5 benefits of expense management software for business

Companies unaware of automated expense management software continue to struggle in managing business and employee expenses. The result of which can be witnessed in inefficient expense reporting, behind-the-block expense tracking, inaccurate employee accountability, and overall blinkered financial health.

So how do companies manage their scattered costs without spending a hefty sum of money or comprise on their existing accounting software? Volopay's spend management software actively addresses your company accounting needs, identifies your pressing points, uncovers your financial mistakes, and provides a comprehensive platform to manage business expenses.

Features of expense management software

Companies have depended on manual accounting methods for bookkeeping and maintaining financial records for a long time now. Volopay's multi-dimensional and automated expense tracking software caters to various expense management needs that allow you to achieve the most satisfactory results without any inherent complexities.

Corporate cards

Expense management software uses corporate cards for enhanced expense visibility and tracking. Employees can use these cards to finance various expenses and initiate payments to third parties. Physical cards are issued to the employees in the organization. With the help of these cards, they can readily finance their business trips and either make in-store or online payments. Virtual cards have no physical existence and are primarily used for subscription management and vendor payments.

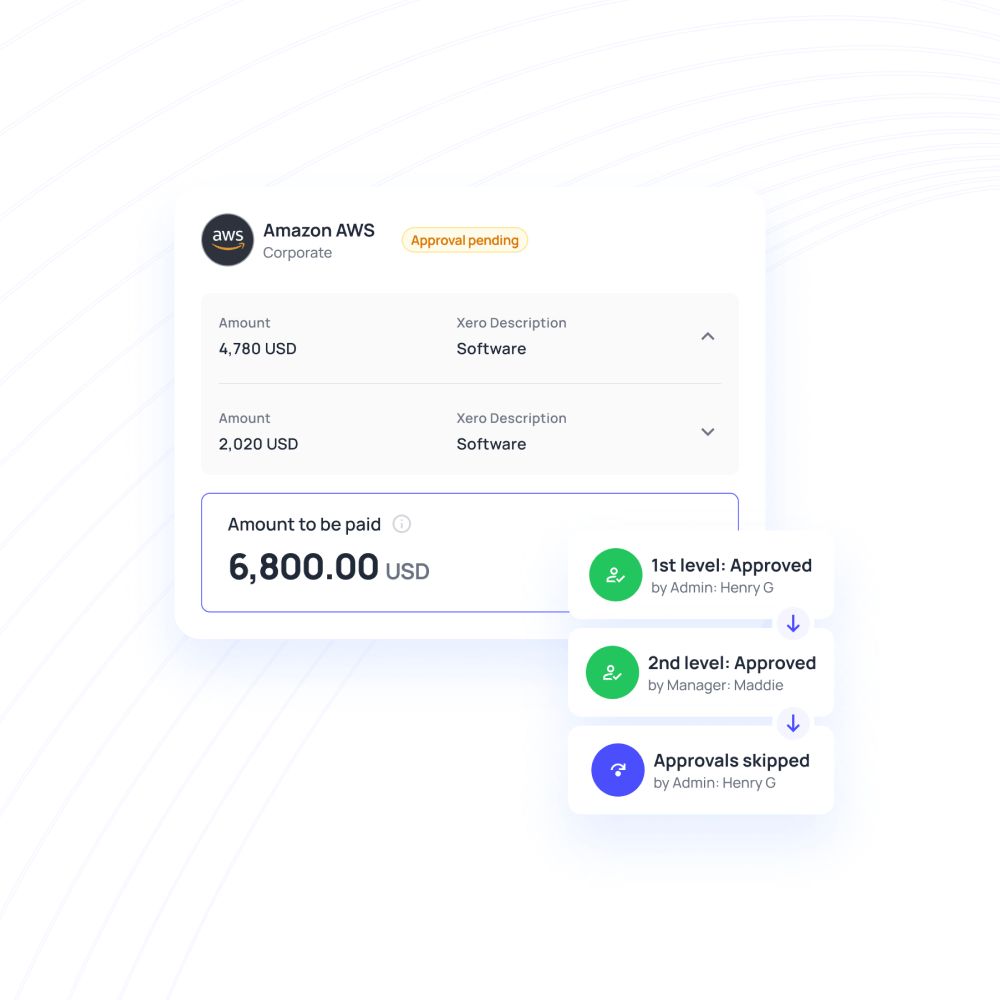

Automated approval workflow

Are you worried that your employees might spend more than the allowed amount? With Volopay, you don't have to? We brings an automated multi-level approval workflow that stretches down to five-level to help you validate every outgoing expense. You don't have to approve every low to high-dollar value transaction manually. Create a pre-approval workflow for small transactions and designate approvers for high-value transactions.

Automated data extraction

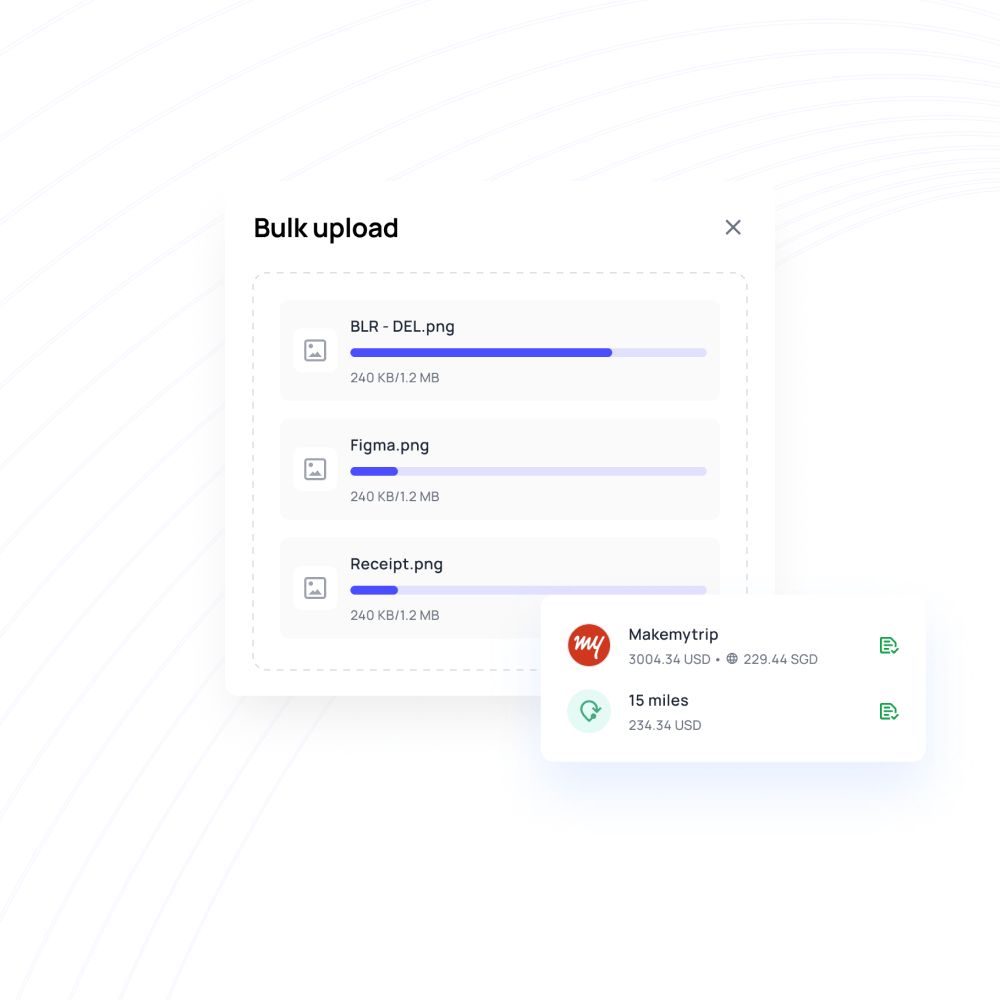

Invoice capturing is more snappy and convenient with Volopay's data extraction via OCR technology. You don't have to document every invoice by a typing-to-enter method. Users can scan the invoice with invoice generation tool, verify the captured data again, and hit enter. That's how you do it for every invoice. To ensure you don't have to go back every time after scanning the invoice, Volopay's OCR capture is optimized for 98.9% accuracy.

Multi currency support

Does your company deal in more than one currency? Do you face challenges while currency conversion and maintaining separate wallets for each currency? We offers a multi-currency wallet that enables you to store more than 65+ currencies and transfer to more than 130+ countries with economical FX rates. Make instant domestic transfers with no transaction or hidden fees.

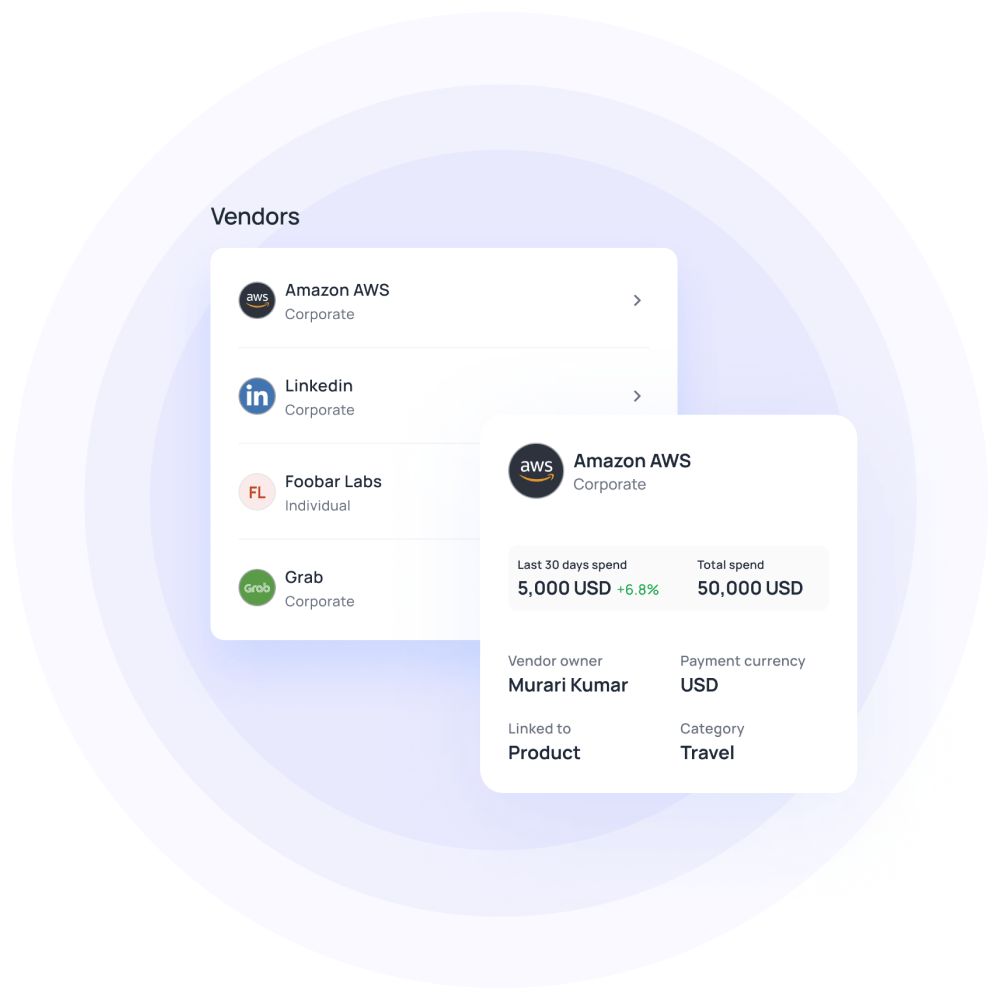

Seamless integration with accounting software

Don't want to maintain the hassle of shifting from one accounting software to other? Try Volopay's coherent accounting integrations that allow you to sync your accounting software with Volopay without any data loss or mix-up of entries or any manual coding for integrations.

Real time policy checks

Our expense tracking software works based on your company expense policy. According to your expense policy, we create a submission and approval policy that helps ensure your expenses are following the set procedure. Any out-of-policy transactions are immediately flagged for you to take corrective action.

Interesting read: 6 signs to switch to an expense management software

Benefits of using expense management software for business

After knowing which aspects of accounting and finance we solve, it's time to read the outcomes you achieve by employing expense automation.

Avoid delays and errors

We safeguards your accounting and financial data from human error and omissions. Our notifications tab displays all your unapproved requests and upcoming payments to avoid delays in payments and approvals. Similarly, any duplicate or suspicious transactions are immediately flagged and notified to the admins.

Improved visibility and efficiency

Because our expense tracking software meticulously captures every entry and transaction, you obtain an unambiguous and transparent expense overview for each corporate card and payment made. Also, since every accounting task is being automated and synced, your company is bound to unlock new levels of efficiency.

Reduce frauds

Modern employees are clever to get away with fraud or misuse of corporate cards. But with high-grade security and multi-level fraud-prevention coding in our automated expense reporting platform. To secure our platform, we do periodic Vulnerability assessment and Penetration Testing (VAPT) on our Network and Applications every two months.

Faster employee reimbursement

With the automated reimbursement process, you don't have to file manual expense claims and wait for a month to get your reimbursement approved and reflected in your account. Our automated expense management software lets you instantly file a reimbursement claim, get approvals in real-time, and receive the approved amount immediately in your bank account.

Increased expense policy compliance

Even though you switched to automated expense management software, it's still imperative that your expenses are guided through your company spending policy. And to ensure you can do this, we have approval policies that work on limiting your costs. You can create departmental budgets and establish spending limits on each corporate card through budgeting.

Manage all your business expenses and payments on a single platform

How can Volopay help my businesses with expense management software?

Volopay is every company's one-stop solution that is looking to modernize their accounting techniques, get on top of their costs, and identify the areas of cost-cutting. Our online business expense management platform provides instantaneous yet granular details about your company's spend culture and ways to optimize your costs to keep moving from financially vulnerable to financially healthy.

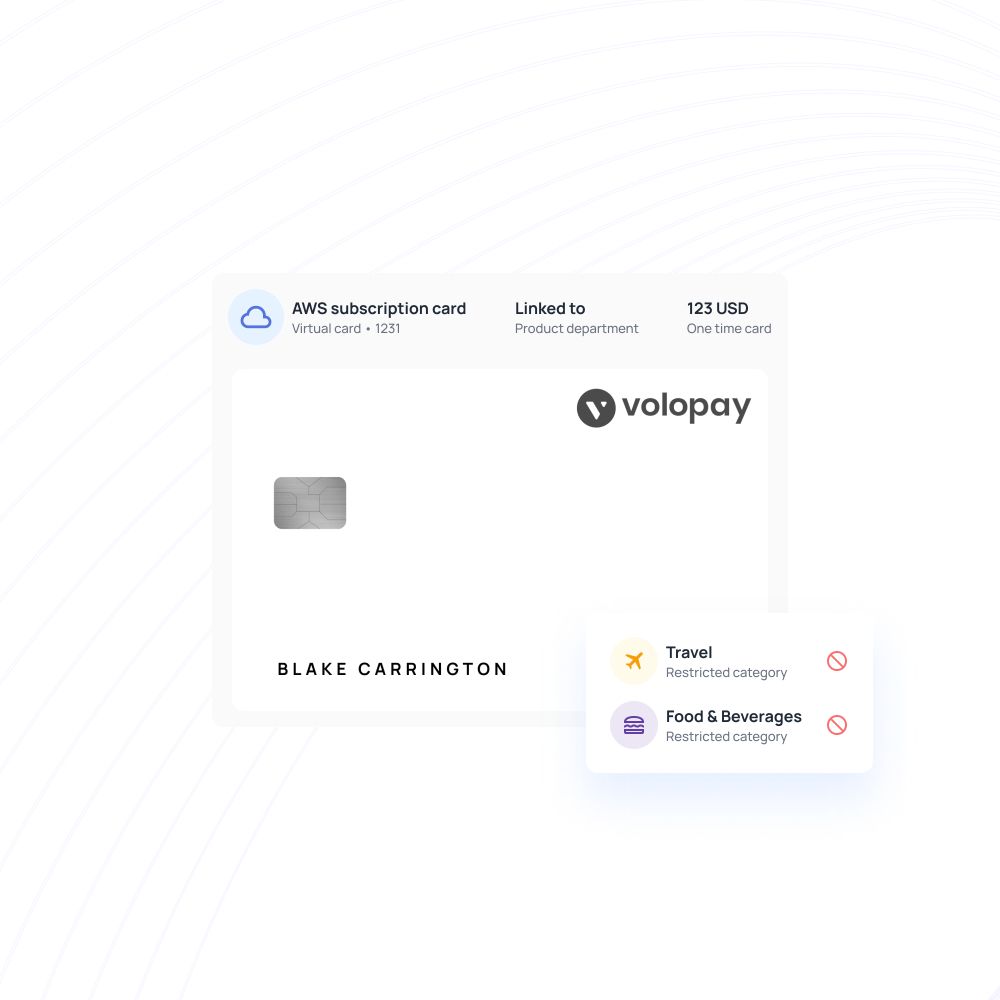

Issue separate virtual cards to teams

Whether you have five or fifty departments, every department is bound to incur expenses, and each has varied costs from one another. Managing them through a single corporate card becomes difficult as the team expands.

However, through Volopay, you can issue unlimited virtual cards with almost no additional charges. Our virtual cards work like any other debit card, where you are required to load funds and use them whenever needed.

How does Volopay's expense automation system makes it easier to create and use virtual cards?

- Users can use virtual cards for object-specific activities.

- You can create virtual cards for every departments.

- Subscription management for SaaS tools.

- Volopay's virtual cards are linked to a single budget to make the fund loading process more narrowed.

- Easy vendor payments with encrypted virtual card details.

- Since a virtual card isn't connected to your bank account, no bank details can be comprised, even in the case of card fraud.

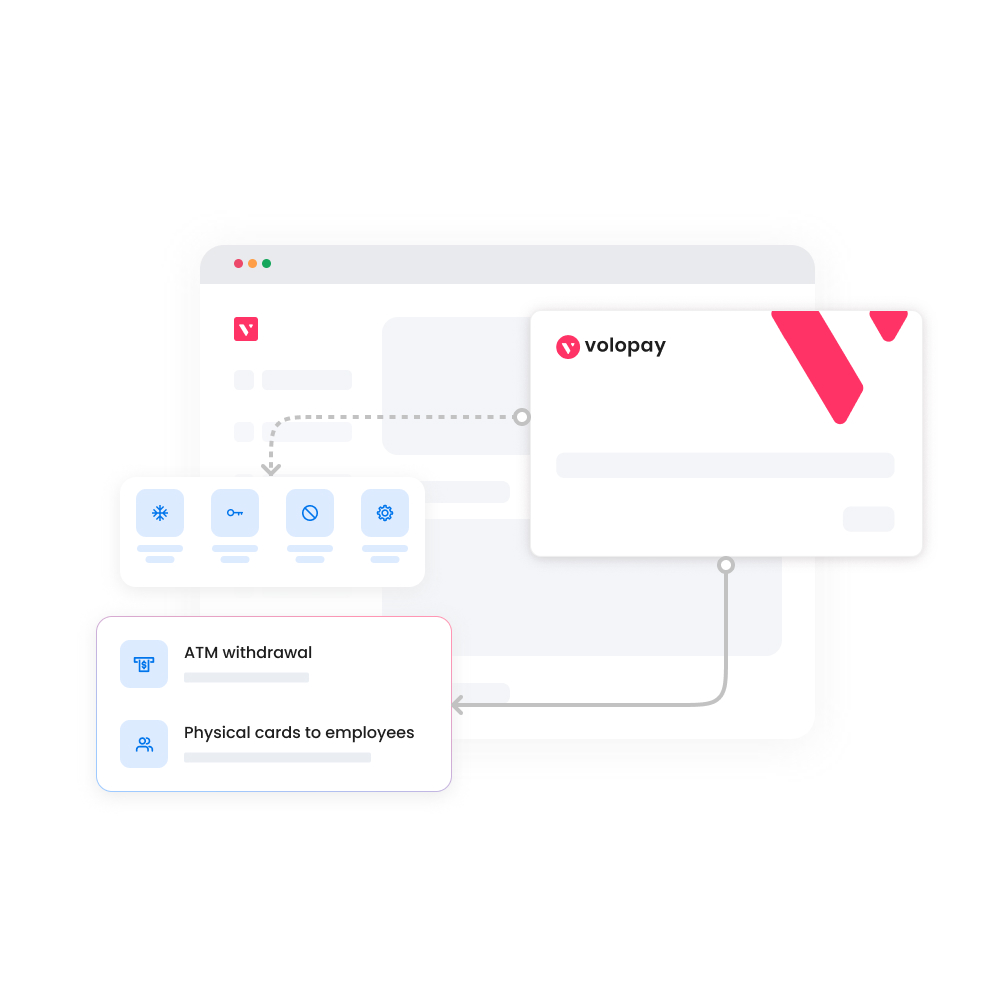

Issue physical cards to your employees

Virtual cards cannot be swiped in-store; that's why Volopay offers physical cards for employees. These cards can be issued to employees based on their position and requirement.

What can you expect from Volopay's physical cards?

- Employees can use these cards during their business trips, either online or in-store.

- No personal liability or interest fees against any corporate card.

- Customized spending limits for each employee's spending card.

- Department-based roles and cards.

- Approval and submission policies to monitor and control employee expenses.

- Instant fund requests and automated pre-approvals.

- When maker checker is enabled, all the requests will need the approval of at least two distinct approvers in the approval flow.

Multi-level approval Workflow

Volopay's expense management automation system is equipped with a multi-level approval process. This system states in Volopay a fund request, Bill Pay request, or Reimbursement cannot be approved by the first-level approver unless specified. Whenever an employee raises a request, the request travels through the pre-decided matrix and reaches all the approvers. If multiple approvers are on the same level, acceptance of anyone approver will approve the request. However, if any approvers decline the request, the request gets rejected.

Since employees raise multiple requests a day, it becomes difficult to account for them. Hence, in Volopay, users can pre-approve specific requests. For example, fund requests below $15 will be pre-approved. After activation of this functionality, fund requests below $15 will be automatically approved, and no additional authorization be required from anyone. Regardless, the admins and budget owners will be notified of the same.

Reimbursements for employees

For comparatively smaller workforces, automated reimbursements work pretty well and are highly operational. With reimbursements, being at the core of Volopay's automated expense management software, employees can swiftly file for reimbursements and get the sanctioned amount into their bank accounts.

Creating reimbursement claims under Volopay is an uncomplicated and easy process. After filling out the reimbursement form, you must submit the documents as per the submission policy. Later, the approval policy guides the approvers.

SaaS subscription management

Volopay offers a dynamic subscription management platform to bring together and manage your scattered SaaS subscriptions. Users can create subscription cards for all online subscriptions and lock all the subscription transactions under the same card. This makes it easy to clear the air about which subscriptions are currently in use, what amount is paid as SaaS fees, and which employee initiated the payment.

Moreover, to keep your SaaS management up to date, Volopay offers two payment frequency types.

One-time - The cards under this functionality will be funded only once through the budget.

Recurring- The cards will automatically get financed at the set date every month.

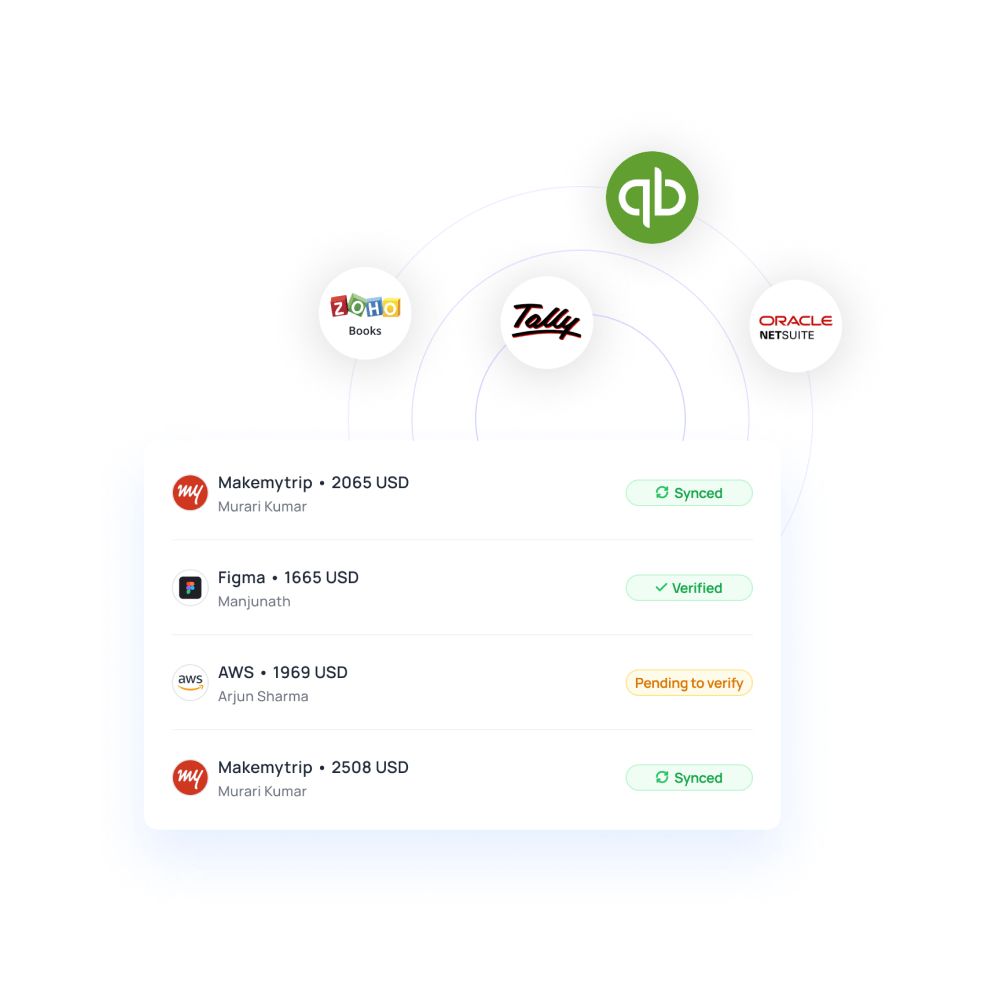

Accounting software integration

Accounting integrations are a prerequisite to scale your business bookkeeping. We offers accounting integrations with platforms like QuickBooks, Xero, Deskera, and NetSuite. But does this mean users have to pass double entries for both the softwares? No, absolutely not.

Our accounting framework is designed in a way where users have to conduct minimal accounting work. Select the transactions and entries you want to sync in the accounting software, and all of them will automatically be synced within a fraction of seconds.

Trusted by finance teams at startups to enterprises.