👋 Exciting news! UPI payments are now available in India! Sign up now →

Get the best employee expense management software in India

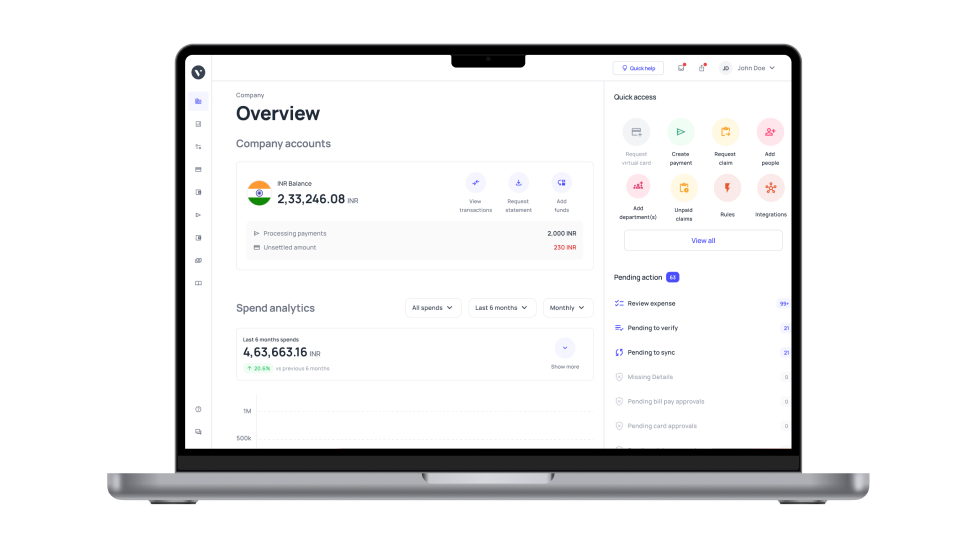

Discover the unparalleled effectiveness of Volopay’s specifically designed financial control tools, one of India's best expense management software offerings.

Designed to automate, simplify, and optimize processes, this software offers real-time spending tracking, seamless reimbursement processing, subscription management, and a range of other services.

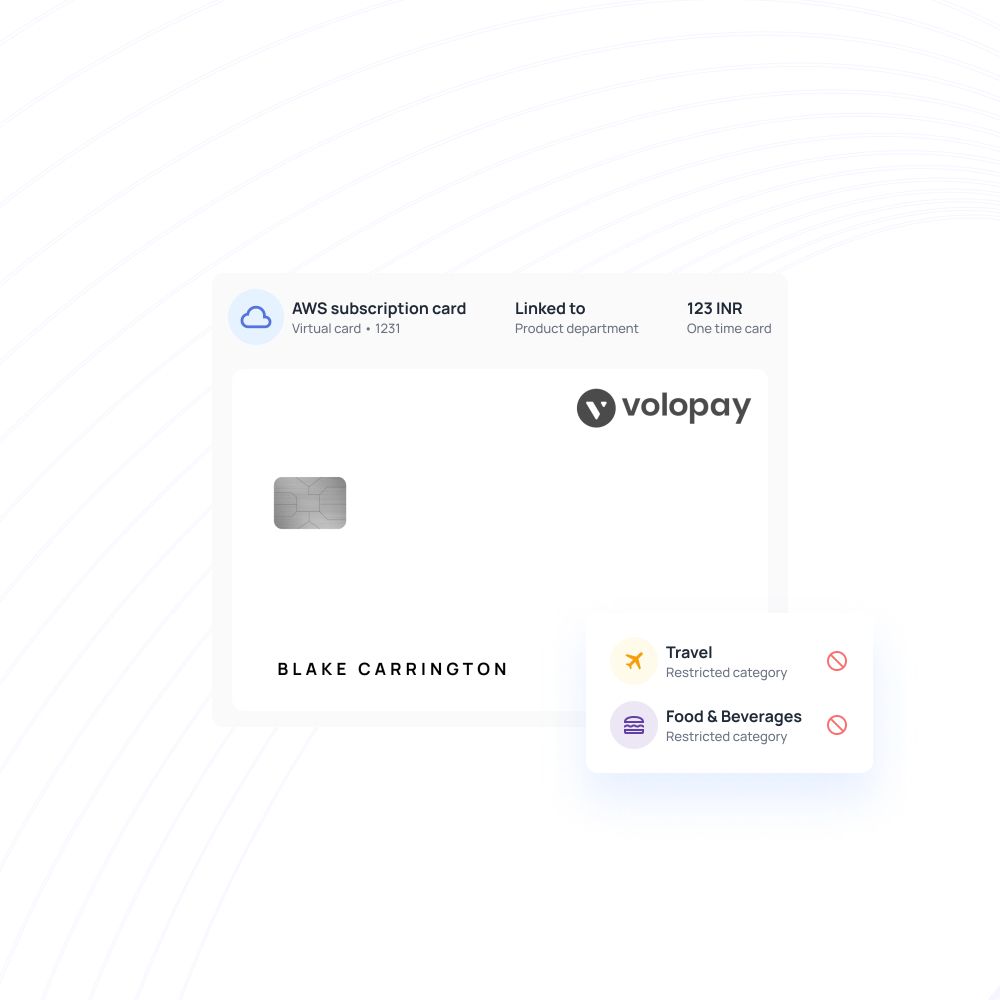

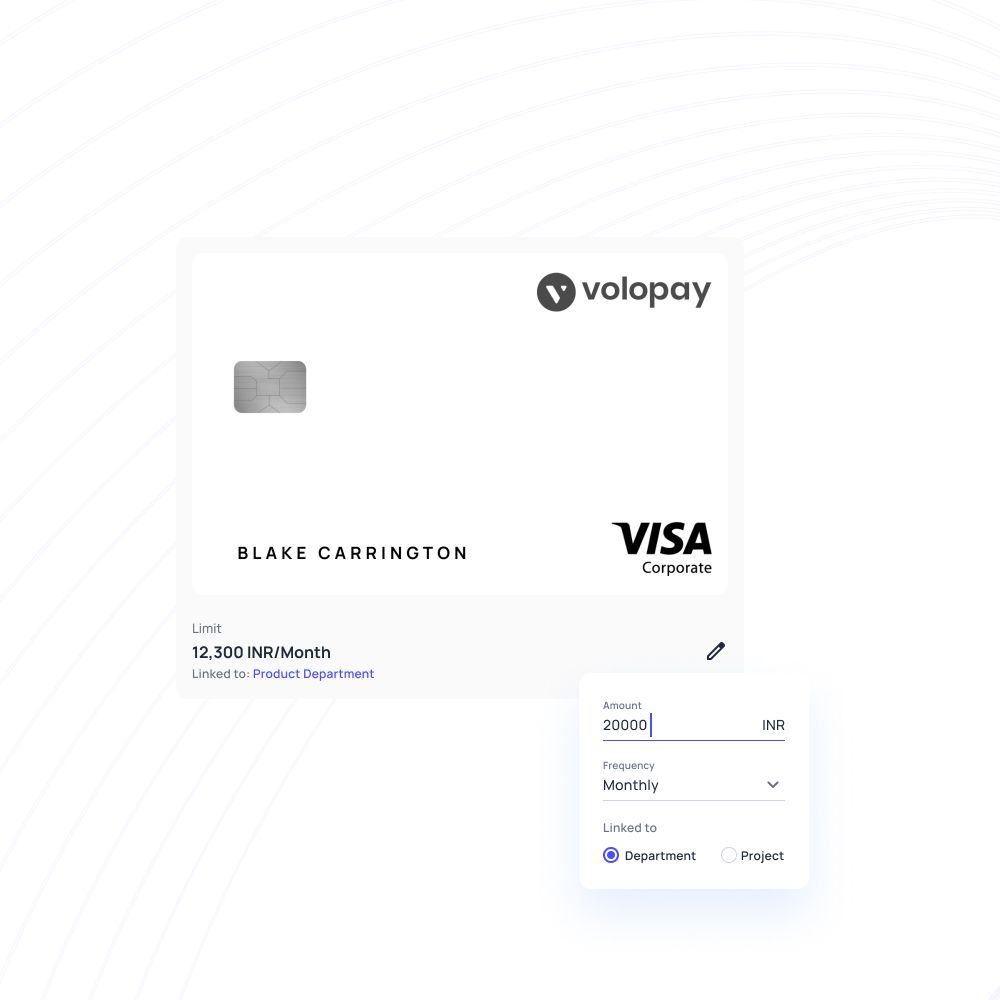

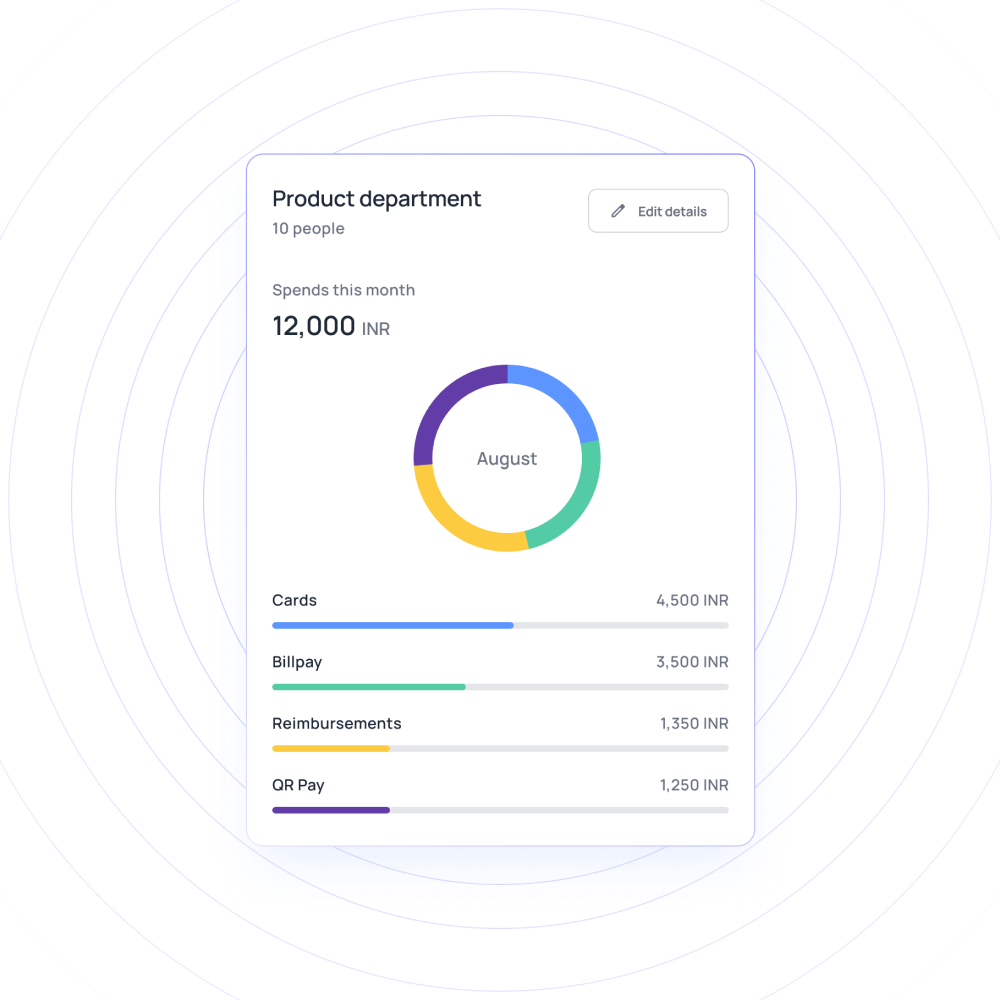

Manage business expenses with corporate cards

Take complete control of expenditures with Volopay's corporate cards, allowing precise merchant control at various levels—company-wide, departmental, project-specific, and individual card levels.

Easily manage transactions by restricting or allowing based on merchant categories and names. Enjoy the flexibility of cards, all linked to a centralized system for real-time updates on card activity.

Unlimited virtual cards

Manage online payments by creating unlimited number of virtual cards. Customize to a vendor, an employee, or even a department. Volopay virtual card have the same functionality as a physical card, with the extra benefit of being immediately useable. Limits can always be set to keep your spending under control.

Physical cards

Issue customized physical prepaid cards to your travelling employees. With built-in expenditure rules, you can keep track of every payment and automatically collect unpaid receipts in real time.

Streamline employee reimbursements

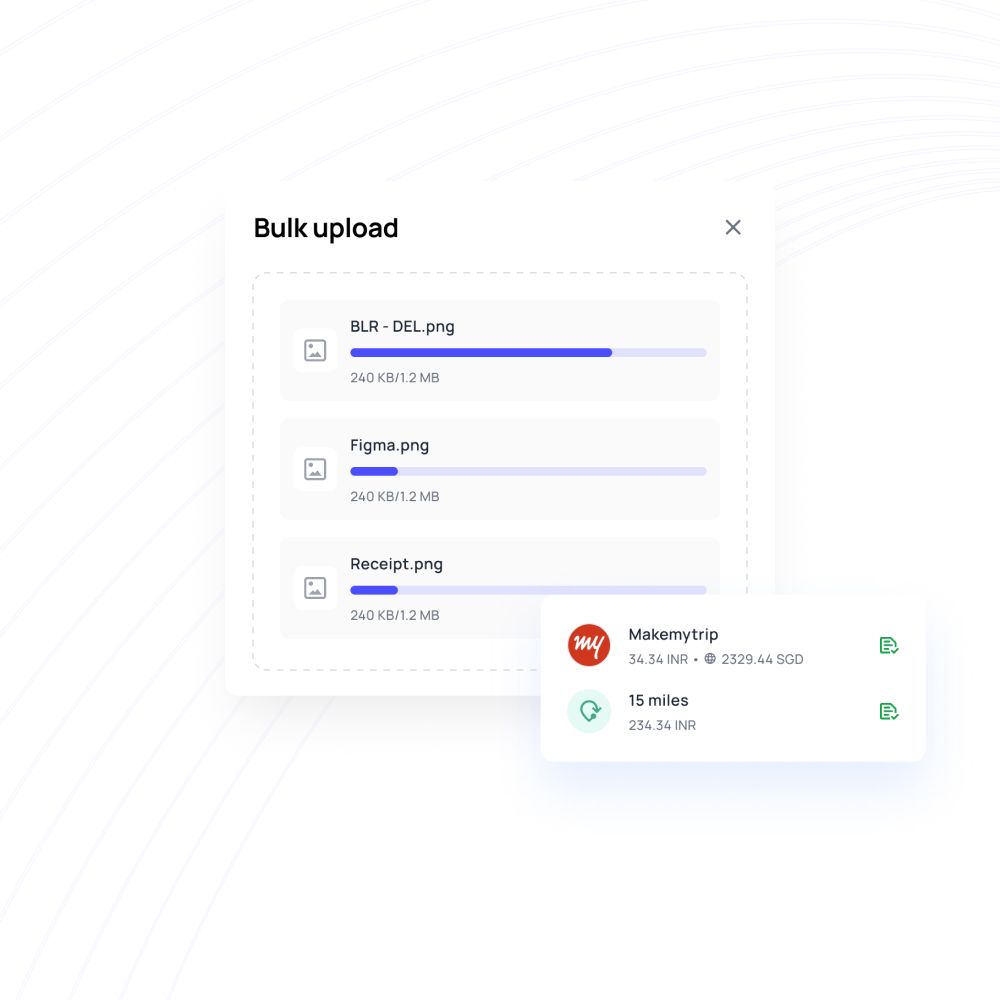

Simplify expense claims with Volopay's intuitive platform instead of making employees chase paperwork. Upload receipts effortlessly, leveraging our optical character recognition (OCR) system to automatically identify reimbursable amounts.

Automate payments and schedule settlements for approved claims, with mileage claims accurately calculated and visually mapped for convenience. Customize mileage rates for different countries as needed.

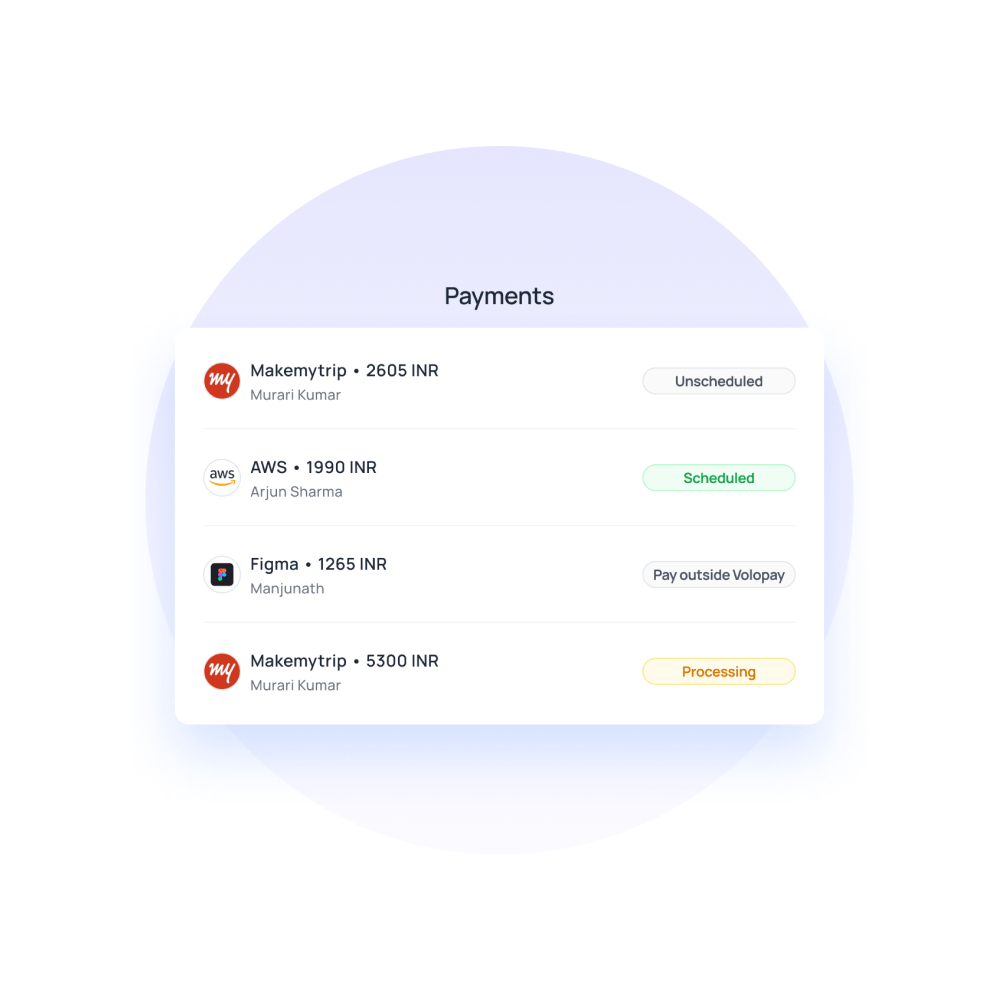

Manage software subscriptions efficiently

Our business expense management solution lets you easily manage global subscriptions. SaaS payments are significantly easier to administer remotely using virtual cards. Cards can be generated for both one-time and recurring payments.

Simply load the payment gateway and enter the card number. These cards keep track of spending as they happen and can be refilled as needed. With individual cards for each subscription, accounting becomes even faster.

Effortless expense management at your fingertips!

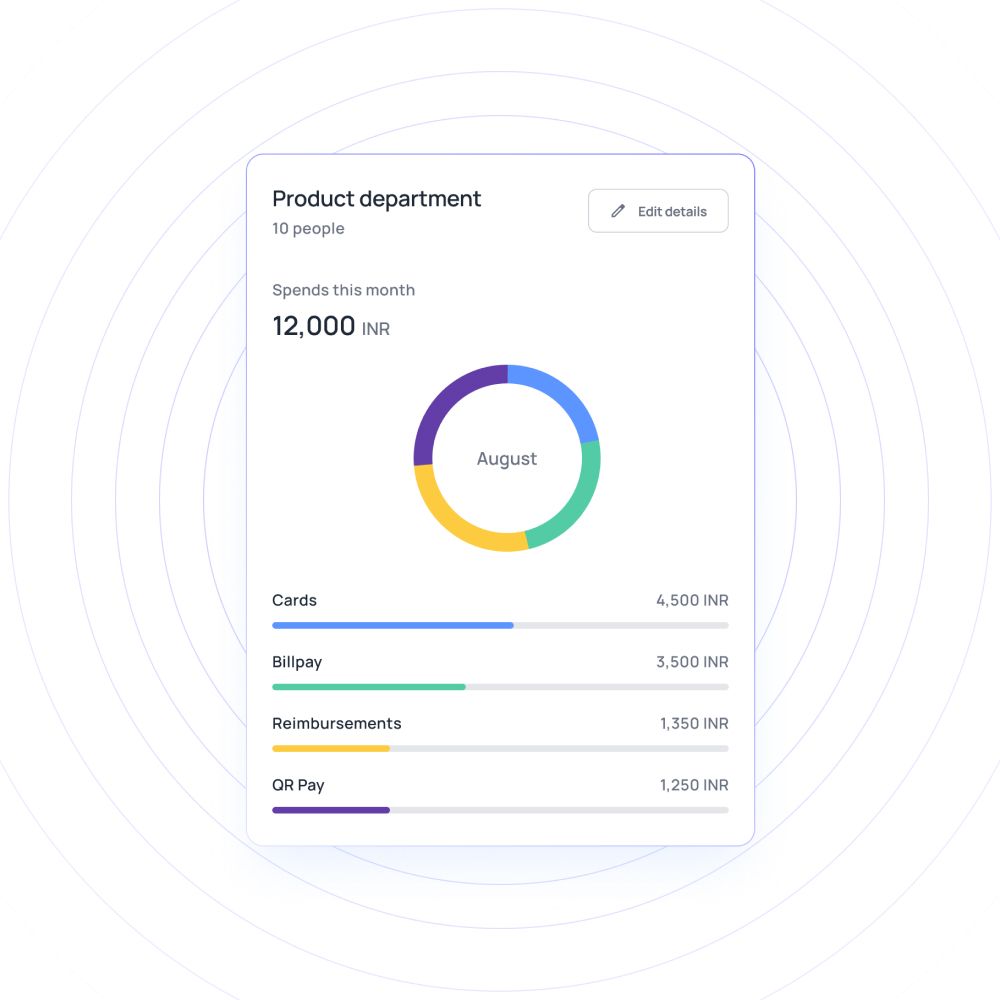

Sync transactions and spend data in real-time

Your end-of-month statement can no longer surprise you. Sync expenses in real-time to keep track of your spending as soon as a payment is made, whether from your accounts payable dashboard or through a card.

For better expense reporting, expenses are logged quickly and synced to the ledger. Company spend policies become much easier to implement with our expense management system.

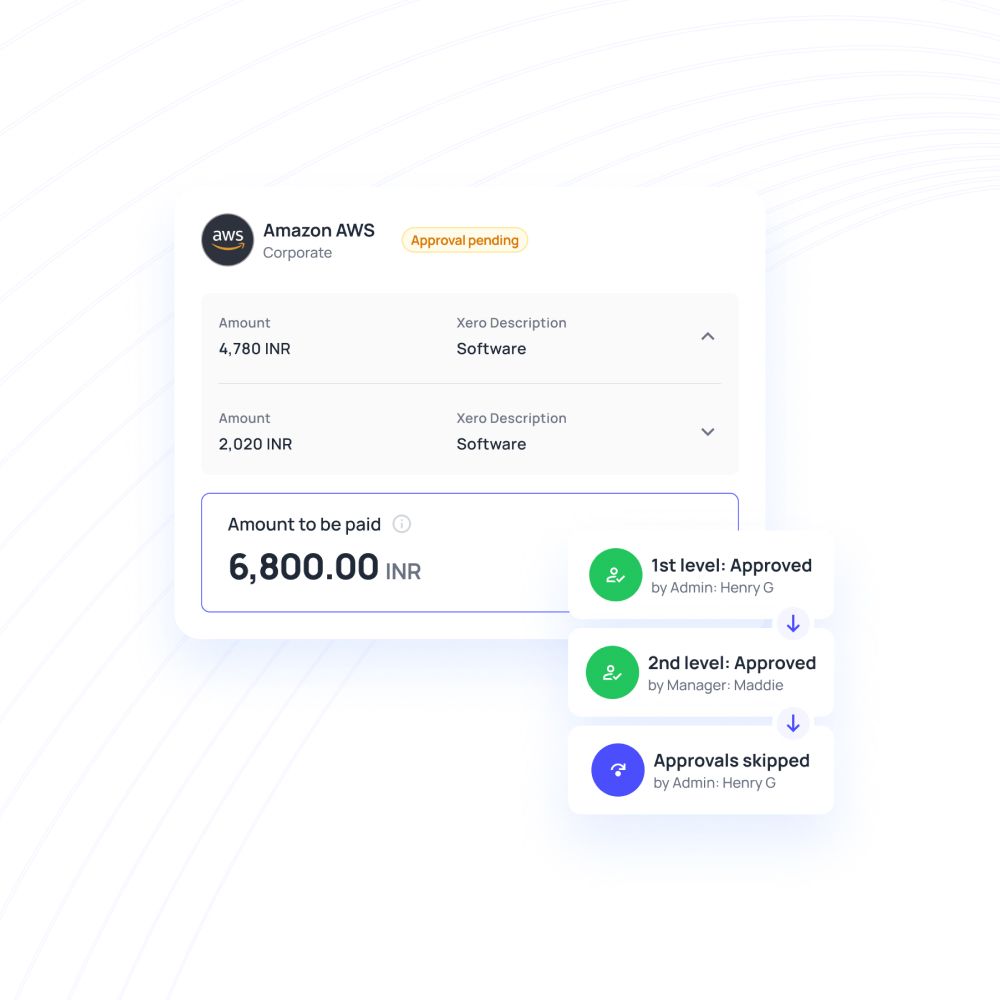

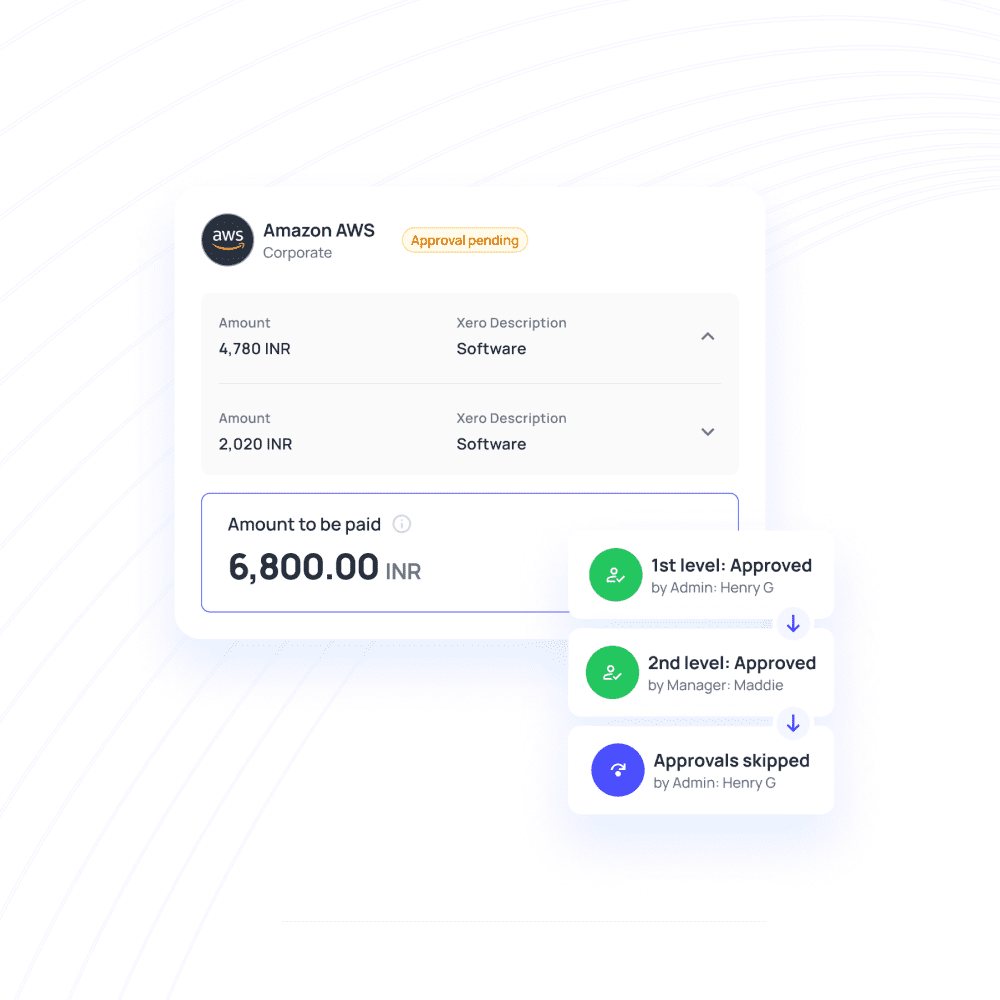

Set custom multi-level approval workflows

Set company-wide policies and tailor them to organizational needs with Volopay's flexible settings. Customize parameters, workflows, and user roles by department or project, streamlining the approval process for greater efficiency.

Volopay lets you implement a multi-tier maker-checker system so that processes are followed and payment approvals are transparent. You can also create flexible policies on a department or project level, to ensure that the right funds are being spent on the right thing.

Control spending before it even happens

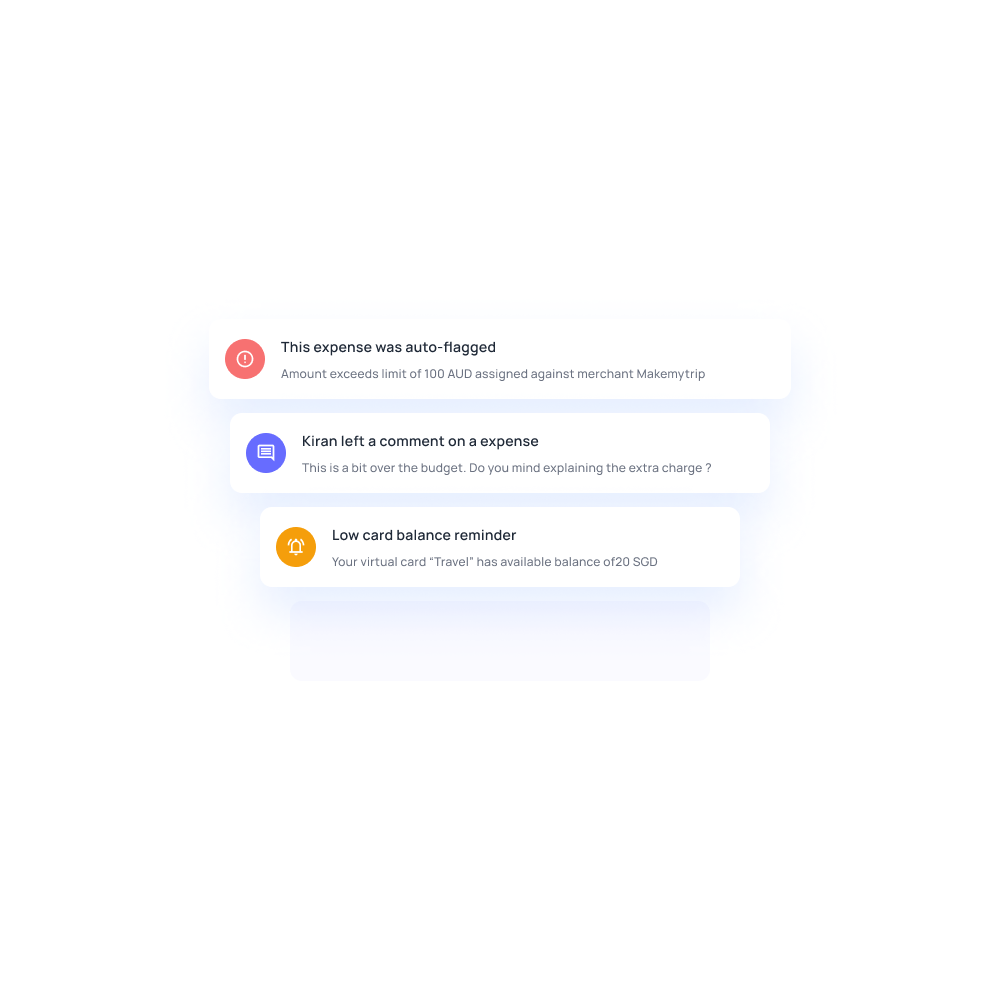

Exercise precise spending control with Volopay's customizable limits and alert systems. Receive notifications for duplicate payments and define criteria for flagging expenses based on the amount, department, category, or merchant.

The only corporate expense management software in India to let you set company-wide spending policies, with department- and project-specific customizations. Ensure compliance and prevent overpayments.

Impose a smarter spending culture

Control and policy awareness go hand in hand with better expense management software for business. Centralize spending transparency with Volopay's comprehensive platform. Set up automatic payments, allocate department or project budgets, and minimize manual data entry with OCR Integration, all from a single interface.

Your employees, too, have a certain level of accessibility. Receipts can be directly submitted to the site, and reimbursements can be claimed. Employees can request funds for their cards at any time and from any location through our corporate expense management software.

Experience hassle-free business expense tracking with Volopay

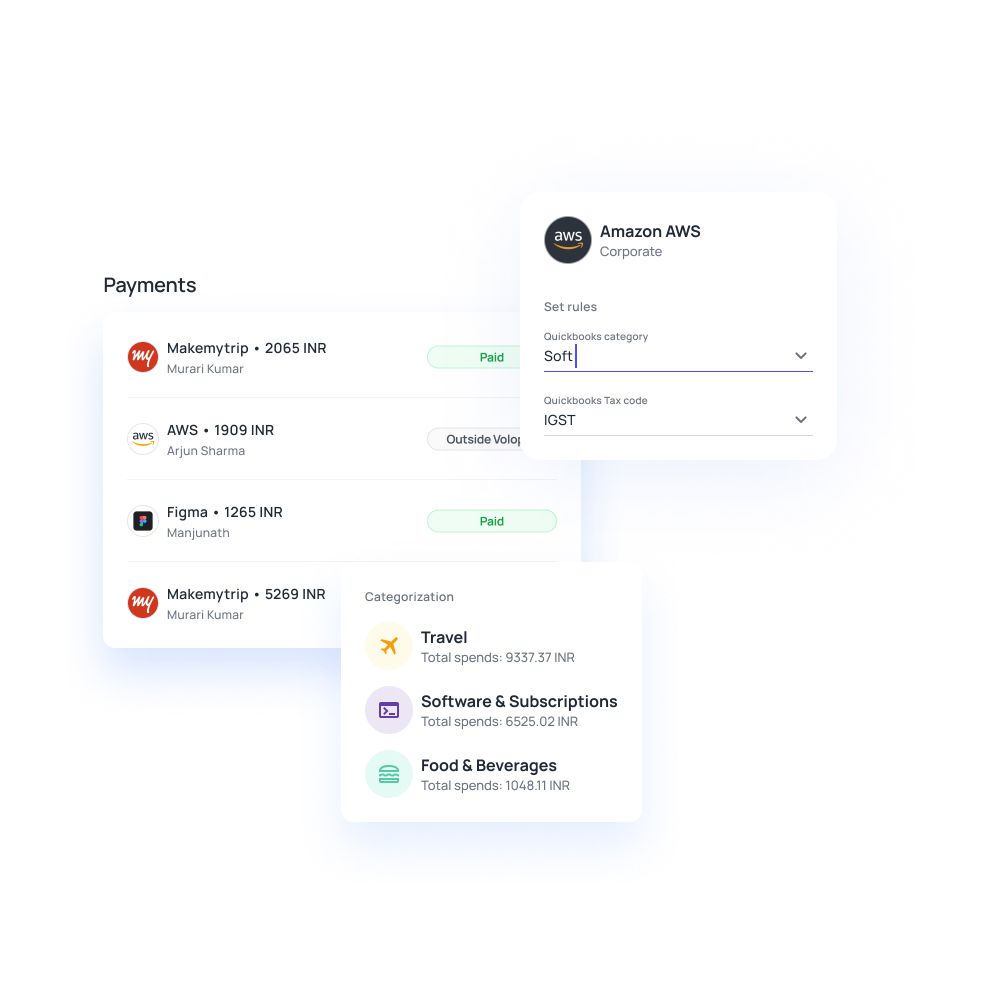

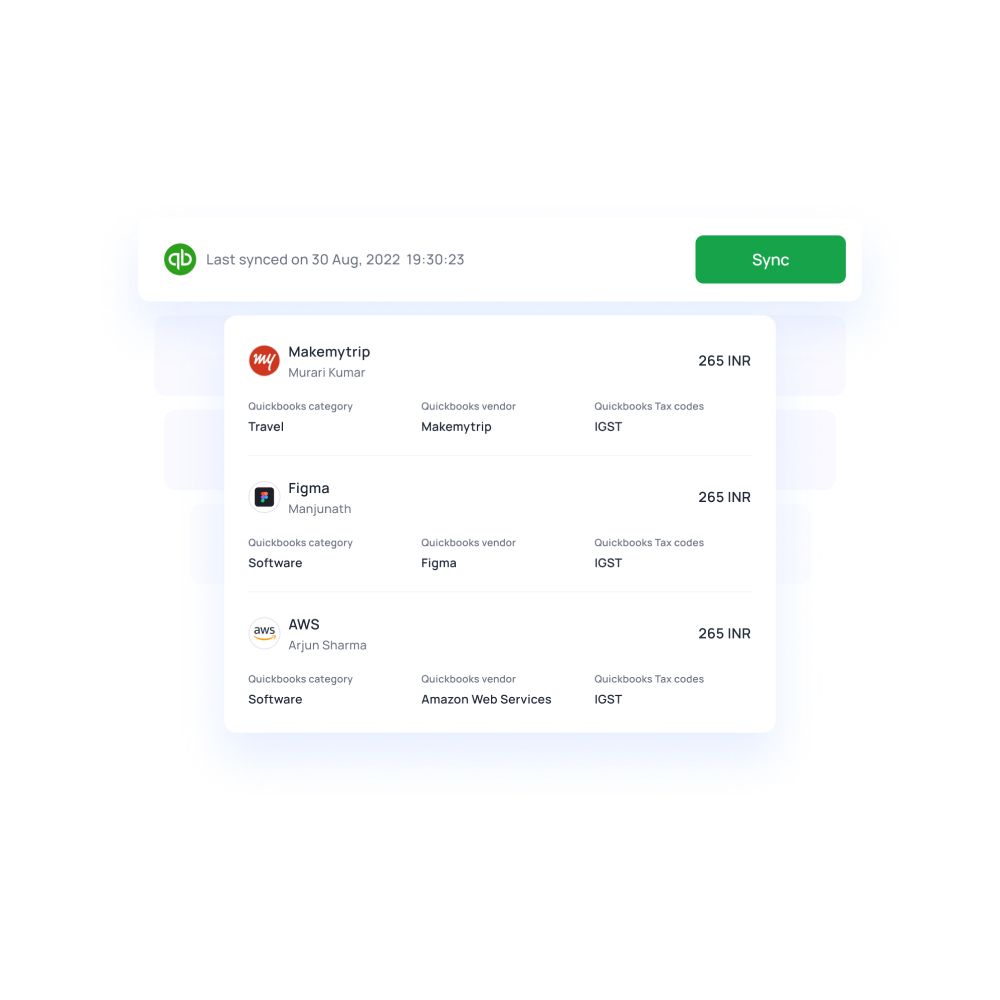

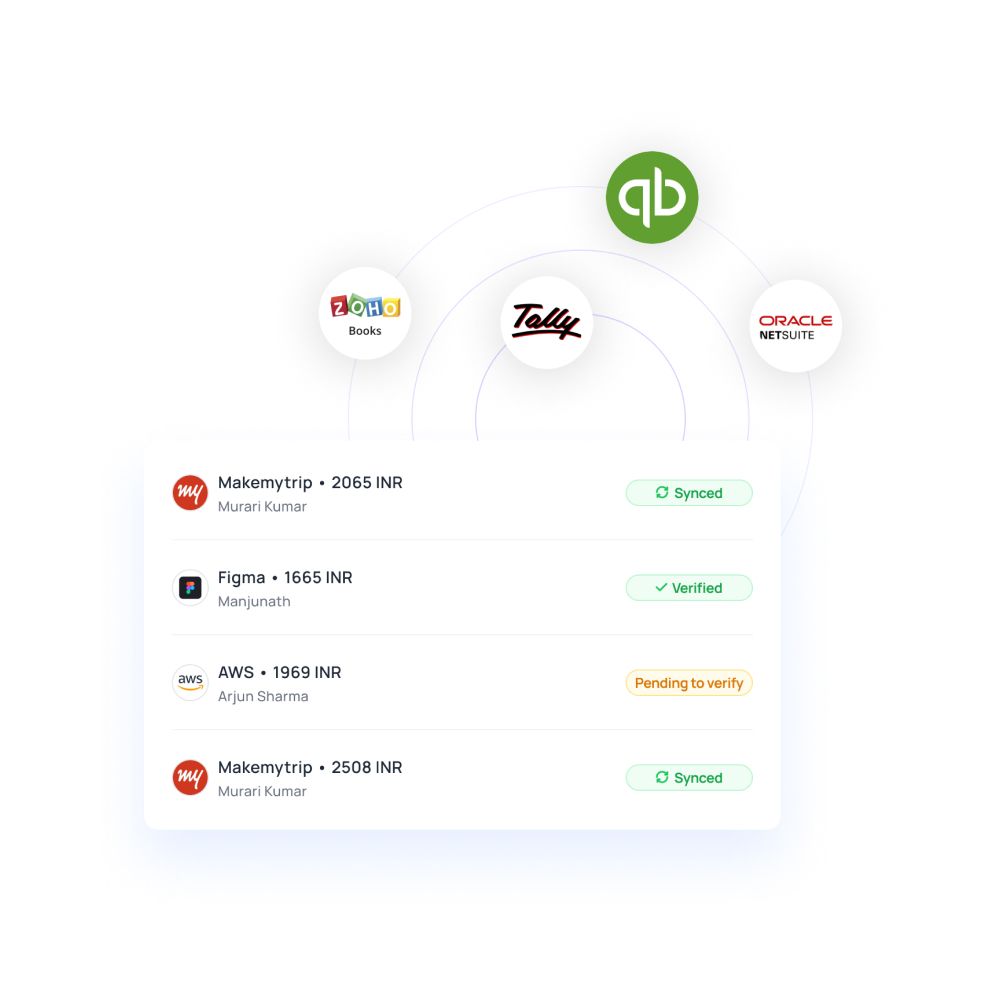

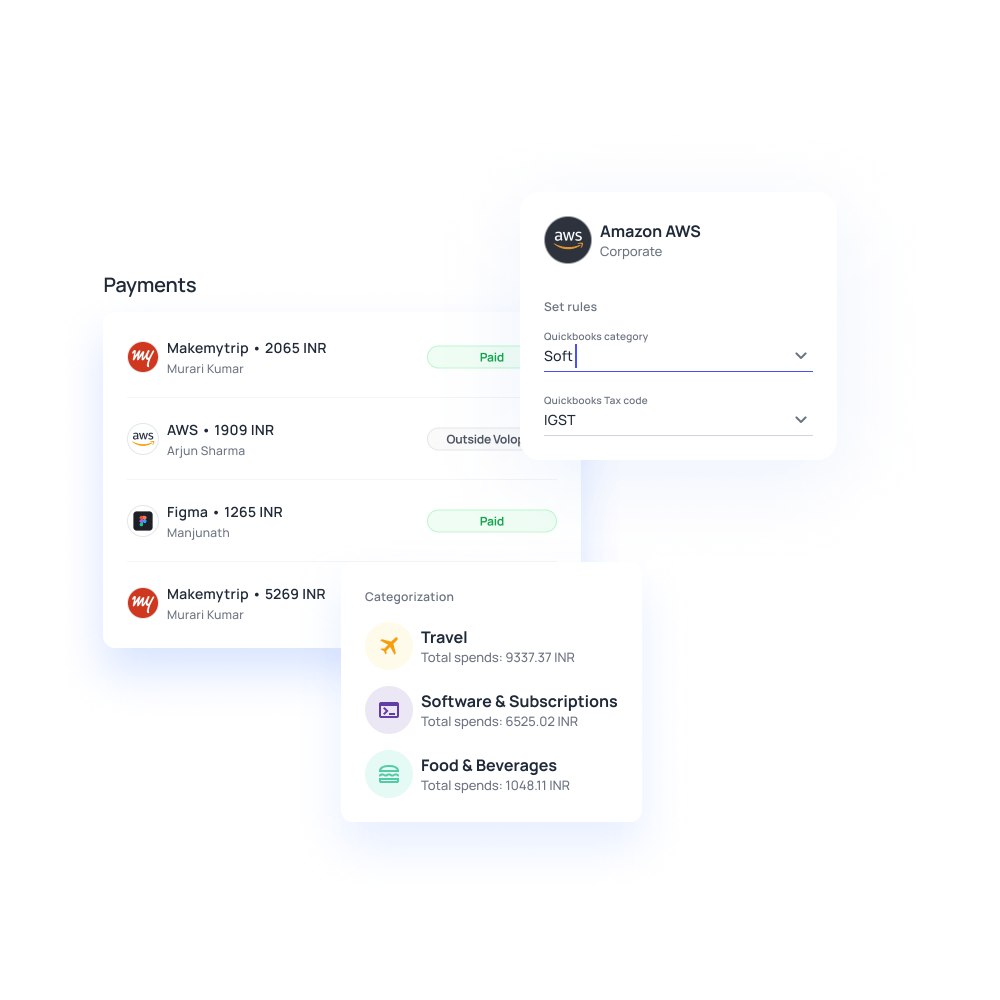

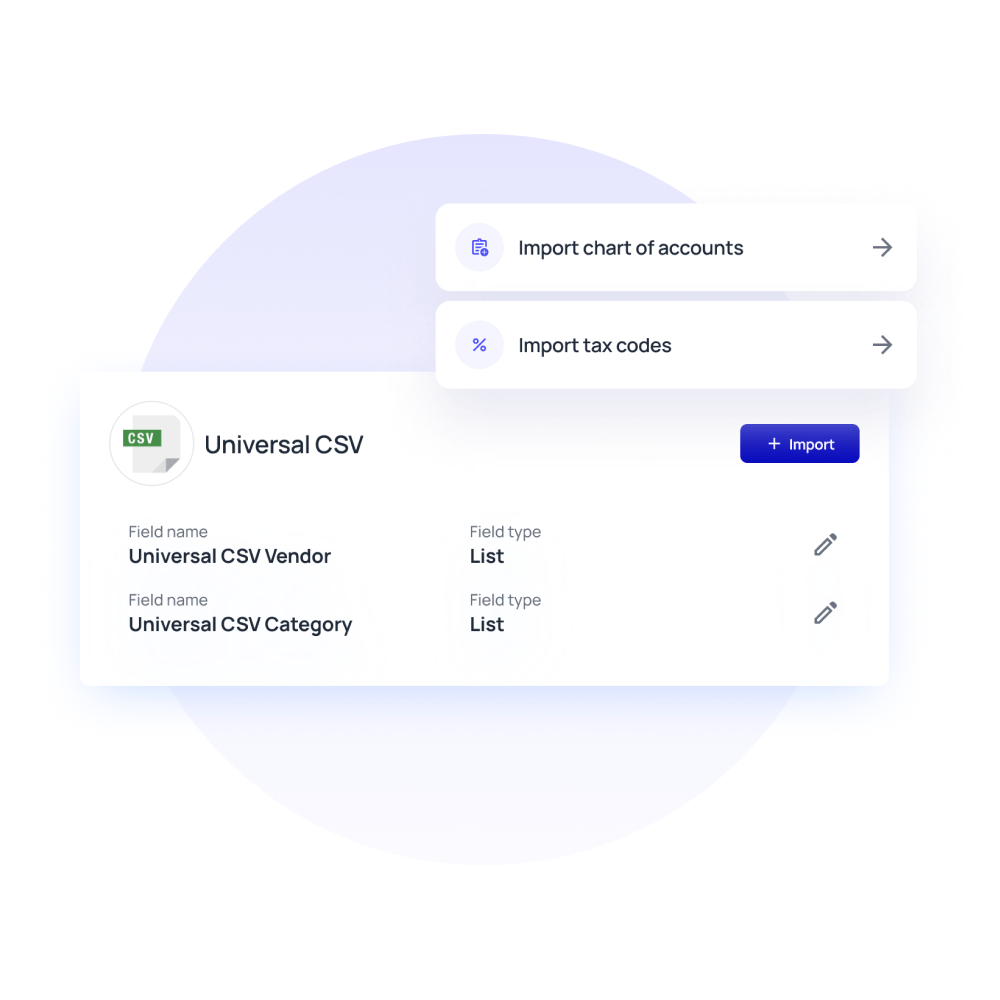

Effortless accounting software integration

The best corporate expense management software in India offers seamless integration with popular accounting software available in the market.

This integration allows for smooth data transfer between systems, ensuring that expense records are automatically updated in the company's accounting books.

This not only simplifies the process for finance teams but also keeps both the expense management and accounting system in sync with one another.

Automated reconciliation

Automated reconciliation is one of the standout features of top-notch expense management software. By integrating with company corporate cards and bank accounts, these systems can automatically match expenses with corresponding transactions. This saves considerable time and effort in manual data entry, eliminating the need for manual cross-referencing and reducing the risk of human error.

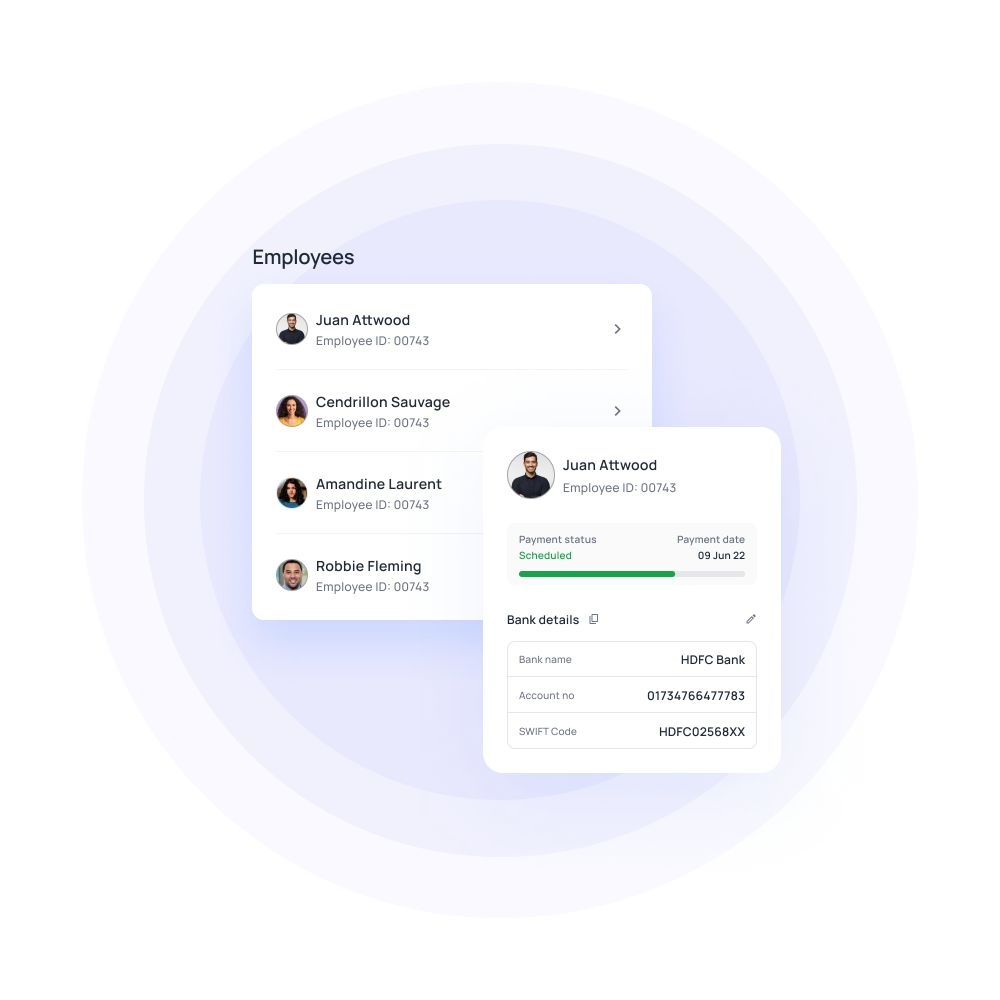

Payroll management

Simplify payroll processing with Volopay's integrated tools, so that your employees can get paid on time. Utilize downloadable CSV templates for bulk payment processing, ensuring smooth handling of Tax Deduction at Source (TDS) to meet regulatory requirements.

Automate payroll payments with scheduled dates for timely disbursements, minimizing manual intervention.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

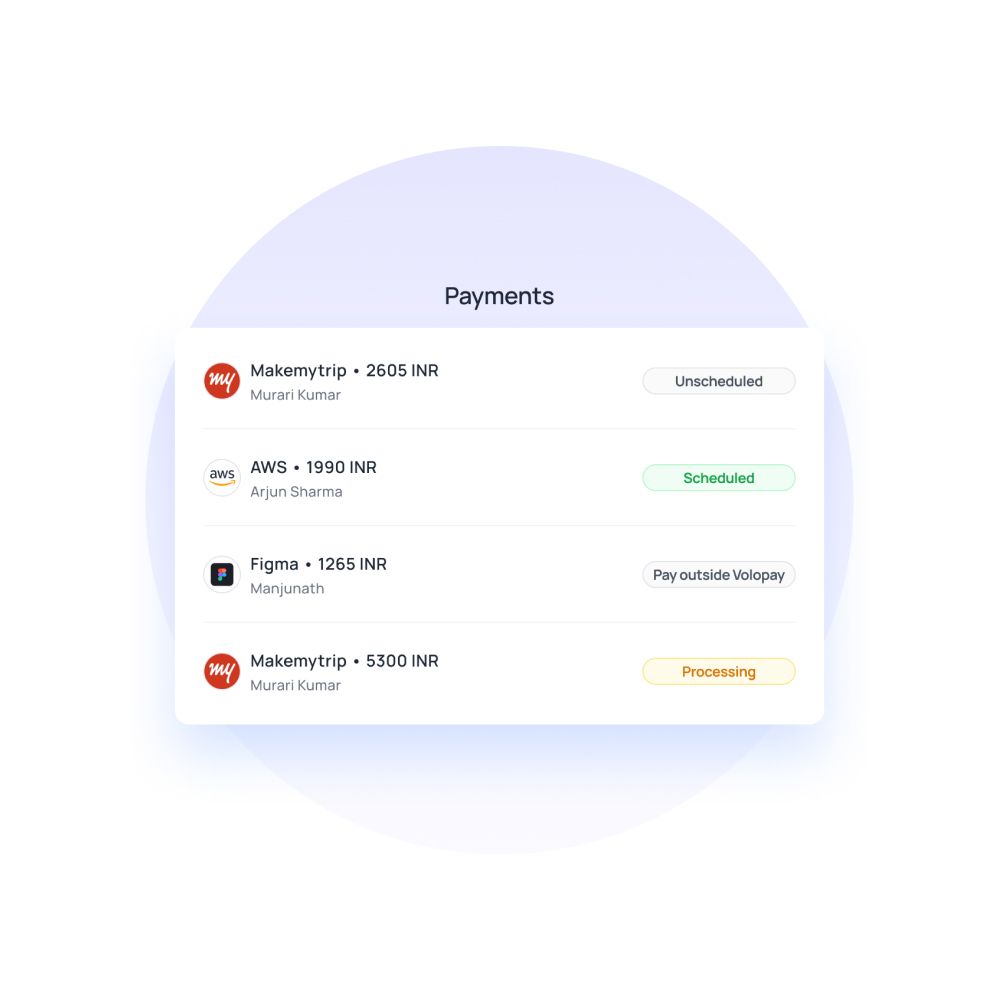

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

One platform, countless benefits: Volopay for all industries

Volopay's expense management software is perfect for startups, offering budget-friendly tools to track expenses and improve cash flow easily.

Automating manual tasks helps you save valuable time, minimize costly errors, and focus more on scaling your business—all while keeping costs low and processes streamlined for maximum efficiency.

Volopay’s expense management system helps small businesses automate expense reporting, reducing manual errors and saving valuable time.

It ensures compliance with financial regulations while providing a simple, user-friendly solution to track expenses, so you can focus more on growing your business and less on paperwork.

Volopay’s corporate expense management software is designed for large enterprises, offering seamless integration with your existing systems.

It gives you complete visibility into corporate spending, helping you maintain better control while streamlining processes, so managing expenses across departments becomes easier and more efficient.

Real-time expense tracking with Volopay

Identify spend policy violations

Expense policies are made to regulate employee expenses related to the business. But some employees voluntarily misuse this to gain more.

Having a transparent payment system helps in preventing such instances. Your money won’t be wasted and employees will know the repercussions of surpassing a policy knowingly or unknowingly.

Insights into duplicate expenses

Duplicate payments are the same payments that are made twice. Such payments will be a common occurrence if you don’t have expense management software. It’s even harder to recognize them when they happen.

Volopay corporate expense management system gives a real-time view of your payments. Also, the whole invoice processing is automated, leaving no way for a payment to get duplicated.

Reduce fraud risks

Small businesses are always prone to both internal and external payment fraud. It’s either an insider who tries to attach falsified records and process payments higher than required, or an external vendor sending invoices for goods that are never delivered.

To save your business from perpetrators, you need an extensive corporate expense management software, which makes Volopay the right choice for your business.

Better supplier evaluation

Maintaining a good relationship with suppliers is necessary for your business continuity. An expense management platform not just aids this by expediting vendor payments but also contributes to vendor evaluation.

Measure your vendor’s performance (quality of goods, customer service, cost, financial stability, etc) against the payments you make and decide the effectiveness of your partnership with Volopay.

Scan and capture receipts with Volopay

Certain suppliers still send manual invoices to their clients. If you are one of those clients, fret not about how the software can accept your input.

Our corporate expense management system comes with an AI-based technology called OCR that recognizes your manual document, fetches the data, and uploads it into the expense management system.

● Policy checks in real-time

It’s not possible for your employees to remember the entire travel spend and expense policies. But the system should be careful enough to only let through expenses that meet your company policy.

Volopay does real-time policy checks and only processes expense reports that match the updated guidelines.

● One-click expense reporting

For employees who travel frequently, reimbursement and expense reporting are a major concern.

Help your employees submit one-click reimbursement requests and upload scanned receipts right there. Volopay lets them do this anywhere, even when they are traveling through the desktop suite or mobile app.

● Automate expense approvals

When a request is submitted by an employee, it automatically gets transferred to the first level of approval.

Upon single or double authorization, it further travels and makes it to the settlement stage. Approvers are notified to promptly authorize the request waiting in their queue.

Drive business growth through streamlined expense management!

Approval policies to streamline reimbursement and expense approval

Pre-approval policy

Be proactive about your employee expenses and save time that’s wasted on request raising and approvals. Set pre-approval policies and approve definite expenses before even they happen.

This will require your employees to share the expense report with you before they go on the business trip. It also prevents employees from wasting money on non-eligible items.

Auto approval policy

There are a few expenses that don’t require approvals at all. Under the pre-approval policy, they qualify for the direct settlement of payment without going through approvals.

For starters, you can add categories, spending amount, authorized person/department to spend, and duration till which they can be auto-approved.

Multi-level approval policy

This is the ideal policy for small businesses that want to double-check and ensure details before settling claims or credit requests.

Here you can set up to five levels of approvers depending on the severity of the expense. And there is no rule that you should choose a fixed number of approvals for all expenses.

Maker checker policy

This is an approver workflow where there will be a maker and a checker. The maker will be the person creating the request and the checker will be the reviewer and approver.

Any errors or policy violations will be caught by the checker and sent down for settlement or further processing.

Why choose Volopay business expense management software?

Get accurate company spending reports

Cut down the effort your finance team puts into creating spending reports and analysis. If they have the ready-made data in their hand, making analysis and financial decisions is easier for them.

Volopay can help them achieve this and generate up-to-date and accurate accounts payable data time and again.

Makes expense reporting a breeze for employees

Employees spend up to a day to get their expense reporting sorted after a trip. Following that, they have to get in touch with different teams to get status.

Instead of being clueless, they can use Volopay expense management system to submit expense reports in a few steps and track them periodically.

Better compliance and accountability

Accounting is constantly regulated by compliance and governance policies. For smoother tax returns, you need to stay compliant with your tax authoritator’s requirements.

Volopay business expense management solution helps you with staying compliant and updating any changes implemented.

Manage company spending with business budgets

Make your budgets work for you by practically connecting them to your expense management software. You can update your company budgets and track departmental expenses and make budgeting work in real-time.

With higher controls and limiting options, you can curb unnecessary expenses and open doors for a positive cash flow.

Instant reimbursements for employees

Happier employees lead to the happiest and most productive workspaces. If you could make reimbursements easier for employees, they can focus better on tasks that deserve their real attention.

They can submit reimbursement requests on the go and receive payments quicker. Corporate cards reduce the burden by facilitating pre-approved spending.

Integration with preferred accounting software

Volopay can be connected with any accounting software you use. This connection enables safe and encrypted data transfer from Volopay to the destined application.

Your accountants will no longer juggle multiple windows and transfer data manually.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our expense management software

Switch from having to use multiple tools and systems to a single, more modern, organized, and consolidated expense management software for business. Bring approvals, corporate cards, account payments, employee expense reimbursements, accounting automation, and many more under a single roof.

Multi-level approvals

Multiple approvers ensure that no single individual is liable for an expense and that all payments are well-checked and thoroughly verified. Payments, reimbursement sanctions, policy enforcement, and card reloading can all be assigned to up to five approvers on Volopay.

Before approving, they can also seek information or flag errors to ensure that no data is missing during the accounting process. The only expense management software in India to redefine the way businesses gain complete control over every rupee being spent.

Employee reimbursement

Enabling employees to request reimbursement for out-of-pocket expenses on the employee expense management software makes the process much easier to manage, rather than allowing them to be intimidated by week-long procedures.

They only need to file a receipt and include payment information; approvers must then check and approve the refund. Money is immediately transferred to their bank account, thereby making the entire process easy and quick.

Subscription management

Virtual cards can be generated for each vendor so that you can precisely allocate funds and identify who was paid how much money with just one glance at an expense report.

This also allows you to handle cross-border vendors and halt payments for subscriptions that have been forgotten. One-click solution to all SaaS subscription management situations that businesses struggle with.

Real-time visibility

Admins, accountants, and managers can see the movement of your business funds as they happen with real-time insight. You always have control over how your company's money is spent, so you don't have to worry about shocking expense reports or significant debt.

Before it's too late, know every detail of every rupee spent, approve it fast, or freeze it.

Interested to know more about expense management?

Business expenses refer to the costs incurred by a company in its regular operations to generate revenue and maintain its operations.

Master your business finances! Explore our comprehensive guide to cash flow management, offering strategies for optimizing inflows and outflows.

Navigate Indian tax compliance with ease. This guide covers everything businesses need to know about GST, from registration to returns.

Learn the essentials of petty cash management. Discover how to effectively track and control small, routine business expenses for financial accuracy.

Compare India's top expense management software. Discover why Volopay stands out as the best choice for your business.

Optimize your company's entire spending lifecycle. Learn spend management strategies and automation tips to gain control and maximize efficiency.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

ParallelDots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on expense management

Expense management software is a digital solution that helps businesses manage and control their spending activities. It automates expense tracking, submission, approval, and reimbursement processes, streamlining financial workflows.

Volopay's employee expense reimbursement is faster than the traditional and manual process of expense reimbursement. Employees submit claim requests for mileage or out-of-pocket reimbursements directly on the platform. There are choices to include the vendor's name, the reason for payment, and a receipt. The expense can be accepted as soon as an approver looks at it. The employee is immediately alerted, and the payment is completed. Instead of dealing with weeks of back-and-forth communication, approvers can request more information, which the employee can furnish when they receive the notification.

Use Volopay's corporate cards for subscription and online payments, by creating unique cards based on different spend categories and types. The assigned cardholder's card information can be saved on the vendor's site in the case of recurring payments. The payment will go through as long as the card is funded and valid either as and when required or by regularly reloading funds to the card. For improved reconciliation and verification, virtual cards allow you to create vendor-specific cards for one-time payments. This also allows you to keep track of missed payments and freeze a vendor card to cancel a subscription.

Our automated expense reporting applies expense policies, making compliance and spend analysis easier. The scanning of receipts and invoices allows for improved vendor management. Payments can be scheduled ahead of time to avoid late fees, and early payments might result in discounts. Forecasting and analysis demand less data collecting and data entry with the help of one-click report generating. Instead of unnecessary mundane effort and human intervention, expense reporting streamlines the entire financial operations and management process in your business.

Expense reports reflect all of the data you've filtered. The ledgers provide information on who made payments, from which account (wallet or card), and to which department. This payment is linked to vendor information, invoices, and receipts. You can filter information based on the type of cost report you want to create, but all of this information is available by default.

Volopay improves expense reporting through its advanced features like automated reconciliation, effortless integration with accounting software, detailed audit trail, and customizable policy enforcement.

By automating manual tasks, Volopay simplifies the expense reporting process, enhances accuracy, and provides real-time insights into company spending.

Yes, expense management software is highly useful for small businesses. As small businesses often have limited resources, automating expense management can significantly reduce administrative burden and minimize the risk of errors.