Multi-currency wallets to improve your business finances

Over the years, multi-currency business accounts have gained significant traction from business owners because of their traits like convenience, versatility, and usability. Remitting from home country to abroad can be an exhaustive process, primarily due to the conversion rates, hefty remittance charges, and applicable tax rates.

What is a multi-currency wallet?

A multi-currency wallet enables companies to pay, receive, and hold multiple currencies in a single digital wallet without maintaining separate accounts for each international currency.

The multi-currency digital wallet facilitates business international payments as well as business exchange rates. Companies can shun heavy currency conversion fees through these wallet's use, avoid long transfer time, and monitor all their international transactions through a unique platform.

While using a multi-currency account, your exchanges and international remittances are instant and hassle-free. You never have to worry about the wallet’s complex transfer process or any hidden charges while initiating the transaction.

Your business can seamlessly make money transfers regularly in multiple currencies without bothering you with any inconvenience. If you're wondering how does a multi-currency account work, it allows you to hold and manage various currencies in one account, facilitating easy conversions and cross-border payments with minimal effort.

How do multi-currency wallets work?

A multi-currency exchange wallet essentially works the same way as a digital wallet. It lets you perform a series of standard functions to all multi-currency business accounts, though some platforms offer additional features to their capacity.

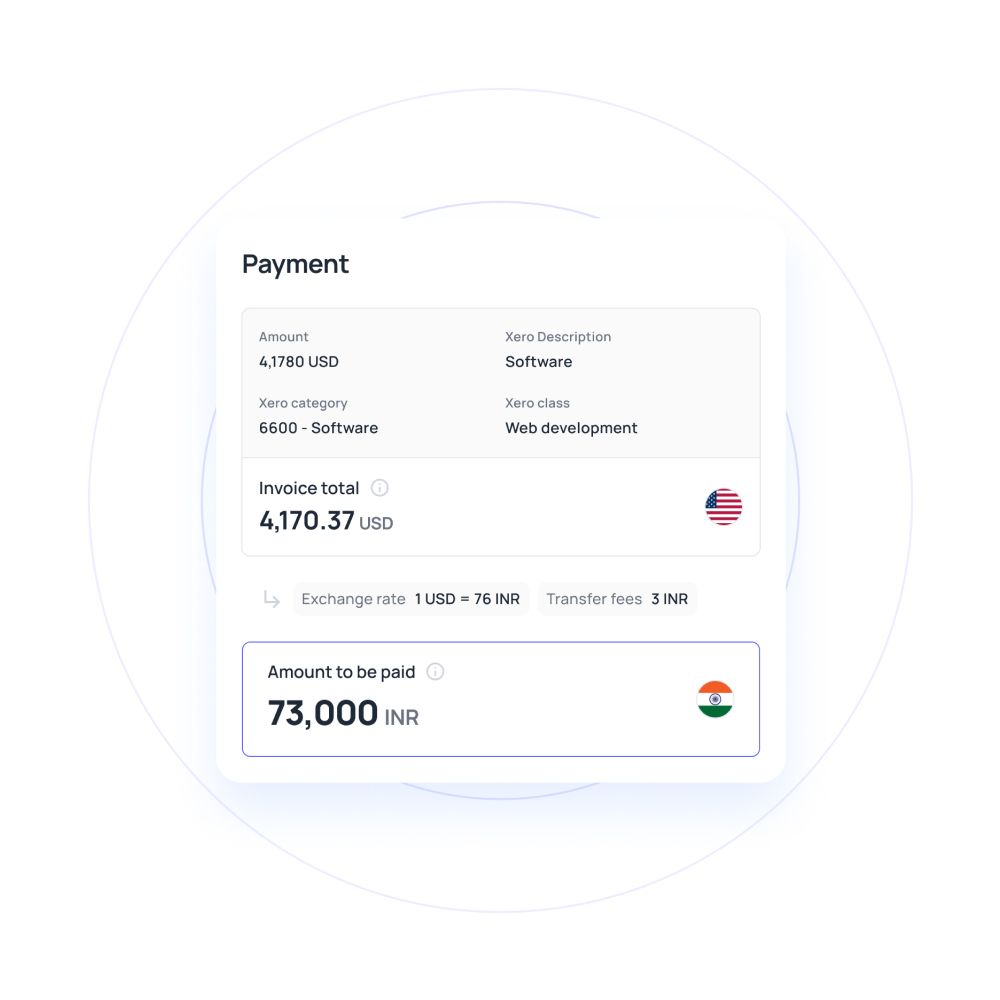

Similar to any bank account, a global currency account also attracts some charges for creating your account and some while making remittances.

The most common of these are withdrawal fees, overdraft charges, transfer fees, annual maintenance fees, which your relationship manager (RM) will keep you informed of. However, there shouldn’t be any additional fees or charges from the regular ones you find while opening a bank account.

Why should businesses consider multi-currency wallets?

Maintaining and managing your international payments through a single wallet is a win-win for any business. Firstly, you avoid the hassle of multiple wallets for each currency, and secondly, you avoid the unnecessary fees paid to each platform.

No hefty costs

Remitting via bank account calls for hefty charges in terms of transaction fees, conversion rates, store fees, and so on.

Through multi-currency digital wallets, companies save a good amount of money by avoiding these recurring charges.

These digital wallets offer competitive multi-currency account fees, which are supposed to be paid at the time of opening the account, and minimal annual maintenance fees.

Additionally, there’s no minimum balance requirement for your account; you can simply hold whatever amount of money without paying extra charges on it.

Quick transfers

Cross-border transactions are inherently slow to reflect into the beneficiary’s bank account; in some cases, it can take 2-3 working days to deposit the amount.

This lag in processing time can disrupt cash flow and delay business operations, especially for companies that rely on quick payments.

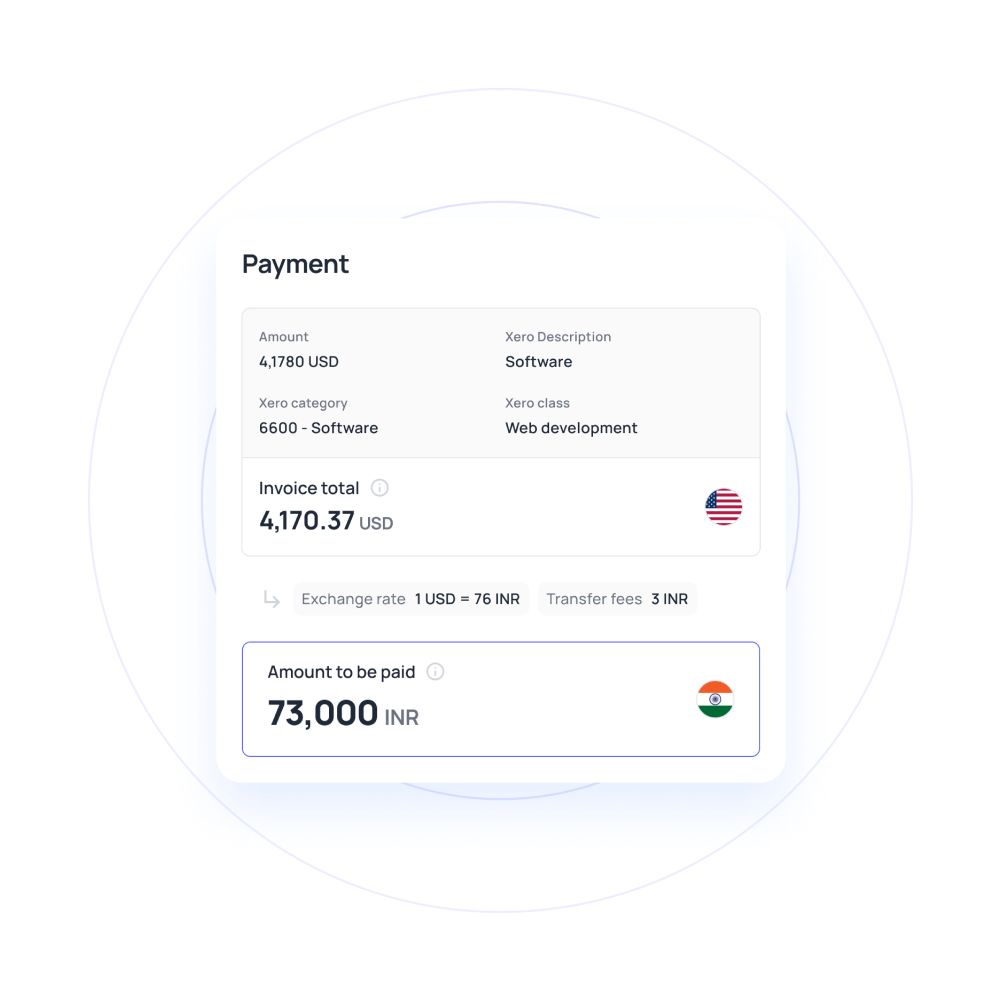

To eliminate this delayed mechanism, multi-currency digital wallets allow you to transfer money with minimum hassle, instant settlement, and convenient FX rates.

This method offers businesses a faster, more efficient solution to overcome the traditional challenges of cross-border payments.

Ease of use

Multi-currency wallets are undoubtedly among the most well-timed, highly efficient, and serviceable tools available for any business that is regularly involved in transactions across various countries and currencies.

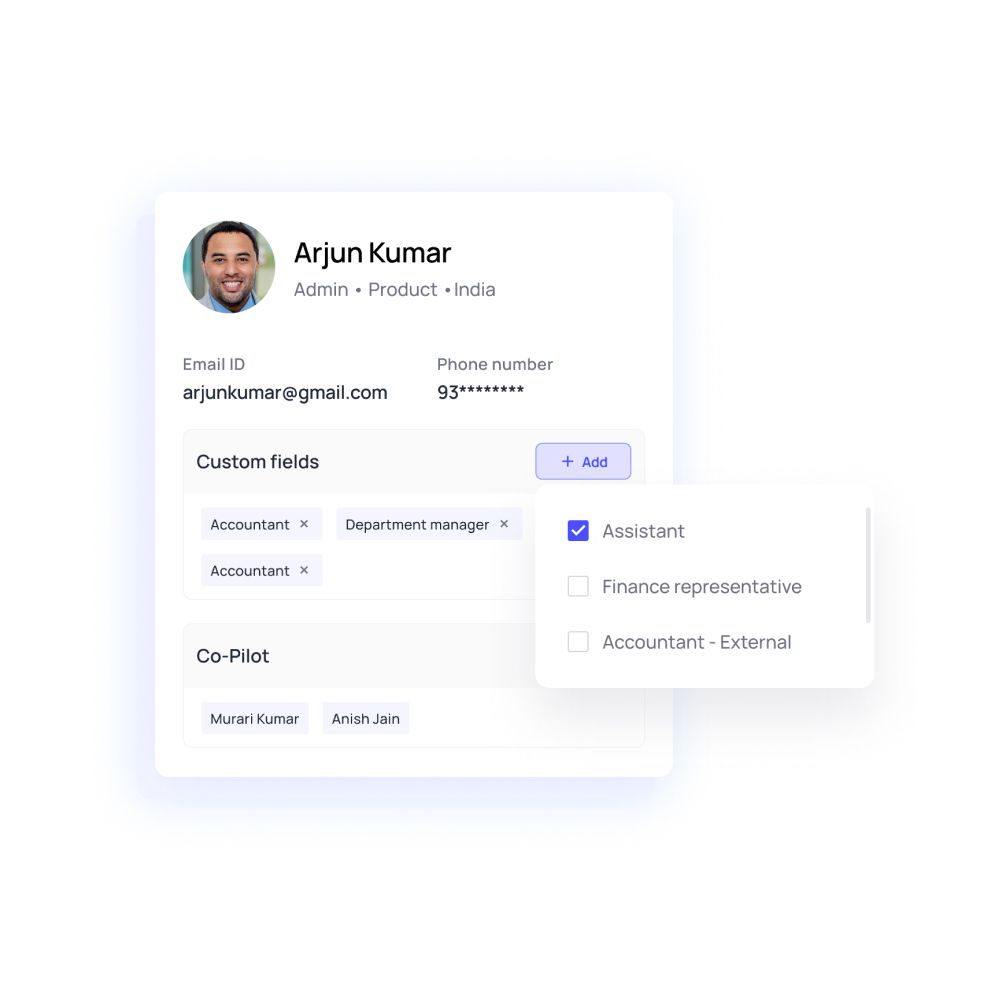

These wallets are super simple to use with an interactive user interface that does not unnecessarily complicate the transaction or any process keeping it thorough and streamlined.

Maintaining multiple accounts for different currencies causes your team to track, manage, and reconcile every transaction made under each tab. This process causes sheer wastage of employee time and effort.

Get started with a multi-currency account for your business

How do multi-currency wallets help businesses expand globally?

In simpler terms, a multi-currency wallet helps you manage your international payments swiftly. But in a broader sense, that’s not all they do. They cater to multiple business processes and activities without your team realizing it.

Eliminate unessential transaction costs

Partnering your multi-currency wallet with local payment methods lets you pay and receive the funds as a local company. Since you are considered a local business or a home company, you no longer have to bear the conversion costs.

Your international customers in the US can pay you in dollars; customers in the UK can send funds in GBP without you being subjected to any multi-currency exchange rate.

Provide easy payment options to international customers

Customer satisfaction is at the top of a business funnel. Companies strive hard to ensure customers face no hurdles in reaching their product and the associated activities. Slow sailing international payments have caused friction between businesses and customers.

By enabling the use of multi-currency business accounts, customers can directly remit the amount to the company's bank account without involving third parties like banks in the supply chain. Streamlining the payment process ultimately leads to customer happiness and a strong base.

Uncomplicated reconciliation process

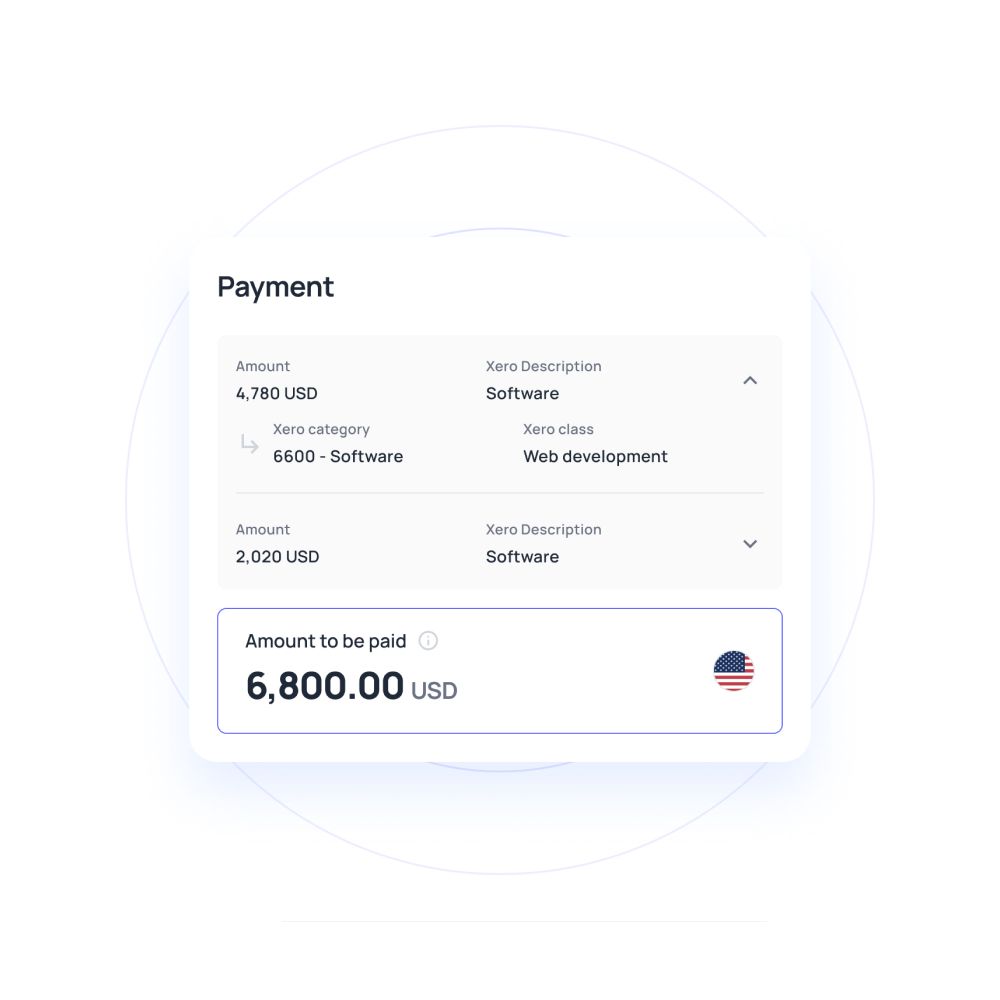

Incorporating a global wallet explicitly organizes and eases your accounting and month-end closing process. Now that all your cross-border transactions are being pipelined through the same channel, your accounts team can easily reconcile them in the accounting software without switching between multiple accounts.

The main aim behind a single wallet is that — companies can discharge their accounting department from overseeing multiple transactions, reduce multi-currency account fees cross-checking between various software, and run safety checks to ensure the payment is received from an authorized customer.

How to assess the need for a multi-currency account for your business?

Maintaining a multi-currency wallet is an easy yet demanding task at the same time. Companies cannot simply opt for such tools because they have a handful of international transactions or customers. Carrying out lighter tasks like international remittance can also be conducted via your bank account.

Multi-currency business accounts are specially designed for businesses with a foreign customer base and, thus, frequent cross-border transactions.

To clear some air, we have created a checklist for your business. Before taking a final call on adopting global wallets, we recommend you glance through the benefits of a multi-currency account and evaluate how these advantages align with your business needs:-

- Your business sends regular international payments to suppliers, contractors, and other stakeholders.

- Receives cross-border payments from customers, clients, and other third parties.

- Your business models include selling and shipping your products and services to other countries.

- You are planning for a business expansion in foreign countries.

- Import or export raw materials.

- You have employees based in other countries.

- Your business outsource or hire freelancers or consultants from abroad.

- Your company sends employees for business conferences or meetings frequently.

- Your employees need to travel internationally for business purposes.

Manage more than 65+ major currencies with one account!

Volopay's multi-currency account

Volopay has built a unique and all-in-one platform to help you transact smoother with cost-effective FX rates to address the needs of international business and their payments.

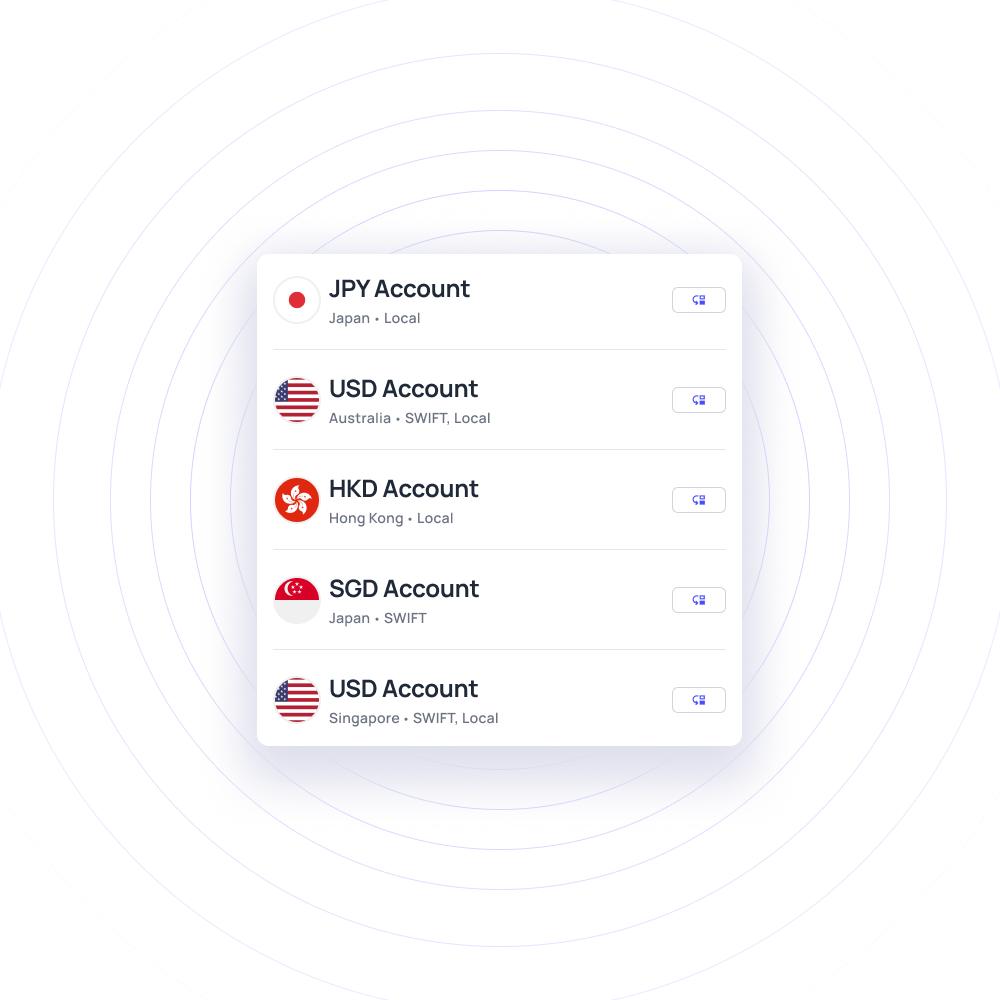

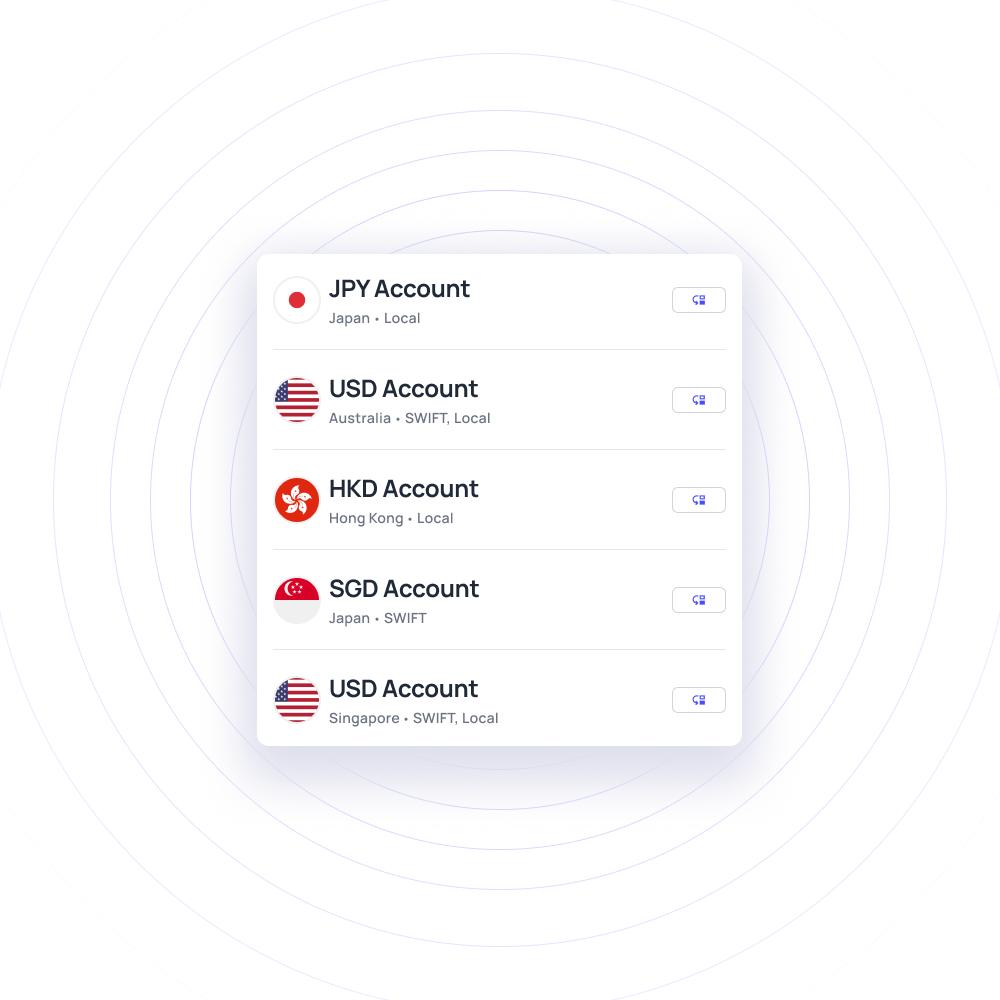

We eliminate the need to maintain multiple accounts for each currency; instead, we let you manage all the international payments through a single wallet with no minimum balance requirement.

Transact in all the major currencies

To empower our customers, we actively support money transfers in more than 65+ major currencies in 180+ countries without any hassle of conversion rates.

Volopay’s business account allows you to pay, receive and hold funds in your wallet for any amount of time without being subjected to any additional charges or fees.

Trusted by finance teams at startups to enterprises.