👋 Exciting news! UPI payments are now available in India! Sign up now →

Flexible small business line of credit that's hassle-free

Your day-to-day business operating costs should not be a source of anxiety. Get a quick, and simple business line of credit in India to help you manage your expenditures rather than pushing your funds to their limit.

You can spend more efficiently while saving money with our flexible business credit line. Benefit from one of the fastest credit checks and approval processes available, with flexible repayment intervals.

Trusted by finance teams at startups to enterprises.

Quick & uncomplicated approval procedure

Unlike a bank, Volopay does not require weeks to process your application. Our clearance and verification processes are much faster, taking just two working days.

You can quickly obtain access to your authorized company line of credit and begin spending right away.

Repayment cycle that is customized for you

Apply for and be authorized for a flexible repayment schedule business line of credit in India. The cycle is customized to meet the needs of your business as well as your credit limit.

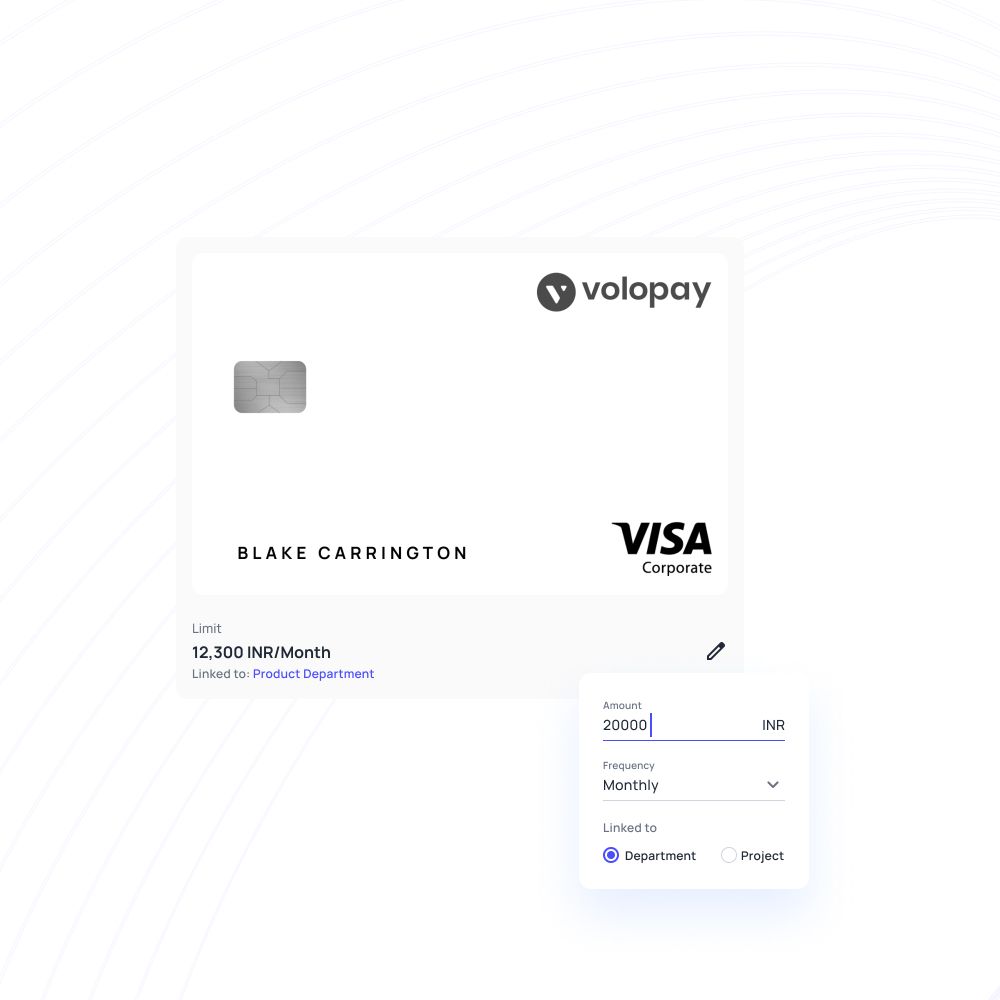

Take advantage of the flexible business credit line accessible through our corporate cards instead of breaking your head over pricey, inflexible credit repayments with traditional banks.

Minimal hassle credit

Forget about the time-consuming process and paperwork that come with a standard business loan. Get a large credit limit with no personal guarantees and minimal paperwork.

Credit checks and approvals are handled as quickly as possible, and your flexible business credit limit grows as your company expands further.

Smart corporate cards with built-in credit

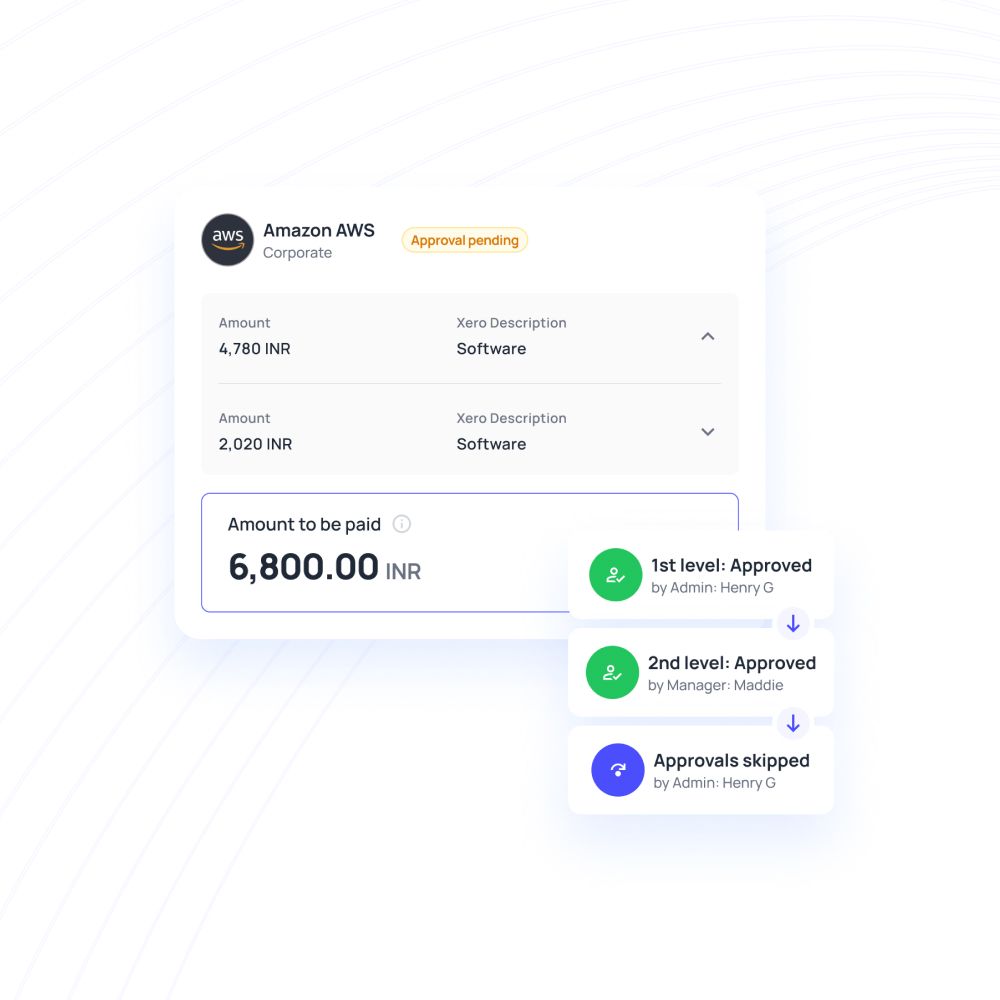

Give your employees corporate credit cards with a business line of credit that they can use immediately. Set up controls to keep tabs on expenditure in real time, as well as approval processes to ensure that nothing goes wrong.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments.

Manage vendors, approve invoices and automate payments.

Save hours daily, and close your books faster every month.

Integrate with the all the tools and software that you use daily.

Learn more about our business credit

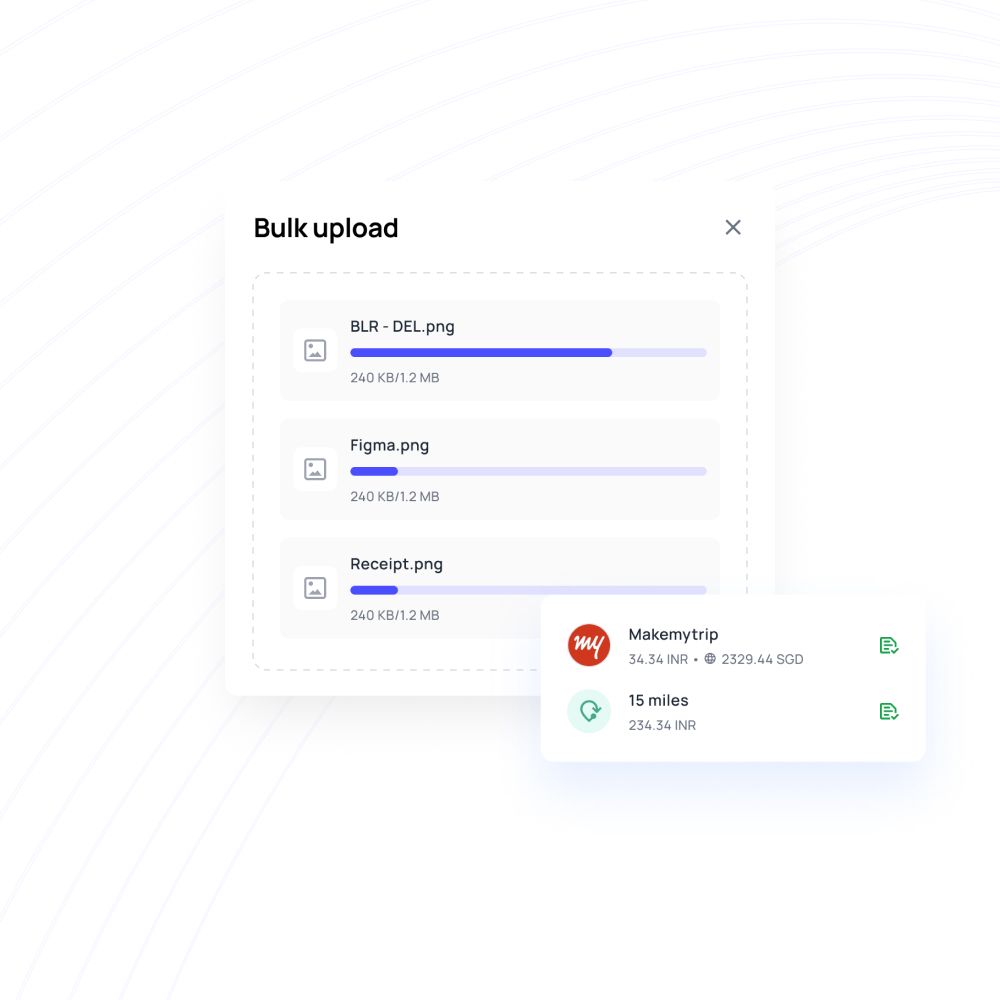

Volopay is the only expense management software in India that allows you to centralize all of your financial management activities. With approvals, corporate cards, bills, reimbursements, and accounting automation all in one place, you'll never have to worry about gathering data anymore.

Global business accounts

Instead of juggling your funds in numerous places, you may open a multi-currency account with Volopay. Keep track of your spending around the world by keeping money in multiple currencies in different wallets.

Domestic money transfers

You can manage all of your payments from a single dashboard by sending money to vendors and workers using your accounts payable wallet or cards. Domestic transfers are quick and appear in your ledgers straightaway.

International money transfers

Our platform makes international money transfers a breeze. Because of cheaper remittance rates and competitive FX pricing, you won't lose a lot of money paying a vendor in another country. Instead, international transfers are more efficient, less expensive, and easier to manage.

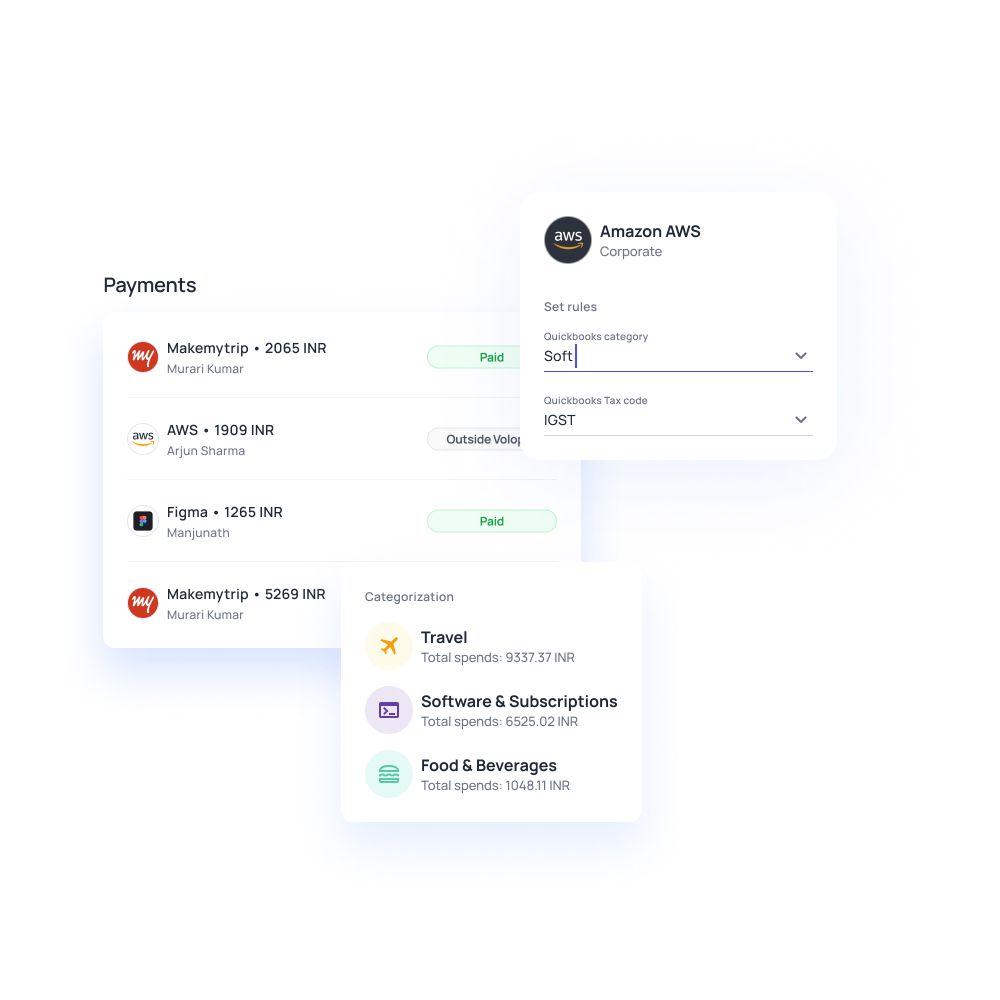

Accounting automation

Automate your entire accounting process with a one-click sync with your accounting software. From the recorded transaction in the ledger to reconciliation in your accounting software, everything is handled by the system. We integrate with industry leaders including Xero, Quickbooks, Deskera, MYOB, Netsuite, and a plethora of others.

Know more about business line of credit

Get to know the different schemes that startups can apply for in order to get collateral-free business loans in India.

Understand what a revolving credit is, its benefits and how it can act as a continuous funding source for your business.

Get to know the common cash flow challenges faced by manufacturing businesses and how to overcome it.

FAQs on business credit

The credit limit for your business is decided by your current credit score and the status of your business documentation. However, only your company's financial history is considered, not your personal credit score or bills. When you apply for credit, you must submit these documents.

You can submit your papers for assessment by our credit team to determine your eligibility for business credit. They'll look over your documentation swiftly and let you know if you are eligible for a credit line. In general, having your company's credit score documents and financial history on hand is necessary for clearance.

You don't need to put up any guarantees or collateral to get a business credit line with Volopay. You would have to with a traditional bank loan. However, if your other documentation is in order, we can provide you a line of credit with no collateral.

Yes, you can seek an increase in your credit line limit at any time. This will be determined by a rise in revenue, expenditures, or any other factor that demonstrates your eligibility for the raise.

Bring Volopay to your business

Get started now