Business credit card vs. Corporate card - Key differences

Know the difference between corporate cards and business credit cards. Choose the better card for your business by analyzing the pros and cons of each of the digital cards.

What are business credit cards?

Business credit cards are cards issued to businesses (by banks) for carrying out their activities. These cards come with special privileges to help businesses manage and declutter their finance activities through a single card. To explore top-rated options that align with your business needs, see our guide on the best company credit card.

Employee credit cards are the new way to empower employees to make on-the-go business purchases and business payments, all via the company’s funding. Having these cards helps employees and management escape the complex and time-consuming reimbursement process.

Being a digital tool, this method doesn’t call for creating manual expense reports. Employee credit cards help build a convincing credit score that allows businesses to avail easy loans.

Benefits of business credit cards

Business credit cards deployed to employees yield a multitude of benefits to the workforce and the management.

Building your credit score

Credit cards were created because of their inherent quality of building a credit score. So, credit cards help businesses and individuals establish a good credit rating in any form.

Before any lending institution grants business credit, their previous record of loan and repayment is thoroughly scrutinized. A solid credit history pushes organizations as a priority, and loan sanctioning becomes swifter. The timely refund of the amount and sound credit management also help potential investors build confidence in the company’s activities.

Easy payments and purchases

Having easy money options for employees enable them to make instant purchases for business supplies or other essentials. This way, they are not constrained by any limit or budgetary controls. Though these cards have a maximum spend limit, it's usually higher than other options available and can be easily modified according to the employee’s requirements. These cards give complete autonomy to card owners to make payments on behalf of the company.

Simplified expense management

The credit card system works on the wheels of automation and AI (Artificial Intelligence). Being a completely digital tool, manual intervention in any process is minimal. Every task is carefully designed to make functions more accessible and efficient, from issuing cards to making payments.

The business credit card software is a multi-functional platform, where bills are easily uploaded, expense reports are instantly generated, and expense recognition takes place like never before. Any manual tasks are almost negligible while using this option.

Cash flow management

The monthly statements give out a detailed description of the payouts done by each employee card. This, in turn, helps management infer the employees' spending habits. Accordingly, the departments or areas where more funds are required can be identified.

Rewards

Business credit card companies seek to give their clients lucrative rewards or cashbacks for using their services. This enables them to increase their customer base. The rewards can include cashbacks, discount coupons, brand vouchers, air miles, etc.

Looking for corporate cards to manage your employee expenses?

Corporate cards vs business credit cards

- Budgetary controls

- Issuing body

- Costs

- Credit score affect

Disadvantages of business credit cards

The biggest sting in the tail of the business credit card option is the huge interest rate and other hidden charges. Apart from the usual interest charges, annual fees, transfer fees, and credit card issuing fees are enough to burn the pocket.

Employees with business credit cards can sometimes outsmart the management by making personal purchases with the company credit card. Their dishonesty might not get reflected in the bank statement, but such prolonged behavior might cost huge bucks to the company.

Business Credit cards allow customers to use bank funds for purchasing supplies and other items. Employees can misuse these funds to avail costlier options than required. As there is no budgetary constraint on any of the cards, employees can purchase items that are not necessary by any means.

Credit cards are more vulnerable to fraud. Credit card skimming can take place on any card and cause a considerable threat to the company’s funds.

Non-repayment or late payment of the funds damage the credit score heavily. And since the credit card does not belong to any individual but the company, a low credit rating affects the goodwill of the company and investor confidence.

Choosing reliable corporate card for your business

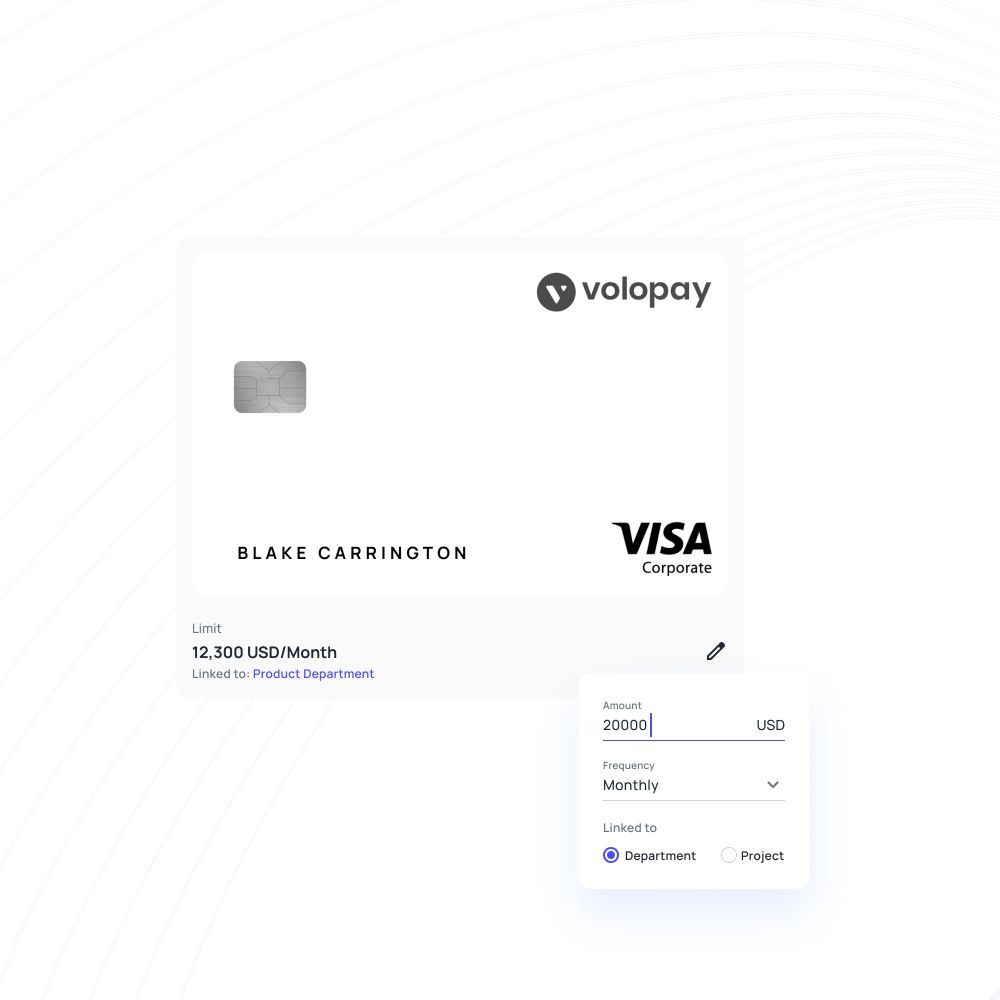

Corporate cards are company-issued cards to the employees. Unlike credit cards, these cards do not come with a credit; rather, admins allocate funds to each card according to the employee requirement.

Corporate cards are linked to specific budgets and have a limit. These cards come with real-time tracking and offer intuitive, data-driven spend analytics. Having individual card expense reports helps to infer each employee's spending behavior.

Related pages to corporate credit cards

Understand the key differences between business credit cards and corporate credit cards. Learn which is best for your company's structure, liability needs, and financial goals.

Business credit card vs. debit card: Discover the fundamental distinctions in spending, credit building, and risk to choose the best option for your business.

Credit card vs. charge card for business: Learn the core differences in payment terms, spending limits, and financial flexibility to make the right choice for your company.