How to record per diem in expense report form?

Certain organizations establish the per diems expense report system as their employees endure business expenses like food, travel, and other business expenses. However, it doesn’t have pesky approval processes.

Per diem expenses can be complicated to track, if the company is not equipped with an advanced automated program. Expense fraud is also very common as this is easy for employees to steal money from the company. All of this together puts the company looking for a better arrangement to track, monitor, and store records of employee per diem expenses.

What is per diem allowance?

Per diem denotes per day. In simple words, per diem expenses are the funds distributed to employees to manage their food, transportation, or other business costs. These are daily allowances provided to employees through corporate cards, fixed cash, or added to their monthly salary. Companies offer full or partial compensation for how much their employees have spent daily.

Employees find it appealing as they don’t have to make business expenses out of their pocket. They can cover anything from taking a client out on business lunch to taxi charges for local business trips.

Depending on the company type, location, working style, per diem expenses, report template changes. The per diem expense report is not foolproof because they don't need bills or receipts for documentation. And since the per diem rate is a tax-free element, if employees submit accurate expense reports.

Different business expenses in per diem expense report

Every company should refer to their local government guidelines to determine the per diem rate and be aware of what’s acceptable and how much can be used to cover them.

Meals

Meals and travel are the basic and widely covered per diem expenses. When employees travel on business needs, companies will offer them a per diem expense fund that covers a basic charge of food. It also includes business lunches with other team members or clients.

Lodging

Overnight business trips have lodging needs as well. Lodging and travel per diem can be covered in advance or paid later once the employee files an expense report for per diem.

Incidental needs

These are random, miscellaneous charges like hotel staff tips, dry cleaning services, mailing costs, and other random expenses. Employees spend a considerable amount on these miscellaneous charges that are often neglected during reimbursement. They fall under incidental expenses, so they get covered up too.

What does the per diem expense report form include?

Even though employees are not asked to provide bills and proof for the travel per diem, they still have to fill in the expense report and send it within 1 or 2 months from the travel date. The reason to ask for a per diem expense report is to avoid fraudulent entries and develop trust between employees and the management.

It also ensures that the company is not left clueless about how employees spend the per diem coverage. To avoid complexing the per diem expense report template with too many details, read further to the must-include data in the expense report.

Employee details: To know who is filing this, it should have the employee's name, employee ID, position, etc.

Business trip location: location is a must as it gives identification to the report because employees can go on multiple trips within a month.

Date, time, and duration: when the trip has happened and how long should be documented.

Expenses and their categories: what exactly are the costs the employee endured that per diem cost made up for.

Receipts: it is not possible to have receipts for every expense. But receipts that employees can demand and get should be included.

Business purpose: Why the trip was carried out, official reasons for the journey.

What’s not included in expense report

Flight ticket charges: The employees can pay out of pocket and apply for reimbursement, or the company can take responsibility for booking tickets.

How can you make it easy for employees to record per diem expenses?

When you are armed with technologically advanced solutions, the per diem expense report process can never go wrong. Empower your employees with highly sophisticated software with a per diem expense report template. This way, none of the expenses would go unreported, and you can have the per diem expense documents stored safely.

Here is what you should do to make the per diem reporting undemanding for your employees:

1. Introduce them to online platforms

You save tons of time when there are web or mobile applications that can capture this information without them having to type in paragraphs. These business trip expense report templates have auto-filled categories and values that one can choose from.

Implementing a receipt scanner app in expense report forms can go a long way in ensuring that every documented expense has proof added. It takes a few clicks to attach the digital receipts to the respective expense report for per diem.

2. Integrate your applications

Find a means to integrate the expense report application with your team's other finance and accounting-related online software. This can prevent redoing the same work in different places. The finance team often thinks they have been kept in the dark when they see a row of expenses without clear notes. When they are well-informed about the per diem rate, they don’t have to chase around anyone to be in the know.

3. Go a little beyond receipts tracking

Instead of using a system that lets users scan and upload bills, get a more inclusive expense report form that will take automation to the next level. For instance, by connecting the application with google maps, employees can track the distance covered to cover the mileage cost.

This way, it’s precise and fast. No one’s logging into any system to fill in details. For that matter, Google or any suite application has umpteen features that minimize manual workload, when integrated with an expense report application.

How can you efficiently handle per diem costs?

An ingenious, multitasking, and modern expense reporting application mutually benefits employees and management. On one hand, it pushes the employees to file the per diem report within seconds. While on the other hand, it helps finance and accounting teams to keep abreast of the current per diem report status. To handle the per diem expense report like a pro, you should consider implementing an an-all-in-all payment solution like Volopay.

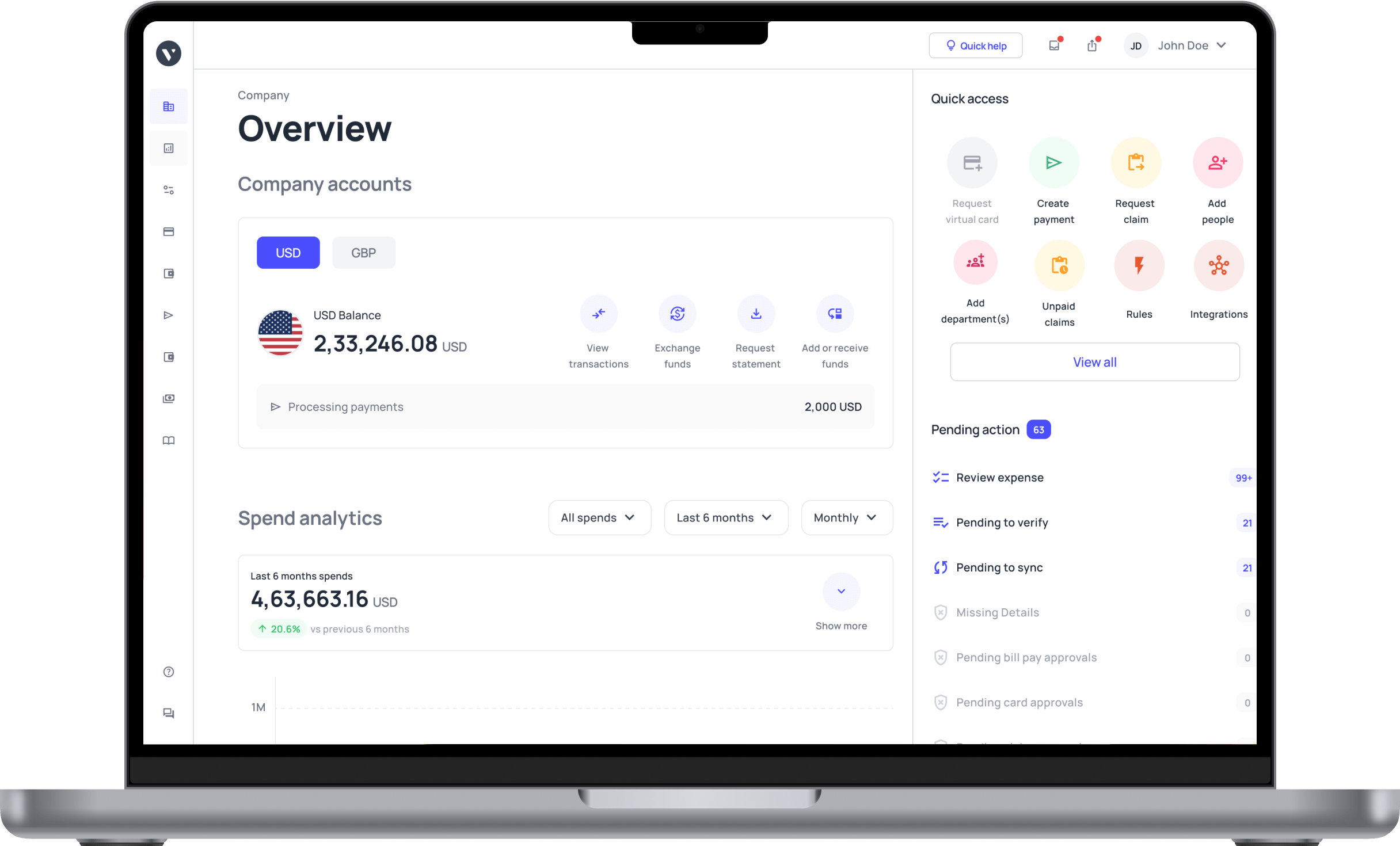

Volopay is finance and spend management platform that has transformed the way SMBs make their business payments. It spoils you with a variety of choices to carry out business transactions. To handle the per diem expenses of employees, you are given access to a groundbreaking platform called corporate card management. You get the privilege to add and assign virtual and physical prepaid corporate cards to your employees with which they can take care of per diem payments.

This is suitable for companies with any number of employees as you can assign as many cards as possible. These act like prepaid cards where a specific amount is added and if needed more, employees can appeal and after approvals, the requested funds will be released. Attachment of receipts and recording per diem expense reports will not take more than seconds as there is a mobile application. Volopay also has an intelligent employee expense reimbursement portal where employees can handle their expense report for per diem and get settlements as fast as possible.