👋 Exciting news! UPI payments are now available in India! Sign up now →

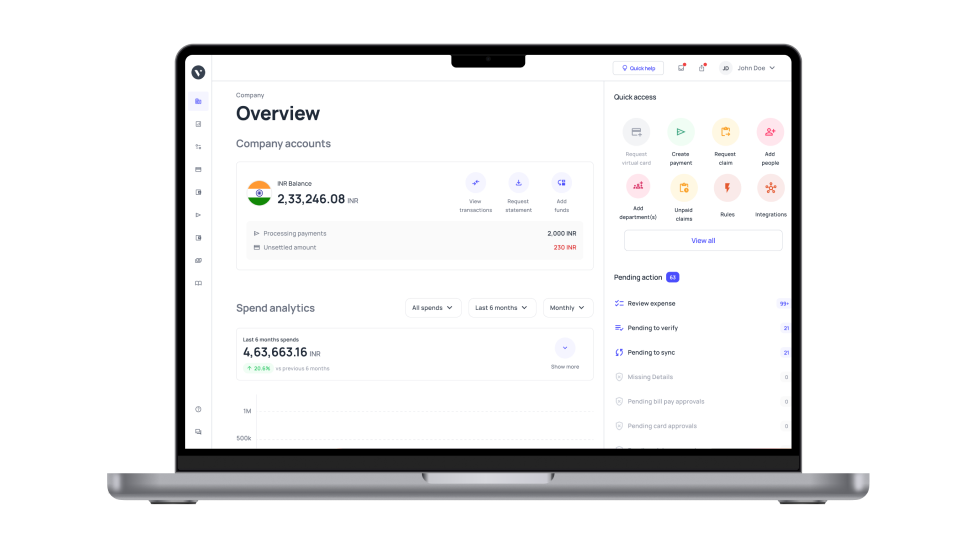

Business prepaid card in India for employee expense management

Give your employees access to company funds with smart spending restrictions by providing them with the best business prepaid cards in India.

Prepaid cards for business expenses help you track money in real-time and reconcile your account in a matter of seconds. Your employees won't have to worry about making business purchases anymore.

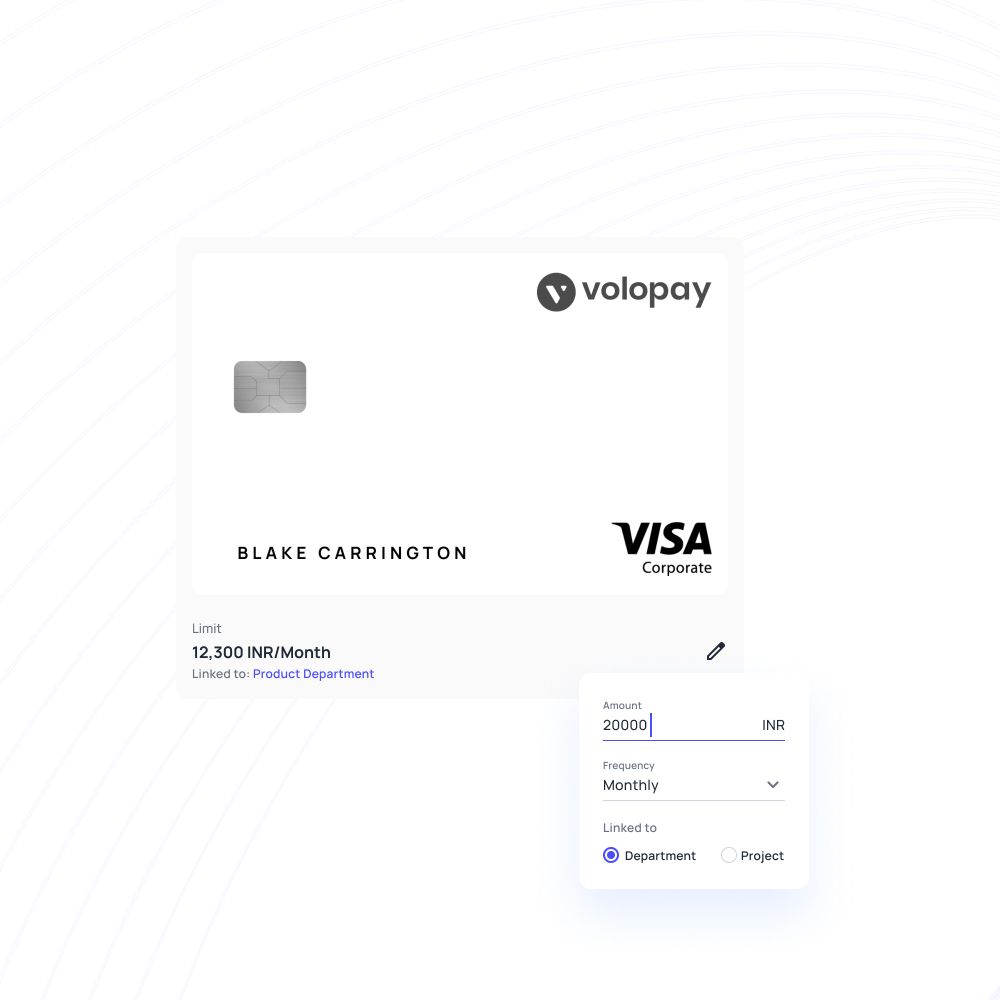

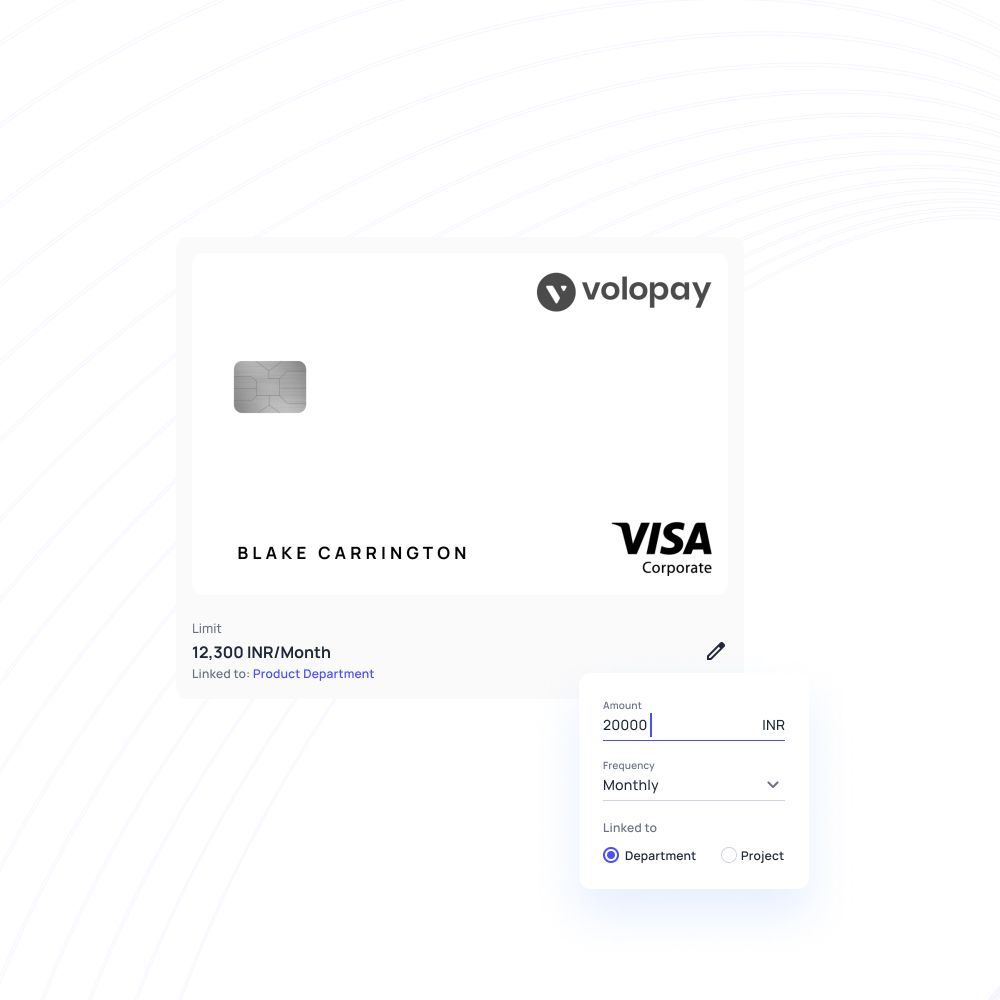

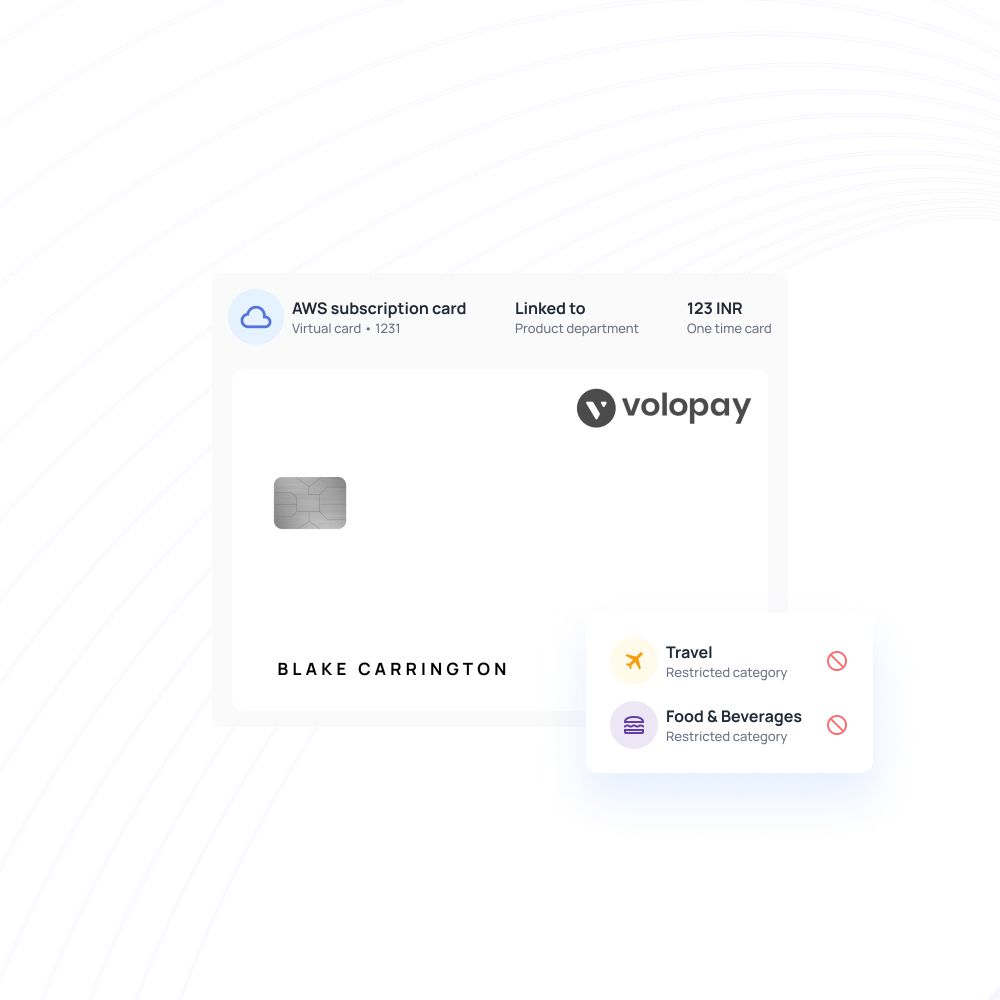

Prepaid cards with built-in spending limits

Prepaid business cards come with built-in spending limit controls to help you make sure that employees don’t overspend the allotted budget.

So employers can load money for the entire year on a corporate prepaid card and set a limit for monthly usage. This way the budget is equally divided throughout the year.

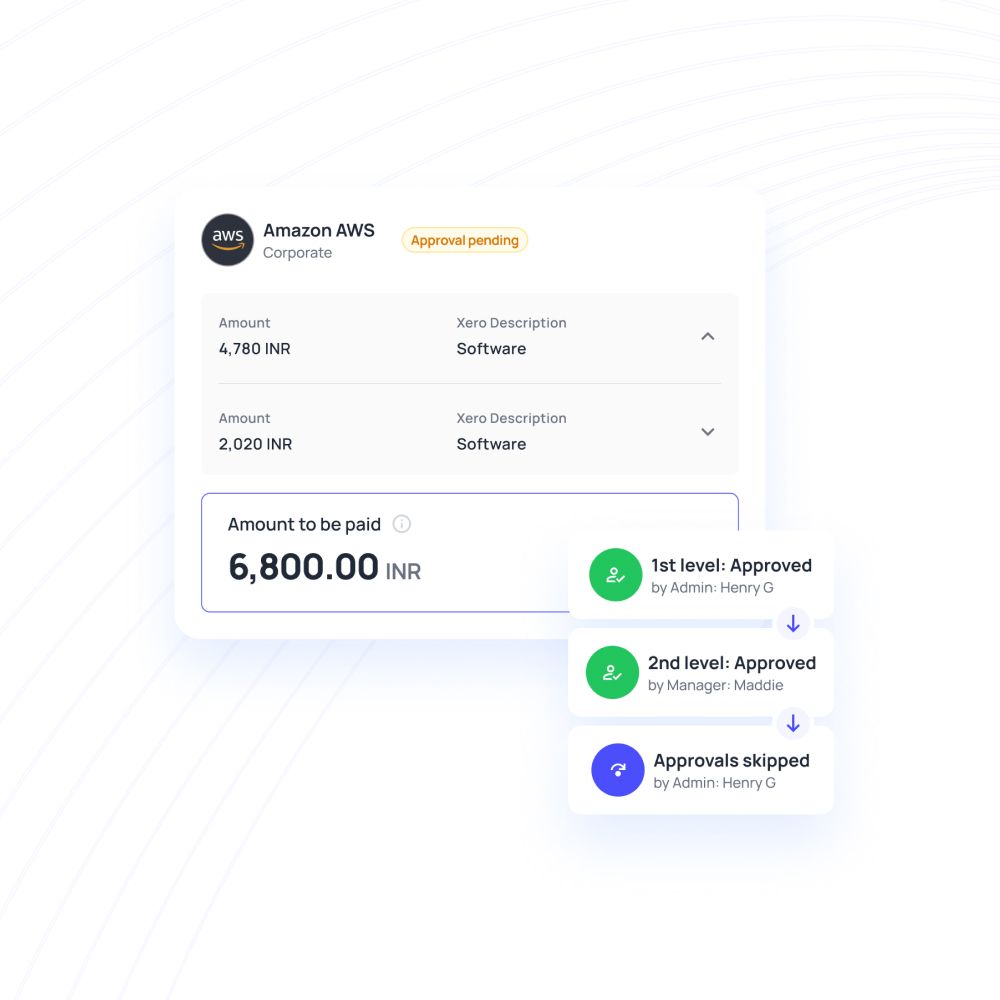

Approvals to manage company spending

Since there are custom controls to restrict overspending there is no chance that there will be out-of-budget expenses.

But in case a need arises for an employee to exceed their spending limit, they can easily do so by requesting additional funds in their prepaid card. This process goes through an approval system where the employee’s approving manager must approve the request for the funds to be transferred.

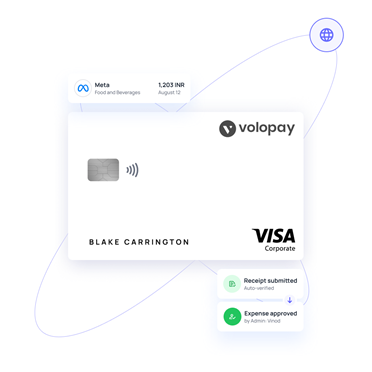

Track expenses in real-time

Volopay prepaid cards are linked to our expense management platform. This allows company admins and card owners to track expenses in real-time.

Each transaction that happens through a Volopay card is instantly recorded on the system under the card ledger so there is complete transparency and visibility of expenses at all times.

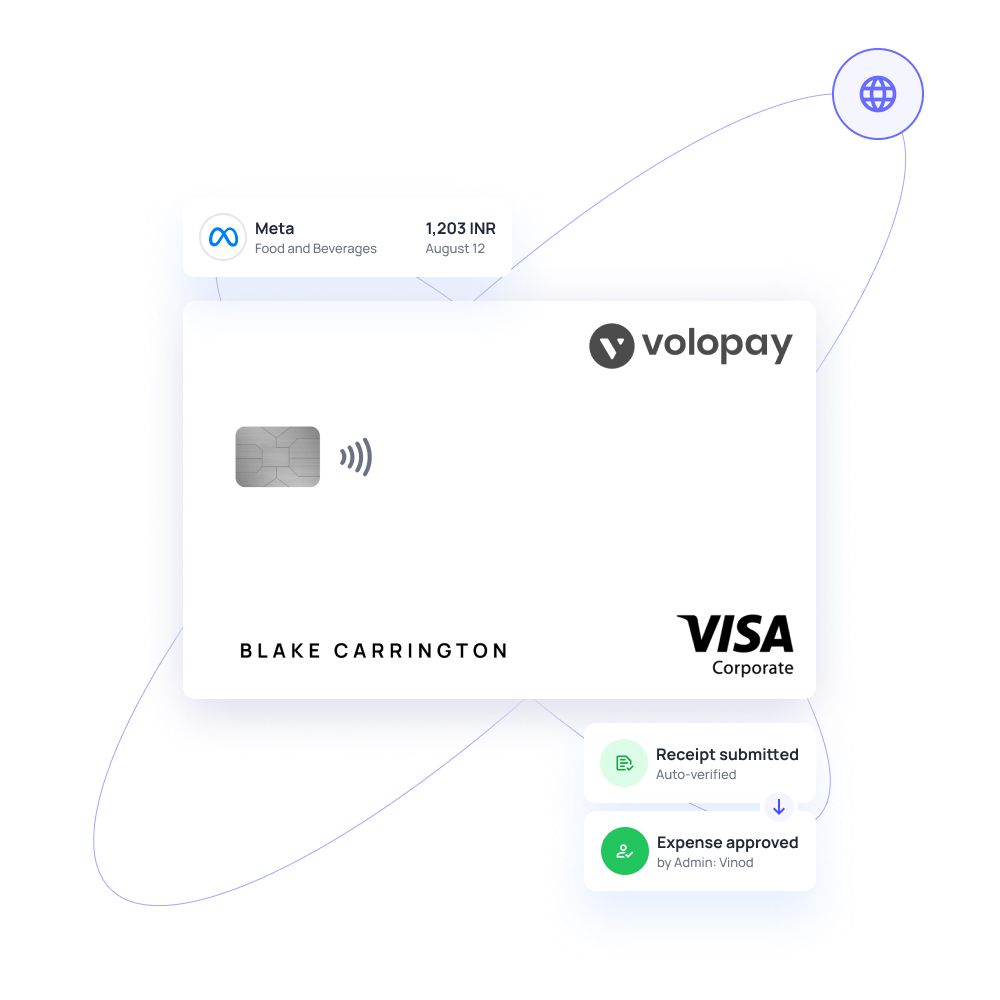

Streamlined international payments

If your business needs to make transactions in another currency to pay a vendor in another country, Volopay’s international corporate cards are your solution. These physical cards are globally accepted, which means that your teams can use them anywhere in the world.

If your employees frequently travel, then these international corporate cards can be used to make travel-related payments and can be swiped at international POS terminals.They can also be used online for payments to global vendors, subscription services, and recurring SaaS fees.

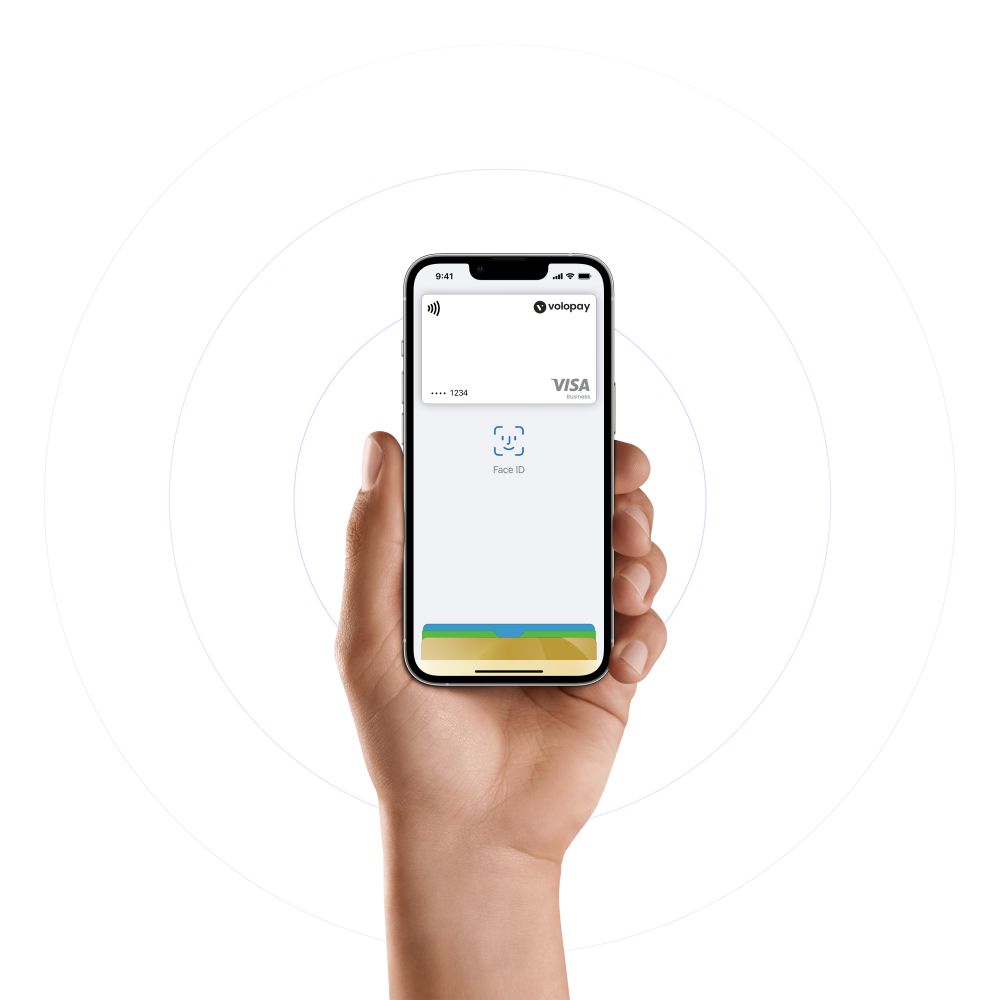

Make business payments easier with UPI

Volopay’s UPI-enabled corporate prepaid cards simplify business payments with instant activation, quick payments, and complete real-time visibility of all transactions. Track all of your expenses on a single dashboard and make safe payments straight from your smartphone.

Every transaction is recorded instantly, giving you complete financial transparency at all times. Set spending limits, manage budgets, and stay in control of your company’s expenses effortlessly. With advanced security and universal merchant compatibility, your payments are always secure and hassle-free.

Get the perfect prepaid card for your business!

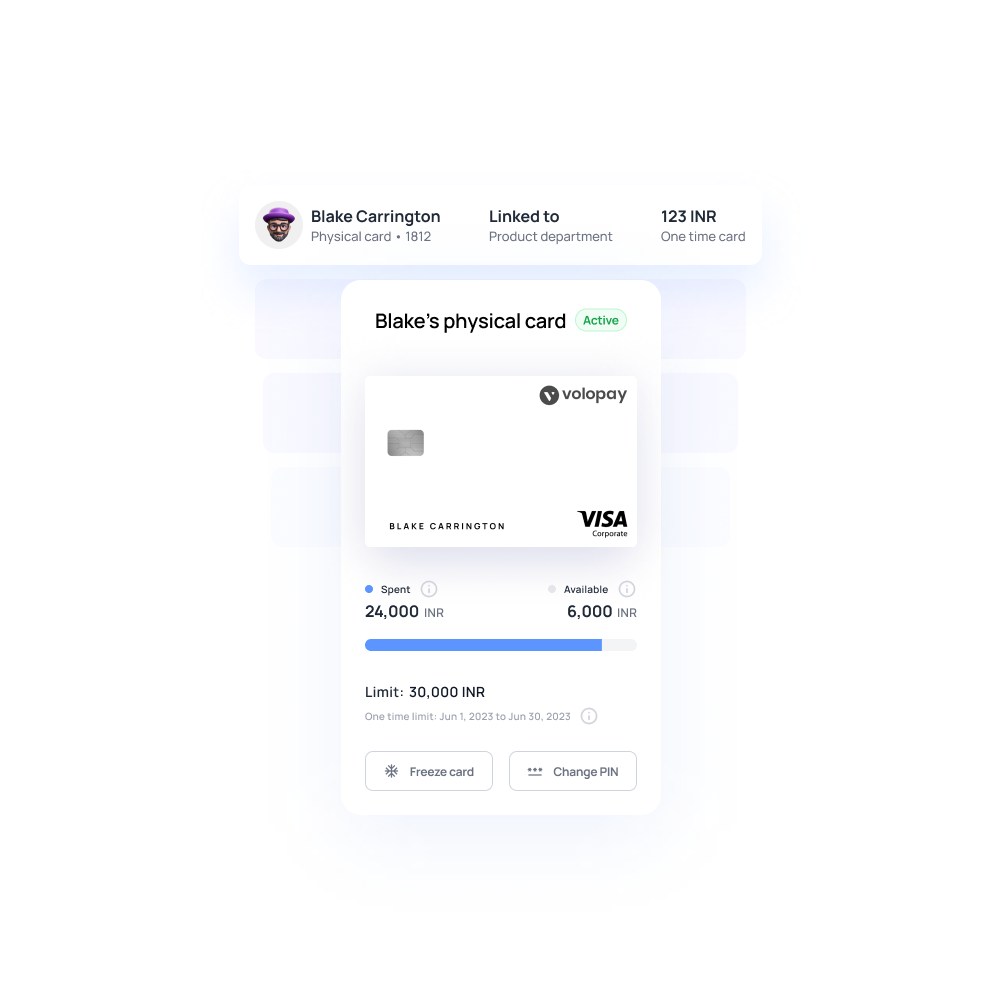

Enhanced security

Apart from the custom spending limit controls, Volopay prepaid business cards also come with features such as temporary freezing or permanent blocking. This ensures that in case the card is stolen or lost, your funds will be kept safe at all times.

In case a card is lost or stolen, you can immediately use the Volopay web or mobile app to freeze the card until it’s found or permanently block it if you think it cannot be recovered anymore.

Easy to load and easy to use

Loading money into each card is extremely simple. The finance team member, admin, or department manager can easily load money into a card through our platform. The corporate prepaid cards can be easily used for online transactions as well as physical POS terminal payments.

If your employees find themselves in need of instant cards or funds, you can create unlimited virtual business prepaid cards on the platform to manage all online expenses. These cards come with the same degree of control and security as physical cards.

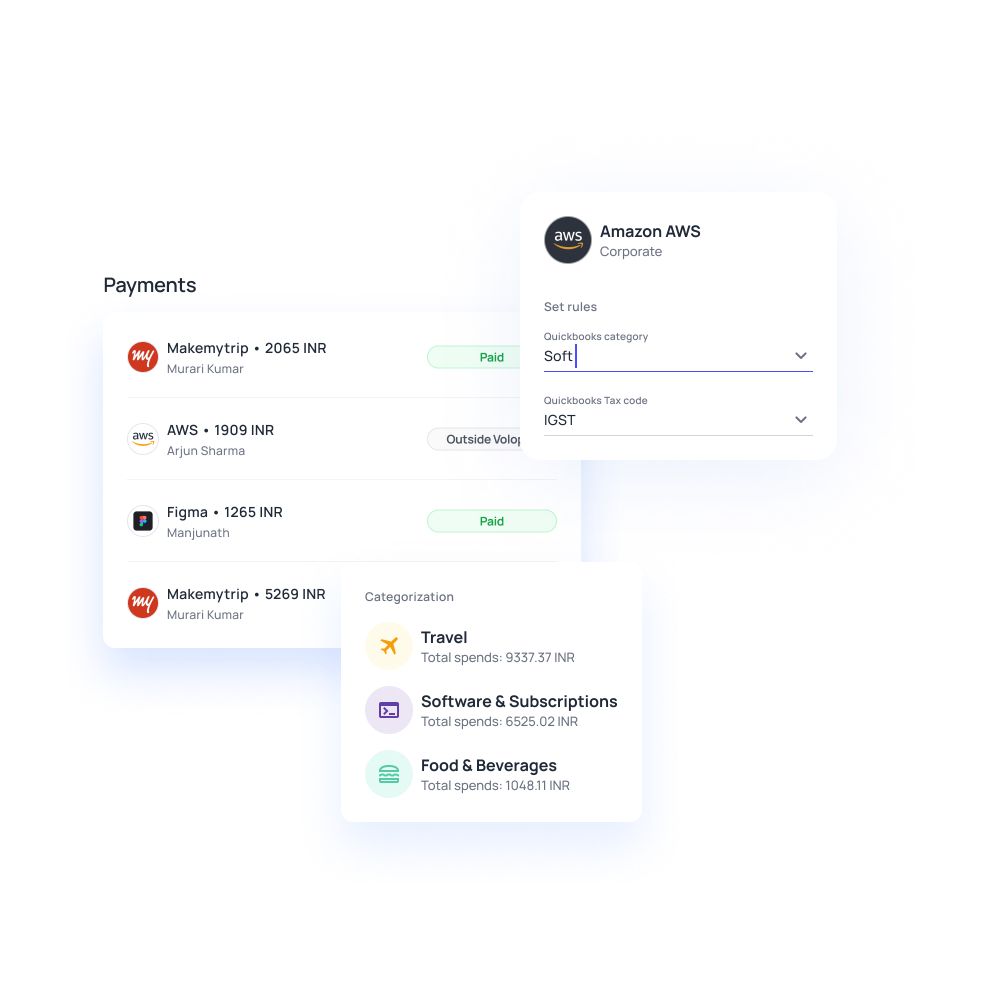

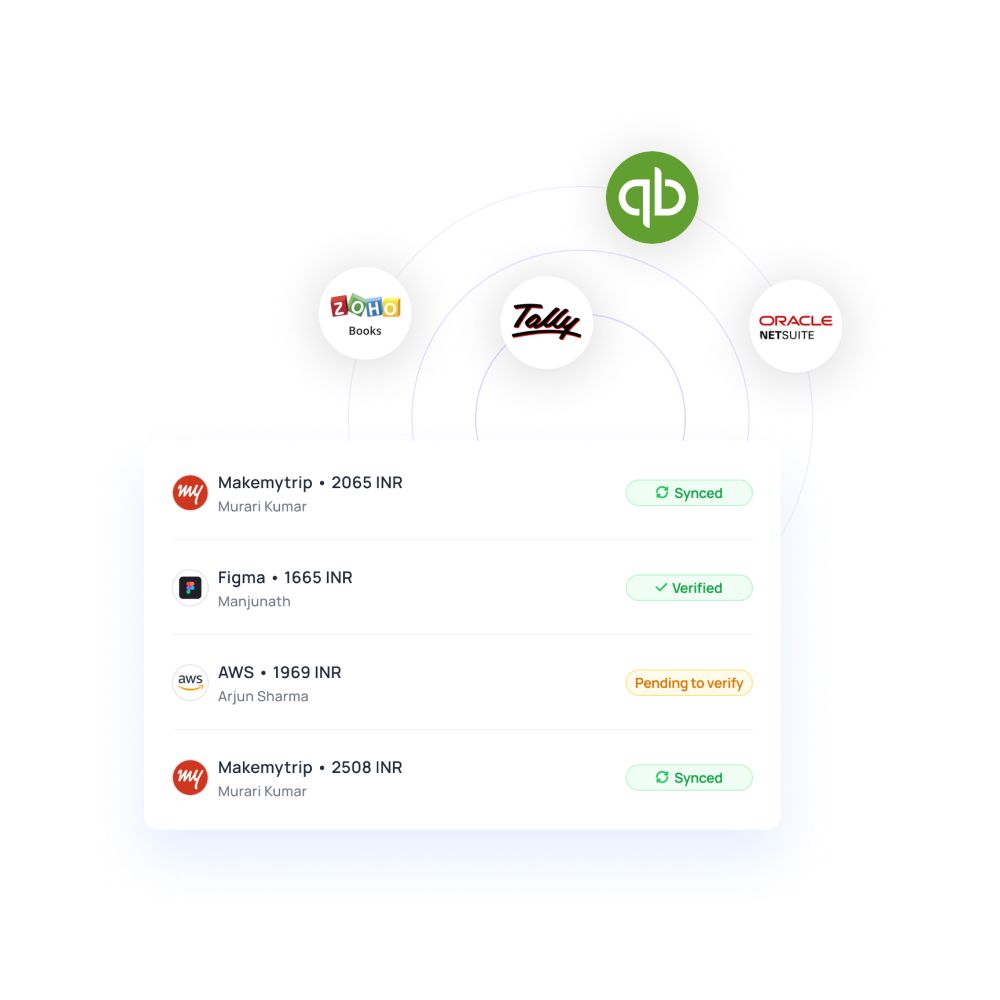

Easy integration with accounting systems

Volopay’s platform has native integrations with some of the leading accounting software platforms such as Netsuite, Xero, Quickbooks, MYOB, Tally, Zoho Books, Deskera, and more! This ensures that all your business expense data is easily synced and exported into your accounting tool automatically.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Your role, your card, your benefits: Tailored for every professional

Volopay’s prepaid business cards give CFOs real-time expense tracking, enhancing financial control, transparency, and overall expense management efficiency.

With business prepaid cards, CFOs can set department-specific spending limits, ensuring budget control, preventing overspending, and upholding financial discipline.

Volopay’s business prepaid cards provide CFOs with comprehensive insights into spending patterns, supporting more accurate budgeting decisions and long-term financial planning to drive smarter business strategies.

Volopay’s prepaid cards allow CTOs to control spending on tech purchases, ensuring budget adherence and providing visibility into how funds are allocated for technology needs.

With prepaid cards, CTOs can easily track expenses for software subscriptions, ensuring timely payments while maintaining control over recurring IT costs.

Volopay’s prepaid cards simplify vendor payments for IT services, streamlining processes and allowing CTOs to manage multiple vendor transactions with greater efficiency and accuracy.

Volopay’s prepaid cards automate reconciliation for accountants, significantly reducing manual errors and ensuring smoother financial processes, saving time and increasing accuracy in transaction tracking.

With prepaid cards, accountants have access to real-time reports, enabling accurate financial records and better decision-making based on up-to-date data.

Volopay’s prepaid cards offer simplified audit trails, ensuring compliance by providing detailed, traceable transaction histories that make audits easier and more efficient.

Volopay’s business prepaid cards help marketing managers manage campaign budgets by setting custom spending limits, ensuring cost control while driving successful marketing initiatives.

With business prepaid cards, marketing managers can make instant payments to vendors, streamlining processes and avoiding delays in campaign execution.

Volopay’s business prepaid cards provide real-time tracking and detailed insights into marketing expenses, giving managers full visibility and precise control over campaign spending for better budget management.

Volopay’s business prepaid cards allow HR managers to monitor employee-related expenses, such as travel and training, ensuring better oversight and budget control across the organization.

With corporate prepaid cards, HR managers can set spending limits for recruitment activities, managing costs effectively while staying within the hiring budget.

Volopay’s business prepaid cards streamline the approval process for employee reimbursements, making it faster, more efficient, and significantly improving overall operational efficiency and accuracy.

Why do you need a prepaid business card?

Travel expenses

Many employees who need to travel a lot for their work need business prepaid cards so that they can manage travel expenses, including airfare, hotel, and rental car expenses.

Petty cash

Volopay cards are a great replacement for petty cash. With cards, there is complete transparency of all transactions and no chance of leakage or wastage of money.

Employee expenses

Volopay cards are a great way to manage employee expenses such as food and entertainment expenses. They let each employee have the flexibility to make spending choices while still giving the company control over the overall expenses.

Purchasing and procurement

Prepaid cards help the operations team easily purchase and procure the needed raw materials for production. Corporate prepaid cards enable faster business operations without any halts due to the unavailability of funds.

Online purchases

Many companies have online payments to be made such as software subscriptions, office supplies, and marketing materials. All of these expenses can be easily paid for and handled through prepaid business cards.

One-time purchases

These corporate prepaid cards are also great for any kind of one-time business purchases such as festival gifts for employees, office repairs, etc. A vendor can also be easily paid for their services using these cards.

Prepaid cards to help streamline your expense reporting process

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Features that make Volopay cards ideal for startups and enterprises

1. Prepaid card security

Each Volopay corporate card comes with security features like card freezing and blocking. This ensures that in case the card is stolen or lost, your funds will be kept safe at all times.

2. Superior support

Every business is appointed a customer success representative to onboard and set up their account, clarify any doubts or queries, & troubleshoot problems.

3. Unlimited virtual cards

You can create unlimited virtual business prepaid cards on the platform to manage all online expenses. These cards come with a wide range of features that are provided specifically for the purpose of control and efficiency.

4. No hidden fees

There are no hidden costs or extra fees involved in using the Volopay cards. Any kind of fee or charge will always be mentioned clearly before making any payments.

5. Instant card issuing

Once your Volopay account is created ordering a card is as easy as a click of a button. You simply have to fill in the necessary details and you will receive the card within a few days.

6. Market leader

Established in 2020, Volopay has already expanded to four markets including Singapore, Australia, India, and Indonesia.

7. Maximum control

Each card can be set with its own custom spending limit to ensure there is no overspending. This can be controlled from both the mobile app and our web app.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our prepaid cards

Volopay is a centralized business financial control center that combines innovative solutions such as smart corporate cards, AP automation, efficient automated accounting, approvals, and employee reimbursements.

Global corporate card

Make use of Volopay global corporate cards to manage international transactions with ease, offering features like worldwide acceptance, seamless expense tracking, and effortless subscription management, all with no top-up limits.

Real-time expense reporting

Make a system for keeping track of your spending that allows you to see where, when, and why each item was purchased.

Custom filters can be used to create reports that only show information that is relevant to data collection and analysis. Forecasting and making preventative financial decisions are now much easier.

Multi-level approvals

To ensure that no transaction is missed or goes against company policy, you can set five layers of approval.

To handle all employee expenditures and payments, all fund requests are forwarded to the company policy and approval algorithms.

Subscription management

Create payments and schedule them using our virtual cards for subscriptions to avoid late payments and service interruptions. Real-time tracking can help you avoid making numerous payments.

Block and freeze options also protect you from spending for SaaS models that you no longer use.

Accounting automation

Accounting software has progressed. Our system integrates with the most widely used accounting software in the world, allowing you to sync your data in real time. You can plug and play your spending from card swipe to closed books with tools like Xero, Quickbooks, Netsuite, Deskera, and others.

They loved Volopay, you will too

Explore more about business prepaid cards

Explore the concept of prepaid cards, understand how they function and their practical uses cases for businesses.

Analyze India's top prepaid card options. Discover why Volopay offers superior features and stands as the optimal choice for businesses.

Bring Volopay to your business

Get started now

FAQs on physical cards

A business prepaid card is a type of payment card that can be loaded with a certain amount of money in it. No money apart from the amount that was loaded onto this card can be spent through it.

Yes, most prepaid cards let you withdraw cash if you use them at an ATM. Depending on the card provider, they might charge you a certain fee to do so.

Yes, you can apply for physical cards if you have a Volopay account. To order actual cards, go to the physical cards section of your dashboard and select "Order." You'll be asked for information about the employee who will receive the physical card.

All physical cards can have their own approval policy, spend restriction, or custom reload limit. When you first set up the card, you can specify this restriction. You can also designate who is in charge of approving employee requests to change this restriction.

You must create an account and onboard with a bank or a modern FinTech company that offers prepaid cards for businesses.

A prepaid card and a debit card are very similar in the way they function except that a debit card is connected to a checking/bank account whereas a prepaid card isn’t. The answer to which card is better depends on the provider you choose and your business needs.

All card expenses are updated in real time in the general ledger. When a payment is made, it is immediately recorded. If you wish to review the spending on a certain card, you can use the ledger filters to set precise filters.

Native integrations are available for Xero, Deskera, Netsuite, and Quickbooks. We also have export options for MYOB and Talenox. You can design an export template for your card ledger, export the files, and import them into your accounting program without having to manually edit any data.

Volopay uses modern technology and infrastructure to ensure that all our client's important and confidential information is safe.

Volopay is ISO 27001 certified, as well as PCI DSS certified which means we're fully compliant and verified in our standards of information security management.