👋 Exciting news! UPI payments are now available in India! Sign up now →

Best corporate credit and prepaid card in India with UPI

Don’t waste your time worrying about how to easily make business expenses. There's no cause to worry about reimbursements, checks, or petty cash. Use Volopay corporate cards to streamline your payments while exercising utmost control over your company funds.

Just like corporate credit cards, you can set them up, load them up, and spend with them.

Quick and easy international payments

Volopay’s corporate cards in India are equipped to effortlessly handle global transactions. Worldwide acceptance allows your teams to streamline payments anywhere—whether it be for subscription management, for use during business travel, or even to pay an international vendor.

With no top-up limits, admins can add funds to the cards as needed and employees can conduct business transactions without hindering operations. Integrate the card management into the Volopay dashboard for automated accounting and expense management.

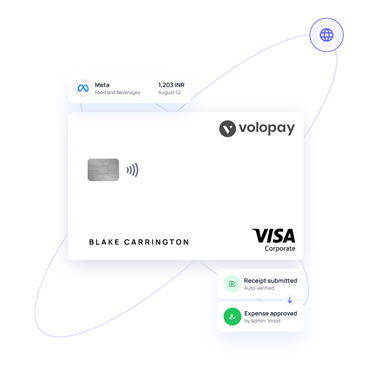

Seamless business payments with UPI

Make business payments quickly, securely, and easily using Volopay's UPI-enabled virtual cards. Instantly activate UPI, make payments in real-time from your mobile, and easily track each transaction on an intuitive dashboard.

Set spending limits, manage budgets, and easily keep tabs on your company's spending. All of your payments are secure and hassle-free thanks to cutting-edge security and universal merchant compatibility. Each transaction is recorded instantly, ensuring complete financial transparency for your business at all times.

Faster and simpler payments

No need to stress about making business payments – it’s all easy and quick with corporate cards. Order, activate, and start using cards, all through an intuitive dashboard interface.

Stay alerted of all expenses made with your Volopay cards. Create predefined criteria and automatically get notifications when certain expenses meet them.

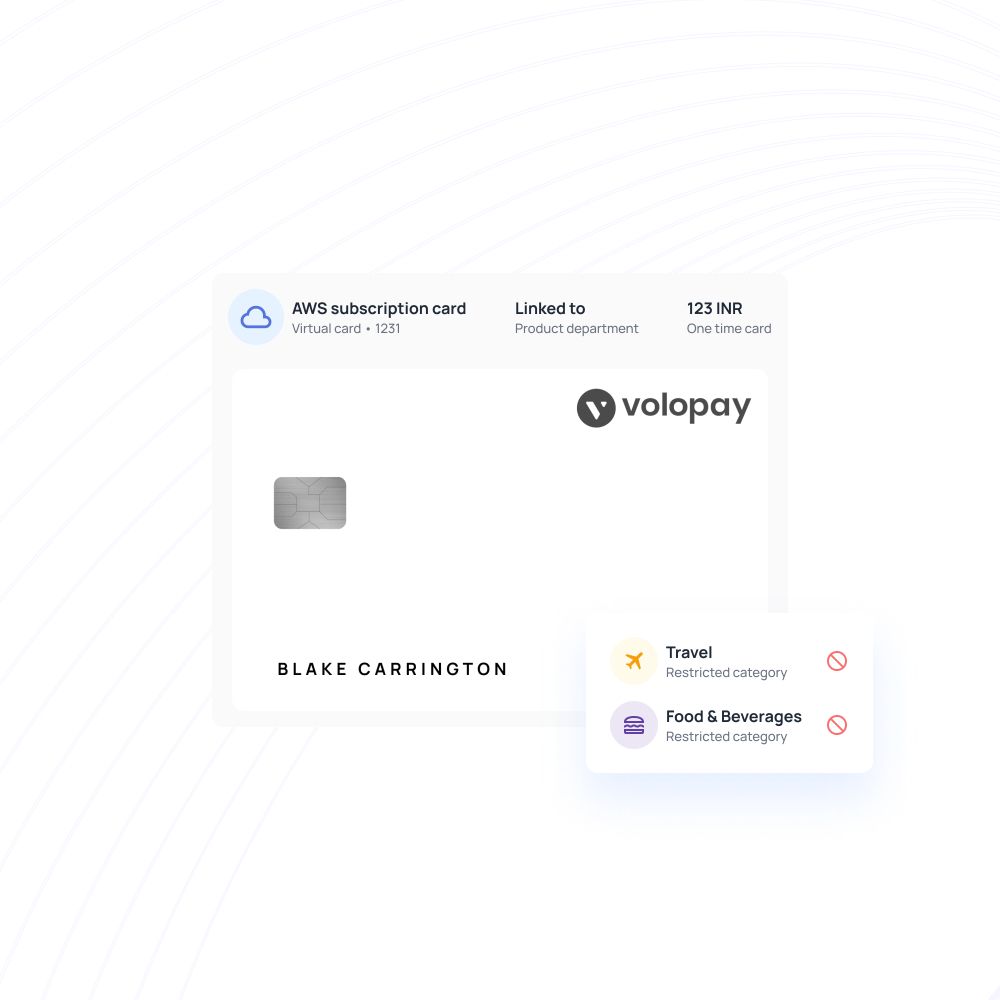

Virtual cards for subscriptions

If your remote team doesn't feel the necessity for physical cards, you can still empower them with the same benefits as corporate credit cards. Create and assign multiple virtual cards to your employees for burner use, or even recurring cards to manage online payments.

For improved reporting, you can even create vendor-specific cards. Link cards to whichever department or project you wish to so that all spends are routed to the correct approvers and reconciled efficiently.

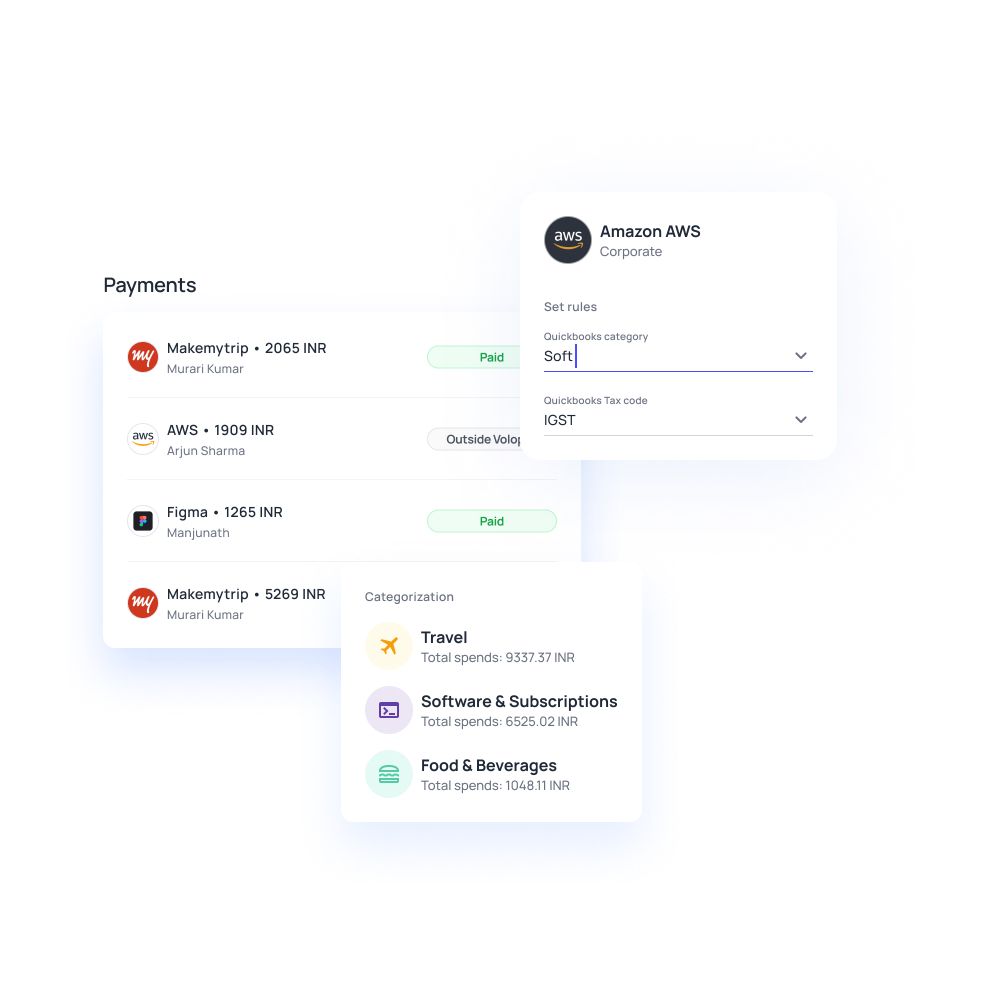

Real-time spend tracking

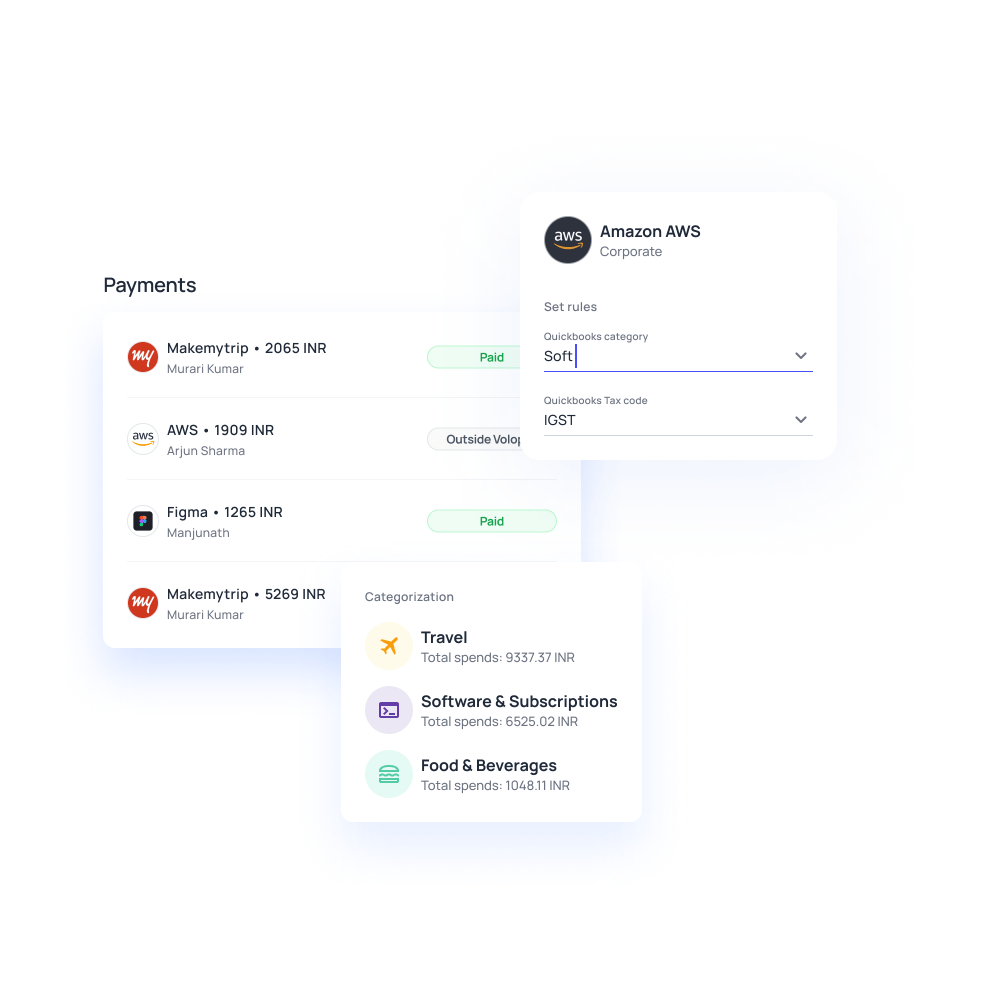

Don’t wait around for the end-of-month statement, unlike with a standard corporate credit card. With Volopay, you can get real-time tracking of all your expenses. Transactions are documented as they occur.

Every line item on the spend-tracker can be categorized according to your needs, and given details such as the time, merchant, purpose, and receipt. Auto-approve trusted merchants, link every expense to its appropriate department or project, and access insights into your spending.

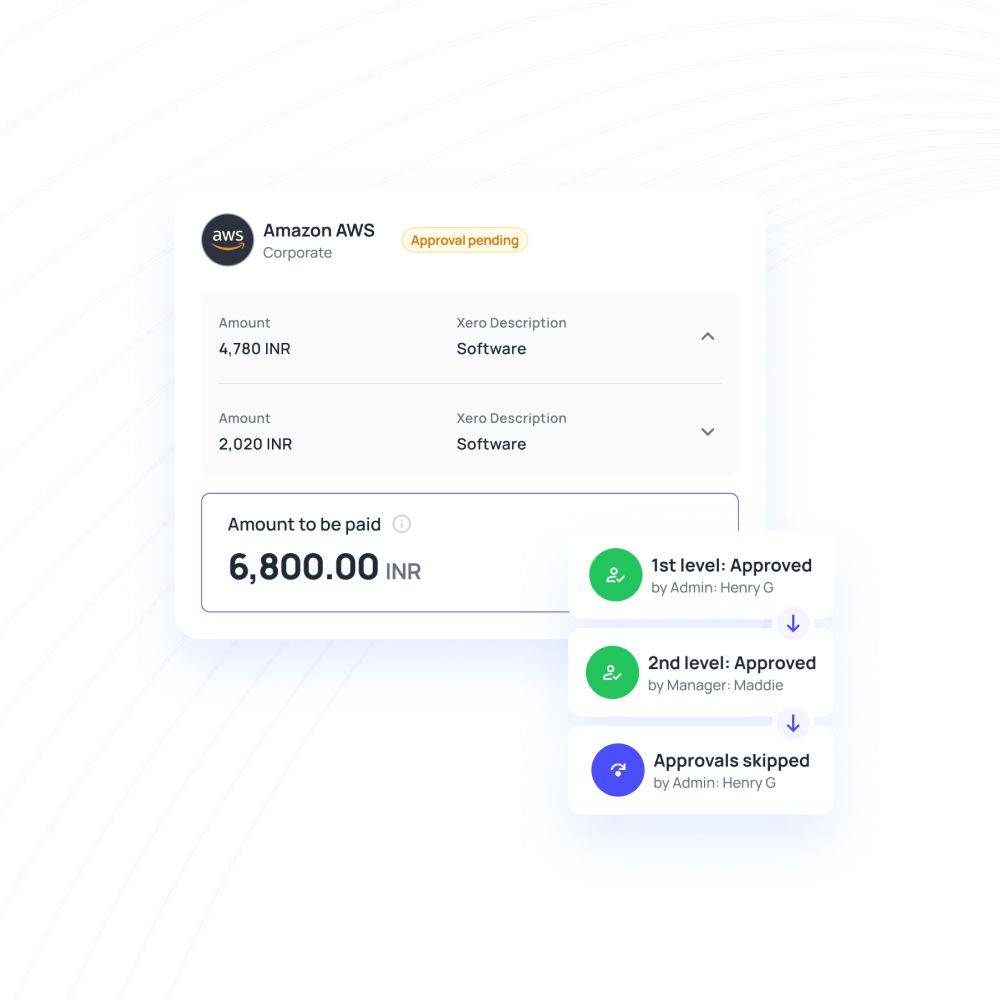

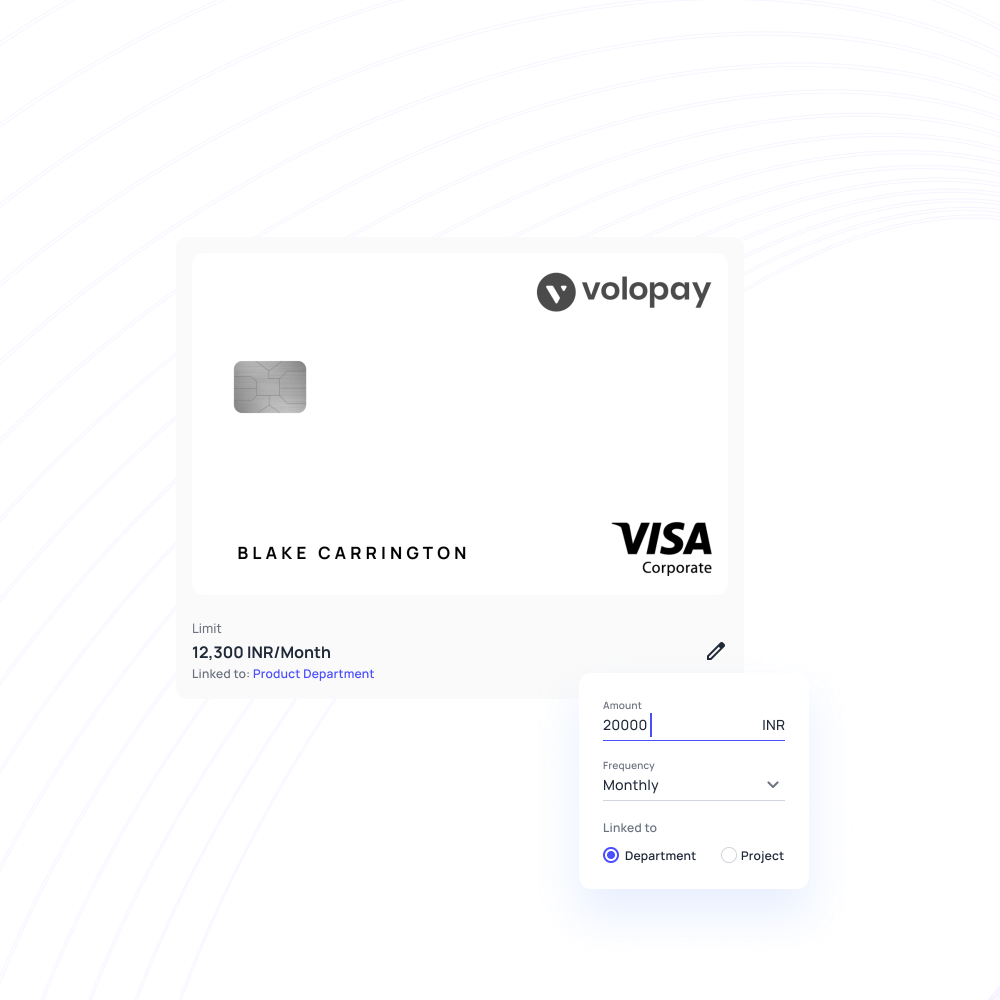

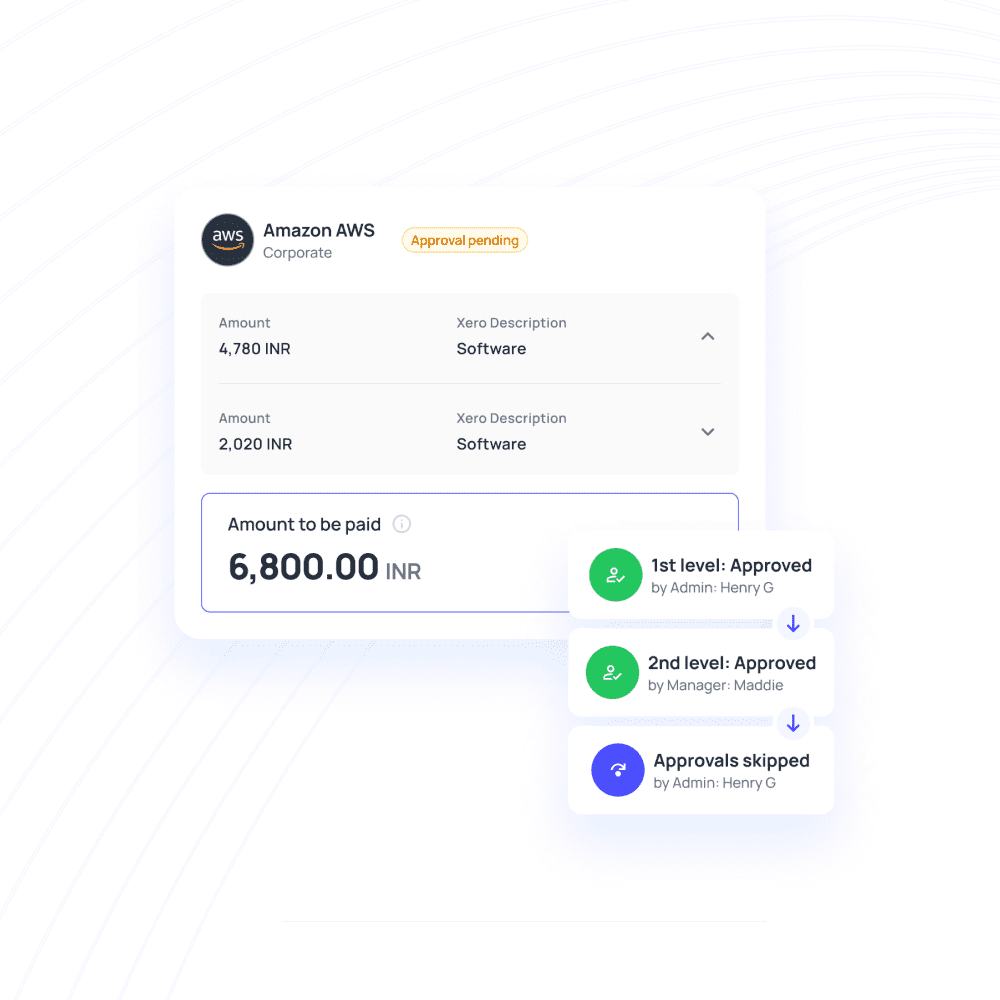

Multi-level approvals and controlled card spending

Manage card spending with advanced multi-level approval policies that bring a new level of transparency and ease of use. With the comment feature, it’s easy to communicate spending queries.

Admins can set customizable transaction limits to easily non-compliant transactions. Automatically flag expense requests based on inappropriate amounts, categories, or merchants. All card settings are easily customizable through the Volopay platform.

Make secure and convenient business payments with corporate cards

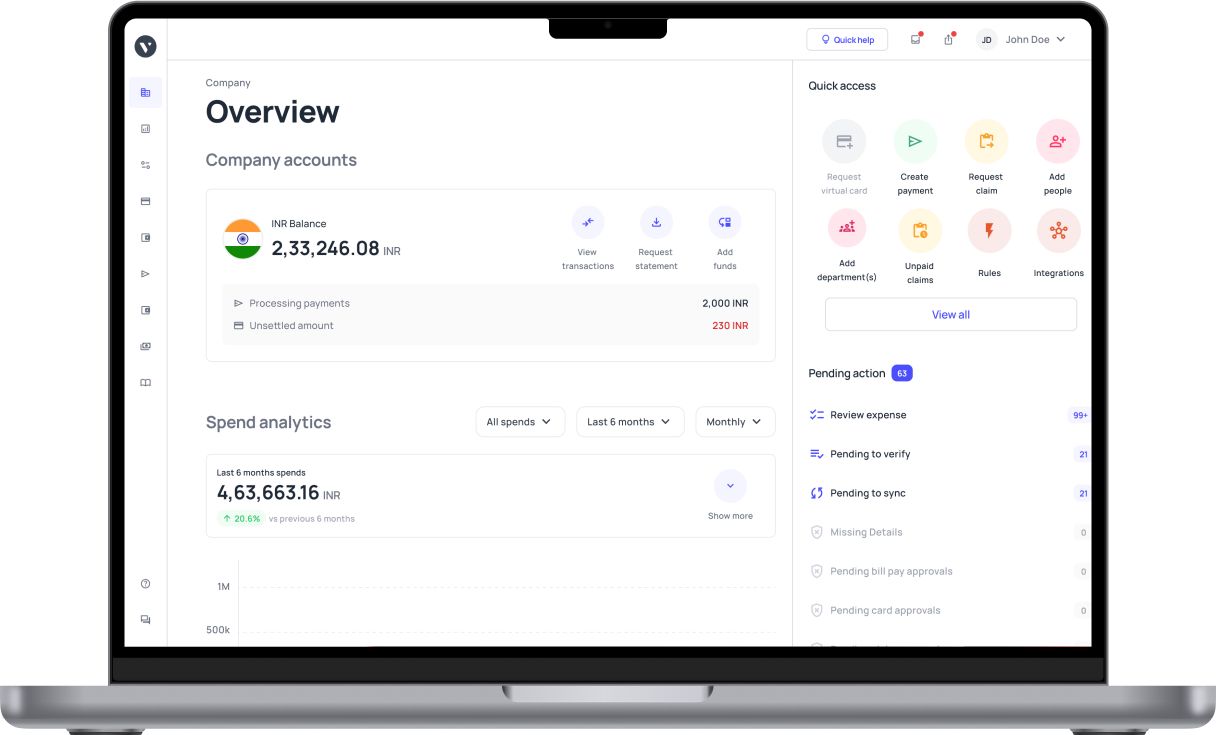

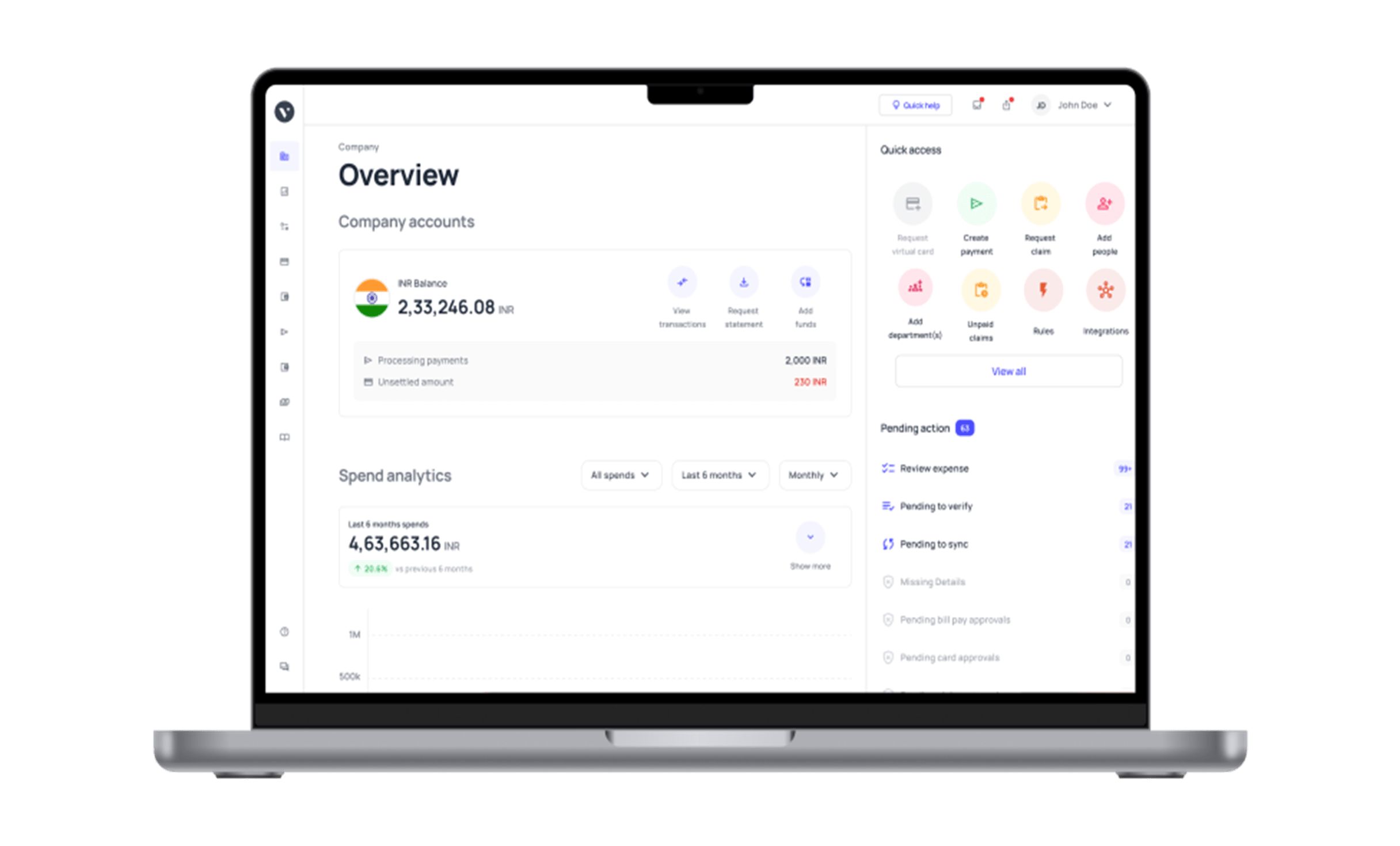

Easy-to-use dashboard for all your needs

Get an intuitive dashboard interface that every employee can use with ease. Use a single platform to flag suspicious transactions, start expense discussions in comments, and request repayments for non-compliant expenses.

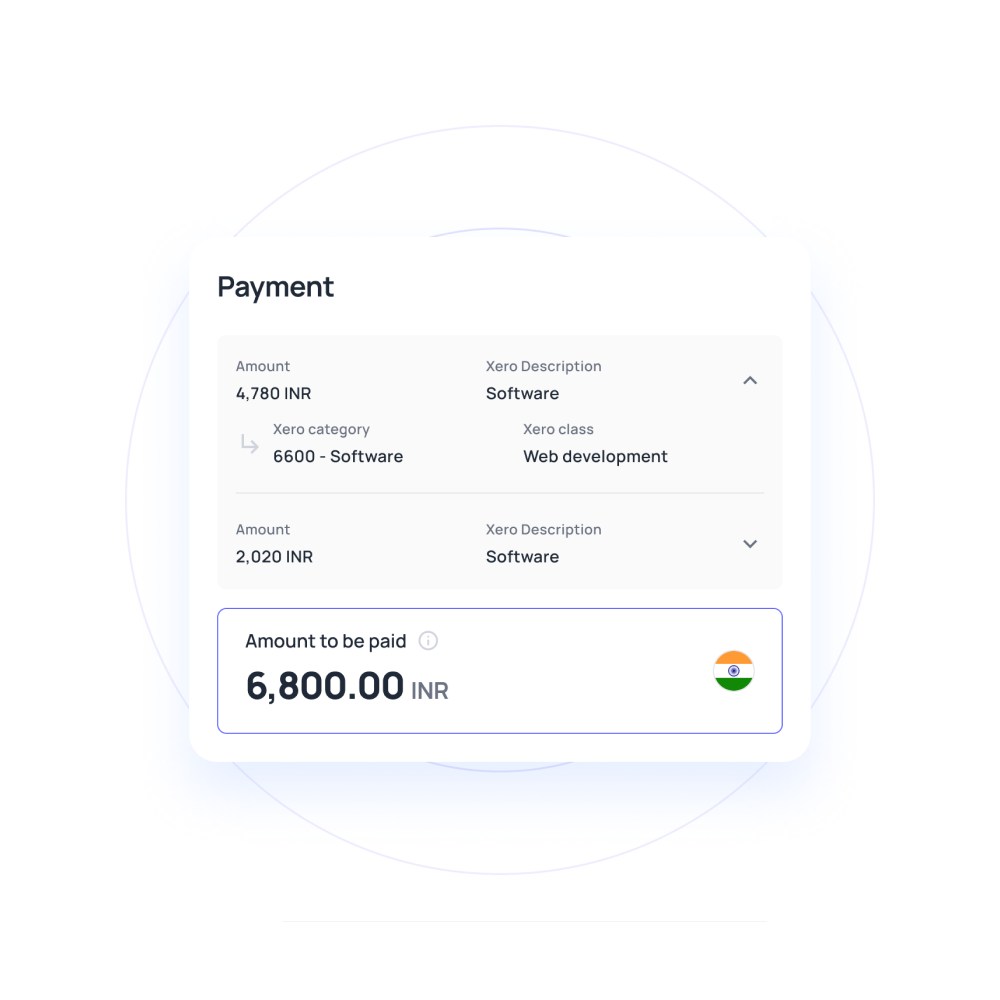

Volopay makes it easy to split expenses into multiple line items when recording them. It’s easy to get all the necessary card expense details in just a few clicks.

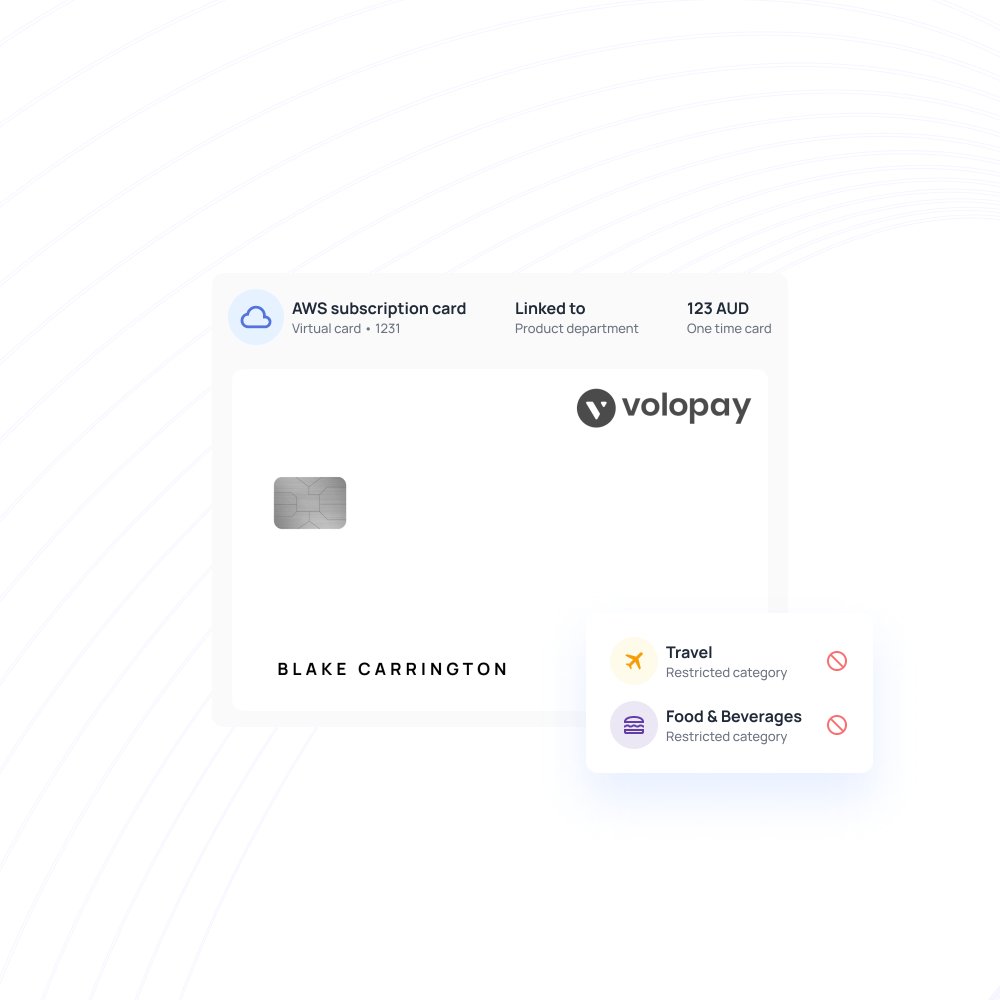

Reconcile expenses, ensure compliance

Never miss a single rupee used by your business. Take advantage of Volopay’s card history feature and view every expense on every card.

Customize merchant category controls. Block transactions in categories that don’t comply with your policies, or only allow transactions for specific merchants. Ensure every expense is clear by communicating through comments, right on your dashboard. Reconciliation and compliance have never been easier!

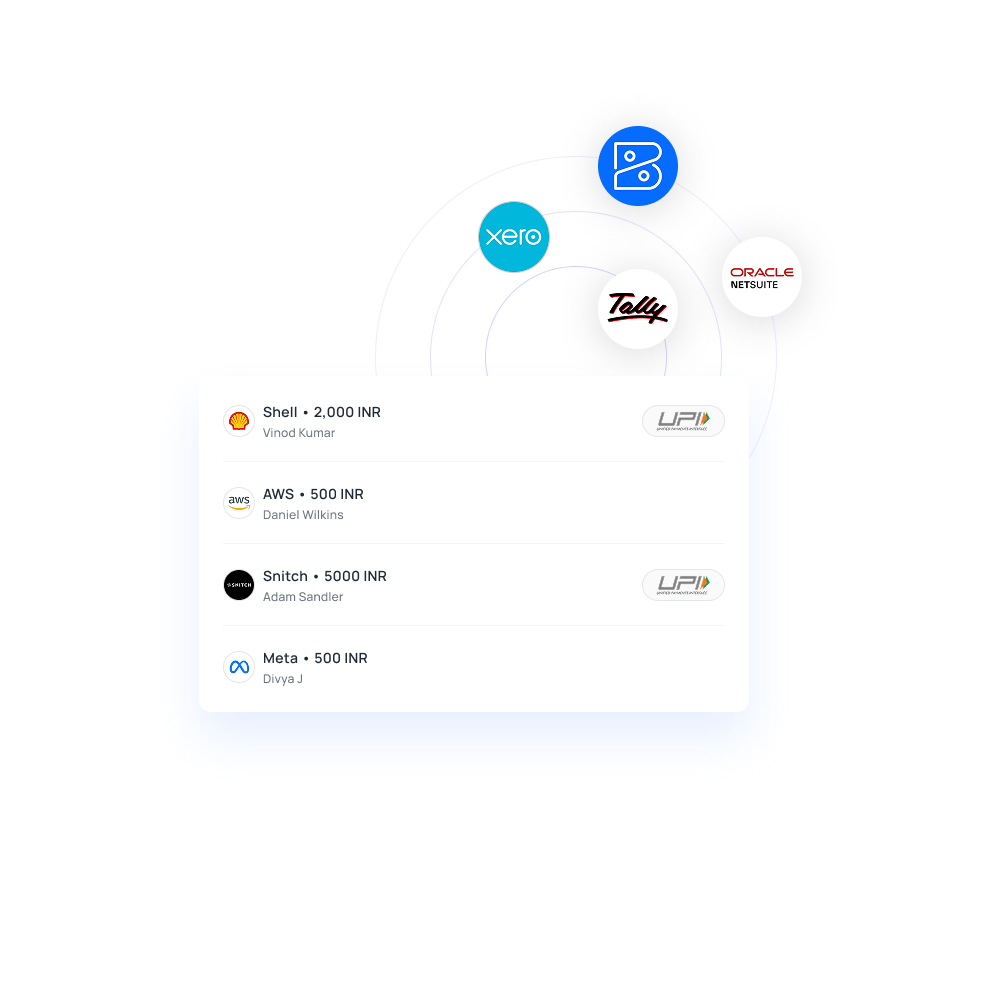

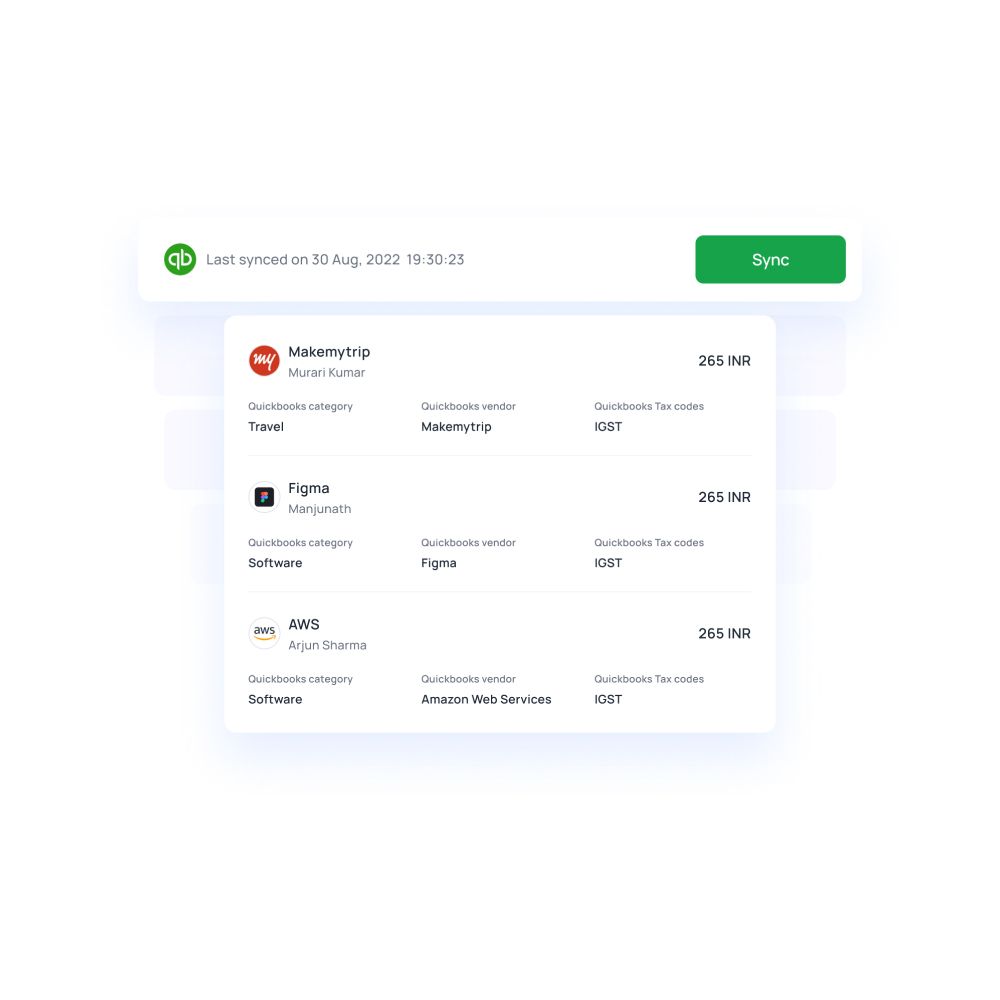

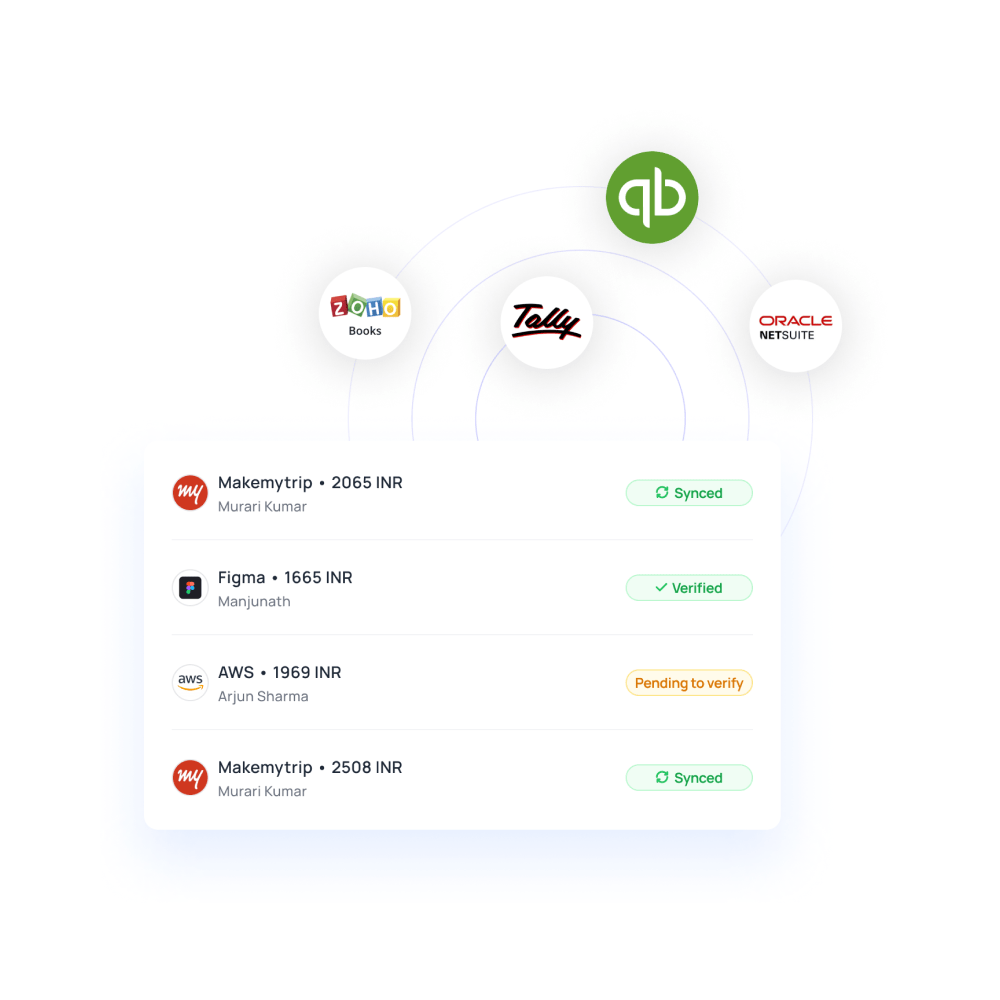

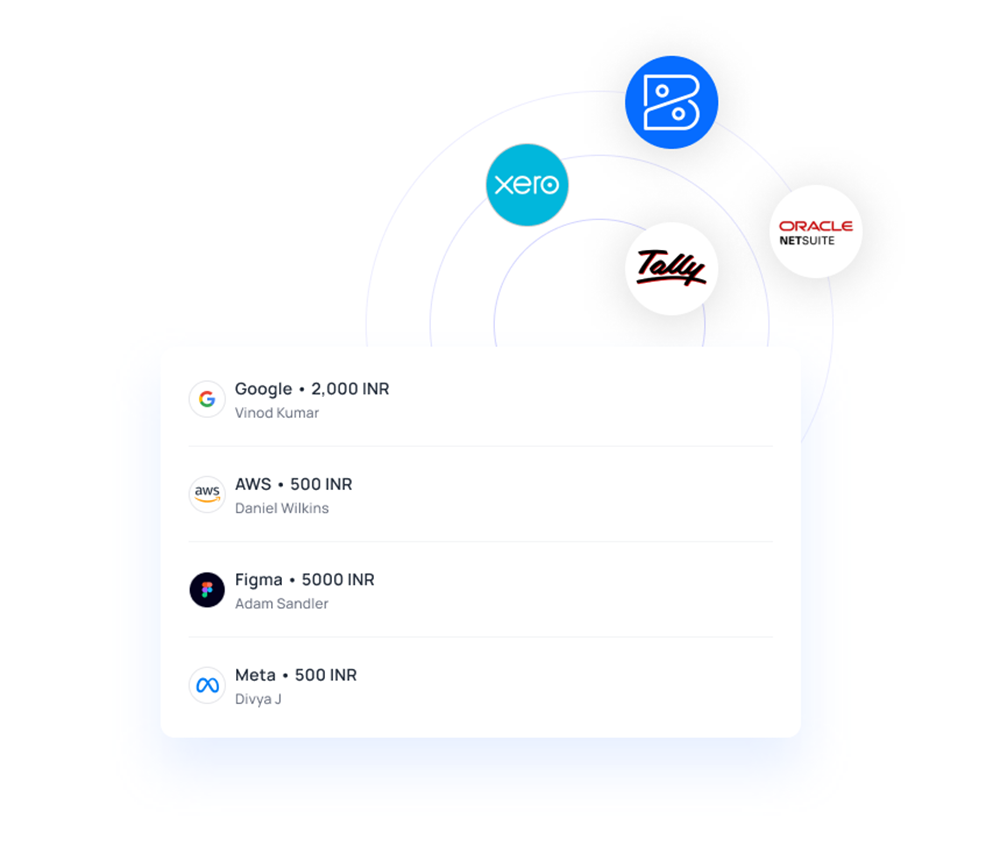

Robust accounting integration capabilities

The days of wasting time on manual data entry are long gone. Make accounting integrations easy with Volopay, complete with direct sync of all your card expenses.

Split expense line items for every transaction. With easily customizable advanced rules, setting up automated accounting triggers for seamless accounting synchronization is hassle-free.

Streamlined subscription management

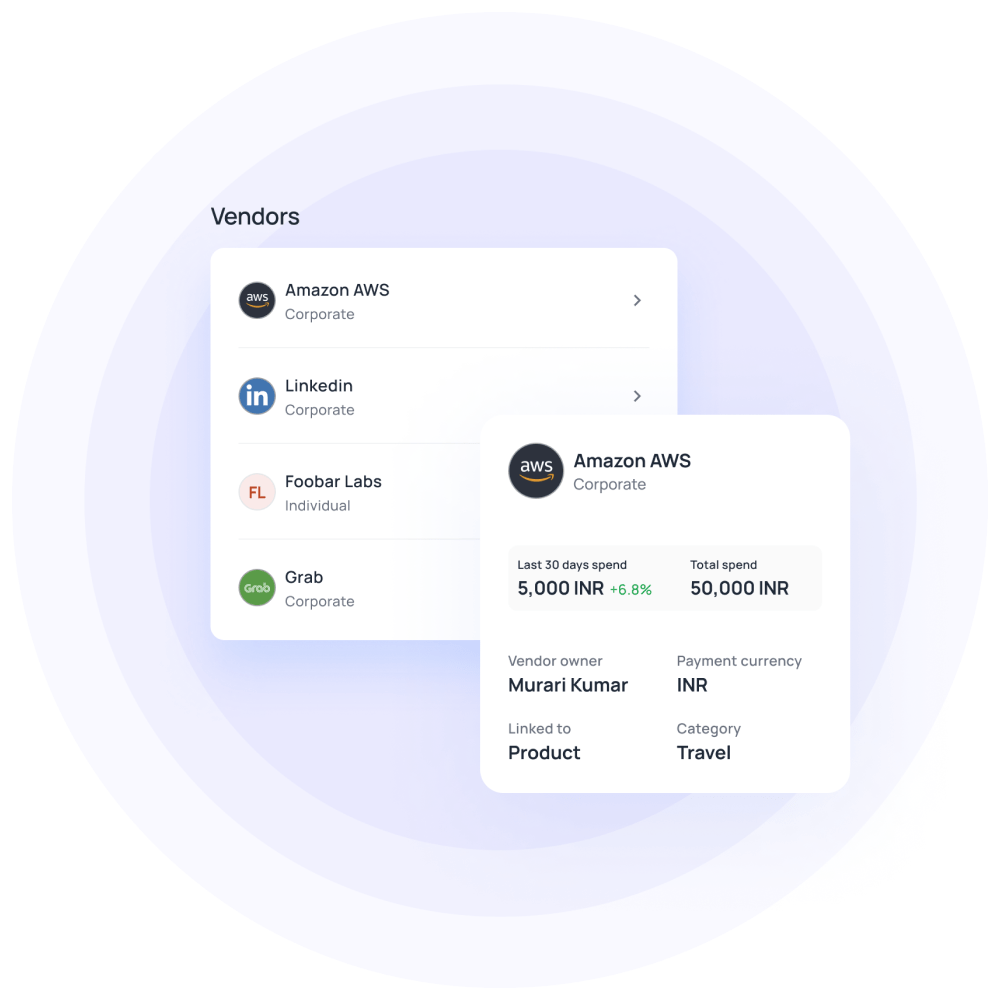

You can empower remote teams with the same benefits as corporate credit cards. Create and assign multiple virtual cards to your employees for burner use, or even recurring cards to manage online payments.

For improved reporting, you can even create vendor-specific virtual cards. Link cards to whichever department or project you wish to so that all spends are routed to the correct approvers and reconciled efficiently.

Have to subscribe to an international service? Equip your team with international corporate cards to set up recurring payments with any SaaS provider in the world.

Simplified expense reporting

Make expense reporting dynamic instead of dealing with dreadful paperwork. Volopay streamlines the process by automating spend tracking. The appeal of corporate credit cards in India is the speed of real-time updates. Volopay offers you the same.

Swipe our corporate cards anywhere and the spends are updated automatically. This is reflected in the smartphone app, which makes reporting easier. There isn't a single rupee that hasn't been accounted for.

Be on top of your business expenses with corporate cards

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay corporate cards vs traditional business cards

Volopay corporate cards vs business cards

Consistently rated at the top

Volopay takes pride in being consistently recognized as a top performer on G2. Our G2 badges are a testament to the outstanding value and satisfaction we deliver to our users.

These recognition demonstrates our commitment to offering cutting-edge financial solutions and outstanding customer support, which positions us as a reliable option for companies all around the world.

Learn more about our corporate cards

Every aspect of expense management must be brought together and accessible for everyone - all admins, employees, and accountants - in one place.

We provide a solution for everything, from physical and virtual corporate cards and business credit to approvals, reimbursements, and accounting.

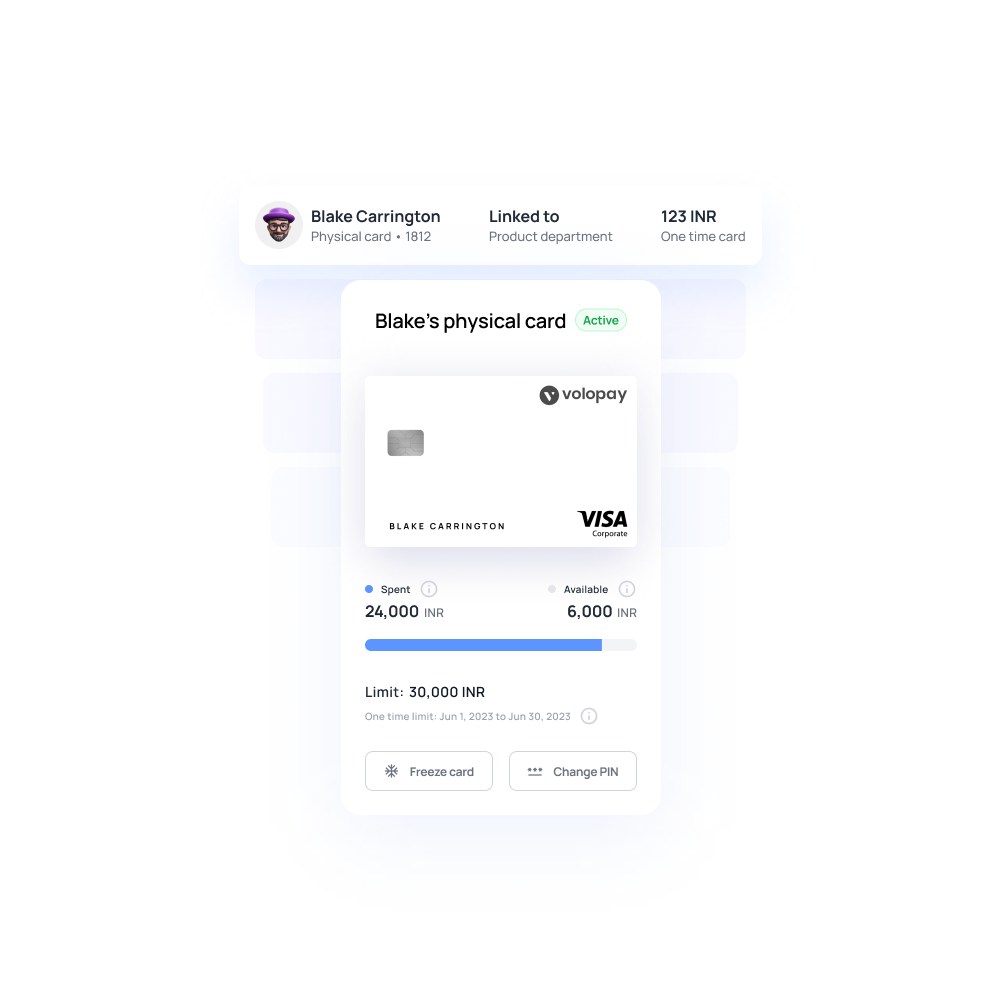

Physical cards

Your employees no longer have to use their personal cards or make out-of-pocket expenses. With the help of corporate physical cards issued with bank-grade encryption, security and quality, employees can be spend at a variety of merchant portals and on offline transactions. Enjoy simplified expense tracking with spend analytics.

Virtual cards

You have access to an infinite number of virtual cards. Assign to individual employees, departments, or even to keep track of payments made to certain vendors. With virtual corporate cards, make contactless and online payments more efficient than ever.

Business prepaid card

We offer business prepaid cards with built-in spending limit controls that you can assign to employees. With these prepaid cards, you can easily track all expenses in real-time and reconcile your account in a matter of seconds.

Global corporate card

Make use of Volopay global corporate cards to manage international transactions with ease, offering features like worldwide acceptance, seamless expense tracking, and effortless subscription management, all with no top-up limits.

Explore more about corporate cards

Understand corporate cards: how they centralize spending, enhance control, and streamline expense management for your business operations.

Discover top corporate credit cards in India. Learn how they work and what documents you need to apply for the best fit.

Explore prepaid cards: how they provide strict spend control with pre-loaded funds. A flexible solution for efficient expense management.

Craft a robust corporate credit card policy to prevent misuse. Ensure secure business spending and clear guidelines for employee accountability and compliance.

Unlock the advantages of corporate travel cards. Streamline employee expense management for travel, improve tracking, and gain better financial oversight on the go.

Dive into Buy Now Pay Later benefits for businesses. Understand how this payment option can improve cash flow and provide financial flexibility for purchases.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on corporate cards

There is no minimum criteria to qualify for a Volopay corporate card.

Each business is vetted for their financial health and stability based on the documents they provide. We use this to determine whether a business is eligible to get access to Volopay cards.

Our corporate cards in India are provided by VISA and can be used to make both domestic and international payments. Cross-border payments can be made with both physical and virtual corporate cards and employees can also make payments in other countries using cards assigned to them via the mobile app. A truly user-friendly and convenient approach to corporate spend management.

Yes, this is one of the most common ways for companies to financially empower their people. If your team travels regularly both within India and overseas, consider providing them with a recurring corporate card that is reloaded on a monthly basis. You can provide an employee a card with a limited budget and an expiration date if they have a one-time travel need. If additional funds are needed at any moment, they can be sought and approved directly from the dashboard.

All of the company's expense and accounting regulations are applied to corporate cards automatically. Department-specific rules can be used in addition to the basic defaults. You can also determine who the approvers are, what the reload cycle is, and what the maximum budget allowance is when a card is generated. The ultimate control over every rupee that leaves your company and over who spends it provided by the only corporate credit card India has to offer.

Yes. Card transactions and expenses are synced in real time as and when they happen. This transaction ledger is accessible from both the website and the mobile app, making it simple to track and review card spends. Admins and approvers can also, if necessary, request extra details for a transaction.

You can order a physical card directly from your Volopay account. You do not need to follow any additional processes.

Our physical cards support ATM withdrawal on the prefunded model.