Top 10 Expensify alternatives for July 2025

When considering Expensify alternatives, it’s clear that not every software is suited to every business. While Expensify remains a strong option for managing expenses, your company might have specific needs that call for a different approach.

The good news is that the market is abundant with various Expensify competitors in 2024, each offering distinct advantages that could be a better fit for your operations. With so many alternatives to Expensify available, you have the fluidity to find a solution that aligns perfectly with your goals.

Your business might prioritize scalability as it grows, or perhaps flexibility is what you need to manage complex global operations. The right alternative should adapt to how you work, not the other way around. Whether you’re looking for easier integration, more advanced reporting, or simply a tool that fits better within your budget, you have a wide range of options to explore.

These choices empower you to pick software that truly supports your company’s unique workflow, operational style, and growth trajectory, ensuring you stay efficient and well-organized in your financial processes.

What is Expensify?

Expensify is a powerful expense management platform that optimizes your company’s spending processes. It helps you handle everything from receipt scanning and expense tracking to bill payments and travel bookings. With Expensify, you can gain valuable insights into your spending patterns, allowing you to make informed financial decisions.

Expensify further integrates seamlessly with your accounting, HR, payroll, and travel systems, providing you with real-time visibility and control over your expenses. Its features include automated expense reporting, next-day reimbursements, and synchronization with accounting software.

As you explore Expensify competitors and alternatives, you’ll find various options that cater to different needs and preferences. These alternatives to Expensify often provide similar functionalities, such as expense tracking, report generation, and integration capabilities, but may offer unique features or pricing models.

By evaluating these Expensify alternatives, you can choose the tool that best suits your organization’s requirements and enhances your expense management process.

Why do you need an alternative to Expensify?

While Expensify offers comprehensive expense management solutions, exploring Expensify alternatives can provide your business with options that better meet your specific needs.

By considering different Expensify competitors, you can find tools that align more closely with your priorities, whether they involve privacy and security, customer support, or other features. Here’s why you might want to look beyond Expensify.

Account cancellation

The ease of account cancellation is crucial when selecting an expense management tool. Some Expensify competitors offer more straightforward and hassle-free processes for discontinuing services.

Opting for Expensify alternatives with a simple cancellation policy can save your company significant time and effort, ensuring a smoother transition if you decide to switch tools, and minimizing potential disruptions to your expense management operations.

Pricing

Pricing structures differ widely among Expensify alternatives. While Expensify provides a comprehensive feature set, some alternative platforms may offer more cost-effective solutions that better fit your company’s budget.

By exploring various Expensify competitors, you can find a tool that delivers comparable or enhanced features at a lower cost or with more flexible pricing plans, helping you manage expenses within your financial constraints.

Customer support

Effective customer support can significantly impact issue resolution. Some Expensify alternatives offer more responsive and personalized assistance than Expensify.

These Expensify competitors might provide dedicated account managers, extended support hours, or faster response times.

Opting for a solution with superior support ensures you receive timely help, making expense management smoother and more efficient for your company.

Virtual card

Virtual cards are an innovative solution for managing business expenses. Some Expensify alternatives offer more advanced or customizable virtual card features compared to Expensify.

These options offer greater convenience and control over spending, allowing you to manage transactions more effectively and track expenses with greater ease.

Exploring different Expensify competitors can help you find a virtual card solution that better meets your company’s specific needs, preferences, and goals.

Expense reporting

Effective expense reporting is vital for maintaining financial clarity. While Expensify offers sturdy reporting tools, exploring Expensify competitors may reveal alternatives with superior capabilities.

These alternatives to Expensify might provide more detailed insights, customizable report formats, or enhanced integration with your existing financial systems.

Choosing a solution with advanced reporting features can streamline your expense management process and deliver a clearer view of your financial data.

Privacy & security

Privacy and security are essential for managing sensitive financial data. Expensify competitors might offer more robust security features that align better with your company’s data protection policies.

Alternatives to Expensify, which mainly focus on security issues, could provide stronger encryption, stricter data access controls, and improved compliance with industry standards.

Choosing a reliable solution with these enhanced security measures ensures that your company’s information remains fully protected and secure at all times.

Top 10 Expensify alternatives in 2025

1. Volopay

● Overview

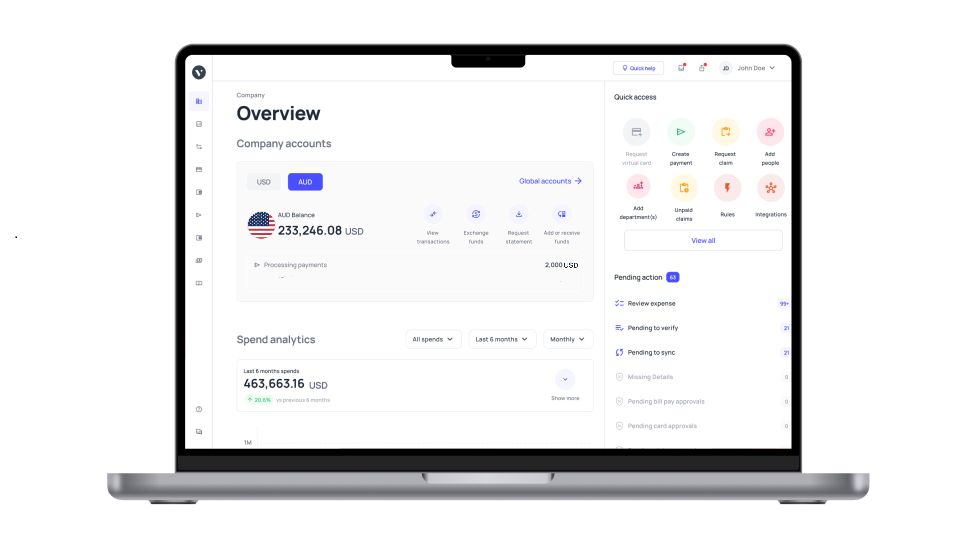

Volopay stands out as one of the top Expensify alternatives in 2024, offering a comprehensive platform designed for managing corporate expenses.

Tailored for global businesses, it integrates comprehensive expense management with smart corporate cards, giving you a unified solution for all your financial operations.

● Key features and benefits

Volopay’s unified platform simplifies bill payments, vendor management, and invoice processing with automation. The platform’s multi-currency digital wallets support global transactions with competitive FX rates, making it a standout for businesses with international operations.

You also benefit from real-time expense tracking and detailed analytics, providing you with the insights needed to make informed financial decisions and optimize your budget.

● Advantages

Volopay’s seamless integration with popular accounting tools ensures easy synchronization of financial data. Its user-friendly interface and multi-level approval workflows accelerate expense management, reducing manual tasks and errors.

Additionally, Volopay offers customizable workflows and virtual cards to fit your company’s unique financial processes. The mobile app is another important plus, ensuring you can manage expenses on the go.

● Limitations

Adopting a new expense management system like Volopay might involve a brief learning curve for your employees, requiring some initial adjustment and training.

● Fees and charges

Volopay offers transparent pricing with plans tailored to different business needs. While there are fees for premium features, basic functions remain accessible at a reasonable cost.

● G2 rating

Volopay enjoys a strong G2 rating of 4.2/5, reflecting user satisfaction with its innovative features and reliable support.

● Conclusion : Why choose Volopay over Expensify

You should choose Volopay over Expensify if you need a unified platform that supports international payments, offers real-time tracking, and integrates seamlessly with your existing systems. It’s ideal Expensify competitors for global businesses looking for a scalable, all-in-one expense management solution.

2. Zoho Expense

● Overview

Zoho Expense is one of the versatile Expensify competitors known for its expense-tracking capabilities. It integrates smoothly with other Zoho applications, making it a great option for businesses already using Zoho’s ecosystem.

● Key features and benefits

Zoho Expense offers automated expense reporting, easy receipt scanning, and multi-currency support. Its integration with popular accounting software ensures that your financial data is synced in real time. The platform also provides advanced analytics, enabling better financial decision-making.

● Advantages

Zoho Expense is known for its ease of use, making it accessible to small and medium-sized businesses. It also supports customizable workflows, allowing you to tailor the platform to meet your specific needs.

● Limitations

The platform’s advanced features may be unnecessary for very small businesses.

● Fees and charges

Zoho Expense offers a free plan with basic features, while its premium plans are competitively priced, making it affordable for businesses of all sizes.

● G2 rating

Zoho Expense has a solid G2 rating of 4.5/5 , reflecting its reliability and ease of integration with other tools.

● Conclusion : Why choose Zoho Expense over Expensify

If you’re seeking cost-effective alternatives to Expensify that integrate well with other Zoho apps and offer customizable workflows, Zoho Expense is the right choice for you.

3. Ramp

● Overview

Ramp is a leading choice for Expensify alternatives designed to optimize expense management for businesses. Combining corporate cards with automated expense tracking, Ramp offers a solution that simplifies financial operations while delivering valuable insights.

The platform focuses on helping businesses save money and improve efficiency through its streamlined, user-friendly interface and robust automation features.

● Key features and benefits

Ramp provides automated expense categorization, real-time analytics, and policy enforcement to ensure compliance. It integrates seamlessly with popular accounting software, allowing for smooth financial data management.

A standout feature is Ramp’s cashback rewards on purchases, providing an additional incentive for businesses to use the platform. Additionally, Ramp’s spend management tools help you control expenses while enhancing overall financial transparency.

● Advantages

Ramp’s no-fee structure sets it apart, offering a corporate card with no annual fees. The platform’s powerful automation capabilities significantly reduce manual data entry, saving time and minimizing errors.

● Limitations

While Ramp is robust, it primarily caters to mid-sized and large businesses, which may limit its appeal to smaller companies. Additionally, some users may find its feature set less comprehensive compared to other alternatives to Expensify.

● Fees and charges

Ramp’s unique fee policy makes it a cost-effective option for businesses seeking advanced financial management tools without extra costs.

● G2 rating

Ramp boasts a high G2 rating of 4.8/5, with users highlighting its cost-saving features, automation, and ease of use.

● Conclusion : Why choose Ramp over Expensify

Ramp is an ideal choice for your business if you’re looking for a no-fee corporate card that also provides powerful automation features. By helping you optimize expenses and maximize financial efficiency, Ramp delivers a compelling value proposition for businesses focused on growth and cost control.

4. Navan

● Overview

Navan, formerly known as TripActions, is one of the comprehensive Expensify alternatives that seamlessly merges travel management with expense tracking.

It’s an ideal choice for businesses that need a unified platform to handle both travel bookings and expenses, simplifying operations for companies with substantial travel requirements.

● Key features and benefits

Navan provides integrated travel booking and expense management, offering complete visibility into travel-related expenses. The platform automates expense reporting, provides real-time budget tracking, and offers a mobile app for managing bookings and expenses on the go.

Additionally, Navan’s AI-powered system gives personalized travel recommendations, improving both the user experience and cost efficiency.

● Advantages

Navan’s all-in-one platform reduces the complexity of managing travel and expenses separately. Its real-time insights and policy enforcement tools ensure compliance, while its intuitive interface enhances user convenience.

The mobile app allows employees to manage bookings, submit receipts, and track expenses from anywhere, streamlining the entire travel and expense process.

● Limitations

Navan’s focus on travel management may be excessive for businesses with limited travel needs.

● Fees and charges

Navan offers flexible, usage-based pricing, tailored to the specific services and features you require. However, the comprehensive nature of its features may result in higher costs compared to other alternatives to Expensify.

● G2 rating

Navan has a strong G2 rating of 4.7/5, especially for its travel management capabilities.

● Conclusion : Why choose Navan over Expensify

Navan is an excellent choice for Expensify competitors if your business needs an integrated solution for travel and expense management. Its ability to handle both areas within a single platform makes it the perfect choice for companies with significant travel demands, delivering convenience and efficiency.

5. Airbase

● Overview

Airbase is one of the Expensify alternatives that merges expense management, accounts payable automation, and corporate cards into one unified platform.

It’s designed to empower businesses with full control over financial operations, offering increased visibility, automation, and efficiency in managing company spending.

● Key features and benefits

Airbase’s robust platform provides real-time expense reporting, automated bill payments, and a centralized dashboard for managing all financial processes.

Airbase’s spend management tools allow you to monitor budgets and track expenses with precision, giving you greater control over your financial planning.

● Advantages

Airbase’s all-in-one platform optimizes financial operations from expense tracking to vendor payments, reducing manual work and errors.

The platform’s real-time visibility into spending helps you make informed decisions and stay within budget. Integrations with accounting software make reconciliation and financial reporting seamless, saving time and effort.

● Limitations

Airbase’s extensive feature set can be overwhelming for small businesses with simpler needs. Additionally, the initial setup process may require significant time investment, especially for companies new to automation.

● Fees and charges

Airbase offers various pricing plans, though costs may be on the higher side for smaller businesses. However, the comprehensive features and automation capabilities deliver strong value for mid-sized to large companies.

● G2 rating

Airbase maintains a high G2 rating of 4.7/5, with users highlighting its powerful feature set, seamless integrations, and suitability for larger organizations.

● Conclusion : Why choose Airbase over Expensify

Airbase is the go-to alternatives to Expensify if you need a solution that integrates expense management with accounts payable automation, offering unparalleled control over your financial operations and enhancing overall efficiency.

6. SAP Concur

● Overview

SAP Concur is renowned as an Expensify competitor recognized for its extensive capabilities in travel, expense, and invoice management. As part of the SAP ecosystem, it seamlessly integrates with other SAP products, making it a top choice for large enterprises with complex financial needs.

● Key features and benefits

SAP Concur offers automated expense reporting, integrated travel management, and advanced analytics to monitor spending. The platform’s compliance features ensure adherence to company policies, helping you control costs and avoid overspending.

● Advantages

SAP Concur’s deep integration with the SAP ecosystem makes it the go-to solution for businesses already using SAP software. Its multi-currency and multi-language support make it ideal for global organizations.

The platform’s advanced analytics offer actionable insights into spending patterns, aiding in better financial planning and cost management.

● Limitations

The platform’s robust features come with a steep learning curve, requiring substantial time and resources to fully implement. Moreover, SAP Concur’s pricing can be prohibitive for smaller companies or those with limited budgets.

● Fees and charges

SAP Concur provides tiered pricing based on the services required. Although more costly than many other alternatives to Expensify, its features justify the investment for larger enterprises.

● G2 rating

SAP Concur enjoys a good G2 rating 0f 4.0/5, particularly for its comprehensive feature set and global capabilities.

● Conclusion : Why choose SAP Concur over Expensify

Choose SAP Concur if your business needs a globally capable platform that integrates seamlessly with SAP products while offering advanced features for managing travel, expenses, and invoices.

7. Fyle

● Overview

Fyle is one of the intuitive Expensify alternatives designed to simplify expense management for businesses. It focuses on providing essential automation tools while maintaining ease of use, making it a popular choice for small to mid-sized companies looking to streamline and accelerate expense reporting.

● Key features and benefits

Fyle offers automated receipt scanning, real-time expense tracking, and policy enforcement, ensuring compliance and accuracy in expense management on your existing credit card. Its straightforward integration with accounting software ensures that your financial data is always up to date.

● Advantages

Fyle’s user-friendly interface and simplicity make it accessible for businesses with limited resources. The platform’s powerful automation features reduce manual data entry for your team, ensuring faster processing and accurate reporting.

● Limitations

Fyle may lack the advanced features that larger enterprises require. The platform’s customization options are also somewhat limited compared to more complex alternatives to Expensify, which might restrict businesses with unique workflows.

● Fees and charges

Fyle offers competitive pricing plans tailored to different business sizes. The platform delivers strong value for small to mid-sized businesses seeking core expense management features without unnecessary complexity.

● G2 rating

Fyle holds a high G2 rating of 4.6/5, with users appreciating its ease of use, automation, and smooth integration capabilities.

● Conclusion : Why choose Fyle over Expensify

Fyle is the right choice if your business needs a simple, automated expense management solution that prioritizes ease of use, policy compliance, and efficient integration.

8. Brex

● Overview

Brex is a leading name among Expensify competitors that provides a unified financial platform offering corporate cards, expense management, and credit-building features.

● Key features and benefits

Brex offers corporate cards with high limits, no personal guarantees, and rewards tailored to business needs. The platform automates expense tracking, bill payments, and real-time budget management, allowing you to stay on top of your finances.

● Advantages

Brex’s tailored offerings provide credit-building opportunities, fast approvals, and rewards suited to high-growth companies. Additionally, Brex’s ability to issue virtual cards enhances flexibility and control over business expenses.

● Limitations

The platform’s eligibility requirements, such as minimum funding levels, could be restrictive for some businesses, especially those still in early growth stages.

● Fees and charges

Brex offers no-fee corporate cards, with access to additional features available through their tiered pricing structure. This structure makes it a cost-effective solution for businesses seeking expense management and credit-building without significant overhead costs.

● G2 rating

Brex maintains a strong G2 rating of 4.7/5, with users appreciating its automated tools, and straightforward financial management capabilities.

● Conclusion : Why choose Brex over Expensify

Brex is the perfect alternatives to Expensify if your business is seeking access to credit, expense management, and financial insights in one streamlined platform built specifically for high-growth needs.

9. BILL

● Overview

BILL is a top-tier Expensify alternatives offering a comprehensive solution for accounts payable automation, expense management, and optimized payment processes. It’s designed for businesses that aim to automate financial workflows.

● Key features and benefits

BILL automates invoice processing, vendor payments, and expense tracking with powerful tools that integrate seamlessly with popular accounting softwares.

The platform also offers multi-level approvals, ensuring adherence to company policies while accelerating payment cycles.

● Advantages

BILL’s automation significantly reduces manual data entry, enabling faster vendor payments and more efficient invoice management.

The platform’s deep integration capabilities allow you to manage all financial processes from a single platform, streamlining workflows and improving overall accuracy.

● Limitations

While BILL is feature-rich, its capabilities may exceed the needs of new businesses that don’t handle a high volume of invoices or vendor payments. Additionally, the platform’s cost might be a challenge for businesses with limited budgets.

● Fees and charges

BILL offers tiered pricing based on the level of services you require, with its costs ranging higher than the simpler alternatives to Expensify.

● G2 rating

BILL holds a favorable G2 rating of 4.4/5, with users praising its accounts payable automation and seamless integration.

● Conclusion : Why choose BILL over Expensify

BILL is the alternatives to Expensify you should choose if you need comprehensive accounts payable automation, integrated payment solutions, and enhanced financial insights.

10. Payhawk

● Overview

Payhawk is a versatile option as Expensify competitors that combines corporate cards, expense management, and global payment solutions in a unified platform.

● Key features and benefits

Payhawk offers a robust platform featuring automated expense reporting, real-time budget tracking, and corporate cards with spend controls. It also supports multi-currency accounts, making it a strong choice for businesses operating across different regions.

● Advantages

Payhawk’s end-to-end financial management capabilities streamline complex workflows, making it ideal for businesses with diverse needs. The platform’s automation tools reduce manual work while ensuring compliance with financial policies.

● Limitations

Payhawk’s pricing structure may be on the higher side for companies with limited budgets, especially those not requiring advanced global features.

● Fees and charges

Payhawk offers scalable pricing based on usage. While it may be more expensive than some simpler alternatives to Expensify, its value lies in the comprehensive features and global capabilities it provides.

● G2 rating

Payhawk holds a high G2 rating of 4.5/5, with users praising its comprehensive feature set, scalability, and support for global operations.

● Conclusion : Why choose Payhawk over Expensify

Payhawk is the choice you should make if you need a scalable platform that supports global operations, offers advanced automation features, and provides robust multi-currency management for comprehensive financial control.

Simplify expense management with Volopay

Key factors to consider when choosing Expensify alternatives

When selecting Expensify alternatives, it’s essential to evaluate several factors to ensure the tool meets your business’s specific needs.

Expensify competitors offer unique features that could enhance your expense management process. By considering these aspects, you can choose an option that best aligns with your company’s requirements.

Streamlined expense reporting

One crucial factor is how effectively the Expensify alternatives streamline expense reporting. Seek out tools that simplify capturing, categorizing, and reporting expenses.

The best solutions automate these processes to minimize your team’s manual effort, allowing you to generate accurate reports quickly and efficiently.

This capability helps you maintain financial clarity and manage your company’s expenses with minimal effort, ensuring that you stay on top of your financial data and reporting needs.

Data security

Data security should be a top priority when evaluating Expensify competitors. Ensure the tool offers robust security measures, such as encryption and secure access controls.

Reliable Expensify competitors will prioritize protecting your sensitive financial data and ensure compliance with industry standards.

Strong data security measures safeguard your company’s information from unauthorized access and breaches, providing peace of mind that your financial data remains protected and secure.

Proactive customer support

Proactive customer support greatly influences your experience with Expensify alternatives. Opt for a tool that provides responsive, helpful support services.

Look for features like dedicated account managers, extended support hours, and prompt issue resolution. Effective support ensures you receive timely assistance, minimizing disruptions and making it easier to manage your company’s expenses efficiently.

By choosing Expensify competitors with robust support, you can enhance your overall expense management experience.

Seamless integration

Seamless integration with your existing systems is crucial when selecting Expensify alternatives. Ensure that the tool you choose integrates smoothly with your accounting, HR, payroll, and travel software.

This capability accelerates data transfer and minimizes manual entry errors, making expense management more efficient.

By choosing a tool that integrates seamlessly well with your current systems, you create a cohesive financial ecosystem that enhances overall productivity and reduces the chances of errors in your business processes.

In-built budgeting software

Consider whether alternatives to Expensify include in-built budgeting software. This feature allows you to set and monitor budgets directly within the expense management tool.

Integrated budgeting capabilities enable you to track spending against budgeted amounts, make informed financial decisions, and maintain better control over your company’s finances.

By having budgeting features within the same tool, you facilitate financial oversight and improve your ability to manage and plan your company’s expenses effectively.

Multi-currency feature

If your business operates internationally, a multi-currency feature is essential. Expensify competitors with this capability let you handle transactions in various currencies and manage expenses from different regions efficiently.

This feature simplifies international expense reporting and ensures accurate financial management across borders.

By choosing Expensify alternatives with multi-currency support, you streamline global financial operations and ensure international transactions are handled accurately and efficiently.

Pre-approved spending capacity

Pre-approved spending capacity is another important consideration. Look for Expensify alternatives that allow you to set spending limits and approvals in advance.

This functionality helps you manage expenses by ensuring expenditures stay within authorized limits before they occur. By implementing pre-approved spending, you reduce the risk of overspending and maintain adherence to your budget.

This feature contributes to better financial control and prevents unauthorized or excessive expenditures within your company.

Accurate corporate credit card reconciliation

Accurate reconciliation of corporate credit card transactions is vital for efficient expense management. Choose alternatives to Expensify that offer precise and automated reconciliation processes.

This feature simplifies the matching of card transactions with reported expenses, reducing manual reconciliation efforts.

Accurate reconciliation keeps your financial records up-to-date, helping maintain a clear view of corporate spending and enabling smoother financial management.

How to choose the best Expensify alternatives?

Choosing the right expense management software involves assessing your unique business needs. While Expensify is popular, several Expensify alternatives might offer better features, pricing, or integration options suited to your requirements.

By considering factors like business size, specific needs, ROI, and the onboarding process, you can make an informed decision when exploring Expensify competitors.

1. Determine the size of your business

Start by evaluating your business size and structure. Larger organizations with multiple departments require comprehensive software with advanced controls, multi-level approvals, and detailed reporting.

Smaller businesses or startups typically prioritize simplicity and cost-effectiveness. Depending on your business needs, various Expensify alternatives offer tailored features that scale as you expand. Assessing your company’s size ensures you choose software that aligns with your current operations while supporting growth.

2. Prioritize your needs

Identify your key priorities when choosing expense management software. Do you need streamlined expense reporting, better integration with accounting tools, or international payment support? Rank your priorities to narrow down your options.

Some Expensify competitors may excel in specific areas like automation, while others focus on ease of use. Knowing your top needs helps in evaluating the best alternatives to Expensify for your business.

3. Study past employee spending data

Analyze your company’s past spending patterns to identify where expenses typically occur. Review how frequently employees submit reports, which categories incur the most costs, and whether your current software efficiently addresses these needs.

Understanding these trends helps you pinpoint alternatives to Expensify that better manage expenses, minimize manual work, and provide improved reporting tailored to your business. This analysis ensures the software you choose aligns with your expense management goals and operational requirements.

4. Calculate ROI with cost

Determine the value you expect to gain versus the costs involved. Account for direct and hidden costs like subscription fees, integration charges, and support expenses. Compare these with the benefits such as time savings, improved efficiency, and enhanced spending control.

High-ROI solutions from Expensify competitors often deliver more cost-effective options without sacrificing key features. Evaluating ROI helps ensure you select software that balances cost with value, making it a smart choice for your business’s financial management.

5. Identify business-specific requirements

Your industry or operational model might require specialized features like mileage tracking, travel expense management, or global compliance. While comparing alternatives to Expensify, seek tools that align with your specific business needs.

This could involve specialized reporting, industry-specific integrations, or customized workflows. By identifying these requirements early, you can focus on Expensify alternatives that offer solutions tailored to your operational demands, ensuring the software you select seamlessly supports your processes and enhances overall efficiency.

6. Onboarding process

The onboarding and implementation process is critical when choosing Expensify alternatives. A smooth transition ensures employees can quickly adapt without significant setbacks.

Look for Expensify competitors that provide comprehensive training, intuitive interfaces, and responsive customer support to minimize learning curves.

Efficient onboarding allows your team to start using the platform effectively from the outset, reducing downtime and ensuring a seamless transition. Prioritizing platforms with strong onboarding features can lead to faster adoption and better long-term performance.

7. Determine department-wise effect of the software

Assess how each department will interact with the new software. HR may focus on reimbursements, while finance manages vendor payments. Analyzing these department-specific impacts helps identify Expensify alternatives that cater to varied needs across your organization.

Choose solutions that offer cross-functional benefits while allowing department-specific customization. This ensures smoother operations across all teams, enhancing collaboration and efficiency while addressing unique departmental workflows and requirements.

8. Compare alternatives for better ROI

Create a list of top Expensify alternatives and compare their features, pricing, and customer feedback. Solutions like Volopay, Zoho Expense, and Brex offer benefits like scalability, integrated financial tools, and advanced automation.

Analyzing these options ensures you select the most effective alternatives to Expensify that maximize your ROI while meeting your specific requirements. A thorough comparison can reveal the best combination of cost, functionality, and flexibility for your business.

9. Cost of making a switch

Switching software involves more than just subscription costs—it includes data migration, training, and potential downtime. When evaluating Expensify competitors, factor in these transition expenses.

Some alternatives to Expensify offer migration support, discounts for new users, or assistance to offset switching costs. Carefully calculate whether the long-term benefits justify the investment and ensure the switch causes minimal disruption. Balancing these factors helps you make a financially sound decision while smoothly transitioning to your chosen platform.

Take control of your finances

How does Volopay help grow your business?

Volopay offers a comprehensive financial management platform designed to accelerate your business operations, optimize spending, and drive growth.

By combining features like corporate cards, automated expense management, business bank accounts, and accounting automation, Volopay positions itself as a powerful alternative to traditional systems and popular Expensify competitors.

With tailored solutions for businesses of all sizes, Volopay is one of the top alternatives to Expensify for companies seeking growth and efficiency.

1. Corporate cards

Volopay’s corporate cards empower your team to make purchases with full control and transparency. You can issue virtual and physical cards to employees while setting spending limits and rules.

Real-time tracking ensures you stay updated on all transactions. Unlike many Expensify alternatives, Volopay’s cards offer flexibility and control while minimizing risks associated with unauthorized spending. This feature strengthens overall financial oversight and supports better financial management in your growing business.

2. Expense management

With Volopay's expense management system, handling expenses becomes seamless and efficient. Automated expense tracking reduces manual work, while policy enforcement ensures compliance. The platform’s easy-to-use interface allows employees to submit and categorize expenses instantly.

Compared to other Expensify competitors, Volopay offers advanced reporting and analytics, helping you identify spending patterns and optimize budgets. This automated approach to expense management saves time, reduces errors, and contributes to more strategic financial planning.

3. Business accounts

Volopay provides multi-currency business accounts that simplify global transactions. You can hold and convert currencies at competitive rates, making international payments more efficient.

Unlike traditional banking or certain Expensify alternatives, Volopay's business account integrates seamlessly with other financial tools, offering an all-in-one solution. The platform’s global payment support and real-time fund tracking help your business manage international operations smoothly, supporting expansion into new markets.

4. Accounts payable

Volopay streamlines your accounts payable process, from vendor management to invoice payments. You can automate payments, set approval workflows, and gain real-time visibility into outstanding payables.

This feature reduces bottlenecks and speeds up payment cycles. When compared to Expensify alternatives, Volopay’s accounts payable solutions offer greater customization and automation, allowing you to maintain strong supplier relationships while optimizing cash flow management.

5. Accounting automation

Volopay’s accounting automation streamlines repetitive tasks like reconciliation, data entry, and report generation. The platform integrates with popular accounting software, ensuring accurate financial records without manual intervention.

This automation helps reduce errors, improves data accuracy, and frees up your finance team for more strategic work.

Among Expensify competitors, Volopay stands out with its robust accounting automation, making it a top choice for businesses aiming to streamline financial processes and scale operations efficiently.

6. System integrations

Volopay integrates seamlessly with a wide range of business tools, including ERPs, HR systems, and accounting software. These integrations enhance data flow across your organization and ensure consistent financial reporting.

Compared to other alternatives to Expensify, Volopay’s extensive integrations offer greater flexibility, allowing you to build a connected ecosystem that fits your unique business needs. By integrating your systems, you improve efficiency, reduce data silos, and enhance overall operational performance, driving sustainable growth.

Ready to streamline your finances?

FAQs

Volopay offers a unified platform that goes beyond just expense management, making it a comprehensive alternative to Expensify. With features like corporate cards, accounts payable automation, and real-time insights, Volopay provides an all-in-one solution tailored for growing businesses. It contests other Expensify competitors by offering multi-level approvals, seamless global payment options, and vendor management in a single dashboard. For businesses seeking integrated financial tools with scalability, Volopay is a standout among Expensify alternatives.

The key difference between Volopay and Expensify is Volopay’s integrated financial management approach. While Expensify focuses primarily on expense tracking, Volopay offers a broader suite of features, including automated bill payments, vendor management, and multi-currency accounts for international transactions. Volopay’s platform also excels in offering real-time analytics, customizable approval workflows, and global expense management, making it more versatile.