👋 Exciting news! UPI payments are now available in India! Sign up now →

Domestic money transfer in India made quick and hassle-free

Have a variety of payment methods for different merchants? Volopay can replace time-consuming procedures. Consolidate your various spending requirements by using our employee and vendor payment services.

Money will appear in seconds after you send it locally. You can keep track of every rupee that leaves your company with India's fastest domestic money transfers.

Quick and easy money transfers

Volopay's employee vendor payment services allow you to pay within India in a matter of seconds. There are no additional, hidden charges. In just a few clicks, you may pay your local companies and employees, as well as send money.

Volopay also enables users to have a dedicated wallet for QR Pay transactions. You can easily set a limit on the budget for this wallet. Additionally, this feature tracks and records all payments made through the QR Pay system. Payments are categorized into various sections depending on their status, providing a comprehensive overview of all QR transactions.

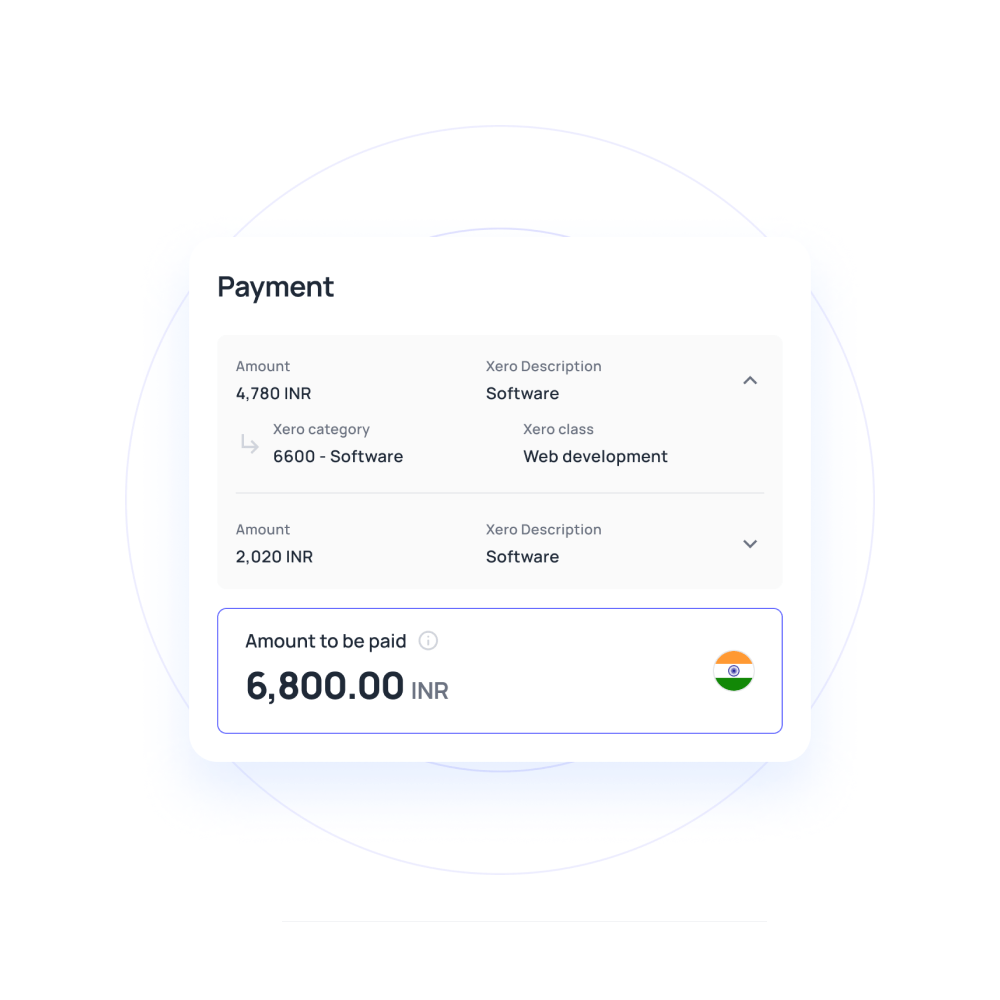

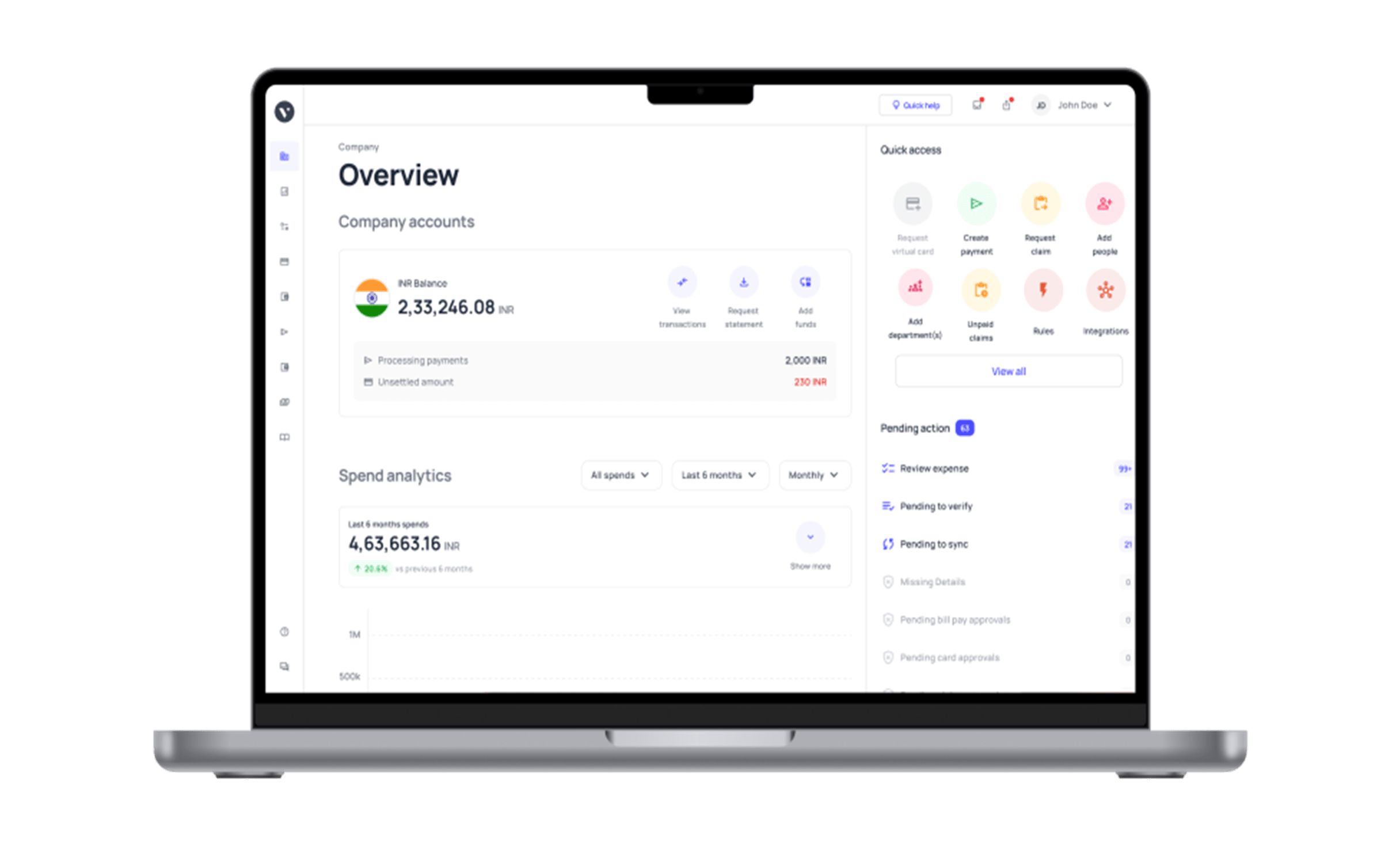

One dashboard to track all expenses

Whether it's our vendor payment services, reimbursement, or payroll, manage and track all transactions on our simple, live dashboard. Get full transparency on all domestic money transfers in India, including who made them, when, where, and why.

On a single platform, you can access all corporate invoices and receipts from anywhere in the world.

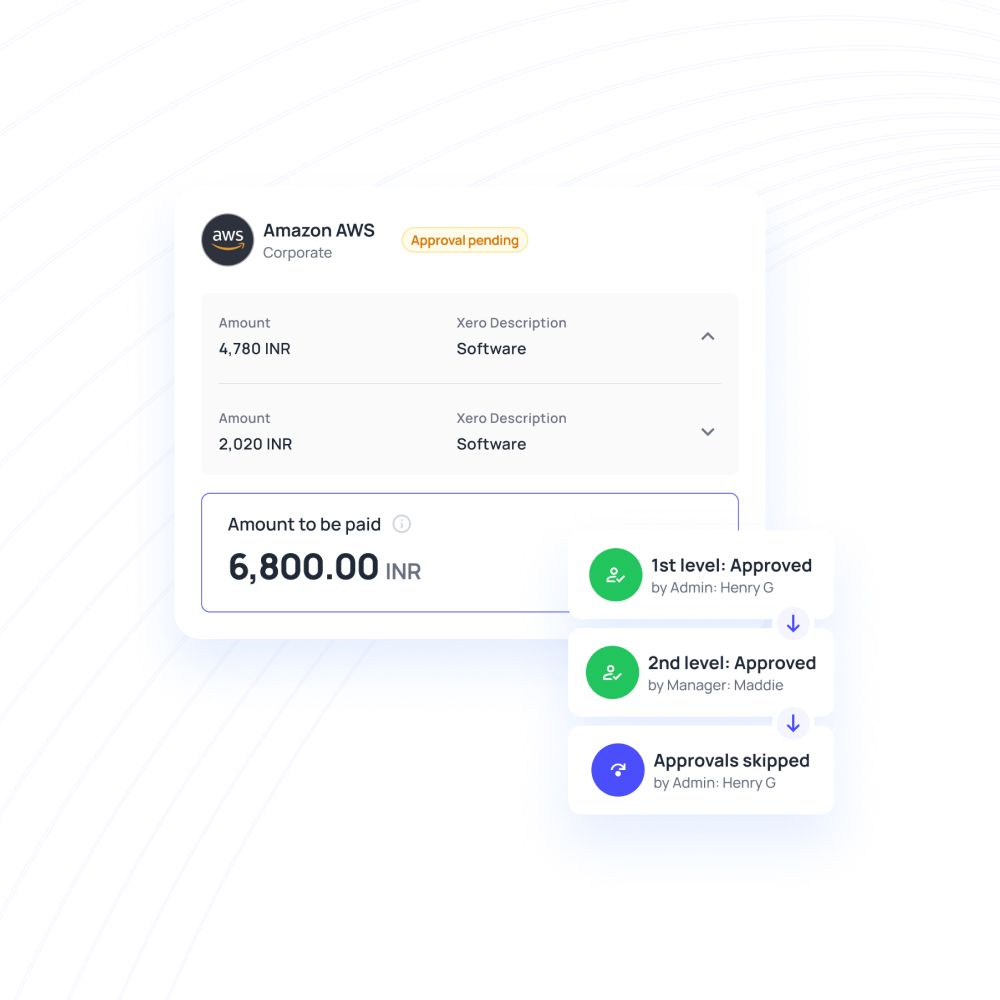

Advanced multi-level approval workflow

For each expense that travels through our system, create multi-level approval protocols.

Assign several approvers at every level and choose from a variety of built-in policies, such as the maker-checker policy, which assures that the expense's maker is never the lone checker.

Create a complex multi-level approval policy for every payment that goes through the platform. Create custom policies as per your company's requirements. Additionally, enable admins to expedite payment processing by bypassing approval policies when appropriate.

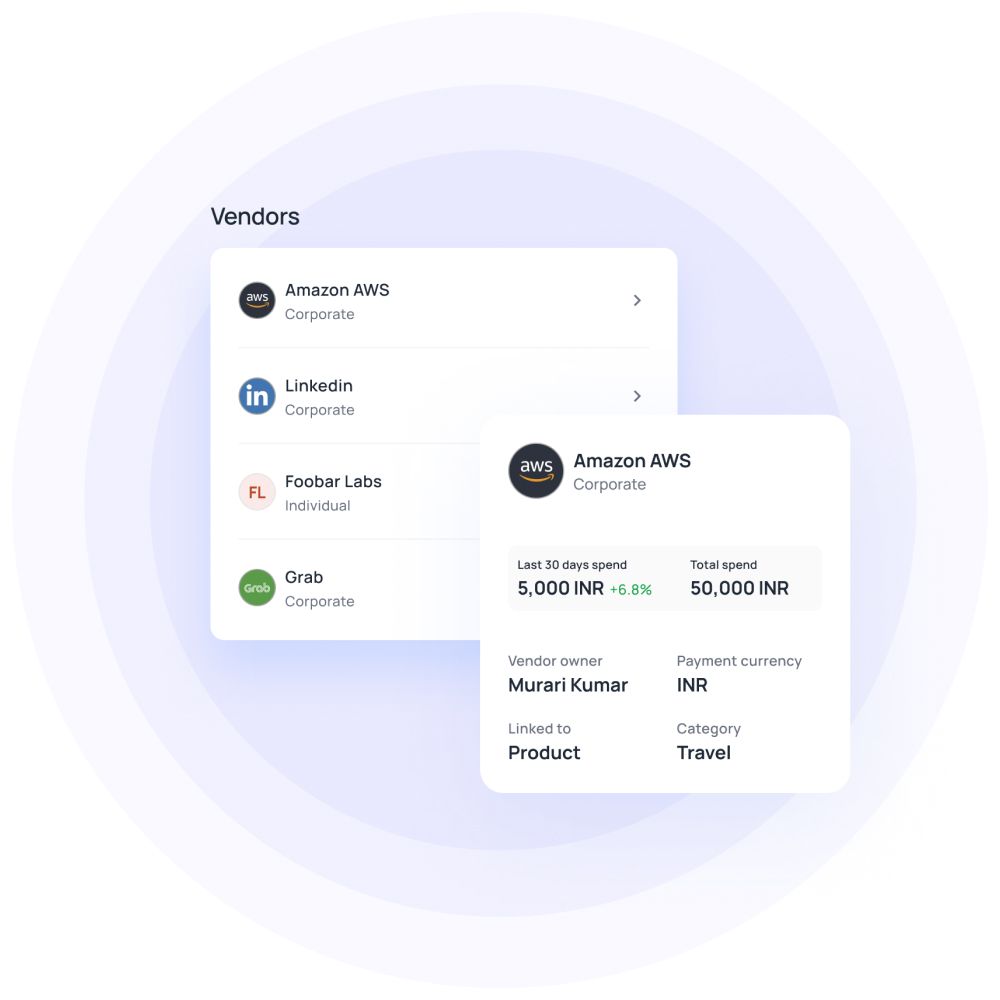

Vendor management made simpler

Manage all your vendors from a single dashboard. Create payments without any hassles and add or remove vendors in just a few clicks. Speed up vendor creation by initially creating the vendor profile and adding bank details later, improving efficiency.

Choose the best business account platforms for simple domestic money transfers in India with Volopay.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our domestic money transfers

Volopay offers a number of services to help streamline the accounts payable process from start to finish. Invoice processing, reimbursement, corporate cards, approvals, and integrated accounting automation are all available on a single platform.

Global business account

Open a multi-currency international business account to store funds in all major currencies. Fees for foreign exchange are far cheaper than those levied by other traditional financial institutions. There are no remittance costs for simple international payments.

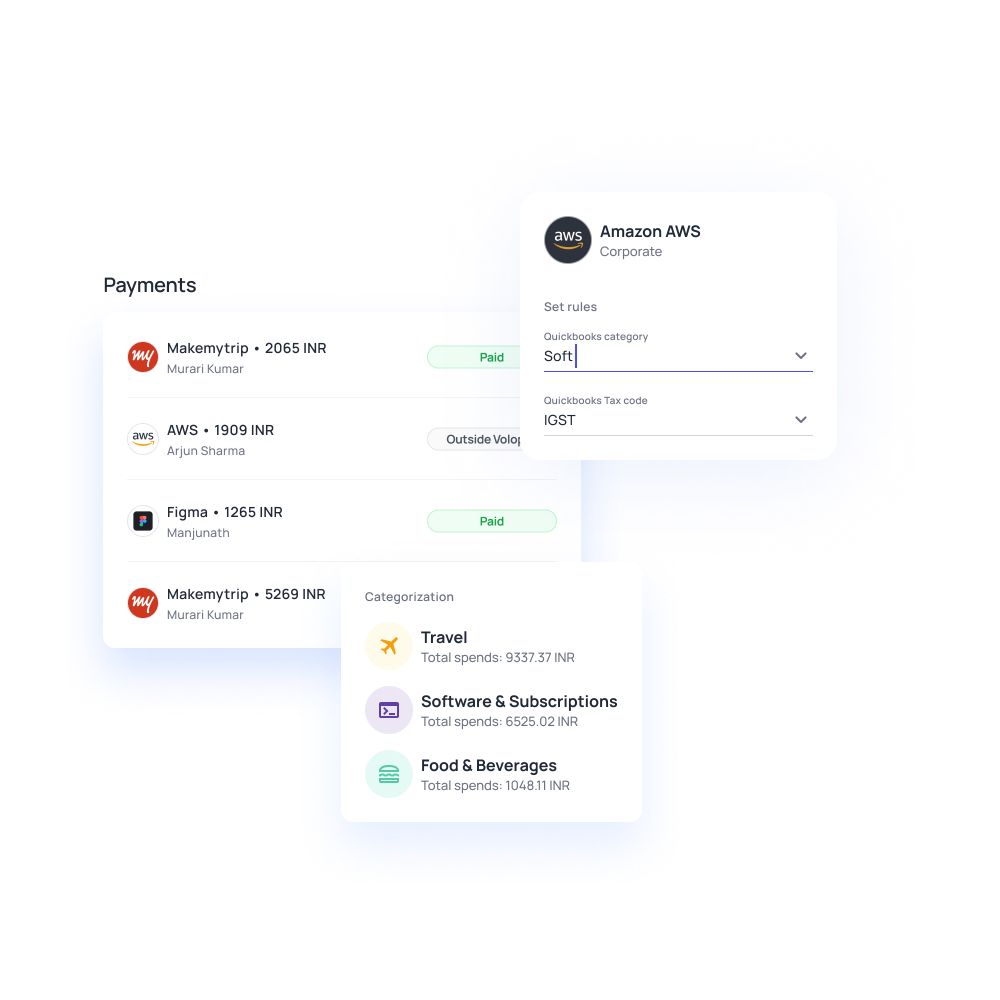

Accounting automation

The world's fastest accounting integrations are right at your fingertips. You can close your books in record time with automated accounting. Volopay works with a variety of accounting software, including Xero, Quickbooks, NetSuite, Deskera, and MYOB.

Vendor payouts

Volopay enables you to pay providers regardless of their location. You can make local and cross-border B2B payments using non-SWIFT and SWIFT alternatives. You may create invoices, schedule payments, and automate the process with our Bill Pay feature. Vendors on the Volopay platform will give you discounts if you pay them in full ahead of time.

Bring Volopay to your business

Get started now

FAQs on domestic money transfer

For greater visibility and reconciliation, Volopay's live dashboard maintains track of each and every money transfer. Rather than going through multiple payment methods and reconciling expenses arbitrarily, Volopay gathers all essential information into every single transaction (bills, invoices, or receipts) to track and categorise spending in a more efficient manner.

When organisations develop with unbridled ambition, why should spending management be any different? Volopay allows an unlimited number of transactions for all domestic money transfers. Pay in bulk or as soon as you receive an invoice to take advantage of super-fast payments with no costs.

Volopay is a perfectly safe and secure form of payment. Volopay does not have access to your e-wallet funds; we are only a one-stop shop for managing your accounts payable procedure from start to finish. To protect your business funds, you can top up your e-wallet, which functions similarly to an escrow account. In addition, we issue VISA business cards that are exceptionally secure because they do not enable direct access to your account or e-wallet funds.