👋 Exciting news! UPI payments are now available in India! Sign up now →

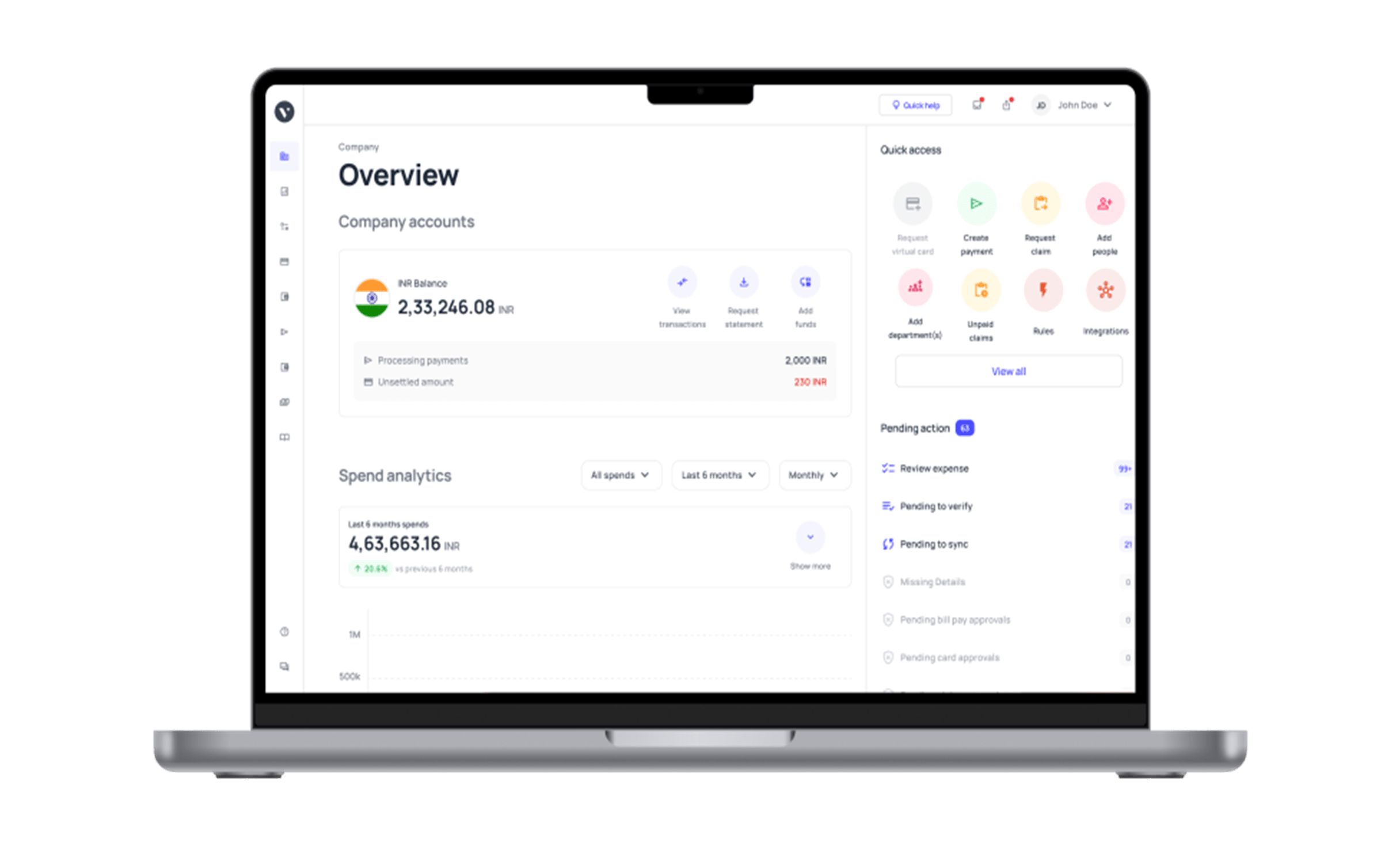

Expense reimbursement software for businesses

Volopay provides Indian businesses with the employee expense reimbursement software they require. Instead of stacking a big pile of receipts and claims, employee reimbursement software allows you to automate the entire process.

It merely takes one click to upload a receipt, which is then approved quickly. Your employees will be able to manage their business spending properly without having to wait months for payment.

Faster expense reimbursements

With expense reimbursement software, businesses can expedite the reimbursement process significantly. An employee reimbursement tool automates the process leading to faster approvals and reimbursement claim processing.

Additionally, once reimbursement claims are approved by the necessary individual within your organization on the platform, dates can be set when all these claims will automatically be paid rather than having the finance team process each reimbursement separately.

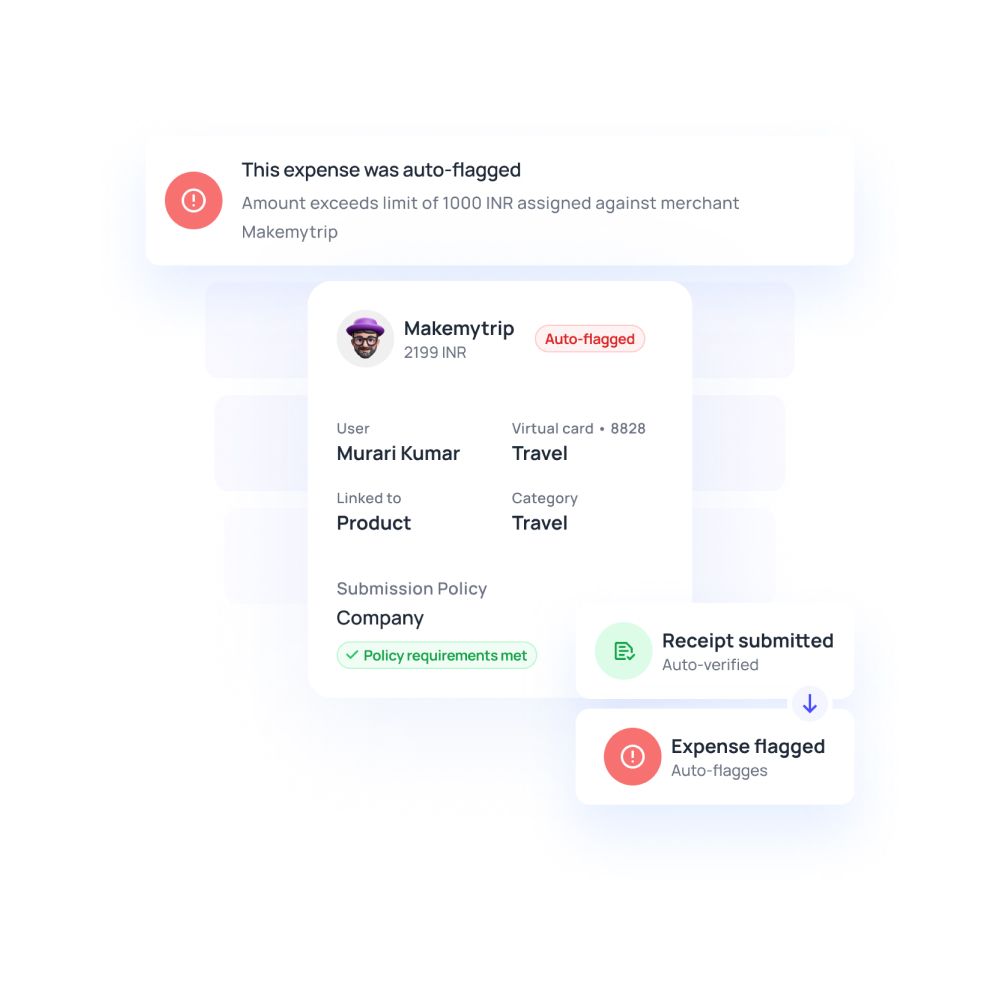

Automatically enforce policy compliance

Volopay's employee reimbursement software can help finance departments ensure that expense policies are followed even when out-of-pocket expenses are incurred. Expense claims that are not in compliance with the policy will be immediately refused.

Create required fields for employees so that information is provided to the relevant approvers. Volopay admins can limit the amount that can be claimed through reimbursements for specific expense categories. This ensures that employees are careful about how much they spend on certain categories they need to be reimbursed.

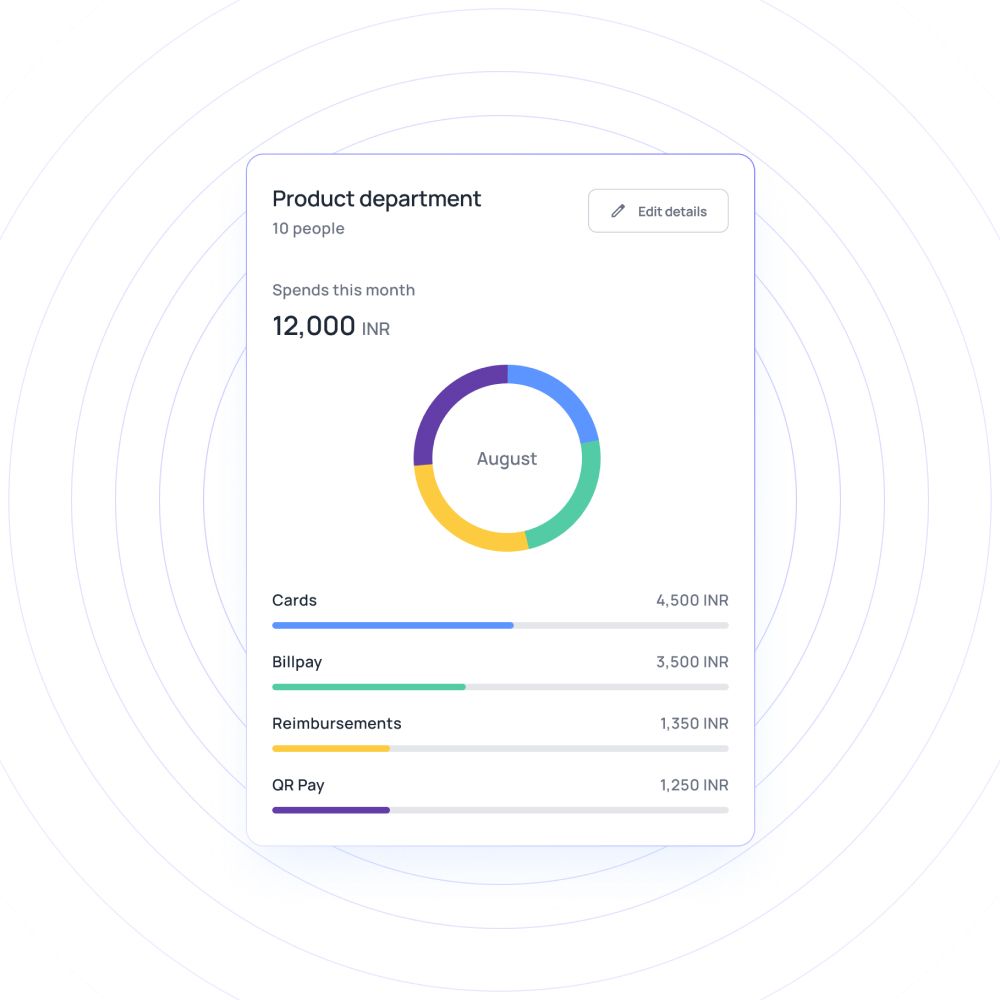

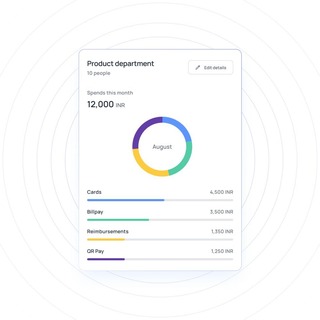

Actionable insights into expenses

Expense reimbursement software offers analytical tools to gain insights into the spending patterns of employees and expense trends within different teams across the organization.

These data-driven insights enable businesses to make informed decisions, identify cost-saving opportunities, and optimize expense management effectively.

Experience hassle-free reimbursements

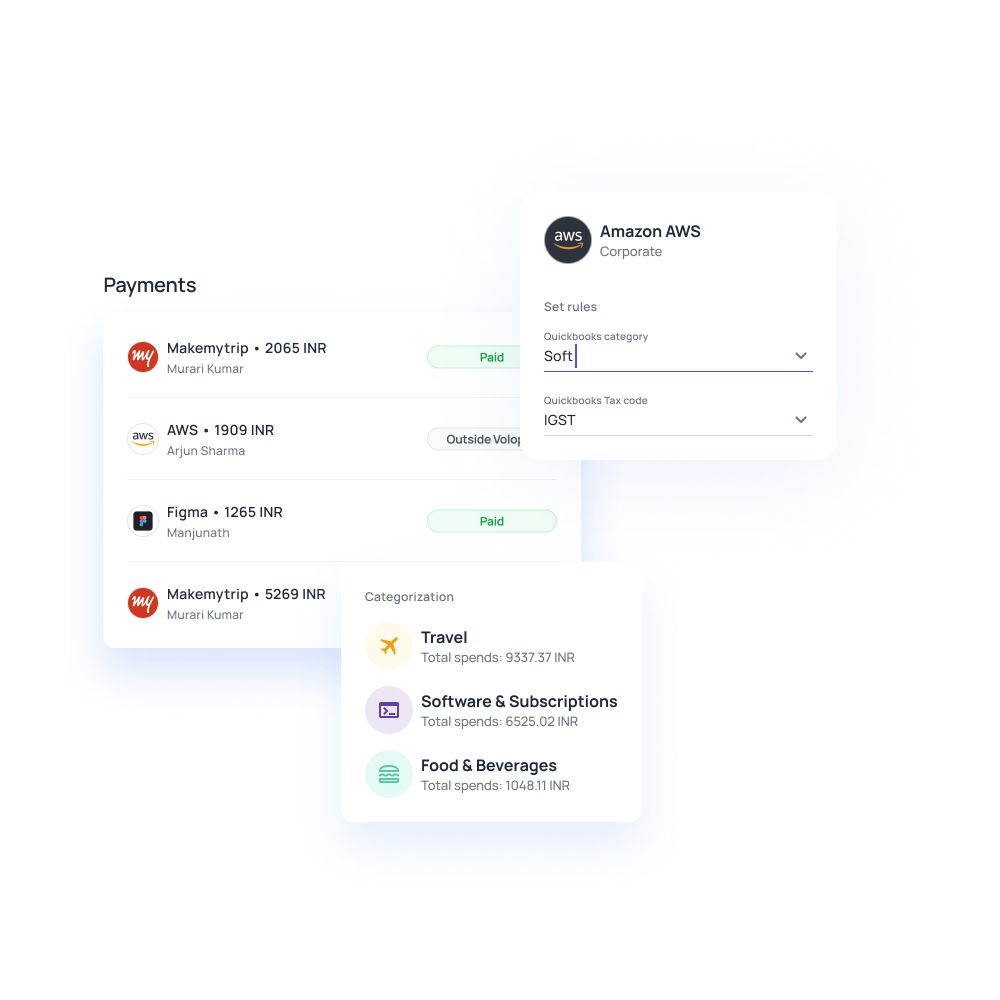

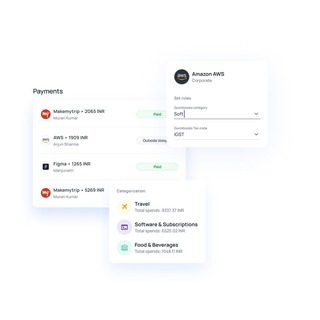

Auto-expense categorization

Automated expense categorization is a valuable feature of reimbursement software. The employee submitting the reimbursement does not have to manually choose a category anymore.

This enables accurate tracking and better financial analysis. Employees can also link a reimbursement claim to specific projects or departments. This will help the finance team analyze the expense behavior and track expenses more accurately.

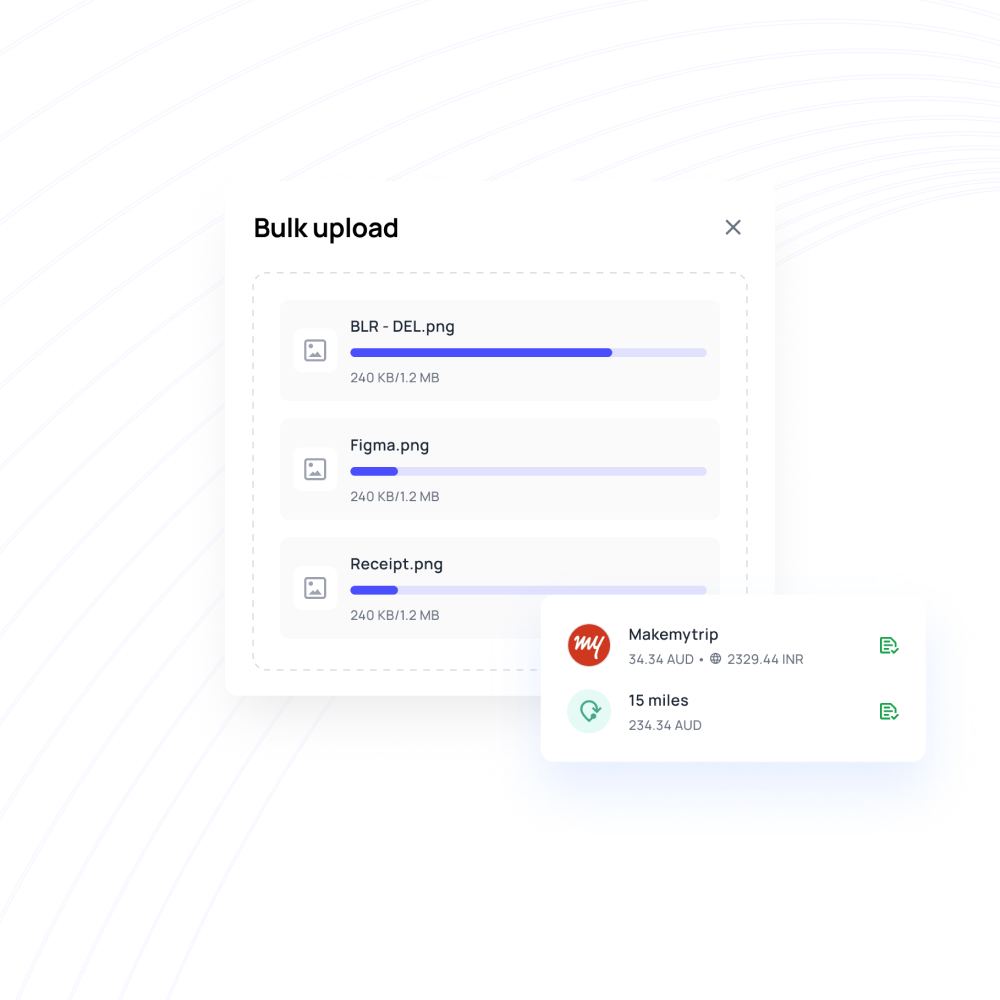

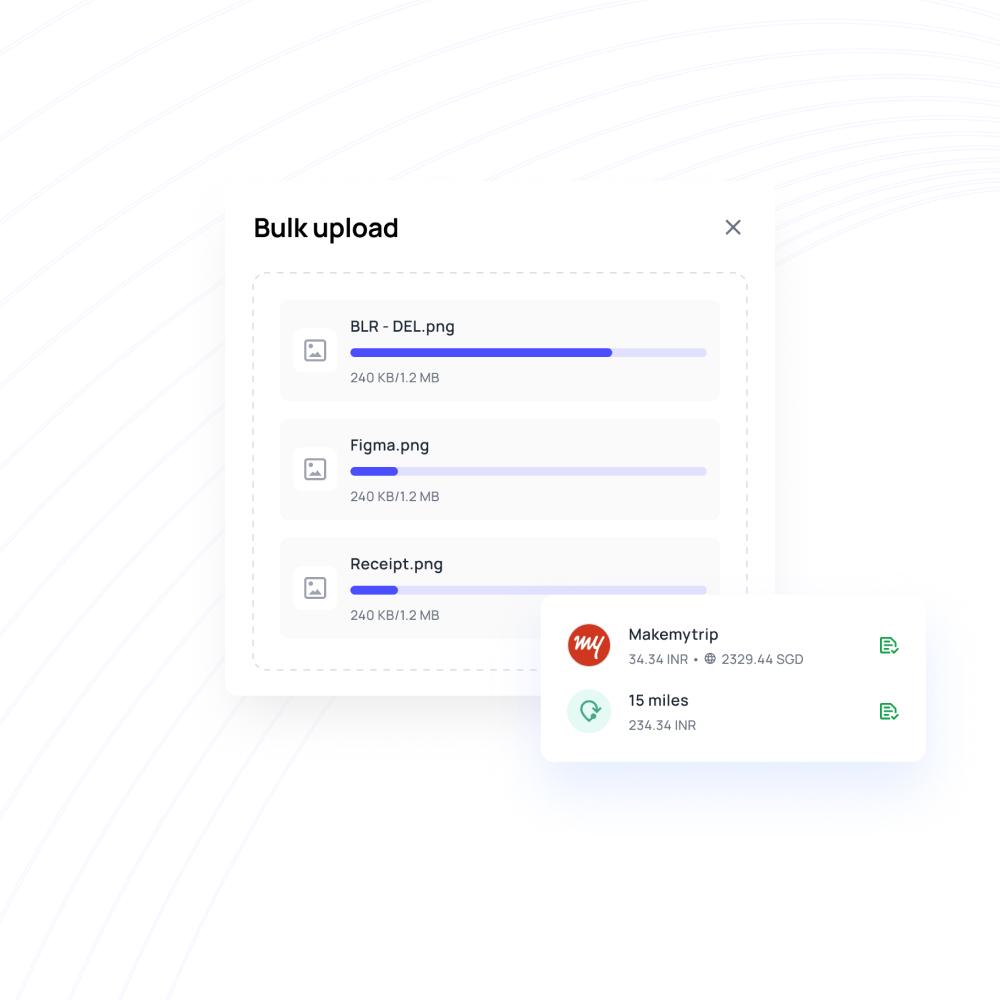

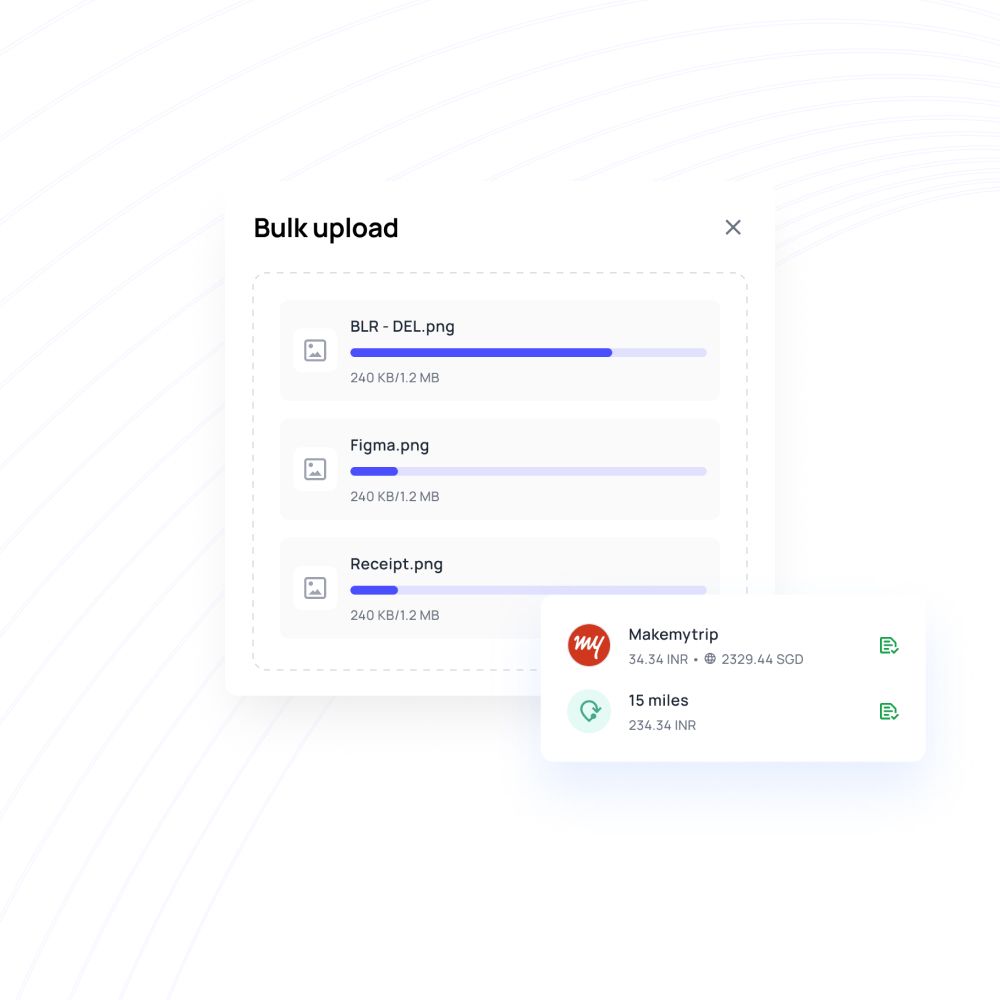

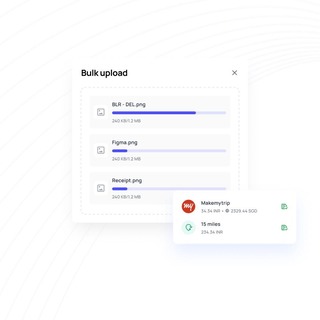

Receipt auto-capture

Gone are the days of manually attaching receipts in an expense report for an employee reimbursement.

Expense reimbursement software can automatically capture data from receipts through OCR (Optical Character Recognition) technology by scanning the receipts and filling in the necessary data.

This eliminates the risk of lost or misplaced receipts and ensures all the important information is recorded for reimbursement purposes.

Detailed audit trail and reporting

Having a detailed audit trail is crucial for compliance and financial transparency.

Employee reimbursement software creates a comprehensive record of all transactions and approvals, allowing businesses to maintain a transparent and accountable expense management process. This also helps in conducting smooth internal and external audits.

Streamlined reimbursement processes

With expense reimbursement software, businesses can expedite the reimbursement process significantly. Replace the traditional manual process by using an employee reimbursement tool, leading to faster approvals and reimbursement claim processing.

Admins and managers can approve multiple reimbursement claims at the same time rather than approve each of them one by one. This functionality enhances efficiency, enabling approvers to handle a batch of claims in one action. This feature is extremely useful for teams handling a huge volume of reimbursement claims.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Reimbursements made simple: Volopay tailored for every industry

Volopay’s employee expense reimbursement solution makes it easy for startups to manage quick, hassle-free reimbursements.

It helps maintain financial agility by fully automating the process, reducing paperwork, and keeping employees satisfied with timely payments, so your team stays focused on growing the business.

Volopay’s expense reimbursement software simplifies expense claims for small businesses, automating the entire process.

By significantly reducing the administrative workload and minimizing potential errors, it frees up time for you to focus on business growth, while ensuring that employees are reimbursed quickly and efficiently.

Volopay’s expense expense reimbursement solution streamlines approvals and detailed reporting, enabling large enterprises to manage reimbursements efficiently.

With real-time tracking and insights, you’ll have complete control over all expenses while ensuring employees are reimbursed promptly, accurately, and with full transparency.

How to shorten the reimbursement cycle?

Continuous process improvement

Different organizations have different needs. So regularly review and improve the reimbursement process to identify bottlenecks and implement efficiency-enhancing measures.

Streamline payment methods

Adopt faster payment methods like electronic fund transfers to reduce processing time. Having a standardized payment system will help keep things simple and avoid any confusion.

Set and enforce policy

Standardizing the submission process will help maintain a structured way of going about reimbursing employees.

Clearly define reimbursement policies, including submission deadlines and eligible expenses, and enforce them consistently.

Minimize manual data entry

Use expense reimbursement software to eliminate manual data entry and reduce paperwork.

Thanks to the software’s cloud storage facility, the data is accessible anywhere from a compatible device.

Train and encourage employees

Educate employees about the reimbursement process and encourage them to submit expense reports promptly.

This will help the finance team process them quickly rather than dealing with all of them at the end of the month.

Real-time expense submission

Encourage employees to submit expenses as soon as they are incurred, minimizing delays and improving accuracy.

Not only does this settle the claims faster but also keeps the employee’s morale high as they receive their funds back sooner.

Simplify and streamline your entire reimbursement process

Why should businesses start using Volopay?

1. Reduces the burden on employees

The traditional method of submitting reimbursement expense claims was extremely tedious and took a lot of time due to the manual work of filling expense reports with all the receipts.

Volopay simplifies the expense submission process, reducing the workload on employees and allowing them to focus on their core responsibilities.

2. Low chances of error

With automated systems in place, Volopay minimizes the risk of errors and inaccuracies in expense reporting, ensuring precise financial records.

Inaccurate expense details entered due to human error are negated when the system automatically scans the receipt using OCR technology for accurate data.

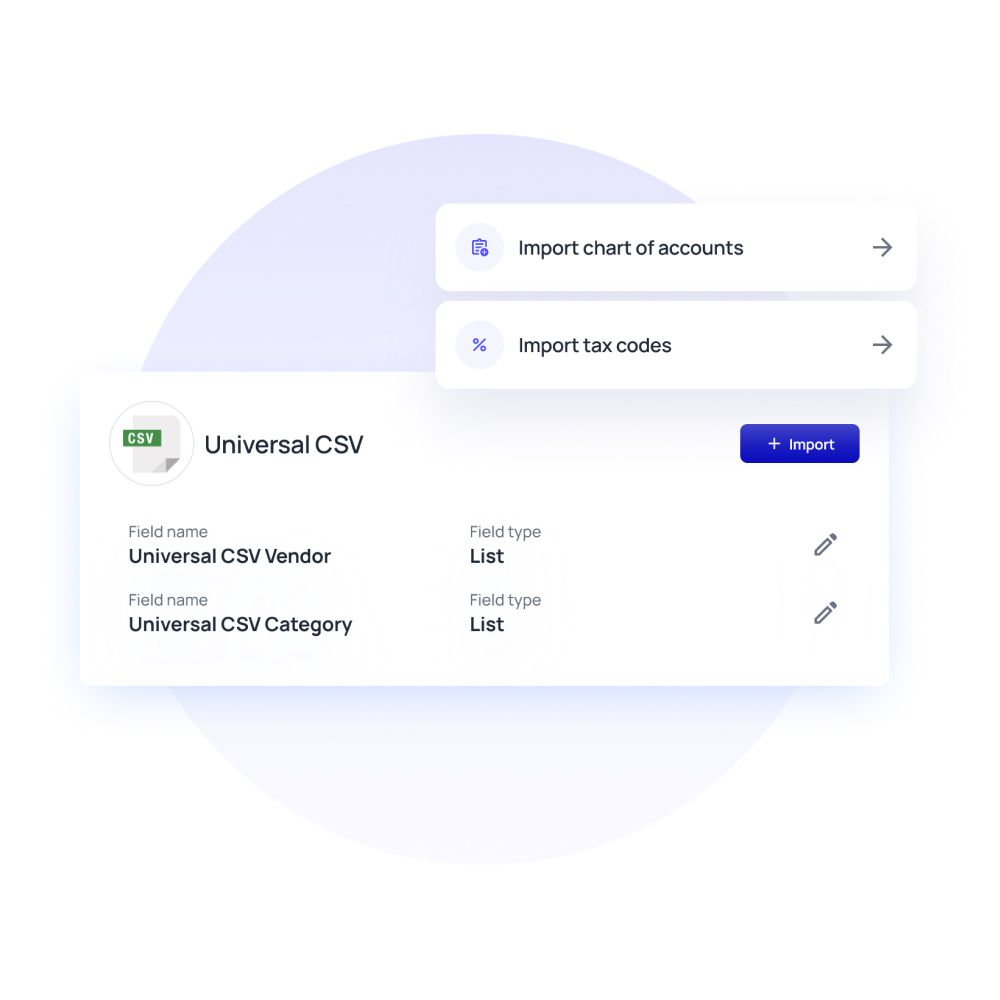

3. Easy integration for end-to-end accounting

Volopay natively integrates with accounting systems like Netsuite, Xero, Quickbooks, Tally, Zoho Books, MYOB, and Deskera.

It can also integrate with any other accounting software with the universal CSV function. This facilitates smooth data flow and eliminates the need for manual data entry of all reimbursements.

4. Auto reconciliation to speed up the accounting process

Reconciling all expenses that the accountants usually end up spending a lot of time on. The platform's automatic reconciliation feature saves valuable time for finance teams, accelerating the accounting process.

5. Customization for finance team control

Volopay offers customizable features that empower the finance team to manage expenses effectively and enforce policy compliance.

You can set up custom approval workflows spending on the payment volume for employees to make money transfers through Volopay.

6. Corporate card for payments

Volopay's corporate card streamlines payment processes, consolidating expenses and simplifying the reimbursement cycle.

Issuing corporate cards for your employees will also eliminate the need for employees to file reimbursement claims altogether.

You’ll also get to control the expenses by setting custom spending limits on each card that you issue.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our employee reimbursement software

Volopay offers advanced invoice management, accounting integrations, smart corporate cards, and employee cost reimbursement features. You can get all of your financial requirements fulfilled in one place.

Multi-level approvals

You don't have to rely on late payments any longer. Our comprehensive approval workflows are ideal for Indian teams' who are in need of an expense reimbursement software.

Ensure that all data is reconciled quickly and in accordance with the company's expenditure policy.

Real-time visibility

There will no longer be any ambiguity. You may set up your expense reporting system so that you are aware of every detail of each transaction as it happens.

Know where your company's dollars go, why they go there, and when they go there. With real-time expense reporting and reconciliation, closing the books is much faster.

Corporate travel

Corporate travel has now become a lot less difficult. Volopay has collaborated with TruTrip to let you book all of your corporate travel, including flights, concierge, hotels, and taxis, directly from your accounts payable wallet.

Expense reimbursement software in India allows employees to claim money and mileage spent on company trips.

Accounting automation

Using a secure and simple accounting system, you can close your books faster. Integrate your accounting software with your Volopay account to ensure that all transactions are linked in real time and that you aren't wasting time manually entering information. Because of the two-way interface, all of your data is maintained up to date.

Explore more about expense reimbursement

Explore this in-depth guide to understand the essentials of expense reimbursement, its processes, policy formulation and much more.

Read our article to understand how travel expense reimbursement works, its processes and the role of automation in it.

Read our guide to understand employee reimbursement policies, how to make one, its challenges and the best practices to overcome them.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

ParallelDots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs on employee reimbursement

Approvers can now detect duplicate claims and reject them before any funds are deducted. A thorough claims history also prevents duplication of claims.

Employee expense reimbursement software has an approval process. An employee can go to the claims section and start filing a claim with the click of a button. The vendor's identification, the amount, and a payment receipt must all be included. After it's been submitted, it goes via an approval queue. As soon as the final approval is received, the money is transferred to the employee's bank account.

Yes, all claims in the expense report and ledger can be reviewed using a filter. If you're an admin or approver, you may also examine the claims history in your notifications and alerts log.

Simply attach the receipt and the employee reimbursement software will decide whether it is legitimate or not. You have the option of adding more details to line items if the approver asks more information. In contrast, the claim method allows you to simply add a single receipt and the total amount.