6 expense management challenges faced by consulting firms

Every industry has its struggles and challenges with expense management. If there is one sector that continuously toils with streamlining its expenses, it’s consultancy firms.

Some of them are able to identify the root cause and find a suitable solution. But others have an uphill climb every month to tally their accounts and manage budgets.

Regardless of the tools they use, the expense management challenges for consulting firms always exist in some ways.

Challenges consulting firms face with expense management

As an accounting and finance stack partner for many consulting firms, Volopay has observed the challenges faced by them. Most of them are unique to consulting firms because of the nature of their work.

1. Expenses incurred on business travel

Consulting firms have employees who constantly travel to other business sites or clients’ locations. This requires them to collect important documents and receipts to get reimbursed.

But their busy schedules don’t give them enough time to sort bills or apply for reimbursement at the end of the day. Piling bills in their bags only lead to losing or damaging them.

Hence, it’s common for consulting firms' employees to use their own money for business travels and get only a part of it claimed back.

With a smart reimbursement solution like Volopay, traveling employees can submit instant reimbursements and discard receipts as soon as it’s done.

Related read - Corporate travel management: Essential guide for businesses

2. Have to process expenses and produce invoices quickly

Another expense management challenge faced by consulting firms is the need to be up-to-date about the expenses made for a specific project.

As they don’t have constant billing or valued based pricing model, they have to estimate the price spent to determine customers’ billable amount. In order to receive payments quickly, they have to generate invoices promptly.

Not having unified expense platforms delays payment calculations and thereby delays customer payments. This is why having a unified expense platform helps overcome challenges for consulting firms to categorize expenses automatically.

No matter how many categories you use to determine the invoice amount, you can still make it on time. You can generate invoices and receive instant payments with higher accuracy, raising no more questions from customers.

3. Expenses need to be split among customers or projects

Consulting firms often deal with situations where they have to split an expense between two or more customers or projects while billing them.

It can take hours for you to make expense reports and map relevant costs for each customer. Though estimating it with the help of spreadsheets and manual calculations is feasible, it’s not viable in the long run.

However, when you have an intuitive expense dashboard with advanced controls, you can generate this within minutes and split expenses among customers.

4. Project’s budget and anticipated expenses

Consulting firms often can’t meet their budgets and end up overspending. In other terms, they have limited ways to oversee if they are on track with meeting budgets.

The project's fees depend upon the anticipated expenses and budget allocated. As a consultant, it’s your responsibility to monitor and not make it exceed the budget.

To do this every moment, a consultant needs real-time access to the day-to-day expenses of the project. Expense management software can guarantee that and help them track the project’s budget and limit spending.

5. Hard to control and predict expenses for future

One of the key expense management challenges for consulting firms is to regulate spending and prevent infringements.

You cannot avoid overspending by limiting the budget. Your whole team must come forward to ensure strict compliance with the company’s expense policies.

Even if they bypass policies and make an unauthorized spend, there is no toll system that filters out unauthorized spending.

Also, the prediction of expenses that the future has on hold is another concern. Finance teams cannot draw patterns and identify trends without expense-tracking applications.

You can overcome both of the above by using an advanced expense-tracking application. These applications allow you to upload your custom approval workflows to regulate incoming expense reports.

6. Hard to keep up with changing mileage and per diem regulations

As per diem and mileage expenses are eligible for tax deductions, they must be recorded in a destined way. But the regulations are often changing, making it difficult for companies to authorize per diem expenses.

Certain consulting firms have employees working in different parts of the world. Now the challenge is even bigger as they have to be in the know of regulations worldwide.

On the contrary, some consultancies successfully tackle this by using approved and appropriate expense reporting applications.

Employees use tools like GPS to record their mileage accurately and report that to their organization. They, in turn, process it and reimburse it right away.

Who is the victim anyway?

The real victim is the employee who is not tired of constant traveling but reporting expenses and claiming one after another.

Nervous of not getting the money back, they save every piece of receipt they can and submit it as soon as they get time. Not knowing the allowed expenses verbatim also doesn’t let them spend freely.

There is a history of employees who have called it quits after repeated bitter incidents. This a loss for the consulting firm as it has let go of its best talents due to inadequate practices.

Rather, consulting firms should aim to create a pro-environment where employees are empowered with powerful financial tools.

How can Volopay better manage expenses for consulting firms?

Consulting firms start their year with big goals and reasonable budgets. Yet, due to the consulting industry's expense management challenges, they don’t grow as expected.

This part is for the companies that face stunted growth due to the above challenges. Volopay has transformed the state of expense management and financial reporting in many consulting firms.

By streamlining the expense management process, Volopay helps firms improve cash flow by ensuring timely reimbursements, reducing overhead costs, and eliminating unnecessary spending delays.

Here is how Volopay could fix its clients’ unique expense-related consulting challenges.

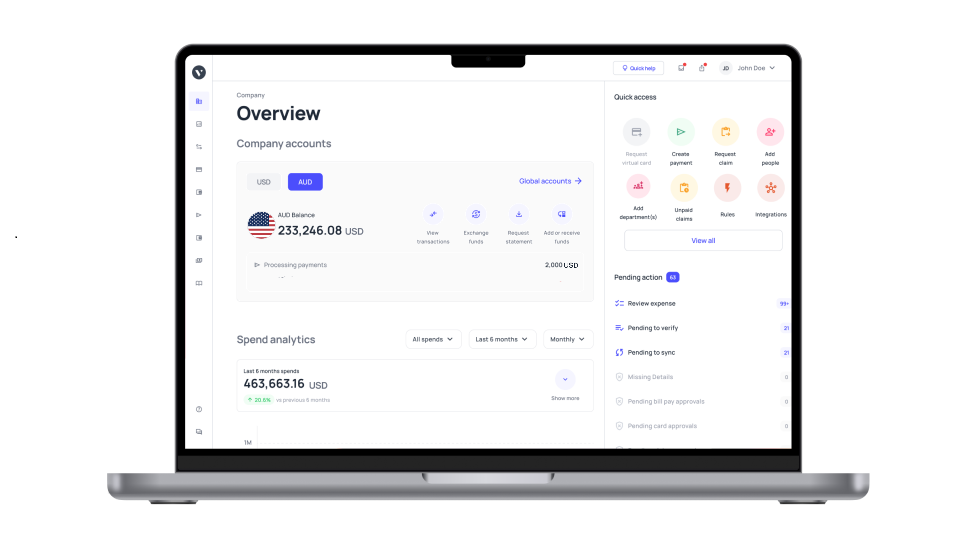

Expense reporting dashboard and phone application

Employees can submit expense reports on the go and don’t have to carry their bills forever. It takes a few minutes to quickly scan the invoices and submit them on the Volopay dashboard.

This also works for mileage and per diem expenses. Once the expense report walks in, it automatically gets transferred to the approvers' bin and processed as soon as it's approved.

Corporate cards

Go further and provide corporate cards to your employees to cover travel expenses. You can simply create a virtual card, assign it to them, and add the required credits here. Without approvals, they can spend the credit on online expenses.

Real-time expense tracking

To avoid exceeding budgets, you can track your project-related expenses in the Volopay dashboard.

Integrations

Volopay can integrate and sync data with other accounting applications, reducing manual workload from your end.

It has many other tools and functions to simplify your payment and accounting management. Consulting firms can take advantage of the above benefits and improve the drawbacks of their current payment processes.

Learn how Volopay fixed payment and accounting challenges faced by a boutique consulting firm, Black Pine.

FAQs

An expense management tool is necessary to spend the business funds carefully and calculatedly. It’s easy to make budgets. But to meet them in real-time and curb business expenses within limits, an expense management tool is necessary.

An expense management tool is an application where accounts payable teams can make payments and schedule upcoming expenses. This is also the place where they can track previous expenses, upload budgets, and generate monthly reports.

Every company should have expense policies in place. It should talk about the allowed expenses for employees from different hierarchies.

Your employees should know the allowed ones and have a way to report the costs incurred. After reviewing the expense request, your company should process it and pay back the employee.