7 key benefits of automation in accounting

Finance and accounting are crucial parts of any organization’s daily activity.

Making sure that all transactions are being processed correctly along with their recording is something that helps the executives have a real-time view of the financial standing of the business.

But doing all of this manually is a time-intensive process that leaves very little room for CFOs and financial managers to analyze all the data and come up with useful insights.

This is where automation comes into play. Savings in the amount of time spent conducting daily tasks that need to be done, reduction of errors thanks to accurate tech systems, and ultimately better budget utilization throughout the company.

To achieve all this and more, companies have started using expense management automation systems.

Why should you automate your financial processes?

Every problem that you see today with manual finance and accounting processes was not really a problem, to begin with. This is because a decade ago technology was not commercialized.

Businesses had not started using tech systems on a daily basis at affordable rates. There were no SaaS subscriptions or online tools. So there was no choice but to do things manually.

As of today, you would know that manual financial and accounting processes have many limitations that stop organizations from reaching their full potential of efficiency.

One of the major problems with manual finance and accounting processes is how much time they end up taking to execute.

This becomes even more severe when the volume of activities to be done such as invoice processing, accounts payable, accounts receivable, and bookkeeping is very large.

The more time it takes to close your books and finish financial tasks, the further you will be from analyzing business operations and their results.

You can take quick decisions only when you are able to measure the impact of an activity. And knowing the financial impact that operations and marketing have is important to go in the right direction.

Another problem that manual processes have is errors. Humans can do some things better than machines. But when it comes to being accurate, technology takes the win 99% of the time.

A simple error in the calculation of financial transactions or accounting can cause a huge loss to the company. Duplicate invoices and duplicate payments are a result of such errors. Rectifying these errors is also a time-consuming process.

So when you look at the traditional process of handling finances and accounts through the lens of all the expense management automation tools that are available today, you will realize how fruitful it can be to implement a modern spend management system.

Challenges of manual accounting

Manual data entry

With manual data entry come two challenges. The first is that it becomes a time-consuming task when the volume of work is very high.

And the second challenge is that when humans try to push themselves and cram work into shorter spaces of time they tend to make errors.

Miscalculations and incorrect entries in accounting are huge problems. It can end up costing a company a lot of time and money to identify and rectify the issue.

Inefficient information flow

Accurately recording and storing financial data is the crux of accounting. This is done so that the company can easily go back and look at the performance to analyze financial health.

But when the system that your company uses is a manual one for accounting and retrieving important documents becomes a time-consuming task as all the bills, invoices, and other important documents are stored together.

Lack of visibility & control

When making payments for accounts payable, following a manual system is alright for making the payments, but the tracking and visibility after are almost non-existent.

There is no central system that can help you track the progress of all the payments that you have made and have peace of mind to know that each one has reached its respective destination.

Security risk

A by-product of not having visibility and control over the AP process is the chances of fraud and theft.

When you do not have an expense management automation system to track your payment, the portals and systems you use might have security breaches that can cause your and your client's important data to be at risk.

Challenges of manual expense reporting process

Time-consuming

When a company relies on finance managers or accountants to request each employee to submit their expense reports periodically, it is a time-consuming effort for the employee to create an expense report.

And then also for the accountant to check and verify all transactions. It involves too much back and forth and the loss of precious time that could have been spent on more productive activities.

Less control

When employees make business expenses on through their own personal funds, the chances of them accidentally making an expense that is not covered by the company is quite high.

Sometimes even the amount that is allowed is superseded. Manually the only thing you can do is set expense policies and often, even that is overlooked by many employees causing further issues.

No tracking

There is no tracking of expenses when employees have to create expense reports themselves. When expenses are not tracked, the chances of overspending the allotted budget are always a risk.

Benefits of automation in accounting

1. Data accuracy

The first and most prominent benefit of automation in accounting is the improved accuracy at which data is recorded.

Since these systems use technology such as OCR(optical character recognition) to scan documents and enter data, the chances of errors occurring in them are far less as compared to an individual manually looking at each document.

While most companies would still want their accountants to verify and check whether the information has been recorded accurately, the process is much better than manually having the person go through each one and enter the data.

Accounting automation benefits various industries, including healthcare, retail, manufacturing, and professional services. In particular, the healthcare sector—facing intricate billing processes, strict compliance regulations, and numerous payer systems—can greatly benefit from automated systems.

If you're interested in how automation specifically addresses the unique challenges of healthcare accounting and streamline operations, you can explore more in our Guide on healthcare accounting.

2. Compliance

When you choose to implement an expense management system for handling your accounting requirements, another benefit that you get is the ability to enforce compliance.

This is done in the form of approval workflows for employees to make payments and also setting up mandatory expense policies.

Setting up an approval workflow ensures that senior-level management always verifies and approves a payment being made through the company.

And an expense policy such as a submission policy ensures that an employee submits important documents like a receipt when they are making claims for reimbursements.

3. Efficient

From recording data to retrieving it, setting up an automation system to handle all your accounting processes just makes the entire task much more efficient than the time-consuming manual method.

Most automation systems for managing expenses also come with native integrations with some of the leading accounting software tools.

This is helpful in case you are already using one of these software applications and just need a better way to manage your expenses.

4. Faster processes

Whether you are making payments or trying to match and verify the details on an invoice with its respective purchase order, the process of doing so with an automation system is always faster than doing it manually.

The attribute of being fast and efficient comes thanks to the tech and automation parts of the centralized expense management tool.

So tasks like retrieving information such as a particular bill or invoice no more take hours of searching through files and folders. You can simply use the tech system to look it up easily.

5. Visibility & control

Since the entire expense management tool brings most accounting functionality under one system, you gain complete visibility of all transactions that are happening across your organization by all your employees in real-time.

This visibility helps you track budget spending behaviors and change any budget allocation if needed instantly.

When you can see all the transactions happening through a single dashboard, you can easily control them by setting spending limits on tools like physical and virtual corporate cards.

You can also set approval workflows for online money transfers that occur through the platform.

6. Enhanced security

Being a tech-enabled system, the infrastructure that an expense management automation system is built on is extremely robust.

It has the right security protocols set in place to ensure that all the information that you input in the system is not jeopardized by any outside party application.

The chances of online fraud are also reduced because of the system’s security measures that are being taken 24x7 to make sure that there is no kind of data leak.

7. Convenient storage

Another one of the major benefits of automation in accounting is that most of these tools are online services that run on the internet and store data on cloud servers.

What this means is that it is a service that requires you to simply remember your login credentials and you will be able to access and work on all your accounting data from anywhere in the world as long as you have an internet connection and a compatible electronic device.

What are the benefits of expense category automation

1. Faster expense reporting

Rather than making your employees wait an entire month or week in order to create and submit expense reports, an automation system lets them report expenses in real-time remotely using the tools mobile app.

Employees simply have to upload all the necessary details of the reimbursement claim and attach its receipt with it. This relieves employees of having to carry the burden of safely storing all receipts till the end of the month.

2. Real-time visibility

Whether employees are filing for reimbursements, making payments through corporate cards, or through the money transfer feature, you will be able to track all of it on a single dashboard and view expenses in real-time.

The admins on the platform, a role that is usually assigned to the senior management and members of the finance and accounting teams are the people who will be able to see all expenses and control them.

3. Scalable

An automation system is extremely scalable as it does not require a person to be physically present in one location to be able to use and gain its benefits.

So even companies that work remotely are easily able to divide budgets, set controls, and accurately give everyone the freedom to make spending decisions to continue business operations no matter where they are.

4. Fraud detection & prevention

Being a centralized system that runs on cloud servers, automation tools have to maintain hefty security protocols and take measures in order to detect and prevent fraud.

On an internal level, admins can view and see any fishy behavior from employees and also spot an attempt at deception and stop them from occurring.

Automating finances with Volopay

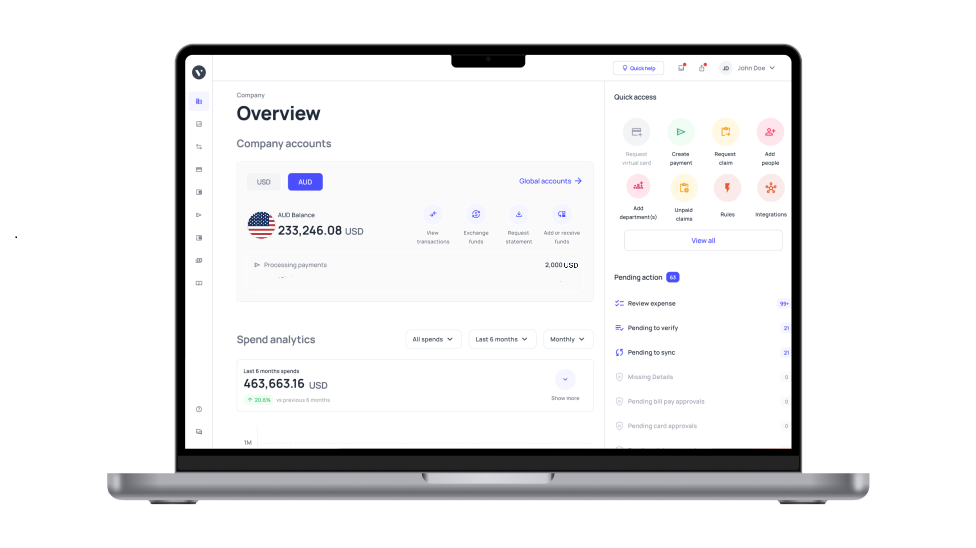

Volopay is an all-in-one expense management and accounts payable management platform for businesses to track, control, and manage all their expenses through a centralized system.

With financial tools like corporate cards and a mobile app, the platform gives your employees the freedom to make spending decisions.

And while the employees have more freedom, the management also has more control over the budget because of custom approval workflows and the ability to set custom spending limits for each employee's corporate card.

Accounting automation

Accounting automation with Volopay allows users to easily sync all their expense data into your accounting software seamlessly thanks to native integrations with industry-leading accounting software.

Users also get to auto-classify transactions based on the budget, vendor, user, or card and fill in data faster.

Expense category automation

The benefits of automation in expense management include complete visibility of expenses throughout the organization, tracking each and every payment in real time, and controlling spending through limits and custom approval systems.

All of this in a centralized system helps finance and accounting executives easily analyze data provided by the tool and derive useful insights to make strategic financial decisions.