What is healthcare accounting and its importance?

Like any other sector, those in the healthcare sector must keep track of their finances to keep their organizations running.

Not only will healthcare accounting provide transparency to all the stakeholders involved in your business, but it will also give you a better view of your cash management.

This is essential for your business to keep your cash flow positive, and being in the healthcare sector is no exception. If anything, it becomes all the more important.

With how rapidly growing and changing the healthcare industry is, understanding both the complexities and importance of healthcare accounting for smoother bookkeeping is a necessity.

What is healthcare accounting?

Healthcare accounting has similar basic principles as accounting as a general concept, which involves reviewing and recording financial transactions.

As your business flourishes, the books and accounting records you keep will follow the generally accepted accounting principles (GAAP). Like other accountants, your healthcare accountants will still maintain and track the business’ finances and cash flow.

However, what sets apart healthcare accounting principles is that it involves a more complex network that other sectors may not have.

For example, businesses in other sectors will not have to consider the presence of insurance companies.

In healthcare management, the presence of insurance companies means that payment tracking will involve tracking money not only from patients but also from insurance companies and other sorts of payment providers.

There are also other stakeholders involved in healthcare accounting such as pharmaceutical agencies partnering with your healthcare business and government agencies and lawmakers, which creates a multi-layered and complex web that is not present in regular accounting.

Key stakeholders involved in healthcare accounting

While healthcare accounting records and tracks transactions to maintain the financial stability of your business, it also provides transparency for all your stakeholders involved in the process.

The stakeholders involved in healthcare accounting also are often interconnected with each other, adding a layer of complexity. Key stakeholders, you may have include:

Patients

Patients play a major role in the healthcare sector, the obvious reason being that you provide your services to them. They are also the people which you bill, regardless of whether your receivables come from them or not.

Patients interact with not only their healthcare providers, but also with insurance providers, and pharmaceutical companies from which they purchase medicine or other medical aids.

On the occasion that their insurance is provided by the state, the government agency responsible for the state insurance.

Healthcare providers and care facilities

The only way to keep your healthcare facility running is to have enough money to fund your daily operations. Therefore, healthcare accounting is a necessity to be sure that your business’ finances are healthy.

As a healthcare provider, you want to provide the best services available there is to your patients, which requires you to do many things, one of which is keeping track of your funds with healthcare accounting.

Insurance companies

Your healthcare business may grant patients the option of paying for your offered services through their insurance.

When doing your books, it is important to note that some of your patients will pay for the use of your services through insurance companies, which means that payment may be delayed. This needs to be noted so no payments are missed.

Employees and employers

Employees and employers are key stakeholders in healthcare accounting because your employees will be on a payroll, which is one form of expense for your company.

As their employer, you are also a stakeholder as it is in your best interest to know what expenses you are spending on your employees. That could be the payroll or other expenses that the employees need to make.

Oftentimes healthcare businesses will have many different departments of employees, and it is key for the employer to know what department is spending on what.

Pharmaceutical companies and medical device manufacturers

A lot of hospitals and healthcare providers have partnerships with pharmaceutical companies and medical device manufacturers.

There could be medicine or medical devices purchased by your healthcare business from these companies as your vendors. The stock and assets you purchase from them will be noted as key expenses in healthcare accounting.

These companies and manufacturers may also have patients whose payments are made through your hospital or healthcare facility and vice versa.

Government agencies and lawmakers

Your healthcare organization will produce financial reports that will be available to the public, which includes government agencies and lawmakers responsible for overseeing the health sector.

Healthcare accounting shows good healthcare management and guarantees that you comply with any regulations regarding your funds.

Transform your healthcare accounting today

What is the role of a healthcare accountant?

A healthcare accountant is responsible for recording and tracking revenue and expenses in healthcare businesses through the use of healthcare accounting principles and reports. The key responsibilities of their role include:

1. Measuring revenues and expenses

The main responsibility of a healthcare accountant is to keep track of and measure the revenues and expenses of a business at any given time.

Your healthcare accountant will likely look at accounts receivables and payables and make use of accounting reports to measure the revenues and expenses.

This would then be used to measure what the financial health of your business looks like.

2. Allocating revenue

Hospitals and other healthcare businesses often have different sources of accounts receivable, such as upfront payments by patients, late payments or partial payments, and even payments made by insurance companies on behalf of the payments.

Revenue can also come in the form of money from other sorts of funders such as the government if your healthcare business is partially (or even fully) government funded.

Healthcare accounting will help you keep track of where money is coming from into your business so that nothing is amiss.

3. Calculating depreciation

Assets that you may own in your healthcare business may last you over a few years. Take a dental chair as an example.

If you own a dental clinic and you purchase a chair five years ago when you were starting the business, the dental chair is still an asset that you use provided that it’s still in good condition.

However, as the chair experiences wear and tear, its value as an asset will depreciate. Healthcare accounting takes the cost of this depreciation over the years into account.

4. Generating accounting reports

It’s the job of a healthcare accountant to create accounting reports such as profit & loss statements, balance sheets, and cash flow statements.

A healthcare accountant is also responsible for collating all this for your business's end-of-year fiscal report.

Healthcare accounting software can be utilized to help automate this process and make it less tedious and time-consuming for healthcare accounting professionals.

5. Tracking reimbursement

Oftentimes healthcare businesses have expenses that are made out-of-pocket by employees, such as transport or employee parking costs.

These expenses must be reimbursed, and it’s the responsibility of healthcare accountants to note which payments have been made and reimbursed as part of the business’ expenses.

6. Developing the budget

Healthcare accounting help provides you with a better understanding of where your funds are coming from and going to, which in turn can provide better budgeting.

Healthcare accountants are responsible for overseeing the business’ cash flow, and therefore would be aware of where the most money is gained and spent.

This would then help them allocate your business’ funds for departmental budgeting for different types of operations.

7. Monitoring financial reporting

Not only is a healthcare accountant responsible for generating reports, but they also must be able to monitor, verify and sync the data across all the reports and relevant documents.

This is to ensure that all finances have been reported correctly and that there are no discrepancies between the different reports. Your healthcare accountants may use healthcare accounting software to help monitor these reports.

There is a lot of extensive work that a healthcare accountant must do, some of which can be tedious manual work.

However, with the help of healthcare accounting software, accountants can automatically track and record revenue and expenses seamlessly, which will help you as the decision-maker make more informed decisions in less time.

Related read: 9 ways to improve business finance and accounting efficiency

What is the importance of accounting in healthcare industry?

Like any other business, good financial health is a staple to get your business off the ground and keep it running. Healthcare accounting is important so that you can have the best cash management possible for your business.

A key point to healthcare management is improving the services you provide to your patients. To do this, you must allocate funds to fields that you want to improve.

Healthcare accounting helps you keep track of your cash flow, which then leads to better management of your cash. This means that you can then allocate more budget to departments or services that need more funds in order to improve.

The inflow and outflow of money in your healthcare business can also be complex due to factors such as late or even non-payments as well as insurance claims.

It is important to keep track of all these factors by following healthcare accounting principles. Being able to have all of this information available to you provides you with transparency and clarity within your business.

This is not only important internally within the business, but also externally with any third parties involved such as funders and investors, government agencies and lawmakers, and even insurance companies for who you are awaiting payment.

How can Volopay help healthcare professionals in accounting automation?

With the shift that is beginning to popularize telehealth consultations, not only are you doing business in an era where remote and hybrid working environments are rapidly becoming popular.

But you may start seeing an increase in vendor payments for subscriptions or other SaaS that your healthcare business uses. Automating your accounting and bookkeeping becomes even more important.

Using healthcare accounting software instead of manually doing your books ensures that every receivable or payable transaction is easier to track and avoids the percentage of human error.

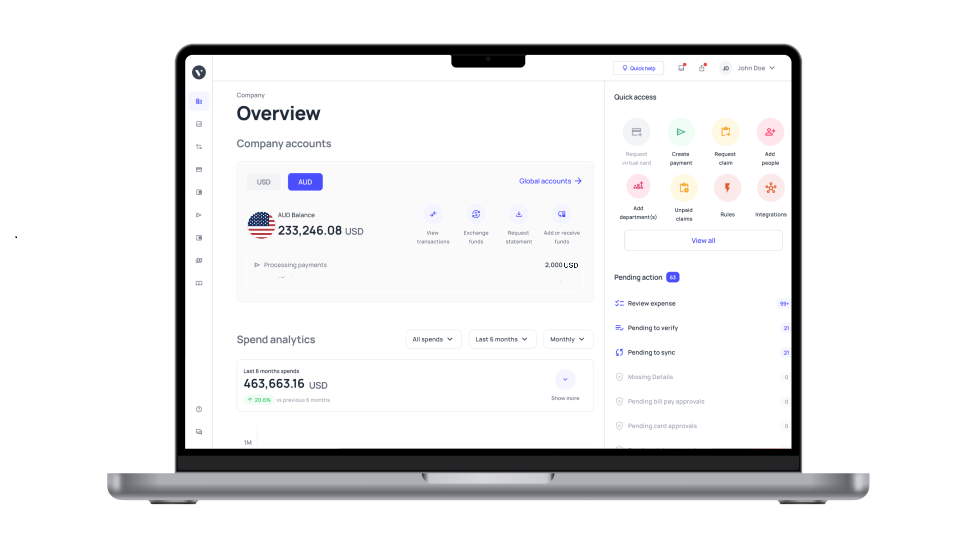

With Volopay's accounting automation, all your card transactions accounts payable, and reimbursements can be logged onto the platform and integrated into popular accounting software such as Xero, Netsuite, Quickbooks, Oracle, and others.

This reduces the time that your healthcare accountants have to spend manually logging books and ensures that all your transactions are synced up without missing anything.

Healthcare accountants can also filter transactions and spending of different departments or use built-in filters on the ledger in Volopay’s accounting feature.

With this automation, healthcare accounting professionals can be freed up from doing menial work and instead focus on tackling the other layers that make healthcare accounting complex as well as analyzing your business’ finances to develop better budgets.