Business expense management industry trends for 2026

The corporate world looks a whole lot different than it did earlier. The past few years have changed the way companies and their employees work, and also how they spend company capital.

While we have seen a sudden shift from on-site job profiles to hybrid and remote work environments, we have also witnessed a major overhaul in how companies track business expenses.

Corporate expense management is also experiencing a massive overhaul in its accounting and payroll services. By keeping costs down and tracking expenses, small business owners can stay afloat in these uncharted waters.

7 business expense management trends

Digitalization of expense management continues

Digitalization has been the need of the hour for a long time, but recent years have pushed this widespread agenda into high gear. As more and more teams choose to work remotely, digitalizing your business expense management processes has become a crucial task. One can see digitalization in the form of cloud-based data storage, online spend management vis-a-vis vendor and invoice management, and stringent cybersecurity.

Not only is this move beneficial for employees, but it also benefits your finance and accounting departments as automating these processes reveals more cost-saving avenues and sharper financial forecasting than ever before. Having a single platform and a unified database ensures data that is extremely accurate and standardized. Digitalization is also beneficial for employees using the platform, as it eliminates the need for paper-based business expense.

Payment solution for cash flow efficiency

With the advent of digitalization and automation, traditional corporate expense management systems have now been rendered inefficient. Hybrid work environments cannot thrive on broken systems and fractured payment processes. One of the most significant changes in business expense management recently is the growing demand for a centralized and streamlined payment solution. A single payment tool to track business expenses, whether local or international has become a driving force for global B2B payments.

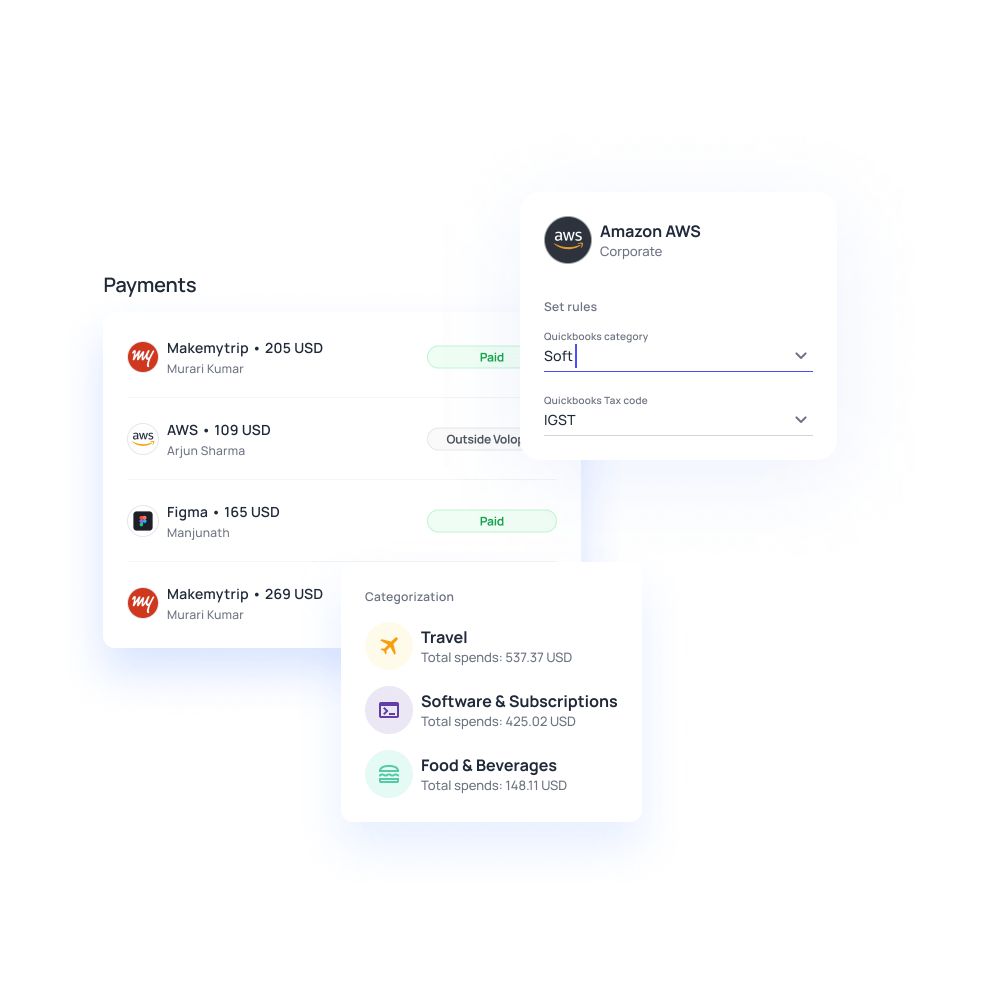

For efficient expense management, companies now rely on spend management platforms like Volopay that allow a unified view into payment processes, approvals, reimbursements, and seamless integration with existing accounting systems and ERPs. Volopay’s corporate cards and flexible credit line solves the supply chain delays, straining your cashflow and vendor relationships. All payment solutions you need manage and monitor expenses – right into one single platform.

Security of B2B payments is unavoidable topic

When businesses process global B2B payments and utilize company capital, security becomes an absolute necessity. Cyber fraud and financial scams pose a real threat to companies everywhere, and therefore companies need to invest rigorously in putting high-security controls in place for compliance. To counter incidences of fraudulent activities, companies are looking for a business expense management solution that safeguards company funds.

To eliminate security risks, Volopay offers corporate cards with unlimited virtual cards for the safest payments ever. Each virtual card comes with a unique 16-digit number for convenient single-time payments and trial subscriptions. All Volopay cards are pre-loaded first, which keeps your company capital completely safe. Moreover, when used online, Volopay cards come with 3DS security and the ability to instantly block or freeze the card from within the app, making business credit cards and complicated banking features obsolete.

Outsourcing bank connectivity

When it comes to tracking expenses, small business owners find banking “solutions” to be a nightmarish experience. From fetching vendor details to retrieving financial statements, legacy financial systems like banks are proving to be severely lagging in their payment processes. In this time and age of lightning-fast growth, businesses need a payment solution that can grow at the pace with which the business grows. Spend management software can provide seamless banking connectivity without glaring issues.

We can track business expenses for easy auditing as fast as it can process cross-border B2B payments to up to 100+ countries with SWIFT and non-SWIFT payment options. Unlike banks that provide only financial statements and put the burden of manual data entry on your accounting team, Volopay offers integration with leading accounting software such as Xero, Quickbooks, and NetSuite.

No more spreadsheets

Corporate expense management in 2026 is all about wishing farewell to outdated accounting systems, in this case, spreadsheets. Spreadsheets were all the rage back when they were first introduced, but as automation technology grew leaps and bounds, spreadsheets just cannot provide the same ease. Spreadsheets offer little to no scope for teamwork, collaboration and communication.

Spreadsheets limit conversations through email which is neither time-saving nor cost-effective. With spreadsheets, there is tremendous manual data entry involved, not to mention the huge margin for errors, lack of an audit trail for compliance, and the overarching reliance on human elements to run processes smoothly. With accounting automation, all these problems are eliminated. With intuitive business expense management software, you can easily process payments, match invoices, bills, and receipts, and export them categorically to the accounting software of your choice – all within a few clicks!

Account reconciliation

To optimize expense management, companies are now seeking solutions that offer effortless reconciliation. After all, an easy reconciliation process is a positive sign that an enterprise has streamlined its accounts payable processes and invoice management. Furthermore, easy account reconciliation offers transparency and visibility into the company’s funds and how they can be better utilized to improve overall efficiency.

Account reconciliation ensures data related to every transaction is stored in an organized manner and mistakes are spotted, rectified, and reduced immediately. In 2026, when it comes to tracking expenses, small business owners are turning to all-in-one expense management software such as Volopay, which offers a smooth reconciliation process with a unified view of all your accounts payable workflows, payments, vendors, and invoices. Our 3-way matching feature collates all the necessary documents such as bills, invoices, and receipts to its relevant transaction for seamless reconciliation and a smooth auditing experience.

Alignment between accounting, finance, and IT

Business expense management can best be described as a tightrope act – a delicate balance between different functions that directly affect how a company’s capital is being utilized. When the accounting, finance, and IT departments work in siloes rather than collaborating and presenting a unified fund, it can severely impact the financial status of your business.

To promote alignment and dialogue between these three key departments, you need to invest in a corporate expense management system that is completely transparent, accessible, speedy, and reliable. By switching from legacy financial systems to innovative and automated spend management solutions, your core business teams are encouraged to use their full potential and strategize looking ahead, instead of scrutinizing the past.

Expense management software for companies

The corporate world has seen an immense, irreversible shift in the way business expense management is done, and the progress is for the better. Companies are reimagining their traditional financial processes and finding ways to automate their spend management.

Instead of relying on what has always been offered, businesses are now sifting through their financial stack and demanding better solutions that integrate with their system, putting the power of corporate expense management software back in the hands of business owners.

Trusted by finance teams at startups to enterprises.