Benefits of automated expense management for finance teams

Expense management is an expansive arena that can fit many subjects and concerns under its umbrella. But do finance teams pay attention to all or even half of them? A big no, as anything other than cost reduction, budgets and meeting budgets are always overlooked.

There is a whole world beyond this that can optimize finance management. On chasing budgets and finding profitable solutions, what other key factors did the finance team miss?

Importance of expense management process

The finance team should always be keen on devising new strategies to improve finance processes and cash flow management and reach new targets. Expense management is crucial to achieving this.

For instance, employee expense management is one of the most neglected areas that can be modified to conserve what has been wasted. Finance teams flounder a lot in handling this due to the lack of clarity and guidelines on the T&E policy.

Key areas of expense management that finance departments ignore

Following are the sections that are unnoticed or not adequately addressed in many companies. As a first step, every finance team should overview how the below-mentioned departments are processed in their respective company to improvise finance management.

Relying too much on paper

Fortunately, we can notice a huge shift in companies shifting to electronic documents and systems from paper files and physical documents. But this is not enough; you should digitize every corner of the finance management. And, small businesses still rely on paper invoices and manual processing for accounting functions. Paper documentation and storage are harmful to our earth and your finance management. They can be inaccurate, and missing even one document can lead to big problems.

Financial fraud

Here, We don’t mean the fraud that happens on a vast scale, because they are easily noticeable. When your system is leaky and fragile, the odds of financial fraud and other misdeeds are very high. Lack of visibility and control are the major contributors to financial fraud in every company. Working closely with this, an employee can sense this vulnerability and turn this in their favor. To prevent this from happening, you should have financial management software in place that displays real-time financial stats.

Business planning & forecasting

Business planning is how to evaluate what went well in the last year to derive what must be done in the consecutive year. Your company will set new goals and objectives for each department. But, an out-and-out business plan doesn’t stop here. It digs out the risks, pitfalls, and opportunities too. This thorough approach is not followed commonly by the finance team due to the extra work involved. Knowing risks beforehand can help you prepare for an unanticipated concern ahead of time. Again, finance automation can favor you here with its powerful data analysis tools.

Reimbursement process

Reimbursements are processed for a wide range of reasons other than business travels. The role of a finance team here is to identify the categories of spending, set budgets, and create a comprehensive Travel and expense policy. But many companies still run outdated policies that are not relevant to their current financial state and market rates.

Also, this process must discuss the workflow on which approvals will be routed for each expense category. Even if one of the above sections is not explicit, the reimbursement is managed for a namesake.

Checking on employee spending

So, there is a proper employee reimbursement process, and employees go through some steps to apply for reimbursement and get their money back once approved. But, it shouldn’t be a careless process without tracking and recording expenses.

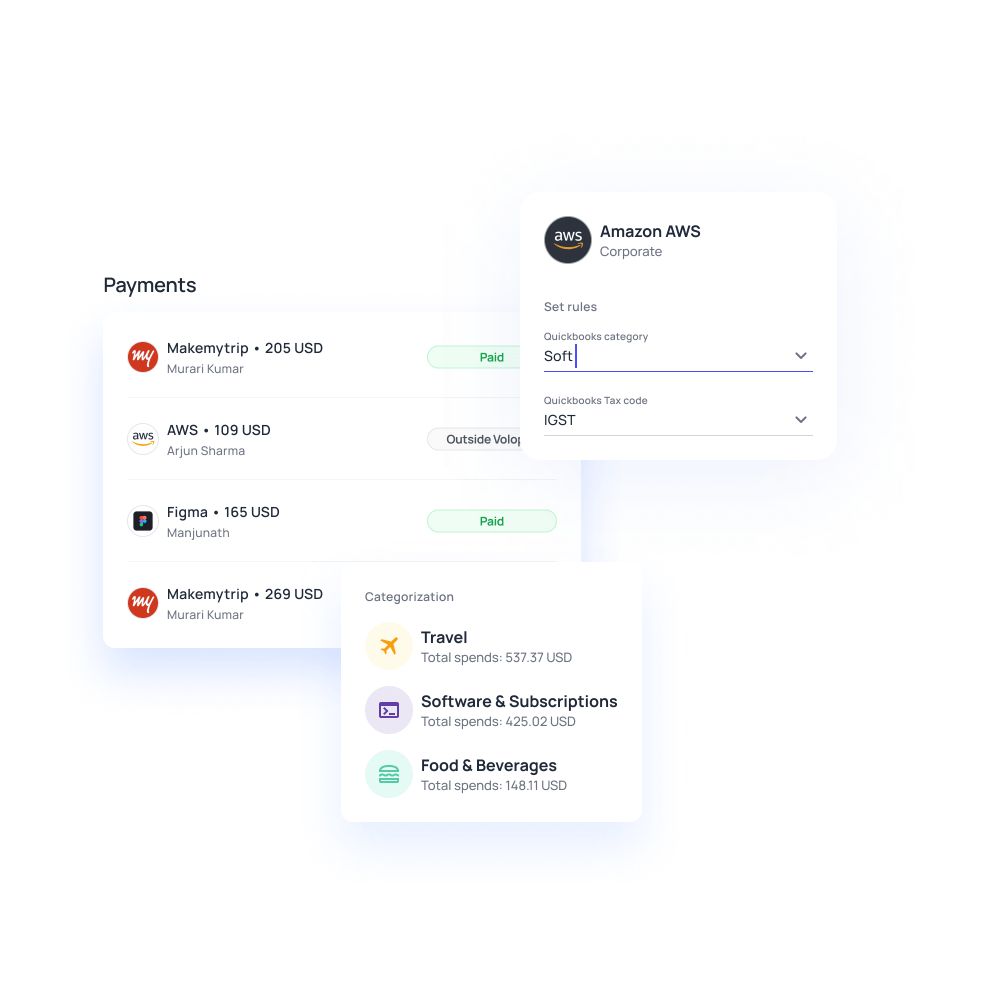

Only when it happens, the finance team can notice how much is spent for each category and what’s the most expensive. This step can further lead to identifying means to reduce or replace the over expensive categories. For tracking purposes, expense management automation can help. This software can capture the expense data, organize it based on categories and increase visibility.

Managing expense reports

An expense report is a document that employers use to track their employee spending and see the list of business expenses employees made. When there is no proper expense report management, the reimbursement process gets affected too because expense reports decide if an expense qualifies for a refund or not.

The finance team should think of ways to automate this process. The team must store the documentation and receipts of expenses properly for tax purposes. Without spend management software, expense reports can be impossible to manage. You can also check our article to know more about the features of an expense management software.

Eliminate paperwork with the expense management software

How to improve expense management process for finance department?

Audit your existing processes

It is impossible to make changes or upgrades without knowing how the system works. Start an internal review and collect documents and guidelines that show how your expense reporting and management functions. Talk to the concerned team members from finance, accounting, HR, and employees.

Get to know their pain points. Review how employees submit necessary documents and how they are stored. Circle down the areas that need improvement and think of ways to implement financial automation here.

Reduce paperwork stack

Have you found any entirely manual step that involves paperwork during your review? E.g., employees submitting hand-written expense reports or paper bills. Your goal is to minimize this with expense management automation. Replace paper files with electronic documents, spreadsheets, or financial management software. Paperworks denote the presence of inaccuracy and unreliability in the system.

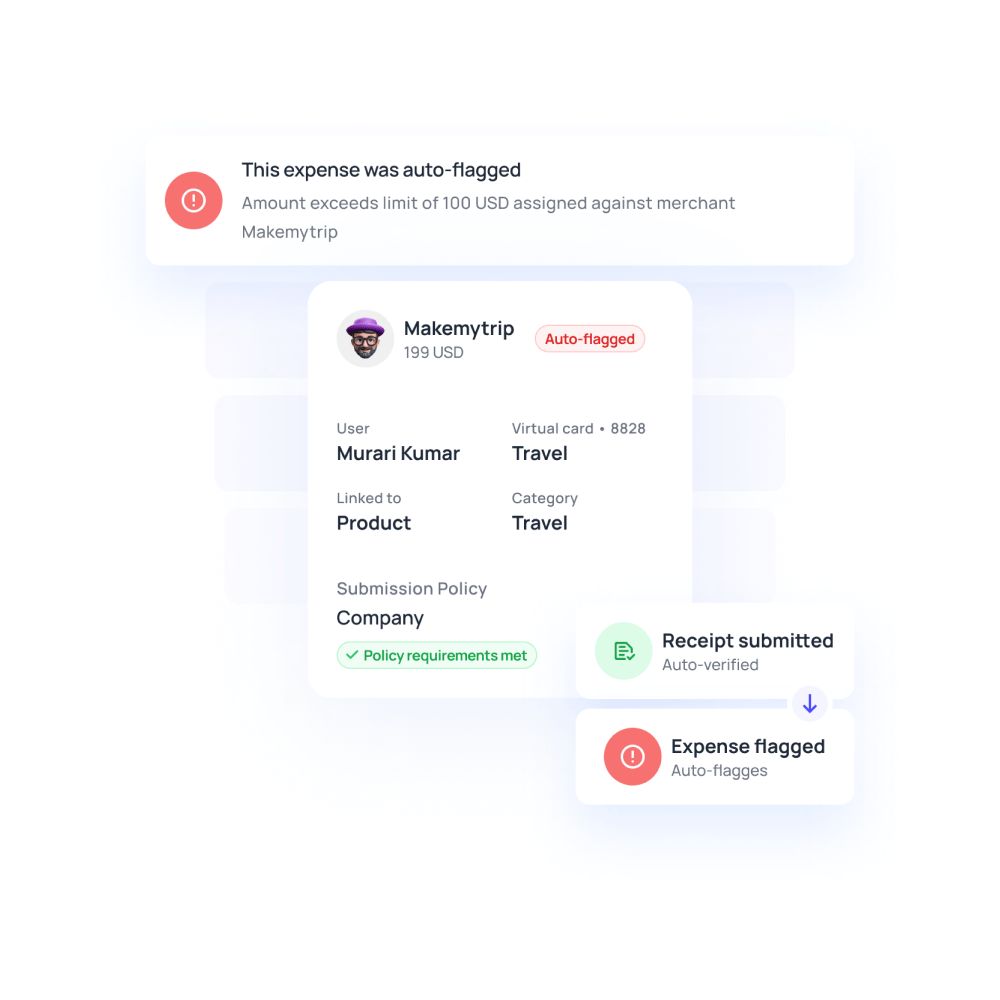

Monitor spending in real-time

It is crucial to monitor and keep track of employee expenses regularly to check if they don’t exceed the budget and spot anomalies. Keeping an eye on costs is a necessity to avoid employee fraud. This real-time tracking can also predict patterns in spending and make reformed budgets for consecutive years.

Set clear expense policies in place

Ambiguous T&E policies confuse both employees and approvers. Due to this, employees aren’t aware of their policies and make incorrect expenses. Go over your current policies to make updates and remove the unclear ones. As a next step, communicate this with everyone involved.

Your expense policy should briefly discuss what expense categories are allowed, expense limits, if any, and conditions and clauses to be noted. When there is a clear policy, you can avoid wrong and fraudulent claims by employees.

Make expense reports convenient

Employees love business travels but hate expense reporting. They are a long, exhaustive process that requires them to add insubstantial data and receipts from their trip. But reimbursements don’t have to be this hard. For smart finance management and expense reporting, change the process by bringing in software or mobile app for submitting expenses.

Employees will open their app, scan documents and extract information to fill in the expense report. One can track the status of their request too.

Automate accounting and reconciliation

In a nutshell, bring in financial automation to automate every step of accounting and expense reporting. This reduces manual work, speeds up the accounting process, and narrows down the chances for errors. So, when there is an expense request in the queue, it will automatically travel from one level to another and reach the appropriate approver's queue.

Post-approval, it gets processed automatically. New-gen finance management software allows the expense to reconcile with the ledger system and bank statements. Since the application communicates with other major accounting and finance software, you don’t have to update the expense data into other systems manually. This way, you can achieve continuous closing instead of closing weekly, monthly or annual.

Offer credit cards to employees

Credit cards are a more refined way to handle employee expenses than reimbursement. Providing physical or virtual corporate cards to employees liberates them from making their business expenses on their own within a limit. The app will record every payment in the card management system, where the admin can create, delete or modify the card. Credit cards are the ultimate way to do away with reimbursements and switch to what’s new in the fintech world.

Improve your finance process with Volopay

To improve finance processes and bring an organization, you are in need of proactive expense management automation software. Volopay is the answer to your finance automation search!

It makes finance management stress-free by automating every payment process. It will be irresistible to deny this product once you see its interactive reimbursement portal, unlimited corporate cards, swift local and foreign transfers.

Trusted by finance teams at startups to enterprises.