How does multi-currency account work with Volopay?

When starting a business, the way your organization handles payments is not something that people are very concerned about. It is an everyday task that needs to be completed for operations to run smoothly.

But as your company scales, the systems and processes you build around handling finances, specifically all your expenses, can make a big difference to the health and stability of the business. This is especially true if you are dealing with vendors and suppliers who are in a different country.

Making payments across international borders can be cumbersome and slowly burn through your budget due to forex charges and other kinds of transfer fees. This is where multi-currency bank accounts come into play.

What are multi-currency accounts?

A multi currency business account is a type of bank account that lets you hold and send money in different currencies. These accounts are great for businesses that deal with vendors and suppliers outside their national borders and in a different currency. By using multi-currency wallets, your business can store money in an account in the currency that your vendor deals in.

By doing this, you can send money to your vendor in their local currency. It will act as a domestic transfer and your business will not have to pay any charges for converting money from one currency to another. If you have regular payouts to vendors abroad, using such an multi currency business account can save your business a lot of money.

How does multi currency business account work with Volopay?

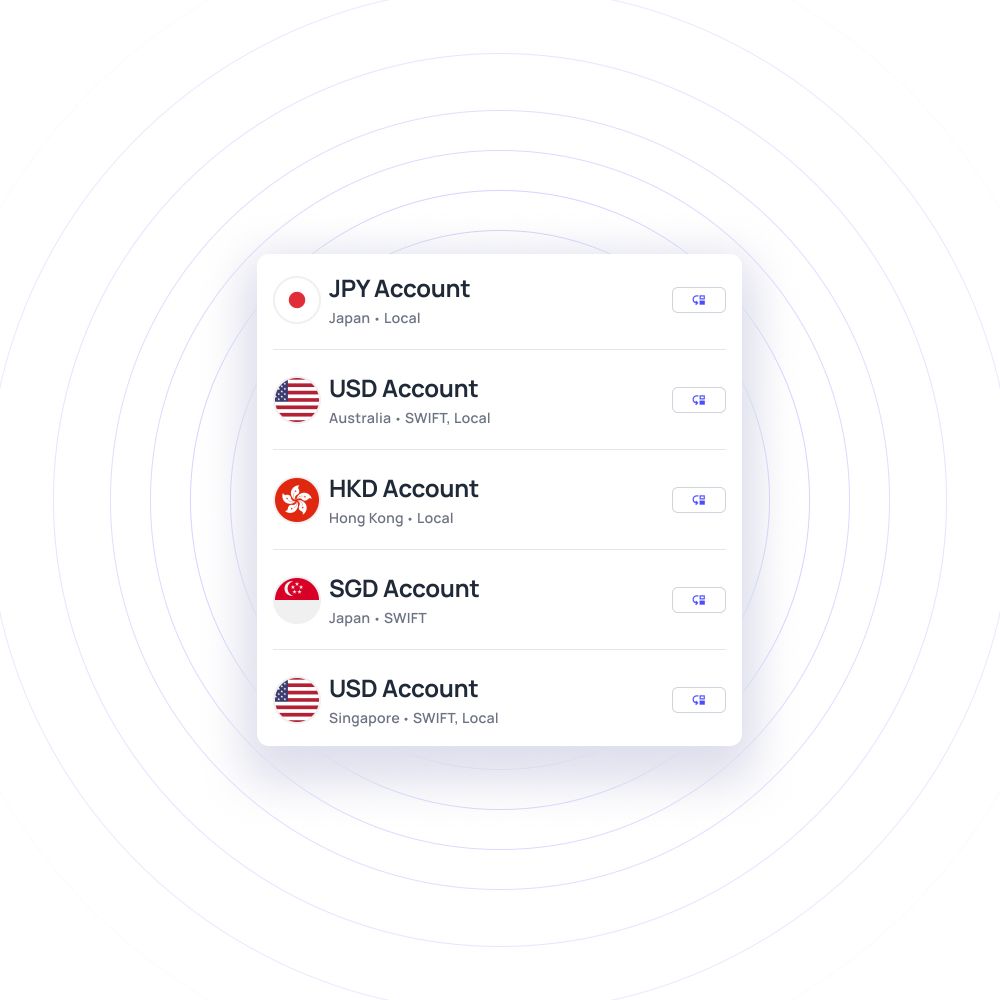

Volopay gives you access to an online multi currency business account through our platform. You can use this account that acts as an online wallet to perform the following functions.

Adding or receiving money

Here you can top up money in the multi currency business account with the given bank details. You can use the LOCAL or SWIFT method of transferring money to top-up money in the other currencies your account has access to other than your local currency. Also easily receive payments into your wallet by sharing the account details with your clients.

Check account details

This section gives you access to the account details of your multi currency business account for business such as the bank name, bank account number, account name, and bank identification code (BIC). Having access to this information is important so that you can transfer money to your account.

Exchange

This feature allows you to transfer your money from one currency wallet to another within Volopay. The available balance in a particular currency will be used to make this exchange. Before you make the exchange, you will clearly be shown the amount that you’re transferring, the exchange rate, and the amount that your chosen currency wallet will receive.

Make payments

After you have topped up your multi currency business account, you can easily use it to send payments to international vendors and save money on each transfer.

View transactions

This allows you to see all the transactions that have been made using your account in the form of a ledger within the platform itself.

Download ledger

Once you choose to view all the transactions, you will also get the option to download all the transactions from the ledger in the form of a PDF or XLSX.

Benefits of multi-currency account for a business

Individual account for international transactions

Multi-currency wallets essentially enable the creation of separate individual accounts for different currencies. By doing this, it negates the hassle for businesses to go and create separate bank accounts with different banks.

This saves them a lot of time and the effort of having to constantly maintain a certain balance in different accounts.

Instant payments to local currencies

Multi-currency bank accounts might be holding foreign currencies, but this doesn’t mean that they are only meant for international transactions.

The base account for this type of online account is always created in your business's local currency. This means that you also get to send payments locally with the ease you would with any other normal domestic bank account.

Smooth international transactions

A major benefit of multi currency business accounts and where it truly shines is of course international payments. You bypass any time delays that are present in normal international transfers as the digital infrastructure that these accounts are built on is extremely robust.

Your vendor or supplier in another country receives money in a matter of minutes and sometimes even seconds and since you are using a separate account within the multi currency business account.

This basically holds money in the currency of the receiver, the transaction essentially acts as a domestic transfer helping you avoid any forex fees or bank conversion charges.

View and control funds

Instead of having multiple bank accounts where you constantly need to log in and log out of portals to check balances and make transfers, a multi currency business account for business gives you access to all account information within a single portal.

This way you can control all your funds from a single dashboard and make payments more quickly.

Save money on forex conversions

The biggest and most obvious selling point for a multi currency business account is its ability to save money that is spent on FX charges that banks take to convert money from one currency to another.

Easily pay vendors in the currency of choice

Using a multi-currency account also builds a better relationship with your vendors as they receive payments quickly and in a currency of their choice without it being a hassle for your business.

This development in business relationships can also enable loyalty and better discounts in the future.

Multi-currency account for international payment

Volopay is an expense management platform that allows businesses to use a multi currency business account through our platform. You can use it to make payments in 100+ countries and 60+ currencies with access to the most used currencies globally.

Volopay acts as a central dashboard to make all your payments without the trouble of having to create multiple separate accounts through different banks.

This makes it convenient for your finance and accounting team to handle all payments to vendors from one place and also allows you to process employee payroll in different countries.

FAQ's

There are no hidden charges for using a multi-currency wallet on Volopay. Even if you have to exchange currencies within wallets on Volopay, you will be shown the exact exchange rate that will be used to convert your funds from one currency to another.

Provided you are in a region where we can provide multi-currency wallets, it doesn’t take any time to open a multi-currency account through Volopay. As soon as you onboard on our platform, you will have access to load funds into a multi-currency wallet of your choice.

Depending on the bank you choose there might be different requirements to open a multi-currency account. When you choose to use Volopay, there are no requirements to use our platform’s multicurrency account but there are certain requirements to access credit.

Yes, using a multi-currency wallet online is a safe option as most providers use robust digital infrastructure to increase security to keep your money and information safe. You must always choose a reputable provider for the same to ensure that your funds are safe.

Trusted by finance teams at startups to enterprises.