What are the key features of expense management software?

Expense management has always been a daunting task for new business owners. It looks manageable at the start but snowballs as you deal with more vendors.

Accountants don’t prefer organizations that dump them with manual workloads. Thankfully, we live in the digital era. There are technically advanced payment solutions that businesses can adapt to get work done faster.

Expense management automation software is one of them. The best part is that it works well even for small companies. It cuts down manual work and human intervention.

But there are many products available in the market. Knowing the features of the expense management software beforehand will help you in selecting the most suitable software for your business.

How has traditional expense management been affecting businesses?

Manual expense management isn’t easy. There are many drawbacks to it. And accountants spend their whole day fighting these challenges. This gives them no time to reflect on their spending or contribute to financial forecasting.

Using physical files or spreadsheets also limits their potential. They can use their Excel knowledge to create formulas, color-coded documents, and graphs. But this data serves no purpose as it’s all over the place.

Other challenges are:

● Lengthy billing process

The onus of pushing a bill forward and sending the money falls on the accountant. If an approver delays, they have to wait or remind them over emails or calls. Such follow-ups drag out time.

● Expense fraud

Either the employee or the vendor can forge a bill and make false payments. No one will know it until an audit happens. Reconciliation becomes trouble as they can’t find the root of the scam.

● Error-filled

Any mistake that happens in one step gets carried forward to the next until they have to do it over. 100% accuracy is not guaranteed with manual expense management.

Why should businesses consider expense management automation?

Over time, businesses have realized the above shortcomings. But they still don’t make the switch in one day. Here is why you must implement an automatic expense management system in your organization.

1. Reduces unnecessary spends

Think of a spreadsheet full of numbers and names. You cannot figure out anything even if it’s highlighted. You have the expenses list. You know the total amount spent.

But it takes time to dig into what became expensive, what has turned out cheaper, and what exhausted the budget.

Until you know this, it will be impossible to make out a viable budget plan and lessen avoidable expenses. Smart spending goes a long way in building better cash flow and revenue.

2. Better compliance and accountability

There are accounting standards that registered taxpayers must follow while reporting their annual spending. They change frequently and each government has its own regulations.

Lack of compliance can land you in trouble. You will be penalized heavily. Mainly, financial reporting must be precise. You must have receipts and proof for every reported transaction.

For financial reporting and documentation practices, one must be aware of local government regulations and adhere to them. An expense management automation software automatically meets compliance requirements.

3. Real-time visibility and transparency

Expense management apps don’t limit the data but share it with everyone in the team depending on their level of the hierarchy.

Especially, the finance team and decision makers get a good peak over expenses in real-time. They can monitor the expenses at any time in the dashboard and also know what they pertain to.

This height of transparency reduces unnecessary questions around it. Everyone understands the paid, unpaid, scheduled, and pending bills, and the overall spending of any time period.

4. Save productive hours of the workforce

Employees become more productive and active when their job has a clear set of responsibilities.

The features of expense management software help them stay productive at work and achieve their tasks more quickly. You don’t have to pay them for doing limited, unproductive work.

Rather, you can make them contribute more to spending analysis, budget plans, and reporting and pay the same money. The quicker they finish their day-to-day tasks, the better they feel about their workplace and nature.

5. Boosts employee satisfaction and morale

Employees feel valued knowing that their company invests in advanced tools to support them at work. This boosts their morale and loyalty and creates a positive impact in the workplace.

When they are equipped with the right tools, their knowledge and expertise increase. Modern expense management automation software brings the right level of team collaboration.

They no longer chase approvers but engage with them in productive work-related activities.

Manage all your business expenses and payments on a single platform

Key features of expense management software

The features of expense management software differ from one provider to another. But the most important ones are.

1. Real-time visibility into spending

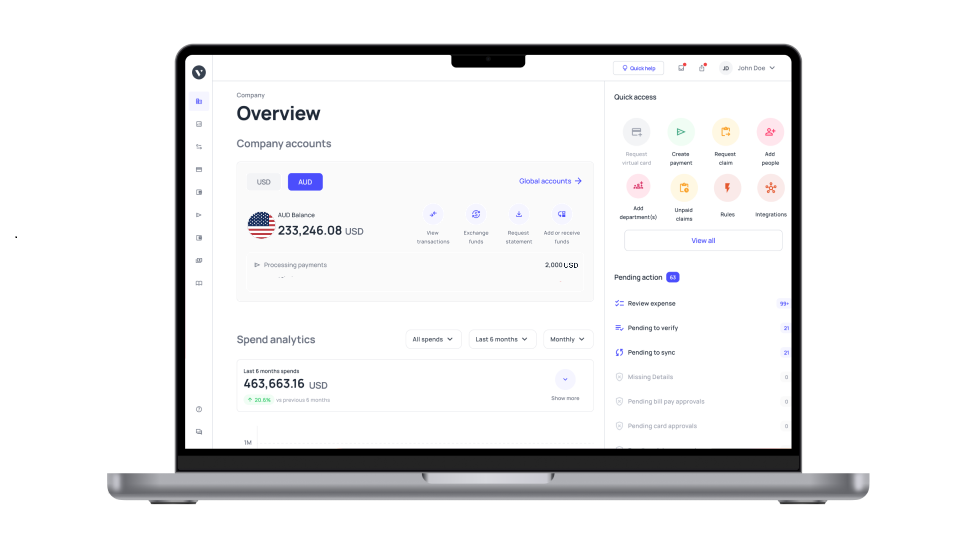

An automated expense management software must have an intuitive dashboard with up-to-date spending data, including the history. This data is very useful to overview regular and one-time expenses and derive actionable insights from that.

This feature must also include:

● Spend patterns, insights, and anomalies in the form of data or graphs

● Expenses that are categorized based on time, vendor, department, expense category, etc.

● Current balance availability

● List of expenses and their details

2. Easy expense reporting process

Expense reporting is the process of collecting the business expenses of employees in one place. As the company has to reimburse these expenses, the app must support the claim process, collect forms, and process it.

Employees wait forever to get their money back due to traditional reporting methods. This key feature of expense management software must do the following to simplify expense reporting.

● Easy-to-fill digital claim forms that accept receipts

● Automated approval workflows and notifications to let approvers know

● Real-time status tracking enabled for employees

● Department-based spending analysis to reduce unnecessary expenses

3. Integration with preferred accounting software

Every business uses different accounting software for reconciliation and other accounting purposes. When their automated expenses management software has an open application interface, it can get connected with other accounting apps.

This integration allows them to communicate with each other and share data. Without someone manually transferring the data, the sync transfers it automatically.

Hence, the expense software must have an integration option available for most common accounting software.

4. Checks policy in real-time

Expense policies are made by companies to regulate employee spending. If an app just allows reimbursements to be claimed but doesn’t enforce these policies, it’s simply useless.

An automatic expense management solution must allow you to add these policies and update changes in them. So, when an employee tries to submit a claim, the policy should check and decide if it’s an eligible claim or not.

If the policy doesn’t allow a certain expense, it can flag and reject it right away. This way, the employee is aware of it too, rather than hearing a negative response after so long.

5. Digital audit trails

Digital audit trails denote tracing back to the root of an expense to know why and who initiated it.

It is mostly used in the expense reporting process but is also applicable to other bills, and invoices. An effective expense management automation software must record the entire flow of payment.

So, anyone can easily comprehend why the expense is approved. This chronological record can also be considered a document proof and stored with other financial records.

6. Advanced data analytics

One of the features of expense management software is that it can play around with data and offer an analytical view.

These data-driven insights can definitely help finance teams to understand their current financial state and what the future looks like. Some functions that it can do includes,

● Flags to determine fraudulent activities

● Employee monitoring and policy violation notice

● Budget planning and forecasting

● Showing expense trends

● Financial reports generation

7. Easy expense approval process

Expense approval is a basic feature of expense management software. You must be able to set custom workflows for different expense types. And there should be an option to set single to multi-level approvers.

Based on the raised bill, the software must automatically route to the desired approver. Push and email notifications, so that the approver can make decisions on the go.

This whole process must be simple and no approver should stall the payment, as they find it hard to operate.

Get the best expense management software for your business

Benefits of using an expense management automation software

The features of expense management software help employees and managers in different ways. Looking that way, here is how it benefits both groups.

1. Management

● Receipt management

They don’t have to find storage solutions to keep their financial and accounting records safely. The app can safely carry them and store them in the cloud where no one can access them.

● Approval workflow automation

They won’t be answerable to anyone when a vendor gets annoyed due to a late payment. In a unified platform, they can see the pending requests and approve them right away.

● Compliance with policies

It’s a headache to stick to regulatory measures without the help of automated software. The product will take care of this, reducing the stress on the management.

● Digital audit trail

Finding the reason and history of expenses is very simple. They can access audit trail logs instantly and track payments in a second. Accessing related receipts and proof to validate the expense is also possible.

● Accounting integrations

The management can finally achieve continuous closing and keep the accounts synced. They feel more comfortable working with updated data and applications.

● Real-time visibility into expenses

No need of checking with accountants regarding payment statuses. They can directly check in the dashboard and find the status. The same applies to processed payments also.

2. Employees

● Easily automated data extraction

It’s employees who do the dirty work of basic data entry. They can be relieved from that and save time. Instead, they can choose to sync or not sync an expense and move it to another application.

● Unlimited scanning of receipts

There are certain times when businesses receive huge numbers of invoices. Accountants slog hard to update and process them.

But bulk upload and unlimited scanning are one of the features of expense management software. It takes a few seconds to get this done.

● Mileage tracking

In companies where employees get travel mileage, mileage tracking can help a lot. This involves using a mobile app. Turn on GPS while commuting to the workplace or work-related events.

This app will calculate the distance traveled and mileage, record it in the app, and transfer it to the payments section. This also helps management to maintain fair expense reporting practices.

● Mobile apps to help with reporting expenses

Employees don’t have to store their receipts. They can open the mobile app and upload receipts to initiate reporting.

● File expenses in bulk

Employees who travel often will have many receipts to upload. In such cases, it’s easy to upload them one by one and submit reporting. Following up can be done in seconds.

● Easier bookkeeping process

Automatic bookkeeping helps accountants maintain precise records. Auditing or tax preparation sessions won’t be stressful anymore, as they have everything in one place.

Reap the benefits of expense management automation with Volopay

Looking for an application that has all the required features of expense management software? Volopay is the answer. Volopay is the best solution for expense management and bookkeeping.

Volopay has tools to automatically schedule domestic and international payments. It also has an intuitive interface with which real-time tracking is possible.

As it has an open API, connecting with other software like Netsuite, Quickbooks, and more. Your accounting data will be always synchronized and reconciled.

It also has a simplified reimbursement platform. Employees can submit reports with receipts and receive money faster. An advanced solution to this is corporate cards.

You can distribute virtual corporate cards to employees and manage the spending data centrally through the platform. Automate every step of invoice and bill processing and integrate your applications wisely to save time.

FAQs

It reduces manual work by implementing automatic data capture and integrations. Instead of manually copying data, employees can rely on this tool to input data into the software.

Automated expense management systems will show your current spending. With this, you can project future expenses and make accurate budgeting decisions. Departmental budgets can be applied to control expenses on team levels.

Making expenses from a centralized platform is the best way to track expenses from one location. Volopay has all tools you need to make all kinds of business payments.

The Volopay onboarding process is quite simple. It takes only a few days to get started and learn to operate the suite.

Expense management software has a reimbursement tool that allows employees to submit claim reports. With approval workflows, the request can be routed to relevant departments.