Using automation in accounting and finance for business

Automation has proven to transform business in many ways. If done correctly, it can save your business tons of money, systemize processes and create an error-free environment. It is a pain to carry over monotonously repetitive tasks for a long time. At some point, you need to stop and take the help of technology. That’s when business process automation steps in.

When we say tedious tasks, it’s hard to think of any other department than accounting. Accounting automation can put an end to this and bring order. Technology is becoming an integral part of business operations, and the sooner one embraces it, the mightier one becomes.

Automated business processes improve workflows

Automation is not only about doing away with pen and paper and switching to digital means.

It’s about establishing an automated accounting system that minimizes or eliminates the need for manual work and sets an automated pattern to your workload. Business process automation reduces the number of manual tasks in every process and hones it to be more efficient. It also significantly reduces the possibility of errors which are unavoidable when you prefer manual ways.

For instance, if not controlled, accounting errors can bring financial losses while also tarnishing your reputation. It increases the overall stress associated with accounting processes.

On the other hand, an accounting automation software runs like a well-oiled machine with minimal supervision, and you get the efficiency you need.

Why does your accounting team need automation?

Accounting is well-known for its dreadful humdrum. Month and year-end closing can become a pain if something goes amiss. To subside the effects, many SMBs now possess some kind of accounting automation software. But many are not using upgraded and modern solutions that can do more than the intended with high precision.

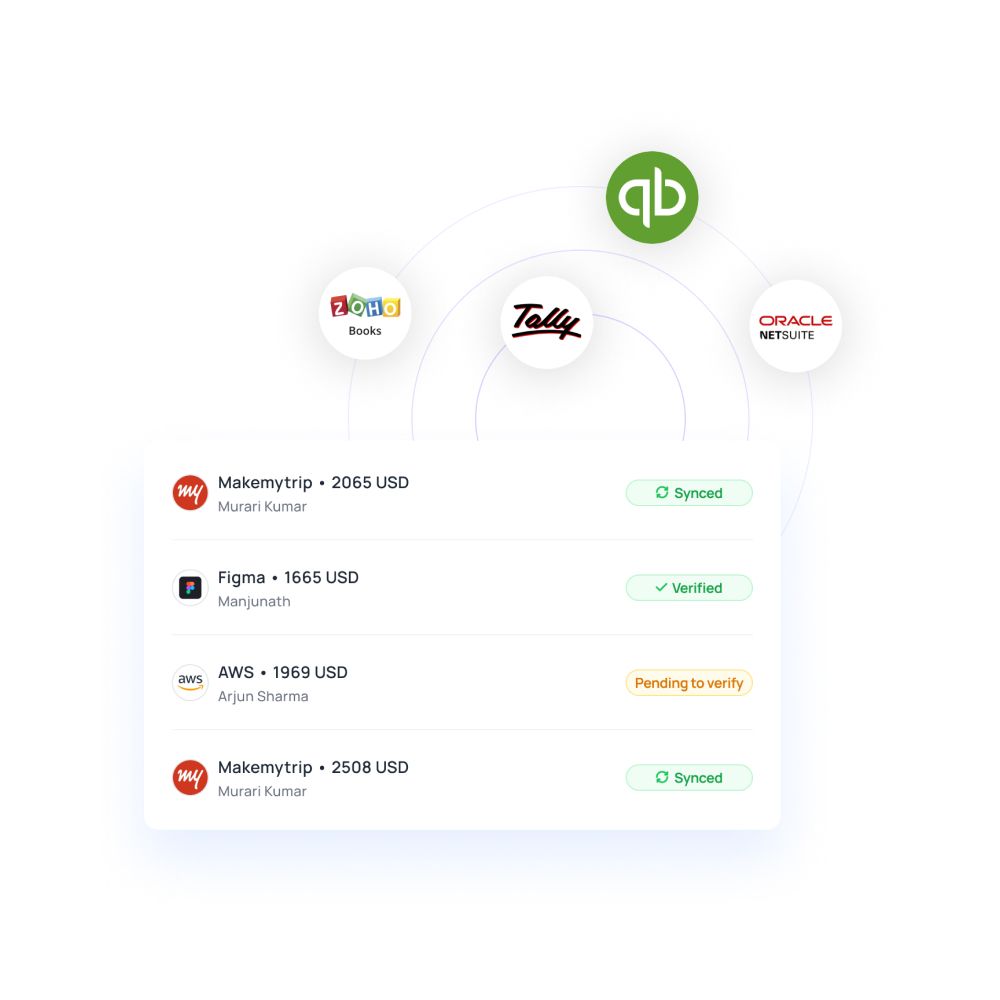

Moreover, using multiple systems for different functions and manually communicating between these applications make the situation worse. What works best here is a consolidated platform that can perform most of the accounting functions and work collaboratively with other applications.

Related page: How to reconcile expense reports?

How to leverage automation for better management of accounting expenses?

Invoice processing

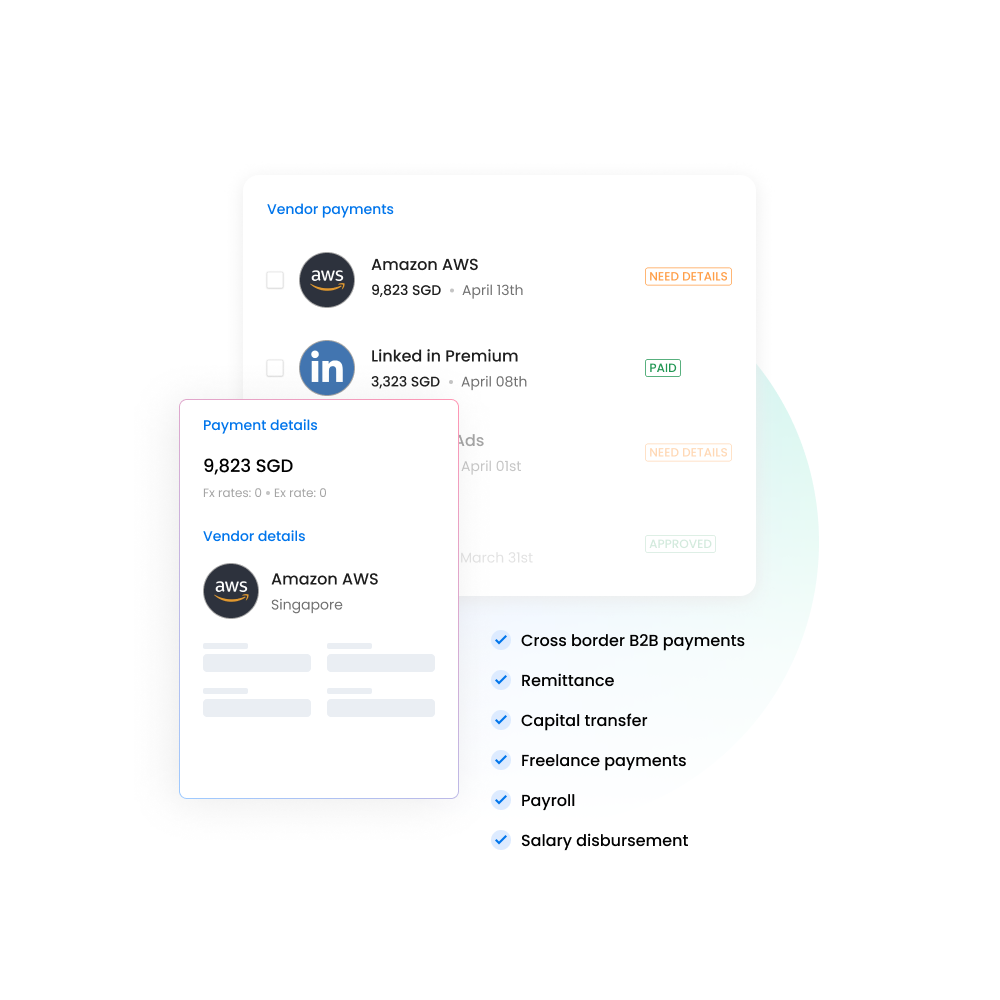

Invoice processing typically involves 4 to 5 steps. And if not done meticulously, there are chances of double or duplicate payments, missed invoices, late payments, and penalty charges. It’s also risking your business relationships with your vendors. But when you have a rapid automated accounting system, you can set a customized, automated path for incoming invoices and handle it till payment processing.

With automated invoice processing, you have clear records for every vendor payment you make. While saving time with automation software, you can also make payments before time and enjoy early bird offers.

Easier account reconciliation

Manually maintained accounts and ledgers are a pain as the bank records and account statements should be in agreement, this is not always the case with reconciliation. With accounting automation and applications that integrate with one another, reconciliation gets automated. Automating reconciliation helps reduce technical errors and to ensures data compliance.

Tap into your financial data

By thoroughly looking into historical financial data can help you estimate the position of financial health and stability of your business. Accounting automation helps you move miles closer towards making accurate financial projections and predictions. Having these applications gives an edge to your financial team to tap into the organized, up-to-date data and predict patterns, abnormalities, and interconnections.

Furthermore, advanced features are available in these applications that constantly provide insights based on the expenses from time to time. Business process automation is the way to process a massive chunk of data, categorize, derive helpful information to make informed decisions for your business.

Continuous closing with direct integrations

Closing around the end of the month or end of the year is becoming a thing of the past. Continuous closing is when you close frequently, let's say around 3 or 4 times a day. This way, you are sure that the accounts stay precise and up-to-date any time of the year. But when your business makes tons of daily payments, how can this be possible? With the help of automation.

Modern accounting software has direct integration features that allow them to connect with other software. So any new payment or credit that happens gets updated automatically in your ledger without requiring a manual effort. You build an agile workforce and keep your financial data clean and compliant with continuous closing.

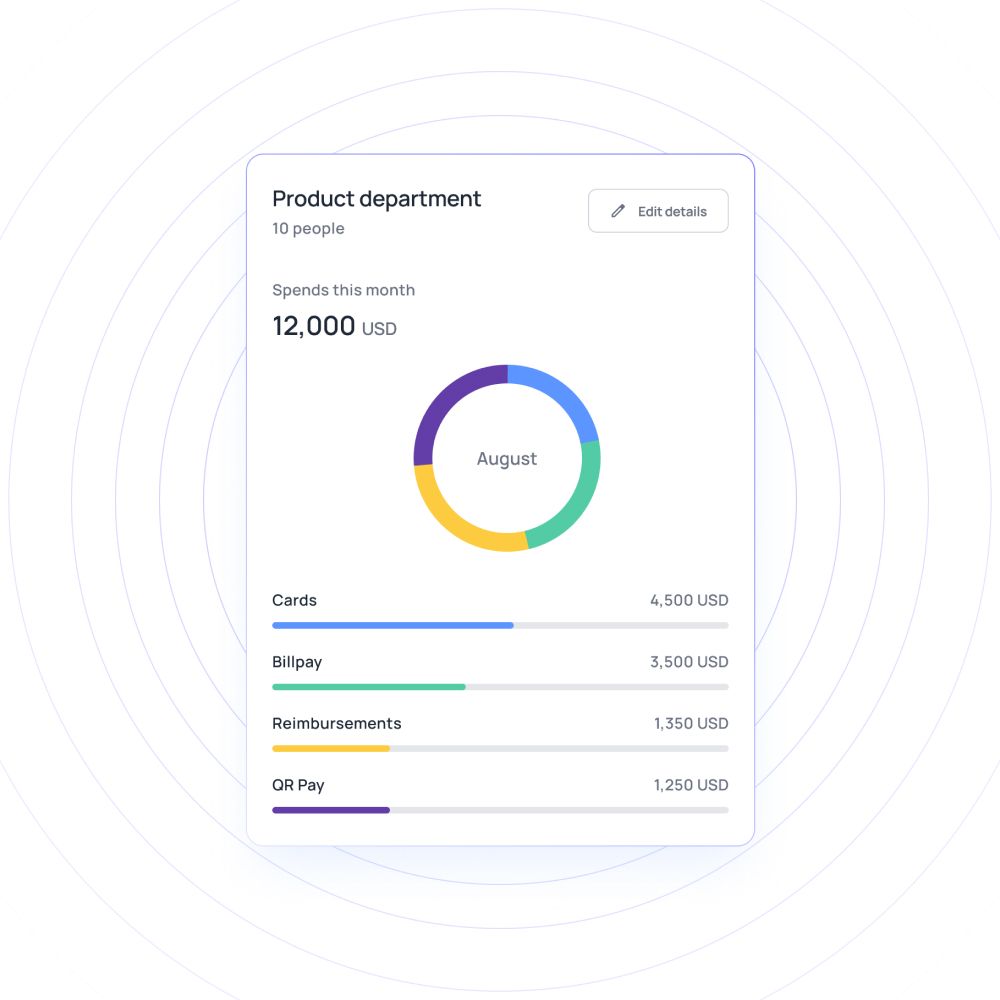

Categorization of expense requests

There is a diverse range of expenses that organizations typically incur. New-gen accounting applications let you add a category tag to these costs like office utilities, marketing, supplies, payroll, etc. By staying organized in the arrangement of expense data, you can save a lot of time in budgeting discussions and audit sessions. When you categorize your expenses, you can see where you have spent the most and most minor and thereby make quick budgeting decisions.

It also gives you an opportunity to look into the most expensive categories that need your attention. A timely observation can save you a lot of money. There can be uncategorized, one-time expenses too. The accounting team can look into it and decide.

Payrolls

Payroll can be tedious and back-breaking. It includes a long and painstaking process if it is done manually. Businesses promptly hire third-party vendors to take care of this exclusively, fearing manual work. However, present-day, ingenious applications don’t take much effort as they do it automatedly and safeguard your employee’s private data.

Automated payroll systems can even perform tricky calculations like calculating hourly wages, extra hours, tax, and reimbursements and deliver precise numbers that your employee rightly owns. They help generate accurate payroll information while maintaining complete data security.

Streamline communication and task management

Accounting automation helps you establish an all-inclusive level of communication in your organization. Conventionally, accounting functions happen within the team and sometimes beyond the team, which requires constant communication and follow-ups. Moreover, there can be mix-ups if anything is not conveyed correctly. And business process automation is here to put an end to this broken line of disclosure like unresponsive emails or phone calls. When there is an automated accounting system, distinct communication between teams is instantaneously facilitated.

Related page: How to choose accounting software for small businesses?

Achieve more with Volopay

The first step towards automation can be scary. You need accounting automation software that can make the transition smooth and make this whole process easy.

End-to-end payment management

Volopay can ease the difficulties in automating your payment system all the way through. You can make your invoice payments, go through receipts, approve charges, maintain payroll, reimburse employee expenses, and many more with the Volopay automated expense management system.

Seamless integrations

Volopay works perfectly with other applications too. You can integrate with your accounting applications like QuickBooks, zero, etc. You can schedule payments beforehand and automate them even before its due.

Insights and analytics

With regular insights about your financial transactions from the app, making decisions is easy. The dashboard shows you up-to-date stats so that you stay updated of your current financial status. Every expense is tagged and categorized. This way, you can track where every penny goes. Set budgets and control your spending automatically. If there is an encroachment, the automation software will notify you.

Frequently asked questions

As Volopay offers automatic integrations and has automatic reconciliation features, you don’t have to wait till the month end to make payments. You can achieve continuous closing with Volopay.

Leveraging automation means fine-tuning your current accounting process to be more efficient, accurate, and expeditious.

Yes. Volopay can automate the entire process from capturing the data in your invoice to taking through approvals to making payment and saving the receipt received.

No matter how small your accounting team is, you can still benefit from automation. Volopay works for businesses of all sizes. When your team expands tomorrow, you can still reap its benefits and continue to manage your payment system efficiently.

In Volopay, you have better visibility as the platform demonstrates your accounting stats visually. The admin can view the status of your accounts anytime and keep track of it.