👋 Exciting news! UPI payments are now available in India! Sign up now →

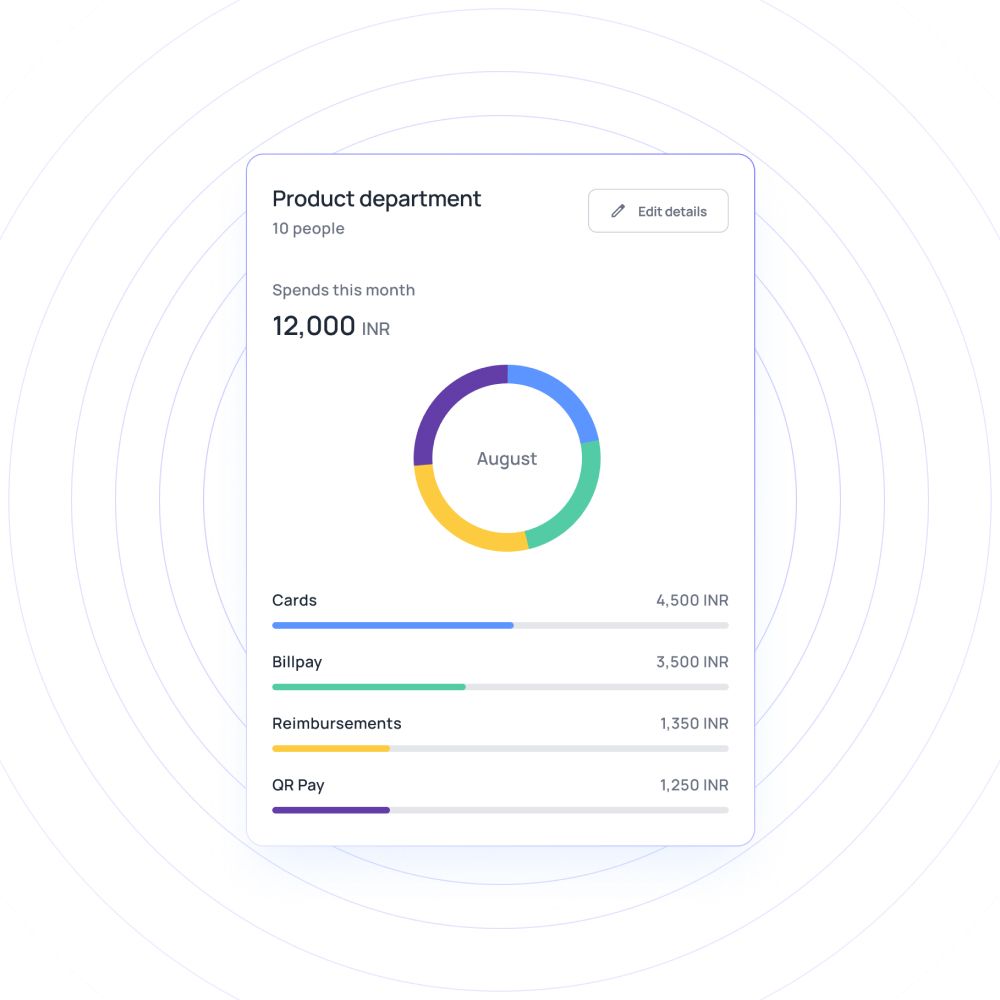

Real-time monitoring of your business expenses

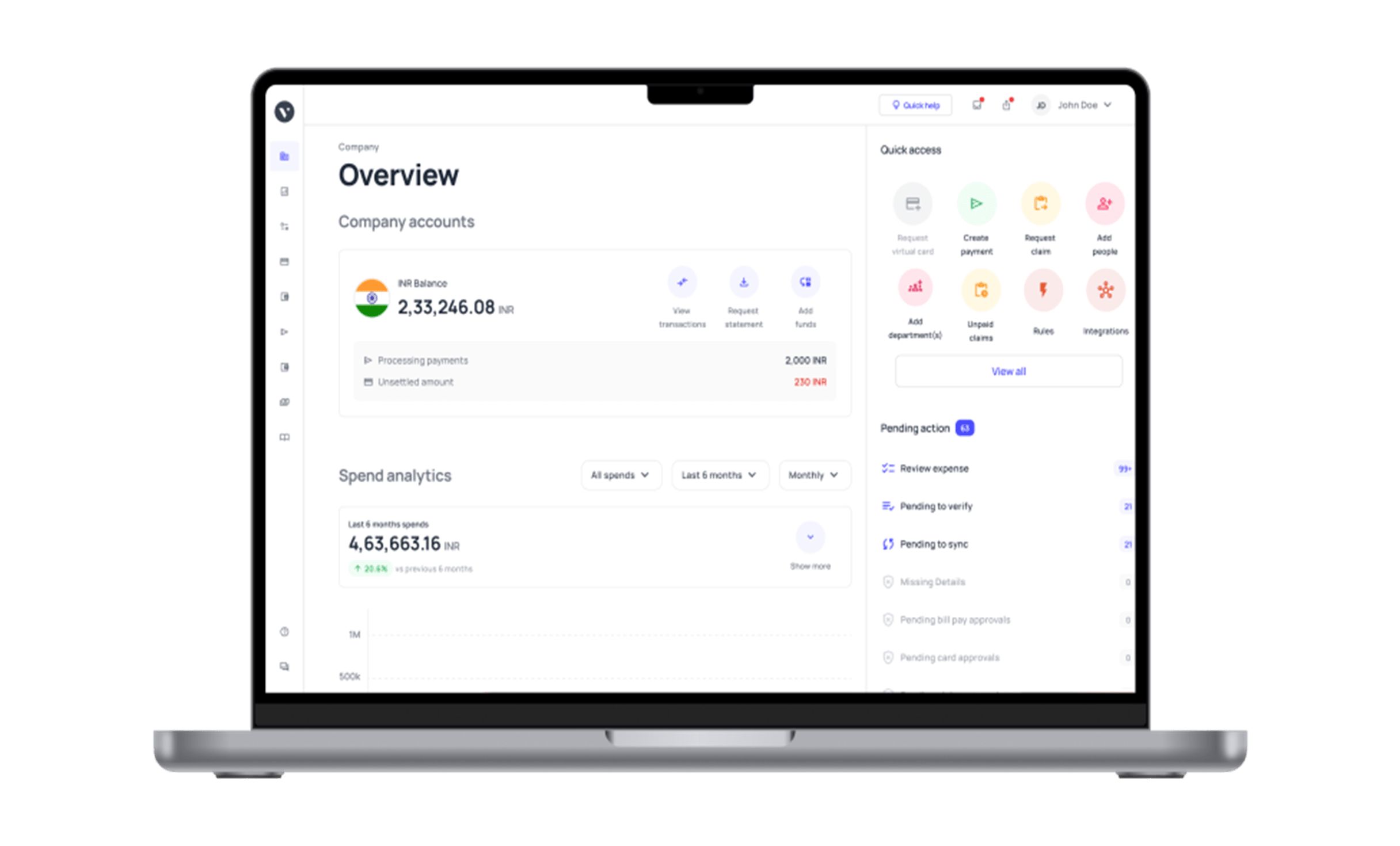

Spend visibility is required in any corporate cost tracking programme. Instead of spending time on monthly statements, Volopay allows you to see all of your expenses in real time. From cards to accounts payable to reimbursements, everything is in the same place, as soon as it occurs.

Instant business-wide visibility

From the minute you sign up for Volopay's simple employee expense tracking software, you'll be able to see all of your company's expenses on a single dashboard.

With just one click, you can check employee expenditures, corporate card usage, and your business account status. At any moment, you can access expense reports and insights. Sync all of your spending sources into one spot to get a complete picture of your spending.

Real-time spend visibility of virtual cards

Card spending is no longer a mystery when you have all-in-one expense tracking software. You can see your spending on all the company cards, both virtual and physical. You can sort the information by employee, department, vendor, or transaction amount. Get immediate updates for every transaction, as well as push notifications from the mobile app.

Auto-reconciliation of budgets and actuals

Budget forecasting can only be done effectively if there is an existing budget to compare actual expenditures to. This is managed by spending visibility. Expense reports are accessible at any time and provide an up-to-date picture of the company's expenses.

These allow you to ensure that all departments are operating within a budget and also help you create future budgets. The finance department does not need to intervene every time something goes wrong.

Streamlined reporting of spending

Our employee expense tracking software simplifies the process of reporting company-wide spending. You can get a thorough report for each and every expense your employees or departments have incurred.

This can include things like a purchase order, a vendor invoice, subscriptions, transfers, and even corporate cards. Reconciliation is automatic because the solution provides complete spend visibility. If your accounting software is integrated, closing the books is also faster.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

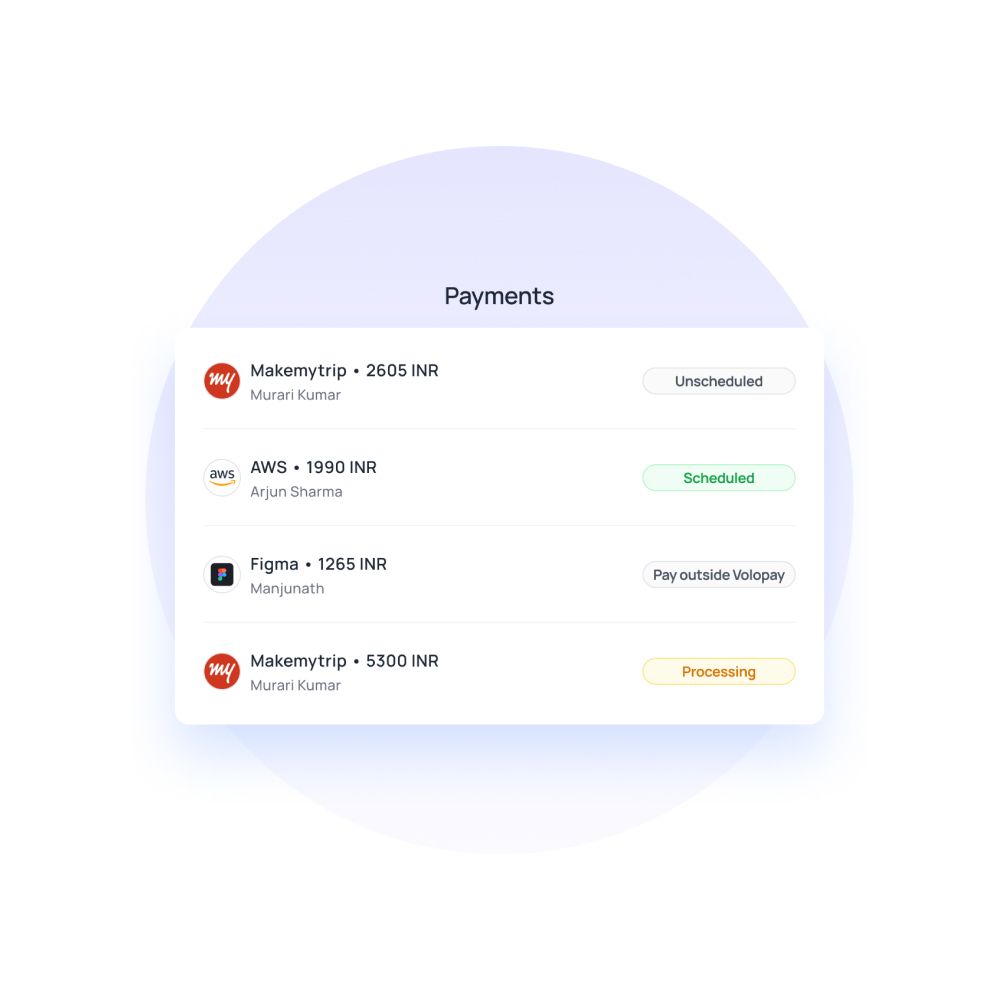

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our expense tracking software

A comprehensive approach to budgeting and expense control. Volopay brings all parts of your expense management together in one spot, from cards to bills, reimbursements to accounting.

Employee physical cards

To improve your employees' access to company funds, provide them smart physical corporate cards. Reimbursement headaches are no longer an issue. Rather, transfer funds to the card right away and keep track of any expenditure as it occurs. With proactive spend controls, you may establish the card budget and approval workflow.

Virtual cards

Better control over payments made to distant vendors and SaaS subscriptions. Create an infinite number of virtual cards in seconds to make online buying a breeze. These virtual cards, which can be used for international transactions, allow your business to expand overseas without worrying about duplicate payments or lost receipts.

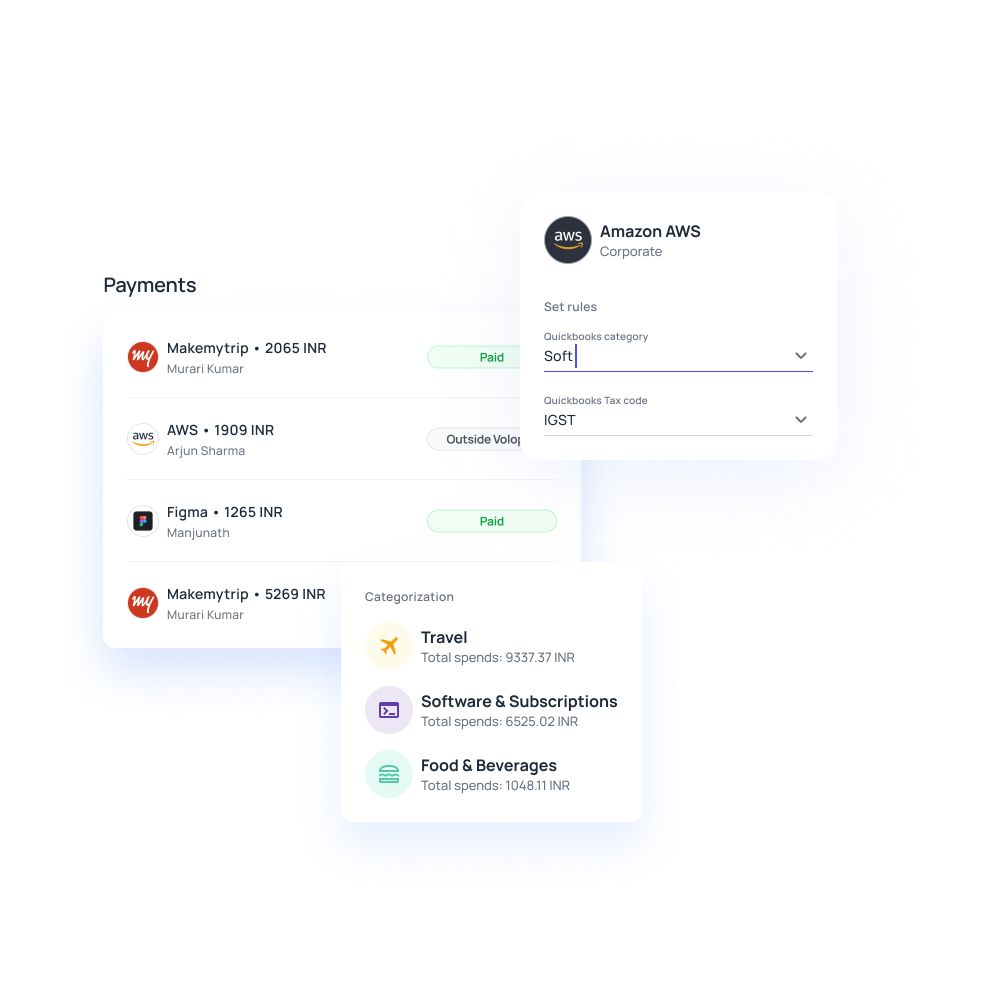

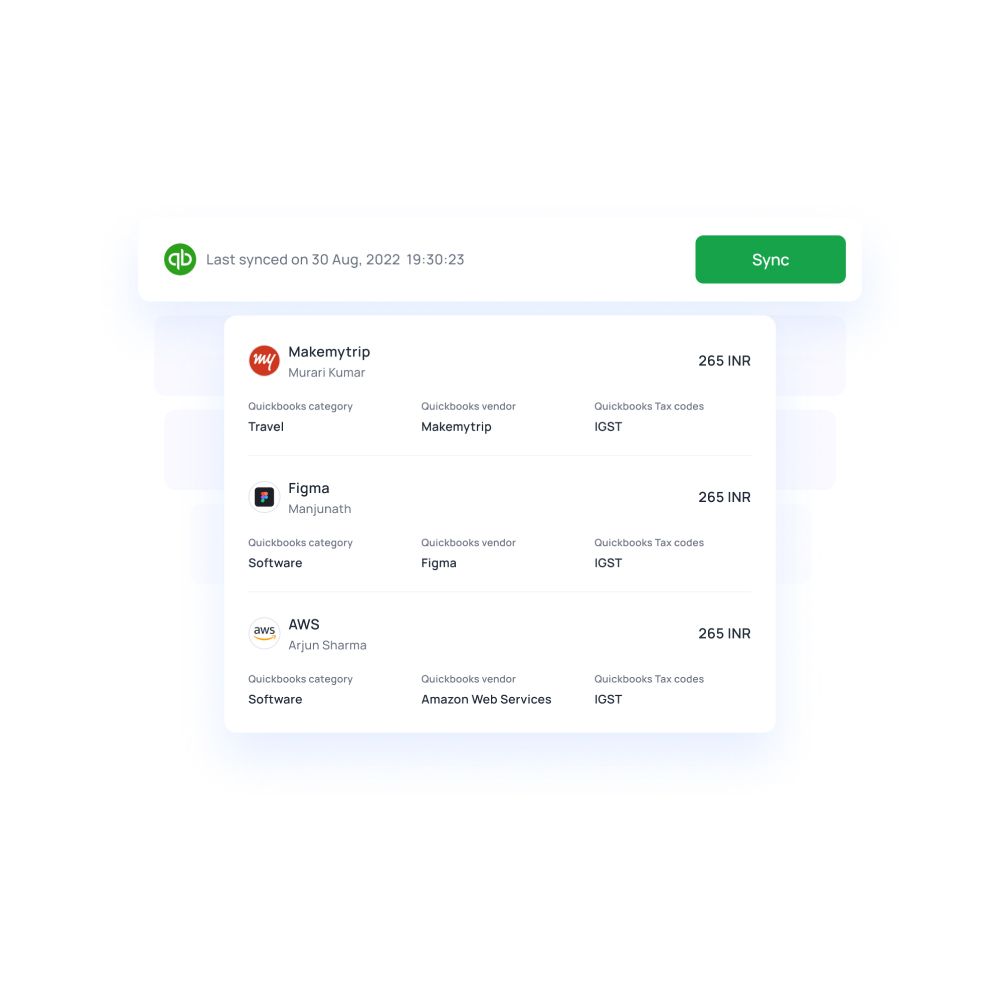

Automate accounting

To ensure rapid bookkeeping, you can integrate your expense management software with your accounting software. Volopay integrates with Xero, Quickbooks, Netsuite, Deskera, and a slew of other accounting applications. Simply set it up and let your ledger update your books automatically for all reconciliation and compliance.

Bring Volopay to your business

Get started now

FAQs on real-time visibility

On the Volopay platform, all expenses, vendor payments, remittances, and subscription payments are subject to expense and approval policies, as well as multi-level approval workflows that allow you to keep track of every transaction. It enables you to verify, approve, or prohibit transactions, guaranteeing that every rupee leaving the organization is tracked. Expense reports are accessible at any time and provide an up-to-date picture of the company's expenses.

Yes, you can create exact spend controls on each virtual and physical card you use with Volopay to prevent out-of-policy transactions and ensure expense policy compliance. Set spending rules, and any transactions that don't follow them will be rejected immediately by your company's virtual cards. To ensure that all of your expenses and transactions are in line, set up several approvers and develop an approval workflow. As needed, approve or deny, and acquire a detailed picture of who, what, when, and how each expenditure is made.

Yes, using ledger structure and accounting triggers, our expense management software can automatically categorise items like vendors, transaction categories, tags, and tax codes. Create unique mapping rules for each of your critical accounting fields, merchants, departments, and other entities. Simply upload your chart of accounts, and we'll categorise and sync everything in your ledger for you instantly.