Business credit card vs debit card: Which one to choose for business?

Long gone are the days when businesses sent out checks and physical cash to make payments. Whether to use business debit cards or business credit card has always been a debate among new business owners.

While business debit cards are designated for company usage, they are not widely used by small and medium-sized businesses. They find business credit cards more reliable and versatile for online transactions.

Furthermore, financial institutions have special business card programs where they provide business credit cards for employees to manage their business expenses. So, what works best for business spending intents? We have compared business credit card vs debit card so that you can choose the right one.

Overview of business credit card vs debit card

Both business credit card vs debit card is intended for making business transactions except for a few differences in the way they work. Business debit cards are cards issued by banks where you maintain your business checking account and store your entire business funds.

When you create an account in a traditional bank to store your business finances, they create a business checking account to deposit them. Business debit cards are distributed to access these funds for your everyday needs. Any transaction you make through this will be deducted from your main account.

Since you are spending your money, you don’t have to worry about repaying this at the end of the month. Business credit cards let you borrow money to pay your business expenses and collect it back at the end of the billing period.

They are easy to obtain and use and come with limits that suit your transactional capabilities. Credit card programs can be compared to a short-term loan that’s furnished on a monthly basis.

Both banks and private institutions offer business credit cards after assessing your credit history, financial statements, and other proof. If you don’t pay the full amount on time, interest will be accrued along with the remaining balance.

Disadvantages of using business debit cards

Here are the reasons why businesses don’t prefer debit cards and run towards business credit cards for small businesses.

1. They are expensive to use

Business debit cards aren’t free to use. You will be charged by the bank on account of the following occasions such as local/international cash withdrawal, overstepping daily/monthly limits of transactions, exhausting minimum balance, and so on.

If you initiate a transaction when your account is low on balance, it can attract an overdraft fee as the bank has fulfilled the transaction by paying the required amount.

2. Your money can be at risk

Another main reason why businesses lean away from business debit cards is safety as the debit card is directly linked to the savings account.

If you have lost it or someone stole the card details or duped your signature, your whole money can be at stake. If you block your account, you will have to wait till your next card arrives to be able to access funds online.

Before you use debit cards for business payments, you should understand that they hold no liability to protect your resources against unauthorized transactions.

Getting assistance from the bank or an insurance cover in case of any fraudulent activity is a less likely occurrence.

3. Obstruction to building your credit history

When you use business credit cards, borrow money and repay them on time, you make way for a positive credit score. This score will act as a credibility factor when you have to request financial assistance in the future.

Since business debit cards let you use your own money, this affects your credit score in no way.

4. No exciting offers or rewards

Credit card programs offer many rewards to businesses for every use. You get a certain percentage of cashback loaded to your account or discounts for purchases from well-known suppliers.

On the other hand, business debit cards have less scope in this area and you gain nothing from using them other than an interest-free spending authority.

Why is a business credit card better than a debit card?

1. Separate your personal expenses from business expenses

And set apart your business expenses from your financial reserves. Your checking account can remain undisturbed getting itself accumulated with your revenue when you handle your expenses through an independent credit card.

Also, By getting a business credit card, you get to have your own positive credit score and reduce the chances of having to produce your personal credit score.

2. Accounting simplified

With business credit cards, you get monthly statements when your bill is due. That bill would sum up your entire business expenses of the month making it easy for the accounting team to track.

Many business credit cards provide access to their online platforms or applications for account maintenance purposes. This neat, organized spending documentation can be used for taxation and auditing reasons too.

3. Push your cash flow limits

Many businesses tend to shelve their executions due to the lack of cash flow. Lack of additional funding can stand in the way of your business functions.

Having a credit card can provide you with additional funds every month that you can repay at a convenient time.

Business credit cards for small businesses offer a short grace period to extend the billing cycle and pay comfortably. You can tackle your unexpected and unmanageable expenses with this additional credit and repay after making returns.

4. Best rewards and servicing

Business credit cards for employees offer discounts for bookings and purchases on certain sites. With every usage, many credit card programs guarantee cashbacks and redeemable points in future transactions.

They also offer attractive signup bonuses that interest business users. If you meticulously spend, you can earn a little through your spending from business credit cards as well.

Business credit card users always get the best and unparalleled customer service and experience as they generate revenue for financial institutions. Any concerns they have will be taken care of instantly and support is available 24/7.

5. Theft and fraud protection

Unlike business debit cards, business credit cards offer theft protection to your money. When you identify an unauthorized purchase through your card, you can just cancel, freeze, or block the card and move on.

As the card doesn’t store your money, the only security threat you can be worried about is illicit and pirated usage by someone else other than your company users.

If you have paid through your credit card to a vendor and they don’t deliver your goods, you can address the dispute through the card provider and get back the used credit.

6. Transparency and visibility on spend management

Companies who use manual reimbursement steps have no control over how much their employees spend and what they spend it on.

It also takes time and wastes your company’s money on undue employee expenses. In contrast, when companies empower by offering business credit cards for employees, they can assign limits to spending and monitor it as well.

Why choose Volopay’s corporate cards?

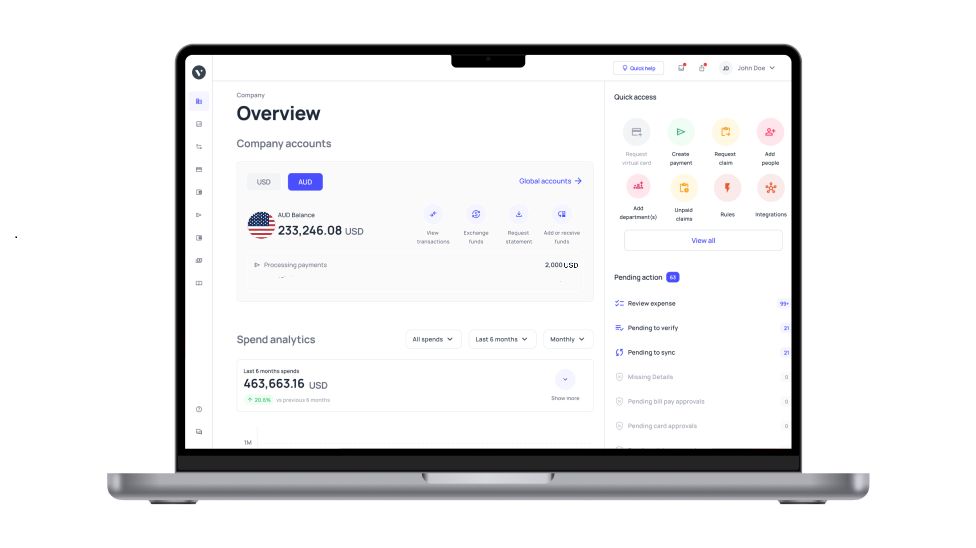

Volopay provides both virtual and physical cards to fuel your employees’ and teams’ expenses. You can create unlimited virtual cards and assign them to different teams, projects, or employees.

Each corporate card has a specific card detail that can be used for online and subscription platforms. You can use this as travel corporate credit cards for employees. To extend the limits of the card, approvals can be set.

To sum up, corporate credit cards are superior to debit cards in many ways. Using flexible card management platforms like Volopay can take your spending control to new heights. Hope this on comparison of business credit card vs debit card has given you better clarity on what to choose for your business.