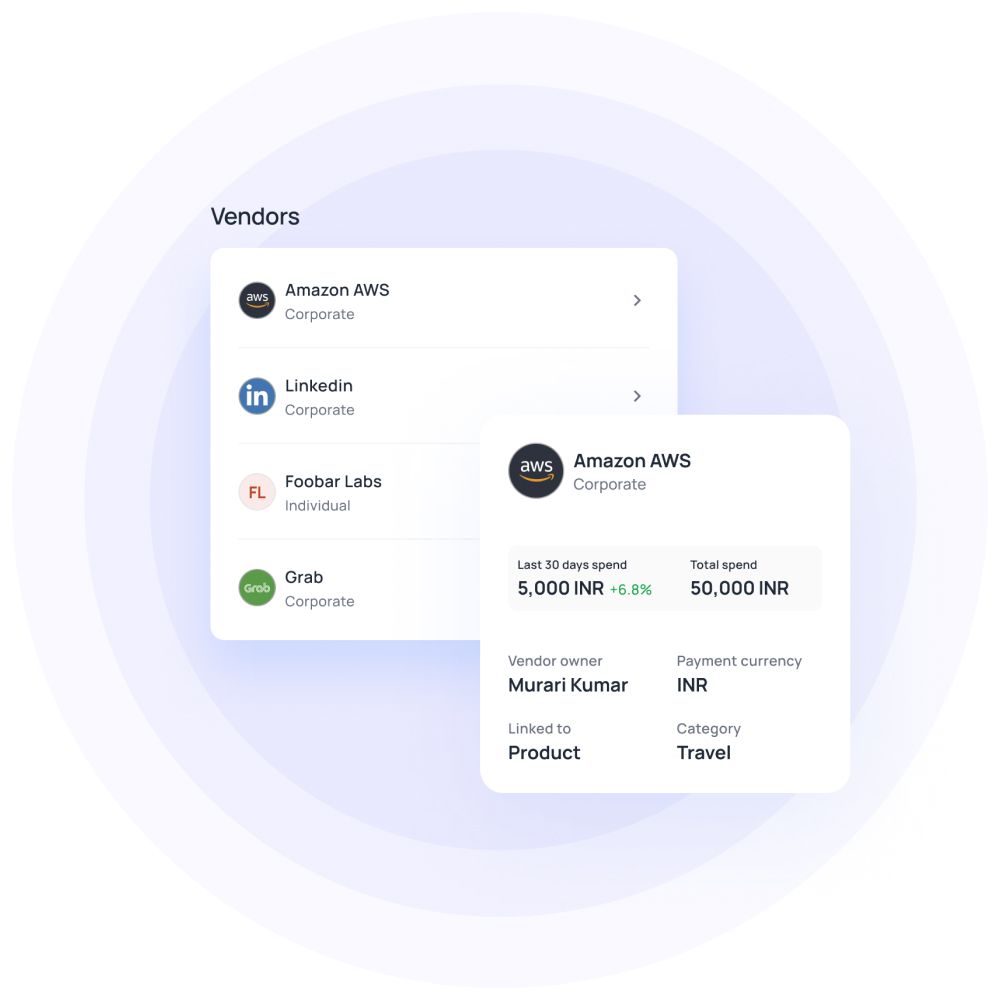

Efficiently manage vendors

Manage and add vendors with your automated accounts payable software. Vendors get their own detailed entry, complete with their bank accounts and payment information. You can even request vendors to add their own details!

Appoint vendor owners for better accountability, link vendors to departments or projects, and access all vendor payment history in just a few clicks with our accounts payable software.

Approve invoices on-the-go

Say goodbye to late payments because of process delays. Volopay offers better software accessibility via our mobile application. Use it from anywhere at any time to review and approve your invoices.

You’ll be automatically notified when there is an invoice that needs attention. Set up mobile alerts so that each approver can get alerts after an invoice is routed through your approval workflow.

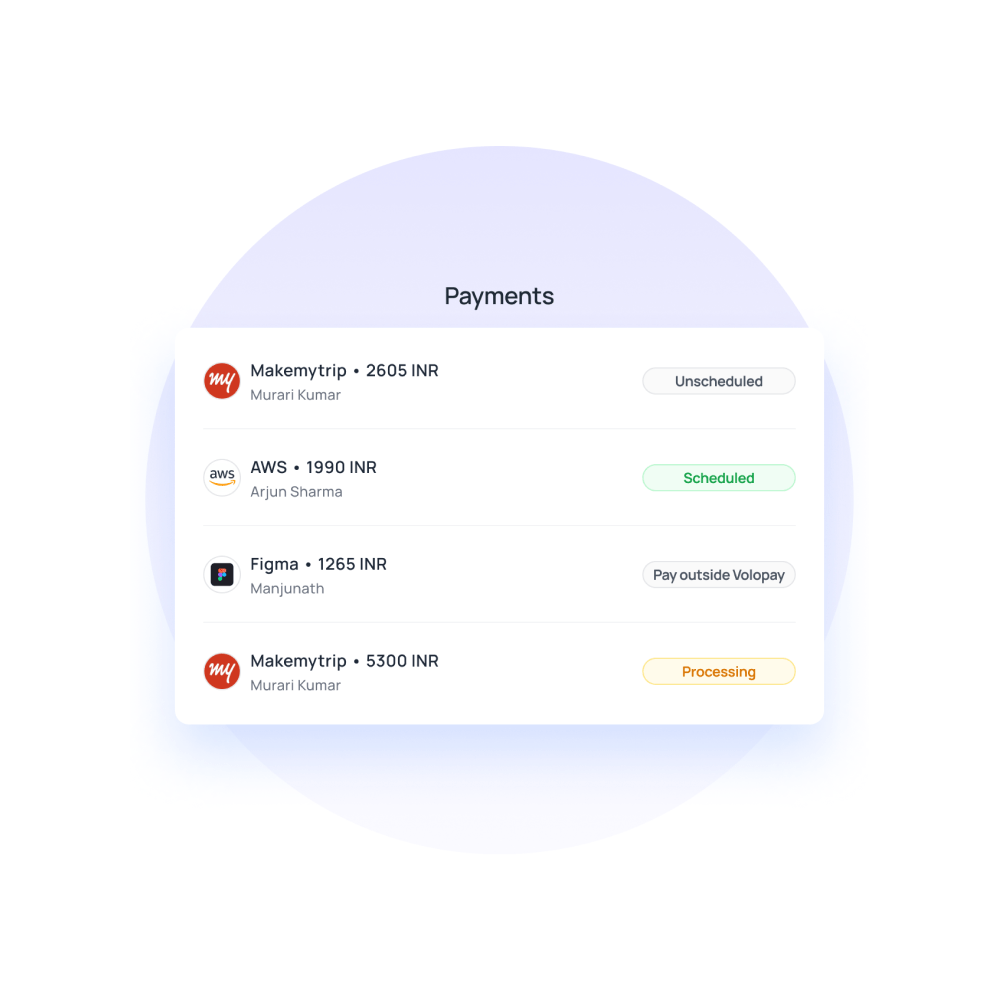

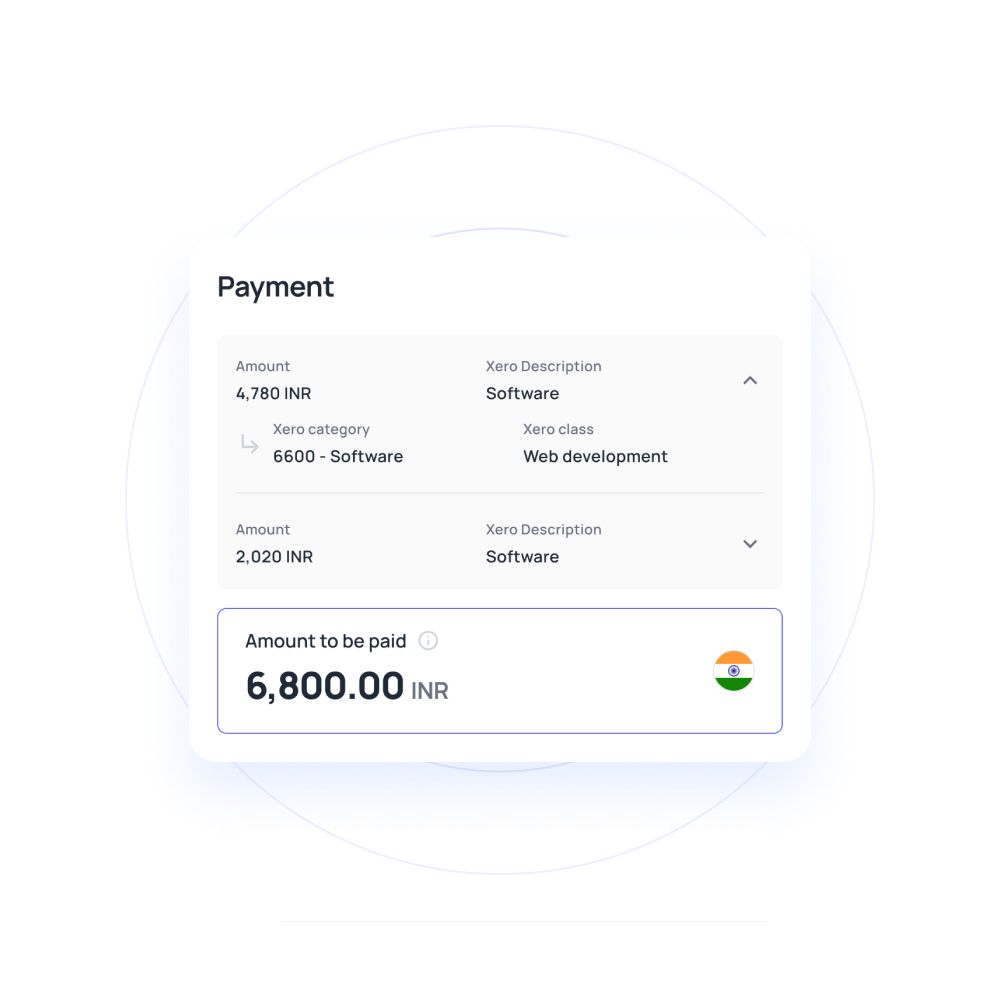

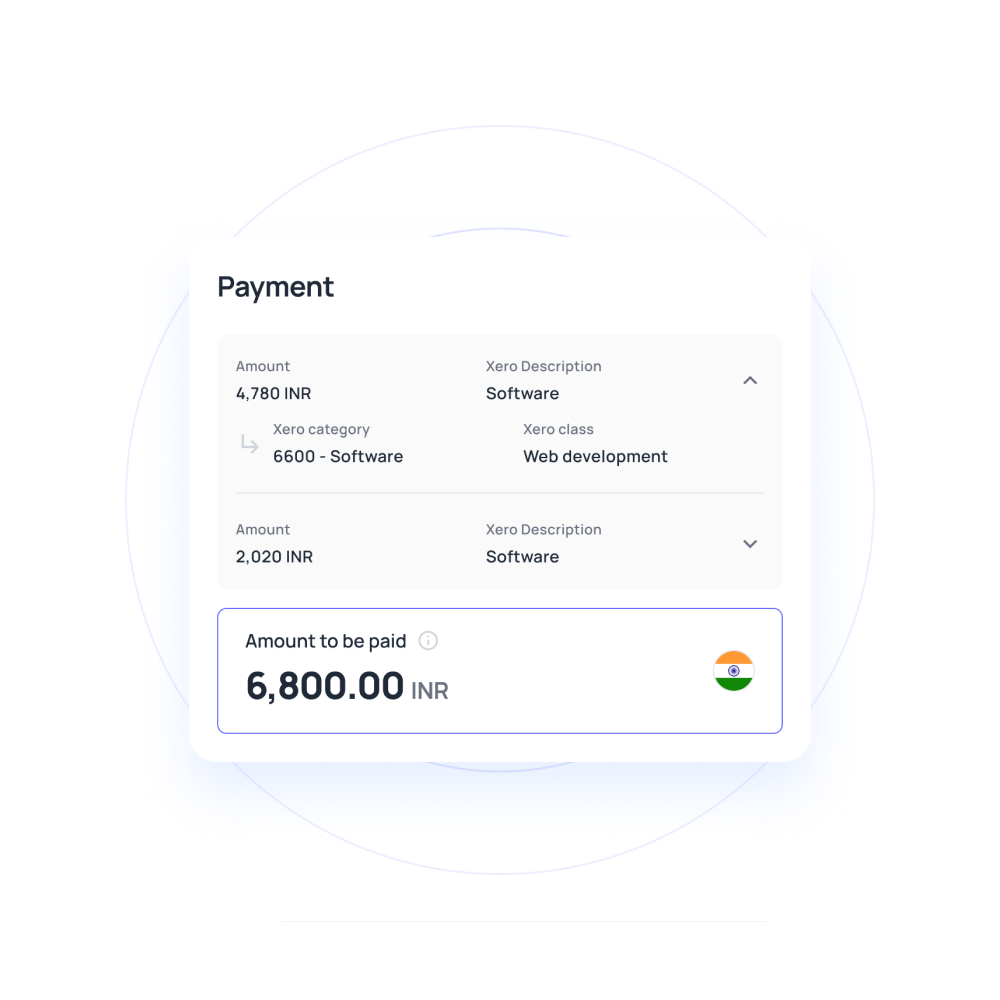

Make streamlined vendor payments

Don’t spend any more time than necessary on vendor payouts. Seamlessly settle your invoices by scheduling both one-time and recurring payments with our accounts payable software. Never miss another payment and get real-time alerts whenever your payment has been processed.

Volopay makes it easy to monitor and categorize payments for your records. Project-specific vendors will only pull from its budget to ensure all payments are within constraints. Any payments settled outside of Volopay can be synced through your dashboard.

Supercharge your AP process with our advanced software solution

Automated accounts payable accounting

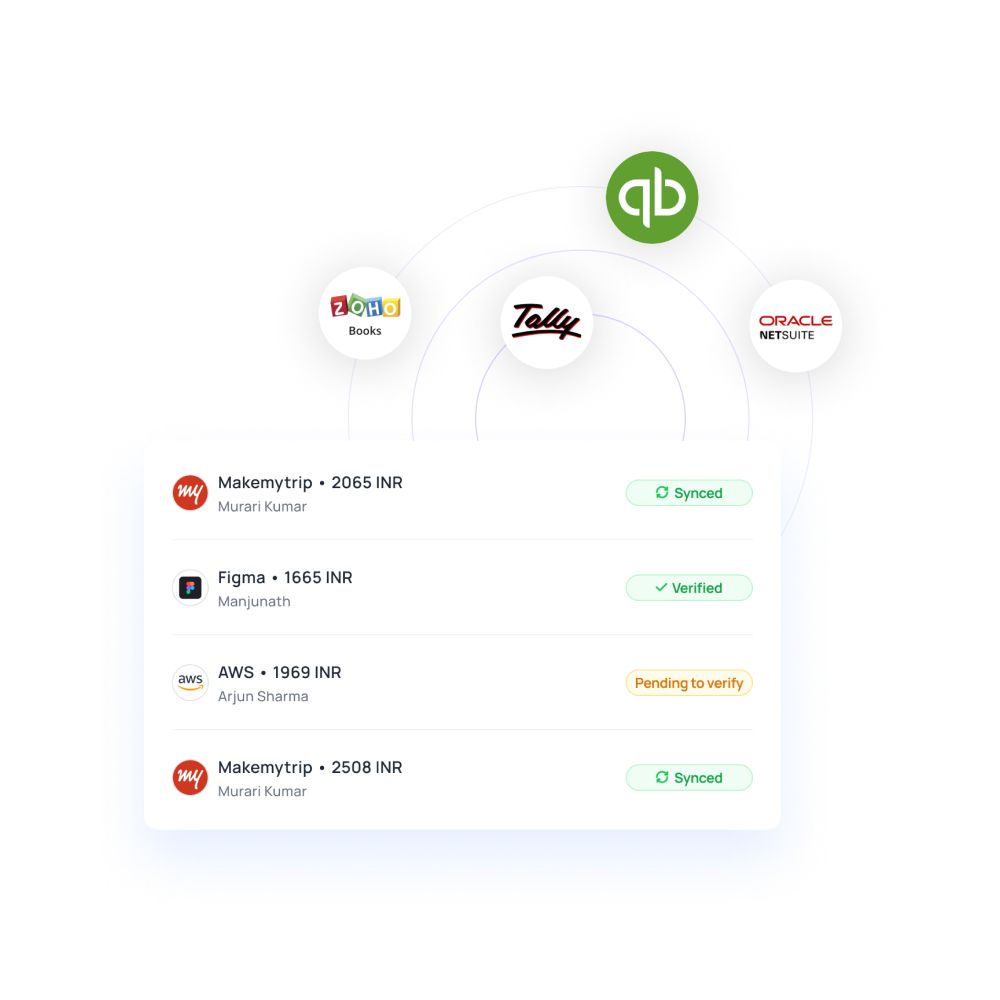

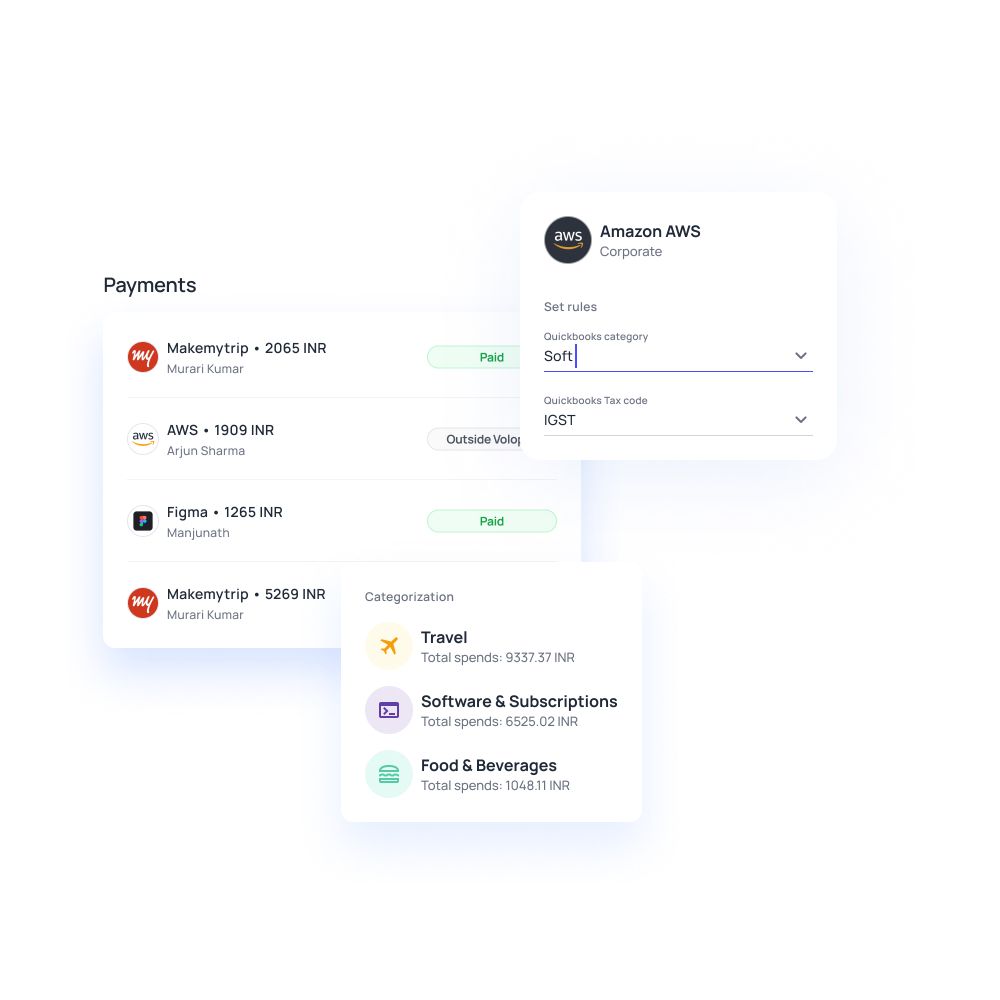

Volopay offers direct integration with some of the best accounting software your business can use. Set up advanced rules for accounting triggers and automate your bookkeeping.

Use Volopay to categorize your expenses, sync your transaction entries, and attach receipts to records, all on one accounts payable software. Even accounting for your expenses can be automated, saving your team a lot of time and effort.

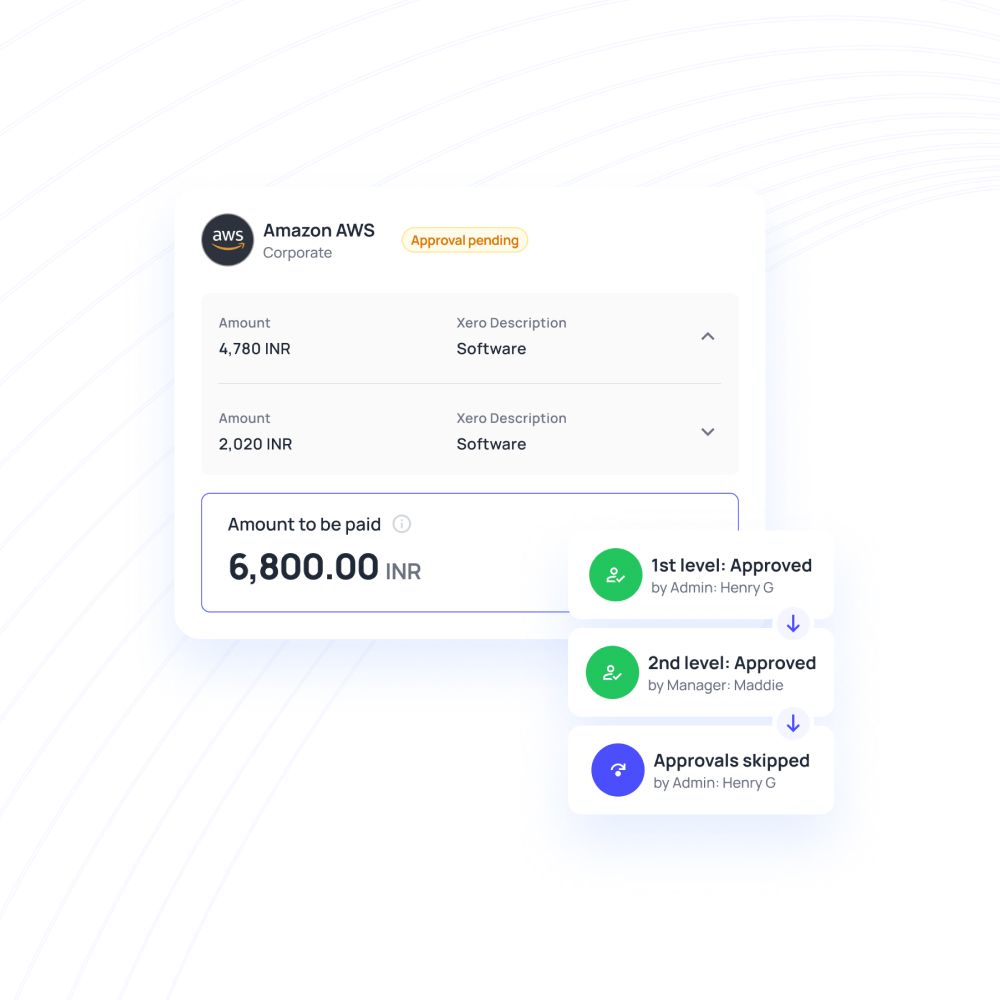

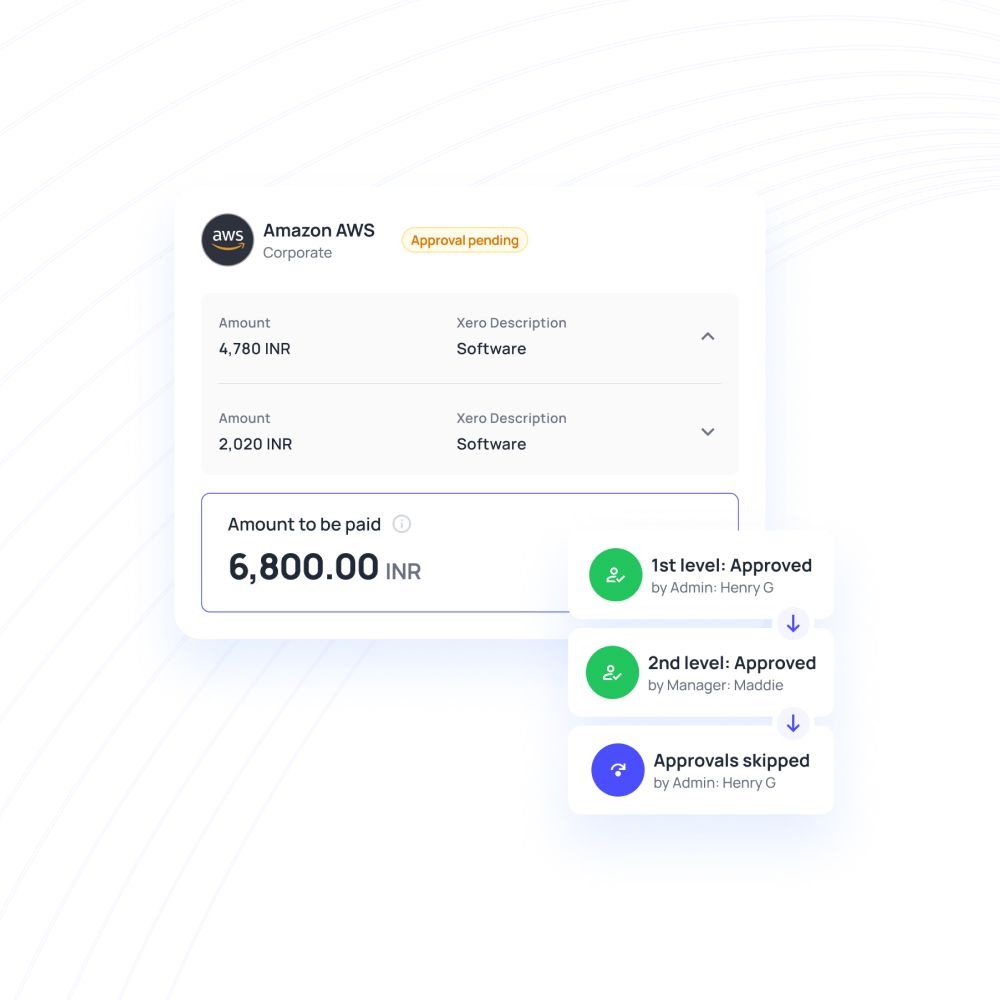

Multi-level approvals and customizable workflows

Create multi-level approval workflows to streamline and simplify your invoice validation process with Volopay's accounts payable software. Customize workflows according to your company policies and automatically route invoices through their respective approval workflows.

Approvers can use the comment feature to get better clarity on accounts payable management activities. Avoid confusion and create transparent and inclusive financial management.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Seamless accounts payable: Volopay for diverse industries

Volopay’s accounts payable software helps startups automate vendor payments, significantly reducing manual effort, improving accuracy, and minimizing errors.

This allows teams to focus more on growth and scaling operations while maintaining smooth financial processes and ensuring timely, accurate vendor payments.

Volopay’s AP software simplifies accounts payable management for small businesses, saving valuable time, reducing human errors, and improving overall efficiency.

Automating payment processes, streamlines operations, improves accuracy, and allows companies to focus on growth rather than administrative tasks.

Volopay’s accounts payable software integrates seamlessly with ERP systems, providing large enterprises with accurate, real-time payment processing.

This ensures timely payments across departments, improves financial control, and enhances overall efficiency in managing large-scale vendor relationships and transactions.

AP automation software for enhanced efficiency

Streamlined workflow

Streamline your accounts payable workflow by centralizing end-to-end invoice processing using accounts payable software.

Get rid of manual data entry tasks to achieve a simpler process for every employee involved.

Reduced manual labor

Empower your team by cutting back on the tedious, manual administrative tasks they previously had to do.

A reduced workload means they’ll have more time to focus on other tasks that require higher levels of attention.

Regulatory compliance

You don’t have to worry about non-compliance when you use Volopay’s accounts payable automation features.

Let the system automatically flag all suspicious invoices and payment requests, sending you automated notifications to ensure double-checks.

Reduced paper usage

Be environmentally friendly and join in the sustainability initiative by making the switch to an accounts payable automation platform.

You’ll significantly reduce your paper usage, which also saves you costs and storage space.

Detailed transaction logs

Each transaction made on your Volopay accounts payable software will be automatically recorded, allowing you to easily view your logs.

Get all the details from your transactions presented to you in just a few clicks.

Faster invoice processing

No more wasting time on slow, tedious manual administrative tasks during your invoice processing.

Speed up the entire process to ensure you always make timely invoice payments by using AP automation tools.

Discover the benefits of streamlined processes and improved efficiency

Your AP, your way: Custom solutions for every role

CFOs

Volopay’s accounts payable software provides CFOs with full visibility over outgoing payments, enabling better financial oversight and control to ensure timely and accurate payments.

With accounts payable software, CFOs gain detailed insights into payment trends, which support strategic decision-making and help optimize cash flow management.

Volopay’s accounts payable software offers customizable approval workflows, allowing CFOs to streamline processes and ensure that payments are authorized quickly and efficiently.

Finance managers

Volopay’s AP software allows finance managers to track vendor payments in real time, providing visibility into payment statuses and improving overall financial management.

With AP software, finance managers can simplify invoice management, reducing manual effort, improving efficiency, and ensuring accurate payment processing across departments.

Volopay’s AP software automates payment reminders, ensuring timely payments and helping finance managers avoid late fees and maintain strong vendor relationships.

Accountants

Volopay’s AP software integrates seamlessly with existing accounting software, streamlining workflows and enhancing overall financial efficiency for accountants managing vendor payments.

With Volopay’s accounts payable software, accountants benefit from error-free reconciliation, reducing discrepancies and ensuring accurate financial reporting and oversight.

Volopay’s AP software provides detailed audit trails, ensuring compliance by offering transparent transaction histories that simplify audits and support regulatory requirements for accountants.

Auditors

Volopay’s AP software provides auditors with easy access to payment records, facilitating quick reviews and enhancing the efficiency of the auditing process.

With Volopay's accounts payable software, auditors enjoy full traceability for every transaction, ensuring transparency and accountability in financial operations.

Volopay’s AP software features efficient compliance and reporting mechanisms, helping auditors streamline audits and ensure that all financial activities meet regulatory standards.

Step-by-step process of using an AP software

Onboarding and setup

Before you can start using your accounts payable approval software, you’ll need to set it up and onboard your accounts payable team.

Customize the settings according to your business processes and requirements. Good automation tools will help make existing processes easier.

Invoice receipt and capture

Use optical character recognition (OCR) to scan your invoices and quickly capture data. You don’t need to manually perform data entry with accounts payable software.

By scanning your invoices, you’ll automatically record your invoice data. All it takes is a few clicks!

Invoice approval

Make sure that you verify your invoice sources, as this helps you eliminate any fraudulent and fake invoices. Route your invoices through an approval workflow to ensure that all of them are accurately paid for.

You can do this automatically with accounts payable automation.

Invoice processing

Process verified invoices so you can make sure every invoice gets paid on time.

It’s recommended that you perform 3-way matching with the help of your AP automation software to guarantee better accuracy and faster turnover time.

Payment processing

Once an invoice is ready for payment, the next step is to process your payment. This involves creating and scheduling a payment, getting it approved, and authorizing it for processing.

Volopay’s accounts payable automation software will manage every step through a single dashboard.

Reporting and analytics

Get automation features that allow you to generate accounts payable reports quickly. Take advantage of your software’s dashboard to present your data.

You want to make use of the system’s automatic expense tracking and regularly analyze your spending patterns.

Vendor management

With invoices to pay to multiple vendors, you’ll find that it is difficult to manage invoices without proper vendor management.

Use AP automation software to automatically list your vendor details and save their information on a single platform for easy access.

Archiving and compliance

The last thing you want is to lose your accounts payable records. Establish a standardized archiving process to ensure that you’re always audit-ready.

Your accounts payable software will help you store all the necessary information in one place, making compliance much easier!

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our accounts payable software

Our accounts payable automation software India offers you to manage everything from invoice management and processing, and vendor management and payouts, to corporate cards, reimbursements, approvals systems, and accounting automation in a single consolidated dashboard.

Invoice management

With this seamless, modern accounts payable software, you can keep track of your bills. With enhanced invoice verification and payment synchronisation, you can make payments to any vendor in any country.

Invoices can be manually uploaded, emailed as attachments, or transmitted directly from accounting. The use of OCR technology speeds up the procedure.

Vendor payouts

Volopay corporate cards and the accounts payable automation in India makes it easy to pay vendors. Manage several currencies and make payments from anywhere in the world with ease.

On-time, at a lower cost, and with real-time data for easy reporting. Nothing goes unnoticed, and everything gets reconciled more quickly.

Automated accounting

Eliminate switching between different accounting systems. You can sync the accounting software of your choice with the Volopay platform smoothly. As a result, all of your recorded expenses are automatically uploaded to your accounting system for easier reconciliation. Manually collecting data, statements, and sheets takes longer than closing books.

Our accounts payable automation software makes it easier to use interfaces with Zoho, Tally, Xero, Deskera, Netsuite, Quickbooks, and MYOB, you can close books almost 10 times faster.

Know more about accounts payable automation

Know how to manage your invoice payment process effectively with AP automation.

Learn about key details such as compliance issues, regulations, procedures and applications related to vendor payments.

Get to know what is 3 way matching, how it streamlines the accounts payable process and ways to implement it.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs on accounts payable

Volopay offers two-way and three-way matching verification systems for accounts payable transactions to reduce incorrect data and fraud. To guarantee that everything is in order, invoices and bills (and, if necessary, receipts) can all be matched. POs can also be attached to the fourth level of verification as supplemental papers if desired.

Volopay enables you to speed up each component of the accounts payable process, resulting in a more efficient overall process. You can automate expense reporting, record invoice data, set up payments, create approval lists, and capture invoice data. Furthermore, using a credit card allows make FX transactions cheaper. Your system is not only better, but it is also more cost-effective. Above all, a well-functioning accounts payable software has a beneficial impact on your vendor relations.

Integrate with leading accounting software in India like Zoho and Tally along with other accounting systems like Xero, Netsuite, Deskera, Quickbooks, and MYOB. If you don't use any of the accounting software, you can still export the files by creating templates that match your software's requirements.

Yes, Volopay's software incorporates OCR (optical character recognition) technology. The line data from any invoice supplied to the system is automatically entered into the report, eliminating the need to manually transfer data from the receipt image/file to the data fields. If your accounting software receives invoices directly, you can integrate it with Volopay so that the data is captured from there. If you receive invoices as email attachments, you can have them automatically transferred to Volopay for upload.

Vendor payments made through our platform are far faster and less complicated than bank wire transfers. Domestic payments and payments made without using SWIFT (from accounts housed locally) are handled within a few hours. International payments made over the SWIFT network may take up to two working days to process, depending on the vendor's country and bank. To minimise any last-minute headaches, you can set up advance payments.

Yes! You can use Volopay to make payments within India and also overseas. You can choose to activate a multi-currency wallet, which allows you to store funds in currencies other than INR. Furthermore, our corporate cards can be used to make overseas payments. These choices will save you money on foreign exchange and remittance fees, plus you'll be able to send money to over 130 countries.