What is accounts payable aging report and how to manage it?

Every business has to deal with accounts payable, which is money that your business owes to suppliers and vendors.

As your business grows, it is likely that you will have more vendors to pay and invoices to settle. While this can be difficult to track, the accounts payable aging report could help you ensure that you are on top of your debts.

What is accounts payable aging report?

Given that your business is likely to purchase from different suppliers on different dates, it can be difficult to stay on top of all your payments. This is where the accounts payable aging report comes in.

You could be asking what is accounts payable aging report. The simple answer is that it’s essentially a summary of what your business owes to suppliers.

What the AP aging report does is visualize all your debts and make them easier for you to track. A standard aging report has information such as:

• Vendor details: Information about your vendors will remind you of who they are and what products you bought from them when sorting out your payments.

• Outstanding amount: Having your outstanding payments visualized on one document will help you track everything that you owe.

• Amount of time you have owed your debts: Not only do you have the amount that you owe, but you can also see how much time you have left to settle your payments.

• Details of past due payments: There may be payments that you missed the deadline of. The AP aging report will help you track these details.

• Unused credit details and debt obligations: You can see unused credit that you have, which will be easy to view using your accounts payable aging report.

Having all your outstanding debts laid out for you in an accounts payable aging report helps you make sure that you pay all your bill payments and vendors accurately and on time.

What are the components of the AP aging report?

While the details of your accounts payable aging report may not be identical to your competitor’s, the basic structure remains the same.

First column → Suppliers

In the first column, you will have your suppliers' and vendors’ details. Each vendor and supplier has their own row detailing your outstanding debts to them.

Second column → Amount due to each supplier

The column next to your vendor details is for the amount you owe your suppliers. This will be the total amount that you still have to pay to settle your invoices.

Subsequent columns → Payables by outstanding dates

The accounts payable aging report has several columns dedicated to the age of the invoice. These columns show which payments are still within their current period and which are past their due dates.

Traditionally, the AP aging report assumes that all your invoice terms are 30 days. The columns of payables by outstanding dates are in 30-day increments.

Final column → Total for each supplier

Sometimes you may purchase products on credit which results in several transactions with the same vendor.

Your report will show you the total you owe your suppliers regardless of when your transactions are due. This is a cumulation of the payments that you owe.

Benefits of using AP aging summary for small businesses

Ultimately, you ask the question what is AP aging report because you want to know how it can benefit your business. Here are some benefits of using an AP aging summary for your business processes.

1. Optimizing and managing cash flow

Using the accounts payable aging report can help you decide on what you have to pay first. Prioritizing your debts is especially useful when you’re tight on cash flow.

Instead of bleeding expenses in a short amount of time, you can pay off your debts according to their deadlines.

Tracking deadlines and ensuring that you are making the correct payments with the AP aging report will help you maintain and even improve your cash flow.

2. Budgeting and forecasting

When you have your payments laid out for you, it makes it easier to plan out future expenses.

For example, if it turns out you still have payments past their due and several current ones, you may reconsider making big expenses in the next month or so.

Conversely, if it turns out that you don’t have a lot of payments outstanding, you could afford to spend more. Having this understanding allows you to budget better.

3. Smooth flow of company operation activities

An overview of the debts that you owe could help you make better strategic decisions. If you keep on having past-due payments, then you may want to take another look at your purchasing trends and why that keeps on happening.

Additionally, having data on your purchasing behavior that is visualized for you helps you understand your purchasing behavior better. This could lead to smoother negotiations.

4. Increased visibility for financial data

Accounts payable aging report is helpful because it allows you to catch issues in your processes. Having a summary of the debts that you owe means you have a wider view of your accounts payable process.

Consistent late payments could mean an issue with one of your processes. With this increased visibility over your finances, you can avoid late payments and ensure that all your expenses are within the budget.

How to manage accounts payable aging reports?

For your accounts payable aging report to be beneficial, you have to maintain and manage it. Part of managing your report includes ensuring that all your data is accurate. Traditionally, you could manage your AP aging report manually.

This includes chasing down all your paper invoices and organizing them into one pile so that you can manually enter your vendor data. You will then have to match your invoice data with other documents by hand.

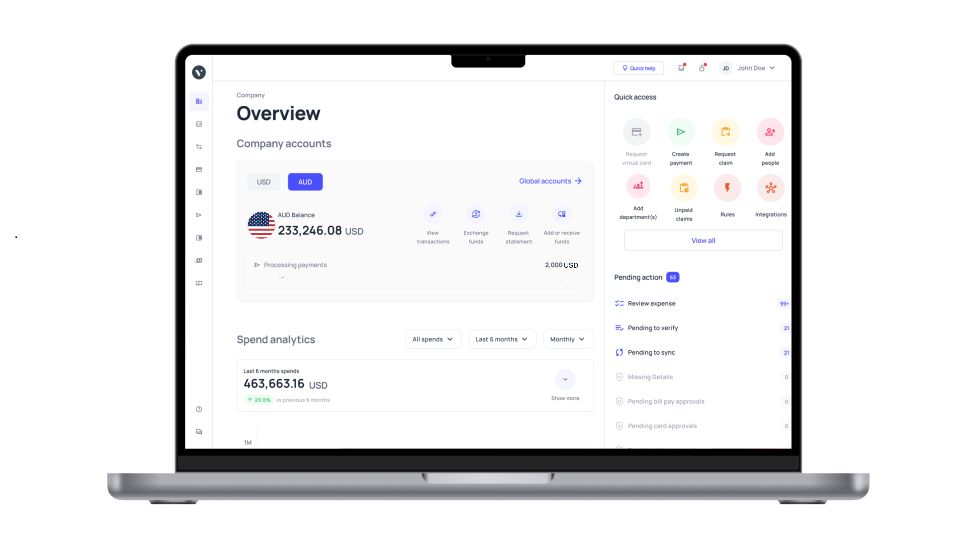

However, using accounting or accounts payable software like Volopay to automate your processes could make managing your reports easier. Here are some practices to help you make the most of automating your reports.

Automate your workflows

You want to set up a system for your accounts payable. With Volopay, you can extract all necessary information from an invoice automatically.

This frees you up from having to manually enter all your vendor data, making it easier to produce reports.

Enter invoices immediately

As your business grows, it is likely that you will be using accrual accounting. This way, you’ll record an invoice as you receive it rather than when you pay it.

Make a habit of doing this to maintain your accounts payable aging report. Volopay’s data extraction helps you do this faster and in real-time.

Make payments automatically

There are only so many benefits you can get from a report if your payments don’t get settled in a timely manner.

To ensure that you are on top of both your reports and payments, schedule your vendor payments with Volopay according to their due dates on your accounts payable aging report.