👋 Exciting news! UPI payments are now available in India! Sign up now →

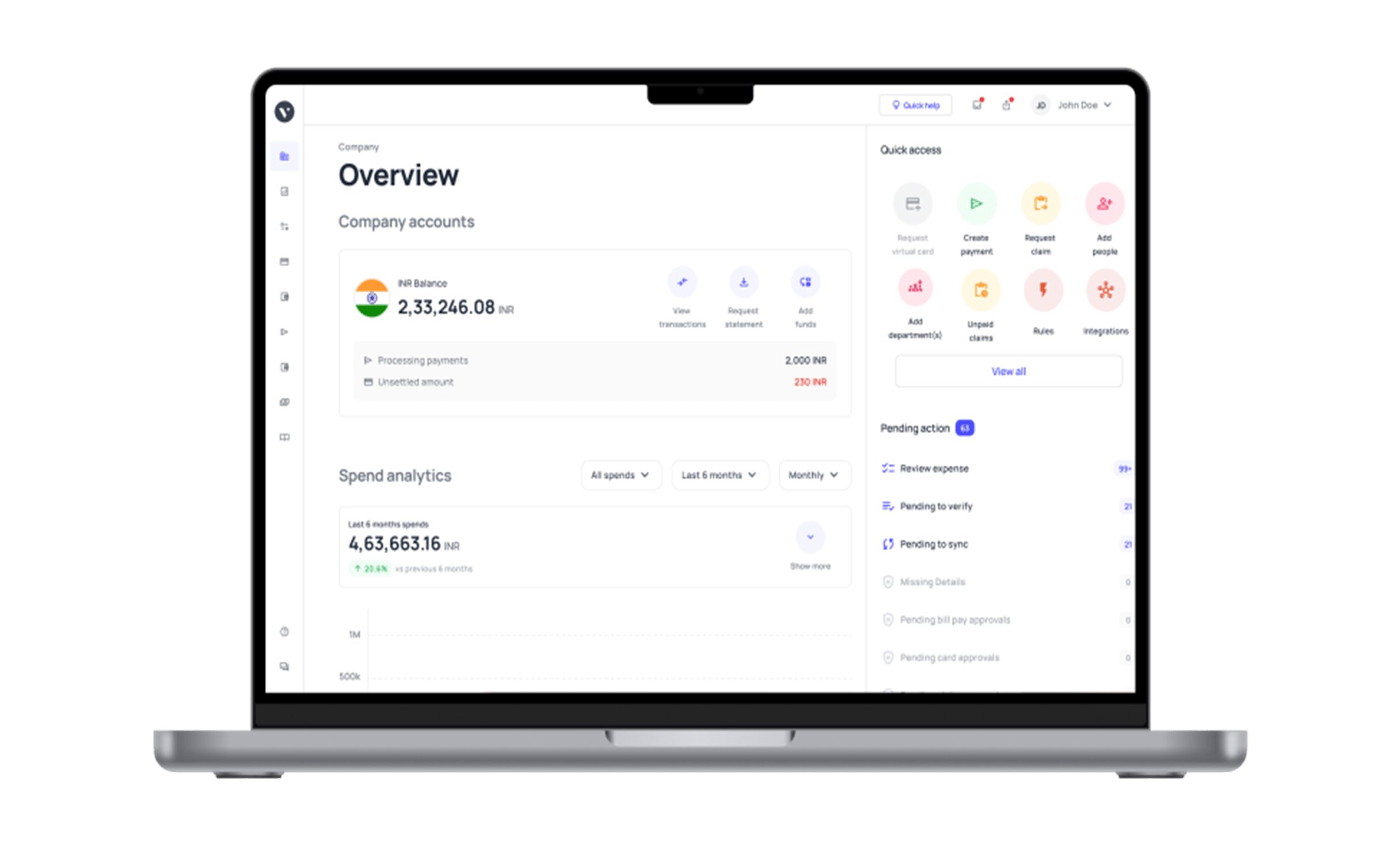

A business bank account for easier fund management

Why juggle multiple bank accounts to make payments when you can use the best business account in India? Volopay helps you manage all your expenses through a single dashboard.

Opening a new business account with Volopay is extremely simple and hassle-free. Simplify your transactions with just one business account.

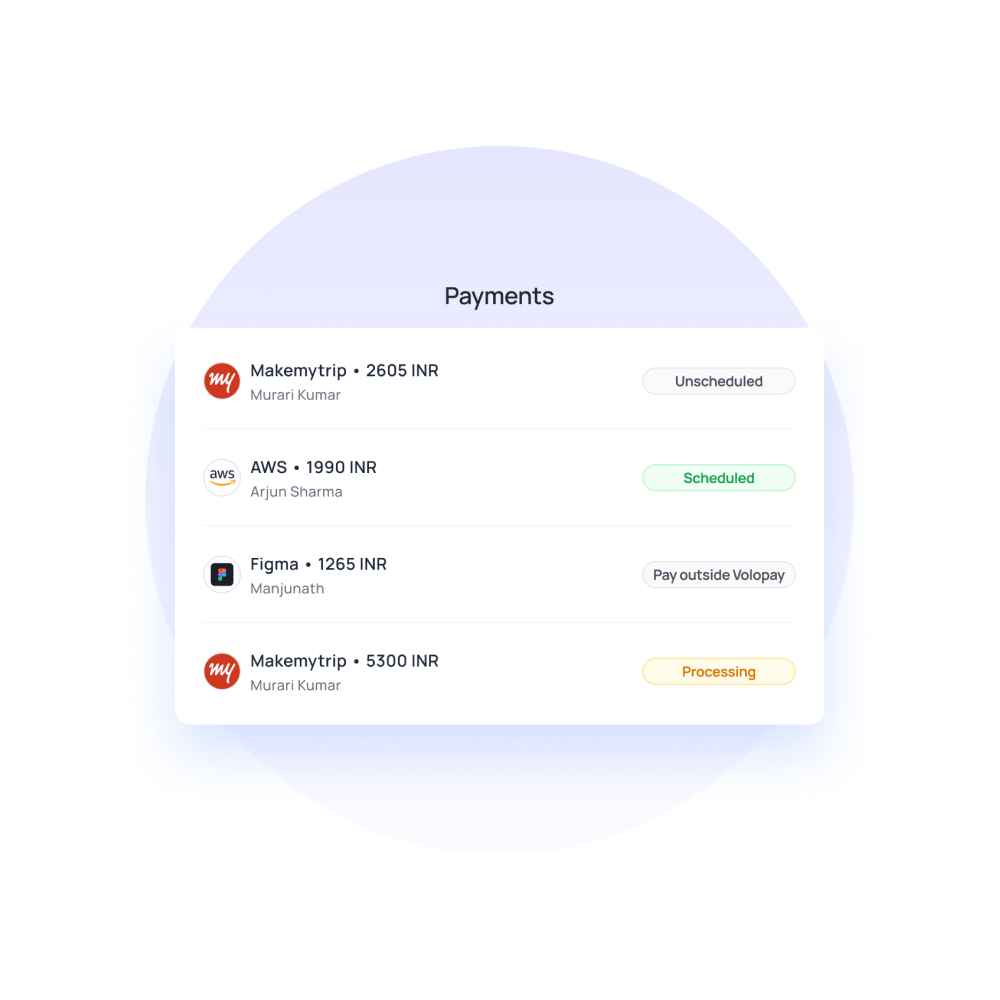

Modern account to manage bill payments

With Volopay, bid farewell to hefty transaction charges. Our wallets empower you to transact without the fear of exorbitant fees eating into your profits. Hold your funds securely, and reduce the risk associated with shuffling through multiple bank accounts.

Compared to traditional banks, you save considerably on management costs, allowing you to allocate resources efficiently.

Local payments made faster

Volopay streamlines domestic payments, ensuring transactions are executed swiftly and seamlessly. With our platform, get real-time payment data, empowering you with insights to make informed financial decisions.

Furthermore, quicker local transactions enhance operational efficiency, giving your business the competitive edge it deserves.

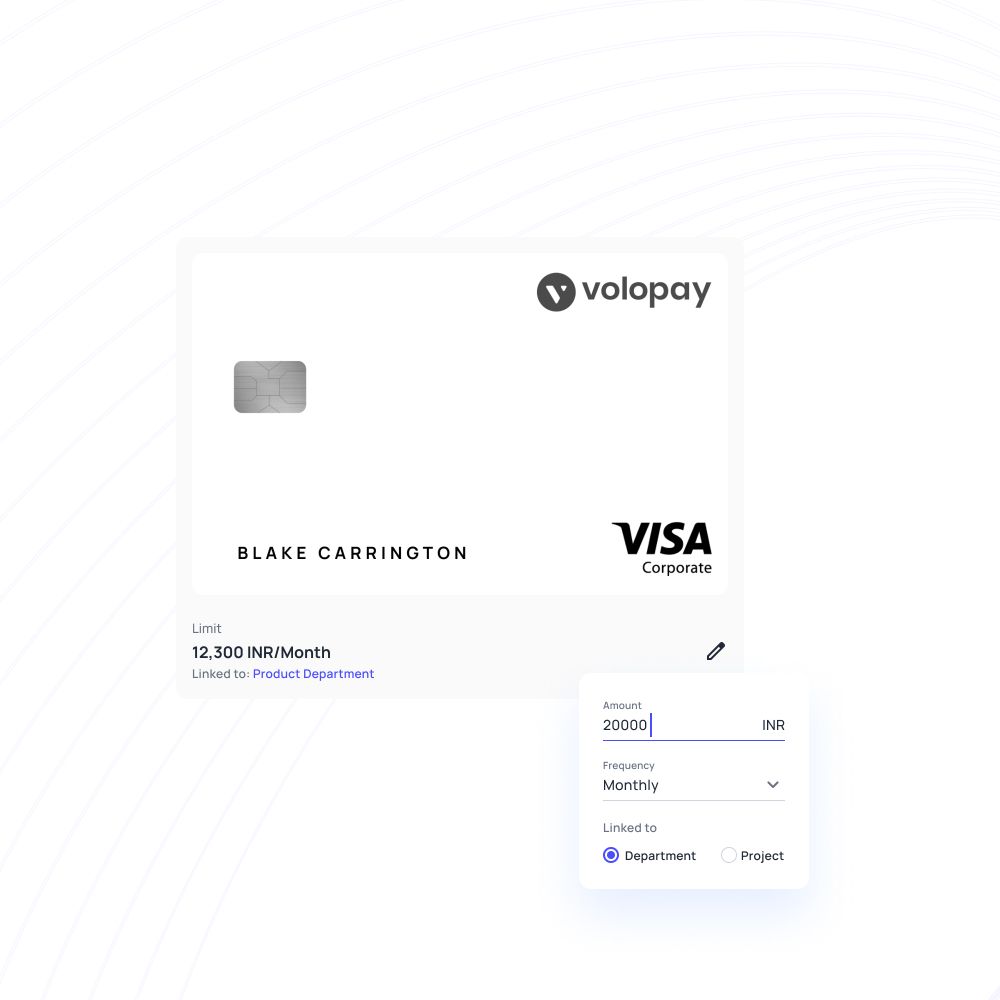

Corporate cards for employees & teams

Set budgets for projects and departments, control spending, and create custom approval cycles with our corporate cards.

Rather than chasing money, your staff may make business purchases with ease. The spending is tracked in real-time because the cards are linked to your business account.

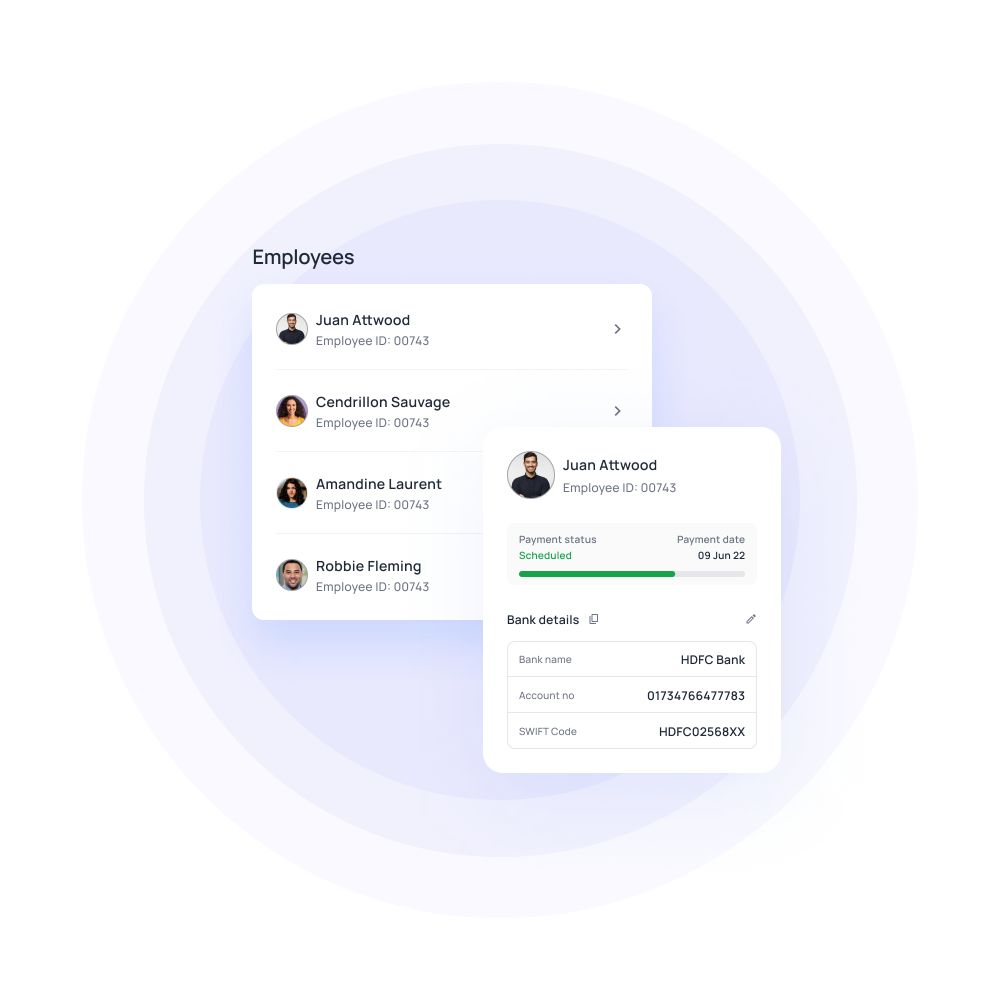

Salaries on time, every time

Volopay simplifies payroll management by enabling you to pay employees faster, without incurring hefty charges. Say goodbye to unnecessary transfer fees for large-scale payroll requirements.

Automate payroll dispersal to ensure that your payroll transactions are executed seamlessly, allowing you to focus on nurturing your workforce and driving business growth.

Want to switch to Volopay from your traditional business bank account?

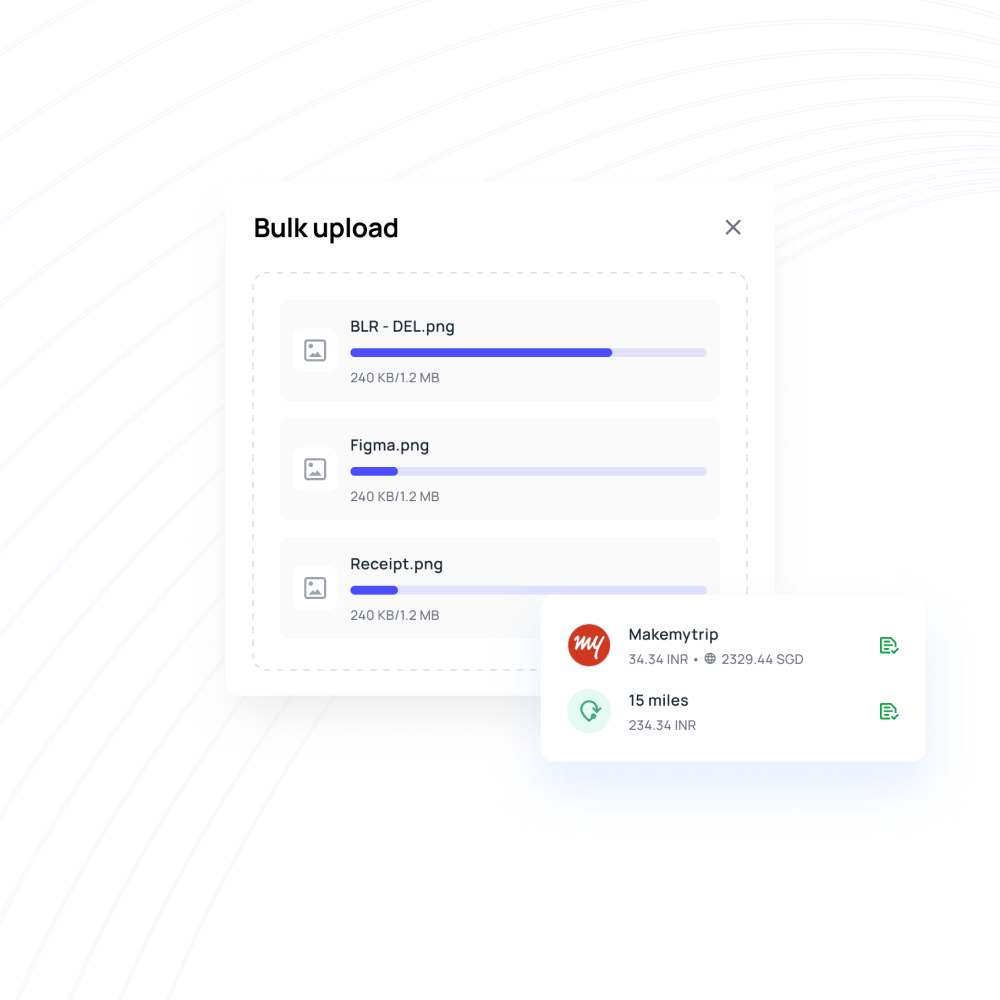

Reimbursement management made simpler

Our system allows you to reimburse expenses in the currency they were spent in, eliminating the need for complicated currency conversions. Manage bulk claims effortlessly, saving time and resources.

Additionally, set up auto-compliance with company policies, ensuring that all reimbursements adhere to your organization's guidelines seamlessly.

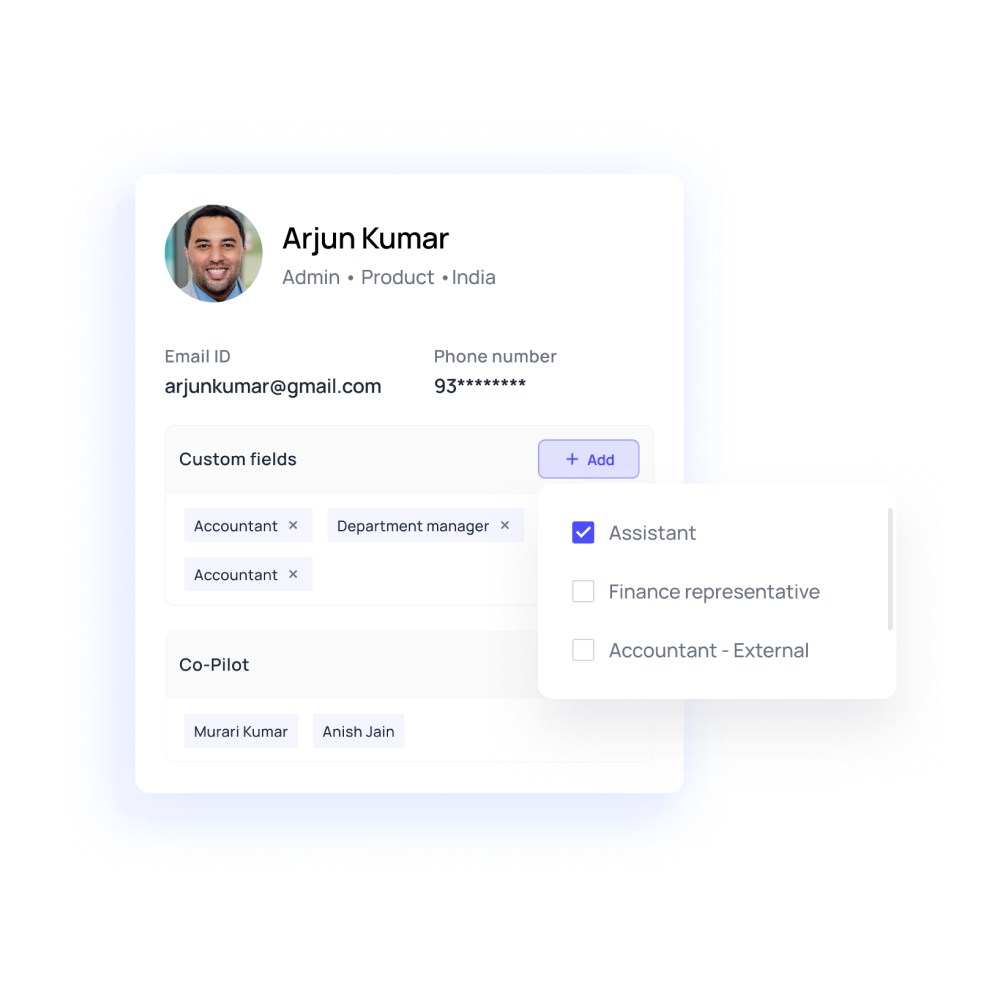

Unique roles for unique people

Tailor user roles to fit your organization's needs with Volopay's custom user roles feature. Whether it's granting access to specific functionalities or restricting certain actions, our platform empowers you to fine-tune user permissions with ease.

Need assistance? Gain valuable insights into user behavior and preferences with our advanced user insights.

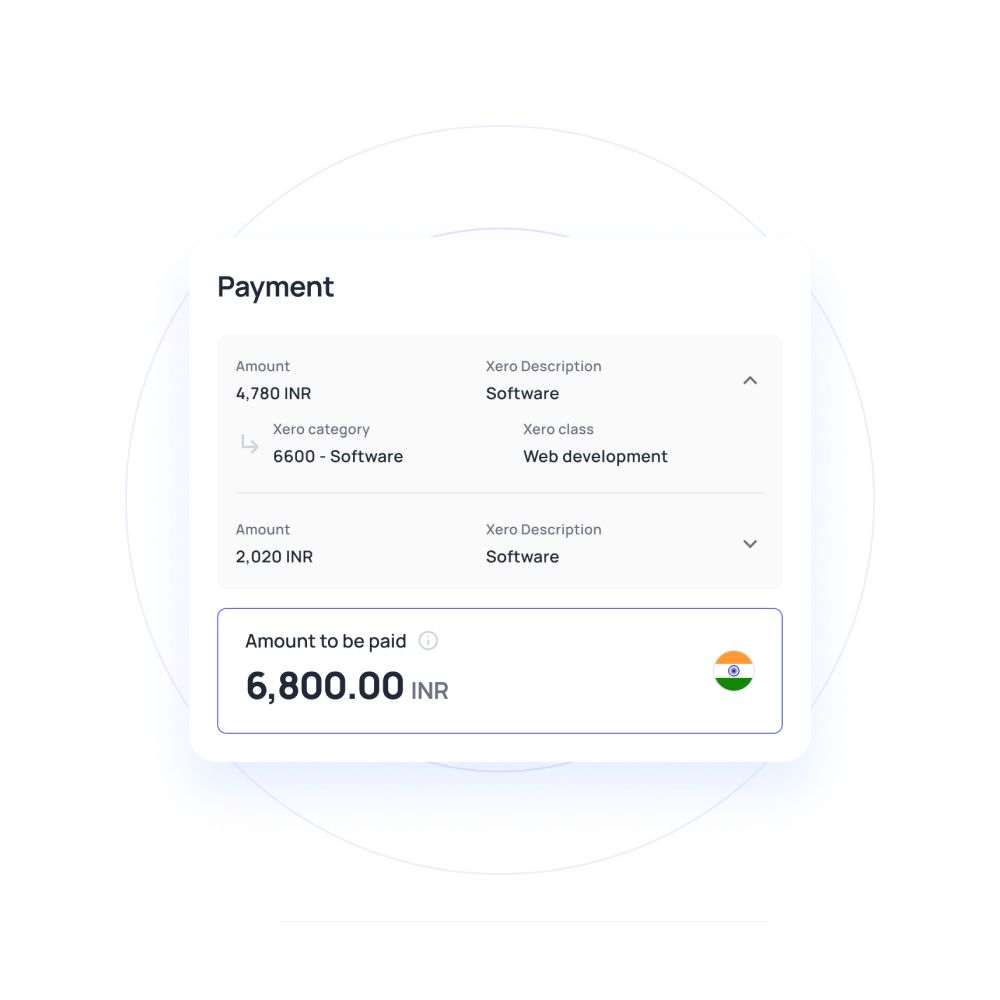

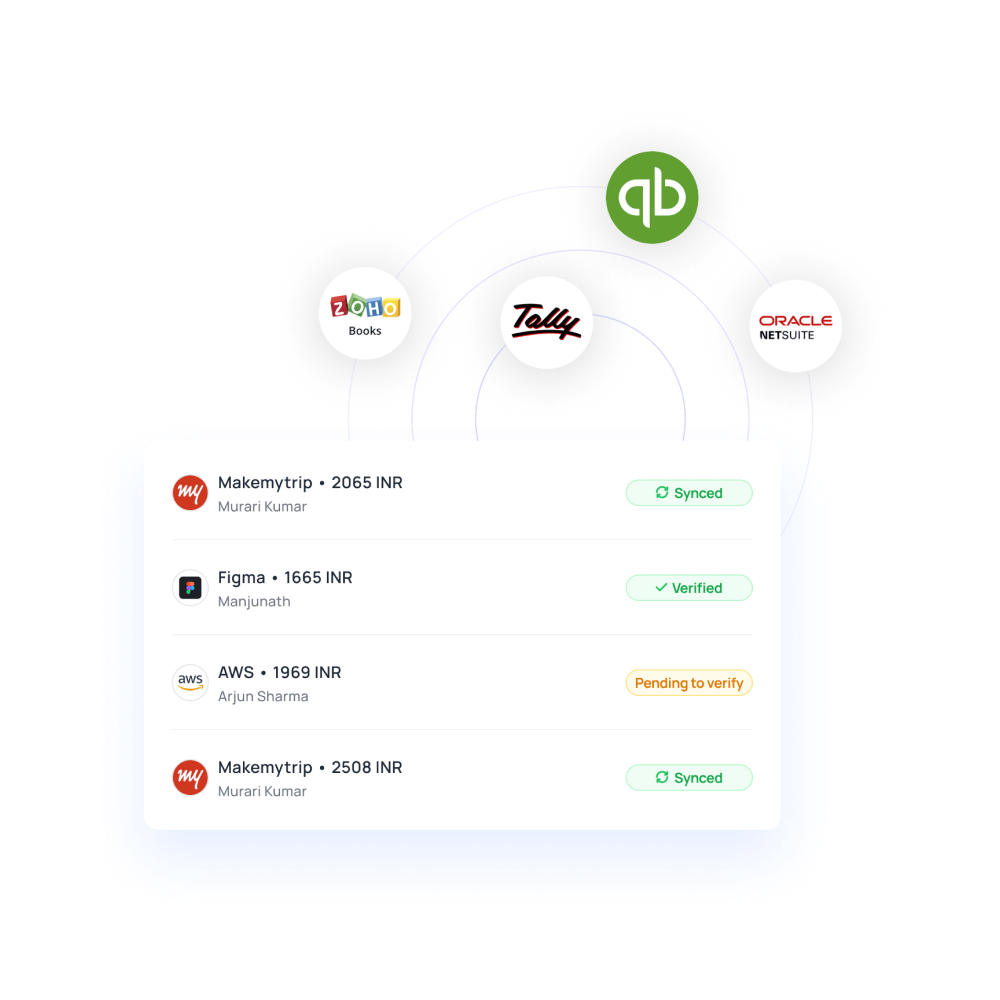

Streamlined accounting

Volopay offers synchronized accounting, ensuring that all financial data is seamlessly integrated across your systems in real time. Take control with advanced rules and controls, allowing you to customize settings to match your business requirements.

With continuous synchronization of all currency payments, you can trust that your financial records are always accurate and up-to-date.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay Vs. Traditional business bank account

A comparison between Volopay and traditional business bank accounts highlights major differences in features, flexibility, and efficiency. The table below outlines these distinctions to help you determine the right choice for your business.

Volopay vs traditional business bank account

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our business account

You can now manage all approvals, accounts, bills, reimbursements, accounting, and cards from a single dashboard.

Domestic money transfers

Set up advance payments for vendors, expedite payroll, and fund your business credit cards for domestic use. Local money transfers at a moment's notice, with real-time reporting for greater management and approvals.

International money transfers

Your international payments are as simple to manage as your local payments. You can send money to anyone, anywhere in the globe, using the Bill Pay dashboard. All payments are logged in the ledger so you can see when, when, and how much you spent.

Global business account

Make a truly global impact by paying overseas merchants using the best multi currency account India has to offer to businesses to hold money in multiple currencies and pay vendors and employees without the time-consuming processes and fees that come with traditional wire transfers. We offer some of the industry's best FX rates, as well as support for over 180 currencies.

Accounting automation

Stop doing your bookkeeping the old-fashioned way. Automate your accounting for real-time synchronisation and reconciliation of all transactions from a simple card swipe to a large payment. With the help of integration with your choice of accounting software, everything is neatly reported, documented, and accounted for.

Business credit

Use Volopay's corporate credit line to make spending easier for your company. Your company's growth will be aided by the flexible cycles and simple approval process. A truly flexible credit line that will help your business credit score.

Accounts payable

You can manage all of your bills in one spot. Create suppliers, enter them into the system, and keep a detailed record of payments and invoices. For easy reconciliation and accounting, the bill pay platform keeps all payments, POs, invoices, and receipts in one place. It's also easier to avoid late fees if you set up monthly payments in advance.

FAQs on business accounts

Once you book a demo with us, our representative will take you through the entire dashboard interface. You will need to submit documentation about your business and bank statements. Once verified (a short process), an administrator account will be created for the nominated POC of your company. The account is then yours to use.

With Volopay, your money is always safe. Your funds are held in escrow and safeguarded following all security, legal, and financial regulations and compliances. Even employee information is kept safe because all data is encrypted.

Volopay’s multi currency account allows you to hold funds in different currencies, unlike a traditional business account. Add funds to an infinite number of virtual cards, and data will be synced to your accounting software of choice instantly. Instead of waiting for a monthly statement, get real-time transaction details. You save money by paying a fee that is far lower than the amount charged by a regular business bank account. Instant domestic and international transfers at cheap remittance and FX rates are faster than wire transactions. Apply for a credit line with no collateral.