Physical cards vs virtual cards: What's the differences?

Choose amongst physical cards or virtual cards & simply use Volopay for a seamless corporate card culture. Corporate cards are the payment facilitator issued to employees on behalf of the company.

The company gives these cards to its employees for conducting a range of business activities, right from payments to travel bookings. Corporates rely heavily on such cards owing to their benefits like spending monitors, budgetary controls, and secured networking.

What are physical cards and how do they work?

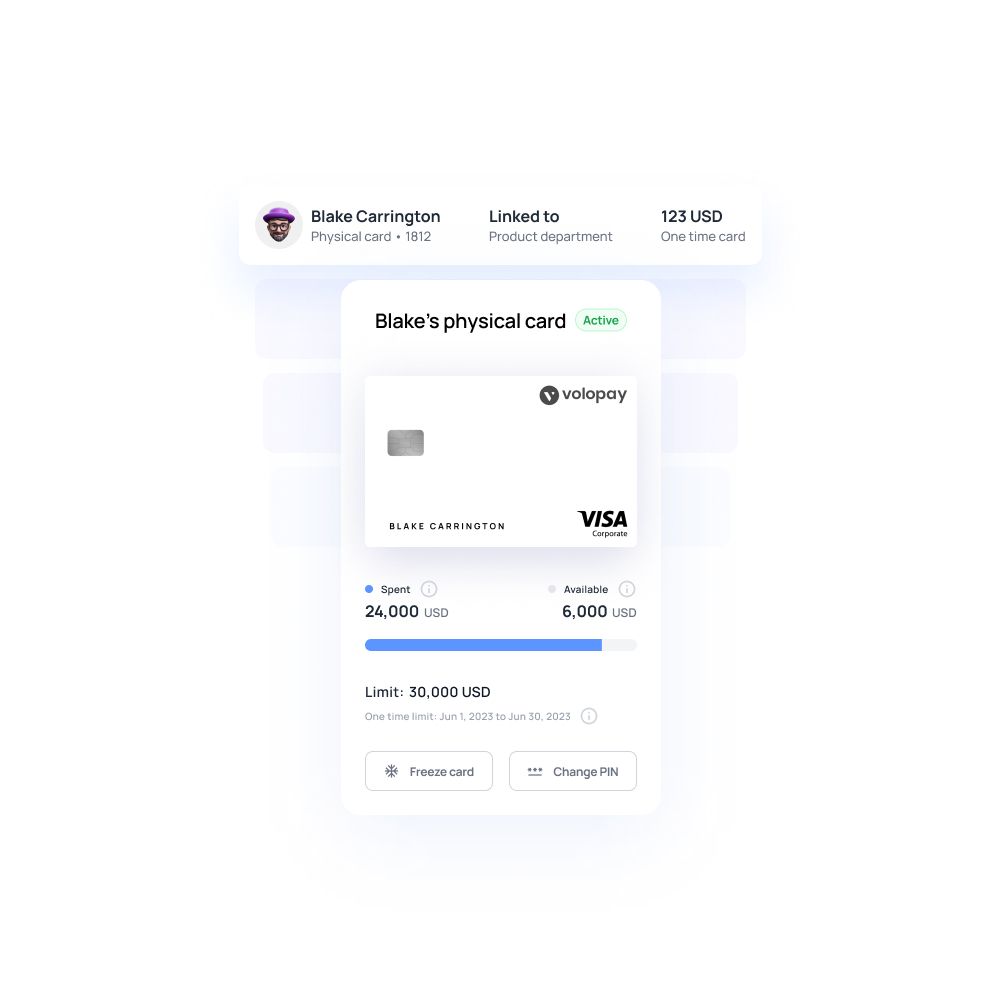

Physical cards are employee cards with a 16-digit number, an expiration date, and CVV. These cards aim to make a significant shift from reimbursements to instant payments.

Employees use these cards to make business purchases, vendor payments, and leverage benefits while undertaking business trips. Corporate cards are centrally linked to an expense management system.

What are virtual cards and why are they important for businesses?

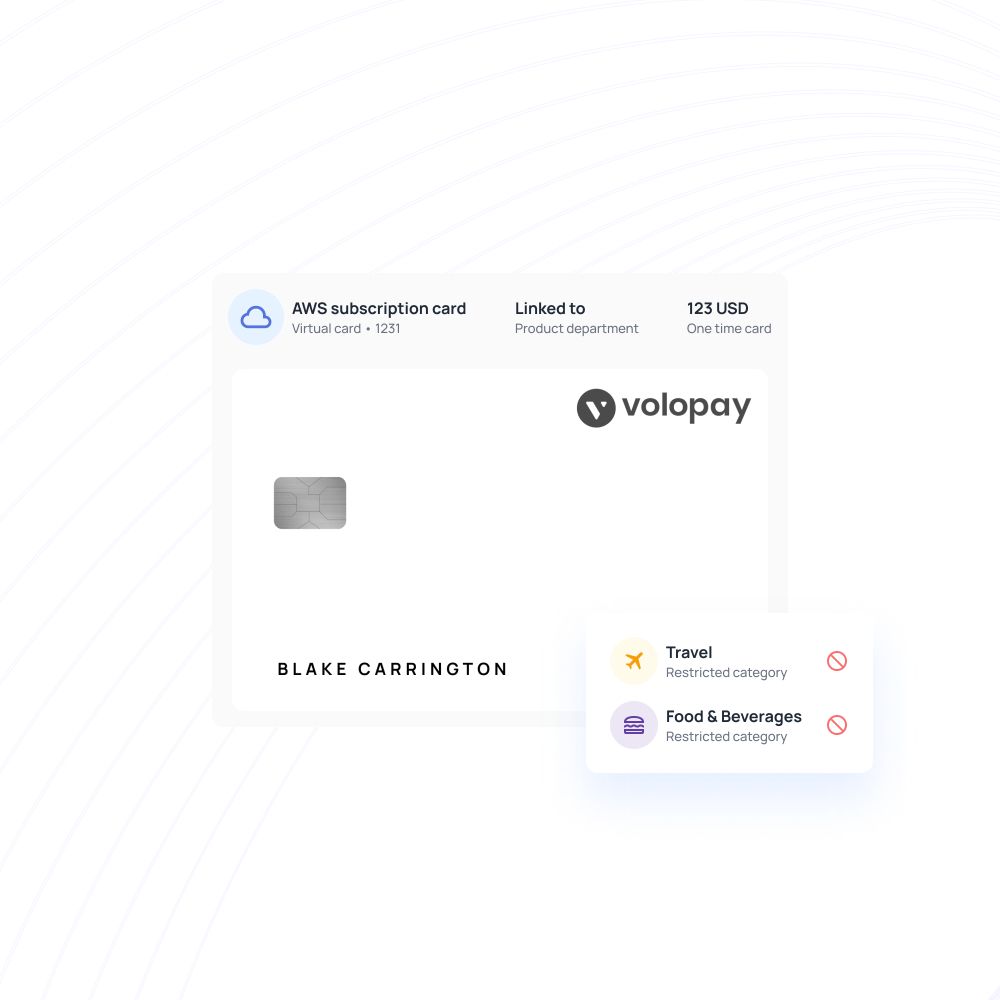

Virtual cards are digitally issued payment cards that operate in much the same way as traditional physical debit or credit cards, but they exist exclusively in an online, non-physical format.

Each virtual card is equipped with a distinct 16-digit card number, a specific expiration date, a CVV (Card Verification Value) code, and often a personal identification number (PIN), all of which enable secure, reliable, and efficient digital payment transactions across various online platforms.

In business settings, employees often use virtual cards for specific departmental expenses such as marketing, sales, advertising, or software subscriptions. These cards are typically assigned with usage limits to ensure they’re used only for work-related purposes, offering both convenience and control.

One of the key benefits of virtual cards is that they are connected to a card management system or expense management software, ensuring all transactions made with each virtual card are neatly recorded and stored—no more obscure transactions!

Core differences between virtual and physical cards

When managing business expenses, you face a critical choice: virtual card vs physical card. Each offers distinct advantages, and understanding their differences helps you select the best fit for your company.

This guide breaks down the virtual card vs physical card comparison, highlighting key features, benefits, and use cases. While understanding the nuances of corporate card solutions, you’ll discover how to optimize your financial workflows. Make an informed decision that aligns with your business goals.

Choosing between virtual card vs physical card involves weighing several factors that impact your business operations. From format to transaction capabilities, each card type serves unique purposes. Below, we compare key distinctions to help you decide which aligns with your needs, whether you prioritize speed, security, or flexibility.

1. Card format and accessibility

Virtual cards exist digitally, accessible via your mobile device or computer, offering instant access without physical handling. You can generate them through platforms like Volopay for immediate use.

Physical cards, however, are tangible, requiring you to carry them for transactions. They’re ideal when digital access isn’t an option, but they risk loss or damage. The difference between virtual card and physical card lies in convenience—virtual cards excel for online use, while physical cards are suited for in-person payment scenarios.

2. Transaction capabilities

Virtual cards shine for online transactions, such as SaaS subscriptions or vendor payments, but they’re limited when it comes to in-person purchases. Physical cards support both online and offline transactions, including point-of-sale (POS) purchases and ATM withdrawals.

If your team frequently travels or makes retail purchases, physical cards offer broader utility. The virtual card vs physical card distinction here depends on your transaction needs—digital for virtual, versatile for physical.

3. Issuance and deployment speed

You can issue virtual cards instantly through platforms like Volopay, enabling rapid deployment for urgent expenses. Physical cards take longer, often requiring days for production and delivery.

If you need immediate access for a new employee or project, virtual cards are faster. The difference between virtual card and physical card in issuance speed makes virtual cards ideal for dynamic, fast-paced businesses.

4. Cost considerations

Virtual cards typically incur no production or shipping costs, making them cost-effective for high-volume issuance. Physical cards involve manufacturing and delivery fees, which add up for large teams.

However, virtual cards may require robust monitoring to manage subscriptions and keep track of issuance. When comparing virtual card vs physical card, virtual cards often save on upfront costs, while physical cards may incur replacement fees if lost.

5. Customization options

Virtual cards offer extensive customization, allowing you to set spending limits, assign them to specific vendors, or create single-use cards. Physical cards have fewer customization options, typically limited to spending caps.

For tailored expense control, virtual cards provide more flexibility. The virtual card vs physical card comparison highlights virtual cards as superior for precise spending management.

6. Lifespan and maintenance

Virtual cards can be single-use or have set expiration dates, reducing long-term maintenance. Physical cards last for years but require replacement if lost or damaged, incurring additional costs.

They also usually have pre-set expiration dates, and renewal requires another round of wait time. You’ll find virtual cards easier to manage for temporary projects, while physical cards suit long-term use. This difference between virtual card and physical card impacts ongoing administrative efforts.

7. Geographic and merchant acceptance

Virtual cards excel online but are limited offline, as they lack a physical form for POS terminals. Physical cards boast 99% acceptance at global POS systems, making them ideal for travel or retail. When evaluating virtual card vs physical card, consider your team’s spending patterns—virtual for digital, physical for universal acceptance.

8. User management and control

Virtual cards allow you to manage users via dashboards, set real-time limits, and track expenses instantly. Physical cards require manual tracking or integration with expense software, which can be slower. Volopay’s platform simplifies management for both, but virtual cards offer superior real-time control. The virtual card vs physical card difference here favors virtual for streamlined oversight.

Issue smart physical and virtual cards to your employees

Benefits of virtual corporate cards

Virtual corporate cards empower digital-first businesses with speed, security, and efficiency. By leveraging Volopay’s virtual cards, you gain tools to streamline expenses and enhance control. Here’s why virtual cards are a game-changer for modern companies.

Advanced security features

Virtual cards reduce fraud risks with single-use options and tokenization, ensuring sensitive data stays secure. You can generate a unique card for each transaction, minimizing exposure.

Two-factor authentication adds another layer of protection. Compared to physical cards, the difference between virtual card and physical card in security makes virtual cards a safer choice for online spending.

Efficient subscription management

Assign virtual cards to SaaS tools or vendors for recurring payments, simplifying subscription tracking. You can set specific limits for each card, ensuring budget compliance.

Volopay’s platform lets you monitor all of these expenses in real time, considerably reducing manual oversight. This efficiency makes virtual cards the best choice for managing digital subscriptions seamlessly.

Seamless expense tracking

Volopay’s dashboards let you monitor virtual card spending instantly, categorizing expenses effortlessly. You gain insights into team spending patterns, improving budgeting accuracy.

This feature outshines physical cards, which often require manual reconciliation, highlighting a key virtual card vs physical card advantage for data-driven businesses.

Rapid card deployment

You can issue unlimited virtual cards instantly through Volopay for urgent expenses, such as last-minute vendor payments or ad campaigns.

Unlike physical cards, which require delivery, virtual cards are ready within seconds. This speed ensures your team stays agile, addressing the virtual card vs physical card need for quick financial solutions.

Environmental sustainability

Virtual cards are paperless, reducing your company’s carbon footprint. By eliminating physical production and shipping, you contribute to eco-friendly practices.

For businesses that prioritize sustainability, virtual cards align much better with green goals, offering a modern and better alternative to traditional physical cards.

Benefits of physical corporate cards

Physical corporate cards remain a staple for businesses needing versatile, in-person transaction options. With Volopay’s physical card solutions, you equip your team for traditional scenarios. Here’s why physical cards excel in specific contexts.

In-person transaction flexibility

Physical cards are perfect for travel, client meetings, or retail purchases. You can use them at 99% of POS terminals worldwide, unlike virtual cards, which are online-only. This flexibility addresses a key physical card vs virtual card need for businesses with frequent in-person expenses.

Cash access via ATMs

Physical cards allow you to withdraw cash for emergencies, a feature virtual cards lack. Whether covering unexpected travel costs or small cash-based purchases, this capability ensures your team stays prepared. The physical card vs virtual card advantage here is clear for on-the-go scenarios.

Broad merchant acceptance

Accepted at 99% of global POS terminals, physical cards offer unmatched reliability for in-person purchases. From restaurants to retail, you face fewer restrictions compared to virtual cards. This universal acceptance makes physical cards a go-to for diverse spending needs.

Employee accessibility

Physical cards use a familiar format, requiring minimal training for your staff. Employees accustomed to personal credit cards adapt quickly, streamlining adoption. This ease of use gives physical cards an edge in the physical card vs virtual card comparison for traditional teams.

Durable design

Built with EMV chip technology, physical cards withstand frequent use. Their robust design suits employees who travel or make regular in-person purchases. Unlike virtual cards, physical cards are engineered for longevity in physical environments, ensuring reliability.

Security comparison: Virtual vs physical cards

How are virtual cards more secure than physical cards? The answer lies in their digital nature—virtual cards eliminate risks associated with loss or theft and can be instantly frozen or replaced if compromised, ensuring better security. Physical cards, on the other hand, provide a more traditional payment method that employees can use for in-person transactions and travel expenses.

Security is paramount when comparing a virtual card vs physical card. Both offer robust protections, but their approaches differ. Volopay’s solutions enhance security for both, addressing fraud and compliance concerns effectively.

Virtual card security mechanisms

Virtual cards reduce risk with tokenization, 2FA, and single-use cards, minimizing data exposure by generating a unique card for each transaction.

Volopay’s platform ensures encrypted transactions, making virtual cards highly secure for online use compared to physical cards.

Physical card security measures

Physical cards rely on PIN protection and EMV chips to safeguard transactions. These features prevent unauthorized use at POS terminals.

While effective, physical cards are vulnerable to theft or loss, unlike virtual cards. Volopay enhances physical card security with real-time monitoring.

Fraud risk exposure

Virtual cards limit exposure through single-use numbers and digital containment, reducing the impact of breaches. Physical cards risk theft or skimming, increasing fraud potential.

The virtual card vs physical card comparison shows virtual cards as less vulnerable to physical threats.

Approval and monitoring

Both card types benefit from Volopay’s multi-level approval systems and real-time monitoring. You can set spending limits and receive instant alerts for suspicious activity.

Virtual cards enable control with faster changes, unlike manual updates with physical cards.

Practical use cases for virtual and physical cards

Understanding where each card type excels helps you optimize expense management. The virtual card vs physical card decision depends on your business’s spending patterns. Volopay supports both, enabling tailored solutions.

Virtual cards for digital expenses

Use virtual cards for SaaS subscriptions, online ads, or vendor payments. You can assign specific cards to each service, ensuring precise budget control. Volopay’s platform simplifies tracking, making virtual cards ideal for tech-driven businesses with heavy digital spending.

This highlights a key difference between virtual and company cards—virtual cards offer greater flexibility, control, and tracking for online expenses, while company (typically physical) cards are better suited for in-person purchases and travel-related spending.

Physical cards for on-site needs

Physical cards suit travel expenses, client entertainment, or office supplies. You can use them at retail stores or restaurants, where virtual cards aren’t accepted. Their versatility makes physical cards essential for businesses with frequent in-person transactions.

Hybrid card strategies

Combine virtual and physical cards for comprehensive coverage. Issue virtual cards for online subscriptions and physical cards for travel or retail. Volopay’s unified platform lets you manage both seamlessly, addressing diverse expense needs with a single solution.

Industry-specific applications

Tech startups benefit from virtual cards for digital tools, while retail or hospitality businesses rely on physical cards for POS purchases. The physical card vs virtual card choice depends on your industry—Volopay tailors solutions to fit specific sectoral demands.

Enable safe, flexible payments with both virtual and physical cards

Understanding the challenges and limitations of virtual and physical cards

No card type is perfect. Recognizing the drawbacks of virtual card vs physical card ensures you make an informed choice. Volopay mitigates these challenges, but understanding limitations is key.

Virtual card constraints

Virtual cards are limited to online use, making them unsuitable for in-person purchases or ATM withdrawals. If your team needs cash or POS access, you’ll need physical cards.

Volopay’s hybrid approach helps, but virtual cards alone can’t cover all scenarios, a key difference between virtual card and physical card.

Physical card drawbacks

Physical cards risk loss or theft, potentially exposing your funds. Physical card issuance is typically slower, taking days compared to virtual cards’ instant deployment.

Card replacement fees add costs. These limitations make physical cards less agile in the physical card vs virtual card comparison.

Integration complexities

Both card types require setup with accounting systems. You may face challenges syncing data or training staff on new workflows.

Volopay simplifies integration, but initial setup demands time and resources for both virtual and physical cards.

Cost management

Physical cards incur production and replacement fees, increasing expenses. Virtual cards require diligent monitoring to prevent subscription creep.

You must balance these costs to optimize budgets. Volopay’s dashboards help, but proactive management is essential for both card types.

Integration with business systems

Sync virtual and physical cards with QuickBooks, Xero, or NetSuite for automated expense tracking. You can categorize transactions and generate reports effortlessly.

Volopay ensures both card types integrate smoothly, reducing manual work and improving financial accuracy.

Integrate cards with enterprise systems to enhance data flow. You can track all of your business expenses within your ERP or link payments to CRM data for better client insights.

Volopay’s robust integrations ensure both card types align with your business processes.

Virtual cards offer advanced API options for automation, allowing you to tailor workflows. Physical cards have limited API flexibility but still integrate with core systems.

Volopay’s advanced API support makes virtual cards particularly powerful for tech-savvy businesses.

Cost efficiency and scalability

Comparing cost structures and growth potential helps you choose wisely. The virtual card vs physical card decision impacts your budget and scalability.

Virtual card cost benefits

Virtual cards eliminate production and shipping costs, making them cost-effective for high-volume issuance. You can issue unlimited cards without added fees, ideal for growing teams. Volopay’s scalable virtual card solutions suit dynamic businesses with fluctuating needs.

Physical card cost factors

Physical cards involve production and delivery costs, limiting scalability. Replacement fees for lost cards add expenses. For stable teams with predictable spending, physical cards remain viable, but costs accumulate compared to virtual cards.

Scalability for business growth

Virtual cards scale effortlessly, supporting rapid expansion with instant issuance. Physical cards suit fixed teams but struggle with large-scale deployment. Volopay’s platform balances both, ensuring flexibility as your business grows.

Simplify expense management with virtual and physical employee cards

How to choose the right card type for your business?

Selecting between a virtual card vs physical card requires aligning with your business needs. Volopay’s solutions make the choice easier by supporting both.

1. Analyze expense patterns

Review your spending to determine if digital or in-person transactions dominate. If online expenses like SaaS tools are primary, prioritize virtual cards. For travel or retail, physical cards are better. Volopay’s analytics help you map expense patterns accurately.

2. Consider team dynamics

Assess your team’s size and mobility. Remote or digital-first teams benefit from virtual cards, while field staff need physical cards. Volopay’s unified platform supports both, ensuring all employees have appropriate tools for their roles.

3. Evaluate security needs

If fraud prevention is critical, virtual cards’ single-use and tokenization features offer superior protection. Physical cards suit lower-risk environments with robust chip technology. Volopay’s security features enhance safety for both card types.

4. Plan for scalability

For rapid growth, virtual cards provide flexibility with instant issuance. Physical cards work for stable teams but scale more slowly. Volopay’s hybrid approach lets you adapt as your business evolves, balancing cost and growth potential.

Implementing Volopay's advanced corporate card program in your organization

Adopting Volopay’s corporate card program streamlines your expense management. Here’s how you can implement it effectively.

Onboarding process

Sign up with Volopay and complete a straightforward onboarding process. You provide business details, and Volopay sets up your account. The platform guides you through initial steps, ensuring quick integration with your systems.

Card issuance & management

Issue virtual cards instantly or order physical cards through Volopay’s dashboard. You can set spending limits, assign cards to employees, and monitor usage in real time. The platform simplifies management for both card types, saving you time.

Employee training

Train your team on Volopay’s platform with minimal effort. Virtual cards require basic digital literacy, while physical cards are intuitive. Volopay provides resources to ensure your staff adapts quickly, reducing learning curves.

Ongoing support

Volopay offers 24/7 support to address issues, from card issuance to integration challenges. You receive dedicated assistance to optimize your card program, ensuring smooth operations and quick resolution of any concerns.

Why Volopay is the ultimate choice for corporate cards

Volopay stands out as the leading provider for both physical and virtual cards, offering unmatched flexibility and control. Here’s why you should choose Volopay.

Unified card platform

Manage virtual and physical cards in one intuitive dashboard. You can track spending, set limits, and generate reports seamlessly. Volopay eliminates the complexity of juggling multiple systems, making it ideal for businesses of all sizes.

Robust integrations

Sync Volopay with QuickBooks, Xero, NetSuite, and more for streamlined workflows. You can automate expense tracking and integrate with ERP or CRM systems, enhancing efficiency. Volopay’s integrations support both card types effortlessly.

Enterprise-grade security

Volopay employs multi-level approvals, encryption, and compliance features to protect your funds. Virtual cards use tokenization, while physical cards leverage EMV chips. You gain peace of mind with robust security for all transactions.

Global transaction support

Handle multi-currency payments with ease, whether online or in person. Volopay’s corporate cards support global transactions, ensuring your team can operate anywhere. This flexibility makes Volopay a top choice for international businesses.

Bring Volopay to your business

Get started free

FAQs

Volopay offers a unified dashboard to manage virtual and physical cards, set limits, and track expenses in real time. You gain insights through automated reports and integrations with accounting software, simplifying financial oversight for your business.

Yes, Volopay’s physical cards allow ATM withdrawals for cash access in emergencies. Unlike virtual cards, they provide flexibility for cash-based needs. You can set withdrawal limits via Volopay’s platform to maintain control.

You can issue a Volopay virtual card instantly through the platform, ready for use within seconds. This speed suits urgent expenses, unlike physical cards, which take days to deliver, highlighting a key advantage for fast-paced businesses.

Volopay integrates with QuickBooks, Xero, NetSuite, and more, automating expense tracking and reporting. You can also connect to ERP and CRM systems for enhanced data flow. These integrations streamline workflows for both virtual and physical cards.